0001374310

false

0001374310

2023-09-18

2023-09-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

September 18, 2023

Date of Report (Date of earliest event reported)

Cboe Global Markets, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-34774 |

20-5446972 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

433 West Van Buren Street

Chicago, Illinois 60607

(Address of principal executive office and zip code)

(312) 786-5600

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol |

|

Name of Exchange on which registered: |

| Common

Stock, par value of $0.01 per share |

|

CBOE |

|

CboeBZX |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangement of Certain Officers.

(b) Departure of Chief Executive Officer

and Director

On September 18, 2023, Edward T. Tilly, Chief

Executive Officer of Cboe Global Markets, Inc. (the “Company”), resigned and voluntarily terminated his employment with

the Company without Good Reason (as defined under his existing employment agreement with the Company), effective as of September 18,

2023 (the “Effective Date”). Mr. Tilly also resigned from the Company’s Board of Directors (the “Board”),

effective as of the Effective Date. Mr. Tilly’s resignation follows the conclusion of an investigation led by the Board and

outside independent counsel that was launched in late August 2023. The Board determined that Mr. Tilly did not disclose personal

relationships with colleagues, which violated Company policies, and stands in stark contrast to the Company’s values. The conduct

was not related to and does not impact the Company’s strategy, financial performance, technology and market operations, reporting

or internal controls.

In connection with his resignation,

the Company and Mr. Tilly have entered into a Letter Agreement (the “Letter Agreement”), attached hereto as Exhibit 10.1

and incorporated herein by reference, pursuant to which, among other things, the parties acknowledge the payments and other benefits due

to Mr. Tilly under the terms of his employment agreement as a result of Mr. Tilly’s resignation without Good Reason. Pursuant

to the Letter Agreement, (1) Mr. Tilly will be allowed to retain a pro rata portion of his outstanding time-based restricted

stock units based on the number of days worked through the Effective Date and will forfeit the remainder, and (2) Mr. Tilly

will be allowed to retain a pro rata portion of his outstanding performance-based restricted stock units based on the number of days worked

through the Effective Date, and which will be paid out based on the Company’s actual performance through the end of the applicable

performance period for each award, and Mr. Tilly will forfeit the remainder. The treatment of Mr. Tilly’s outstanding

equity awards pursuant to the Letter Agreement is no more favorable than what Mr. Tilly is otherwise contractually entitled to receive

in connection with a voluntary termination of employment under the terms of his employment agreement and the award agreements governing

his outstanding equity awards. Under the terms of the Letter Agreement, Mr. Tilly also executed a customary release agreement, and

acknowledges that he will remain subject to the restrictive covenants set forth in his employment agreement for the term specified in

his employment agreement.

(c) Appointment of Chief Executive Officer

The Company also announced,

following Mr. Tilly’s resignation, the appointment of Fredric J. Tomczyk, an existing director of the Company, as Chief Executive

Officer of the Company, effective as of the Effective Date.

Mr. Tomczyk, age 68,

has served on the Board since July 2019, and is the retired President and Chief Executive Officer of TD Ameritrade Holding Corporation,

a position he held from October 2008 to October 2016. Mr. Tomczyk was also a member of the TD Ameritrade board of directors

from 2006 to 2007 and 2008 to 2016. Prior to joining the TD organization in 1999, Mr. Tomczyk was President and Chief Executive Officer

of London Life. He currently serves as the lead independent director of Sagan MI Canada Inc., a publicly traded company, and of its operating

subsidiary Sagan Mortgage Insurance Company Canada. Mr. Tomczyk also serves on the board of directors of Willis Towers Watson PLC,

a publicly traded company, and is a member of the Cornell University Athletic Alumni Advisory Council. Mr. Tomczyk also formerly

served as a director of Knight Capital Group, Inc. and as a trustee of Liberty Property Trust, both formerly publicly traded companies,

and as a director of the Securities Industry and Financial Markets Association. Mr. Tomczyk holds a B.S. degree in Applied Economics &

Business Management from Cornell University and is a Fellow of the Institute of Chartered Accountants of Ontario.

As a result of Mr. Tomczyk’s

appointment as Chief Executive Officer, Mr. Tomczyk has agreed to step down from the Board’s Compensation Committee and Finance

and Strategy Committee.

In connection with his appointment

as Chief Executive Officer of the Company, Mr. Tomczyk and the Company have entered into an Offer Letter (the “Offer Letter”),

attached hereto as Exhibit 10.2 and incorporated herein by reference, which memorializes certain compensation and benefits to which

Mr. Tomczyk will be entitled to in connection with his services as Chief Executive Officer. Under the Offer Letter, Mr. Tomczyk’s

annual base salary will be $1,000,000 per year and his target bonus opportunity will be 165% of his base salary, each of which will be

prorated for 2023 based on the number of days worked. Subject to Compensation Committee ratification and Board approval, Mr. Tomczyk

will also receive an equity incentive award in the form of time-based restricted stock units for shares of the Company’s common

stock with a grant date value of $7,150,000. The restricted stock unit grant will be in lieu of any annual equity incentive award grant

for the 2023 and 2024 fiscal years and will vest in three equal installments, subject to (1) Mr. Tomczyk’s continued employment

through at least the first anniversary of the grant date and (2) continued service on the Board thereafter. Mr. Tomczyk will

also be eligible to participate in the Company’s employee benefit plans available to similarly situated executives and to receive

relocation assistance benefits under the Company’s relocation program.

