UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

UNDER THE SECURITIES EXCHANGE ACT OF 1934

HNR ACQUISITION CORP

(Name of Issuer)

Class A Common Stock, par value $0.0001 per

share

(Title of Class of Securities)

40472A102

(CUSIP Number)

Kirk Pogoloff

c/o Pogo Royalty, LLC

4809 Cole Avenue, Suite 200

Dallas, TX 75205

(214) 871-6812

With a copy to:

Bryan Henderson

Baker Botts L.L.P.

2001 Ross Avenue, Suite 900

Dallas, TX 75201

November 15, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See § 240.13d-7 for other parties to whom copies are to

be sent.

| * | The remainder of this cover page

shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No. 40472A102

| 1. |

Name of Reporting Person

Pogo Royalty, LLC |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Texas |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,010,000(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

2,010,000(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,010,000(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

29.1%(2) |

| 14. |

Type of Reporting Person

OO |

| (1) | Pogo Royalty, LLC, a Texas limited

liability company (“Pogo Royalty”), directly holds (i) 1,800,000 shares of Class B common stock, $0.0001 par value per share

(“Class B Common Stock”), of HNR Acquisition Corp, a Delaware corporation (the “Issuer”), and an equivalent number

of Class B common units (the “OpCo Class B Units”) of HNRA Upstream, LLC, a Delaware limited liability company (“OpCo”),

which together are exchangeable for shares of Class A common stock, $0.0001 par value per share (“Class A Common Stock”)

on a one-for-one basis, of the Issuer and (ii) 210,000 shares of Class A Common Stock of the Issuer (such shares of Class A Common Stock

referenced in (i) and (ii) above, the “Reported Securities”). |

| (2) | Calculated based on an assumed

combined total of 6,897,009 shares of common stock outstanding. This assumed combined total outstanding of the Issuer (i) consists of

5,097,009 shares of Class A Common Stock outstanding as of November 16, 2023, as reported on the Issuer’s Form 8-K filed with the

Securities and Exchange Commission (the “Commission”) on November 21, 2023, and (ii) assumes that all 1,800,000 shares of

Class B Common Stock directly held by Pogo Royalties (along with an equivalent number of OpCo Class B Units) were exchanged for newly-issued

shares of Class A Common Stock on a one-for-one basis. |

CUSIP No. 40472A102

| 1. |

Name of Reporting Person

CIC Pogo LP |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,010,000(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

2,010,000(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,010,000(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

29.1%(2) |

| 14. |

Type of Reporting Person

PN |

| (1) | CIC Pogo LP, a Delaware limited

partnership (“CIC Pogo”), is the controlling member of Pogo Royalty. Pogo Royalty directly holds the Reported Securities

(see Footnote 1 on Page 2 above). Therefore, CIC Pogo LP may be deemed to beneficially own all or a portion of the Reported Securities

that are directly held by Pogo Royalty. This statement shall not be deemed an admission that CIC Pogo is the beneficial owner of the

Reported Securities for the purposes of Section 13(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or any other purpose. |

| (2) | Calculated based on an assumed

combined total of 6,897,009 shares of common stock outstanding. This assumed combined total outstanding of the Issuer (i) consists of

5,097,009 shares of Class A Common Stock outstanding as of November 16, 2023, as reported on the Issuer’s Form 8-K filed with Commission

on November 21, 2023, and (ii) assumes that all 1,800,000 shares of Class B Common Stock directly held by Pogo Royalties (along with

an equivalent number of OpCo Class B Units) were exchanged for newly-issued shares of Class A Common Stock on a one-for-one basis. |

CUSIP No. 40472A102

| 1. |

Name of Reporting Person

CIC IV GP LLC |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,010,000(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

2,010,000(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,010,000(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

29.1%(2) |

| 14. |

Type of Reporting Person

OO |

| (1) | CIC IV GP LLC, a Delaware limited

liability company (“CIC GP”), is the general partner of CIC Pogo, which is the controlling member of Pogo Royalty. Pogo Royalty

directly holds the Reported Securities (see Footnote 1 on Page 2 above). Therefore, CIC GP may be deemed to beneficially own all or a

portion of the Reported Securities that are directly held by Pogo Royalty. This statement shall not be deemed an admission that CIC GP

is the beneficial owner of the Reported Securities for the purposes of Section 13(d) of the Exchange Act, or any other purpose. |

| (2) | Calculated based on an assumed

combined total of 6,897,009 shares of common stock outstanding. This assumed combined total outstanding of the Issuer (i) consists of

