- Gross margin expanded 570 basis points compared with the second

quarter 2024 on $3.7 million less revenue; third quarter revenue

was $30.3 million

- Operating income increased sequentially by $0.2 million and

operating margin expanded 60 basis points on improved mix, cost

actions and operational execution

- Orders1 grew 5% year-over-year and 7% sequentially to $28.1

million; Alfamation orders improved 21% sequentially

- Earnings per diluted share was $0.04 while adjusted earnings

per diluted share2 was $0.10

- Generated $4.2 million in cash from operations in the quarter;

paid down $5.3 million in debt and repurchased $1 million in

shares

inTEST Corporation (NYSE American: INTT), a global supplier of

innovative test and process technology solutions for use in

manufacturing and testing in key target markets which include

automotive/EV, defense/aerospace, industrial, life sciences,

security, and semiconductor (“semi”), today announced financial

results for the quarter ended September 30, 2024. Results include

Alfamation S.p.A. (“acquisition” or “Alfamation”) from the date of

the acquisition, which was March 12, 2024. Alfamation is included

in the Electronic Test division.

Nick Grant, President and CEO, commented, “We delivered a solid

quarter with revenue somewhat below our expectations although we

delivered better than forecasted margins. While we had

approximately $2 million in shipments that were delayed into the

fourth quarter, we had better mix compared with the trailing second

quarter primarily due to semi shipments being more heavily weighted

toward backend test. In addition, we have taken out costs to better

align with current market conditions. Importantly, we generated

cash from operations and, given our financial flexibility, we both

paid down debt and repurchased shares. We believe that investing in

our business is a great use of capital.”

He added, “The team continues to execute on our strategy. We are

adding new customers, continue to optimize our channels to market

and are driving innovation. While our visibility is limited given

market conditions, we are encouraged with what appears to be some

stabilization in our targeted industries as orders gradually

improved through the quarter. We expect demand for our induction

heating technology for front-end semi will lag recovery in our

other markets but remain excited about the underlying fundamentals

that will drive long term growth for these solutions. We believe

the appeal of our engineered solutions, the diversification in our

target markets and our success with scaling the business through

acquisitions has provided relative stability in revenue and the

ability to generate profits through industry cycles.”

1 Orders and backlog are key performance

metrics. See “Key Performance Indicators” below for important

disclosures regarding inTEST’s use of these metrics.

2 Adjusted earnings per diluted share is a

non-GAAP financial measure. Further information can be found under

“Non-GAAP Financial Measures.” See also the reconciliations of GAAP

financial measures to non-GAAP financial measures that accompany

this press release.

Third Quarter 2024 Review (see revenue by market and by

segments in accompanying tables)

Three Months Ended

($ in 000s)

As Restated

Change

Change

9/30/2024

9/30/2023

$

%

6/30/2024

$

%

Revenue

$30,272

$30,941

$(669)

-2.2%

$33,991

$(3,719)

-10.9%

Gross profit

$14,012

$14,447

$(435)

-3.0%

$13,797

$215

1.6%

Gross margin

46.3%

46.7%

40.6%

Operating expenses (incl. intangible

amort.)

$13,525

$11,979

$1,546

12.9%

$13,461

$64

0.5%

Operating income

$487

$2,468

$(1,981)

-80.3%

$336

$151

44.9%

Operating margin

1.6%

8.0%

1.0%

Net earnings

$495

$2,277

$(1,782)

-78.3%

$230

$265

115.2%

Net margin

1.6%

7.4%

0.7%

Earnings per diluted share (“EPS”)

$0.04

$0.19

$(0.15)

-78.9%

$0.02

$0.02

100.0%

Adjusted net earnings (Non-GAAP)3

$1,216

$2,707

$(1,491)

-55.1%

$959

$257

26.8%

Adjusted EPS (Non-GAAP)3

$0.10

$0.22

$(0.12)

-54.5%

$0.08

$0.02

25.0%

Adjusted EBITDA (Non-GAAP)3

$2,441

$3,768

$(1,327)

-35.2%

$2,154

$287

13.3%

Adjusted EBITDA margin (Non-GAAP)2

8.1%

12.2%

6.3%

Sequentially, revenue was $3.7 million lower primarily due to

shipments that were delayed into the fourth quarter for automated

test systems and induction heating technologies. Revenue from semi,

industrial and other markets demonstrated improving trends.

