false

0000887396

0000887396

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_________________

FORM

8-K

_________________

Current

Report

Pursuant

To Section 13 or 15 (d)

of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported):

MAY 15, 2024

_______________________________

EMPIRE

PETROLEUM CORPORATION

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

001-16653 |

73-1238709 |

| (State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

| of Incorporation) |

File Number) |

Identification No.) |

2200

S. Utica Place, Suite 150,

Tulsa, Oklahoma

74114

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s telephone number, including area

code: (539) 444-8002

(Former name or former address,

if changed since last report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Common

Stock $.001 par value

|

EP

|

NYSE

American

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

2.02. | Results

of Operations and Financial Condition. |

On May 15, 2024, Empire Petroleum Corporation

(the “Company”) issued a press release announcing its financial and operating results for the first quarter 2024. A copy

of the press release is furnished herewith as Exhibit 99.

This information is being furnished pursuant

to Item 2.02 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange

Act, except as shall be expressly set forth by specific reference in such a filing.

| Item

7.01. | Regulation

FD Disclosure. |

A Company presentation relating to its financial

and operating results for the first quarter 2024 has been posted to the Company’s website, https://empirepetroleumcorp.com,

under the “Events & Presentations” caption under “Investor Relations.”

This information is being furnished pursuant

to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for the purposes of Section 18 of the

Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing

under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item

9.01. | Financial

Statements and Exhibits. |

| (d) | | Exhibits. |

| | | |

| The following exhibits are filed or furnished herewith. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| |

EMPIRE

PETROLEUM CORPORATION

|

|

| Date:

May 16, 2024 |

By: |

/s/ Michael

R. Morrisett |

|

| |

|

Michael

R. Morrisett

President

and Chief Executive Officer |

|

3

EXHIBIT

99

Empire Petroleum Provides Encouraging North Dakota Drilling Program Update

and Reports Q1 2024 Results

TULSA,

OK – (May 15, 2024) – Empire Petroleum (NYSE American: EP) (“Empire” or the “Company”), an oil

and gas company with producing assets in New Mexico, North Dakota, Montana, Texas, and Louisiana, today provided an update on its North

Dakota development drilling program and reported results for the first quarter of 2024.

FIRST

QUARTER 2024 HIGHLIGHTS

| o | Reported

Q1-24 net sales volumes of 2,207 barrels of oil equivalent per day (“Boe/d”); |

| o | 65%

oil, 17% natural gas liquids (“NGLs”), and 18% natural gas |

| o | Average

daily oil sales volumes grew by 11% sequentially and 8% year-over-year |

| o | Commenced

$20.66M Rights Offering at $5.00 per share to fund current drilling, 3-D seismic imaging,

other strategic initiatives, and operations, which was successfully completed in Q2-24; |

| o | Initiated

3-D & 2-D seismic survey for the North Dakota drilling program, 3-D & 2-D shoot was

completed in May 2024, with data sent for processing and a completion target of the end of

Q2-24; |

| o | Continued

optimization and evaluation around the waterflood units in Empire’s New Mexico assets,

including an upcoming pilot drilling program; and |

| o | Reported

Q1-24 total revenue of $9.4 million, a net loss of $4.0 million, or $0.15 per share and an

Adjusted Net Loss of $3.9 million, or $0.15 per share; |

| o | Generated

Q1-24 Adjusted EBITDA of ($0.7) million |

2024

OUTLOOK

Phil

Mulacek, Chairman, commented, “Recent drilling and data from the North Dakota field and reservoir affirm our confidence in the

opportunity to drive meaningful production improvements in this area. We continue to see excellent well economics within our North Dakota

operations and are pleased to have achieved significant per-well cost reductions as compared to our initial expectations, following the

drilling of our most recent wells. The integration of the new 3-D and the EOR infrastructure in North Dakota are the key drivers for

our production growth goals in 2024, which we expect to be weighted to the second half of the year.”

