| |

Filed

pursuant to Rule 424(b)(5) |

| |

Registration

No. 333-252801 |

Prospectus

Supplement

(To

Prospectus dated May 6, 2021)

AGEAGLE

AERIAL SYSTEMS INC.

1,850 Shares

of Series F 5% Convertible Preferred Stock

(and

14,835,605 Shares of Common Stock Issuable Upon Conversion of Preferred Stock) and

1,500,000

Shares of Common Stock

We

are offering (i) 1,850 shares of our Series F 5% Convertible Preferred Stock (the “Preferred Stock”) to purchase up

to 14,835,605 shares (the “Conversion Shares”) of our common stock, $0.001 par value per share (the “Common

Stock”) to a certain institutional investor and an existing shareholder of the Company (the “Investor”)

and the Investor’s assignees (collectively, the “Purchasers”) and (ii) 1,500,000 shares of our Common

Stock to certain accredited investors.

The

shares of Preferred Stock were sold pursuant to that certain Securities Purchase Agreement, dated June 26, 2022, by and among the Company

and the Investor (the “Original Purchase Agreement”), pursuant to which

the Investor has the right (the “Additional Investment Right”), in its sole discretion, until August 3, 2024, to purchase

additional shares of Preferred Stock and accompanying Common Stock purchase warrants of the Company (the “Warrants” or

“Common Warrants”), in minimum subscription amount tranches of $2,000,000 each (the “Minimum Subscription Requirement”),

up to a total aggregate additional stated value of Preferred Stock equal to $25,000,000, at a purchase price equal to the volume-weighted

average pricings (“VWAPs”) of the Company’s common stock for three trading days prior to the date the Investor gives

notice to the Company that it will exercise the Additional Investment Right (the “Investor Notice”). On November 15,

2023, the Company entered into an Assignment, Waiver and Amendment Agreement with the Investor pursuant to which, among

other things, (i) the Investor has transferred and assigned to certain institutional and accredited investors (the “Assignees”),

the rights and obligations to purchase up to $1,850,000 of Preferred Stock pursuant to the Additional Investment Right provided in

the Original Purchase Agreement (the “Assigned Rights”), (ii) the Original Purchase Agreement was amended

so that the Assignees are parties thereto and have the same rights and obligations thereunder as the Investor to the extent

of the Assigned Rights, (iii) the time period during which the Investor can provide an Investor Notice was extended

from August 3, 2024 until February 3, 2025, and (iv) the Investor and the Company agreed to a one-time waiver of the Minimum Subscription

Requirement to allow exercise of the Assigned Rights. Pursuant to Investor Notices received by the Company from the Investor and

the Assignees on November 15, 2023, the Investor and the Assignees have agreed to purchase an additional 1,850

shares of Preferred Stock convertible into Conversion Shares at a conversion price of $0.1247 per share and accompanying

Warrants to purchase up to 14,835,605 shares of our Common Stock (the “Warrant Shares”) with an exercise

price of $0.1247 per share for an aggregate purchase price of $1,850,000.

The

1,500,000 shares of Common Stock (the “Common Shares”) were sold pursuant to that certain Securities Purchase Agreement,

dated November 15, 2023, between the Company and certain accredited investors party thereto (the “Common Stock Investors”)

at $0.10 per share of Common Stock, for an aggregate purchase price of $150,000 (the “2023 Purchase Agreement”). The 2023

Purchase Agreement was entered into by the Company and the Common Stock Investors following the receipt and acknowledgement of Investor

Notices.

The

Preferred Stock, the Common Shares (collectively, the “Shares”) and Conversion Shares have been registered pursuant

to an effective shelf registration statement on Form S-3 (File No. 333-252801), which was declared effective on May 6, 2021. The Shares and Conversion Shares are being offered pursuant to this prospectus supplement and the accompanying prospectus. For a more

detailed description of the Shares and Conversion Shares, see the section entitled “Description of Our Securities We Are Offering”

beginning on page S-13.

In

a concurrent private placement, we are also selling to the Purchasers of our Preferred Stock, the Warrants. Each Warrant will have

a three year term and will be exercisable immediately upon issuance. The Warrants and the Warrant Shares are not being offered

pursuant to this prospectus supplement and the accompanying prospectus, are being offered in reliance upon the exemption from

registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and Rule

506 promulgated thereunder.

We expect to receive gross proceeds in the amount of $2.0 million

which will be used for working capital and general corporate purposes.

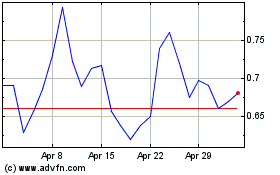

Our

shares of Common Stock are currently traded on the NYSE American under the symbol “UAVS.” On November 15, 2023, the

closing sale price of our shares of Common Stock was $0.1630 per share. There is no established trading market for the Preferred

Stock and we do not expect a market to develop. In addition, we do not intend to apply for the listing of the Preferred Stock on any

national securities exchange or other trading market. Without an active trading market, the liquidity of the Preferred Stock will be

limited.

We have retained Dawson

James Securities, Inc. (the “placement agent” or “Dawson James”) to use its reasonable best efforts to solicit

offers to purchase our securities in this offering. The placement agent has no obligation to purchase any of the securities from us or

to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount

required as a condition to closing in this offering the actual public amount, placement agent’s fee, and proceeds to us, if any,

are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this

prospectus supplement. We have agreed to pay the placement agent the placement agent fees set forth in the table below and to provide

certain other compensation to the placement agent. See “Plan of Distribution” on page S-15 of this prospectus supplement

for more information regarding these arrangements.

As

of the date of this prospectus supplement, we are subject to General Instruction I.B.6 of Form S-3, which limits the amount that we may

sell under the registration statement of which this prospectus supplement is a part. The aggregate market value of our outstanding Common

Stock held by non-affiliates was approximately $74,117, which we calculated based on 117,878,831 shares of outstanding

Common Stock as of November 15, 2023, of which 454,705 shares were held by non-affiliates, and a price per share of $0.1630

which was the closing price of our Common Stock on November 15, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in

no event will we sell, pursuant to the registration statement of which this prospectus supplement forms a part, securities with a value

exceeding one-third of the aggregate market value of our outstanding Common Stock held by non-affiliates in any 12-month period, so long

as the aggregate market value of our outstanding Common Stock held by non-affiliates remains below $75.0 million. During the 12 calendar

months prior to and including the date of this prospectus, we have offered $4,180,000 of securities pursuant to General Instruction

I.B.6 of Form S-3.