Particularly in semi, revenue growth in back-end outpaced the

decline in front-end.

Sequentially, gross profit of $14.0 million and gross margin of

46.3% improved despite lower revenue on better mix and cost

actions. Higher sales of back-end semi test equipment, battery and

flying probe automated test systems as well as improved operating

efficiencies across most businesses contributed to the margin

expansion. Operating income and margin improved reflecting mix and

cost containment measures.

Year-over-year, third quarter revenue decreased $0.7 million.

Alfamation contributed $5.4 million in revenue. Helping to offset

the $7.1 million decline in semi revenue was $4.5 million growth in

auto/EV, $1.1 million increase in industrial revenue and $1.3

million increase in revenue for other markets.

Year-over-year, gross margin contracted 40-basis points

primarily due to lower volume of the organic business and the

impact of Alfamation. Operating expenses increased $1.5 million

over the prior-year period. The $1.9 million incremental operating

expenses related to Alfamation and the additional $0.5 million in

amortization were partially offset by cost reduction efforts and

reduced corporate development costs.

Net earnings for the quarter of $0.5 million, or $0.04 per

diluted share, improved from $0.2 million, or $0.02 per diluted

share in the trailing quarter. Adjusted net earnings (Non-GAAP)3

were $1.2 million, or $0.10 adjusted EPS (Non-GAAP) 3 compared with

$1.0 million, or $0.08 adjusted EPS (Non-GAAP) 3 in the second

quarter of 2024.

3 Adjusted net earnings, adjusted EPS,

adjusted EBITDA, and adjusted EBITDA margin are non-GAAP financial

measures. Further information can be found under “Non-GAAP

Financial Measures.” See also the reconciliations of GAAP financial

measures to non-GAAP financial measures that accompany this press

release.

Balance Sheet and Cash Flow Review

During the quarter, the Company generated $4.2 million in cash

from operations. Cash and cash equivalents at the end of the third

quarter of 2024 were $18.0 million, down $2.4 million from the end

of the second quarter of 2024 reflecting cash used for debt

reduction and share repurchases. During the quarter, the Company

repaid approximately $5.3 million in debt and invested $1.0 million

to acquire 141,117 shares at an average price of $7.38 per share.

Capital expenditures were $0.5 million in the third quarter of

2024, similar to the prior-year period.

At quarter end, total debt was $16.1 million, down $5.0 million

from June 30, 2024, which included the impact of the change in

foreign exchange rates. At September 30, 2024, the Company had $30

million available under its delayed draw term loan facility and no

borrowings under the $10 million revolving credit facility.

Third Quarter 2024 Orders and Backlog1 (see orders by

market in accompanying tables)

Three Months Ended

($ in 000s)

Change

Change

9/30/2024

9/30/2023

$

%

6/30/2024

$

%

Orders

$28,054

$26,854

$1,200

4.5%

$26,182

$1,872

7.1%

Backlog (at quarter end)*

$45,454

$40,491

$4,963

12.3%

$47,672

$(2,218)

-4.7%

*Backlog as of 9/30/23 as restated

Third quarter orders of $28.1 million, including $3.9 million in

orders attributable to Alfamation, grew 5% versus the prior-year

period, and improved 7%, or $1.9 million, compared with the second

quarter of 2024. The year-over-year increase reflects general

strength across most markets although the semi market remains soft

with $5.3 million, or 41%, lower orders. Orders from auto/EV,

including Alfamation, increased $4.1 million, defense/aerospace

increased $1.4 million, industrial grew $0.6 million, and other

markets grew $1.9 million.