5,097,009 shares of Class A Common Stock outstanding as of November 16, 2023, as reported on the Issuer’s Form 8-K filed with Commission

on November 21, 2023, and (ii) assumes that all 1,800,000 shares of Class B Common Stock directly held by Pogo Royalties (along with

an equivalent number of OpCo Class B Units) were exchanged for newly-issued shares of Class A Common Stock on a one-for-one basis. |

CUSIP No. 40472A102

| 1. |

Name of Reporting Person

CIC Partners Firm LP |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,010,000(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

2,010,000(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,010,000(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

29.1%(2) |

| 14. |

Type of Reporting Person

PN |

| (1) | CIC Partners Firm LP, a Delaware

limited partnership (“Firm LP”), is the sole member of CIC GP, which is the general partner of CIC Pogo, which is the controlling

member of Pogo Royalty. Pogo Royalty directly holds the Reported Securities (see Footnote 1 on Page 2 above). Therefore, Firm LP may

be deemed to beneficially own all or a portion of the Reported Securities that are directly held by Pogo Royalty. This statement shall

not be deemed an admission that Firm LP is the beneficial owner of the Reported Securities for the purposes of Section 13(d) of

the Exchange Act, or any other purpose. |

| (2) | Calculated based on an assumed

combined total of 6,897,009 shares of common stock outstanding. This assumed combined total outstanding of the Issuer (i) consists of

5,097,009 shares of Class A Common Stock outstanding as of November 16, 2023, as reported on the Issuer’s Form 8-K filed with Commission

on November 21, 2023, and (ii) assumes that all 1,800,000 shares of Class B Common Stock directly held by Pogo Royalties (along with

an equivalent number of OpCo Class B Units) were exchanged for newly-issued shares of Class A Common Stock on a one-for-one basis. |

CUSIP No. 40472A102

| 1. |

Name of Reporting Person

CIC Partners Firm GP LLC |

| 2. |

Check the Appropriate Box if a Member of a Group

(a) ☐

(b) ☐ |

| 3. |

SEC Use Only

|

| 4. |

Source of Funds

OO |

| 5. |

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items

2(d) or 2(e)

☐ |

| 6. |

Citizenship or Place of Organization

Delaware |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

7. |

Sole Voting Power

0 |

| 8. |

Shared Voting Power

2,010,000(1) |

| 9. |

Sole Dispositive Power

0 |

| 10. |

Shared Dispositive Power

2,010,000(1) |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person

2,010,000(1) |

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares

☐ |

| 13. |

Percent of Class Represented by Amount in Row (11)

29.1%(2) |

| 14. |

Type of Reporting Person

OO |

| (1) | CIC Partners Firm GP LLC, a Delaware

limited liability company (“CIC Firm GP”), is the general partner of Firm LP, which is the sole member of CIC GP, which is

the general partner of CIC Pogo, which is the controlling member of Pogo Royalty. Pogo Royalty directly holds the Reported Securities

(see Footnote 1 on Page 2 above). Therefore, CIC Firm GP may be deemed to beneficially own all or a portion of the Reported Securities

that are directly held by Pogo Royalty. This statement shall not be deemed an admission that CIC Firm GP is the beneficial owner of the

Reported Securities for the purposes of Section 13(d) of the Exchange Act, or any other purpose. |

| (2) | Calculated based on an assumed

combined total of 6,897,009 shares of common stock outstanding. This assumed combined total outstanding of the Issuer (i) consists of

5,097,009 shares of Class A Common Stock outstanding as of November 16, 2023, as reported on the Issuer’s Form 8-K filed with Commission

on November 21, 2023, and (ii) assumes that all 1,800,000 shares of Class B Common Stock directly held by Pogo Royalties (along with

an equivalent number of OpCo Class B Units) were exchanged for newly-issued shares of Class A Common Stock on a one-for-one basis. |

Item 1. Security and Issuer

This statement on Schedule 13D (the “Schedule

13D”) relates to the shares of Class A common stock, $0.0001 par value per share (“Class A Common Stock”) of HNR Acquisition

Corp, a Delaware corporation (the “Issuer”). The principal executive office of the Issuer is located at 3730 Kirby Drive,

Suite 1200, Houston, TX 77098. The Issuer’s shares of Class A Common Stock are listed on the NYSE American under the symbol “HNRA”.