| | |

Per Share of Preferred Stock and

Accompanying

Warrants | | |

Per Share of Common Stock | | |

Total(1)

| |

| Offering Price | |

$ | 1,000 | | |

$ | 0.10 | | |

$ | 2,000,000 | |

| Placement agent’s fees(2) | |

$ | 50 | | |

$ | 0.005 | | |

$ | 100,000 | |

| Proceeds, before expenses, to us | |

$ | 950 | | |

$ | 0.095 | | |

$ | 1,900,000 | |

| (1) |

The

amount of the offering proceeds to us presented in this table does not give effect to any exercise of the Warrants being issued in

this offering or the Placement Agent Warrants (as defined below) to be issued to the placement agent or its designees as

compensation in connection with this offering. |

| |

|

| (2) |

We

will pay the placement agent a cash fee equal to 5% of the aggregate gross proceeds of this offering. In addition, we have agreed to

issue to the placement agent or its designees as partial compensation warrants (the “Placement Agent Warrants”) to

purchase up to a number of shares of our common stock equal to 10.0% of the aggregate number of Warrants sold to the Purchasers in this

offering at an exercise price equal to 100% of the offering price of the Preferred Stock and accompanying Warrant and to reimburse the

placement agent for certain offering-related expenses. See “Plan of Distribution” beginning on page S-15 of this

prospectus supplement for more information regarding this arrangement. |

Investing

in our securities involves a high degree of risk. You should purchase our securities only if you can afford a complete loss of your

investment. See “Risk Factors” beginning on page S-7 of this prospectus supplement and on page 9 of the accompanying

prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

There is no arrangement for funds to be received

in escrow, trust or similar arrangement.

We are a “smaller

reporting company” under the federal securities laws and, as such, we have elected to comply with certain reduced public company

reporting requirements and scaled disclosures for this prospectus and future filings. See “Prospectus Supplement Summary —

Implications of Being a Smaller Reporting Company.”

We

expect that delivery of the Shares being offered pursuant to this prospectus supplement and the accompanying prospectus will be made

on or about November 17, 2023.

The

date of this prospectus supplement is November 15, 2023

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

You

should rely only on the information contained in this prospectus supplement and the accompanying prospectus. We have not authorized anyone

else to provide you with additional or different information. We are offering to sell, and seeking offers to buy, our securities only

in jurisdictions where offers and sales are permitted. You should not assume that the information in this prospectus supplement or the

accompanying prospectus is accurate as of any date other than the date on the front of those documents or that any document incorporated

by reference is accurate as of any date other than its filing date.

No

action is being taken in any jurisdiction outside the United States to permit a public offering of our securities or possession or distribution

of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus

supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe

any restrictions as to this offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to

that jurisdiction.

ABOUT

THIS PROSPECTUS SUPPLEMENT

On

February 5, 2021, we filed with the SEC a registration statement on Form S-3 (File No. 333-252801), utilizing a shelf registration process

relating to the securities described in this prospectus supplement, which registration statement was declared effective on May 6, 2021.

Under this shelf registration process, we may, from time to time, sell up to $200 million in the aggregate of shares of Common Stock,

shares of preferred stock, debt securities, warrants and units.

This

document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also

adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into the prospectus.

The second part, the accompanying prospectus, gives more general information, some of which does not apply to this offering. You should

read this entire prospectus supplement as well as the accompanying prospectus and the documents incorporated by reference that are described

under “Where You Can Find More Information” in this prospectus supplement and the accompanying prospectus.

If

the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information

contained in this prospectus supplement. However, if any statement in one of these documents is inconsistent with a statement in another

document having a later date – for example, a document incorporated by reference in this prospectus supplement and the accompanying

prospectus – the statement in the document having the later date modifies or supersedes the earlier statement. Except as specifically

stated, we are not incorporating by reference any information submitted under Item 2.02 or Item 7.01 of any Current Report on Form 8-K

into any filing under the Securities Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

into this prospectus supplement or the accompanying prospectus.

Any

statement contained in a document incorporated by reference, or deemed to be incorporated by reference, into this prospectus supplement

or the accompanying prospectus will be deemed to be modified or superseded for purposes of this prospectus supplement or the accompanying

prospectus to the extent that a statement contained herein, therein or in any other subsequently filed document which also is incorporated

by reference in this prospectus supplement or the accompanying prospectus modifies or supersedes that statement. Any such statement so

modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement or

the accompanying prospectus.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in this prospectus supplement and the accompanying prospectus were made solely for the benefit of the

parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you unless you are a party to such agreement. Moreover, such representations,

warranties or covenants were accurate only as of the date when made or expressly referenced therein. Accordingly, such representations,

warranties and covenants should not be relied on as accurately representing the current state of our affairs unless you are a party to

such agreement.

Unless

we have indicated otherwise, or the context otherwise requires, references in this prospectus supplement and the accompanying prospectus

to “AgEagle,” the “Company,” “we,” “us” and “our” or similar terms refer

to refer to AgEagle Aerial Systems Inc., a Nevada corporation and its subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the documents we have filed with the SEC that are incorporated herein by reference

contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking statements deal with our current plans, intentions, beliefs and expectations

and statements of future economic performance. Statements containing terms such as “believe,” “do not believe,”

“plan,” “expect,” “intend,” “estimate,” “anticipate” and other phrases of

similar meaning are considered to contain uncertainty and are forward-looking statements. In addition, from time to time we or our representatives

have made or will make forward-looking statements orally or in writing. Furthermore, such forward-looking statements may be included

in various filings that we make with the SEC, or press releases or oral statements made by or with the approval of one of our authorized

executive officers. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions

that could cause actual results to differ materially from those reflected in these forward-looking statements. Factors that might cause

actual results to differ include, but are not limited to, those set forth under “Risk Factors” incorporated by reference

in this prospectus supplement and those discussed in Item 7, “Management’s Discussion and Analysis of Financial Condition

and Results of Operation,” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in our future filings

made with the SEC. Readers are cautioned not to place undue reliance on any forward-looking statements contained in this prospectus supplement,

the accompanying prospectus or the documents we have filed with the SEC that are incorporated herein by reference, which reflect management’s

opinions only as of their respective dates. Except as required by law, we undertake no obligation to revise or publicly release the results

of any revisions to any forward-looking statements. You are advised, however, to consult any additional disclosures we have made or will

make in our reports to the SEC on Forms 10-K, 10-Q and 8-K. All subsequent written and oral forward-looking statements attributable to

us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this prospectus,

any prospectus supplement or any related issuer free writing prospectus.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus supplement. This summary

does not contain all of the information you should consider before investing in the securities. Before making an investment decision,

you should read this entire prospectus supplement as well as the accompanying prospectus carefully, including the risk

factors section as well as the financial statements and the notes to the financial statements incorporated herein by reference.

Our

Company

AgEagle™

Aerial Systems Inc. (“AgEagle” or the “Company”), through its wholly owned subsidiaries, is actively engaged

in designing and delivering best-in-class drones, sensors and software that solve important problems for our customers. Founded in 2010,

AgEagle was originally formed to pioneer proprietary, professional-grade, fixed-winged drones and aerial imagery-based data collection

and analytics solutions for the agriculture industry. Today, the Company is earning distinction as a globally respected market leader

offering customer-centric, advanced, autonomous unmanned aerial systems (“UAS”) which drive revenue at the intersection of

flight hardware, sensors and software for industries that include agriculture, military/defense, public safety, surveying/mapping and

utilities/engineering, among others. AgEagle has also achieved numerous regulatory firsts, including earning governmental approvals for

its commercial and tactical drones to fly Beyond Visual Line of Sight and/or Operations Over People in the United States, Canada, Brazil and the European Union and being awarded Blue UAS certification from the Defense Innovation Unit

of the U.S. Department of Defense.