Sequentially, the 7% increase in orders reflects increases in

auto/EV, defense/aerospace, security and other markets more than

offsetting weakness in semi, industrial and life sciences.

Backlog at September 30, 2024, was $45.5 million and included

$14.7 million of backlog associated with Alfamation. Approximately

42% of the backlog is expected to ship beyond the fourth quarter of

2024.

Fourth Quarter and Full Year 2024 Outlook

The Company has tightened the overall range of its expectations

for the full year and is providing its fourth quarter financial

guidance as shown in the table below. The Company continues to

expect the effective tax rate for the year to be approximately 17%

to 19%.

Fourth quarter 2024 interest expense is expected to be

approximately $210,000. EPS and adjusted EPS (Non-GAAP)3 at the

mid-point of the estimates for the quarter are approximately $0.08

and $0.14, respectively and is based on approximately 12,150,000

weighted average shares. Capital expenditures are expected to

continue to be approximately 1% to 2% of revenue.

(As of November 1, 2024)

Fourth Quarter

Guidance

Full Year Guidance

Revenue

$34 million to $37 million

$128 million to $131 million

Gross margin

Approximately 42%

42% to 43%

Operating expenses

Approximately $13.5 million

Approximately $53 million

Intangible asset amort expense

Approximately $0.9 million

Approximately $3.3 million

Intangible asset amort exp. After

tax

Approximately $0.7 million

Approximately $2.7 million

The foregoing guidance is based on management’s current views

with respect to operating and market conditions and customers’

forecasts. It also assumes macroeconomic conditions remain

unchanged through the end of the year. Actual results may differ

materially from what is provided here today as a result of, among

other things, the factors described under “Forward-Looking

Statements” below. Further information about non-GAAP measures can

be found under “Non-GAAP Financial Measures” and the

reconciliations of GAAP financial measures to non-GAAP financial

measures that accompany this press release.

Conference Call and Webcast

The Company will host a conference call and webcast today at

8:30 a.m. ET. During the conference call, management will review

the financial and operating results and discuss inTEST’s corporate

strategy and outlook. A question-and-answer session will follow. To

listen to the live call, dial (201) 689-8263. In addition, the

webcast and slide presentation may be found at

intest.com/investor-relations.

A telephonic replay will be available from 12:30 p.m. ET on the

day of the call through Friday, November 8, 2024. To listen to the

archived call, dial (412) 317-6671 and enter replay pin number

13749100. The webcast replay can be accessed via the investor

relations section of intest.com, where a transcript will also be

posted once available.

About inTEST Corporation

inTEST Corporation is a global supplier of innovative test and

process technology solutions for use in manufacturing and testing

in key target markets including automotive/EV, defense/aerospace,

industrial, life sciences, and security, as well as both the

front-end and back-end of the semiconductor manufacturing industry.

Backed by decades of engineering expertise and a culture of

operational excellence, inTEST solves difficult thermal,

mechanical, and electronic challenges for customers worldwide while

generating strong cash flow and profits. inTEST’s strategy

leverages these strengths to grow organically and with acquisitions

through the addition of innovative technologies, deeper and broader

geographic reach, and market expansion. For more information, visit

https://www.intest.com/.

Non-GAAP Financial Measures and Forward-Looking Non-GAAP

Financial Measures

In addition to disclosing results that are determined in

accordance with generally accepted accounting practices in the

United States (“GAAP”), we also disclose non-GAAP financial

measures. These non-GAAP financial measures consist of adjusted net

earnings, adjusted earnings per diluted share (adjusted EPS),

adjusted EBITDA, and adjusted EBITDA margin.

Definition of Non-GAAP Measures

The Company defines these non-GAAP measures as follows:

─ Adjusted net earnings is derived by adding acquired intangible

amortization, adjusted for the related income tax expense

(benefit), to net earnings.

