Graphex Group Limited Announces Full Exercise of Over-Allotment Option in Underwritten Public Offering

August 26 2022 - 4:15PM

Graphex Group Limited (NYSE American: GRFX), (“Graphex”, or the

“Company”), a global leader in mid-stream processing of specialized

natural graphite used for electric vehicle (EV) lithium-ion

(Li-ion) batteries, today announced that the underwriters of its

previously completed underwritten public offering have exercised

their over-allotment option to purchase an additional 704,347

American Depositary Shares (ADSs), each ADS representing 20

ordinary shares, par value HK$0.01 per share, of the Company, at

the public offering price of $2.50 per ADS less underwriting

discounts and commissions, for aggregate gross proceeds of

approximately $1.7 million before deducting underwriting discounts,

commissions, and other estimated offering expenses. The 45-day

over-allotment option was granted in connection with the Company's

previously announced underwritten public offering of 4,695,653 ADSs

at a public offering price of $2.50 per share.

EF Hutton, division of Benchmark Investments,

LLC, acted as sole book-running manager for the offering.

A registration statement on Form F-1 (File No.

333-263330), was filed with the Securities and Exchange Commission

("SEC") and was declared effective on August 16, 2022, and a

registration statement on Form F-1MEF (File No. 333-266925), was

filed with the SEC and became effective upon filing. A final

prospectus relating to the offering was filed with the SEC and is

available on the SEC's website at http://www.sec.gov. Electronic

copies of the final prospectus relating to this offering, when

available, may be obtained from EF Hutton, division of Benchmark

Investments, LLC, 590 Madison Avenue, 39th Floor, New York, NY

10022, Attention: Syndicate Department, or via email at

syndicate@efhuttongroup.com or telephone at (212) 404-7002.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About GraphexGraphex Group

Limited is a Cayman Island company with principal and

administrative offices in Hong Kong and subsidiary office in Royal

Oak, Michigan. Graphex is a global leader in the industry,

proficient in commercial deep processing of graphite, and is

currently producing over 10,000 metric tons of spherical graphite

annually. Graphex possesses patents and utility models covering

various technological, design, and processing applications in

addition to trade secrets and technological expertise.

Forward Looking StatementsThis

press release contains statements that constitute "forward-looking

statements," including with respect to the proposed public

offering. Forward-looking statements are subject to numerous

conditions, many of which are beyond the control of the Company,

including those set forth in the Risk Factors section of the

Company's registration statement and preliminary prospectus for the

Company's offering filed with the SEC. Copies of these documents

are available on the SEC's website, www.sec.gov. The Company

undertakes no obligation to update these statements for revisions

or changes after the date of this release, except as required by

law.

Media Inquiries:FischTank

PRgraphex@fischtankpr.com

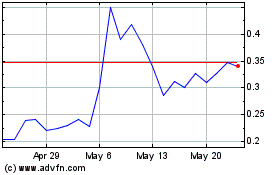

Graphex (AMEX:GRFX)

Historical Stock Chart

From Jan 2025 to Feb 2025

Graphex (AMEX:GRFX)

Historical Stock Chart

From Feb 2024 to Feb 2025