AgEagle’s

shift and expansion from solely manufacturing fixed-wing farm drones in 2018, to offering what the Company believes is one of the industry’s

best fixed-wing, full-stack drone solutions, culminated in 2021 when the Company acquired three market-leading companies engaged in producing

UAS airframes, sensors and software for commercial and government use. In addition to a robust portfolio of proprietary, connected hardware

and software products; an established global network of over 200 UAS resellers; and enterprise customers worldwide; these acquisitions

also brought AgEagle a highly valuable workforce comprised largely of experienced engineers and technologists with deep expertise in

the fields of robotics, automation, manufacturing and data science. In 2022, the Company successfully integrated all three acquired companies

with AgEagle to form one global company focused on taking autonomous flight performance to a higher level.

Our

core technological capabilities include robotics and robotics systems autonomy; advanced thermal and multispectral sensor design and

development; embedded software and firmware; secure wireless digital communications and networks; lightweight airframes; small UAS

design, integration and operations; power electronics and propulsion systems; controls and systems integration; fixed wing flight; flight

management software; data capture and analytics; human-machine interface development and integrated mission solutions.

The

Company is currently headquartered in Wichita, Kansas, where we house our sensor manufacturing operations, and we operate our business

and drone manufacturing in Lausanne, Switzerland which supports our international business activities.

Strategic

Acquisitions

MicaSense,

Inc.

In

January 2021, AgEagle acquired MicaSense™, Inc. (“MicaSense”), a company that has been at the forefront of advanced

drone sensor development since its founding in 2014. In early 2022, AgEagle completed development and brought to market the Altum-PT™

and RedEdge-P™ — next generation thermal and multispectral sensors which offer critical advancements on MicaSense’s

legacy sensor products to customers primarily in agriculture, plant research, land management and forestry management. Today, AgEagle’s

multispectral sensors are distributed in over 75 countries worldwide and help customers use drone-based imagery to make better and more

informed business decisions.

Measure

Global, Inc.

In

April 2021, AgEagle acquired Measure Global, Inc. (“Measure”), a company founded in 2020. Serving a world class customer

base, Measure enables its customers to realize the transformative benefits of drone technology through its Ground Control solution. Offered

as Software-as-a-Service, Ground Control is a cloud-based, plug-and-play operating system that empowers pilots and

large enterprises with everything they need to operate drone fleets, fly autonomously, collaborate globally, visualize data, and integrate

with existing business systems and processes. Ground Control serves a world class customer base, including many Fortune 500 companies.

By adding Measure’s advanced software to the AgEagle platform, combined with its sensors and other data capture and analytics innovations,

our customers can capitalize on the significant economic, safety and efficiency benefits made possible by drones used at scale.

senseFly,

S.A.

In

October 2021, the Company acquired senseFly, S.A. and senseFly Inc. (collectively “senseFly”), a global leader in fixed-wing

drones that simplify the collection and analysis of geospatial data, allowing professionals to make better and faster decisions. Founded

in 2009, senseFly develops and produces a proprietary line of eBee™-branded, high performance, fixed-wing drones which have flown

more than one million flights around the world. Safe, ultra-light and easy to use, these autonomous drones are utilized by thousands

of customers around the world in agriculture, government/defense, engineering, and construction, among other industry verticals, to collect

actionable aerial data intelligence.

2022

Integration Activities

In

2022, the Company built an enterprise architecture designed to seamlessly integrate the acquisitions completed in 2021, thereby unifying

four disparate brands under one global brand: AgEagle. As part of this process, AgEagle executed an action plan to create long-term sustainable

value through the efficiencies derived from economies of scale, sharing and optimizing resources – in particular, human capital

and knowledge – and combining assets. Critical to the success of the integration and integral to the Company’s ability to

stay disciplined, structurally organized and rooted in its core values was:

| |

● |

implementation

of a new enterprise resource planning system; |

| |

|

|

| |

● |

collapse

of all acquired websites and the creation and launch of one website, found at www.ageagle.com, showcasing the Company’s full

suite of products and capabilities; |

| |

|

|

| |

● |

creation

of an Intranet employee portal to support and promote enterprise-wide communication and connectivity; |

| |

|

|

| |

● |

consolidation

of the Company’s business and manufacturing operations in the United States from multiple offices spread across the country

in Kansas, North Carolina, Texas, Washington and Washington, D.C. to three centralized locations in Wichita, Kansas, Raleigh, North

Carolina and Lausanne, Switzerland – an initiative which commenced in late 2022 and is expected to be completed in 2023; |

| |

|

|

| |

● |

commitment

to customer-centric product development roadmaps designed to best leverage the right combination of process, tools, training and

project management to effectively meet product enhancement and new product launch deadlines and achieve post-launch sales and marketing

key performance indicators; and |

| |

|

|

| |

● |

shifts

in the responsibilities of senior and mid-level management to optimize strengths and squarely align functional and cross-functional

goals and objectives. |

Our

Headquarters

Our

principal executive offices are located at 8201 E. 34th Cir N, Wichita, Kansas 67226 and our telephone number is 620-325-6363.

Our website address is www.ageagle.com. The information contained on, or that can be accessed through, our website is not a part of this

prospectus supplement. We have included our website address in this prospectus supplement solely as an inactive

textual reference.

Employees

As

of November 10, 2023, we employed sixty-four (64) full-time employees and one (1) part-time employee.

Implications of Being a Smaller Reporting

Company

We are a “smaller

reporting company” as defined in the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller

reporting companies until the last day of the fiscal year in which (i) the market value of our common equity held by non-affiliates equals

or exceeds $250 million as of the last business day of our most recently completed second fiscal quarter or (ii) (a) the market value

of our common equity held by non-affiliates equals or exceeds $700 million as of the last business day of our most recently completed

second fiscal quarter and (b) our annual revenues as of our most recent fiscal year completed before the last business day of such second

fiscal quarter equaled or exceeded $100 million.

We have elected to take

advantage of certain of the reduced disclosure obligations in this prospectus supplement and in our past filings with the SEC, and may

elect in our future filings with the SEC take advantage of the same and/or other reduced reporting requirements. As a result, the information

that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold

equity interests.