─ Adjusted earnings per diluted share (adjusted EPS) is derived

by dividing adjusted net earnings by diluted weighted average

shares outstanding.

─ Adjusted EBITDA is derived by adding acquired intangible

amortization, net interest expense, income tax expense,

depreciation, and stock-based compensation expense to net

earnings.

─ Adjusted EBITDA margin is derived by dividing adjusted EBITDA

by revenue.

These results are provided as a complement to the results

provided in accordance with GAAP. Adjusted net earnings and

adjusted earnings per diluted share (adjusted EPS) are non-GAAP

financial measures presented to provide investors with meaningful,

supplemental information regarding our baseline performance before

acquired intangible amortization charges as management believes

this expense may not be indicative of our underlying operating

performance. Adjusted EBITDA and adjusted EBITDA margin are

non-GAAP financial measures presented primarily as a measure of

liquidity as they exclude non-cash charges for acquired intangible

amortization, depreciation and stock-based compensation. In

addition, adjusted EBITDA and adjusted EBITDA margin also exclude

the impact of interest income or expense and income tax expense or

benefit, as management believes these expenses may not be

indicative of our underlying operating performance.

Management’s Use of Non-GAAP Measures

The non-GAAP financial measures presented in this press release

are used by management to make operational decisions, to forecast

future operational results, and for comparison with our business

plan, historical operating results and the operating results of our

peers. Reconciliations from net earnings and earnings per diluted

share (EPS) to adjusted net earnings and adjusted earnings per

diluted share (adjusted EPS) and from net earnings and net margin

to adjusted EBITDA and adjusted EBITDA margin, are contained in the

tables below.

Limitations of adjusted net earnings, adjusted earnings per

diluted share (adjusted EPS), adjusted EBITDA, and adjusted EBITDA

margin

Each of our non-GAAP measures have limitations as analytical

tools. They should not be viewed in isolation or as a substitute

for GAAP measures of earnings or cash flows. Limitations may

include the cash portion of interest expense, income tax (benefit)

provision, charges related to intangible asset amortization and

stock-based compensation expense. These items could significantly

affect our financial results.

Management believes these Non-GAAP financial measures are

important in evaluating our performance, results of operations, and

financial position. We use non-GAAP financial measures to

supplement our GAAP results to provide a more complete

understanding of the factors and trends affecting our business.

Adjusted net earnings, adjusted earnings per diluted share

(adjusted EPS), adjusted EBITDA, and adjusted EBITDA margin are not

alternatives to net earnings, earnings per diluted share or margin

as calculated and presented in accordance with GAAP. As such, they

should not be considered or relied upon as substitutes or

alternatives for any such GAAP financial measure. We strongly urge

you to review the reconciliations of adjusted net earnings,

adjusted earnings per diluted share (adjusted EPS), adjusted

EBITDA, and adjusted EBITDA margin along with our financial

statements included elsewhere in this press release. We also

strongly urge you not to rely on any single financial measure to

evaluate our business. In addition, because adjusted net earnings,

adjusted earnings per diluted share (adjusted EPS), adjusted

EBITDA, and adjusted EBITDA margin are not measures of financial

performance under GAAP and are susceptible to varying calculations,

the adjusted net earnings, adjusted earnings per diluted share

(adjusted EPS), adjusted EBITDA, and adjusted EBITDA margin

measures as presented in this press release may differ from and may

not be comparable to similarly titled measures used by other

companies.

Forward-Looking Non-GAAP Financial Measures

This release includes certain forward-looking non-GAAP financial

measures, including estimated adjusted earnings per diluted share

(estimated adjusted EPS). We have provided these non-GAAP measures

for future guidance for the same reasons that were outlined above

for historical non-GAAP measures.

We have reconciled non-GAAP forward-looking estimated adjusted

EPS to its most directly comparable GAAP measure. The

reconciliation from estimated net earnings per diluted share (EPS)

to estimated adjusted EPS is contained in the table below.