There are no family relationships

between Mr. Tomczyk and any Company director or executive officer, and no arrangements or understandings between Mr. Tomczyk

and any other person pursuant to which he was selected as an officer. Mr. Tomczyk is not a party to any current or proposed transaction

with the Company for which disclosure is required under Item 404(a) of Regulation S-K.

(e) Amendment to the Executive Severance

Plan

On September 18, 2023,

the Compensation Committee of the Board approved the First Amendment to the Company’s Amended & Restated Executive Severance

Plan (the “Executive Severance Plan Amendment”), in order to allow Mr. Tomczyk to participate as an eligible executive

under the plan. Mr. Tomczyk’s participation under the plan is expected to be in lieu of any other contractual right to severance

with the Company.

The foregoing description

of the Executive Severance Plan Amendment does not purport to be complete and is subject to, and is qualified in its entirety by, the

full text of the plan, attached hereto as Exhibit 10.3 and incorporated herein by reference.

Item 8.01 Other Events

On September 19, 2023,

the Company issued a press release announcing Mr. Tilly’s resignation, the appointment of Mr. Tomczyk as Chief Executive

Officer, and the appointment of William M. Farrow III as non-executive Chairman of the Board (replacing his prior role as Lead Director

of the Board). A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| |

10.1 |

|

Letter Agreement, dated September 18, 2023, between Cboe Global Markets, Inc. and Edward T. Tilly (filed herewith)* |

| |

10.2 |

|

Offer Letter, dated September 18, 2023, between Cboe Global Markets, Inc. and Fredric J. Tomczyk (filed herewith)* |

| |

10.3 |

|

First Amendment to the Cboe Global Markets, Inc. Amended &

Restated Executive Severance Plan, dated September 18, 2023 (filed herewith)* |

| |

99.1 |

|

Press Release of Cboe Global Markets, Inc. (filed herewith) |

| |

104 |

|

Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document) |

*Indicates Management Compensatory Plan, Contract or Arrangement

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CBOE GLOBAL MARKETS, INC.

(Registrant) |

| |

|

| |

By: |

/s/ Patrick Sexton |

| |

|

Patrick Sexton |

| |

|

Executive Vice President, General Counsel and Corporate Secretary |

| |

|

|

| |

|

Dated: September 19, 2023 |

Exhibit 10.1

| 433 W Van Buren St.

Chicago, Ill

60607

United States | cboe.com |

September 18, 2023

Edward T. Tilly

Via email

RE: Upcoming Resignation from Cboe Global Markets, Inc.

Dear Edward,

This letter agreement (this

“Letter Agreement”) confirms your resignation from your position as Chief Executive Officer of Cboe Global Markets, Inc.

(the “Company”) effective Monday, September 18, 2023 (the “Resignation Date”).

By signing and acknowledging

below, the Company and you agree to the following:

| 1. | You have elected to resign and terminate your employment with the Company without Good Reason (your “Resignation”)

as defined by and pursuant to the terms of your employment agreement with the Company dated February 9, 2023 (the “Employment

Agreement”), effective on the Resignation Date. Note that terms not otherwise defined in this Letter Agreement will have the

meaning assigned to them in the Employment Agreement, except as otherwise indicated herein. |

| 2. | You are also resigning from the Board of Directors of the Company (the “Board”), your

position as Chairman of the Board and as a director, manager or any other positions with the Company and all of its subsidiaries and affiliates

on the Resignation Date. In addition, you agree to provide any additional documentation that may be reasonably requested by the Company

to evidence your resignation from the Board or similar governing body of any subsidiary or affiliate of the Company. |

| 3. | For the avoidance of doubt, the Company hereby: |

(a) accepts your Resignation as

timely and properly submitted under the Employment Agreement; (b) waives the notice of termination requirements in Section 5(d) of

the Employment Agreement; (c) confirms that it will timely make all payments and provide all benefits set forth in Section 5(d) of

the Employment Agreement; and (d) waives any rights it may have under any other provisions in the Employment Agreement or elsewhere

to refuse to make any such payments or refuse to provide any such benefits; provided, however, that the Company expressly reserves and

retains all rights under law and equity to enforce the Employment Agreement, LTIP and equity incentive award agreements for matters arising

after the date of this Letter Agreement, including but not limited to the restrictive covenants and confidentiality covenants contained

in your equity incentive award agreements, the restrictive covenants, non-disparagement and confidentiality covenants contained in Sections

9 and 10 of the Employment Agreement, the clawback provisions contained in Section 25 of the Employment Agreement, and/or any terms

of the release agreement, which is included as Exhibit A to this Letter Agreement.

