Prospectus

Supplement No. 2

Filed

pursuant to Rule 424(b)(3)

Registration

No. 333-273332

AGEAGLE

AERIAL SYSTEMS INC.

Dated

February 29, 2024

To

the Prospectus dated July 27, 2023 (as supplemented by Prospectus Supplement No. 1 dated September 12, 2023)

This

Prospectus Supplement No. 2 updates, amends and supplements the prospectus dated July 27, 2023, (as supplemented by Prospectus Supplement

No. 1 dated September 12, 2023, (the “Prospectus”)), which forms a part of our Registration Statement on Form S-1

(Registration No. 333-273332).

This

Prospectus Supplement No. 2 is being filed to update, amend, and supplement the information included in the Prospectus with the information

contained in our (i) Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023, filed on August 14, 2023; and (i) Quarterly

Report on Form 10-Q for the fiscal quarter ended September 30, 2023, filed on November 13, 2023, which are set forth below.

This

Prospectus Supplement No. 2 is not complete without the Prospectus. This Prospectus Supplement No. 2 should be read in

conjunction with the Prospectus, which is to be delivered with this Prospectus Supplement No. 2, and is qualified by reference

thereto, except to the extent that the information in this Prospectus Supplement No. 2 updates or supersedes the information

contained in the Prospectus. Please keep this Prospectus Supplement No. 2 with your Prospectus for future reference.

Our

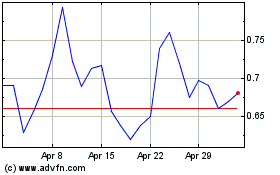

Common Stock is traded on The NYSE American under the symbol “UAVS.” On February 28, 2024, the last reported sale

price of our Common Stock was $1.20 per share.

INVESTING

IN OUR COMMON STOCK INVOLVES RISKS. YOU SHOULD CAREFULLY CONSIDER THE “RISK FACTORS” INCLUDED IN OUR ANNUAL REPORT ON FORM

10-K FOR THE YEAR ENDED DECEMBER 31, 2022 AS WELL AS SUBSEQUENTLY FILED FORM 10-QS BEFORE YOU DECIDE TO INVEST.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these

securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

THE

INFORMATION IN THIS PROSPECTUS SUPPLEMENT NO. 2 IS NOT COMPLETE AND MAY CHANGE. THIS PROSPECTUS SUPPLEMENT NO. 2 IS NOT AN OFFER TO SELL

THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

The

date of this Prospectus Supplement No. 2 is February 29, 2024

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended June 30, 2023

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to ________

Commission

file number: 001-36492

| AGEAGLE

AERIAL SYSTEMS INC.

|

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

88-0422242 |

(State or other jurisdiction

of incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

| 8863 E. 34th Street North, Wichita, Kansas |

|

67226 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (620) 325-6363

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.001 per share |

|

UAVS |

|

NYSE American LLC |

Securities

registered pursuant to Section 12(g) of the Act: None.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer,” “emerging growth company”

and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As

of August 14, 2023, there were 109,512,375 shares of Common Stock, par value $0.001 per share, issued and outstanding.

AGEAGLE

AERIAL SYSTEMS INC.

TABLE

OF CONTENTS

PART

I – FINANCIAL INFORMATION

Item

1. Financial Statements.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

As of | |

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| CURRENT ASSETS: | |

| | | |

| | |

| Cash | |

$ | 4,202,427 | | |

$ | 4,349,837 | |

| Accounts receivable, net | |

| 2,103,120 | | |

| 2,213,040 | |

| Inventories, net | |

| 6,520,314 | | |

| 6,685,847 | |

| Prepaid and other current assets | |

| 901,143 | | |

| 1,029,548 | |

| Notes receivable | |

| 185,000 | | |

| 185,000 | |

| Total current assets | |

| 13,912,004 | | |

| 14,463,272 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 650,990 | | |

| 791,155 | |

| Right of use assets | |

| 3,546,549 | | |

| 3,952,317 | |

| Intangible assets, net | |

| 10,069,558 | | |

| 11,507,653 | |

| Goodwill | |

| 23,179,411 | | |

| 23,179,411 | |

| Other assets | |

| 354,339 | | |

| 291,066 | |

| Total assets | |

$ | 51,712,851 | | |

$ | 54,184,874 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Accounts payable | |

$ | 1,502,463 | | |

$ | 1,845,135 | |

| Accrued liabilities | |

| 1,582,153 | | |

| 1,680,706 | |

| Promissory note, net of debt discount | |

| 1,589,660 | | |

| 287,381 | |

| Contract liabilities | |

| 440,165 | | |

| 496,390 | |

| Current portion of lease liabilities | |

| 801,887 | | |

| 628,113 | |

| Current portion of COVID loans | |

| 458,422 | | |

| 446,456 | |

| Total current liabilities | |

| 6,374,750 | | |

| 5,384,181 | |

| | |

| | | |

| | |

| Long term portion of lease liabilities | |

| 2,842,944 | | |

| 3,161,703 | |

| Long term portion of COVID loans | |

| 417,296 | | |

| 446,813 | |

| Defined benefit plan obligation | |

| — | | |

| 106,163 | |

| Long term portion of promissory note, net of debt discount | |

| 897,031 | | |

| 1,861,539 | |

| Total liabilities | |

| 10,532,021 | | |

| 10,960,399 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES (SEE NOTE 11) | |

| - | | |

| - | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY: | |

| | | |

| | |

| Preferred Stock, $0.001 par value, 25,000,000 shares authorized: | |

| | | |

| | |

| Preferred Stock, Series F Convertible, $0.001 par value, 35,000 shares authorized, 7,025 shares issued and outstanding as of June 30, 2023, and 5,863 shares issued and outstanding as of December 31, 2022, respectively | |

| 7 | | |

| 6 | |

| Preferred Stock, $0.001 par value, 25,000,000 shares authorized: Preferred Stock, Series F Convertible, $0.001 par value, 35,000 shares authorized, 7,025 shares issued and outstanding as of June 30, 2023, and 5,863 shares issued and outstanding as of December 31, 2022, respectively | |

| 7 | | |

| 6 | |

| Common Stock, $0.001 par value, 250,000,000 shares authorized, 109,491,375 and 88,466,613 shares issued and outstanding as of June 30, 2023, and December 31, 2022, respectively | |

| 109,492 | | |

| 88,467 | |

| Additional paid-in capital | |

| 167,247,840 | | |

| 154,679,363 | |

| Accumulated deficit | |

| (126,354,420 | ) | |

| (111,553,444 | ) |

| Accumulated other comprehensive income | |

| 177,911 | | |

| 10,083 | |

| Total stockholders’ equity | |

| 41,180,830 | | |

| 43,224,475 | |

| Total liabilities and stockholders’ equity | |

$ | 51,712,851 | | |

$ | 54,184,874 | |

See

accompanying notes to these condensed consolidated financial statements.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(UNAUDITED)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

