false

0001120970

0001120970

2024-08-07

2024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

COMSTOCK INC.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

(State or Other

Jurisdiction of Incorporation)

|

001-35200

(Commission File Number)

|

65-0955118

(I.R.S. Employer

Identification Number)

|

117 American Flat Road, Virginia City, Nevada 89440

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (775) 847-5272

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.000666 per share

|

LODE

|

NYSE AMERICAN

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On August 7, 2024, Comstock Inc. (the “Company”) entered into a $325 million non-binding term sheet to (i) accept $272 million of direct investments into subsidiaries of the Company (Comstock Fuels - $200 million, Comstock Metals - $22 million and Comstock Mining - $50 million), with the Company maintaining majority ownership of each of such subsidiaries, (ii) sell a direct equity investment of $3 million into the Company, and (iii) sell Nevada real estate and water rights owned by the Company for gross proceeds of $50 million.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

COMSTOCK INC.

|

|

| |

|

|

|

|

|

Date: August 8, 2024

|

|

By:

|

|

/s/ Corrado De Gasperis

|

|

| |

|

|

|

Name: Corrado De Gasperis

Title: Executive Chairman and Chief Executive Officer

|

|

Exhibit 99.1

Comstock Secures $325 Million Term Sheet for Investments and Real Estate Sales

VIRGINIA CITY, NEVADA, August 8, 2024 – Comstock Inc. (NYSE American: LODE) a leader in hard technology developments enabling clean energy, today announced the execution of an indicative term sheet for $325 million (about $315 million net of transaction fees) in funding through SBC Commerce LLC (“SBCC”), a U.S. based, globally positioned, private equity group. The transaction is subject to final due diligence and applicable regulatory approvals.

This significant series of milestones, representing a combination of direct investments and certain asset sales, recognizes significant valuations, nearly $500 million, for the Company’s three businesses and secures timely and essential growth capital to advance, elevate and accelerate the commercialization of the Company’s fuels, metals and mining businesses.

The transaction package includes $275 million (about $267 million net of transaction fees) of direct investments into Comstock’s three main operating subsidiaries, including a $3 million direct equity investment into common shares of Comstock itself, as well as an agreement to sell the membership interests in the entities that own Comstock’s directly owned Nevada real estate and water rights for gross proceeds of $50 million ($47 million, net of transaction expenses).

Transaction Details

Subsidiary Investments of $272 million

Comstock Fuels Corporation (“CFC”) will receive a direct $200 million investment that will fund the development and deployment of a commercial-scale demonstration facility to produce advanced lignocellulosic fuels from waste woody biomass feedstocks. SBCC will receive 40% of CFC and Comstock will retain the remaining 60%. This investment will also support ongoing research and development for the continuous improvements of the already industry-leading yields, lower costs, lower capital, and lower carbon-intensity scores of Comstock’s proprietary low-carbon fuel solutions.

Comstock Metals Corporation (“CMC”) will receive a direct $22 million investment to accelerate the deployment of three 100,000-ton-per-year solar panel recycling facilities in Nevada. The solar panel recycling demonstration facility has already moved to two operating shifts, and we are adding the third shift during the third quarter and the teams are fully engaged on both sides of the supply chain with active collaborations for long-term supply and long-term offtake agreements for all residual materials. SBCC will receive 20% of the entity and Comstock will retain 60% on a fully diluted basis after vesting of Comstock Metals existing equity incentives for its president, Dr. Fortunato Villamagna.

Comstock’s Mining segment will receive a direct $50 million investment to advance the development of the southern part of the Comstock district, including the expansion of Dayton resource, the development of a Dayton mine plans, with full reclamation and sustainable, post productive land uses. The production plan anticipates gold and silver extraction within three or four years, depending, in part, on the magnitude of potential resource expansion and breadth and complexity of community development plans. SBCC will receive 40% of the entity and Comstock will retain 60%.

Comstock Direct Equity Investment of $3 million

Comstock Inc will receive a $3 million direct investment in exchange for 7.5 million restricted shares of LODE at $0.40 per share. This investment further invests and aligns SBCC with the broader Comstock mission and shareholders.