| 4. | You have had the opportunity to review the press release regarding your Resignation, as provided by the

Company under separate cover. |

| 5. | You acknowledge and agree that, except as otherwise provided in paragraph 5 of this Letter Agreement,

you are not entitled to any other payment or benefit under the Employment Agreement in connection with your Resignation. |

| 6. | Upon the Resignation Date, pursuant to Sections 5(d) and 12 of the Employment Agreement, you will: |

| a. | Execute a release agreement, which is included as Exhibit A to this Letter Agreement. |

| b. | Remain subject to the restrictive covenants, non-disparagement and confidentiality covenants in Sections

9 and 10 of the Employment Agreement and the restrictive covenants and confidentiality covenants contained in your equity incentive award

agreements under the LTIP, which are incorporated by reference into this Letter Agreement. For purposes of calculating the applicable

restricted period for the restrictive covenants and non-disparagement covenants, the restricted period will commence on the Resignation

Date. For the avoidance of doubt, it is agreed and understood that consequent upon your Resignation, the restricted period for which you

are subject to the restrictive covenants and non-disparagement covenants provided in Section 9 of the Employment Agreement is two

(2) years from the Resignation Date. |

| c. | Become entitled to your pay and benefits earned through the Resignation Date consisting of: |

| i. | Your accrued but unpaid current base salary through the Resignation Date. |

| ii. | Any benefit obligations under any Benefit Plan or Insurance Plan, determined in accordance with the terms of the applicable plan. |

| 7. | With respect to certain equity incentive awards you have been granted under the LTIP prior to the Resignation

Date, you acknowledge and agree that the following treatment applies: |

| a. | All time-based restricted stock units will have pro-rated vesting through the Resignation Date, with vesting

effective on the Resignation Date, as set forth on Exhibit B. |

| b. | All unvested performance-based restricted stock units will have pro-rated vesting through the Resignation

Date, with vesting effective at the end of each applicable Performance Period and determined based on actual achievement of any Performance

Goal(s) specified in the Award at the end of such Performance Period, as set forth on Exhibit B. |

| c. | All unvested time-based restricted stock units and performance-based restricted stock units that do not

pro-rata vest pursuant to paragraph 6(a) and 6(b) of this Letter Agreement will be immediately forfeited, as set forth on Exhibit B. |

| 8. | Upon your resignation, you acknowledge and agree: |

| a. | You will return to the Company, specifically its Chief Human Resources Officer, all known equipment, data,

material, books, records, documents (whether hard copy or stored electronically or on computer hard drives or disks), computer disks,

credit cards, Company keys, I.D. cards and other property, including, without limitation your computer/laptop, printers, telephones

and other electronic devices in your possession, custody or control which are or were owned and/or leased by the Company or any of its

parents, subsidiaries or affiliates in connection with the conduct of the business of the Company or any of its parents, subsidiaries

or affiliates (collectively referred to as “Company Property”). You further warrant that you have not retained, or

delivered to any person or entity, copies of any Company Property or permitted any copies of Company Property to be made by any other

person or entity. |

| b. | You agree to reasonably cooperate with the Company and their respective counsel in connection with any

investigation, administrative proceeding or litigation related to or involving any aspect of your employment with the Company. This cooperation

includes, but is not limited to, meeting with the Company and/or its agents and attorneys to answer questions, preparing for and testifying

at depositions, assisting in responding to discovery demands, preparing for trial and/or arbitration, and preparing for and testifying

at any trial and/or arbitration. For any matters that require your attendance (either virtual or in-person), you will coordinate with

the Company’s counsel(s) to accommodate dates that fit your availability, subject to the confines of any deadlines imposed

by the court or arbitration panel. You agree that whether a matter is related to or involving any aspect of your employment with the Company

is to be determined by the Company in its sole discretion. The Company agrees that it will reimburse you for reasonable travel expenses

(i.e., transportation, meals, and lodging) that you may incur in cooperating with the Company, provided that you follow the Company’s

instructions regarding submission and approval of such expenses. This provision is not intended to affect the substance of any testimony

that you provide; rather, you agree to provide truthful testimony and to otherwise cooperate with the Company in light of and in full

compliance with all applicable laws. All consideration (including monetary payment) received by you in connection with this Agreement

are not for any testimony that you provide in connection with this provision. In addition, except to the extent prohibited by law, you

agree to provide immediate notice (within 3 business days) to the Company if you receive any subpoena, lawsuit, administrative proceeding

or summons (along with copies of such documents) related, in any way, to Cboe. |

If this Letter Agreement accurately

describes your understanding of your Resignation, please sign the below acknowledgement and return a copy of this Letter Agreement to

my attention.

| |

Sincerely, |

|

| |

|

|

| |

/s/ Patrick Sexton |

|

| |

Patrick Sexton |

|

| |

General Counsel & Corporate Secretary |

|

By signing and dating under

your name below, you acknowledge and agree to the terms set out in this Letter Agreement under the terms above.

