UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE

13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE

ACT OF 1934

For

the month of January, 2025

Commission

File Number: 001-41353

Genius

Group Limited

(Translation

of registrant’s name into English)

8

Amoy Street, #01-01

Singapore

049950

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ________.

Note:

Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ________.

Note:

Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that

the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on

which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

Board

Approval of Founder Equity Compensation Plan

On

January 9, 2025, the Company’s Compensation Committee and Board of Directors approved the following Founder Equity Compensation

Plan (the “Plan”).

The

Founder Equity Compensation Plan (the “Plan”) is devised so that the Company’s Founder and CEO, Roger James Hamilton

(“RJH”) has the opportunity to earn and maintain a 20% shareholding in Genius Group Ltd, in addition to the shares he currently

owns or earns and acquires in the future outside of this Equity Compensation Plan, based on achieving specific milestones on the path

to a market capitalization for Genius Group of at least $1 Billion within ten years.

RJH’s

shares in Genius Group have been diluted from an initial 40% to less than 12% due to a various factors including selling a significant

portion of his shares and diluting his ownership to finance the company’s operations. The Board of Directors believes that aligning

RJH’s recovery of his shareholding with the long-term interests of the shareholders through this compensation plan is in the best

interest of Genius Group Ltd. The Compensation committee believes that aligning the milestones with the Company’s Bitcoin-first

strategy and Bitcoin Treasury targets ensures a full alignment between the Company’s target to achieve a $1 Billion market capitalization

and its strategy to build its net asset value.

All

issuances of shares under this Plan are subject to compliance with NYSE rules and regulations. The Board and Compensation Committee has

shareholder approval to set Director & Officer compensation and issue shares under Singapore law.

Details

of the Equity Compensation Plan

Grants.

Over the period of 10 years, starting from January 9, 2025 and ending on December 31, 2035, 10 tranches of Restricted Share are to

be awarded to RJH based on the terms of this plan.

Vesting

of Grants. The Restricted Shares to be issued for each of the 10 tranches will be awarded in the month after each of the market capitalization

goals in the table below are achieved, based on the average market capitalization over a 20 day trading period, together with achieving

an additional one operational goal from any row of Column D (Net Asset Value) or Column E (Revenue) or Column F (Adjusted EBITDA) goals

in the table below. The number of shares to be issued for each tranche will be calculated as a percentage of the issued and outstanding

shares on the date of issue and will be treated as additional compensation.

| Tranche | |

Percentage of shares granted as a % of issued and outstanding | | |

Market Capitalization* | |

Share Price** | | |

COLUMN D NAV | |

COLUMN E Revenue | |

COLUMN F Adjusted EBITDA |

| 1 | |

| 5% | | |

$100 million | |

$ | 1.52 | | |

$100 million | |

$25 million | |

$1 million |

| 2 | |

| 3% | | |

$200 million | |

$ | 3.04 | | |

$200 million | |

$50 million | |

$2 million |

| 3 | |

| 2% | | |

$300 million | |

$ | 4.56 | | |

$300 million | |

$75 million | |

$4 million |

| 4 | |

| 2% | | |

$400 million | |

$ | 6.08 | | |

$400 million | |

$100 million | |

$6 million |

| 5 | |

| 2% | | |

$500 million | |

$ | 7.60 | | |

$500 million | |

$150 million | |

$8 million |

| 6 | |

| 2% | | |

$600 million | |

$ | 9.12 | | |

$600 million | |

$200 million | |

$10 million |

| 7 | |

| 1% | | |

$700 million | |

$ | 10.84 | | |

$700 million | |

$250 million | |

$12 million |

| 8 | |

| 1% | | |

$800 million | |

$ | 12.16 | | |

$800 million | |

$300 million | |

$15 million |

| 9 | |

| 1% | | |

$900 million | |

$ | 13.68 | | |

$900 million | |

$400 million | |

$20 million |

| 10 | |

| 1% | | |

$1 billion | |

$ | 15.20 | | |

$1 billion | |

$500 million | |

$25 million |

*All

amounts in $US

**Share

prices are for example only, based on market capitalization divided by current shares issued, prior to any additional acquisition or

funding activity.

Eligibility:

This compensation plan remains in effect for as long as RJH is employed by Genius Group and a member of its board of directors, or

unless the plan is terminated early as a result of a Change in Control as defined in the Plan.