For the Three Months Ended June 30, | | |

For the Six Months Ended

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 3,278,212 | | |

$ | 5,287,873 | | |

$ | 7,335,281 | | |

$ | 9,129,851 | |

| Cost of sales | |

| 2,246,678 | | |

| 2,737,777 | | |

| 4,325,115 | | |

| 5,214,863 | |

| Gross Profit | |

| 1,031,534 | | |

| 2,550,096 | | |

| 3,010,166 | | |

| 3,914,988 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses: | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 3,498,761 | | |

| 4,437,185 | | |

| 7,078,283 | | |

| 9,918,564 | |

| Research and development | |

| 1,369,479 | | |

| 2,182,313 | | |

| 2,951,822 | | |

| 4,367,237 | |

| Sales and marketing | |

| 955,845 | | |

| 1,319,177 | | |

| 1,933,720 | | |

| 2,499,706 | |

| Lease impairment charge | |

| 79,287 | | |

| — | | |

| 79,287 | | |

| — | |

| Total Operating Expenses | |

| 5,903,372 | | |

| 7,938,675 | | |

| 12,043,112 | | |

| 16,785,507 | |

| Loss from Operations | |

| (4,871,838 | ) | |

| (5,388,579 | ) | |

| (9,032,946 | ) | |

| (12,870,519 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| (289,604 | ) | |

| (6,719 | ) | |

| (595,101 | ) | |

| (23,051 | ) |

| Other expense, net | |

| (129,141 | ) | |

| (206,438 | ) | |

| (262,035 | ) | |

| (304,738 | ) |

| Total Other Expense, net | |

| (418,745 | ) | |

| (213,157 | ) | |

| (857,136 | ) | |

| (327,789 | ) |

| Loss Before Income Taxes | |

| (5,290,583 | ) | |

| (5,601,736 | ) | |

| (9,890,082 | ) | |

| (13,198,308 | ) |

| Provision for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net Loss attributable to common stockholders | |

$ | (5,290,583 | ) | |

$ | (5,601,736 | ) | |

$ | (9,890,082 | ) | |

$ | (13,198,308 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss Per Common Share – Basic and Diluted | |

$ | (0.05 | ) | |

$ | (0.07 | ) | |

$ | (0.11 | ) | |

$ | (0.17 | ) |

| Net Loss Per Common Share – Basic | |

$ | (0.05 | ) | |

$ | (0.07 | ) | |

$ | (0.11 | ) | |

$ | (0.17 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Shares Outstanding During the Period – Basic and Diluted | |

| 96,217,930 | | |

| 81,659,858 | | |

| 92,922,549 | | |

| 79,732,890 | |

| Weighted Average Number of Shares Outstanding During the Period – Basic | |

| 96,217,930 | | |

| 81,659,858 | | |

| 92,922,549 | | |

| 79,732,890 | |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive Loss: | |

| | | |

| | | |

| | | |

| | |

| Net Loss attributable to common stockholders | |

$ | (5,290,583 | ) | |

$ | (5,601,736 | ) | |

$ | (9,890,082 | ) | |

$ | (13,198,308 | ) |

| Amortization of unrecognized periodic pension costs | |

| 699 | | |

| 2,641 | | |

| 44,044 | | |

| 2,641 | |

| Foreign currency cumulative translation adjustment | |

| 72,525 | | |

| 132,136 | | |

| 123,784 | | |

| 152,308 | |

| Total comprehensive loss, net of tax | |

| (5,217,359 | ) | |

| (5,466,959 | ) | |

| (9,722,254 | ) | |

| (13,043,359 | ) |

| Accrued dividends on Series F Preferred Stock | |

| (54,234 | ) | |

| — | | |

| (121,156 | ) | |

| — | |

| Deemed dividend on Series F Preferred Stock and warrant | |

| (4,654,918 | ) | |

| — | | |

| (4,910,894 | ) | |

| — | |

| Total comprehensive loss available to common stockholder | |

$ | (9,926,511 | ) | |

$ | (5,466,959 | ) | |

$ | (14,754,304 | ) | |

$ | (13,043,359 | ) |

See

accompanying notes to these condensed consolidated financial statements.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

FOR

THE THREE AND SIX MONTHS ENDED JUNE 30, 2023

(UNAUDITED)

| | |

Par $0.001 Preferred Stock, Series F Convertible Shares | | |

Preferred Stock, Series F Convertible Amount | | |

Par

$0.001 Common Stock | | |

Common Stock Amount | | |

Additional Paid-In Capital | | |

Accumulated Other Comprehensive Income | | |

Accumulated Deficit | | |

Total

Stockholders’ Equity | |

| Balance as of March 31, 2023 | |

| 7,865 | | |

$ | 8 | | |

| 90,771,375 | | |

$ | 90,772 | | |

$ | 158,378,640 | | |

$ | 104,687 | | |

$ | (116,408,919 | ) | |

$ | 42,165,188 | |

| Sales of common stock, net of issuance costs | |

| — | | |

| — | | |

| 16,720,000 | | |

| 16,720 | | |

| 3,800,680 | | |

| — | | |

| — | | |

| 3,817,400 | |

| Conversion of Preferred Stock, Series F Convertible shares to Common Stock | |

| (840 | ) | |

| (1 | ) | |

| 2,000,000 | | |

| 2,000 | | |

| (1,999 | ) | |

| — | | |

| — | | |

| — | |

| Dividends on Series F Preferred Stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| (54,234 | ) | |

| — | | |

| — | | |

| (54,234 | ) |

| Deemed dividend on Series F Preferred Stock and warrant | |

| — | | |

| — | | |

| — | | |

| — | | |

| 4,654,918 | | |

| — | | |

| (4,654,918 | ) | |

| — | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 469,835 | | |

| — | | |

| — | | |

| 469,835 | |

| Amortization of unrecognized periodic pension costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 699 | | |

| — | | |

| 699 | |

| Foreign currency cumulative translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 72,525 | | |

| — | | |

| 72,525 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (5,290,583 | ) | |

| (5,290,583 | ) |

| Balance as of June 30, 2023 | |

| 7,025 | | |

$ | 7 | | |

| 109,491,375 | | |

$ | 109,492 | | |

$ | 167,247,840 | | |

$ | 177,911 | | |

$ | (126,354,420 | ) | |

$ | 41,180,830 | |

See

accompanying notes to condensed consolidated financial statements.

| | |

Par $0.001 Preferred Stock, Series F Convertible Shares | | |

Preferred Stock, Series F Convertible Amount | | |

Par $0.001 Common Stock Shares | | |

Common Stock Amount | | |

Additional Paid-In Capital | | |

Accumulated Other Comprehensive Income | | |

Accumulated Deficit | | |

Total

Stockholders’ Equity | |

| Balance as of December 31, 2022 | |

| 5,863 | | |

$ | 6 | | |

| 88,466,613 | | |

$ | 88,467 | | |

$ | 154,679,363 | | |

$ | 10,083 | | |

$ | (111,553,444 | ) | |

$ | 43,224,475 | |

| Sales of common stock, net of issuance costs | |

| — | | |

| — | | |

| 16,720,000 | | |

| 16,720 | | |

| 3,800,680 | | |

| — | | |

| — | | |

| 3,817,400 | |

| Issuance of Preferred Stock, Series F Convertible, net of issuance cost | |

| 3,000 | | |

| 3 | | |

| — | | |

| — | | |

| 2,999,997 | | |

| — | | |

| — | | |

| 3,000,000 | |

| Conversion of Preferred Stock, Series F Convertible shares to Common Stock | |

| (1,838 | ) | |

| (2 | ) | |

| 4,304,762 | | |

| 4,305 | | |

| (4,303 | ) | |

| — | | |

| — | | |

| — | |

| Dividends on Series F Preferred Stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| (121,156 | ) | |

| — | | |

| — | | |

| (121,156 | ) |

| Deemed dividend on Series F Preferred Stock and warrant | |

| — | | |

| — | | |

| — | | |

| — | | |

| 4,910,894 | | |

| — | | |

| (4,910,894 | ) | |

| — | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 982,365 | | |

| — | | |

| — | | |

| 982,365 | |

| Amortization of unrecognized periodic pension costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 44,044 | | |

| — | | |

| 44,044 | |

| Foreign currency cumulative translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 123,784 | | |

| — | | |

| 123,784 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (9,890,082 | ) | |

| (9,890,082 | ) |

| Balance as of June 30, 2023 | |

| 7,025 | | |

$ | 7 | | |

| 109,491,375 | | |

$ | 109,492 | | |

$ | 167,247,840 | | |

$ | 177,911 | | |

$ | (126,354,420 | ) | |

$ | 41,180,830 | |

See

accompanying notes to condensed consolidated financial statements.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN

STOCKHOLDERS’ EQUITY

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2022

| | |

Par $0.001 Preferred Stock, Series F Convertible Shares | | |

Preferred Stock, Series F Convertible Amount | | |

Par

$0.001

Common Stock | | |

Common Stock Amount | | |

Additional Paid-In Capital | | |

Accumulated Other Comprehensive

Income (Loss) | | |

Accumulated Deficit | | |

Total

Stockholders’ Equity | |

| Balance as of March 31, 2022 | |

| — | | |

$ | — | | |

| 81,568,546 | | |

$ | 81,568 | | |

$ | 136,988,255 | | |

$ | (50,422 | ) | |

$ | (58,650,916 | ) | |

$ | 78,368,485 | |

| Issuance of Preferred Stock, Series F Convertible, net of issuance costs | |

| 10,000 | | |

| 10 | | |

| — | | |

| — | | |

| 9,919,990 | | |

| — | | |

| — | | |

| 9,920,000 | |

| Conversion of Preferred Stock, Series F Convertible shares to Common Stock | |

| (310 | ) | |

| — | | |

| 500,000 | | |

| 500 | | |

| (500 | ) | |

| — | | |

| — | | |

| — | |

| Exercise of stock options | |

| — | | |

| — | | |

| 75,000 | | |

| 75 | | |

| 30,675 | | |

| — | | |

| — | | |

| 30,750 | |

| Issuance of Restricted Common Stock | |

| — | | |

| — | | |

| 302,024 | | |

| 302 | | |

| (302 | ) | |

| — | | |

| — | | |

| — | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 748,023 | | |

| — | | |

| — | | |

| 748,023 | |

| Foreign currency cumulative translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 132,136 | | |

| — | | |

| 132,136 | |

| Amortization of unrecognized periodic pension costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,641 | | |

| — | | |

| 2,641 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (5,601,736 | ) | |

| (5,601,736 | ) |

| Balance as of June 30, 2022 | |

| 9,690 | | |

$ | 10 | | |

| 82,445,570 | | |

$ | 82,445 | | |

$ | 147,686,141 | | |

$ | 84,355 | | |

$ | (64,252,652 | ) | |

$ | 83,600,299 | |

See

accompanying notes to condensed consolidated financial statements.

| | |

Par $0.001 Preferred Stock, Series F Convertible Shares | | |

Preferred Stock, Series F Convertible Amount | | |

Par

$0.001

Common Stock | | |

Common Stock Amount | | |

Additional Paid-In Capital | | |

Accumulated Other Comprehensive

Income (Loss) | | |

Accumulated Deficit | | |

Total

Stockholders’ Equity | |

| Balance as of December 31, 2021 | |

| — | | |

$ | — | | |

| 75,314,988 | | |

$ | 75,315 | | |

$ | 127,626,536 | | |

$ | (70,594 | ) | |

$ | (51,054,344 | ) | |

$ | 76,576,913 | |

| Sale of Common Stock, net of issuance costs | |

| — | | |

| — | | |

| 4,251,151 | | |

| 4,251 | | |

| 4,579,090 | | |

| — | | |

| — | | |

| 4,583,341 | |

| Issuance of Common Stock for acquisition of senseFly | |

| — | | |

| — | | |

| 1,927,407 | | |

| 1,927 | | |

| 2,998,073 | | |

| — | | |

| — | | |

| 3,000,000 | |

| Issuance of Restricted Common Stock | |

| — | | |

| — | | |

| 302,024 | | |

| 302 | | |

| (302 | ) | |

| — | | |

| — | | |

| — | |

| Issuance of Preferred Stock, Series F Convertible, net of issuance costs | |

| 10,000 | | |

| 10 | | |

| — | | |

| — | | |

| 9,919,990 | | |

| — | | |

| — | | |

| 9,920,000 | |

| Exercise of stock options | |

| — | | |

| — | | |

| 150,000 | | |

| 150 | | |

| 61,350 | | |

| — | | |

| — | | |

| 61,500 | |

| Stock-based compensation expense | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,501,904 | | |

| — | | |

| — | | |

| 2,501,904 | |

| Conversion of Preferred Stock, Series F Convertible shares to Common Stock | |

| (310 | ) | |

| — | | |

| 500,000 | | |

| 500 | | |

| (500 | ) | |

| — | | |

| — | | |

| — | |

| Foreign currency translation adjustment | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 152,308 | | |

| — | | |

| 152,308 | |

| Amortization of unrecognized periodic pension costs | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 2,641 | | |

| — | | |

| 2,641 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (13,198,308 | ) | |

| (13,198,308 | ) |

| Balance as of June 30, 2022 | |

| 9,690 | | |

$ | 10 | | |

| 82,445,570 | | |

$ | 82,445 | | |

$ | 147,686,141 | | |

$ | 84,355 | | |

$ | (64,252,652 | ) | |

$ | 83,600,299 | |

| Balance | |

| 9,690 | | |

$ | 10 | | |

| 82,445,570 | | |

$ | 82,445 | | |

$ | 147,686,141 | | |

$ | 84,355 | | |

$ | (64,252,652 | ) | |

$ | 83,600,299 | |

See

accompanying notes to condensed consolidated financial statements.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

2023 | | |

2022 | |

| | |

For the Six Months Ended June 30, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (9,890,082 | ) | |

$ | (13,198,308 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation | |

| 982,365 | | |

| 2,501,904 | |

| Depreciation and amortization | |

| 2,014,256 | | |

| 1,844,196 | |

| Defined benefit plan obligation and other | |

| (197,649 | ) | |

| (5,644 | ) |

| Amortization of debt discount | |

| 337,770 | | |

| — | |

| Lease impairment charge | |

| 79,287 | | |

| — | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| 132,005 | | |

| (944,064 | ) |

| Inventories, net | |

| 259,406 | | |

| (1,702,158 | ) |

| Prepaid expenses and other assets | |

| 174,320 | | |

| (846,691 | ) |

| Accounts payable | |

| (365,772 | ) | |

| (348,416 | ) |

| Accrued expenses and other liabilities | |

| (54,136 | ) | |

| (290,443 | ) |

| Contract liabilities | |

| (60,191 | ) | |

| 1,168,007 | |

| Other | |

| (194,899 | ) | |

| 193,528 | |

| Net cash used in operating activities | |

| (6,783,320 | ) | |

| (11,628,089 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchases of property and equipment | |

| (48,107 | ) | |

| (137,149 | ) |

| Acquisition of senseFly, net of cash acquired | |

| — | | |

| (489,989 | ) |

| Acquisition of MicaSense, net of cash acquired | |

| — | | |

| (2,446,512 | ) |

| Capitalization of platform development costs | |

| (232,441 | ) | |

| (319,799 | ) |

| Capitalization of internal use software costs | |

| (143,796 | ) | |

| (610,643 | ) |

| Net cash used in investing activities | |

| (424,344 | ) | |

| (4,004,092 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Sales of Common Stock, net of issuance costs | |