Mike

Morrisett, President and CEO, added, “Our team has assembled a strong base of producing assets, and we have a clear, focused strategy

to build value from this portfolio. Our principal focus for the balance of 2024 is to complete our North Dakota development program.

Moving into 2025, the Permian in New Mexico’s Lea County represents a significant production growth opportunity. We have initiated

technical work to identify uplift opportunities at our three prolific waterflood units in Lea County, though we expect it to take a few

more quarters before we can commence our pilot drilling program there.”

North

Dakota – Williston Basin:

Empire expects North Dakota development efforts to drive production improvements targeted

to return operations to positive cash flow and support New Mexico exploration and development in late 2024 and beyond.

| o | 70%

of the horizontal wells completed or in progress and more under development over the next

2 quarters; the remaining 30% of the horizontal laterals will be completed for initial Enhanced

Oil Recovery (EOR) development in Q2-Q3 2024; |

| o | First

stage of the EOR infrastructure to be completed in Q2-2024 and the balance installed in Q3-2024; |

| o | Initial

production impact anticipated to ramp in Q3-2024 to Q4-2024 and beyond; |

| o | Drill

core data, currently being evaluated, has confirmed new zones of potential development; and |

| o | 3-D

seismic program to guide North Dakota drilling and development; |

| o | Completed

3-D & 2-D seismic shoot in early May 2024; expect to complete 3-D processing/analysis

and updated 3-D model by end of Q2-2024 to support launch of development program in Q3-2024 |

New

Mexico – Permian Basin:

| o | Initiated

data and analytics on historical water injection profiles across all injectors in Empire’s

waterflood units; |

| o | Currently

focused on evaluating conformance improvements; |

| o | Optimizing

waterflood aerial performance to enhance overall recovery efficiency; |

| o | Constructed

reservoir simulation model of Eunice Monument South Unit (EMSU), Eunice Monument South Unit-B

(EMSU-B) and Arrowhead Grayburg Unit (AGU) to evaluate performance and impact to SWD injection

and long-term flooding into the San Andres; |

| o | Identified

high potential recompletion opportunities in outlying fields; and |

| o | Initiated

legal and regulatory actions against third parties trespassing on the NM water floods |

FIRST

QUARTER 2024 FINANCIAL AND OPERATIONAL RESULTS

| |

Q1-24 |

Q4-23 |

%

Change2

Q1-24 vs. Q4-23 |

Q1-23 |

%

Change2

Q1-24 vs. Q1-23 |

| |

|

|

|

|

|

| Net equivalent sales (Boe/d) |

2,207 |

2,011 |

10% |

2,206 |

NM |

| Net oil sales (Bbls/d) |

1,437 |

1,294 |

11% |

1,336 |

8% |

| Realized price ($/Boe) |

50.96 |

53.50 |

-5% |

50.87 |

NM |

| Product Revenue ($M) |

10,235 |

9,898 |

3% |

10,100 |

1% |

| Net Income (Loss) ($M) |

(3,975) |

(4,797) |

17% |

(2,460) |

-62% |

| Adjusted Net Income (Loss) ($M)1 |

(3,866) |

(5,753) |

33% |

(2,059) |

-88% |

| Adjusted EBITDA ($M)1 |

(729) |

(2,917) |

75% |

228 |

NM |

________________________________

1

Adjusted Net Income (Loss), EBITDA and Adjusted EBITDA are non-GAAP financial measures. See “Non-GAAP Information”

section later in this release for more information, including reconciliations to the most comparable GAAP measure.

2

NM: A percentage calculation is not meaningful due to change in signs, a zero-value denominator, or a percentage change greater

than 200.

Net

sales for Q1-24 were 2,207 Boe/d, including 1,437 barrels of oil per day; 382 barrels of NGLs per day, and 2,328 thousand cubic feet

per day (“Mcf/d”) or 388 Boe/d of natural gas.

