Current Report Filing (8-k)

October 28 2022 - 8:08AM

Edgar (US Regulatory)

false 0000049938 0000049938 2022-10-28 2022-10-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 28, 2022

IMPERIAL OIL LIMITED

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Canada |

|

0-12014 |

|

98-0017682 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 505 Quarry Park Boulevard S.E., Calgary, Alberta |

|

T2C 5N1 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 1-800-567-3776

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| [ ] |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [✓] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading symbol |

|

Name of each exchange on

which registered |

| None |

|

|

|

None |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

On October 28, 2022, Imperial Oil Limited (the “company”) by means of a press release announced the intention to initiate a substantial issuer bid pursuant to which the company will offer to purchase for cancellation up to $1,500,000,000 of its common shares. A copy of the press release is attached as Exhibit 99.1 to this report.

The tender offer described in this communication (the “Offer”) has not yet commenced. This communication is for informational purposes only. This communication is not a recommendation to buy or sell Imperial Oil Limited shares or any other securities, and it is neither an offer to purchase nor a solicitation of an offer to sell Imperial Oil Limited Shares or any other securities.

On the commencement date of the Offer, Imperial Oil Limited will file an offer to purchase, accompanying issuer bid circular and related letter of transmittal and notice of guaranteed delivery (the “Offering Documents”) with Canadian securities regulatory authorities and mail these to the company’s shareholders. The company will also file a tender offer statement on Schedule TO, including the Offering Documents, with the United States Securities and Exchange Commission (the “SEC”). The Offer will only be made pursuant to the Offering Documents filed with Canadian securities regulatory authorities and as a part of the Schedule TO. Shareholders should read carefully the Offering Documents because they contain important information, including the various terms of, and conditions to, the Offer. Once the Offer is commenced, shareholders will be able to obtain a free copy of the tender offer statement on Schedule TO, the Offering Documents and other documents that Imperial Oil Limited will be filing with the SEC at the SEC’s website at www.sec.gov, with Canadian securities regulatory authorities at www.sedar.com, or from Imperial Oil Limited’s website at www.imperialoil.ca.

| Item 9.01 |

Financial Statements and Exhibits. |

The following exhibit is furnished as part of this report on Form 8-K:

|

|

|

|

|

|

|

99.1

|

|

News release of the company on October 28, 2022 announcing the intention to initiate a substantial issuer bid pursuant to which the company will offer to purchase for cancellation up to $1,500,000,000 of its common shares. |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPERIAL OIL LIMITED |

|

|

|

|

|

|

|

| Date: October 28, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Ian Laing |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

Ian Laing |

|

|

|

|

|

|

Title: |

|

Vice-president, general counsel and corporate secretary |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Cathryn Walker |

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

Cathryn Walker |

|

|

|

|

|

|

Title: |

|

Assistant corporate secretary |

|

|

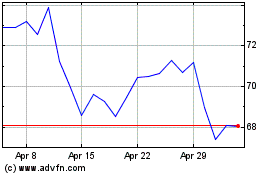

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024