0001281845

true

FY

0001281845

2022-06-01

2023-05-31

0001281845

2022-11-30

0001281845

2023-09-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K/A

(Amendment

No. 1)

(Mark

One)

| ☒ |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended May 31, 2023

| ☐ |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _______ to _______

Commission

file number: 000-50612

| UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| (Exact

Name of registrant as specified in its charter) |

| Nevada |

|

01-0721929 |

| (State

or other jurisdiction of incorporation

or organization) |

|

(I.R.S.

Employer Identification

No.) |

| |

|

|

| 154-09

146th Ave, Jamaica, NY |

|

11434 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Tel:

(718) 978-2000

(Registrant’s

telephone number, including area code)

Securities

registered under Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of exchange on which registered |

| None |

|

None |

|

None |

Securities

registered under Section 12(g) of the Act:

Common Stock, par value $0.001

per share

(Title of class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

☐ No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| |

Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. ☐

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant

included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

☐ No ☒

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, as of the last business

day of the registrant’s most recently completed second fiscal quarter ended November 30, 2022 was $19,179,402.

As

of September 15, 2023, there were 799,141,770 shares of the registrant’s common stock outstanding.

| Audit

Firm Id |

|

Auditor

Name: |

|

Auditor

Location: |

| 688 |

|

Marcum

LLP |

|

New York, NY |

EXPLANATORY

NOTE

Unique

Logistics International, Inc. (the “Company,” “we,” “us,” “our” and other similar terms)

is filing this Amendment No. 1 (this “Amendment”) to its Annual Report on Form 10-K for the year ended May 31, 2023, as filed

with the Securities and Exchange Commission on September 15, 2023 (the “Original Form 10-K”), for the purpose of updating

the exhibit index contained in Part IV, Item 15 to (i) include Exhibit 4.1 (Description of Securities) and (ii) provide an updated Exhibit

21.1 (List of Subsidiaries).

Accordingly,

this Amendment consists only of the facing page, this explanatory note, Item 15, the signature pages to Form 10-K and the applicable

exhibits. The Original Form 10-K is otherwise unchanged. This Amendment should be read in conjunction with the Original Form 10-K. Further,

this Amendment does not reflect any subsequent events occurring after the filing date of the Original Form 10-K and does not modify or

update in any way the disclosures made in the Original Form 10-K except as described above.

Pursuant to Rule 12b-15 under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”), this Amendment contains certifications pursuant to

Section 302 of the Sarbanes-Oxley Act of 2002, which are attached hereto.

TABLE

OF CONTENTS

PART

IV

Item

15. Exhibits and Financial Statement Schedules.

a.

Exhibits

| Exhibit |

|

|

|

Incorporated

by Reference |

|

Filed

or Furnished |

| Number |

|

Exhibit

Description |

|

Form |

|

Exhibit |

|

Filing

Date |

|

Herewith |

| |

|

|

|

|

|

|

|

|

|

|

| 2.1 |

|

Agreement and Plan of Merger and Reorganization, dated October 8, 2020 |

|

8-K |

|

2.1 |

|

10/13/2020 |

|

|

| 2.2 |

|

Agreement and Plan of Merger dated as of December 18, 2022, by and among Edify Acquisition Corp., Edify Merger Sub, Inc., and Unique Logistics International, Inc. |

|

8-K |

|

2.1 |

|

12/19/2022 |

|

|

| 3.1 |

|

Certificate of Designation of Series A Preferred of Innocap, Inc., dated October 7, 2020 |

|

8-K |

|

3.1 |

|

10/13/2020 |

|

|

| 3.2 |

|

Certificate of Designation of Series B Preferred of Innocap, Inc., dated October 7, 2020 |

|

8-K |

|

3.2 |

|

10/13/2020 |

|

|

| 3.3 |

|

Certificate of Designation of Series C Convertible Preferred Stock of Unique Logistics International, Inc., dated December 7, 2021 |