THE

OFFERING

| Issuer: |

|

AgEagle

Aerial Systems Inc. |

| |

|

|

| Shares

of Preferred Stock offered by us pursuant to this prospectus supplement: |

|

1,850 shares of Preferred Stock convertible into 14,835,605 shares Common Stock at $0.1247 per share, subject to

certain adjustment. Holders shall be entitled to receive cumulative dividends at the rate per share (as a percentage of the $1,000 Stated

Value per share) of 5% per annum, payable quarterly on January 1, April 1, July 1 and October 1, beginning on the first conversion date

and subsequent conversion date, with respect to Preferred Stock being converted. |

| |

|

|

| Conversion

Shares underlying Preferred Stock offered by us pursuant to this prospectus supplement |

|

14,835,605 Conversion Shares |

| |

|

|

| Shares of Common Stock offered by us pursuant to this prospectus supplement: |

|

1,500,000 shares of Common Stock |

| |

|

|

| Shares

of Common Stock to be outstanding after this offering assuming full conversion of the Preferred Stock(1) |

|

134,213,981 shares of Common Stock |

| |

|

|

| Concurrent Private Placement of Warrants |

|

In

a concurrent private placement, we will issue to the Purchasers in this offering for no additional consideration, Warrants to purchase

up to an aggregate of 14,835,605 shares of our Common Stock at an exercise price of $0.1247 per share. The Warrants are exercisable upon

issuance and will expire three years upon issuance. The Warrants and Warrant Shares are not being offered pursuant to this prospectus

supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section 4(a)(2) under the Securities

Act and/or Regulation D promulgated thereunder. See “Concurrent Private Placement of Common Warrants” on page S-14 of

this prospectus supplement.

|

| |

|

|

| Use

of proceeds: |

|

We

expect the aggregate net proceeds from the Offering will be approximately $1,900,000, after deducting estimated offering expenses

payable by us. We intend to use the net proceeds from the sale of securities in this offering for working capital, capital expenditures

and other general corporate purposes. See “Use of Proceeds” on page S-10 of this prospectus supplement. |

| |

|

|

| Transfer

agent |

|

EQ

Shareholder Services |

| |

|

|

| Risk

factors: |

|

Investing

in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to

invest in our shares of Common Stock, see the information contained in or incorporated by reference under the heading “Risk

Factors” beginning on page S-7 of this prospectus supplement, on page 9 of the accompanying prospectus, and in the other

documents incorporated by reference into this prospectus supplement. |

| |

|

|

| NYSE

American symbol: |

|

UAVS

|

(1) Excludes

(i) 16,319,165 shares of Common Stock issuable upon exercise of the Warrants and Placement Agent Warrants to be issued in the

concurrent private placement; (ii) 419,722 shares of Common Stock issuable upon exercise of unvested RSUs; (iii) 2,777,732 shares of

Common Stock issuable upon exercise of options under the Company’s 2017 Equity Incentive Plan; (iv) 48,351,747 shares of

Common Stock issuable upon exercise of outstanding common stock warrants; (v) 15,000,000 shares of Common Stock reserved for future

issuance under the Company’s Amended 2017 Equity Incentive Plan; and (vi) 25,100,000 shares of Common Stock issuable upon the

conversion of 6,275 shares of Preferred Stock issued prior to this offering. The number of shares of our Common Stock to be

outstanding immediately after this offering is based on 117,878,831 shares of Common Stock outstanding as of November

15, 2023.

RISK

FACTORS

Before

you make a decision to invest in our securities, you should consider carefully the risks described below, together with other information

in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein. If any of

the following events actually occur, our business, operating results, prospects or financial condition could be materially and adversely

affected. This could cause the trading price of our Common Stock to decline and you may lose all or part of your investment. The risks

described below are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may

also significantly impair our business operations and could result in a complete loss of your investment.

Risks

Related to This Offering

Since

our management will have broad discretion in how we use the proceeds from this offering and the concurrent private placement of Warrants,

we may use the proceeds in ways with which you disagree.

We

have not allocated specific amounts of the net proceeds from this offering and the concurrent private placement of Warrants for any specific

purpose. Accordingly, our management will have significant flexibility in applying the net proceeds of this offering. You will be relying

on the judgment of our management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your

investment decision, to influence how the proceeds are being used. It is possible that the net proceeds will be invested in a way that

does not yield a favorable, or any, return for us. The failure of our management to use such funds effectively could have a material

adverse effect on our business, financial condition, operating results and cash flow.

Because

we are a small company, the requirements of being a public company, including compliance with the reporting requirements of the Exchange Act, and the requirements of the Sarbanes-Oxley Act and the Dodd-Frank

Act, may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in

a timely or cost-effective manner.

As

a public company with listed equity securities, we must comply with the federal securities laws, rules and regulations, including certain

corporate governance provisions of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) and the Dodd-Frank Act, related

rules and regulations of the SEC and the NYSE American, with which a private company is not required to comply. Complying with these

laws, rules and regulations occupies a significant amount of the time of our Board of Directors and management and significantly increases

our costs and expenses. Among other things, we must:

| |

● |

maintain

a system of internal control over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act

and the related rules and regulations of the SEC and the Public Company Accounting Oversight Board; |

| |

|

|

| |

● |

comply

with rules and regulations promulgated by the exchange; |

| |

|

|

| |

● |

prepare

and distribute periodic public reports in compliance with our obligations under the federal securities laws; |

| |

|

|

| |

● |

maintain

various internal compliance and disclosures policies, such as those relating to disclosure controls and procedures and insider trading

in our Common Stock; |

| |

|

|

| |

● |

involve

and retain to a greater degree outside counsel and accountants in the above activities; |

| |

|

|

| |

● |

maintain

a comprehensive internal audit function; and |

| |

|

|

| |

● |

maintain

an investor relations function. |

Future

sales of our Common Stock, whether by us or our stockholders, could cause our stock price to decline.

If

our existing stockholders sell, or indicate an intent to sell, substantial amounts of our Common Stock in the public market, the trading

price of our Common Stock could decline significantly. Similarly, the perception in the public market that our stockholders might sell

shares of our Common Stock could also depress the market price of our Common Stock. A decline in the price of shares of our Common Stock

might impede our ability to raise capital through the issuance of additional shares of our Common Stock or other equity securities. In

addition, the issuance and sale by us of additional shares of our Common Stock or securities convertible into or exercisable for shares

of our Common Stock, or the perception that we will issue such securities, could reduce the trading price for our Common Stock as well

as make future sales of equity securities by us less attractive or not feasible. The sale of shares of Common Stock issued upon the exercise

of our outstanding options and warrants could further dilute the holdings of our then existing shareholders.

Securities

analysts may not cover our Common Stock and this may have a negative impact on the market price of our Common Stock.

The

trading market for our Common Stock will depend, in part, on the research and reports that securities or industry analysts publish about

us or our business. We do not have any control over independent analysts (provided that we have engaged various non-independent analysts).

We do not currently have and may never obtain research coverage by independent securities and industry analysts. If no independent securities

or industry analysts commence coverage of us, the trading price for our Common Stock would be negatively impacted. If we obtain independent

securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our Common Stock, changes their opinion

of our shares or publishes inaccurate or unfavorable research about our business, our stock price would likely decline. If one or more

of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our Common Stock could decrease and we

could lose visibility in the financial markets, which could cause our stock price and trading volume to decline.