EDWARD T. TILLY

| Signature: |

/s/ Edward T. Tilly |

|

| |

|

|

| Date: |

September 16, 2023 |

|

EXHIBIT A

RELEASE OF CLAIMS

THIS RELEASE OF CLAIMS (the

“Release”) is made and entered into this 18 day of September 2023, to be effective as of (the “Effective

Date”), by and between CBOE GLOBAL MARKETS, INC. (“Cboe”) and EDWARD T. TILLY, a resident of the State

of Illinois (“Tilly”).

1. In

consideration of Cboe’s payments to Tilly described in the Letter Agreement by and between Cboe and Tilly dated September 18,

2023, to which Tilly is not otherwise entitled and the sufficiency of which Tilly acknowledges, Tilly does hereby fully, finally and unconditionally

release and forever discharge Cboe, Cboe’s subsidiaries and affiliates, and the former, current and future officers, directors,

employees, members, shareholders, representatives and agents and all of their respective predecessors, successors, and assigns of Cboe

and Cboe’s subsidiaries and affiliates (collectively “Released Parties”), in their personal, corporate and representative

capacities, from any and all rights, claims, liabilities, obligations, damages, costs, expenses, attorneys’ fees, suits, actions,

and demands, of any and every kind, nature and character, known or unknown, liquidated or unliquidated, absolute or contingent, in law

and in equity, enforceable or arising under any local, state or federal common law, statute or ordinance relating to Tilly’s past

employment with Cboe or any past actions, statements, or omissions of Cboe or any of the Released Parties occurring prior to Tilly’s

execution of this Release, including but not limited to all claims for defamation, wrongful termination, back pay and benefits, pain and

suffering, negligent or intentional infliction of emotional distress, breach of contract, and interference with contractual relations,

tort claims, employment discrimination claims, and all claims arising under the Age Discrimination in Employment Act of 1967, as amended

(“ADEA”), Title VII of the Civil Rights Act of 1964, as amended, the Civil Rights Act of 1866, as amended by the Civil

Rights Act of 1991 (42 U.S.C. § 1981), the Family and Medical Leave Act, the Equal Pay Act, the Fair Labor Standards Act, the Americans

with Disabilities Act, the Older Workers Benefit Protection Act, the Illinois Human Rights Act, the Workers Adjustment and Retraining

Act, and the Chicago and Cook County Human Rights Ordinances, and any other statutory, contract, implied contract, or common law claim

arising out of or involving Tilly’s employment, the termination of Tilly’s employment, or any continuing effects of Tilly’s

employment with Cboe.

2. Tilly

agrees not to sue Cboe or any of the Released Parties with respect to rights and claims covered by this Release. If any government agency

or court assumes jurisdiction of any charge, complaint, or cause of action covered by this Release, Tilly will not seek and will not accept

any personal equitable or monetary relief in connection with such investigation, action, suit, or legal proceeding.

3. Tilly

agrees that he will refrain from making any statement to any third party regarding any matters related to his resignation, including,

but not limited to, the investigation preceding his resignation, the resignation itself, or the terms of this Agreement. Tilly agrees

that if there are inquiries from third parties regarding any matters related to his resignation, he will respond, “no comment”

and direct such inquires to the appropriate representatives for Cboe. The terms “third party” and “third parties”

are to be construed broadly and include any person or entity other than Tilly or the Released Parties.

4. Tilly

agrees: (a) he has not made or brought against the Company or the Released Parties any charge, claim, civil action, administrative

action, or internal or external complaint or allegation of discrimination, harassment (including sexual harassment), failure to prevent

an act of workplace harassment or discrimination based on sex, sexual assault or abuse, retaliation, or any other unlawful employment

practice (all collectively, hereinafter, “Unlawful Employment Practices Claims”); (b) there is no factual basis

for any Unlawful Employment Practices Claim; (c) this Release is not in settlement of an employment dispute or other Unlawful Employment

Practices Claim; and (d) none of the payments provided under the Letter Agreement are payments related to any Unlawful Employment

Practices Claims. Tilly agrees that to the extent he has knowledge of or information regarding any Unlawful Employment Practices by or

involving the Company or the Released Parties (including but not limited to discrimination, harassment (including sexual harassment),

failure to prevent an act of workplace harassment or discrimination based on sex, sexual assault or abuse, or retaliation), Tilly will

maintain as confidential and not disclose such knowledge or information, except to the extent permitted by Section 5 of this Release.

5. Notwithstanding

anything in this Agreement to the contrary, nothing in this Agreement prohibits Tilly from confidentially or otherwise communicating or

filing a charge or complaint with a governmental or regulatory entity, participating in a governmental or regulatory entity investigation,

or giving truthful testimony or making other disclosures to a governmental or regulatory entity (in each case, without having to disclose

any such conduct to Cboe), or from responding if properly subpoenaed or otherwise required to do so under applicable law. In addition,

nothing in this Agreement limits Tilly’s right to receive an award from a governmental or regulatory entity for information provided

to such an entity (and not as compensation for actual or alleged personal injury or damages to Tilly). Tilly acknowledges and agrees that

this Release is not in settlement of a claim of sexual discrimination or harassment.