Key Performance Indicators

In addition to the foregoing non-GAAP measures, management uses

orders and backlog as key performance metrics to analyze and

measure the Company’s financial performance and results of

operations. Management uses orders and backlog as measures of

current and future business and financial performance, and these

may not be comparable with measures provided by other companies.

Orders represent written communications received from customers

requesting the Company to provide products and/or services. Backlog

is calculated based on firm purchase orders we receive for which

revenue has not yet been recognized. Management believes tracking

orders and backlog are useful as it often is a leading indicator of

future performance. In accordance with industry practice, contracts

may include provisions for cancellation, termination, or suspension

at the discretion of the customer.

Given that each of orders and backlog are operational measures

and that the Company’s methodology for calculating orders and

backlog does not meet the definition of a non-GAAP measure, as that

term is defined by the U.S. Securities and Exchange Commission, a

quantitative reconciliation for each is not required or

provided.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. These statements do not convey historical

information but relate to predicted or potential future events and

financial results, such as statements of the Company’s plans,

strategies and intentions, or our future performance or goals, that

are based upon management’s current expectations. These

forward-looking statements can often be identified by the use of

forward-looking terminology such as “appears,” “believe,”

“continue,” “could,” “expects,” “guidance,” “may,” “outlook,”

“will,” “should,” “plan,” “potential,” “forecasts,” “target,”

“estimates,” or similar terminology. These statements are subject

to risks and uncertainties that could cause actual results to

differ materially from those expressed or implied by such

statements. Such risks and uncertainties include, but are not

limited to, any mentioned in this press release as well as the

Company’s ability to execute on its 5-Point Strategy, realize the

potential benefits of acquisitions and successfully integrate any

acquired operations, grow the Company’s presence in its key target

and international markets, manage supply chain challenges, convert

backlog to sales and to ship product in a timely manner; the

success of the Company’s strategy to diversify its markets; the

impact of inflation on the Company’s business and financial

condition; indications of a change in the market cycles in the semi

market or other markets served; changes in business conditions and

general economic conditions both domestically and globally

including rising interest rates and fluctuation in foreign currency

exchange rates; changes in the demand for semiconductors; access to

capital and the ability to borrow funds or raise capital to finance

potential acquisitions or for working capital; changes in the rates

and timing of capital expenditures by the Company’s customers; and

other risk factors set forth from time to time in the Company’s

Securities and Exchange Commission filings, including, but not

limited to, the Annual Report on Form 10-K for the year ended

December 31, 2023. Any forward-looking statement made by the

Company in this press release is based only on information

currently available to management and speaks to circumstances only

as of the date on which it is made. The Company undertakes no

obligation to update the information in this press release to

reflect events or circumstances after the date hereof or to reflect

the occurrence of anticipated or unanticipated events, except as

required by law.

– FINANCIAL TABLES FOLLOW –

inTEST CORPORATION

Consolidated Statements of

Operations

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

As Restated

As Restated

Revenue

$

30,272

$

30,941

$

94,087

$

95,418

Cost of revenue

16,260

16,494

53,202

50,889

Gross profit

14,012

14,447

40,885

44,529

Operating expenses:

Selling expense

4,281

4,295

12,976

13,411

Engineering and product development

expense

2,182

1,802

6,382

5,689

General and administrative expense

7,062

5,882

20,212

16,099

Total operating expenses

13,525

11,979

39,570

35,199

Operating income

487

2,468

1,315

9,330

Interest expense

(219

)

(168

)

(612

)

(526

)

Other income

301

423

949

678

Earnings before income tax expense

569

2,723

1,652

9,482

Income tax expense

74

446

265

1,595

Net earnings

$

495

$

2,277

$

1,387

$

7,887

Earnings per common share - basic

$

0.04

$

0.19

$

0.11

$

0.70

Weighted average common shares outstanding

- basic

12,189,761

11,886,005

12,150,240

11,294,306

Earnings per common share - diluted

$

0.04

$

0.19

$

0.11

$

0.68

Weighted average common shares and common

share equivalents outstanding - diluted

12,251,712

12,212,317

12,246,763

11,665,850

inTEST CORPORATION

Consolidated Balance

Sheets

(In thousands)