Item 2. Identity and Background

This Schedule 13D is being filed by Pogo Royalty,

LLC, a Texas limited liability company (“Pogo Royalty”), CIC Pogo LP, a Delaware limited partnership (“CIC Pogo”),

CIC IV GP LLC, a Delaware limited liability company (“CIC GP”), CIC Partners Firm LP, a Delaware limited partnership (“CIC

Firm LP”) and CIC Partners Firm GP LLC, a Delaware limited liability company (“CIC Firm GP”). Pogo Royalty, CIC Pogo,

CIC GP, CIC Firm LP and CIC Firm GP are sometimes referred to in this Schedule 13D individually as a “Reporting Person” and,

collectively, they are referred to herein as the “Reporting Persons.” CIC Pogo, CIC GP and CIC Firm LP, collectively, are

referred to herein as the “CIC Entities.”

The principal business of Pogo Royalty is its investment

in the securities of the Issuer. The principal business of each of the CIC Entities and CIC Firm GP is to either invest in securities

or serve as a general partner or management company of an entity that invests in securities. The address of the principal office of Pogo

Royalty is 4809 Cole Avenue, Suite 200, Dallas, TX 75205. The address of the principal office of the CIC Entities and CIC Firm GP is 3879

Maple Avenue, Suite 400, Dallas, Texas, 75219.

Information regarding the executive officers, managers

or other control persons of Pogo Royalty, the CIC Entities and CIC Firm GP is set forth on Schedule A, Schedule B and Schedule

C, respectively, attached hereto. Schedule A, Schedule B and Schedule C attached hereto set forth the following

information as to each such person:

| (ii) | residence or business address; |

| (iii) | present principal occupation or employment and the name, principal

business and address of any corporation or other organization in which such employment is conducted; and |

During the last five years, to the best of the

Reporting Person’s knowledge, no person named on Schedule A, Schedule B or Schedule C attached hereto, has been (a) convicted in

a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) a party to civil proceeding of a judicial or administrative

body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future

violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect

to such laws.

Item 3. Source and Amount of Funds or Other Consideration

On November 15, 2023, the Issuer consummated the

previously announced acquisition (the “Closing”) pursuant to that certain Amended and Restated Membership Interest Purchase

Agreement, dated as of August 28, 2023 (the “A&R MIPA”), by and among CIC Pogo, DenCo Resources, LLC, a Texas limited

liability company (“DenCo”), Pogo Resources Management, LLC, a Texas limited liability company (“Pogo Management”),

4400 (together with CIC Pogo, DenCo and Pogo Management, collectively, “Seller” and each a “Seller”), the Issuer,

HNRA Upstream, LLC, a Delaware limited liability company (“OpCo”), HNRA Partner, Inc., a Delaware corporation (together with

the Issuer and OpCo, collectively, “Buyer” and each a “Buyer”) and, solely with respect to Section 6.20 of the

A&R MIPA, HNRAC Sponsors LLC, a Delaware limited liability company (“Sponsor”). Immediately upon the Closing and pursuant

to its terms, OpCo (i) issued 2,000,000 Class B common units of OpCo (the “OpCo Class B Units”), equal to and exchangeable

into 2,000,000 shares of Class A Common Stock, (ii) issued 1,500,000 preferred units (the “OpCo Preferred Units”), convertible

into OpCo Class B Units pursuant to the terms of the A&R OpCo LLC Agreement and (iii) sold, contributed, assigned and conveyed 2,000,000

shares of Class B common stock, par value $0.0001 per share, of the Issuer (the “Class B Common Stock”), to Pogo Royalty.

The foregoing description of the A&R MIPA is not complete and is qualified in its entirety by reference to the copy thereof filed

as Exhibit 2.2 hereto, which is incorporated herein by reference.

In connection with the Closing, HNRA Royalties,

LLC, a Delaware limited liability company and a wholly-owned subsidiary of the Issuer (“HNRA Royalties”) and Pogo Royalty

entered into that certain Option Agreement, dated as of November 15, 2023. Pogo Royalty owns certain overriding royalty interests in certain

oil and gas assets owned by Pogo Resources, LLC (the “ORR Interest”). Pursuant to the Option Agreement, in exchange for 10,000

shares of Class A Common Stock, Pogo Royalty granted an irrevocable and exclusive option to HNRA Royalties to purchase the ORR Interest

for the Option Price (as defined below) at any time prior to November 15, 2024. The purchase price for the ORR Interest upon exercise

of the option is: (i) (1) $30,000,000 the (“Base Option Price”), plus (2) an additional amount equal to interest on the Base

Option Price of twelve percent (12%), compounded monthly, from November 15, 2023 through the date of acquisition of the ORR Interest,

minus (ii) any amounts received by Pogo Royalty in respect of the ORR Interest from the month of production in which the effective date

of the Option Agreement occurs through the date of the exercise of the option (such aggregate purchase price, the “Option Price”).