6. Tilly

has twenty-one (21) days (until October 9, 2023) within which to consider this Release, although Tilly may accept it at any time

within those twenty-one (21) days. Once Tilly has signed this Release, Tilly will still have seven (7) days in which to revoke his

acceptance of the ADEA portion of the Release by notifying Cboe, and specifically, its Chief Human Resources Officer. The ADEA portion

of the Release will not be effective or enforceable until the seven (7) day revocation period has expired. If the ADEA portion of

the Release is revoked, the remainder of this Release shall remain in full force and effect as to all of its terms except for the release

of claims under the ADEA, and Cboe will have three (3) business days to rescind the entire Release at its own discretion by so notifying

Tilly.

7. Tilly

agrees that he will continue to be governed by those obligations arising under Sections 9, 10 and 11 of the Employment Agreement by and

between the Cboe and Tilly dated February 9, 2023, which are incorporated by reference herein, shall not be released, shall be unaffected

hereby, and shall remain in full force and effect.

8. This

Release shall be binding upon and inure to the benefit of Cboe and its successors and assigns and Tilly and his heirs, executors and administrators.

9. This

Release shall be construed and interpreted under the laws of the State of Illinois to the extent not preempted by applicable laws of the

United States.

CBOE GLOBAL MARKETS, INC.

By: _________________________________

Its: _________________________________

Dated:_______________________________

EXHIBIT B

OUTSTANDING EQUITY AWARD TREATMENT

Restricted Stock Units

| Grant Date | |

Original Award

Amount (#) | | |

Unvested Amount at

Resignation Date (#) | | |

Pro Rata Amount to

Vest at Resignation

Date (#) | | |

Amount Forfeited at

Resignation Date (#) | |

| 2/19/2021 | |

| 28,113 | | |

| 9,371 | | |

| 6,675 | | |

| 2,696 | |

| 2/19/2022 | |

| 23,319 | | |

| 15,546 | | |

| 5,537 | | |

| 10,009 | |

| 2/19/2023 | |

| 26,457 | | |

| 26,457 | | |

| 6,282 | | |

| 20,175 | |

Performance Stock Units

| Grant Date | |

Award Amount

(#) | | |

Pro Rata Amount

of rTSR PSUs

Eligible for

Performance

Vesting (#) | | |

Pro Rata Amount

of EPS PSUs

Eligible for

Performance

Vesting (#) | | |

Amount of rTSR

PSUs Forfeited

at Resignation

Date (#) | | |

Amount of EPS

PSUs Forfeited

at Resignation

Date (#) | |

| 2/19/2021 | |

| 28,114 | | |

| 12,709 | | |

| 12,709 | | |

| 1,348 | | |

| 1,348 | |

| 2/19/2022 | |

| 23,320 | | |

| 6,656 | | |

| 6,656 | | |

| 5,004 | | |

| 5,004 | |

| 2/19/2023 | |

| 26,458 | | |

| 3,141 | | |

| 3,141 | | |

| 10,088 | | |

| 10,088 | |

Exhibit 10.2

September 18, 2023

Fredric Tomczyk

Via email

| RE: | Offer

Letter from Cboe Global Markets, Inc. |

Dear Fred,

I am very pleased to confirm our offer employment

with Cboe Global Markets, Inc. (the “Company”). This offer letter (this “Offer Letter”) details

the terms and conditions that govern your employment as Chief Executive Officer of the Company effective September 18, 2023.

| Position |

Your

position will be Chief Executive Officer of the Company. You will continue to serve on the Board of Directors of the Company (the

“Board”). |

| Location |

You

will work in Chicago, Illinois |

| Status/

FLSA Classification |

This

position is a Full time Exempt position |

| Job

Duties |

Your

primary duties and responsibilities will include those commensurate with the role of Chief Executive Officer. Other duties

as applicable will be assigned. |

| Base

Salary |

Your

annual salary will be at the rate of $1,000,000, less applicable withholdings. You will be paid on a semi-monthly basis on the 15th

and last day of each month via direct deposit in accordance with our regular payroll practices. For the 2023 fiscal year, your base

salary will be pro-rated based on the number of days worked in fiscal 2023. |

| Annual

Bonus Opportunity |

You

will be eligible for an annual short-term discretionary incentive (“STI”) payment (bonus). STI award amounts are

based upon the financial performance of the Company as well as your individual performance. Your annual STI target is expected

to be 165% of your base salary, and pro-rated based on your start date. Additionally, you must be actively employed on the date the

bonus awards are paid (typically in February of the year following the bonus plan year and in no event later than March 15

of such year) in order to receive a bonus payout. |

| Benefits |

You

will be eligible to participate in and receive benefits under any employee benefit and insurance plans, programs or arrangements

available to similarly situated executives of the Company, subject to and consistent with the terms, conditions and overall administration

of each such benefit plan, program or arrangement. The Company reserves the right to amend or terminate any employee benefit plan,

program or arrangement at any time in its sole discretion, subject to the terms of such plan, program or arrangement and applicable

law. |

| Business

Expenses and Reimbursements |

You

will be reimbursed for all reasonable and necessary business expenses incurred in the course and scope of your employment. You

must timely submit requests for expense reimbursements with corresponding receipts in accordance with the Company’s expense

reimbursement policies and procedures as in effect from time to time. |

| Relocation

Benefits |

You

will be entitled to receive certain relocation benefits in accordance with the Company’s relocation program, which will be

set forth in a separate relocation repayment agreement entered into with the Company. |

| Equity

Grant |

Subject to approval of the Compensation Committee

and ratification by the Company’s Board of Directors, the Company will grant you an award of time-based restricted stock units

for shares of the Company’s common stock with a grant date value of $7,150,000 (the “RSU Grant”). The RSU