September 30,

December 31,

2024

2023

(Unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

17,972

$

45,260

Trade accounts receivable, net of

allowance for credit losses of $419 and $474, respectively

28,357

18,175

Inventories

31,661

20,089

Prepaid expenses and other current

assets

3,212

2,254

Total current assets

81,202

85,778

Property and equipment:

Machinery and equipment

8,848

7,118

Leasehold improvements

4,205

3,601

Gross property and equipment

13,053

10,719

Less: accumulated depreciation

(8,480

)

(7,529

)

Net property and equipment

4,573

3,190

Right-of-use assets, net

11,292

4,987

Goodwill

32,475

21,728

Intangible assets, net

27,877

16,596

Deferred tax assets

-

1,437

Restricted certificates of deposit

100

100

Other assets

848

1,013

Total assets

$

158,367

$

134,829

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Current portion of Term Note and other

long-term debt

$

8,269

$

4,100

Current portion of operating lease

liabilities

1,947

1,923

Accounts payable

9,212

5,521

Accrued wages and benefits

5,009

4,156

Accrued professional fees

1,405

1,228

Customer deposits and deferred revenue

6,978

3,797

Accrued sales commissions

1,077

1,055

Domestic and foreign income taxes

payable

-

1,038

Other current liabilities

2,042

1,481

Total current liabilities

35,939

24,299

Operating lease liabilities, net of

current portion

9,649

3,499

Term Note and other long-term debt, net of

current portion

7,822

7,942

Contingent consideration

823

1,093

Deferred revenue, net of current

portion

1,208

1,331

Deferred tax liabilities

761

-

Other liabilities

1,789

384

Total liabilities

57,991

38,548

Commitments and Contingencies

Stockholders' equity:

Preferred stock, $0.01 par value;

5,000,000 shares authorized; no shares issued or outstanding

-

-

Common stock, $0.01 par value; 20,000,000

shares authorized; 12,453,957 and 12,241,925 shares issued,

respectively

124

122

Additional paid-in capital

57,218

54,450

Retained earnings

43,583

42,196

Accumulated other comprehensive

earnings

393

414

Treasury stock, at cost; 79,382 and 75,758

shares, respectively

(942

)

(901

)

Total stockholders' equity

100,376

96,281

Total liabilities and stockholders'

equity

$

158,367

$

134,829

inTEST CORPORATION

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Nine Months Ended

September 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

As Restated

Net earnings

$

1,387

$

7,887

Adjustments to reconcile net earnings to

net cash provided by (used in) operating activities:

Depreciation and amortization

4,469

3,515

Provision for excess and obsolete

inventory

509

385

Foreign exchange (gain) loss

(78

)

17

Amortization of deferred compensation

related to stock-based awards

1,450

1,623

Discount on shares sold under Employee

Stock Purchase Plan

20

21

Loss on disposal of property and

equipment

24

11

Proceeds from sale of rental equipment,

net of gain

148

153

Deferred income tax expense (benefit)

140

(1,101

)

Adjustment to contingent consideration

liability

-

(358

)

Changes in assets and liabilities:

Trade accounts receivable

(3,694

)

480

Inventories

(129

)

(9

)

Prepaid expenses and other current

assets

569

(313

)

Other assets

(27

)

(492

)

Operating lease liabilities

(1,173

)

(1,275

)

Accounts payable

(1,029

)

(100

)

Accrued wages and benefits

(533

)

125

Accrued professional fees

177

305

Customer deposits and deferred revenue

468

(105

)

Accrued sales commissions

25

(292

)

Domestic and foreign income taxes

payable

(817

)

(292

)

Other current liabilities

(360

)

320

Deferred revenue, net of current

portion

(123

)

1,033

Other liabilities

(189

)

