Why Frontier Markets ETFs are Still Attractive - ETF News And Commentary

September 18 2013 - 8:00AM

Zacks

Emerging markets have

been in the limelight due to their stellar performance in the past

few years but they have lost their luster lately. So far in 2013,

many emerging markets suffered steep declines, mainly due to the

‘taper talk, which is making investors reconsider emerging markets

in general.

Beyond the taper, current account deficits and political woes have

also impacted these markets. Investors are growing concerned about

the political situation in many countries, in addition to rising

inflation and growing current account deficits.

Many nations in this space have seen their benchmarks fall by

double digits, pushing a number of developing nations into crash

territory. Lately, emerging country funds from India, Indonesia,

Thailand, Turkey and China have been struggling with weak numbers.

(Read: Time to Panic About Emerging Markets?)

On the other hand, many smaller emerging markets or frontier

markets have managed to remain rather unaffected by the turmoil in

the broader emerging markets space.

About Frontier Markets

Frontier markets include countries that are in the early stages of

economic development and are less established and developed than

emerging nations. When compared to emerging markets, frontier

markets have low market capitalization and liquidity (Read:

Frontier Markets: A Better Choice for ETF Investors?).

Moreover, frontier markets have a low correlation with the

developed markets which may benefit investors at a time when

investing in emerging nations isn’t fruitful. Further, they have

relatively lower valuations as well as higher income

yield.

One of the reasons for outperformance of frontier markets is the

currency factor. ETFs tracking frontier markets are dominated by

Middle East countries. Many of these countries peg their currencies

to the US dollar or to a basket dominated by the US dollar. As such

these currencies have remained steady while currencies of most

emerging markets have suffered a lot of pain. Currency losses have

been a big factor is emerging markets’ poor performance.

Further, during its latest classification review MSCI promoted UAE

and Qatar to emerging market status from frontier market. The

upgrade resulted in increase in capital flows to the Middle East

region.

Why should you play here?

Of late, frontier funds have amassed $1.5 billion in assets this

year in contrast to steep outflows for many of the largest emerging

market ETFs, reports Bank of America Merrill Lynch.

The space mostly benefits from the markets of Kuwait, Qatar and

United Arab Emirates (UAE) that are more focused on local demand

and are free from global market risks (Read: Time for Frontier

Markets ETFs?).

The Risks

Though the frontier markets provide a good investment strategy for

those looking for attractive returns over the long term, a high

level of volatility and poor liquidity are risks that run high in

these markets. High inflation levels are also a headwind, as many

have trouble keeping inflation under control.

How to play?

For investors who are willing to take some risk and seek to reap

the benefits, we have highlighted two ETFs which track broader

frontier markets space.

iShares MSCI Frontier 100 Index

(FM)

Launched in Sep 2012, FM tracks the MSCI Frontier Markets Index,

which is ranked by float adjusted market capitalization. It is one

of the most popular funds in the space and puts more focus in large

cap securities. The fund has an asset base of $286.3 million and

has an average daily trading volume of 115,000 shares a day.

The ETF holds 101 securities in its basket. The top ten holdings of

the fund take almost 39% share in the basket. In terms of

country exposure, Kuwait (25.75%), Qatar (19.02%) and the UAE

(14.74%) are in the top three spots. Financials dominates in terms

of sector exposure, accounting for a whopping 56% of the total

assets, while Telecommunication (14.15%) and Industrials (11.56%)

round out the top three.

The fund is a bit costly in the space, charging investors a hefty

fee of 79 bps. However, the fund has given strong returns of over

17% year to date and also pays a 30-day SEC yield of 4.09%.

PowerShares MENA Frontier Countries ETF

(PMNA)

Launched in Jul 2008, PMNA tracks the NASDAQ OMX Middle East North

Africa index, which seeks the performance of liquid companies in

MENA (Middle East and North Africa) frontier countries. So far, the

fund has amassed only $15.2 million in assets.

The fund holds 43 securities in its basket. The fund is more

concentrated in its top 10 holdings as it puts nearly 55% share.

Citadel Capital, National Bank of Kuwait and Union Land Development

Corp. are the top three company holdings of the fund.

The ETF is tilted more towards Financials as it leads the sector

with about 74% share, while

Telecom and Industrials allocate a respective 14% and 8%. In terms

of country exposure, Kuwait (23.53%), UAE (18.3%), Egypt (16.19%)

and Qatar (15.17%) account for the majority of asset holdings.

The product charge investors 70 bps in fees. The fund has generated

returns of 9.5% on a year-to-date basis and has a decent yield of

1.68% (Find all broad emerging markets

ETFs) .

Want the latest recommendations from Zacks Investment Research?

Today, you can download7 Best Stocks for the Next 30 Days.

Click to get this free report >>

ISHRS-MSCI F100 (FM): ETF Research Reports

PWRSH-MENA FRON (PMNA): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

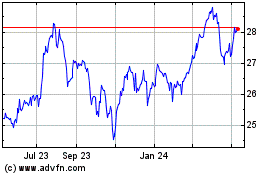

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Jan 2025 to Feb 2025

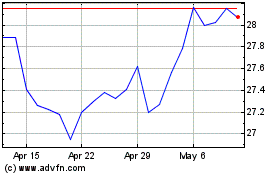

iShares Frontier and Sel... (AMEX:FM)

Historical Stock Chart

From Feb 2024 to Feb 2025