|

8-K |

|

3.1 |

|

12/13/2021 |

|

|

| 3.4 |

|

Certificate of Designation of Series D Convertible Preferred Stock of Unique Logistics International, Inc., dated December 7, 2021 |

|

8-K |

|

3.2 |

|

12/13/2021 |

|

|

| 3.5 |

|

Certificate of Correction to Certificate Designation of Series C Convertible Preferred Stock of Unique Logistics International, Inc., dated December 8, 2021 |

|

8-K |

|

3.3 |

|

12/13/2021 |

|

|

| 3.6 |

|

Certificate of Correction to Certificate Designation of Series D Convertible Preferred Stock of Unique Logistics International, Inc., dated December 8, 2021 |

|

8-K |

|

3.4 |

|

12/13/2021 |

|

|

| 3.7 |

|

Certificate of Correction to Certificate Designation of Series C Convertible Preferred Stock of Unique Logistics International, Inc., dated December 15, 2021 |

|

10-Q |

|

3.5 |

|

01/14/2022 |

|

|

| 3.8 |

|

Certificate of Correction to Certificate Designation of Series D Convertible Preferred Stock of Unique Logistics International, Inc., dated December 15, 2021 |

|

10-Q |

|

3.6 |

|

01/14/2022 |

|

|

| 3.9 |

|

Amended and Restated Articles of Incorporation |

|

8-K |

|

3.1 |

|

01/14/2021 |

|

|

| 3.10 |

|

Amended and Restated Bylaws |

|

8-K |

|

3.1 |

|

11/09/2021 |

|

|

| 3.11 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on April 26, 2022 |

|

8-K |

|

3.1 |

|

04/29/2022 |

|

|

| 3.12 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on October 4, 2022 |

|

8-K |

|

3.1 |

|

10/07/2022 |

|

|

| 3.13 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on October 4, 2022 |

|

8-K |

|

3.2 |

|

10/07/2022 |

|

|

| 3.14 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series D Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on October 4, 2022 |

|

8-K |

|

3.3 |

|

10/07/2022 |

|

|

| 3.15 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on March 31, 2023 |

|

10-Q |

|

3.1 |

|

04/20/2023 |

|

|

| 3.16 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series C Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on March 31, 2023 |

|

10-Q |

|

3.2 |

|

04/20/2023 |

|

|

| 3.17 |

|

Certificate of Amendment of Certificate of Designations, Preferences and Rights of Series D Convertible Preferred Stock of Unique Logistics International, Inc., filed with the Nevada Secretary of State on March 31, 2023 |

|

10-Q |

|

3.3 |

|

04/20/2023 |

|

|

| 4.1 |

|

Description of Securities |

|

|

|

|

|

|

|

X |

| 10.1 |

|

Stock Purchase Agreement, dated April 28, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.1 |

|

09/19/2022 |

|

|

| 10.2 |

|

Share Sale and Purchase Agreement (Unique Logistics International (India) Private Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.2 |

|

09/19/2022 |

|

|

| 10.3 |

|

Share Sale and Purchase Agreement (ULI (North & East China) Company Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.3 |

|

09/19/2022 |

|

|

| 10.4 |

|

Share Sale and Purchase Agreement (Unique Logistics International Co., Ltd.), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.4 |

|

09/19/2022 |

|

|

| 10.5 |

|

Share Sale and Purchase Agreement (TGF Unique Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.5 |

|

09/19/2022 |

|

|

| 10.6 |

|

Share Sale and Purchase Agreement (Unique Logistics International (H.K.) Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.6 |

|

09/19/2022 |

|

|

| 10.7 |

|

Share Sale and Purchase Agreement (Unique Logistics International (Vietnam) Co., Ltd.), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.7 |

|

09/19/2022 |

|

|

| 10.8 |

|

Share Sale and Purchase Agreement (Unique Logistics International (ULI (South China)) Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.8 |

|

09/19/2022 |

|

|

| 10.9 |

|

Share Sale and Purchase Agreement (Unique Logistics International (South China) Limited), dated September 13, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.9 |