(17

)

Net cash provided by operating

activities

1,234

11,521

CASH FLOWS FROM INVESTING

ACTIVITIES

Acquisition of business, net of cash

acquired

(18,727

)

-

Purchase of property and equipment

(1,161

)

(983

)

Net cash used in investing

activities

(19,888

)

(983

)

CASH FLOWS FROM FINANCING

ACTIVITIES

Net proceeds from public offering of

common stock

-

19,244

Repurchases of common stock

(1,042

)

-

Repayments of short-term borrowings

(1,856

)

-

Repayments of long-term borrowings

(5,475

)

(3,075

)

Proceeds from stock options exercised

145

978

Proceeds from shares sold under Employee

Stock Purchase Plan

111

118

Settlement of employee tax liabilities in

connection with treasury stock transaction

(41

)

(687

)

Net cash (used in) provided by

financing activities

(8,158

)

16,578

Effects of exchange rates on cash

(476

)

(7

)

Net cash (used in) provided by all

activities

(27,288

)

27,109

Cash, cash equivalents and restricted cash

at beginning of period

45,260

14,576

Cash and cash equivalents at end of

period

$

17,972

$

41,685

Cash payments for:

Domestic and foreign income taxes

$

1,147

$

2,988

Details of acquisition:

Fair value of assets acquired, net of

cash

$

36,055

Liabilities assumed

(25,838

)

Stock issued

(2,086

)

Goodwill resulting from acquisition

10,596

Net cash paid for acquisition

$

18,727

inTEST CORPORATION

Revenue by Market

(In thousands)

(Unaudited)

($ in 000s)

Three Months Ended

As Restated

Change

Change

9/30/2024

9/30/2023

$

%

6/30/2024

$

%

Revenue

Semi

$11,410

37.6%

$18,476

59.8%

$(7,066)

-38.2%

$10,124

29.8%

$1,286

12.7%

Industrial

3,534

11.7%

2,456

7.9%

1,078

43.9%

3,415

10.0%

119

3.5%

Auto/EV

6,250

20.6%

1,775

5.7%

4,475

252.1%

10,735

31.6%

(4,485)

-41.8%

Life Sciences

1,322

4.4%

1,330

4.3%

(8)

-0.6%

2,194

6.5%

(872)

-39.7%

Defense/Aerospace

3,239

10.7%

3,392

11.0%

(153)

-4.5%

3,682

10.8%

(443)

-12.0%

Security

666

2.2%

967

3.1%

(301)

-31.1%

792

2.3%

(126)

-15.9%

Other

3,851

12.7%

2,545

8.2%

1,306

51.3%

3,049

9.0%

802

26.3%

$30,272

100.0%

$30,941

100.0%

$(669)

-2.2%

$33,991

100.0%

$(3,719)

-10.9%

Orders by Market

(In thousands)

(Unaudited)

($ in 000s)

Three Months Ended

Change

Change

9/30/2024

9/30/2023

$

%

6/30/2024

$

%

Orders

Semi

$7,648

27.2%

$12,935

48.2%

$(5,287)

-40.9%

$11,026

42.1%

$(3,378)

-30.6%

Industrial

2,237

8.0%

1,637

6.1%

600

36.7%

3,485

13.4%

(1,248)

-35.8%

Auto/EV

7,141

25.5%

3,051

11.3%

4,090

134.1%

4,721

18.0%

2,420

51.3%

Life Sciences

534

1.9%

931

3.5%

(397)

-42.6%

1,025

3.9%

(491)

-47.9%

Defense/Aerospace

4,470

15.9%

3,032

11.3%

1,438

47.4%

2,665

10.2%

1,805

67.7%

Security

1,062

3.8%

2,212

8.2%

(1,150)

-52.0%

81

0.3%

981

1211.1%

Other

4,962

17.7%

3,056

11.4%

1,906

62.4%

3,179

12.1%

1,783

56.1%

$28,054

100.0%

$26,854

100.0%

$1,200

4.5%

$26,182

100.0%

$1,872

7.1%

inTEST CORPORATION

Segment Data

(In thousands)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

As Restated

As Restated

Revenue:

Electronic Test

$

15,481

$

11,547

$

42,756

$

32,911

Environmental Technologies

6,734

7,000

21,835

23,178

Process Technologies

8,057

12,394

29,496

39,329

Total Revenue

$

30,272

$

30,941

$

94,087

$

95,418

Division operating income:

Electronic Test

$

2,311

$

3,268

$

5,867

$

8,487

Environmental Technologies

426

523

1,434

2,479

Process Technologies

1,070

2, 094

4,001

7,362

Total division operating income

3,807

5,885

11,302

18,328

Corporate expenses

(2,376

)

(2,902

)

(7,551

)

(7,416

)

Acquired intangible amortization

(944

)

(515

)

(2,436

)

(1,582

)

Interest expense

(219

)

(168

)

(612

)

(526

)

Other income

301

423

949

678

Earnings before income tax

expense

$

569

$

2,723

$

1,652

$

9,482

inTEST CORPORATION Reconciliation of

Non-GAAP Financial Measures (In thousands, except per share

and percentage data) (Unaudited)

Reconciliation of Net Earnings to Adjusted Net Earnings

(Non-GAAP) and Earnings Per Diluted Share to Adjusted EPS

(Non-GAAP):

Three Months Ended

9/30/2024

9/30/2023

6/30/2024

As Restated

Net earnings

$495

$2,277

$230

Acquired intangible amortization

944

515

897

Tax adjustments

(223)

(85)

(168)

Adjusted net earnings

(Non-GAAP)

$1,216

$2,707

$959

Diluted weighted average shares

outstanding

12,252

12,212

12,330

Earnings per diluted share:(1)

Net earnings

$0.04

$0.19

$0.02

Acquired intangible amortization

0.08

0.04

0.07

Tax adjustments

(0.02)

(0.01)

(0.01)

Adjusted EPS (Non-GAAP)

$0.10

$0.22

$0.08

(1)

Components may not add up to totals due to

rounding.

Reconciliation of Net Earnings and Net Margin to Adjusted

EBITDA (Non-GAAP) and Adjusted EBITDA Margin

(Non-GAAP):

Three Months Ended

9/30/2024

9/30/2023

6/30/2024

As Restated

Net earnings

$495

$2,277

$230

Acquired intangible amortization

944

515

897

Net interest (income) expense

36

(276)

41

Income tax expense

74

446

66

Depreciation

355

262

356

Non-cash stock-based compensation

537

544

564

Adjusted EBITDA (Non-GAAP)

$2,441

$3,768

$2,154

Revenue

30,272

30,941

33,991

Net margin

1.6%

7.4%

0.7%

Adjusted EBITDA margin

(Non-GAAP)

8.1%

12.2%

6.3%

Reconciliation of Fourth Quarter 2024 Estimated Earnings Per

Diluted Share to Estimated Adjusted EPS (Non-GAAP):

Estimated

Estimated earnings per diluted

share

~$0.08

Estimated acquired intangible

amortization

~0.08

Estimated tax adjustments

~(0.02)

Estimated adjusted EPS

(Non-GAAP)

~$0.14

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241101843944/en/

inTEST Corporation Duncan Gilmour Chief Financial Officer

and Treasurer Tel: (856) 505-8999

Investors: Deborah K. Pawlowski Alliance Advisors IR

dpawlowski@allianceadvisors.com Tel: (716) 843-3908

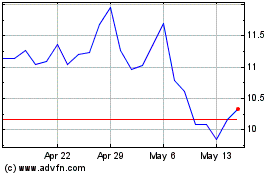

inTest (AMEX:INTT)

Historical Stock Chart

From Oct 2024 to Nov 2024

inTest (AMEX:INTT)

Historical Stock Chart

From Nov 2023 to Nov 2024