Empire

reported Q1-24 total revenue of $9.4 million versus $10.1 million in Q1-23. Contributing to the decrease was a $0.9 million net loss

on derivatives versus a net loss on derivatives of $0.07 million in Q1-23. Partially offsetting the change in derivatives loss was the

increase in oil production due to new wells completed in North Dakota.

Q1-24

lease operating expenses increased to $7.4 million versus $6.5 million for Q1-23, primarily due to higher power and fuel costs, higher

contract labor and an increase in employee headcount.

Production

and ad valorem taxes for Q1-24 were $0.8 million, slightly higher year-over-year as a result of higher product revenues.

Depreciation,

Depletion, Amortization and Accretion (“DD&A”) for Q1-24 was $1.98 million versus $1.02 million for Q1-23. The increase

in production and the impact of higher capitalized costs associated with the new drilling activity in North Dakota drove DD&A expense

higher year-over-year.

General

and administrative expenses, excluding share-based compensation expense, were $2.9 million, or $14.33 per Boe in Q1-24 versus $3.0 million,

or $15.23 per Boe in Q1-23. The year-over-year decrease was primarily due to severance expense for the former CEO in Q1-23, which more

than offset a Q1-24 increase in salaries and benefits associated with an increase in employee headcount.

Interest

expense for Q1-24 was $0.3 million compared to $0.2 million for Q1-23.

Empire

recorded a Q1-24 net loss of $4.0 million, or $0.15 per diluted share, versus a Q1-23 net loss of $2.5 million, or $0.11 per diluted

share.

Adjusted

EBITDA was a loss of $0.7 million for Q1-24 compared to Adjusted EBITDA of $0.2 million in Q1-23.

CAPITAL

SPENDING, BALANCE SHEET & LIQUIDITY

For

the three months ended March 31, 2024, Empire invested approximately $13.4 million in capital expenditures, primarily reflecting the

completion of 4 wells in North Dakota.

As

of March 31, 2024, Empire had approximately $3.5 million in cash on hand and approximately $1.1 million available on its credit facility.

Empire received proceeds of approximately $20.66 million following the close of the Rights Offering in April 2024.

ABOUT

EMPIRE PETROLEUM

Empire

Petroleum Corporation is a publicly traded, Tulsa-based oil and gas company with current producing assets in New Mexico, North Dakota,

Montana, Texas, and Louisiana. Management is focused on organic growth and targeted acquisitions of proved developed assets with synergies

with its existing portfolio of wells. More information about Empire can be found at www.empirepetroleumcorp.com.

SAFE

HARBOR STATEMENT

This

release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements involve a wide variety of risks and uncertainties, and include, without

limitations, statements with respect to the Company’s estimates, strategy, and prospects. Such statements are subject to

certain risks and uncertainties which are disclosed in the Company’s reports filed with the SEC, including its Form 10-K for

the fiscal year ended December 31, 2023, and its other filings with the SEC. Readers and investors are cautioned that the

Company’s actual results may differ materially from those described in the forward-looking statements due to a number of

factors, including, but not limited to, the Company’s ability to acquire productive oil and/or gas properties or to

successfully drill and complete oil and/or gas wells on such properties, general economic conditions both domestically and abroad,

and other risks and uncertainties related to the conduct of business by the Company. Other than as required by applicable securities

laws, the Company does not assume a duty to update these forward-looking statements, whether as a result of new information,

subsequent events or circumstances, changes in expectations, or otherwise.