|

09/19/2022 |

|

|

| 10.10 |

|

Amendment No. 1 to Stock Purchase Agreement, dated January 23, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited. |

|

8-K |

|

10.1 |

|

02/27/2023 |

|

|

| 10.11 |

|

Amendment No. 2 to Stock Purchase Agreement, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited. |

|

8-K |

|

10.2 |

|

02/27/2023 |

|

|

| 10.12 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for Unique Logistics International (India) Private Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited. |

|

8-K |

|

10.3 |

|

02/27/2023 |

|

|

| 10.13 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for ULI (North & East China) Company Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.4 |

|

02/27/2023 |

|

|

| 10.14 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for Unique Logistics International Co., Ltd., dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.5 |

|

02/27/2023 |

|

|

| 10.15 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement TGF Unique Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.6 |

|

02/27/2023 |

|

|

| 10.16 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for Unique Logistics International (H.K.) Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.7 |

|

02/27/2023 |

|

|

| 10.17 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for Unique Logistics International (Vietnam) Co., Ltd., dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.8 |

|

02/27/2023 |

|

|

| 10.18 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for Unique Logistics International (South China) Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.9 |

|

02/27/2023 |

|

|

| 10.19 |

|

Amendment No. 1 to the Share Sale and Purchase Agreement for ULI (South China) Limited, dated February 21, 2023, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.10 |

|

02/27/2023 |

|

|

| 10.20 |

|

Promissory Note in the principal amount of $1,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.11 |

|

02/27/2023 |

|

|

| 10.21 |

|

Promissory Note in the principal amount of $4,500,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.12 |

|

02/27/2023 |

|

|

| 10.22 |

|

Promissory Note in the principal amount of $5,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.13 |

|

02/27/2023 |

|

|

| 10.23 |

|

Promissory Note in the principal amount of $5,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.14 |

|

02/27/2023 |

|

|

| 10.24 |

|

Promissory Note in the principal amount of $2,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.15 |

|

02/27/2023 |

|

|

| 10.25 |

|

Promissory Note in the principal amount of $1,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.16 |

|

02/27/2023 |

|

|

| 10.26 |

|

Promissory Note in the principal amount of $2,500,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.17 |

|

02/27/2023 |

|

|

| 10.27 |

|

Promissory Note in the principal amount of $2,000,000, dated February 21, 2023, in favor of Unique Logistics Holdings Limited |

|

8-K |

|

10.18 |

|

02/27/2023 |

|

|

| 10.28 |

|

Stock Purchase Agreement, dated February 21, 2023, by and between Unique Logistics International, Inc. and Frangipani Trade Services, Inc. |

|

8-K |

|

10.19 |

|

02/27/2023 |

|

|

| 10.29 |

|

Promissory Note in the principal amount of $500,000, dated February 21, 2023, in favor of Frangipani Trade Services, Inc. |

|

8-K |

|

10.20 |

|

02/27/2023 |

|

|

| 10.30 |

|

Shareholders Agreement for ULI (South China) Company Limited |

|

8-K |

|

10.21 |

|

02/27/2023 |

|

|

| 10.31 |

|

Shareholders Agreement for TGF Unique Limited |

|

8-K |

|

10.22 |

|

02/27/2023 |

|

|

| 10.32 |

|

Share Purchase and Asset Transfer Agreement for ULI (North and East China) Company Limited and Supplement |

|

8-K |

|

10.23 |

|

02/27/2023 |

|

|

| 10.33 |

|

Financing Agreement, dated March 10, 2023, by and among Unique Logistics International, Inc., Unique Logistics Holdings, Inc., Unique Logistics International (NYC), LLC, Unique Logistics International (BOS), Inc., Alter Domus (US) LLC, CB Agent Services LLC, CB Participations SPV, LLC, and CP IV SPV, LLC |