| 3,817,400 | | |

| 4,583,341 | |

| Sale of Preferred Stock, Series F Convertible | |

| 3,000,000 | | |

| 9,920,000 | |

| COVID loans | |

| (40,927 | ) | |

| — | |

| |

| — | | |

| 61,500 | |

| Net cash provided by financing activities | |

| 6,776,473 | | |

| 14,564,841 | |

| | |

| | | |

| | |

| Effects of foreign exchange rates on cash flows | |

| 283,781 | | |

| (17,633 | ) |

| | |

| | | |

| | |

| Net decrease in cash | |

| (147,410 | ) | |

| (1,084,973 | ) |

| Cash at beginning of period | |

| 4,349,837 | | |

| 14,590,566 | |

| Cash at end of period | |

$ | 4,202,427 | | |

$ | 13,505,593 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | |

| | | |

| | |

| Interest cash paid | |

$ | — | | |

$ | — | |

| Income taxes paid | |

$ | — | | |

$ | — | |

| NON-CASH INVESTING AND FINANCING ACTIVITIES: | |

| | | |

| | |

| Conversion of Preferred Stock, Series F Convertible to Common Stock | |

$ | 4,305 | | |

$ | 500 | |

| Issuance of Restricted Common Stock | |

$ | — | | |

$ | 302 | |

| Dividends on Series F Preferred Stock | |

$ | 121,155 | | |

$ | — | |

| Deemed dividend on Series F Preferred stock and warrant | |

$ | 4,910,894 | | |

$ | — | |

| Stock consideration for senseFly Acquisition | |

$ | — | | |

$ | 3,000,000 | |

See

accompanying notes to condensed consolidated financial statements.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

1 – Description of the Business and Basis of Presentation

Description

of Business – AgEagle™ Aerial Systems Inc. (“AgEagle” or the “Company”), through its wholly-owned

subsidiaries, AgEagle Aerial, Inc., DBA MicaSense™, Inc. (“MicaSense”), Measure Global, Inc. (“Measure”),

senseFly SA and senseFly Inc. (collectively “senseFly”), is actively engaged in designing and delivering best-in-class drones,

sensors and software that solve important problems for its customers in a wide range of industry verticals, including energy/utilities,

infrastructure, agriculture and government.

Founded

in 2010, AgEagle was originally formed to pioneer proprietary, professional-grade, fixed-winged drones and aerial imagery-based data

collection and analytics solutions for the agriculture industry. Today, the Company is earning distinction as a globally respected

market leader offering customer-centric, advanced, autonomous unmanned aerial systems (“UAS”) which drive revenue at the

intersection of flight hardware, sensors and software for industries that include agriculture, military/defense, public safety,

surveying/mapping and utilities/engineering, among others. AgEagle has also achieved numerous regulatory firsts, including earning

governmental approvals for its commercial and tactical drones to fly Beyond Visual Line of Sight (“BVLOS”) and/or

Operations Over People (“OOP”) in the United States, Canada, Brazil and the European Union .D

AgEagle’s

shift and expansion from solely manufacturing fixed-wing farm drones in 2018, to offering what the Company believes is one of the industry’s

best fixed-wing, full-stack drone solutions, culminated in 2021 when the Company acquired three market-leading companies engaged in producing

UAS airframes, sensors and software for commercial and government use. In addition to a robust portfolio of proprietary, connected hardware

and software products; an established global network of over 200 UAS resellers; and enterprise customers worldwide; these acquisitions

also brought AgEagle a workforce comprised largely of experienced engineers and technologists with deep expertise in

the fields of robotics, automation, manufacturing and data science. In 2022, the Company succeeded in integrating all three acquired

companies with AgEagle to form one global company focused on taking autonomous flight performance to a higher level.

The

business acquisitions completed during the year ended December 31, 2021, by the Company of 100% of the outstanding stock of MicaSense,

Measure and senseFly, respectively, are collectively referred to as the “2021 Business Acquisitions.”

The

Company is currently headquartered in Wichita, Kansas, where it houses its sensor manufacturing operations and Lausanne, Switzerland

where we it operates its drone manufacturing operations.

Basis

of Presentation – The condensed consolidated financial statements of the Company are presented in United States dollars and

have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

In the opinion of management, the Company has made all necessary adjustments, which include normal recurring adjustments, for a fair

statement of the Company’s consolidated financial position and results of operations for the periods presented. Certain information

and disclosures included in the annual consolidated financial statements prepared in accordance with U.S. GAAP have been condensed or

omitted pursuant to the U.S. Securities and Exchange Commission (“SEC”) rules. These condensed consolidated financial statements

should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year ended December 31,

2022, included in the Company’s Annual Report on Form 10-K, as filed with the SEC on April 4, 2023. The results for the three-

and six-month periods ended June 30, 2023, and 2022, are not necessarily indicative of the results to be expected for a full year, any

other interim periods or any future year or periods.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

1 – Description of the Business and Basis of Presentation - Continued

The

condensed consolidated financial statements include the accounts of AgEagle and its wholly-owned subsidiaries, AgEagle Aerial, Inc.,

Measure Global, Inc., senseFly S.A. and senseFly Inc. All significant intercompany balances and transactions have been eliminated in

consolidation.

A

description of certain of the Company’s accounting policies and other financial information is included in the Company’s

audited consolidated financial statements filed with the SEC on Form 10-K for the year ended December 31, 2022. The summary of significant

accounting policies presented below is designed to assist in understanding the Company’s condensed consolidated financial statements.

Such condensed consolidated financial statements and accompanying notes are the representations of the Company’s management, who

are responsible for their integrity and objectivity.

Liquidity

and Going Concern – In pursuit of the Company’s long-term growth strategy and acquisitions, the Company has sustained

continued operating losses. During the six months ended June 30, 2023, the Company incurred a net loss of $9,890,082

and used cash in operating activities of $6,783,320.

As of June 30, 2023, the Company has working capital of $7,537,254

and an accumulated deficit of $126,354,420.

While the Company has historically been successful in raising capital to meet its working capital needs, the ability to continue raising

such capital is not guaranteed. There is substantial doubt about the Company’s ability to continue as a going concern as the Company

will require additional liquidity to continue its operations and meet its financial obligations for twelve (12) months from the date

these condensed consolidated financial statements were issued. The Company is evaluating strategies to obtain the required additional

funding for future operations and the restructuring of operations to grow revenues and reduce expenses.

If

the Company is unable to generate significant sales growth in the near term and raise additional capital, there is a risk that the Company

could default on additional obligations; and could be required to discontinue or significantly reduce the scope of its operations if

no other means of financing operations are available. The condensed consolidated financial statements do not include any adjustments

relating to the recoverability and classification of recorded asset amounts or the amount and classification of liabilities or any other

adjustment that might be necessary should the Company be unable to continue as a going concern.

Note

2 – Summary of Significant Accounting Policies

The

summary of significant accounting policies presented below is designed to assist in understanding the Company’s condensed consolidated

financial statements. Such condensed consolidated financial statements and accompanying notes are the representations of the Company’s

management, who are responsible for their integrity and objectivity. These accounting policies conform to accounting principles generally

accepted in the United States of America (“US GAAP”) in all material respects and have been consistently applied in preparing

the accompanying condensed consolidated financial statements.