The Option Agreement and the option will immediately terminate upon the earlier of (a) Pogo Royalty’s transfer or assignment of

all of the ORR Interest in accordance with the Option Agreement and (b) November 15, 2024. The foregoing description of the Option Agreement

is not complete and is qualified in its entirety by reference to the copy thereof filed as Exhibit 10.1 hereto, which is incorporated

herein by reference.

In connection with the Closing, Pogo exercised

the OpCo Exchange Right (as defined below) as it relates to 200,000 shares of Class B Common Stock and 200,000 OpCo Class B Units.

The information set forth in Item 4 and Item 6 of this Schedule 13D

is incorporated by reference herein.

Item 4. Purpose of Transaction

The Reporting Persons intend to review their investment

in the Issuer on an ongoing basis and, in the course of their review, may take actions (including through one or more of their affiliates)

with respect to their investment or the Issuer, including communicating with the board of directors of the Issuer (the “Board”),

members of management or other security-holders of the Issuer, or other third parties from time to time, and taking steps to explore,

prepare for or implement a course of action, including, without limitation, engaging advisors, including legal, financial, regulatory,

technical and/or industry advisors, to assist in any review, evaluating strategic alternatives as they may become available and entering

into confidentiality, standstill or other similar agreements with the Issuer, its subsidiaries and/or any advisors or third parties. Such

discussions and other actions may relate to, subject to the terms and conditions of the documents described herein to which the Reporting

Persons are a party, various alternative courses of action, including, without limitation, those related to an extraordinary corporate

transaction (including, but not limited to a merger, reorganization or liquidation) involving the Issuer or any of its subsidiaries; business

combinations involving the Issuer or any of its subsidiaries; a sale or transfer of a material amount of assets of the Issuer or any of

its subsidiaries; material asset purchases; the formation of joint ventures with the Issuer or any of its subsidiaries or the entry into

other material projects; changes in the present business, operations, strategy, future plans or prospects of the Issuer, financial or

governance matters; changes to the Board (including Board composition) or management of the Issuer; acting as a participant in debt or

equity financings of the Issuer or any of its subsidiaries; changes to the capitalization, ownership structure, dividend policy, business

or corporate structure or governance documents of the Issuer; de-listing or de-registration of the Issuer’s securities, or any action

similar to those enumerated above. The Reporting Persons may participate in an auction or similar process regarding any such courses of

action (including, but not limited to, an extraordinary corporate transaction) with respect to the Issuer or its subsidiaries, including

submitting an indication of interest, letter of intent, term sheet, offer letter or other similar expression of interest and in connection

therewith; engaging advisors; communicating with the Issuer, its subsidiaries and other third parties (including various advisors), taking

actions regarding prospective financing for any such course of action, including, without limitation, exchanging information, negotiating

terms and entering into commitment letters and related agreements and/or any other similar agreements; and preparing, revising, negotiating

into agreements with Issuer and its subsidiaries. Such discussions and actions may be preliminary and exploratory in nature, and not rise

to the level of a plan or proposal.

In connection with the Closing, the Issuer entered

into that certain Director Nomination and Board Observer Agreement (the “Board Designation Agreement”) with CIC Pogo. Pursuant

to the Board Designation Agreement, CIC Pogo has the right, at any time CIC Pogo beneficially owns capital stock of the Issuer, to appoint

two board observers to attend all meetings of the board of directors of the Issuer. In addition, after the time of the conversion of the

OpCo Preferred Units owned by Pogo Royalty, CIC Pogo will have the right to nominate a certain number of members of the Board depending

on Pogo Royalty’s ownership percentage of Class A Common Stock as further provided in the Board Designation Agreement. The foregoing

description of the Board Designation Agreement is not complete and is qualified in its entirety by reference to the copy thereof filed

as Exhibit 10.5 hereto, which is incorporated herein by reference.

Except to the extent the foregoing may be deemed

a plan or proposal, the Reporting Persons do not have any current plans or proposals which relate to, or could result in, any of the matters

referred to in paragraphs (a) through (j), inclusive, of Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time

to time, review or reconsider their position and/or change their purpose and/or formulate plans or proposals with respect thereto.

The information set forth in Items 5 and 6 of this Schedule 13D is

incorporated by reference herein.

Item 5. Interest in Securities of the Issuer

(a)-(b) The

information contained on the cover pages to this Schedule 13D is incorporated herein by reference.