Grant will be in lieu of any annual equity incentive award grant for the 2023 and 2024 fiscal years and shall vest in three equal

annual installments, subject to (1) your continued employment through at least the first anniversary of the grant date and (2) continued

service on the Board of Directors thereafter. The RSU Grant shall be subject to the terms and conditions of the Second Amended and

Restated Cboe Global Markets, Inc. (f/k/a CBOE Holdings, Inc.) Long-Term Incentive Plan (as may be amended from time to

time) or any similar or successor plan (the “LTIP”) and the applicable award agreement to be agreed upon between

you and the Compensation Committee.

Beginning in the 2025 fiscal year, you will

be eligible to receive equity incentive awards under the LTIP, in amounts and subject to such terms determined by the Compensation

Committee in its sole discretion. |

| Restrictive

Covenants |

You

agree that you will be governed by those obligations arising from any restrictive covenants contained in all agreements between the

you and the Company (e.g., LTIP, equity award agreement, etc.), which are incorporated by reference herein. |

| Clawback |

All

incentive compensation paid to you pursuant to this Offer Letter or otherwise in connection with your employment with the Company

shall be subject to any clawback policy in effect or as adopted by the Company and by applicable law, including, without limitation,

the provisions of any Company clawback policy to the extent required by the Securities Exchange Act of 1934 and any applicable rules or

regulations issued by the Securities and Exchange Commission or any national securities exchange or national securities association

on which the Company’s stock may be traded. |

| Employment

Authorization |

Employment

with the Company is contingent upon verification of work eligibility and your review and acknowledgement of the Cboe U.S. Handbook

for employees and the associate policy for privacy of information. To comply with current immigration law, we must verify your

authorization to work in the United States. Please bring acceptable documentation with you on your first day of work. A social

security card and a current driver's license or state I.D., or a U.S. Passport, are some of the acceptable documents to satisfy this

requirement. This offer of employment is also contingent upon the Company obtaining verification, to the sole satisfaction of the

Company, of information regarding your previous employment, education and references. Additionally, the Company requires that all

employees are fingerprinted upon hire, and this offer is contingent upon the successful completion of fingerprint results and conducting

a background check to the sole satisfaction of the Company. |

| No

Conflicts |

Unless

written permission is granted, you agree that during your employment with the Company, you will not render services for any third

party or for your own account that conflict with your duties to the Company. From time to time, the Company will require

you to disclose any conflicts of interest. |

| Rules of

Conduct |

As

a Company employee, you will be expected to abide by the Company’s rules and standards, including, but not limited to

the Cboe Global Markets, Inc. and Subsidiaries Code of Business Conduct and Ethics. |

| Term |

Your employment is at-will and not for any

term. Your employment can be terminated at any time.

Should you resign from your employment, you

will give the Company 30 days’ prior written notice. |

To accept the Company’s offer of employment,

please sign and date this Offer Letter in the space provided below. If you accept our offer, your first day of employment will be deemed

to be September 18, 2023. This Offer Letter sets forth the terms of your employment with the Company and supersede any prior representations

or agreements including, but not limited to, any representations made during your recruitment, interviews or pre-employment negotiations,

whether written or oral. This Offer Letter, including, but not limited to, its at-will employment provision, may not be modified or amended

except by a written agreement by the Company and you.

If this Offer Letter accurately describes your

understanding of your employment with the Company, please sign the below acknowledgement and return a copy of this Offer Letter to my

attention.

[Signature page follows]

Sincerely,

| /s/ Edward J. Fitzpatrick |

|

| Edward J. Fitzpatrick |

|

| Chairman of the Compensation Committee |

|

By signing and dating under your name below,

you acknowledge and agree to the terms set out in this Offer Letter under the terms above.

FREDRIC TOMCZYK

| Signature: |

/s/ Fredric Tomczyk |

|

| |

|

|

| Date: |

September 18, 2023 |

|

Exhibit 10.3

FIRST AMENDMENT TO AMENDED & RESTATED

CBOE GLOBAL MARKETS, INC. EXECUTIVE SEVERANCE PLAN

This First Amendment (this “Amendment”)

to the Cboe Global Markets, Inc. Executive Severance Plan, dated January 1, 2011 and as further amended and restated February 11,

2021 (the “Plan”), is hereby made and entered into by Cboe Global Markets, Inc. (the “Corporation”),

effective as of September 18, 2023 (the “Effective Date”).