CONTACTS

Empire

Petroleum Corporation

Mike

Morrisett

President

& CEO

539-444-8002

Info@empirepetrocorp.com

Kali

Carter

Communications

& Investor Relations Manager

918-995-5046

IR@empirepetrocorp.com

EMPIRE

PETROLEUM CORPORATION

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| Revenue: | |

| | |

| | |

| |

| Oil Sales | |

$ | 9,441,964 | | |

$ | 9,106,041 | | |

$ | 8,938,715 | |

| Gas Sales | |

| 377,130 | | |

| 410,816 | | |

| 656,035 | |

| Natural Gas Liquids ("NGLs") Sales | |

| 416,211 | | |

| 381,497 | | |

| 504,954 | |

| Total Product Revenues | |

| 10,235,305 | | |

| 9,898,354 | | |

| 10,099,704 | |

| Other | |

| 10,086 | | |

| 15,705 | | |

| 19,364 | |

| Gain (Loss) on Derivatives | |

| (858,150 | ) | |

| 1,253,708 | | |

| (66,823 | ) |

| Total Revenue | |

| 9,387,241 | | |

| 11,167,767 | | |

| 10,052,245 | |

| | |

| | | |

| | | |

| | |

| Costs and Expenses: | |

| | | |

| | | |

| | |

| Lease Operating Expense | |

| 7,387,423 | | |

| 7,956,264 | | |

| 6,520,163 | |

| Production and Ad Valorem Taxes | |

| 833,447 | | |

| 772,781 | | |

| 758,114 | |

| Depletion, Depreciation & Amortization | |

| 1,490,130 | | |

| 1,035,059 | | |

| 622,489 | |

| Accretion of Asset Retirement Obligation | |

| 485,349 | | |

| 478,881 | | |

| 401,275 | |

| Impairment | |

| — | | |

| — | | |

| — | |

| General and Administrative Expense: | |

| | | |

| | | |

| | |

| General and Administrative | |

| 2,879,037 | | |

| 4,536,237 | | |

| 3,023,279 | |

| Stock-Based Compensation | |

| 710,002 | | |

| 855,514 | | |

| 949,639 | |

| Total General and Administrative Expense | |

| 3,589,039 | | |

| 5,391,751 | | |

| 3,972,918 | |

| | |

| | | |

| | | |

| | |

| Total Cost and Expenses | |

| 13,785,388 | | |

| 15,634,736 | | |

| 12,274,959 | |

| | |

| | | |

| | | |

| | |

| Operating Income (Loss) | |

| (4,398,147 | ) | |

| (4,466,969 | ) | |

| (2,222,714 | ) |

| | |

| | | |

| | | |

| | |

| Other Income and (Expense): | |

| | | |

| | | |

| | |

| Interest Expense | |

| (315,049 | ) | |

| (328,445 | ) | |

| (237,299 | ) |

| Other Income (Expense) | |

| 738,000 | | |

| 465 | | |

| 422 | |

| Income (Loss) before Taxes | |

| (3,975,196 | ) | |

| (4,794,949 | ) | |

| (2,459,591 | ) |

| | |

| | | |

| | | |

| | |

| Income Tax (Provision) Benefit | |

| — | | |

| (2,528 | ) | |

| — | |

| | |

| | | |

| | | |

| | |

| Net Income (Loss) | |

$ | (3,975,196 | ) | |

$ | (4,797,477 | ) | |

$ | (2,459,591 | ) |

| | |

| | | |

| | | |

| | |

| Net Income (Loss) per Common Share: | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.15 | ) | |

$ | (0.20 | ) | |

$ | (0.11 | ) |

| Diluted | |

$ | (0.15 | ) | |

$ | (0.20 | ) | |

$ | (0.11 | ) |

| Weighted Average Number of Common Shares Outstanding: | |

| | | |

| | | |

| | |

| Basic | |

| 25,688,427 | | |

| 23,912,271 | | |

| 22,096,796 | |

| Diluted | |

| 25,688,427 | | |

| 23,912,271 | | |

| 22,096,796 | |

EMPIRE PETROLEUM CORPORATION

Condensed Operating Data

(Unaudited)