You

will experience immediate and substantial dilution.

Because

the effective offering price per share in this offering exceeds the net tangible book value per share of our Common Stock outstanding

prior to this offering you will incur an immediate and substantial dilution in the net tangible book value of the shares of Common Stock

or Conversion Shares you purchase in this offering. After giving effect to the sale of the Shares at the offering price of $0.1247 per

share for the Preferred Stock and $0.10 per share for the Common Shares, and after deducting estimated expenses payable by us, our net

tangible book value as of September 30, 2023 would have been approximately $4,415,000 or $0.0329 per Common Stock. This represents an

immediate increase in as adjusted net tangible book value per common share of $0.0116 to the existing stockholders and an immediate decrease

in as adjusted net tangible book value of $0.0918 and $0.0671 in per common share to the Purchasers of Preferred Stock and to the Common

Stock Investors of Common Shares participating in this Offering, respectively.

In

addition, we are selling the Warrants and Placement Agent Warrants to purchase an aggregate of 16,319,165 shares of Common Stock in a

concurrent private placement and we may in the future offer additional shares of our common stock or other securities convertible into

or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. In the event that the

Warrants, Placement Agent Warrants or the other outstanding options or warrants are exercised or settled, or that we make additional

issuances of Common Stock or other convertible or exchangeable securities, you could experience additional dilution. We cannot assure

you that we will be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than

the price per share paid in this offering, and investors purchasing shares or other securities in the future could have rights superior

to existing stockholders, including investors who purchase shares of Preferred Stock and Common Stock in this offering. The price per

share at which we sell additional shares of our Common Stock or securities convertible into Common Stock in future transactions, may

be higher or lower than the price per share in this offering. Additionally, the exercise of warrants, exercise of outstanding stock options,

conversion of outstanding preferred stock, and vesting of other stock awards may result in further dilution of your investment. See the

section entitled “Dilution” appearing elsewhere in this prospectus supplement for a more detailed illustration of the dilution

you would incur if you participate in this offering.

You

may experience future dilution as a result of future equity offerings or other equity issuances.

We

may in the future issue additional shares of our Common Stock or other securities convertible into or exchangeable for shares of our

Common Stock. We cannot assure you that we will be able to sell shares of our Common Stock or other securities in any other offering

or other transactions at a price per share that is equal to or greater than the price per share paid by Purchasers in this offering.

The price per share at which we sell additional shares of our Common Stock or other securities convertible into or exchangeable for our

Common Stock in future transactions may be higher or lower than the price per share in this offering.

The

price of our Common Stock may be volatile or may decline, which may make it difficult for investors to resell shares of our Common Stock

at prices they find attractive.

The

trading price of our Common Stock may fluctuate widely as a result of a number of factors, many of which are outside our control. In

addition, the stock market is subject to fluctuations in the share prices and trading volumes that affect the market prices of the shares

of many companies. These broad market fluctuations could adversely affect the market price of our Common Stock. Among the factors that

could affect our stock price are:

| |

● |

actual

or anticipated quarterly fluctuations in our operating results and financial condition, and, in particular, further deterioration

of asset quality; |

| |

|

|

| |

● |

changes

in revenue or earnings estimates or publication of research reports and recommendations by financial analysts; |

| |

|

|

| |

● |

failure

to meet analysts’ revenue or earnings estimates; |

| |

|

|

| |

● |

speculation

in the press or investment community; |

| |

● |

strategic

actions by us or our competitors, such as acquisitions or restructurings; |

| |

|

|

| |

● |

actions

by institutional stockholders; |

| |

|

|

| |

● |

fluctuations

in the stock price and operating results of our competitors; |

| |

|

|

| |

● |

general

market conditions and, in particular, developments related to market conditions for the commercial drone, agricultural and hemp industries; |

| |

|

|

| |

● |

proposed

or adopted regulatory changes or developments; |

| |

|

|

| |

● |

anticipated

or pending investigations, proceedings or litigation that involve or affect us; or |

| |

|

|

| |

● |

domestic

and international economic factors unrelated to our performance. |

The

stock market has experienced significant volatility recently. As a result, the market price of our Common Stock may be volatile. In addition,

the trading volume in our Common Stock may fluctuate more than usual and cause significant price variations to occur. The trading price

of the shares of our Common Stock and the value of our other securities will depend on many factors, which may change from time to time,

including, without limitation, our financial condition, performance, creditworthiness and prospects, future sales of our equity or equity

related securities, and other factors identified above in “Cautionary Note Regarding Forward-Looking Statements.”

Accordingly,

the shares of our Common Stock that an investor purchases, whether in this offering or in the secondary market, may trade at a price

lower than that at which they were purchased, and, similarly, the value of our other securities may decline. Current levels of market

volatility are unprecedented. The capital and credit markets have been experiencing volatility and disruption for more than a year. In

some cases, the markets have produced downward pressure on stock prices and credit availability for certain issuers without regard to

those issuers’ underlying financial strength.

A

significant decline in our stock price could result in substantial losses for individual stockholders and could lead to costly and disruptive

securities litigation.

We

have not paid and do not intend to pay dividends on our Common Stock. Purchasers in this offering may never obtain a return on their

investment.

We

have not paid dividends on our Common Stock inception, and do not intend to pay any dividends on our Common Stock in the foreseeable

future. We intend to reinvest earnings, if any, in the development and expansion of our business. Accordingly, you will need to rely

on sales of your shares of Common Stock issued upon conversion of the Preferred Stock or exercise of the Warrants after price appreciation,

which may never occur, in order to realize a return on your investment.

There

is no public market for the Preferred Stock.

There

is no established public trading market for the Preferred Stock being offered in this offering and we do not expect a market to develop.

In addition, we do not intend to apply for listing of the Preferred Stock on any securities exchange or automated quotation system. Without

an active market, the Purchasers in this offering may be unable to readily sell the Preferred Stock.

USE

OF PROCEEDS

We

estimate that the net proceeds from this offering will be approximately $1,900,000, after deducting the estimated offering

expenses payable by us. We will receive an additional $1,850,000 if the Warrants and Placement Agent Warrants are

exercised in full for cash.

We

intend to use the net proceeds from this offering for working capital, capital expenditures and other general corporate purposes; provided,

however, that none of such proceeds will be used, directly or indirectly: (a) for the satisfaction of any portion of the Company’s

debt (other than payment of trade payables in the ordinary course of the Company’s business and prior practices), (b) for the repurchase

of any Common Stock or Common Stock equivalents, (c) for the settlement of any outstanding litigation, or (d) in violation of FCPA or

OFAC regulations.

The

amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used

by our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation of

the net proceeds of this offering. In addition, while we have not entered into any agreements, commitments or understandings relating

to any significant transaction as of the date of this prospectus supplement, we may use a portion of the net proceeds to pursue acquisitions,

joint ventures and other strategic transactions.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our Common Stock. We anticipate that we will retain any earnings to support operations

and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends in the foreseeable future.