Pogo Royalty directly holds (i) 1,800,000 shares

of Class B Common Stock and an equivalent number of OpCo Class B Units, which together are exchangeable for shares of Class A Common Stock

and (ii) 210,000 shares of Class A Common Stock (such shares of Class A Common Stock referenced in (i) and (ii) above, the “Reported

Securities”). CIC Pogo, in its capacity as the controlling member of Pogo Royalty, has the ability to direct the management of Pogo

Royalty’s business regarding the vote and disposition of securities held by Pogo Royalty; therefore for

the purposes of Rule 13d-3 promulgated under the Exchange Act, CIC Pogo may be deemed to have indirect beneficial ownership

of the Reported Securities owned by Pogo Royalty. CIC GP, in its capacity as general partner of CIC Pogo, has the ability to direct the

management of CIC Pogo’s business regarding the vote and disposition of securities held by Pogo Royalty; therefore for

the purposes of Rule 13d-3 promulgated under the Exchange Act, CIC GP may be deemed to have indirect beneficial ownership of

the Reported Securities owned by Pogo Royalty. CIC Firm LP, in its capacity as sole member of CIC GP, has the ability to direct the management

of CIC GP’s business regarding the vote and disposition of securities held by Pogo Royalty; therefore for

the purposes of Rule 13d-3 promulgated under the Exchange Act, CIC Firm LP may be deemed to have indirect beneficial ownership

of the Reported Securities owned by Pogo Royalty. CIC Firm GP, in its capacity as general partner of CIC Firm LP, has the ability to direct

the management of CIC Firm LP’s business regarding the vote and disposition of securities held by Pogo Royalty; therefore for

the purposes of Rule 13d-3 promulgated under the Exchange Act, CIC Firm GP may be deemed to have indirect beneficial ownership

of the Reported Securities owned by Pogo Royalty.

The filing of this statement shall not be construed

as an admission by any Reporting Person that such person is, for the purposes of sections 13(d) or 13(g) of the Exchange Act, the beneficial

owner of any securities covered by this statement.

(c) The information provided or incorporated by

reference in Item 3 is incorporated by reference herein.

(d) No person other than the Reporting Persons

have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Class

A Common Stock reported on this Schedule 13D.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer

The information provided or incorporated by reference in Items 3 and

4 is incorporated by reference herein.

First Amendment to Amended and Restated Membership Interest Purchase

Agreement

On November 15, 2023, Buyer, Seller and Sponsor

entered into that certain First Amendment to Amended and Restated Membership Interest Purchase Agreement (the “MIPA Amendment”),

pursuant to which Buyer, Seller and Sponsor agreed to extend the outside date for the transaction to November 30, 2023, and to place 500,000

shares of Class B Common Stock into escrow instead of 500,000 OpCo Class B Units. The foregoing description of the MIPA Agreement is not

complete and is qualified in its entirety by reference to the copy thereof filed as Exhibit 2.2 hereto, which is incorporated herein by

reference.

Option Agreement

In connection with the Closing, HNRA Royalties and Pogo Royalty entered

into the Option Agreement. Pogo Royalty owns certain overriding royalty interests in certain oil and gas assets owned by Pogo (the “ORR

Interest”). Pursuant to the Option Agreement, in exchange for 10,000 shares of Class A Common Stock, Pogo Royalty granted an irrevocable

and exclusive option to HNRA Royalties to purchase the ORR Interest for the Option Price (as defined below) at any time prior to November

15, 2024.

The purchase price for the ORR Interest upon exercise of the option

is: (i) (1) $30,000,000 the (“Base Option Price”), plus (2) an additional amount equal to interest on the Base Option Price

of twelve percent (12%), compounded monthly, from November 15, 2023 through the date of acquisition of the ORR Interest, minus (ii) any

amounts received by Pogo Royalty in respect of the ORR Interest from the month of production in which the effective date of the Option

Agreement occurs through the date of the exercise of the option (such aggregate purchase price, the “Option Price”).

The Option Agreement and the option will immediately terminate upon

the earlier of (a) Pogo Royalty’s transfer or assignment of all of the ORR Interest in accordance with the Option Agreement and

(b) November 15, 2024. The foregoing description of the Option Agreement is not complete and is qualified in its entirety by reference

to the copy thereof filed as Exhibit 10.1 hereto, which is incorporated herein by reference.

