A rough 2013 for commodities continues, and in many ways has

intensified, in April. Products in a variety of segments have seen

rough days thanks to a strong dollar and uncertain demand prospects

from many key markets.

While much of the focus has been on gold and base metals, a few

others have also begun to show weakness as well. This has been

particularly the case in the silver market, as the white metal has

seen some weak trading sessions over the past few weeks (read 3 ETF

Strategies for Long Term Success).

In fact, prices are now down almost 20% for the trailing one

month period, levels that make gold ETF performance in products

like GLD seem like bull runs in comparison. This is even more so

the case this week, as some lackluster China data has kept silver

prices depressed, especially when compared to their gold

cousins.

What Happened?

Chinese data was quite weak signaling to some that the country

might be seeing a slowdown in its manufacturing sector. The HSBC

Flash Purchasing Managers Index, fell to a two month low of 50.5 in

April, from a final reading of 51.6 in March, according to

Investors.com.

This is important because it is just a tad above the key 50.0

level, which, if confirmed, could signal a contraction in the

sector. A slowdown would then carry over to silver, as the metal

has a bevy of industrial uses, unlike its more ‘safe haven’

oriented counterpart, gold (read 4 Ways to Short Gold with

ETFs).

Beyond the prospect of lower demand from a key user of the

metal, it also doesn’t help that Morgan Stanley slashed their 2013

and 2014 silver price forecasts. Their outlook for the metal in

2013 plunged by 19%, while they pushed the 2014 price target lower

by 15%, underscoring how weak they think the market will be in the

near term.

Silver ETF impact

The advent of ETFs has made silver investing far easier for the

average investor. Not only can the metal be played via a bullion

route, but it can also be targeted by looking at miners as

well.

However, these options have been terrible performers as of late,

falling victim to the weakness in commodities and silver’s more

localized issues (also read Zacks Top Ranked Silver ETF).

The two most popular funds in this segment the iShares Silver

Trust (SLV) and the ETF Securities Silver Trust (SIVR), have both

lost 18.5% in the trailing one month period. Meanwhile, both are

down about 23% YTD, leading the pack lower in the precious metals

ETF market.

Beyond this, investors should also note that there is a silver

oriented ‘white metal basket’ ETF on the market, WITE, which has

also been impacted by this slump. The fund is down 14.9% in the

past month, largely thanks to its significant holding in silver

which accounts for just over half the portfolio.

Silver Mining ETF

Silver miners can often trade as a leveraged play on the

underlying commodity. So, when the environment is bullish, mining

ETFs can lead the way on the upside, but when bearishness reigns,

these can lose more than their bullion counterparts (also read

Brutal Trading Continues in Gold Mining ETFs).

Given the extreme bearishness in the silver market lately,

investors shouldn’t be too surprised to note that the Global X

Silver Miners ETF (SIL) has lost nearly a quarter of its value in

the past month alone. And, the fund is actually down a shocking 40%

in the YTD time frame, showcasing just how bad a leveraged

performance on the metal can be during bear markets.

Other Options

For those looking to play silver but in a potentially lower risk

manner, there is now a covered call ETN that could be a decent

choice. The product, the Credit Suisse Silver Shares

Covered Call ETN (SLVO), debuted just a short while ago

and could be a nice mix of income and silver ETFs.

The ETN looks to sell out of the money notional calls each

month, while maintaining a notional long position in SLV shares.

Via this technique, the ETN looks to play silver while still

providing investors with a monthly income stream (read Combine

Silver ETFs and Covered Calls with SLVO).

The product is a bit pricey at 65 basis points a year, and

volume is still light for the time being though. Still, with the

potential for a double digit yield and the rockiness in silver ETFs

as of late, this could make for an interesting play.

Bottom Line

Silver prices have been beaten down as of late, succumbing to

the broad commodity weakness and the stronger dollar. This has led

to extreme weakness in silver bullion ETFs, and especially so in

silver mining funds.

To avoid this scenario, investors could consider the new SLVO

which seeks to get rid of some of the risk in silver trading, while

still providing investors exposure to the metal along with income.

Either way though, it looks to be some rough trading in the near

term for silver ETF investors, suggesting that extreme caution

should be taken no matter what your longer term outlook is for the

precious metal.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-GOLD TRUST (GLD): ETF Research Reports

GLBL-X SILVER (SIL): ETF Research Reports

(SILV): Get Free Report

ISHARS-SLVR TR (SLV): ETF Research Reports

(SLVO): Get Free Report

ETFS-WHITE METL (WITE): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

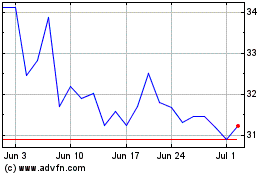

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global X Silver Miners (AMEX:SIL)

Historical Stock Chart

From Dec 2023 to Dec 2024