“These transactions recognize the significant opportunity we have positioned and the tremendous value that has already been created for our shareholders, and should provide the critical capital necessary for each of our three core businesses to achieve profitability while simultaneously supporting many of the prerequisites for our long-term growth plans,” said Corrado De Gasperis, Executive Chairman and CEO of Comstock Inc. “We have forged a well-aligned partnership with a capable capital partner keen on enabling systemic decarbonization and rapid, globally impacting growth. We have invested over a year into this construct, and we are thrilled about what this means for Comstock and our shareholders.”

Asset Sales of $50 million

SBCC agreed to acquire 100% of Comstock’s directly owned industrial and commercial real estate and water rights in Nevada. Comstock will receive gross proceeds of $50 million ($47 million, net of transaction expenses) which, upon closing, will be used for the elimination of debt and other obligations, continued development and growth of the Company’s strategic portfolio of advanced technologies for the energy transition and general corporate purposes.

“These transactions immediately recognize and unlock over a half a billion in realized value, validate the direction and sufficiency of our solution and the dedicated efforts of our management team to deliver this shareholder value under Corrado’s leadership,” said Mr. William Nance, Independent Director. He added, “Our team exhibited tremendous focus and calm in the face of remarkable technological, regulatory, and capital market challenges, and they just delivered.”

The company will provide a detailed walkthrough of these transactions during the Company’s Q2 2024 Earnings Release conference call on Thursday, August 8, 2024, at 4:30 pm ET. To register to join the call, please use this link.

About Comstock Inc.

Comstock Inc. (NYSE: LODE) commercializes innovative technologies that contribute to global decarbonization and the clean energy transition by efficiently converting under-utilized natural resources, primarily, woody biomass into low-carbon renewable fuels, end-of-life metal extraction and renewal, and generative AI-enabled advanced materials synthesis and mineral discovery for sustainable mining. To learn more, please visit www.comstock.inc.

Comstock Social Media Policy

Comstock Inc. has used, and intends to continue using, its investor relations link and main website at www.comstock.inc in addition to its Twitter, LinkedIn and YouTube accounts, as means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD.

CONTACTS:

For investor inquiries:

RB Milestone Group LLC

Tel (203) 487-2759

ir@comstockinc.com

For media inquiries or questions:

Comstock Inc., Zach Spencer

Tel (775) 847-7532

questions@comstockinc.com

Forward Looking Statements

This press release and any related calls or discussions may include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts, are forward-looking statements. The words “believe,” “expect,” “anticipate,” “estimate,” “project,” “plan,” “should,” “intend,” “may,” “will,” “would,” “potential” and similar expressions identify forward-looking statements but are not the exclusive means of doing so. Forward-looking statements include statements about matters such as: future market conditions; future explorations or acquisitions; future changes in our research, development and exploration activities; future financial, natural, and social gains; future prices and sales of, and demand for, our products and services; land entitlements and uses; permits; production capacity and operations; operating and overhead costs; future capital expenditures and their impact on us; operational and management changes (including changes in the Board of Directors); changes in business strategies, planning and tactics; future employment and contributions of personnel, including consultants; future land and asset sales; investments, acquisitions, joint ventures, strategic alliances, business combinations, operational, tax, financial and restructuring initiatives, including the nature, timing and accounting for restructuring charges, derivative assets and liabilities and the impact thereof; contingencies; litigation, administrative or arbitration proceedings; environmental compliance and changes in the regulatory environment; offerings, limitations on sales or offering of equity or debt securities, including asset sales and associated costs; business opportunities, growth rates, future working capital, needs, revenues, variable costs, throughput rates, operating expenses, debt levels, cash flows, margins, taxes and earnings. These statements are based on assumptions and assessments made by our management in light of their experience and their perception of historical and current trends, current conditions, possible future developments and other factors they believe to be appropriate. Forward-looking statements are not guarantees, representations or warranties and are subject to risks and uncertainties, many of which are unforeseeable and beyond our control and could cause actual results, developments, and business decisions to differ materially from those contemplated by such forward-looking statements. Some of those risks and uncertainties include the risk factors set forth in our filings with the SEC and the following: adverse effects of climate changes or natural disasters; adverse effects of global or regional pandemic disease spread or other crises; global economic and capital market uncertainties; the speculative nature of gold or mineral exploration, and lithium, nickel and cobalt recycling, including risks of diminishing quantities or grades of qualified resources; operational or technical difficulties in connection with exploration, metal recycling, processing or mining activities; costs, hazards and uncertainties associated with precious and other metal based activities, including environmentally friendly and economically enhancing clean mining and processing technologies, precious metal exploration, resource development, economic feasibility assessment and cash generating mineral production; costs, hazards and uncertainties associated with metal recycling, processing or mining activities; contests over our title to properties; potential dilution to our stockholders from our stock issuances, recapitalization and balance sheet restructuring activities; potential inability to comply with applicable government regulations or law; adoption of or changes in legislation or regulations adversely affecting our businesses; permitting constraints or delays; challenges to, or potential inability to, achieve the benefits of business opportunities that may be presented to, or pursued by, us, including those involving battery technology and efficacy, quantum computing and generative artificial intelligence supported advanced materials development, development of cellulosic technology in bio-fuels and related material production; commercialization of cellulosic technology in bio-fuels and generative artificial intelligence development services; ability to successfully identify, finance, complete and integrate acquisitions, joint ventures, strategic alliances, business combinations, asset sales, and investments that we may be party to in the future; changes in the United States or other monetary or fiscal policies or regulations; interruptions in our production capabilities due to capital constraints; equipment failures; fluctuation of prices for gold or certain other commodities (such as silver, zinc, lithium, nickel, cobalt, cyanide, water, diesel, gasoline and alternative fuels and electricity); changes in generally accepted accounting principles; adverse effects of war, mass shooting, terrorism and geopolitical events; potential inability to implement our business strategies; potential inability to grow revenues; potential inability to attract and retain key personnel; interruptions in delivery of critical supplies, equipment and raw materials due to credit or other limitations imposed by vendors; assertion of claims, lawsuits and proceedings against us; potential inability to satisfy debt and lease obligations; potential inability to maintain an effective system of internal controls over financial reporting; potential inability or failure to timely file periodic reports with the Securities and Exchange Commission; potential inability to list our securities on any securities exchange or market or maintain the listing of our securities; and work stoppages or other labor difficulties. Occurrence of such events or circumstances could have a material adverse effect on our business, financial condition, results of operations or cash flows, or the market price of our securities. All subsequent written and oral forward-looking statements by or attributable to us or persons acting on our behalf are expressly qualified in their entirety by these factors. Except as may be required by securities or other law, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Neither this press release nor any related calls or discussions constitutes an offer to sell, the solicitation of an offer to buy or a recommendation with respect to any securities of the Company, the fund, or any other issuer.

v3.24.2.u1

Document And Entity Information

|

Aug. 07, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

COMSTOCK INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 07, 2024

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-35200

|

| Entity, Tax Identification Number |

65-0955118

|

| Entity, Address, Address Line One |

117 American Flat Road

|

| Entity, Address, City or Town |

Virginia City

|

| Entity, Address, State or Province |

NV

|

| Entity, Address, Postal Zip Code |

89440

|

| City Area Code |

775

|

| Local Phone Number |

847-5272

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LODE

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001120970

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

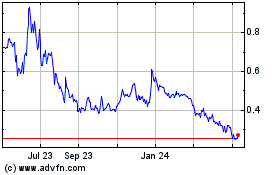

Comstock (AMEX:LODE)

Historical Stock Chart

From Nov 2024 to Dec 2024

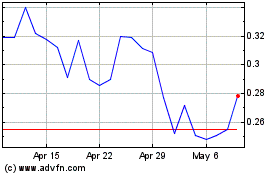

Comstock (AMEX:LODE)

Historical Stock Chart

From Dec 2023 to Dec 2024