WHEREAS, the Corporation

sponsors and maintains the Plan for the purpose of providing certain severance benefits for its eligible executive;

WHEREAS, the Corporation

has reserved the right to amend the Plan in accordance with Section 8.1 of the Plan; and

WHEREAS, the Corporation

would like to amend the plan to add the Chief Executive Officer of the Corporation as an eligible participant in the Plan and provide

that the Chief Executive Officer of the Corporation will be eligible to receive severance benefits at the level of an executive vice president

under the Plan.

NOW, THEREFORE, BE IT RESOLVED,

that the Plan is hereby amended as follows, effective as of the Effective Date.

1. Section 2

of the Plan shall be amended to add the following definition:

“Chief

Executive Officer” or “CEO” means an Executive who has the title and position of chief executive officer

of the Corporation.”

2. The

definition of “Executive” in Section 2 of the Plan shall be amended in its entirety to read as follows:

“Executive”

means: (a) the Chief Executive Officer; (b) an eligible employee who has a title and position of EVP or SVP of the Employer

designated from time to time by the Chief Executive Officer; and (c) any individual who was eligible to participate in the Plan prior

to the Effective Date, as described in Section 3.1 below. No individuals other than the Chief Executive Officer, those designated

from time to time by the Chief Executive Officer and those eligible to participate in the Plan prior to the Effective Date at the time

of employment termination will be eligible to receive Severance Benefits.”

3. The

first paragraph of Section 3.1 of the Plan shall be amended in its entirety to read as follows:

“Subject to

the conditions and limitations of the Plan, an Executive who experiences an Involuntary Termination shall be entitled to receive Severance

Benefits as set forth below. The Chief Executive Officer shall be treated as an EVP for purposes of the Severance Benefits under the Plan

and shall be entitled to receive all Severance Benefits that an EVP is entitled under Article 3 of the Plan. In addition, any individual

who was eligible to participate in the Plan prior to the Effective Date but is no longer eligible to participate in the Plan on or after

the Effective Date shall continue to be eligible to receive Severance Benefits, upon such individual’s Involuntary Termination,

pursuant to the terms of the Plan prior to the Effective Date.”

4. Except

as specifically amended herein, the provisions of the Plan shall remain in full force and effect.

[REMAINDER OF PAGE LEFT INTENTIONALLY BLANK]

IN WITNESS WHEREOF, this Amendment has been duly executed on behalf

of the Corporation on this this 18th day of September 2023, to be effective as of the Effective Date.

| |

CBOE GLOBAL MARKETS, INC. |

| |

Title: |

Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

|

News

Release

Page 1

of 3 |

Cboe Global Markets

Announces Leadership Transition

| · | Fredric

J. Tomczyk, current member of Cboe Global Markets Board of Directors, and former President

and Chief Executive Officer of TD Ameritrade Holding Corporation, named CEO |

| · | Edward

T. Tilly resigns as Chairman and CEO of Cboe Global Markets |

| · | William

M. Farrow, III, currently Lead Director, named non-executive Chairman of the Board of

Directors of Cboe Global Markets |

CHICAGO –

September 19, 2023 – Cboe Global Markets, Inc. (Cboe: CBOE), the world's leading derivatives and securities exchange

network, announced today that it has appointed Fredric J. Tomczyk, a current member of Cboe’s Board of Directors, to the role of

CEO, effective immediately. Mr. Tomczyk succeeds Edward T. Tilly, who has resigned from the company following the conclusion of

an investigation led by the Board of Directors and outside independent counsel that was launched in late August 2023. The Board

of Directors determined that Mr. Tilly did not disclose personal relationships with colleagues, which violated Cboe’s policies

and stands in stark contrast to the company’s values. The conduct was not related to and does not impact the company’s strategy,

financial performance, technology and market operations, reporting, or internal controls.

Mr. Tomczyk

served as President and CEO of TD Ameritrade Holding Corporation from October 2008 through October 2016. Before that, he served

as Vice Chairman of TD Bank Financial Group. Prior to his time with TD, he was President and CEO of London Life and London Insurance

Group. He joined Cboe’s Board of Directors in July 2019.

William M. Farrow, III,

currently Lead Director of Cboe, has been named non-executive Chairman of the Board of Directors, effective immediately.

“Cboe strives

to uphold the highest ethical standards across the organization, and fully investigates and takes appropriate action when it determines

that any of its policies have been violated,” said Mr. Farrow. “Fred’s familiarity with Cboe’s business,

combined with his multi-decade experience in the financial services industry, will provide stability and reinforce the company’s

commitment to growth for Cboe, its associates, customers, index partners, and investors during this period of transition. We have every

confidence that the company will continue to execute on Cboe’s mission of building a trusted, inclusive global marketplace that

enables people to pursue a sustainable financial future.”

