Select Sector SPDR Funds Experience Record Expansion in May; $1.75 Billion Expansion in Assets in May Eclipses Prior Monthly Rec

June 09 2005 - 10:13AM

Business Wire

The Select Sector SPDRs, a family of Exchange Traded Funds (ETFs)

that divide the S&P 500 into nine individual sector funds, saw

its collective assets under management grow 17.3% in May, rising to

more than $11.8 billion. The $1.75 billion monthly expansion is the

largest on record for the funds group, surpassing the previous

record of $1.3 billion achieved in February of this year. With

S&P 500 performance posting a 3.0% gain for the month, the vast

majority of the Sector SPDR asset expansion is due to inflows of

new money. This data provides fresh evidence of the continuing

surge in popularity of ETFs in general and the Sector SPDRs in

particular. "Not only have retail investors come to understand that

ETFs are a lower cost alternative to actively managed mutual funds,

but they are increasingly seeing them as a substitute to single

stock investing," said Dan Dolan, Director - Wealth Management

Strategies, Select Sector SPDR Trust, and the architect of Select

Sector SPDRs. "Every time a blue chip stock gets stung by bad

headlines, more and more single-stock investors come to favor the

diversification a Sector SPDR can offer. If you are looking to

capitalize on a specific investment theme you no longer need to

expose your portfolio to single stock risk." Although entire ETF

assets have grown more than 8% thus far in 2005 (expanding to $242

billion), assets in the Sector SPDR Funds have grown 26% over the

same time frame. (This growth continues a trend that saw the Funds'

assets expand by 52% in 2004.) This popularity is due perhaps to

the continuing improvement in the cost structure of the funds which

are now offered with total expenses of 25 basis points per year.

"ETF's are popular for the right reasons with retail investors and

fee-based advisors," said financial advisor Paul Dickey of INS

Capital, LLC in Denver, CO. "With ETFs, investors always know

exactly where this money is allocated, which removes one of the

risks associated with traditional mutual funds. ETF's can serve as

the perfect core component of a diversified portfolio that offers a

high degree of customization and transparency, all for extremely

low cost." On a sector basis, percentage monthly expansion was lead

by the 33.3% growth of the Energy SPDR (XLE), 32.5% for the

Financial SPDR (XLF), 28.8% for the Materials SPDR (XLB), and 25.4%

for the Consumer Discretionary SPDR (XLY). The Industrial SPDR

(XLI) was the only sector that saw a pullback in assets for the

month (-2.9%). On an aggregate dollar basis, monthly expansion was

lead by the $719 million increase in Energy, $366 million in

Financials, $187 million in Materials, and $148 million in

Technology. About Select Sector SPDRs Select Sector SPDRs are

unique ETFs that divide the S&P 500 into nine sector index

funds: Consumer Discretionary, Consumer Staples, Energy,

Financials, Healthcare, Industrials, Materials, Technology and

Utilities. Select Sector SPDRs allow investors to customize their

portfolios by picking and weighting the sectors to meet specific

investment goals. Select Sector SPDR shares are actively traded on

the American Stock Exchange throughout the trading day providing

the attributes of a mutual fund, the focus of a sector fund, and

the tradability of a stock. SSgA Funds Management, Inc. serves as

the Adviser to the Trust and, subject to the supervision of the

Board of Trustees, is responsible for the investment management of

the Select Sector SPDR Funds. An investor should consider

investment objectives, risks, charges, and expenses carefully

before investing. To obtain a prospectus which contains this and

other information, visit www.sectorspdrs.com. Please read the

prospectus carefully before investing. The Select Sector SPDR is a

trademark of the McGraw-Hill Companies, Inc. and has been licensed

for use. The stocks included in each Select Sector Index were

selected by the compilation agent. The composition and weighting of

each Index can be expected to differ from that of any similar index

that is published by Standard & Poor's. Select Sector SPDRs

bear a higher level of risk than more broadly diversified funds. *

Ordinary brokerage commissions apply when buying or selling Sector

SPDR shares. ALPS Distributors Inc., a registered broker-dealer, is

the distributor for the Select Sector SPDR Trust.

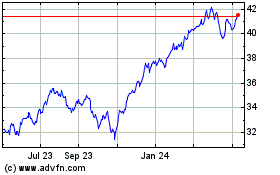

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Jun 2024 to Jul 2024

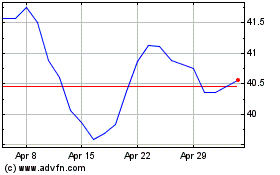

Financial Select Sector (AMEX:XLF)

Historical Stock Chart

From Jul 2023 to Jul 2024