OpCo A&R LLC Agreement

In connection with the Closing, the Issuer and Pogo Royalty, entered

into an amended and restated limited liability company agreement of OpCo (the “A&R OpCo LLC Agreement”). Pursuant to the

A&R OpCo LLC Agreement, each OpCo unitholder (excluding the Issuer) will, subject to certain timing procedures and other conditions

set forth therein, have the right (the “OpCo Exchange Right”) to exchange all or a portion of its OpCo Class B Units for,

at OpCo’s election, (i) shares of Class A Common Stock at an exchange ratio of one share of Class A Common Stock for each OpCo Class

B Unit exchanged, subject to conversion rate adjustments for stock splits, stock dividends and reclassifications and other similar transactions,

or (ii) an equivalent amount of cash. Additionally, the holders of OpCo Class B Units will be required to exchange all of their OpCo Class

B Units (a “Mandatory Exchange”) upon the occurrence of the following: (i) upon the direction of the Issuer with the consent

of at least fifty percent (50%) of the holders of OpCo Class B Units; or (ii) upon the one-year anniversary of the Mandatory Conversion

Trigger Date (as defined below). In connection with any exchange of OpCo Class B Units pursuant to the OpCo Exchange Right or acquisition

of OpCo Class B Units pursuant to a Mandatory Exchange, a corresponding number of shares of Class B Common Stock held by the relevant

OpCo unitholder will be cancelled.

The OpCo Preferred Units will be automatically converted into OpCo

Class B Units on the two-year anniversary of the issuance date of such OpCo Preferred Units (the “Mandatory Conversion Trigger Date”)

at a rate determined by dividing (i) $20.00 per unit (the “Stated Conversion Value”), by (ii) the Market Price of the Class

A Common Stock (the “Conversion Price”). The “Market Price” means the simple average of the daily VWAP of the

Class A Common Stock during the five (5) trading days prior to the date of conversion. On the Mandatory Conversion Trigger Date, the Issuer

will issue a number of shares of Class B Common Stock to Pogo Royalty equivalent to the number of OpCo Class B Units issued to Pogo Royalty.

If not exchanged sooner, such newly issued OpCo Class B Units shall automatically exchange into Class A Common Stock on the one-year anniversary

of the Mandatory Conversion Trigger Date at a ratio of one OpCo Class B Unit for one share of Class A Common Stock. An equivalent number

of shares of Class B Common Stock must be surrendered with the OpCo Class B Units to the Company in exchange for the Class A Common Stock.

As noted above, the OpCo Class B Units must be exchanged upon the one-year anniversary of the Mandatory Conversion Trigger Date. The foregoing

description of the A&R OpCo LLC Agreement is not complete and is qualified in its entirety by reference to the copy thereof filed

as Exhibit 10.2 hereto, which is incorporated herein by reference.

Registration Rights Agreement

In connection with the Closing, the Issuer and Pogo Royalty entered

into that Registration Rights Agreement, dated as of November 15, 2023 (the “Registration Rights Agreement”), pursuant to

which the Issuer has agreed to provide Pogo Royalty with certain registration rights with respect to the shares of Class A Common Stock

issuable upon exercise of the OpCo Exchange Right, including (i) the filing with the Securities and Exchange Commission (the “Commission”)

of an initial registration statement on Form S-1 covering the resale by the Pogo Royalty of the shares of Class A Common Stock issuable

upon exercise of the OpCo Exchange Right so as to permit their resale under Rule 415 under the Securities Act, (ii) the use of its commercially

reasonable efforts, no later than thirty (30) days following the Closing, to have the initial registration statement declared effective

by the Commission as soon as reasonably practicable following the filing thereof with the Commission, and (iii) the use of its commercially

reasonable efforts to convert the Form S-1 (and any subsequent registration statement) to a shelf registration statement on Form S-3 as

promptly as practicable after the Issuer is eligible to use a Form S-3 shelf registration statement.

In certain circumstances, Pogo Royalty can demand the Issuer’s

assistance with underwritten offerings, and Pogo Royalty will be entitled to certain piggyback registration rights. The foregoing description

of the Registration Rights Agreement is not complete and is qualified in its entirety by reference to the copy thereof filed as Exhibit

10.3 hereto, which is incorporated herein by reference.

Backstop Agreement

In connection with the Closing, the Issuer entered into that certain

Backstop Agreement, dated November 15, 2023 (the “Backstop Agreement”) by and among the Issuer, Pogo Royalty and certain of

the Issuer’s founders listed therein (the “Founders”), whereby the Pogo Royalty will have the right (“Put Right”)

to cause the Founders to purchase the OpCo Preferred Units at a purchase price per unit equal to $10.00 per unit plus the product of (i)

the number of days elapsed since the effective date of the Backstop Agreement and (ii) $10.00 divided by 730. Seller’s right to

exercise the Put Right will survive for six (6) months following the date the Trust Shares (as defined below) are not restricted from

transfer under the Letter Agreement (as defined in the A&R MIPA) (the “Lockup Expiration Date”).

