Zacks #2 Ranked Industrial ETF in Focus - ETF News And Commentary

November 26 2012 - 7:15AM

Zacks

With the implementation of the third round of quantitative

easing (QE3) and the extension of operation twist aimed at keeping

long term borrowing costs low, the markets seem to be flooded with

liquidity. Many are hoping that these low borrowing costs will

ensure high levels of consumption, and thus jumpstart the economy

heading into 2013.

At least on some level, this appears to be working as many are

starting to spend again. After all, there is rising consumer

confidence, an increase in employment levels and growing personal

consumption expenditure (PCE) that the U.S. economy has seen of

late. With this backdrop one could argue that the much-condemned

efforts of the central bank have not gone in vain (read Spending is

Surging: Stock Up on These ETFs).

Everything seemed to be going as planned until ‘Superstorm’

Sandy showed up and created havoc mostly along the eastern region

of the US. While it had its effects in almost all sectors of the

economy, primarily the energy and industrial sector have been the

worst affected (see Time to Buy the Oil Equipment ETFs?).

Nevertheless, the industrial sector seemed to be enjoying a

decent run this fiscal both in terms of earnings growth and stock

market performance. Industrials are one of the leading contributors

in terms of earnings growth as well as the bull run in the market

(read State Street Debuts Unique Momentum and Value ETFs).

However, the industry had faced a severe hiccup on account of

the hurricane as industrial production slumped by 0.4% in October

after an increase of 20 basis points in the preceding month

(according to the data provided by the Federal Reserve).

This has gone a long way in hurting investor confidence as the

sector companies witnessed sell offs after the hurricane episode.

Nevertheless, with the holiday season approaching and the housing

sector recovery constituting definite key positives going forward,

as the top lines are expected to increase on account of increased

demand for intermediate products.

Investors can easily target the producers of these intermediate

products by playing the industrial sector. This segment could be a

less bid up way to play the market, while still targeting positive

trends (see ETFs That We Are Thankful For).

Given this, a look at a top ranked industrial ETF could be the

way to target the best of the segment with lower levels of

risk.

About the Zacks ETF Rank

The Zacks ETF Rank provides a recommendation for the ETF in the

context of our outlook of the underlying industry, sector, style

box, or asset class. Our proprietary methodology also takes into

account the risk preferences of investors as well.

The aim of our models is to select the best ETFs within each

risk category. We assign each ETF one of five ranks within each

risk bucket. Thus, Zacks Rank reflects the expected return of an

ETF relative to other ETFs with similar level of risk.

Using this strategy, we have found an ETF Ranked 2 or ‘Buy’ in

the Industrial Sector which we have highlighted in greater detail

below:

Industrial Select Sector SPDR

(XLI)

Launched in December of 1998, XLI tracks the performance of

companies listed in the S&P 500 which belong to the industrial

sector. The ETF has had a decent run so far this year returning

around 9% as of 20th November 2012, compared to the S&P 500

returning 10.35% for the same time period (see more in the

Zacks ETF Center).

The ETF had been hit hard by the fall in industrial production

which has affected the overall sector. This coupled with the sharp

post-election sell-off from the equity markets have led to lose a

bit in AUM for much of November.

XLI has an asset base of around $3.24 billion and does an

average volume of around 14 million shares daily. It charges

investors 18 basis points in fees and expenses and pays out a yield

of 2.19%. It holds around 64 securities in its portfolio with

around 50% allocation in the top 10 holdings (read Forget Interest

Rate Risk with These Bond ETFs).

In terms of individual holdings, General Electric Co. accounts

for a lion’s share of its portfolio with around 12.5% allocation.

United Technologies Corp (5.19%), Union Pacific Corp., (4.80%) and

3M Co. (4.54%) are some of its other top holdings.

From a risk analysis point of view, XLI has a relatively lower

annualized standard deviation of 22.50%. This reflects our

‘Low’ risk outlook for the ETF along with a

Zacks Rank of 2 or ‘Buy’, suggesting this could be

a less volatile way to target the market as we head into 2013.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-INDU SELS (XLI): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

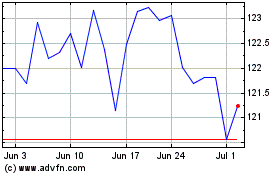

Industrial Select Sector (AMEX:XLI)

Historical Stock Chart

From May 2024 to Jun 2024

Industrial Select Sector (AMEX:XLI)

Historical Stock Chart

From Jun 2023 to Jun 2024