“Cboe’s

business is stronger than ever, and I look forward to working alongside our Global President, Dave Howson, and the entire management

team to continue to execute on our global strategy of building on our position as the world’s leading securities and derivatives

network,” said Mr. Tomczyk. “Cboe’s incredible success over the past 50 years is a testament to the hard work

of each and every associate. I have the utmost confidence in the team, and I am excited to work together as we continue to build trusted

markets around the globe.”

| —More — |  |

|

News Release

Page 2 of 3 |

About Cboe Global

Markets, Inc.

Cboe

Global Markets (Cboe: CBOE), the world's leading derivatives and securities exchange network, delivers cutting-edge trading,

clearing, and investment solutions to people around the world. Cboe provides trading solutions and products in multiple asset

classes, including equities, derivatives, FX, and digital assets, across North America, Europe, and Asia Pacific.

Above all, we are committed to building a trusted, inclusive global marketplace that enables people to pursue a sustainable

financial future. To learn more about the Exchange for the World Stage, visit www.cboe.com.

Cautionary Statements

Regarding Forward-Looking Information

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve

a number of risks and uncertainties. You can identify these statements by forward-looking words such as “may,” “might,”

“should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,”

“predict,” “potential” or “continue,” and the negative of these terms and other comparable terminology.

All statements that reflect our expectations, assumptions or projections about the future other than statements of historical fact are

forward-looking statements. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions

about us, may include projections of our future financial performance based on our growth strategies and anticipated trends in our business.

These statements are only predictions based on our current expectations and projections about future events. There are important factors

that could cause our actual results, level of activity, performance or achievements to differ materially from those expressed or implied

by the forward-looking statements.

We

operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible

to predict all risks and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor,

or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Some

factors that could cause actual results to differ include: the loss of our right to exclusively list and trade certain index options

and futures products; economic, political and market conditions; compliance with legal and regulatory obligations; price competition

and consolidation in our industry; decreases in trading or clearing volumes, market data fees or a shift in the mix of products traded

on our exchanges; legislative or regulatory changes or changes in tax regimes; our ability to protect our systems and communication networks

from security vulnerabilities and breaches; our ability to attract and retain skilled management and other personnel, including compensation

inflation; increasing competition by foreign and domestic entities; our dependence on and exposure to risk from third parties; global

expansion of operations; factors that impact the quality and integrity of our indices; our ability to manage our growth and strategic

acquisitions or alliances effectively; our ability to operate our business without violating the intellectual property rights of others

and the costs associated with protecting our intellectual property rights; our ability to minimize the risks, including our credit and

default risks, associated with operating a European clearinghouse; our ability to accommodate trading and clearing volume and transaction

traffic, including significant increases, without failure or degradation of performance of our systems; misconduct by those who use our

markets or our products or for whom we clear transactions; challenges to our use of open source software code; our ability to meet our

compliance obligations, including managing potential conflicts between our regulatory responsibilities and our for-profit status; our

ability to maintain BIDS Trading as an independently managed and operated trading venue, separate from and not integrated with our registered

national securities exchanges; damage to our reputation; the ability of our compliance and risk management methods to effectively monitor

and manage our risks; restrictions imposed by our debt obligations and our ability to make payments on or refinance our debt obligations;

our ability to maintain an investment grade credit rating; impairment of our goodwill, long-lived assets, investments or intangible assets;

the impacts of pandemics; the accuracy of our estimates and expectations; litigation risks and other liabilities; and operating a digital

asset business and clearinghouse, including the expected benefits of our Cboe Digital acquisition, cybercrime, changes in digital asset

regulation, losses due to digital asset custody, and fluctuations in digital asset prices. More detailed information about factors that

may affect our actual results to differ may be found in our filings with the SEC, including in our Annual Report on Form 10-K for

the year ended December 31, 2022 and other filings made from time to time with the SEC.

| —More — |  |

|

News Release

Page 3 of 3 |

We

do not undertake, and we expressly disclaim, any duty to update any forward-looking statement whether as a result of new information,

future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date hereof.

| Cboe Media Contacts: | Analyst

Contact: |

|

| Angela Tu & Tim Cave |

| Kenneth Hill, CFA |

|

| corporatecommunications@cboe.com |

| (312) 786-7559 |

|

|

| khill@cboe.com |

|

CBOE-F

Trademarks:

Cboe®, Cboe

Global Markets®, Cboe Volatility Index®, Bats®, BIDS Trading®, BZX®, BYX®, Chi-X®, EDGX®, EDGA®,

EuroCCP®, MATCHNow®, and VIX® are registered trademarks of Cboe Global Markets, Inc. and its subsidiaries. All other

trademarks and service marks are the property of their respective owners.

| # # # |  |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

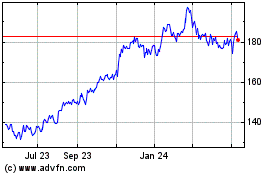

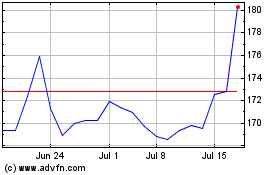

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cboe Global Markets (AMEX:CBOE)

Historical Stock Chart

From Jul 2023 to Jul 2024