Avery's Q3 Earnings Beat Estimates - Analyst Blog

October 25 2013 - 4:00PM

Zacks

Avery Dennison

Corporation (AVY) reported adjusted earnings of 69 cents

per share in the third quarter of 2013, up 35% from 51 cents per

share reported in the year-ago quarter and ahead of the Zacks

Consensus Estimate of 65 cents. Results benefited from the growth

in revenues in the core segments as well as Avery’s restructuring

and other productivity actions that were initiated last year.

Including restructuring costs and other items, earnings from

continuing operations were 62 cents per share in the quarter

compared with 35 cents in the year-ago quarter.

Total revenue increased 4% (organic as well as reported basis) to

$1.505 billion from $1.447 billion in the prior-year quarter.

However, revenues missed the Zacks Consensus Estimate of $1.509

billion by a whisker.

Cost of sales in the reported quarter rose 3% to $1.1 billion.

Gross profit increased 6% to $402 million from $381 million in the

prior-year quarter. Gross margin expanded 40 basis points to

26.7%.

Marketing, general & administrative expenses were $286 million

versus $287 million in the year-ago quarter. Adjusted operating

profit increased 23% to $116 million. Adjusted operating margin

improved 120 basis points to 7.7%.

Segmental Performance

Total revenue in the Pressure-sensitive Materials segment increased

4% to $1.09 billion. Label and Packaging Materials sales increased

in low-single digits, while sales for Graphics, Reflective, and

Performance Tapes increased in mid-single digits. Adjusted

operating profit increased 18% to $115 million in the quarter

driven by benefit of productivity initiatives and higher volume,

which helped mitigate changes in product mix.

Total revenue from Retail Branding and Information Solutions

increased 4% to $391 million from $376 million in the year-earlier

quarter. The improvement was driven by increased demand from

European retailers and brands. The segment’s adjusted operating

income rose 25% to $23 million on productivity initiatives and

higher volumes, partially offset by employee related expenses.

Other specialty converting businesses segment reported net sales of

$19.5 million, up 3% from $18.9 million in the year-ago quarter.

The segment reported an operating loss of $0.6 million, narrower

than the year ago quarter’s loss of $2.9 million.

Financial Position

As of Sep 28, 2013, Avery Dennison had cash and cash equivalents of

$310 million, up from $191 million as of Sep 29, 2012. Long-term

debt was $951 million as of Sep 28, 2013, compared with $703

million as of Sep 29, 2012. Debt to capitalization ration improved

to 40.6% as of Sep 28, 2013 from 46.5% as of Sep 29, 2012.

Cash flow from operating activities was $95.7 million during the

first nine months of 2013 compared with $214 million in the

prior-year comparable period. Free cash flow during the first nine

months of 2013 was $105 million, up from $102 million in the

prior-year comparable period. Avery repurchased 5.2 million shares

for $224 million so far in 2013.

Cost Reduction Actions

The company had initiated a restructuring program in the first half

of 2012 to trim costs across all its segments; owing to which the

company incurred restructuring costs of approximately $56 million

in 2012 and net cost of $20 million in the first three quarters of

2013. Avery has achieved annualized savings of $110 million from

this program. The company expects gains from the program to exceed

costs in the fourth quarter.

Fiscal 2013 Outlook

The company raised its adjusted earnings forecast to the range of

$2.60 to $2.70 per share from the previous range of $2.40 to $2.60

per share. The revised guidance represents annual growth of 33% to

38%. Free cash flow from continuing operations is expected between

$275 million and $315 million in 2013.

Sale of Businesses

On Jul 1, 2013, Avery completed the sale of its Office and Consumer

Products and Designed and Engineered Solutions businesses to CCL

Industries Inc., a global leader in specialty packaging solutions.

The net proceeds of approximately $400 million will be utilized to

repurchase shares.

Our Take

With the divestiture of the underperforming Office and Consumer

Products unit, Avery Dennison will be able to focus on its core

segments and increase its growth profile. Further share repurchases

will also provide a boost to Avery’s earnings. However, the

uncertain macroeconomic environment remains a headwind.

Pasadena, Calif.-based Avery Dennison manufactures

pressure-sensitive materials and tickets, tags, labels and other

converted products. Avery has over 200 manufacturing and

distribution facilities in more than 60 countries.

Avery currently holds a Zacks Rank #3 (Hold).

Peer Performance

An Avery Dennison peer, United Stationers Inc.

(USTR) reported an 11% year-on-year improvement in its third

quarter earnings of $1.01 a share, which however fell a penny short

of the Zacks Consensus Estimate. Among other peers, ACCO

Brands Corp. (ACCO) is expected to announce its results on

Oct 30 followed by CompX International Inc. (CIX)

on Nov 4.

ACCO BRANDS CP (ACCO): Free Stock Analysis Report

AVERY DENNISON (AVY): Free Stock Analysis Report

COMPX INTL INC (CIX): Free Stock Analysis Report

UTD STATIONERS (USTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

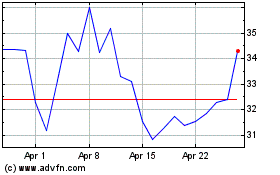

CompX (AMEX:CIX)

Historical Stock Chart

From Aug 2024 to Sep 2024

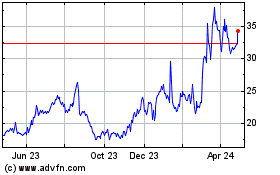

CompX (AMEX:CIX)

Historical Stock Chart

From Sep 2023 to Sep 2024