Risks

and Uncertainties – Global economic challenges, including the impact of war, pandemics, rising inflation and supply-chain

disruptions and adverse labor market conditions could cause economic uncertainty and volatility. The aforementioned risks and their respective

impacts on the UAV industry and the Company’s operational and financial performance remain uncertain and outside of the Company’s

control. Specifically, because of the aforementioned continuing risks, the Company’s ability to access components and parts needed

in order to manufacture its proprietary drones and sensors, and to perform quality testing have been, and continue to be, impacted. If

either the Company or any of its third parties in the supply chain for materials used in our manufacturing and assembly processes continue

to be adversely impacted, the Company’s supply chain may be further disrupted, limiting its ability to manufacture and assemble

products.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

2 – Summary of Significant Accounting Policies-Continued

Use

of Estimates – The preparation of financial statements in conformity with accounting principles generally accepted in the United

States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ from those estimates. Significant estimates include the reserve for obsolete

inventory, valuation of stock issued for services and stock options, valuation of intangible assets, and the valuation of deferred tax

assets.

Fair

Value Measurements and Disclosures – ASC Topic 820, Fair Value Measurement (“ASC 820”), requires companies

to determine fair value based on the price that would be received to sell the asset or paid to transfer the liability to a market participant.

ASC 820 emphasizes that fair value is a market-based measurement, not an entity-specific measurement.

The

guidance requires that assets and liabilities carried at fair value be classified and disclosed in one of the following categories:

| ● |

Level 1: Quoted market prices in active markets for

identical assets or liabilities. |

| |

|

| ● |

Level 2: Observable market-based inputs or unobservable

inputs that are corroborated by market data. |

| |

|

| ● |

Level 3: Unobservable inputs that are not corroborated

by market data. |

For

short-term classes of our financial instruments, which include cash, accounts receivable, prepaid expenses, notes receivable,

accounts payable and accrued expenses, their carrying amounts approximate fair value due to their short-term nature. The outstanding

loans related to the COVID Loans and promissory note are carried at face value, which approximates fair value. As June 30, 2023, and

December 31, 2022, the Company did not have any financial assets or liabilities measured and recorded at fair value on the

Company’s condensed consolidated balance sheets on a recurring basis.

Inventories

–

Inventories, which consist of raw materials, finished goods and work-in-process, are stated at the lower of cost or net realizable value,

with cost being determined by the average-cost method, which approximates the first-in, first-out method. Cost components include direct

materials and direct labor. At each balance sheet date, the Company evaluates its inventories for excess quantities and obsolescence.

This evaluation primarily includes an analysis of forecasted demand in relation to the inventory on hand, among consideration of other

factors. The physical condition (e.g., age and quality) of the inventories is also considered in establishing its valuation. Based upon

the evaluation, provisions are made to reduce excess or obsolete inventories to their estimated net realizable values. Once established,

write-downs are considered permanent adjustments to the cost basis of the respective inventories. These adjustments are estimates, which

could vary significantly, either favorably or unfavorably, from the amounts that the Company may ultimately realize upon the disposition

of inventories if future economic conditions, customer inventory levels, product discontinuances, sales return levels or competitive

conditions differ from the Company’s estimates and expectations.

Cash

Concentrations – The Company maintains its cash balances at financial institutions that are insured by the Federal Deposit

Insurance Corporation (“FDIC”) up to $250,000. The Company has significant cash balances at financial institutions which

throughout the year regularly exceed the federally insured limit of $250,000. Any loss incurred or a lack of access to such funds could

have a significant adverse impact on the Company’s financial condition, results of operations, and cash flows.

Revenue

Recognition and Concentration – Most of the Company’s revenues are derived primarily through the sales of drones, sensors

and related accessories, and software subscriptions. All contracts and agreements are at fixed prices and are accounted for in accordance

with ASC Topic 606, Revenue from Contracts with Customers.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

2 – Summary of Significant Accounting Policies-Continued

The

Company generally recognizes revenue on sales to customers, dealers, and distributors upon satisfaction of performance obligations which

generally occurs once controls transfer to customers, which is when product is shipped or delivered depending on specific shipping terms

and, where applicable, a customer acceptance has been obtained. The fee is not considered to be fixed or determinable until all material

contingencies related to the sales have been resolved. The Company records revenue in the statements of operations and comprehensive

loss net of any sales, use, value added, or certain excise taxes imposed by governmental authorities on specific sales transactions and

net of any discounts, allowances and returns.

The

Company’s software subscriptions to its platforms, HempOverview and Ground Control, are offered on a subscription

basis. These subscription fees are recognized equally over the membership period as the services are provided.

Additionally,

customer payments received in advance of the Company completing performance obligations are recorded as contract liabilities. Customer

deposits represent customer prepayments and are recognized as revenue when the term of the sale or performance obligation is completed.

As of June 30, 2023 and December 31, 2022, respectively, contract liabilities represent $440,165

and $496,390.

Internal-use

Software Costs – Internal-use software costs are accounted for in accordance with ASC Topic 350-40, Internal-Use Software.

The costs incurred in the preliminary stages of development are expensed as research and development costs as incurred. Once an application

has reached the development stage, internal and external costs incurred to develop internal-use software are capitalized and amortized

on a straight-line basis over the estimated useful life of the software (typically three to five years). Maintenance and enhancement

costs, including those costs in the post-implementation stages, are typically expensed as incurred, unless such costs relate to substantial

upgrades and enhancements to the software that result in added functionality, in which case the costs are capitalized and amortized on

a straight-line basis over the estimated useful life of the software. The Company reviews the carrying value for impairment whenever

facts and circumstances exist that would suggest that assets might be impaired or that the useful lives should be modified. Amortization

expense related to capitalized internal-use software development costs is included in general and administrative expenses on the condensed

consolidated statements of operations.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

2 – Summary of Significant Accounting Policies - Continued

As

of June 30, 2023 and December 31, 2022, capitalized software costs for internal-use software related to the Company’s implementation

of its enterprise resource planning (“ERP”) software, totaled $699,404 and $721,795, respectively, net of accumulated amortization

and are included in intangible assets, net on the condensed consolidated balance sheets. The Company placed its ERP into service on May

1, 2022.

Further, capitalized software

costs for internal-use software include costs incurred in connection with our HempOverview and Ground Control which we offer

to our customers under SaaS arrangements. We account for these capitalized development costs in accordance with ASC 350-40 as our customer

do not have the contractual right to take possession of the software at any time during the hosting period without significant penalty

nor is it feasible for our customers to run the hosted software on their own. As of June 30, 2023 and December 31, 2022, respectively,

capitalized software development costs for our hosted platforms, net of accumulated amortization, totaled $1,220,659 and $1,332,516, respectively,

and are included in intangible assets, net on the condensed consolidated balance sheets.

Goodwill

and Intangible Assets - The assets and liabilities of acquired businesses are recorded under the acquisition method of accounting

at their estimated fair values at the date of acquisition. Goodwill represents costs in excess of fair values assigned to the underlying

identifiable net assets of acquired businesses. Intangible assets from acquired businesses are recognized at fair value on the acquisition

date and consist of customer programs, trademarks, customer relationships, technology and other intangible assets. Customer programs

include values assigned to major programs of acquired businesses and represent the aggregate value associated with the customer relationships,

contracts, technology and trademarks underlying the associated program and are amortized on a straight-line basis over a period of expected

cash flows used to measure fair value, which ranges from four to five years.

As

of June 30, 2023 and December 31, 2022 our goodwill balance was $23,179,411.