| | |

Three Months Ended | |

| | |

March 31, | | |

December 31, | | |

March 31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

| | |

| | |

| |

| Net Sales Volumes: | |

| | | |

| | | |

| | |

| Oil (Bbl) | |

| 130,760 | | |

| 119,022 | | |

| 120,257 | |

| Natural gas (Mcf) | |

| 211,820 | | |

| 215,855 | | |

| 231,218 | |

| Natural gas liquids (Bbl) | |

| 34,785 | | |

| 30,011 | | |

| 39,756 | |

| Total (Boe) | |

| 200,848 | | |

| 185,009 | | |

| 198,549 | |

| | |

| | | |

| | | |

| | |

| Average daily equivalent sales (Boe/d) | |

| 2,207 | | |

| 2,011 | | |

| 2,206 | |

| | |

| | | |

| | | |

| | |

| Average Price per Unit: | |

| | | |

| | | |

| | |

| Oil ($/Bbl) | |

$ | 72.21 | | |

$ | 76.51 | | |

$ | 74.33 | |

| Natural gas ($/Mcf) | |

$ | 1.78 | | |

$ | 1.90 | | |

$ | 2.84 | |

| Natural gas liquids ($/Bbl) | |

$ | 11.97 | | |

$ | 12.71 | | |

$ | 12.70 | |

| Total ($/Boe) | |

$ | 50.96 | | |

$ | 53.50 | | |

$ | 50.87 | |

| | |

| | | |

| | | |

| | |

| Operating Costs and Expenses per Boe: | |

| | | |

| | | |

| | |

| Lease operating expense | |

$ | 36.78 | | |

$ | 43.00 | | |

$ | 32.84 | |

| Production and ad valorem taxes | |

$ | 4.15 | | |

$ | 4.18 | | |

$ | 3.82 | |

| Depreciation, depletion, amortization and accretion | |

$ | 9.84 | | |

$ | 8.18 | | |

$ | 5.16 | |

| General & administrative expense: | |

| | | |

| | | |

| | |

| General & administrative expense | |

$ | 14.33 | | |

$ | 24.52 | | |

$ | 15.23 | |

| Stock-based compensation | |

$ | 3.54 | | |

$ | 4.62 | | |

$ | 4.78 | |

| Total general & administrative expense | |

$ | 17.87 | | |

$ | 29.14 | | |

$ | 20.01 | |

EMPIRE PETROLEUM CORPORATION

Condensed Consolidated Balance Sheets

| | |

March

31, | | |

December

31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Current

Assets: | |

| | | |

| | |

| Cash | |

$ | 3,491,465 | | |

$ | 7,792,508 | |

| Accounts

Receivable | |

| 7,290,007 | | |

| 8,354,636 | |

| Derivative

Instruments | |

| — | | |

| 406,806 | |

| Inventory | |

| 1,797,342 | | |

| 1,433,454 | |

| Prepaids | |

| 1,250,672 | | |

| 757,500 | |

| Total

Current Assets | |

| 13,829,486 | | |

| 18,744,904 | |

| | |

| | | |

| | |

| Property

and Equipment: | |

| | | |

| | |

| Oil and

Natural Gas Properties, Successful Efforts | |

| 107,020,654 | | |

| 93,509,803 | |

| Less:

Accumulated Depreciation, Depletion and Impairment | |

| (24,427,923 | ) | |

| (22,996,805 | ) |

| Total

Oil and Gas Properties, Net | |

| 82,592,731 | | |

| 70,512,998 | |

| Other

Property and Equipment, Net | |

| 1,729,316 | | |

| 1,883,211 | |

| Total

Property and Equipment, Net | |

| 84,322,047 | | |

| 72,396,209 | |

| | |

| | | |

| | |

| Other

Noncurrent Assets | |

| 1,931,161 | | |

| 1,474,503 | |

| | |

| | | |

| | |

| TOTAL

ASSETS | |

$ | 100,082,694 | | |

$ | 92,615,616 | |

| | |

| | | |

| | |

| LIABILITIES

AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current

Liabilities: | |

| | | |

| | |

| Accounts

Payable | |

$ | 17,194,236 | | |

$ | 16,437,219 | |

| Accrued

Expenses | |

| 7,436,586 | | |

| 7,075,302 | |

| Derivative

Instruments | |

| 440,644 | | |

| — | |

| Current

Portion of Lease Liability | |

| 430,273 | | |

| 432,822 | |

| Current

Portion of Note Payable - Related Party | |

| 1,060,004 | | |

| 1,060,004 | |

| Current

Portion of Long-Term Debt | |

| 486,483 | | |

| 44,225 | |

| Total

Current Liabilities | |

| 27,048,226 | | |

| 25,049,572 | |

| | |

| | | |

| | |

| Long-Term

Debt | |

| 8,533,693 | | |

| 4,596,775 | |

| Term Note

Payable - Related Party | |

| 2,970,000 | | |

| — | |

| Long-Term

Lease Liability | |

| 441,748 | | |

| 544,382 | |

| Derivative

Instruments | |

| 1,292,000 | | |

| — | |

| Asset

Retirement Obligations | |

| 28,105,761 | | |

| 27,468,427 | |

| Total Liabilities | |

| 68,391,428 | | |

| 57,659,156 | |

| |

| | | |

| | |

| Stockholders'

Equity: | |

| | | |

| | |

| Series

A Preferred Stock - $.001 Par Value, 10,000,000 Shares Authorized, 6 and 6 Shares Issued and Outstanding, Respectively | |

| — | | |

| — | |

| Common

Stock - $.001 Par Value, 190,000,000 Shares Authorized, 25,623,674 and 25,503,530 Shares Issued and Outstanding, Respectively | |

| 85,145 | | |

| 85,025 | |

| Additional

Paid-in-Capital | |

| 100,200,135 | | |

| 99,490,253 | |

| Accumulated

Deficit | |

| (68,594,014 | ) | |

| (64,618,818 | ) |

| Total

Stockholders' Equity | |

| 31,691,266 | | |

| 34,956,460 | |

| | |

| | | |

| | |

| TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 100,082,694 | | |

$ | 92,615,616 | |

EMPIRE

PETROLEUM CORPORATION

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Three

Months Ended | |

| | |

March

31, | | |

December

31, | | |

March

31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| Cash Flows

From Operating Activities: | |

| | | |

| | | |

| | |

| Net

Income (Loss) | |

$ | (3,975,196 | ) | |

$ | (4,797,477 | ) | |

$ | (2,459,591 | ) |

| | |

| | | |

| | | |

| | |

| Adjustments to Reconcile Net

Income (Loss) to Net Cash | |

| | | |

| | | |

| | |

| Provided

By Operating Activities: | |

| | | |

| | | |

| | |

| Stock Compensation

and Issuances | |

| 710,002 | | |

| 855,513 | | |

| 949,639 | |

| Amortization

of Right of Use Assets | |

| 135,733 | | |

| 135,733 | | |

| 76,225 | |

| Depreciation,

Depletion and Amortization | |

| 1,490,130 | | |

| 1,035,059 | | |

| 622,489 | |

| Accretion

of Asset Retirement Obligation | |

| 485,349 | | |

| 478,881 | | |

| 401,275 | |

| (Gain)

