Canadian Senate: No Offshore Drilling Ban Needed

August 18 2010 - 2:18PM

Dow Jones News

The risk of an oil spill in Canadian waters similar to the

disaster in the Gulf of Mexico is low enough that the government

shouldn't ban offshore drilling, the Canadian Senate said

Wednesday.

The Senate's Committee on Energy, the Environment and Natural

Resources released a report of its findings on the safety of

Canada's offshore oil and gas drilling after conducting six weeks

of hearings.

"We wanted to find out if there was any imminent danger, and we

found that there was not," said Sen. David Angus, who chairs the

committee, during a press conference in Ottawa. "We were satisfied

that the safety precautions and oversight of the operations were

adequate."

Angus said there is only one offshore well being drilled in

Canada, by Chevron Corp. (CVX) 420 kilometers off the coast of

Newfoundland.

Chevron's well is being drilled in even deeper waters than in

the Macondo field where a rig leased by BP Plc (BP, BP.LN) exploded

in April, leaking hundreds of thousands of barrels of oil into the

Gulf. But the committee said in its report that Chevron was

operating safely and recommended that the "Chevron operation

continue as planned."

The senators also said safety precautions for Canada's existing

offshore oil and gas operations off the east coast were robust, and

in some cases stronger than U.S. regulations.

"There is a much stronger chain of command [in Canada] for when

the government can take over a spill than there was in the BP

Macondo incident," said Sen. Grant Mitchell, a liberal lawmaker

from Alberta who was the deputy chair of the bipartisan

committee.

However, the committee did not investigate the potential safety

issues of deep-water drilling in Canada's arctic, saying it was up

to the National Energy Board, Canada's federal energy regulator, to

investigate those issues. Drilling relief wells and other disaster

relief efforts would be more difficult in the arctic due to the

remote location and extreme weather.

Canada has sold leases for offshore arctic exploration to BP

Plc, Exxon Mobil Corp. (XOM) and Imperial Oil Ltd. (IMO, IMO.T),

but the companies aren't allowed to begin actual exploration until

they get NEB approval.

The Senate committee's report issued two notable recommendations

for future study. It said that the potential for conflicts of

interest at provincial energy regulators that both regulate and

promote offshore oil and gas development should be studied.

It also recommended that guidelines be established for when

producers should be required to drill relief wells as a safety

precaution.

About 12% of Canada's conventional oil comes from offshore

drilling in the country's east coast, and it has revitalized the

economies of Newfoundland and Nova Scotia. About one in every 20

jobs in Newfoundland comes from the oil and gas industry, Mitchell

said.

-By Edward Welsch, Dow Jones Newswires; 403-229-9095;

edward.welsch@dowjones.com

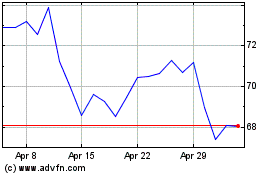

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Imperial Oil (AMEX:IMO)

Historical Stock Chart

From Jul 2023 to Jul 2024