|

8-K |

|

10.1 |

|

03/14/2023 |

|

|

| 10.34 |

|

Fee Letter, dated March 10, 2023, by and among Unique Logistics International, Inc., Unique Logistic Holdings, Inc., Unique Logistics International (NYC), LLC, Unique Logistics International (BOS), Inc., Alter Domus (US) LLC, and CB Agent Services LLC |

|

8-K |

|

10.2 |

|

03/14/2023 |

|

|

| 10.35 |

|

Security Agreement, dated March 10, 2023, by and among Unique Logistics International, Inc., Unique Logistic Holdings, Inc., Unique Logistics International (NYC), LLC, Unique Logistics International (BOS), Inc., and Alter Domus (US) LLC |

|

8-K |

|

10.3 |

|

03/14/2023 |

|

|

| 10.36 |

|

Collateral Assignment, dated March 10, 2023, by and among Unique Logistics International, Inc. and Alter Domus (US) LLC |

|

8-K |

|

10.4 |

|

03/14/2023 |

|

|

| 10.37 |

|

Intercompany Subordination Agreement, dated March 10, 2023, by and among Unique Logistics International, Inc., Unique Logistic Holdings, Inc., Unique Logistics International (NYC), LLC, Unique Logistics International (BOS), Inc., Unique Logistics International (India) Private Ltd., ULI (North & East China) Company Limited, Unique Logistics International (H.K.) Limited, ULI (South China) Limited, Unique Logistics International (South China) Limited, Unique Logistics International (Shanghai) Co., Ltd., Shenzhen Unique logistics International Limited, and Alter Domus (US) LLC |

|

8-K |

|

10.5 |

|

03/14/2023 |

|

|

| 10.38 |

|

Agent Fee Letter, dated March 10, 2023, by and among Unique Logistics International, Inc. and Alter Domus (US) LLC |

|

8-K |

|

10.6 |

|

03/14/2023 |

|

|

| 10.39 |

|

Employment Agreement, dated May 29, 2020, by and between Unique Logistics International, Inc. and Sunandan Ray |

|

8-K |

|

10.3 |

|

10/13/2020 |

|

|

| 10.40 |

|

Amendment dated as of May 29, 21, to Employment Agreement by and between Unique Logistics International, Inc. and Sunandan Ray |

|

8-K |

|

10.2 |

|

06/03/2021 |

|

|

| 10.41 |

|

Employment Agreement, dated August 11, 2021, by and between Unique Logistics International, Inc. and Eli Kay |

|

8-K |

|

10.1 |

|

08/16/2021 |

|

|

| 10.42 |

|

Employment Agreement, dated April 25, 2022, by and between Unique Logistics International, Inc. and Migdalia Diaz |

|

8-K |

|

10.1 |

|

04/26/2022 |

|

|

| 10.43 |

|

Lock-Up Agreement, dated as of December 18, 2022, by and among Edify Acquisition Corp., and various parties thereto |

|

8-K |

|

10.1 |

|

12/19/2022 |

|

|

| 10.44 |

|

Company Voting and Support Agreement, dated as of December 18, 2022, by and among Edify Acquisition Corp., Unique Logistics International, Inc., Frangipani Trade Services, Inc. and Great Eagle Freight Limited |

|

8-K |

|

10.2 |

|

12/19/2022 |

|

|

| 10.45 |

|

Sponsor Support Agreement, dated as of December 18, 2022, by and among Edify Acquisition Corp., Colbeck Edify Holdings, LLC, Unique Logistics International, Inc. and the other parties thereto. |

|

8-K |

|

10.3 |

|

12/19/2022 |

|

|

| 10.46 |

|

Amendment No. 1 to Stock Purchase Agreement, dated as of December 18, 2022, by and between Unique Logistics International, Inc. and Unique Logistics Holdings Limited |

|

8-K |

|

10.4 |

|

12/19/2022 |

|

|

| 21.1 |

|

Subsidiaries of the Registrant |

|

|

|

|

|

|

|

X |

| 31.1 |

|

Principal Executive Officer Certification Pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