We performed an annual impairment test of the Company’s goodwill in the fourth quarter of 2022 and unless events or changes in

circumstances indicate the carrying value of goodwill may be impaired we may look to perform such test sooner versus on an annual

basis. Such events or changes in circumstances may include a significant deterioration in overall economic conditions, changes in

the business climate of our industry, a decline in our market capitalization, decline in operating performance indicators,

competition, or a reorganizations of our business. Our goodwill has been allocated to and is tested for impairment at a level

referred to as the business segment. The level at which we test goodwill for impairment requires us to determine whether the

operations below the business segment constitute a self-sustaining business for which discrete financial information is available

and segment management regularly reviews the operating results which is referred to as a reporting unit.

As

of June 30, 2023 and December 31, 2022 our intangible assets balance was $10,069,558 and $11,507,653, respectively. Finite-lived intangibles

are amortized to expense over the applicable useful lives, ranging from five to ten years, based on the nature of the asset and the underlying

pattern of economic benefit as reflected by future net cash inflows. We perform an impairment test of finite-lived intangibles whenever

events or changes in circumstances indicate their carrying value may be impaired. If events or changes in circumstances indicate the

carrying value of a finite-lived intangible may be impaired, the sum of the undiscounted future cash flows expected to result from the

use of the asset group would be compared to the asset group’s carrying value. If the asset group’s carrying amount exceeds

the sum of the undiscounted future cash flows, we would determine the fair value of the asset group and record an impairment loss in

net earnings.

As

of June 30, 2023, the Company deemed that no impairment was indicated for the carrying value of the goodwill nor its intangible

assets. At December 31, 2022 the Company recorded an impairment expense on its goodwill in connection with its annual impairment

test. At June 30, 2023 there have been no events or changes in circumstances which indicate an interim impairment test is required. The

Company will perform its annual analysis during the fourth quarter of 2023.

Foreign

Currency - The Company translates assets and liabilities of its foreign subsidiary, senseFly S.A., predominately in Swiss

Franc to their U.S. dollar equivalents at exchange rates in effect as of the balance sheet date. Translation adjustments are not

included in determining net income but are recorded in accumulated other comprehensive income on the condensed consolidated balance

sheets. The Company translates the condensed consolidated statements of operations and comprehensive loss of its foreign subsidiary

at average exchange rates for the applicable period. Foreign currency transaction gains and losses, arising primarily from changes

in exchange rates on foreign currency denominated revenues, certain purchases and intercompany transactions are recorded in other

income (expense), net in the condensed consolidated statements of operations and comprehensive loss.

Shipping

Costs – All shipping costs billed directly to the customer are directly offset to shipping costs resulting in a net

expense to the Company, which is included in cost of goods sold in the accompanying condensed consolidated statements of operations and

comprehensive loss. For the three months ended June, 2023 and 2022, shipping costs totaled $57,545 and $85,516, respectively. For the

six-month periods ended June 30, 2023 and 2022, shipping costs totaled $122,481 and $144,975, respectively.

Advertising

Costs – Advertising costs are charged to operations as incurred and presented in sales and marketing expenses in

the condensed consolidated statements of operations and comprehensive loss. For the three months ended June 30, 2023 and 2022,

advertising costs were $27,729

and $103,756,

respectively, and for the six months ended $68,418

and $164,382,

respectively.

Vendor

Concentrations – As of June 30, 2023 and December 31, 2022, there was one significant vendor that the Company relies upon to

perform certain services for the Company’s technology platform. This vendor provides services to the Company, which can be replaced

by alternative vendors should the need arise.

Loss

Per Common Share and Potentially Dilutive Securities – Basic loss per share is computed by dividing net loss by the weighted

average number of common shares outstanding for the period. Diluted loss per share is computed by dividing net loss by the weighted average

number of common shares outstanding plus Common Stock, par value $0.001 (“Common Stock”) equivalents (if dilutive) related

to warrants, options, and convertible instruments. For the three and six months ended June 30, 2023 and 2022, the Company has excluded

all common equivalent shares outstanding for restricted stock units (“RSUs”) and options to purchase Common Stock from the

calculation of diluted net loss per share, because these securities are anti-dilutive for the periods presented. As of June 30, 2023,

the Company had 455,972 unvested RSUs, 2,778,982 options outstanding to purchase shares of Common Stock and 53,351,747 common stock warrants.

As of June 30, 2022, the Company had 675,367 unvested RSUs, 2,452,248 options outstanding to purchase shares of Common Stock and

5,000,000 common stock warrants.

Segment

Reporting – In accordance with ASC Topic 280, Segment Reporting, (“ASC 280”), the Company identifies operating

segments as components of an entity for which discrete financial information is available and is regularly reviewed by the chief operating

decision maker in making decisions regarding resource allocation and performance assessment. The Company defines the term “chief

operating decision maker” to be its chief executive officer.

AGEAGLE AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

2 – Summary of Significant Accounting Policies-Continued

The

Company has determined that it operates in four segments:

| |

● |

Drones, which comprises revenues earned from contractual

arrangements to develop, manufacture and /or modify complex drone related products, and to provide associated engineering, technical

and other services according to customer specifications. |

| |

|

|

| |

● |

Sensors, which comprises the revenue earned through

the sale of sensors, cameras, and related accessories. |

| |

|

|

| |

● |

SaaS, which comprises revenue earned through the offering

of online-based subscriptions. |

| |

|

|

| |

● |

Corporate, which comprises corporate costs only. |

New

Accounting Pronouncements - In March 2022, the FASB issued Accounting Standards Update (“ASU”) No. 2022-02, Financial

Instruments-Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures (“ASU 2022-02”), which addresses

areas identified by the FASB as part of its post-implementation review of its previously issued credit losses standard, ASU 2016-13,

that introduced the Current Expected Credit Loss (“CECL”) model. ASU 2022-02 eliminates the accounting guidance for troubled

debt restructurings by creditors that have adopted the CECL model and enhances disclosure requirements for certain loan refinancings

and restructurings made with borrowers experiencing financial difficulty. In addition, ASU 2022-02 requires a public business entity

to disclose current-period gross write-offs for financing receivables and net investment in leases by year of origination in the vintage

disclosures. ASU 2022-02 is effective for the fiscal years beginning after December 15, 2022, and for periods within those fiscal years.

Early adoption is permitted. The Company adopted ASU 2022-02 effective January 1, 2023 and it did not have a material impact on the Company’s

condensed consolidated financial statements.

Other

recent accounting pronouncements issued by FASB did not or are not believed by management to have a material impact on the Company’s

present or future condensed consolidated financial statements.

Note

3 – Balance Sheets

Balance

Sheet Disclosure

Accounts

Receivable, net

As

of June 30, 2023 and December 31, 2022, accounts receivable, net consist of the following:

Schedule of Accounts Receivable, Net

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Accounts receivable | |

$ | 2,120,217 | | |

$ | 2,229,840 | |

| Less: Provision for doubtful accounts | |

| (17,097 | ) | |

| (16,800 | ) |

| Accounts receivable, net | |

$ | 2,103,120 | | |

$ | 2,213,040 | |

Inventories,

Net

As

of June 30, 2023 and December 31, 2022, inventories, net consist of the following:

Schedule of Inventories

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Raw materials | |

$ | 4,451,551 | | |

$ | 5,288,206 | |

| Work-in process | |

| 849,645 | | |

| 1,106,056 | |

| Finished goods | |

| 1,546,566 | | |

| 614,400 | |

| Gross inventories | |

| 6,847,762 | | |

| 7,008,662 | |

| Less: Provision for obsolescence reserve | |

| (327,448 | ) | |

| (322,815 | ) |

| Inventories, net | |

$ | 6,520,314 | | |

$ | 6,685,847 | |

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

3 – Balance Sheets – Continued

Prepaids

and Other Current Assets

As

of June 30, 2023 and December 31, 2022, prepaid and other current assets, net consist of the following:

Schedule of Prepaid and Other Current Assets

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Prepaid inventories | |

$ | 208,538 | | |

| 281,484 | |

| Prepaid software licenses and annual fees | |

| 326,851 | | |

| 184,429 | |

| Prepaid rent | |

| 131,537 | | |

| 234,691 | |

| Prepaid insurance | |

| 85,107 | | |

| 167,794 | |

| Prepaid VAT charges | |

| 57,373 | | |

| 99,558 | |

| Prepaid other and other current assets | |

| 91,737 | | |

| 61,592 | |

| Prepaid and other current assets | |

$ | 901,143 | | |

$ | 1,029,548 | |

Property

and Equipment, Net

As

of June 30, 2023 and December 31, 2022, property and equipment, net consist of the following:

Schedule

of Property and Equipment, Net

| | |

Useful Life | | |

June 30, | | |

December 31, | |

| | |

Estimated | | |

| |

| | |

Useful Life | | |

June 30, | | |

December 31, | |

| Type | |

(Years) | | |

2023 | | |

2022 | |

| Leasehold improvements | |

| 3 | | |

$ | 106,837 | | |

$ | 106,837 | |

| Production tools and equipment | |

| 5 | | |

| 691,268 | | |

| 632,514 | |

| Computer and office equipment | |

| 3-5 | | |

| 521,505 | | |

| 507,637 | |

| Furniture | |

| 5 | | |

| 73,647 | | |

| 77,799 | |

| Drone equipment | |

| 3 | | |

| 170,109 | | |

| 170,109 | |

| Property and equipment | |

| | | |

| 1,563,366 | | |

| 1,494,896 | |

| Less: Accumulated depreciation | |

| | | |

| (912,376 | ) | |

| (703,741 | ) |

| Property and equipment, net | |

| | | |

$ | 650,990 | | |

$ | 791,155 | |

Property

and Equipment Depreciation Expense

Schedule

of Property and Equipment Depreciation Expense

| Type | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Classification

within the Condensed Consolidated Statements of Operations and Comprehensive Loss. | |

For the Three Months Ended

June 30, | | |

For the Six Months Ended

June 30, | |

| Type | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Cost of sales | |

$ | — | | |

$ | 70,463 | | |

$ | — | | |

$ | 135,306 | |

| General and administrative | |

| 99,227 | | |

| 43,941 | | |

| 199,924 | | |

| 89,833 | |

| Depreciation expense | |

$ | 99,227 | | |

$ | 114,404 | | |

$ | 199,924 | | |

$ | 225,139 | |

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

3 – Balance Sheets - Continued

Intangible

Assets, net

As

of June 30, 2023 and December 31, 2022, intangible assets, net, other than goodwill, consisted of the following:

Schedule of Intangible Assets, net

| Name | |

Estimated Life (Years) | | |

Balance as of December 31, 2022 | | |

Additions | | |

Amortization | | |

Balance as of

June 30, 2023 | |

| Intellectual property/technology | |

| 5-7 | | |

$ | 4,473,861 | | |

$ | — | | |

$ | (404,484 | ) | |

$ | 4,069,377 | |

| Customer base | |

| 3-10 | | |

| 2,885,657 | | |

| — | | |

| (568,830 | ) | |

| 2,316,827 | |

| Tradenames and trademarks | |

| 5-10 | | |

| 1,757,891 | | |

| — | | |

| (103,972 | ) | |

| 1,653,919 | |

| Non-compete agreement | |

| 2-4 | | |

| 335,933 | | |

| — | | |

| (226,561 | ) | |

| 109,372 | |

| Platform development costs | |

| 3 | | |

| 1,332,516 | | |

| 232,441 | | |

| (344,298 | ) | |

| 1,220,659 | |

| Internal use software costs | |

| 3 | | |

| 721,795 | | |

| 143,796 | | |

| (166,187 | ) | |

| 699,404 | |

| Intangibles assets, net | |

| | | |

$ | 11,507,653 | | |

$ | 376,237 | | |

$ | (1,814,332 | ) | |

$ | 10,069,558 | |

As

of June 30, 2023, the weighted average remaining amortization period in years is 4.32 years. For

the three and six months ended June 30, 2023 and 2022, amortization expense was $913,691 and $851,284, respectively, and $1,814,332

and $288,065, respectively.

For

the following years ending, the future amortization expenses consist of the following:

Schedule

of Intangible Assets Future Amortization Expenses

| Name | |

(rest of year) 2023 | | |

2024 | | |

2025 | | |

2026 | | |

2027 | | |

Thereafter | | |

Total | |

| | |

For the Years Ending December 31, | |

| Name | |

(rest of year) 2023 | | |

2024 | | |

2025 | | |

2026 | | |

2027 | | |

Thereafter | | |

Total | |

| Intellectual property/technology | |

$ | 404,484 | | |

$ | 808,968 | | |

$ | 808,968 | | |

$ | 808,968 | | |

$ | 808,968 | | |

$ | 429,021 | | |

$ | 4,069,377 | |

| Customer base | |

| 568,833 | | |

| 889,364 | | |

| 141,145 | | |

| 141,145 | | |

| 141,145 | | |

| 435,195 | | |

| 2,316,827 | |

| Tradenames and trademarks | |

| 103,973 | | |

| 207,944 | | |

| 207,944 | | |

| 207,944 | | |

| 207,944 | | |

| 718,170 | | |

| 1,653,919 | |

| Non-compete agreement | |

| 109,372 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 109,372 | |

| Platform development costs | |

| 369,668 | | |

| 565,232 | | |

| 259,896 | | |

| 25,863 | | |

| — | | |

| — | | |

| 1,220,659 | |

| Internal use software costs | |

| 167,580 | | |

| 346,707 | | |

| 171,220 | | |

| 13,897 | | |

| — | | |

| — | | |

| 699,404 | |

| Intangible assets, net | |

$ | 1,723,910 | | |

$ | 2,818,215 | | |

$ | 1,589,173 | | |

$ | 1,197,817 | | |

$ | 1,158,057 | | |

$ | 1,582,386 | | |

$ | 10,069,558 | |

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

3 – Balance Sheets - Continued

Accrued

Liabilities

As

of June 30, 2023 and December 31, 2022, accrued expenses consist of the following:

Schedule of Accrued Expenses

| | |

June 30, 2023 | | |

December 31, 2022 | |

| Accrued purchases and customer deposits | |

$ | 315,197 | | |

$ | 102,319 | |

| Accrued compensation and related liabilities | |

| 299,445 | | |

| 774,916 | |

| Provision for warranty expense | |

| 296,055 | | |

| 288,807 | |

| Accrued dividends | |

| 293,751 | | |

| 172,596 | |

| Accrued interest | |

| 160,222 | | |

| — | |

| Accrued professional fees | |

| 158,485 | | |

| 262,737 | |

| Other | |

| 58,998 | | |

| 79,331 | |

| Total accrued expenses | |

$ | 1,582,153 | | |

$ | 1,680,706 | |

Note

4 – Notes Receivable

Valqari

On

October 14, 2020, in connection with, and as an incentive to the entry into a two-year exclusive manufacturing agreement (the “Manufacturing

Agreement”) to produce a patented Drone Delivery Station for Valqari, LLC (“Valqari), the Company entered into, as payee,

a Convertible Promissory Note pursuant to which the Company made a loan to Valqari in the principal aggregate amount of $500,000 (the

“Note”). The Note accrues interest at a rate of three percent per annum.