Any future determination relating to our dividend policy will be made at the discretion of our board of directors and will depend on

a number of factors, including future earnings, capital requirements, financial conditions and future prospects and other factors the

board of directors may deem relevant.

DILUTION

If

you invest in our Shares in this offering, your interest will be diluted immediately to the extent of the difference between the offering

price per share of the Shares you will pay in this offering and the as adjusted net tangible book value per share of our Common Stock

after giving effect to this offering. Our historical net tangible book value as of September 30, 2023 was $2,515,086 or $0.0213

per share of Common Stock. Historical net tangible book value per share represents the amount of our total tangible assets less total

liabilities, divided by the number of shares of our Common Stock outstanding on September 30, 2023.

After

giving effect to the assumed sale of the Shares at an assumed offering price of $0.1247 per share for the Preferred Stock and

$0.01 per share for the Common Shares, and after deducting estimated expenses payable by us, our net tangible book value as of September

30, 2023 would have been approximately $4,415,000 or $0.0329 per Common Stock. This represents an immediate increase in as adjusted net

tangible book value per common share of $0.0116 to the existing stockholders and an immediate decrease in as adjusted net tangible book

value of $0.0918 and $0.0671 in per common share to the Purchasers of Preferred Stock and to the Common Stock Investors of Common Shares

participating in this Offering, respectively. The following table illustrates this per share dilution to the Purchaser participating

in this offering:

| Net tangible

book value per share as of September 30, 2023 | |

$ | 0.0213 | | |

| | |

| Increase

attributable to new investor | |

| 0.0116 | | |

| | |

| As

adjusted net tangible book value per share after this offering | |

| | | |

$ | 0.0329 | |

| Dilution

per share to new Preferred Stock investor | |

| | | |

$ | 0.0918 | |

| Dilution per share to new Common

Share investor | |

| | | |

$ | 0.0671 | |

The

above discussion and table are based on 117,878,831 shares of our Common Stock outstanding as of September 30, 2023 and excludes:

| |

● |

16,319,165

shares of Common Stock issuable upon exercise of

the Warrants and Placement Agent Warrants to be issued in the concurrent private placement; |

| |

|

|

| |

● |

2,777,732 shares

of Common Stock that were issuable upon exercise of vested stock options of the Company under the Company’s 2017 Equity

Incentive Plan; |

| |

|

|

| |

● |

6,892,210 shares of Common Stock reserved for future

issuance under the Company’s Amended 2017 Equity

Incentive Plan; |

| |

|

|

| |

● |

419,772 shares of Common Stock issuable upon exercise of

unvested of Restricted Stock Units; and |

| |

|

|

| |

● |

25,100,000 shares of Common Stock issuable upon conversion

of outstanding Preferred Stock. |

To

the extent that any (i) options are exercised, (ii) new options are issued under our 2017 Equity Incentive Plan, or (iii) we otherwise

issue additional shares of Common Stock in the future at a price less than the offering price, there may be further dilution to new Purchasers

purchasing our securities in this offering.

DESCRIPTION

OF OUR SECURITIES WE ARE OFFERING

We

are offering 1,850 shares of our Preferred Stock, up to 14,835,605 shares of Common Stock underlying the Preferred Stock,

and 1,500,000 shares of Common Stock pursuant to this prospectus supplement and the accompanying prospectus. The material terms

and provisions of our Common Stock which includes the Conversion Shares, are described under the caption “Descriptions of the Securities

We May Offer” beginning on page 10 of the accompanying prospectus.

General

Our authorized capital

stock consists of 275,000,000 shares, of which 250,000,000 shares are designated as Common Stock, and 25,000,000 shares are designated

as preferred stock, par value $.001 per share of which (i) no shares have been designated as Series A Preferred Stock, (ii) 1,764 shares

have been designated as Series B Preferred Stock, (iii) 10,000 shares have been designated as Series C Preferred Stock, (iv) 2,000 shares

have been designated as Series D Preferred Stock, (v) 1,050 shares have been designated as Series E preferred stock, and (vi) 35,000

shares have been designated as Series F Preferred Stock. As of November 15, 2023, we had 117,878,831 shares of Common Stock issued and outstanding,

and 6,275 shares of Series F Preferred Stock outstanding.

Transfer Agent and Registrar

The transfer agent and

registrar for our common stock is EQ Shareholder Services.

Anti-Takeover Effects of Certain Provisions

of Nevada Law

The following is a summary

of certain provisions of Nevada law, our articles of incorporation and our bylaws. This summary does not purport to be complete and is

qualified in its entirety by reference to the Nevada Revised Statutes and our articles of incorporation and bylaws.

Effect of Nevada

Control Share Statute. We are subject to Sections 78.378 to 78.3793 of the Nevada Revised Statutes, which are referred to

as the Control Share Statute that is a type of anti-takeover law. In general, these provisions restrict the ability of individuals

and groups acquiring a controlling interest of the voting shares of certain Nevada corporations from exercising the voting rights of

the acquired shares, absent required stockholder approval of the share acquisition transaction. These provisions apply to a Nevada

corporation that has 200 or more stockholders of record, at least 100 of whom have addresses in Nevada. The Control Share Statute provides

that a person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for

the application of these provisions of the Control Share Statute, would enable that person to exercise (1) one-fifth or more, but less

than one-third, (2) one-third or more, but less than a majority, or (3) a majority or more, of all of the voting power of the corporation

in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it

over the threshold and within the 90 days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling

interest become “control shares” to which the voting restrictions described above apply.

To avoid the voting

restriction, the acquisition of a controlling interest must be approved by both (a) the holders of a majority of the voting power of

the corporation, and (b) if the acquisition would adversely alter or change any preference or any relative or other right given to any

other class or series of outstanding shares, the holders of the majority of each class or series affected, excluding those shares as

to which any interested stockholder exercises voting rights, and the approval must specifically include the conferral of such voting

rights. Although we have not opted out of this statute, a corporation alternatively may expressly elect not to be governed by the provisions

in either its articles of incorporation or its bylaws. Additionally, in the face of potential control share transaction, a corporation,

if it has not opted out of the statutory provisions, may opt out of the control share statute by amending its articles of incorporation

or its bylaws prior to the 10th day following the acquisition of a controlling interest by an acquiring person.

Effect of Nevada

Business Combination Statute. We are subject to

Sections 78.411 to 78.444 of the Nevada Revised Statutes, which are referred to as the Business Combination Statute. This statute is

designed to limit acquirers of voting stock of a corporation from effecting a business combination without the consent of the stockholders

or board of directors. The statute provides that specified persons who, together with their affiliates and associates, own, or within

two years did own, 10% or more of the outstanding voting stock of a Nevada corporation with at least 200 stockholders of record cannot

engage in specified business combinations with a Nevada corporation for a period of two years after the date on which the person became

an interested stockholder, unless (a) the business combination or the transaction by which the person first became an interested stockholder

was approved by the Nevada corporation’s board of directors before the person first became an interested stockholder, or (b) the

combination is approved by the board and, at or after that time, the combination is approved at an annual or special meeting of the stockholders

by the affirmative vote of 60% or more of the voting power of the disinterested stockholders.