10-K |

|

31.1 |

|

09/15/2023 |

|

|

| 31.2 |

|

Principal Financial Officer Certification Pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

10-K |

|

31.2 |

|

09/15/2023 |

|

|

| 31.3 |

|

Principal Executive Officer Certification Pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

|

|

X |

| 31.4 |

|

Principal Financial Officer Certification Pursuant to Item 601(b)(31) of Regulation S-K, as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

|

|

|

|

|

|

|

X |

| 32.1 |

|

Principal Executive Officer Certification Pursuant to Item 601(b)(32) of Regulation S-K, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|

10-K |

|

32.1 |

|

09/15/2023 |

|

|

| 32.2 |

|

Principal Financial Officer Certification Pursuant to Item 601(b)(32) of Regulation S-K, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

|

10-K |

|

32.2 |

|

09/15/2023 |

|

|

| 101.INS |

|

Inline XBRL

Instance Document. |

|

|

|

|

|

|

|

X |

| 101.SCH |

|

Inline XBRL

Taxonomy Extension Schema Linkbase Document. |

|

|

|

|

|

|

|

X |

| 101.CAL |

|

Inline XBRL

Taxonomy Calculation Linkbase Document. |

|

|

|

|

|

|

|

X |

| 101.DEF |

|

Inline XBRL

Taxonomy Extension Definition Linkbase Document. |

|

|

|

|

|

|

|

X |

| 101.LAB |

|

Inline XBRL

Taxonomy Label Linkbase Document. |

|

|

|

|

|

|

|

X |

| 101.PRE |

|

Inline XBRL

Taxonomy Presentation Linkbase Document. |

|

|

|

|

|

|

|

X |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

|

|

|

|

|

X |

b.

Financial Statement Schedules

None.

SIGNATURES

Pursuant

to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

| Date:

September 22, 2023 |

UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| |

|

| |

By: |

/s/

Sunandan Ray |

| |

|

Sunandan

Ray |

| |

|

Chief

Executive Officer, Chairman of the Board

(Principal Executive Officer) |

Pursuant

to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the

registrant and in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Sunandan Ray |

|

Director,

Chief Executive Officer |

|

September 22, 2023 |

| Sunandan

Ray |

|

Principal

Executive Officer |

|

|

| |

|

|

|

|

| /s/

Eli Kay |

|

Chief

Financial Officer |

|

September 22, 2023 |

| Eli

Kay |

|

Principal

Financial and Accounting Officer |

|

|

| |

|

|

|

|

| /s/

David Briones |

|

Director |

|

September 22, 2023 |

| David

Briones |

|

|

|

|

| |

|

|

|

|

| /s/

Patrick Lee |

|

Director |

|

September 22, 2023 |

| Patrick

Lee |

|

|

|

|

EXHIBIT

4.1

DESCRIPTION

OF THE REGISTRANT’S SECURITIES

REGISTERED

PURSUANT TO SECTION 12 OF THE

SECURITIES

EXCHANGE ACT OF 1934

The

following description of the common stock and preferred stock of Unique Logistics International, Inc. (“we” or

“us”) is a summary and does not purport to be complete. It is subject to and qualified in its entirety by reference to

our amended and restated articles of incorporation, and our bylaws, as amended, each of which is incorporated herein by reference

and are exhibits to our Amendment No. 1 to the Annual Report on Form 10-K filed with the Securities and Exchange Commission, of

which this Exhibit 4.1 is a part. We encourage you to read our articles of incorporation, our bylaws and the applicable provisions

of the Nevada Revised Statutes for additional information.

Common

Stock

The

Company is authorized to issue 800,000,000 shares of Common Stock, $0.001 par value per share.

Each

share of Common Stock shall have one (1) vote per share for all purpose. Our Common Stock does not provide preemptive, subscription or

conversion rights and there are no redemption or sinking fund provisions or rights. Our common stockholders are not entitled to cumulative

voting for purposes of electing members to our board of directors.

