Why Silver ETFs May Continue to Rise - ETF News And Commentary

August 30 2013 - 8:00AM

Zacks

While 2013 may have begun in a near commodity panic, prices have

begun to rise for a number of natural resources as of late. This is

particularly true in the precious metal market, as hard asset

demand has surged while geopolitical risks have jumped as well.

These conditions have pushed some investors to scoop up precious

metals, hoping to ride a wave of strength higher. While we have

certainly seen this in the gold market, silver is presenting itself

as an interesting opportunity as well (see all the Precious Metal

ETFs here).

That is because this metal plays off of both industrial and safe

haven demand, which has been a great combination as the U.S.

economy—and other key economies such as in Europe—have picked up

steam, while Mideast tensions and concerns over easing programs

have risen too.

Furthermore, interest in silver ETFs in particular has been

relatively high. In fact, while gold ETFs have seen more or less

flat asset accumulation over the past month, silver ETFs have seen

more than $100 million in inflows. This suggests that investors are

increasingly looking at the white metal for opportunities in this

interesting, but still uncertain climate.

Recent Trends, Future Demand

These investors have seen solid gains lately, as silver has risen

by nearly double digits in the last three months, while GLD has

added just over 2.2% and the S&P 500 was actually negative in

the time frame. But investors have to be asking; can this trend

continue and can silver stay on top?

We think that the answer is yes, especially if global manufacturing

activity continues to rise, and if broad industrial demand

increases. After all, nearly half of silver use goes towards

industrial applications, so this looks to be a key driver (see

Silver ETFs Surge on Solid industrial Demand).

Beyond that, international events also look to play a key role.

Geopolitical concerns are building over a possible Syrian conflict,

and there are concerns with spillover into other nations in the

region. Additionally, there has also been some silver interest from

the key Indian market, as import taxes on gold have dulled the

yellow metal’s appeal in comparison, setting up a very favorable

situation for silver from an international perspective.

How to Play

Investors can always just buy up silver bullion, or even look to

silver miners such as in the ETF, SIL. However, another option

might be to play silver with an ETF, such as either of the

following funds:

iShares Silver Trust

(SLV)

This is easily the most popular fund tracking silver bullion, as it

has just less than $8 billion in assets under management. The fund

has a Zacks ETF Rank of 2 (Buy), while the expense ratio comes in

at 50 basis points a year (also read Time to Buy the Covered Call

Silver and Gold ETFs?).

ETFS Physical Silver Shares Trust

(SIVR)

For a cheaper choice in the silver bullion ETF market, investors

have SIVR from ETF Securities. This product is a bit less popular

from an assets perspective though, so there may be slightly wider

bid ask spreads. Still, this ETF also has a Zacks ETF Rank of 2, so

it could be another great option in the space.

More Information

For more on silver ETFs, make sure to watch our short video on the

subject below:

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-GOLD TRUST (GLD): ETF Research Reports

GLBL-X SILVER (SIL): ETF Research Reports

ETF-SILVER TRST (SIVR): ETF Research Reports

ISHARS-SLVR TR (SLV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

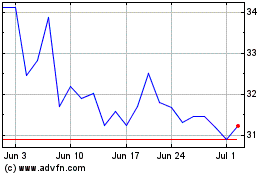

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Dec 2023 to Dec 2024