The

Note matured on April 15, 2021 (the “Maturity Date”), at which time all outstanding principal and interest that had accrued,

but remained, unpaid was due. The Note provides for an automatic six month extension of the Maturity Date under the following circumstances

(i) Valqari has received in writing, (x) a good faith acquisition offer at a consideration value greater than $15,000,000, (y) such offer,

upon consummation, would result in a change in control (as defined in the note) of Valqari, and (z) at such time Valqari, is actively

engaged in the negotiation or finalization of such acquisition transaction; or (ii) Valqari has initiated, or is in the process of initiating,

a conversion to a “C-Corporation” under the Internal Revenue Code, whereas such conversion will be completed no later than

one day prior to the extended Maturity Date. Valqari was not permitted to prepay the Note prior to the Maturity Date.

The

Note is subject to customary representations and warranties by Valqari, as well as events of default, which may lead to acceleration

of the payment of the Note such as (i) failure to pay all of the outstanding principal, plus accrued interest on the Maturity Date or

Extended Maturity Date, (ii) Valqari filing a petition or action under any bankruptcy, or other law, or (iii) an involuntary petition

is filed again Valqari under any bankruptcy statute (that is not dismissed or discharged within 60 days). The indebtedness evidenced

by the Note is subordinated in right of payment to the prior payment in full of any senior indebtedness (as defined in the Note) in existence

on the date of the Note or incurred thereafter.

On

the Maturity Date, AgEagle demanded payment of the Note, including accrued interest, however, Valqari alleged that the Maturity Date

was automatically extended to October 14, 2021 (“Extended Maturity Date”), for an additional six months. Upon the Extended

Maturity Date, AgEagle demanded payment of the Note, including accrued interest; however, Valqari sought a substantial discount on the

amount due under the Note to compensate for alleged breaches by AgEagle under the Manufacturing Agreement. AgEagle disputes the allegations

of breach and believes that it is owed a net amount by Valqari under the Manufacturing Agreement, in addition to the amount due under

the Note. On November 24, 2021, Valqari made a payment of principal on the Note of $315,000. The parties are continuing to negotiate

in an attempt to reach an amicable resolution of their disputes; however, AgEagle reserves the right to take legal action to collect

the Note in the event that a settlement is not reached.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

5 – COVID Loans

In

connection with the senseFly Acquisition, the Company assumed the obligations for two COVID Loans originally made by the SBA to senseFly

S.A. on July 27, 2020 (“senseFly COVID Loans”). As of senseFly Acquisition Date, the fair value of the COVID Loan was $1,440,046

(“senseFly COVID Loans”). For the three and six months ended June 30, 2023, senseFly S.A. made the required payments on the

senseFly COVID Loans, including principal and accrued interest, aggregating approximately $40,927, for the three and six months ended

June 30, 2023, respectively, no payments of principal and interest were required. As of June 30, 2023, the Company’s outstanding

obligations under the senseFly COVID Loans are $875,718.

As

of June 30, 2023, scheduled principal payments due under the senseFly COVID Loans are as follows:

Schedule

of Maturity of SenseFly Covid Loans

| | |

| |

| Year ending December 31, | |

| |

| 2023 (rest of year) | |

$ | 416,931 | |

| 2024 | |

| 91,758 | |

| 2025 | |

| 91,758 | |

| 2026 | |

| 91,758 | |

| 2027 | |

| 183,512 | |

| Total | |

$ | 875,718 | |

Note

6 – Promissory Note

On

December 6, 2022, the Company entered into a Securities Purchase Agreement (the “Promissory Note Purchase Agreement”) with

an institutional investor (the “Investor”) which is an existing shareholder of the Company. Pursuant to the terms of the

Promissory Note Purchase Agreement, the Company has agreed to issue to the Investor (i) an 8% original issue discount promissory note

(the “Note”) in the aggregate principal amount of $3,500,000, and (ii) a common stock purchase warrant (the “Promissory

Note Warrant”) to purchase up to 5,000,000 shares of the Company’s Common Stock (the “Shares”) at an exercise

price of $0.44 per share, subject to standard anti-dilution adjustments. The Note is an unsecured obligation of the Company. It has an

original issue discount of 4% and bears interest at 8% per annum. The Company received net proceeds of $3,285,000 net of the original

issue discount of $140,000 and $75,000 of issuance costs. The Promissory Note Warrant is not exercisable for the first six months after

issuance and has a five-year term from the initial exercise date of June 6, 2023. If at the time of the exercise, there is no effective

registration statement registering, or the prospectus contained therein, is not available for the issuance of the Shares, then the Promissory

Note Warrant may be exercised, in whole or in part, by means of a “cashless exercise.” The Shares issuable to the Investor

upon exercise of the Promissory Note Warrant will be issued in reliance upon the exemption from registration provided by Section 4(a)(2)

of the Securities Act of 1933, as amended (the “Securities Act”), and Rule 506 promulgated thereunder. Neither the Shares

nor the Promissory Note Warrant has been registered under the Securities Act, or applicable state securities laws, and none may be offered

or sold in the United States absent registration under the Securities Act or an exemption from such registration requirements.

The

Company determined the estimated fair value of the common stock warrants issued with the Note to be $1,847,200 using a Black-Scholes

pricing model. In accordance with ASC 470-20 Debt, the Company recorded a discount of $1,182,349 on the Note based on the relative

fair value of the warrants and total proceeds. At Note issuance, the Company recorded a total discount on the debt of $1,397,350 comprised

of the relative fair value of the warrants, the original issue discount, and the issuance costs. The aggregate discount will be amortized

into interest expense over the approximate two-year term of the Note. The Company used the following assumptions in determining the fair

value of the warrants: expected term of five years, volatility rate of 135.8%, risk free rate of 3.73%, and dividend rate of 0%.

During

the three and six months ended June 30, 2023, the Company recognized $168,885 and $337,770, respectively, of interest expense related

to the amortization of the discounts and which has been included in interest expense on the condensed consolidated statements of operations

and comprehensive loss. As of June 30, 2023, the unamortized discount is $1,013,309.

AGEAGLE

AERIAL SYSTEMS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

Note

6 – Promissory Note - Continued

Beginning

June 1, 2023, and on the first business day of each month thereafter, the Company shall pay 1/20th of the original

principal amount of the Note plus any accrued but unpaid interest, with any remaining principal plus accrued interest payable in

full upon the maturity date of December 31, 2024 or the occurrence of an Event of Default (as defined in the Note). In addition, to

the extent the Company raises any equity capital (by private placement, public offering or otherwise), the Company shall utilize 50%

of the net proceeds from such equity financing to prepay the Note, within two business days of the Company’s receipt of such

funds. In the event such equity financing is provided by the Investor, pursuant to the terms of that certain Securities Purchase

Agreement, dated as June 26, 2022, or otherwise (an “Additional Investment”), the Investor shall agree to accept 50%

less warrant coverage in connection with such Additional Investment, up to $3,300,000

of such Additional Investment. During the three and six months ended June 30, 2023, the Company recorded $70,778

and $160,222,

respectively, of interest expense related to the Note in the consolidated statements of operations and comprehensive loss; and as of

June 30, 2023, there is $160,222

of accrued interest including in accrued expenses on the unaudited condensed consolidated balance sheet. As of June 30, 2023, no

payments have been made per the terms of the Note and the Company is currently in discussion with the Investor to amend the terms

of the Note.

As

of June 30, 2023, scheduled principal payments due under the Note and amortization of the discount are as follows:

Schedule

of Principal Payments Due under Note and Amortization of Discount

| | |

Principal Payments | | |

Discount Amortization | | |