Loss on Commodity Derivatives | |

| 858,150 | | |

| (1,253,708 | ) | |

| 66,823 | |

| Settlement

on or Purchases of Derivative Instruments | |

| (10,700 | ) | |

| (266,653 | ) | |

| (41,187 | ) |

| Gain on

Financial Derivatives | |

| (738,000 | ) | |

| — | | |

| — | |

| Change

in Operating Assets and Liabilities: | |

| | | |

| | | |

| | |

| Accounts

Receivable | |

| 1,064,629 | | |

| (1,128,490 | ) | |

| (849,909 | ) |

| Inventory,

Oil in Tanks | |

| (363,888 | ) | |

| 131,230 | | |

| (420,859 | ) |

| Prepaids,

Current | |

| (2,398 | ) | |

| (165,768 | ) | |

| 89,812 | |

| Accounts

Payable | |

| 4,339,024 | | |

| 556,917 | | |

| (213,611 | ) |

| Accrued

Expenses | |

| 361,284 | | |

| 649,185 | | |

| (110,053 | ) |

| Other

Long Term Assets and Liabilities | |

| (446,430 | ) | |

| (160,691 | ) | |

| (3,177,767 | ) |

| Net

Cash Provided By (Used In) Operating Activities | |

| 3,907,689 | | |

| (3,930,269 | ) | |

| (5,066,714 | ) |

| | |

| | | |

| | | |

| | |

| Cash Flows

from Investing Activities: | |

| | | |

| | | |

| | |

| Additions

to Oil and Natural Gas Properties | |

| (16,940,873 | ) | |

| (8,950,338 | ) | |

| (2,210,004 | ) |

| Purchase

of Other Fixed Assets | |

| (31,023 | ) | |

| (173,337 | ) | |

| (27,170 | ) |

| Cash Paid

for Right of Use Assets | |

| (125,238 | ) | |

| (124,485 | ) | |

| (86,545 | ) |

| Sinking

Fund Deposit | |

| — | | |

| — | | |

| 2,779,000 | |

| Net

Cash Provided By (Used In) Investing Activities | |

| (17,097,134 | ) | |

| (9,248,160 | ) | |

| 455,281 | |

| | |

| | | |

| | | |

| | |

| Cash Flows

from Financing Activities: | |

| | | |

| | | |

| | |

| Borrowings

on Credit Facility | |

| 3,950,000 | | |

| 4,492,484 | | |

| — | |

| Proceeds

from Promissory Note | |

| 5,000,000 | | |

| — | | |

| — | |

| Principal

Payments of Debt | |

| (61,598 | ) | |

| (4,517,576 | ) | |

| (569,136 | ) |

| Proceeds

from Option and Warrant Exercises | |

| — | | |

| 9,961,195 | | |

| — | |

| Net

Cash Provided By (Used In) Financing Activities | |

| 8,888,402 | | |

| 9,936,103 | | |

| (569,136 | ) |

| | |

| | | |

| | | |

| | |

| Net Change

in Cash | |

| (4,301,043 | ) | |

| (3,242,326 | ) | |

| (5,180,569 | ) |

| | |

| | | |

| | | |

| | |

| Cash

- Beginning of Period | |

| 7,792,508 | | |

| 11,034,834 | | |

| 11,944,442 | |

| | |

| | | |

| | | |

| | |

| Cash

- End of Period | |

$ | 3,491,465 | | |

$ | 7,792,508 | | |

$ | 6,763,873 | |

Empire

Petroleum Corporation

Non-GAAP

Information

Certain

financial information included in Empire’s financial results are not measures of financial performance recognized by accounting

principles generally accepted in the United States, or GAAP. These non-GAAP financial measures include “Adjusted Net Income (Loss)”,

“EBITDA” and “Adjusted EBITDA”. These disclosures may not be viewed as a substitute for results determined in

accordance with GAAP and are not necessarily comparable to non-GAAP performance measures which may be reported by other companies. Adjusted

Net Income (Loss) is presented because the timing and amount of these items cannot be reasonably estimated and affect the comparability

of operating results from period to period, and current periods to prior periods.

