Gabelli Global Gold, Natural Resources & Income Trust Declares Monthly Distributions of $0.14 Per Share

August 20 2009 - 12:05PM

Business Wire

The Board of Trustees of The Gabelli Global Gold, Natural

Resources & Income Trust (NYSE Amex:GGN) (the “Fund”) declared

monthly cash distributions of $0.14 per share for October,

November, and December 2009.

The distribution for October 2009 will be payable on October 23,

2009 to common shareholders of record on October 16, 2009.

The distribution for November 2009 will be payable on November

20, 2009 to common shareholders of record on November 13, 2009.

The distribution for December 2009 will be payable on December

17, 2009 to common shareholders of record on December 14, 2009.

Each quarter, the Board of Trustees reviews the amount of any

potential distribution and the income, capital gain, or capital

available. The Fund’s portfolio managers believe that attractive

investment opportunities are available in the current environment

and will seek to allocate the Fund’s capital accordingly. The Board

of Trustees will continue to monitor the Fund’s distribution level,

taking into consideration the Fund’s net asset value and the

financial market environment.

The Fund intends to make monthly cash distributions of all or a

portion of its investment company taxable income (which includes

ordinary income and realized net short-term capital gains) to

common shareholders. The Fund also intends to make annual

distributions of its realized net capital gains and may make

distributions constituting a return of capital. Various factors

will affect the level of the Fund’s income, such as its asset mix

and use of covered call strategies. To permit the Fund to maintain

more stable monthly distributions, the Fund may from time to time

distribute more or less than the entire amount of income earned in

a particular period. Because the Fund’s monthly distributions are

subject to modification by the Board of Trustees at any time and

the Fund’s income will fluctuate, there can be no assurance that

the Fund will pay distributions at a particular rate.

If the Fund does not generate sufficient earnings (dividends and

interest income and realized net capital gain) equal to or in

excess of the aggregate distributions paid by the Fund in a given

year, then the amount distributed in excess of the Fund’s earnings

would be deemed a return of capital. For the year ended December

31, 2008, the Fund had deferred capital losses for federal income

tax purposes of $27,842,945, which are available to reduce future

required distributions of capital gains. Notwithstanding, the Board

of Trustees determined to declare monthly cash distributions of

$0.14 per share for October, November, and December 2009. The Fund

is limited in the number of long-term capital gain distributions it

can make in any given year. None of the distributions paid in 2009

include long-term capital gain distributions. Accordingly, the

Board of Trustees will continue to evaluate the effect of any

deferred capital losses on the amount and frequency of any future

distributions and its effect on the Fund’s ability to make future

long-term capital gain distributions.

Short-term capital gains, qualified dividend income, ordinary

income, and paid-in capital, if any, will be allocated on a

pro-rata basis to all distributions to common shareholders for the

year. Based on the accounting records of the Fund as of August 17,

2009, each of the distributions paid in 2009 would include

approximately 9% from net investment income, 29% from net

short-term capital gains, and 62% from paid-in capital on a book

basis. The estimated components of each distribution are provided

to shareholders of record in a notice accompanying the distribution

and are available on our website (www.gabelli.com). The final

determination of the sources of all distributions in 2009 will be

made after year end and can vary from the monthly estimates. All

shareholders with taxable accounts will receive written

notification regarding the components and tax treatment for all

2009 distributions in early 2010 via Form 1099-DIV.

The Gabelli Global Gold, Natural Resources & Income Trust is

a non-diversified, closed-end management investment company with

$426 million in total assets whose primary investment objective is

to provide a high level of current income. The Fund invests

primarily in equity securities of gold and natural resources

companies and intends to earn income primarily through a strategy

of writing (selling) covered call options on equity securities in

its portfolio. The Fund is managed by Gabelli Funds, LLC, a

subsidiary of GAMCO Investors, Inc. (NYSE:GBL), which is a publicly

traded NYSE listed company.

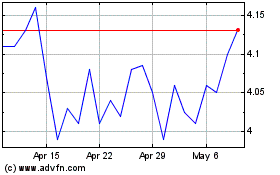

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Jun 2024 to Jul 2024

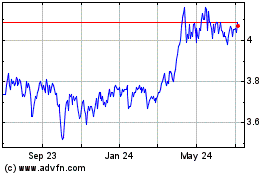

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Jul 2023 to Jul 2024