Dividends

We

have not paid any cash dividends to our shareholders. The declaration of any future cash dividends is at the discretion of our board

of directors and depends upon our earnings, if any, our capital requirements and financial position, our general economic conditions,

and other pertinent conditions. It is our present intention not to pay any cash dividends in the foreseeable future, but rather to reinvest

earnings, if any, in our business operations.

Anti-takeover

Effects of Our Articles of Incorporation and By-laws

The

holders of our Common Stock do not have cumulative voting rights in the election of our directors, which makes it more difficult for

minority stockholders to be represented on the Board. Our articles of incorporation allow our Board to issue additional shares of our

Common Stock and new series of preferred stock without further approval of our stockholders. The existence of authorized but unissued

shares of Common Stock and preferred stock could render more difficult or discourage an attempt to obtain control of our company by means

of a proxy contest, tender offer, merger, or otherwise.

Anti-takeover

Effects of Nevada Law

Business

Combinations

The

“business combination” provisions of Sections 78.411 to 78.444, inclusive, of the Nevada Revised Statutes, or NRS, generally

prohibit a Nevada corporation with at least 200 stockholders of record, a “resident domestic corporation,” from engaging

in various “combination” transactions with any “interested stockholder” unless certain conditions are met or

the corporation has elected in its articles of incorporation to not be subject to these provisions. We have not elected to opt out of

these provisions and if we meet the definition of resident domestic corporation, now or in the future, our company will be subject to

these provisions.

A

“combination” is generally defined to include (a) a merger or consolidation of the resident domestic corporation or any subsidiary

of the resident domestic corporation with the interested stockholder or affiliate or associate of the interested stockholder; (b) any

sale, lease, exchange, mortgage, pledge, transfer, or other disposition, in one transaction or a series of transactions, by the resident

domestic corporation or any subsidiary of the resident domestic corporation to or with the interested stockholder or affiliate or associate

of the interested stockholder having: (i) an aggregate market value equal to 5% or more of the aggregate market value of the assets of

the resident domestic corporation, (ii) an aggregate market value equal to 5% or more of the aggregate market value of all outstanding

shares of the resident domestic corporation, or (iii) 10% or more of the earning power or net income of the resident domestic corporation;

(c) the issuance or transfer in one transaction or series of transactions of shares of the resident domestic corporation or any subsidiary

of the resident domestic corporation having an aggregate market value equal to 5% or more of the resident domestic corporation to the

interested stockholder or affiliate or associate of the interested stockholder; and (d) certain other transactions with an interested

stockholder or affiliate or associate of the interested stockholder.

An

“interested stockholder” is generally defined as a person who, together with affiliates and associates, owns (or within two

years, did own) 10% or more of a corporation’s voting stock. An “affiliate” of the interested stockholder is any person

that directly or indirectly through one or more intermediaries is controlled by or is under common control with the interested stockholder.

An “associate” of an interested stockholder is any (a) corporation or organization of which the interested stockholder is

an officer or partner or is directly or indirectly the beneficial owner of 10% or more of any class of voting shares of such corporation

or organization; (b) trust or other estate in which the interested stockholder has a substantial beneficial interest or as to which the

interested stockholder serves as trustee or in a similar fiduciary capacity; or (c) relative or spouse of the interested stockholder,

or any relative of the spouse of the interested stockholder, who has the same home as the interested stockholder.