| | |

Three

Months Ended | |

| | |

March

31, | | |

December

31, | | |

March

31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

| | |

| | |

| |

| Net

Income (Loss) | |

$ | (3,975,196 | ) | |

$ | (4,797,477 | ) | |

$ | (2,459,591 | ) |

| | |

| | | |

| | | |

| | |

| Adjusted for: | |

| | | |

| | | |

| | |

| (Gain)

loss on commodity derivatives | |

| 858,150 | | |

| (1,253,708 | ) | |

| 66,823 | |

| Settlement

on or purchases of derivative instruments | |

| (10,700 | ) | |

| (266,653 | ) | |

| (41,187 | ) |

| Gain on

financial derivatives | |

| (738,000 | ) | |

| — | | |

| — | |

| CEO severance

(including employer taxes) | |

| — | | |

| — | | |

| 374,820 | |

| Professional

fees for potential financing transactions | |

| — | | |

| 564,588 | | |

| — | |

| | |

| | | |

| | | |

| | |

| Adjusted

Net Income (Loss) | |

$ | (3,865,746 | ) | |

$ | (5,753,250 | ) | |

$ | (2,059,135 | ) |

| | |

| | | |

| | | |

| | |

| Diluted Weighted Average Shares Outstanding | |

| 25,688,427 | | |

| 23,912,271 | | |

| 22,096,796 | |

| | |

| | | |

| | | |

| | |

| Adjusted

Net Income (Loss) Per Share | |

$ | (0.15 | ) | |

$ | (0.24 | ) | |

$ | (0.09 | ) |

The

Company defines Adjusted EBITDA as net income (loss) plus net interest expense, depreciation, depletion and amortization (“DD&A”),

accretion, amortization of right of use assets and other items. Company management believes this presentation is relevant and useful

because it helps investors understand Empire’s operating performance and makes it easier to compare its results with those of other

companies that have different financing, capital and tax structures. Adjusted EBITDA should not be considered in isolation from or as

a substitute for net income, as an indication of operating performance or cash flows from operating activities or as a measure of liquidity.

In addition, Adjusted EBITDA does not represent funds available for discretionary use.

| | |

Three

Months Ended | |

| | |

March

31, | | |

December

31, | | |

March

31, | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

| | |

| | |

| |

| Net

Income (Loss) | |

$ | (3,975,196 | ) | |

$ | (4,797,477 | ) | |

$ | (2,459,591 | ) |

| | |

| | | |

| | | |

| | |

| Add Back: | |

| | | |

| | | |

| | |

| Interest

expense | |

| 315,049 | | |

| 328,445 | | |

| 237,299 | |

| DD&A | |

| 1,490,130 | | |

| 1,035,059 | | |

| 622,489 | |

| Accretion | |

| 485,349 | | |

| 478,881 | | |

| 401,275 | |

| Amortization

of right of use assets | |

| 135,733 | | |

| 135,733 | | |

| 76,225 | |

| Income

taxes | |

| — | | |

| 2,528 | | |

| — | |

| EBITDA | |

$ | (1,548,935 | ) | |

$ | (2,816,830 | ) | |

$ | (1,122,303 | ) |

| | |

| | | |

| | | |

| | |

| Adjustments: | |

| | | |

| | | |

| | |

| Stock based

Compensation | |

| 710,002 | | |

| 855,514 | | |

| 949,639 | |

| (Gain)

loss on commodity derivatives | |

| 858,150 | | |

| (1,253,708 | ) | |

| 66,823 | |

| Settlement

on or purchases of derivative instruments | |

| (10,700 | ) | |

| (266,653 | ) | |

| (41,187 | ) |

| Gain on

financial derivatives | |

| (738,000 | ) | |

| — | | |

| — | |

| CEO severance

(including employer taxes) | |

| — | | |

| — | | |

| 374,820 | |

| Professional

fees for potential financing transactions | |

| — | | |

| 564,588 | | |

| — | |

| | |

| | | |

| | | |

| | |

| Adjusted

EBITDA | |

$ | (729,483 | ) | |

$ | (2,917,089 | ) | |

$ | 227,792 | |

10

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

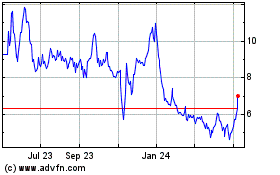

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Empire Petroleum (AMEX:EP)

Historical Stock Chart

From Jul 2023 to Jul 2024