Termination

of Employment: If RJH voluntarily resigns from Genius Group or a successor company as both CEO and Board Director or is terminated

for Cause as defined in the Plan or dies, all shares from unearned tranches are forfeited.

Change

in Control: In the event of a Change in Control all remaining, unpaid Tranches will be automatically granted and awarded. The Plan

will then terminate.

Significant

Issuance Events: In the event of a Significant Issuance Event, RJH will be immediately awarded additional shares to maintain the

same percentage ownership of Genius Group that his share ownership represented prior to the Significant Issuance Event.

Plan

Interpretation, Modification and Administration. The Board of Directors of Genius Group or designees have the full discretion to

implement and administer the provisions of the Plan. Once passed, any changes to this plan requires the consent of RJH.

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GENIUS

GROUP LIMITED |

| |

|

|

| Date:

January 10, 2025 |

|

|

| |

By: |

/s/

Roger Hamilton |

| |

Name: |

Roger

Hamilton |

| |

Title: |

Chief

Executive Officer |

| |

|

(Principal

Executive Officer) |

Exhibit

99.1

Genius

Group increases Bitcoin Treasury to $35 million,

ahead

of schedule towards $120 million target.

SINGAPORE,

January 10, 2025 - Genius Group Limited (NYSE American: GNS) (“Genius Group” or the “Company”), a leading

AI-powered, Bitcoin-first education group, today announced that it had increased its Bitcoin purchases for its Bitcoin Treasury by an

additional $5 million to 372 Bitcoin for $35 million, at an average price of $94,047 per Bitcoin.

The

total purchase of $35 million of Bitcoin has been made within two months of the Company’s announcement on November 12 of its “Bitcoin-first”

strategy that it is committing 90% or more of its current and future reserves to be held in Bitcoin, with an initial target of $120 million

in Bitcoin. The milestone to reach 30% of the initial target is ahead of the Company’s target schedule.

As

at Thursday 9, 2024, the Company’s Bitcoin Treasury of 372 Bitcoin had a market value of $35 million based on the Bitcoin price

of US$94,000 per Bitcoin. The Company’s market cap was $42 million based on 66.0 million issued shares and the share price of $0.64

at market close on Thursday 9, 2024. This gives the Company a BTC / Price ratio of 83%, with the ratio calculated by dividing the market

value of the Company’s Bitcoin Treasury by its market cap.

The

company has increased its Bitcoin loan with crypto-backed loan platform Arch Lending from $10 million to $14 million, giving the Company

a current loan-to-value ratio of 40%.

The

Company has also approved a Founder Compensation Plan with Founder and CEO, Roger Hamilton, with milestones up to a target of $1 billion

market cap within 10 years that incorporate milestones and goals for the growth of the Bitcoin Treasury to $1 billion in net asset value.

Details of the plan can be found in the accompanying 6K filed by the Company with the SEC as of today’s date.

About

Genius Group

Genius

Group (NYSE: GNS) is a Bitcoin-first business delivering AI powered, education and acceleration solutions for the future of work. Genius

Group serves 5.4 million users in over 100 countries through its Genius City model and online digital marketplace of AI training, AI

tools and AI talent. It provides personalized, entrepreneurial AI pathways combining human talent with AI skills and AI solutions at

the individual, enterprise and government level. To learn more, please visit www.geniusgroup.net.

For

more information, please visit https://www.geniusgroup.net/

Forward-Looking

Statements

Statements

made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,”

“will”, “plan,” “should,” “expect,” “anticipate,” “estimate,”

“continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and

uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve

factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue

reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors

under the heading “Risk Factors” in the Company’s Annual Reports on Form 20-F, as may be supplemented or amended by

the Company’s Reports of a Foreign Private Issuer on Form 6-K. The Company assumes no obligation to update or supplement forward-looking

statements that become untrue because of subsequent events, new information or otherwise. No information in this press release should

be construed as any indication whatsoever of the Company’s future revenues, results of operations, or stock price.

Contacts

MZ

Group - MZ North America

(949) 259-4987

GNS@mzgroup.us

www.mzgroup.us

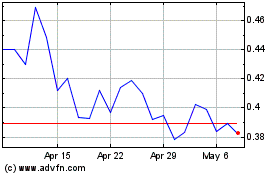

Genius (AMEX:GNS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Genius (AMEX:GNS)

Historical Stock Chart

From Jan 2024 to Jan 2025