If

applicable, the prohibition is for a period of two years after the date of the transaction in which the person became an interested stockholder,

unless such transaction is approved by the board of directors prior to the date the interested stockholder obtained such status; or the

combination is approved by the board of directors and thereafter is approved at a meeting of the stockholders by the affirmative vote

of stockholders representing at least 60% of the outstanding voting power held by disinterested stockholders; and extends beyond the

expiration of the two-year period, unless (a) the combination was approved by the board of directors prior to the person becoming an

interested stockholder; (b) the transaction by which the person first became an interested stockholder was approved by the board of directors

before the person became an interested stockholder; (c) the transaction is approved by the affirmative vote of a majority of the voting

power held by disinterested stockholders at a meeting called for that purpose no earlier than two years after the date the person first

became an interested stockholder; or (d) if the consideration to be paid to all stockholders other than the interested stockholder is,

generally, at least equal to the highest of: (i) the highest price per share paid by the interested stockholder within the three years

immediately preceding the date of the announcement of the combination or in the transaction in which it became an interested stockholder,

whichever is higher, plus compounded interest and less dividends paid, (ii) the market value per share of common shares on the date of

announcement of the combination and the date the interested stockholder acquired the shares, whichever is higher, plus compounded interest

and less dividends paid, or (iii) for holders of preferred stock, the highest liquidation value of the preferred stock, plus accrued

dividends, if not included in the liquidation value. With respect to (i) and (ii) above, the interest is compounded at the rate for one-year

United States Treasury obligations from time to time in effect.

Applicability

of the Nevada business combination statute would discourage parties interested in taking control of our company if they cannot obtain

the approval of our Board. These provisions could prohibit or delay a merger or other takeover or change in control attempt and, accordingly,

may discourage attempts to acquire our company even though such a transaction may offer our stockholders the opportunity to sell their

stock at a price above the prevailing market price.

Control

Share Acquisitions

The

“control share” provisions of Sections 78.378 to 78.3793, inclusive, of the NRS, apply to “issuing corporations”

that are Nevada corporations with at least 200 stockholders of record, including at least 100 stockholders of record who are Nevada residents,

and that conduct business directly or indirectly in Nevada, unless the corporation has elected to not be subject to these provisions.

The

control share statute prohibits an acquirer of shares of an issuing corporation, under certain circumstances, from voting its shares

of a corporation’s stock after crossing certain ownership threshold percentages, unless the acquirer obtains approval of the target

corporation’s disinterested stockholders. The statute specifies three thresholds: (a) one-fifth or more but less than one-third,

(b) one-third but less than a majority, and (c) a majority or more, of the outstanding voting power. Generally, once a person acquires

shares in excess of any of the thresholds, those shares and any additional shares acquired within 90 days thereof become “control

shares” and such control shares are deprived of the right to vote until disinterested stockholders restore the right. These provisions

also provide that if control shares are accorded full voting rights and the acquiring person has acquired a majority or more of all voting

power, all other stockholders who do not vote in favor of authorizing voting rights to the control shares are entitled to demand payment

for the fair value of their shares in accordance with statutory procedures established for dissenters’ rights.

A

corporation may elect to not be governed by, or “opt out” of, the control shares provisions by making an election in its

articles of incorporation or bylaws, provided that the opt-out election must be in place on the 10th day following the date an acquiring

person has acquired a controlling interest, that is, crossing any of the three thresholds described above. We have not opted out of these

provisions and will be subject to the control share provisions of the NRS if we meet the definition of an issuing corporation upon an

acquiring person acquiring a controlling interest unless we later opt out of these provisions and the opt out is in effect on the 10th

day following such occurrence.

The

effect of the Nevada control share statute is that the acquiring person, and those acting in association with the acquiring person, will

obtain only such voting rights in the control shares as are conferred by a resolution of the stockholders at an annual or special meeting.

The Nevada control share law, if applicable, could have the effect of discouraging takeovers of our company.

Transfer

Agent and Registrar

The

transfer agent is Action Stock Transfer, 2469 E. Fort Union Blvd, Suite 214 Salt Lake City, UT

84121.

Listing

Our

common stock is currently traded on the Pink tier of the OTC Markets under the symbol “UNQL.”

Exhibit

21.1

List

of the Registrant’s Subsidiaries

| 1. | Unique

Logistics International (NYC), LLC, a Delaware limited liability company (“UL NYC”) |

| 2. | Unique Logistics International (BOS)

Inc, a Massachusetts corporation (“UL BOS”) |

| 3. | Unique Logistics Holdings, Inc., a

Delaware corporation (“UL HI”) |

| 4. | Unique Logistics International (H.K.)