Preferred

Stock

The

following summary of certain terms and provisions of the Warrants that are being offered hereby is not complete and is subject to, and

qualified in its entirety by the provisions of, the Certificate of Designations.

Conversion

Rights. The Preferred Stock offered hereby will entitle the holders thereof to convert the Preferred Stock into shares of Common

Stock at $0.1247 per share, subject to appropriate adjustment in the event of certain stock dividends and distributions, stock

splits, stock combinations, reclassifications or similar events affecting our Common Stock and also upon any distributions of assets,

including cash, stock or other property to our stockholders. Unless shareholder approval has been obtained, neither the Company nor any

subsidiary shall engage in a Subsequent Financing which would cause any adjustment of the conversion price or the exercise price to the

extent the Purchasers would not be permitted, to convert its outstanding shares of Series F Convertible Preferred and exercise its Warrants

in full, ignoring for such purposes the other conversion or exercise limitations therein.

Voting

Rights. The Preferred Stock offered hereby has no voting rights.

Dividends.

The Preferred Stock offered hereby will entitle the holders thereof to receive cumulative dividends at the rate per share (as a percentage

of the $1,000 Stated Value per share) of 5% per annum, payable quarterly on January 1, April 1, July 1 and October 1, beginning on October

1the first Conversion Date and on each subsequent Conversion Date (with respect only to Preferred Stock being converted) (each such date,

a “Dividend Payment Date”) (if any Dividend Payment Date is not a Trading Day, the applicable payment shall be due on the

next succeeding Trading Day) in cash out of funds legally available therefor.

Limitation

on Beneficial Ownership. The Company shall not convert the Preferred Stock if after such conversion, the beneficial ownership of

the Common Stock by the holder of the Preferred Stock would in excess of 9.99% of the issued and outstanding shares of Common Stock of

the Company after giving effect to the issuance of the Underlying Shares (the “Beneficial Ownership Limitation”). The holder,

upon prior notice, may decrease or increase the Beneficial Ownership Limitation, as long as it is not in excess of 9.99%.

Liquidation

Rights. Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary, the holders of the Preferred

Stock shall be entitled to receive out of the assets of the Company an amount equal to the Stated Value, plus any accrued and unpaid

dividends thereon for each share of Preferred Stock before any distribution or payment shall be made to the holders of Common Stock.

CONCURRENT PRIVATE PLACEMENT OF COMMON

WARRANTS

Concurrently with

the sale of Shares in this offering, we will issue to the Investors in this offering, for no additional consideration, Warrants to

purchase up to an aggregate of 14,835,605 shares of Common Stock at an exercise price of $0.1247 per share. The Common Warrants are

exercisable after the date of issuance and will expire three years after issuance. We will receive proceeds from exercise of the

Common Warrants solely to the extent such warrants are exercised for cash.

The Common Warrants

and the common stock issuable upon the exercise of such warrants are not being registered under the Securities Act, are not being offered

pursuant to this prospectus supplement and the accompanying prospectus and are being offered pursuant to the exemption provided in Section

4(a)(2) under the Securities Act and/or Rule 506(b) promulgated thereunder. Accordingly, the investors may only sell common stock issued

upon exercise of the Common Warrants pursuant to an effective registration statement under the Securities Act covering the resale of

those shares, an exemption under Rule 144 under the Securities Act or another applicable exemption under the Securities Act.

The summary below is

not complete and is subject to, and qualified in its entirety by, the provisions of the Common Warrants, which was filed with the SEC

as an exhibit to a Report on Form 8-K in connection with this offering and incorporated by reference into the registration statement

of which this prospectus supplement and the accompanying prospectus form a part. Prospective investors should carefully review the terms

and provisions of the form of the Common Warrants for a complete description of the terms and conditions of the Common Warrants.

Common Warrants

Exercisability

Each Common Warrant

will be a warrant to purchase one share of common stock and will have an initial exercise price equal to $0.1247 per share. The

Common Warrants will be exercisable upon issuance and expire three years after the issuance. The exercise price and number of shares

of common stock issuable upon exercise is subject to appropriate adjustment in the event of share dividends, share splits,

reorganizations or similar events affecting our Common Stock and the exercise price. The exercise price of the Common Warrants is

subject to further adjustment in the event of (i) a subsequent equity issuance by the Company at an effective price per share that

is lower than the initial exercise price, and (ii) a share combination event where the lowest VWAP during the five consecutive

trading days commencing on the share combination event date is less than the exercise price in effect at the time, then the exercise

price shall be reduced, but in no event increased to such price. The Common Warrants will be issued separately from the shares of

Common Stock but can only be purchased together with the shares of common stock issued and sold in this offering but will be issued

separately.

Cashless Exercise

A holder of the Common

Warrants will have the right to exercise such warrants on a “cashless” basis if there is no effective registration statement

registering the resale of the shares issuable upon the exercise of the Common Warrants. Subject to limited exceptions, a holder of the

Common Warrants will not have the right to exercise any portion of such warrants if the holder, together with its affiliates, would beneficially

own in excess of 4.99% (or 9.99% at the election of the holder prior to the date of issuance) of the number of shares of our common stock

outstanding immediately after giving effect to such exercise, provided that the holder may increase or decrease the beneficial ownership

limitation up to 9.99%. Any increase in the beneficial ownership limitation shall not be effective until 61 days following notice of

such change to us.

Registration Rights

Pursuant to the securities

purchase agreement, as soon as practicable (and in any event, no later than 45 days after the signing of the securities purchase agreement),

the Company is required to file a registration statement with the SEC covering the resale of the shares of common stock issuable upon

the exercise of the Common Warrants, and to use commercially reasonable efforts to have the registration statement declared effective

within 30 days or within 60 days of the filing of the registration statement in the event of a full review by the SEC.

Rights as a Stockholder

Except as otherwise

provided in the Common Warrants or by virtue of such holder’s ownership of shares of our Common Stock, the holders of such warrants

do not have the rights or privileges of holders of our Common Stock, including any voting rights, until they exercise such warrants.

Transferability

The Common Warrants

and the shares of Common Stock issuable upon the exercise of the Common Warrants are being offered pursuant to the exemptions provided

in Section 4(a)(2) under the Securities Act and/or Regulation D promulgated thereunder, and are not being offered pursuant to this prospectus

supplement and the accompanying prospectus.

Exchange Listing

There is no established public trading market for the Common Warrants, and we do not

expect a market to develop. In addition, we do not intend to list the Common Warrants on the NYSE American, any other national securities

exchange or any other nationally recognized trading system.

PLAN

OF DISTRIBUTION

Dowson

James Securities, Inc. has agreed to act as sole placement agent in connection with this offering. The placement agent is not

purchasing or selling any of the Shares offered by this prospectus supplement, but will use its reasonable best efforts to arrange

for the sale of the securities offered by this prospectus supplement. We have entered into an Assignment, Waiver and Amendment

Agreement with the Purchasers and a Securities Purchase Agreement with the Common Stock Investors. We will make offers only to a

limited number of accredited investors. The offering is expected to close on or about November 15, 2023, subject to customary

closing conditions.