As security that the Founders will be able to purchase the OpCo Preferred

Units upon exercise of the Put Right, the Founders agreed to place at least 1,300,000 shares of Class A Common Stock into escrow (the

“Trust Shares”), which the Founders can sell or borrow against to meet their obligations upon exercise of the Put Right, with

the prior consent of Seller. HNRA is not obligated to purchase the OpCo Preferred Units from Pogo Royalty under the Backstop Agreement.

Until the Backstop Agreement is terminated, Pogo Royalty and its affiliates are not permitted to engage in any transaction which is designed

to sell short the Class A Common Stock or any other publicly traded securities of the Issuer. The foregoing description of the Backstop

Agreement is not complete and is qualified in its entirety by reference to the copy thereof filed as Exhibit 10.4 hereto, which is incorporated

herein by reference.

Director Nomination and Board Observer Agreement

In connection with the Closing, the Issuer entered into Director Nomination

and Board Observer Agreement (the “Board Designation Agreement”) with CIC Pogo. Pursuant to the Board Designation Agreement,

CIC Pogo has the right, at any time CIC Pogo beneficially owns capital stock of the Issuer, to appoint two board observers to attend all

meetings of the board of directors of the Issuer. In addition, after the time of the conversion of the OpCo Preferred Units owned by Pogo

Royalty, CIC Pogo will have the right to nominate a certain number of members of the Board depending on Pogo Royalty’s ownership

percentage of Class A Common Stock as further provided in the Board Designation Agreement. The foregoing description of the Board Designation

Agreement is not complete and is qualified in its entirety by reference to the copy thereof filed as Exhibit 10.5 hereto, which is incorporated

herein by reference.

Item 7. Material to be Filed as Exhibits

Exhibit

Number |

|

Description |

| 2.1 |

|

Amended and Restated Membership Interest Purchase Agreement, dated August 28, 2023, by and among Buyer, Seller, and Sponsor (incorporated by reference to Exhibit 2.1 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on August 30, 2023). |

| 2.2 |

|

Amendment No. 1 to the Amended and Restated Membership Interest Purchase Agreement, dated November 15, 2023, by and among Buyer, Seller, and Sponsor (incorporated by reference to Exhibit 2.2 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 10.1 |

|

Option Agreement, dated November 15, 2023, by and between HNRA Royalties, LLC, Pogo Royalty, LLC, and HNR Acquisition Corp (incorporated by reference to Exhibit 10.4 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 10.2 |

|

Amended and Restated Limited Liability Company Agreement of HNRA Upstream, LLC, dated November 15, 2023, by and among HNRA Upstream, LLC, Pogo Royalty, LLC, and HNR Acquisition Corp (incorporated by reference to Exhibit 10.1 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 10.3 |

|

Registration Rights Agreement, dated November 15, 2023, by and between HNRA Acquisition Corp and Pogo Royalty, LLC (incorporated by reference to Exhibit 10.3 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 10.4 |

|

Backstop Agreement, dated November 15, 2023, by and among HNR Acquisition Corp, HNRA Upstream, LLC, Pogo Royalty, and the Founders that are signatory thereto (incorporated by reference to Exhibit 10.6 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 10.5 |

|

Director Nomination and Board Observer Agreement, dated November 15, 2023, by and between HNR Acquisition Corp and CIC Pogo, LP (incorporated by reference to Exhibit 10.5 of HNRA Acquisition Corp’s Current Report on Form 8-K, filed with the Commission on November 21, 2023). |

| 99.1* |

|

Joint Filing Agreement, dated as of November 24, 2023, by and among the Reporting Persons. |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

Date: November 24, 2023

| POGO ROYALTY, LLC |

|

| |

|

| By: |

/s/ Kirk Pogoloff |

|

| Name: |

Kirk Pogoloff |

|

| Title: |

Manager |

|

| |

|

|

| CIC POGO LP |

|

| |

|

| By: |

CIC IV GP LLC, its General Partner |

|

| |

|

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC IV GP LLC |

|

| |

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC PARTNERS FIRM LP |

|

| |

|

|

| By: |

CIC Partners Firm GP LLC, its General Partner |

|

| |

|

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC PARTNERS FIRM GP LLC |

|

| |

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

Schedule A

CONTROL PERSONS OF POGO ROYALTY

The name, business address, present principal

occupation or employment and the name, principal business and address of any corporation or other organization in which such employment

is conducted, of each of the general partner and other control persons of Pogo Royalty are set forth below:

| Name and Business Address |

|

Capacity in which Serves |

|

Principal

Occupation |

|

Name, Principal

Business and

Address of

Organization

in which

Principal

Occupation is

Conducted |

|

CIC Pogo LP

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Controlling Member of Pogo Royalty, LLC |

|

n/a |

|

n/a |

| |

|

|

|

|

CIC IV GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

General Partner of CIC Pogo LP |

|

n/a |

|

n/a |

| |

|

|

|

|

CIC Partners Firm LP

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Sole Member of CIC IV GP LLC |

|

n/a |

|

n/a |

| |

|

|

|

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

General Partner of CIC Partners Firm GP LLC |

|

n/a |

|

n/a |

Schedule B

CONTROL PERSONS OF THE CIC ENTITIES

The name, business address, present principal

occupation or employment and the name, principal business and address of any corporation or other organization in which such employment

is conducted, of each of the general partner and other control persons of the CIC Entities are set forth below:

| Name and Business Address |

|

Capacity in which Serves |

|

Principal

Occupation |

|

Name, Principal

Business and

Address of

Organization

in which

Principal

Occupation is

Conducted |

|

CIC IV GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

General Partner of CIC Pogo LP |

|

n/a |

|

n/a |

| |

|

|

|

|

CIC Partners Firm LP

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Sole Member of CIC IV GP LLC |

|

n/a |

|

n/a |

| |

|

|

|

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

General Partner of CIC Partners Firm GP LLC |

|

n/a |

|

n/a |

Schedule C

CONTROL PERSONS OF CIC PARTNERS FIRM GP, LLC

The name, business address, present principal

occupation or employment and the name, principal business and address of any corporation or other organization in which such employment

is conducted, of each of the general partner and other control persons of CIC Firm GP are set forth below:

| Name and Business Address |

|

Capacity in which Serves |

|

Principal

Occupation |

|

Name, Principal

Business and

Address of Organization in which

Principal Occupation is Conducted |

|

Fouad Z. Bashour

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Director |

|

Director |

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

| |

|

|

|

|

Marshall B. Payne

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Director |

|

Director |

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

| |

|

|

|

|

Michael S. Rawlings

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Director |

|

Director |

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

| |

|

|

|

|

James C. Smith

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Director |

|

Director |

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

| |

|

|

|

|

Amir Yoffe

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

|

Director |

|

Director |

|

CIC Partners Firm GP LLC

3879 Maple Avenue, Suite 400

Dallas, Texas, 75219 |

C-1

Exhibit 99.1

JOINT FILING AGREEMENT

In accordance with Rule

13d-1(k)(1) promulgated under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree that this statement on Schedule

13D (“Statement”) is being jointly filed, and any amendments thereafter signed by each of the undersigned shall be (unless

otherwise determined by the undersigned) jointly filed on behalf of each of the undersigned. Each of the undersigned is responsible for

the timely filing of this Statement and any amendments thereto, and for the completeness and accuracy of the information concerning such

person contained therein; but none of them is responsible for the completeness or accuracy of the information concerning the other persons

making the filing, unless such person knows or has reason to believe that such information is inaccurate. This Joint Filing Agreement

may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one

and the same instrument.

IN WITNESS WHEREOF, the

undersigned hereby execute this Joint Filing Agreement as of the 24th day of November, 2023.

| POGO ROYALTY, LLC |

|

| |

|

| By: |

/s/ Kirk Pogoloff |

|

| Name: |

Kirk Pogoloff |

|

| Title: |

Manager |

|

| |

|

|

| CIC POGO LP |

|

| |

|

| By: |

CIC IV GP LLC, its General Partner |

|

| |

|

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC IV GP LLC |

|

| |

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC PARTNERS FIRM LP |

|

| |

|

| By: |

CIC Partners Firm GP LLC, its General Partner |

|

| |

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Bashour |

|

| Title: |

Manager |

|

| |

|

|

| CIC PARTNERS FIRM GP LLC |

|

| |

|

|

| By: |

/s/ Fouad Z. Bashour |

|

| Name: |

Fouad Z. Bashour |

|

| Title: |

Manager |

|

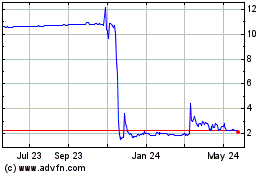

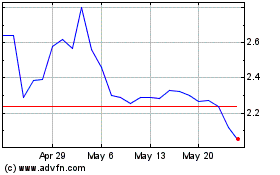

HNR Acquisition (AMEX:HNRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

HNR Acquisition (AMEX:HNRA)

Historical Stock Chart

From Nov 2023 to Nov 2024