Limited |

| 5. | Unique Logistics International (Vietnam)

Co., Ltd. |

| 6. | ULI (South China) Limited |

| 7. | Unique Logistics International (South

China) Limited |

| 8. | Unique Logistics International (India)

Private Ltd. |

| 9. | ULI (North & East China) Company

Limited |

| 10. | Unique Logistics International Co.,

Ltd |

| 11. | TGF Unique Limited |

Exhibit

31.3

CERTIFICATION

I,

Sunandan Ray, certify that:

| |

1. |

I

have reviewed this amendment no. 1 on Form 10-K/A to the annual report on Form 10-K of Unique

Logistics International, Inc.; |

| |

|

|

| |

2. |

Based

on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report; and |

| Date:

September 22, 2023 |

/s/

Sunandan Ray |

| |

Sunandan

Ray |

| |

Chief

Executive Officer |

| |

(Principal

Executive Officer) |

Exhibit

31.4

CERTIFICATION

I,

Eli Kay, certify that:

| |

1. |

I have reviewed this amendment

no. 1 on Form 10-K/A to the annual report on Form 10-K of Unique Logistics International,

Inc.; |

| |

|

|

| |

2. |

Based on my knowledge,

this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this

report; and |

| Date:

September 22, 2023 |

/s/

Eli Kay |

| |

Eli

Kay |

| |

Chief

Financial Officer |

| |

(Principal

Financial and Accounting Officer) |

v3.23.3

Cover - USD ($)

|

12 Months Ended |

|

|

May 31, 2023 |

Sep. 15, 2023 |

Nov. 30, 2022 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

true

|

|

|

| Amendment Description |

Unique

Logistics International, Inc. (the “Company,” “we,” “us,” “our” and other similar terms)

is filing this Amendment No. 1 (this “Amendment”) to its Annual Report on Form 10-K for the year ended May 31, 2023, as filed

with the Securities and Exchange Commission on September 15, 2023 (the “Original Form 10-K”), for the purpose of updating

the exhibit index contained in Part IV, Item 15 to (i) include Exhibit 4.1 (Description of Securities) and (ii) provide an updated Exhibit

21.1 (List of Subsidiaries).

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

May 31, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--05-31

|

|

|

| Entity File Number |

000-50612

|

|

|

| Entity Registrant Name |

UNIQUE

LOGISTICS INTERNATIONAL, INC.

|

|

|

| Entity Central Index Key |

0001281845

|

|

|

| Entity Tax Identification Number |

01-0721929

|

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

|

| Entity Address, Address Line One |

154-09

146th Ave

|

|

|

| Entity Address, City or Town |

Jamaica

|

|

|

| Entity Address, State or Province |

NY

|

|

|

| Entity Address, Postal Zip Code |

11434

|

|

|

| City Area Code |

(718)

|

|

|

| Local Phone Number |

978-2000

|

|

|

| Title of 12(g) Security |

Common Stock, par value $0.001

per share

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 19,179,402

|

| Entity Common Stock, Shares Outstanding |

|

799,141,770

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Firm ID |

688

|

|

|

| Auditor Name |

Marcum

LLP

|

|

|

| Auditor Location |

New York, NY

|

|

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

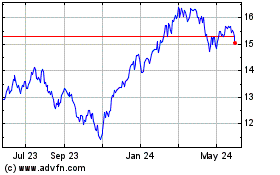

Harbor Disruptive Innova... (AMEX:INNO)

Historical Stock Chart

From Dec 2024 to Jan 2025

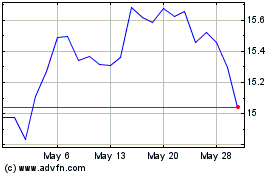

Harbor Disruptive Innova... (AMEX:INNO)

Historical Stock Chart

From Jan 2024 to Jan 2025