We

are offering, pursuant to this prospectus supplement, the Preferred Stock directly to the Purchasers for an aggregate purchase price

of $1,850,000, and Common Shares to the Common Stock Investors for an aggregate purchase price of $150,000. The Warrants are being

sold to the Purchasers in a concurrent private placement and are not being offered pursuant to this prospectus supplement.

Fees and Expenses

This

offering is being conducted on a “best efforts” basis, and the placement agent has no obligation to purchase any of the securities

from us or to arrange for the purchase or sale of any specific number or dollar amount of securities. We have agreed to pay the placement

agent a cash fee equal to 5% of the aggregate gross proceeds raised in this offering.

| | |

Per Share of Preferred Stock and

Accompanying Warrants | | |

Per Share of Common Stock | | |

Total | |

| Offering Price | |

$ | 1,000 | | |

$ | 0.10 | | |

$ | 2,000,000 | |

| Placement agent’s fees | |

$ | 50 | | |

$ | 0.005 | | |

$ | 100,000 | |

| Proceeds, before expenses, to us | |

$ | 950 | | |

$ | 0.095 | | |

$ | 1,900,000 | |

We will also

reimburse the placement agent for all expenses related to the offering including, without limitation, legal fees of Dawson’s

counsel not to exceed in the aggregate $75,000. We estimate the total expenses payable by us for this offering, excluding the

Placement Agent’s fees and expenses, will be approximately $25,000.

Placement Agent Warrants

In addition, we have

agreed to issue to the placement agent as partial compensation warrants to purchase up to 1,483,560 shares of common stock (equal to

10% of the aggregate number of Common Warrants sold to Investors in a concurrent private placement). The Placement Agent Warrants

will have substantially the same terms as the Common Warrants except that they will have a term of five years and will not include

any anti-dilution protection provisions in connection with a subsequent equity issuance, or otherwise.

Indemnification

We have agreed to indemnify

the placement agent and other specified persons against certain civil liabilities, including liabilities under the Securities Act and

the Exchange Act, and to contribute to payments that the placement agent may be required to make in respect of such liabilities.

Regulation M

The placement agent

may be deemed to be an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and

any profit realized on the resale of the securities sold by it while acting as principal might be deemed to be underwriting discounts

or commissions under the Securities Act. As an underwriter, the Placement Agent would be required to comply with the requirements of

the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation

M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of our securities by the placement

agent acting as principal. Under these rules and regulations, the placement agent:

| |

● |

may not engage in any

stabilization activity in connection with our securities; and |

| |

|

|

| |

● |

may not bid for or purchase

any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange

Act, until it has completed its participation in the distribution. |

Transfer

Agent and Registrar

The

transfer agent and registrar for our Common Stock is EQ Shareholder Services, 3200 Cherry Creek South Drive, Suite 430, Denver, CO 80209.

Our transfer agent’s phone number is 303 646 7693.

Listing

Our

shares of Common Stock are quoted on the NYSE American under the trading symbol “UAVS”.

Other Activities and Relationships

The placement agent

and certain of its affiliates are full service financial institutions engaged in various activities, which may include securities trading,

commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing

and brokerage activities. The placement agent and certain of its affiliates have, from time to time, performed and may in the future

perform, various commercial and investment banking and financial advisory services for us and our affiliates, for which they received

or will receive customary fees and expenses.

In the ordinary course of their various business activities, the placement agent and

certain of its affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative

securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers, and such

investment and securities activities may involve securities and/or instruments issued by us and our affiliates. If the placement agent

or its affiliates have a lending relationship with us, they routinely hedge their credit exposure to us consistent with their customary

risk management policies. The placement agent and its affiliates may hedge such exposure by entering into transactions that consist of

either the purchase of credit default swaps or the creation of short positions in our securities or the securities of our affiliates,

including potentially the Common Stock offered hereby. Any such short positions could adversely affect future trading prices of the Common

Stock offered hereby. The placement agent and certain of its affiliates may also communicate independent recommendations, market color

or trading ideas and/or publish or express independent research views in respect of such securities or instruments and may at any time

hold, or recommend to clients that they acquire, long and/or short positions in such securities and instruments.

LEGAL

MATTERS

Certain

legal matters governed by the laws of the State of Nevada with respect to the validity of the offered securities will be passed upon

for us by Sherman & Howard LLP, Las Vegas, Nevada. The placement agent is being represented in connection with this offering

by Haynes and Boone, LLP, New York, New York.

EXPERTS

The

consolidated financial statements of our Company appearing in our annual report on Form 10-K for the fiscal years ended December 31,

2022 and 2021 have been audited by WithumSmith+Brown, PC, independent registered public accounting firm, as set forth in the reports

thereon included therein and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference

in reliance upon such reports given on the authority of such firms as experts in accounting and auditing.

INCORPORATION

OF CERTAIN DOCUMENTS BY REFERENCE

The

SEC allows us to “incorporate by reference” into this prospectus supplement the information from other documents that we

file with it, which means that we can disclose important information to you by referring you to those documents. The information we incorporate

by reference is an important part of this prospectus supplement, and later information that we file with the SEC will automatically update

and supersede some of this information. We incorporate by reference the documents listed below and any future filings we make with the

SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, including filings made after the date of the initial registration statement,

until we sell all of the shares covered by this prospectus supplement or the sale of shares by us pursuant to this prospectus supplement

is terminated. In no event, however, will any of the information that we furnish to, pursuant to Item 2.02 or Item 7.01 of any Current

Report on Form 8-K (including exhibits related thereto) or other applicable SEC rules, rather than file with, the SEC be incorporated

by reference or otherwise be included herein, unless such information is expressly incorporated herein by a reference in such furnished

Current Report on Form 8-K or other furnished document. The documents we incorporate by reference are:

| |

● |

Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 filed on April 4, 2023; |

| |

● |

Current

Report on Form 8-K filed on January 25, 2023; |

| |

● |

Current

Report on Form 8-K filed on February 7, 2023; |

| |

● |

Current

Report on Form 8-K filed on March 14, 2023; |

| |

● |

Current

Report on Form 8-K/A filed on April 14, 2023; |

| |

● |

Current

Report on Form 8-K filed on June 6, 2023; |

| |

● |

Current

Report on Form 8-K/A filed on June 7, 2023; |

| |

● |

Current

Report on Form 8-K filed on June 12, 2023; |

| |

● |

Current

Report on Form 8-K filed on June 20, 2023; |

| |

● |

Current

Report on Form 8-K filed on June 26, 2023; |

| |

● |

Current

Report on Form 8-K filed on August 21, 2023; |

| |

● |

Current

Report on Form 8-K filed on September 15, 2023; |

| |

● |

Current