UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.

)

| Filed by the Registrant ý |

| Filed by a Party other than the Registrant o |

| Check the appropriate box: |

| o |

|

Preliminary Proxy Statement |

| o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o |

|

Definitive Proxy Statement |

| ý |

|

Definitive Additional Materials |

| o |

|

Soliciting Material under §240.14a-12 |

| |

|

|

| 1847 HOLDINGS LLC |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check all boxes that apply): |

| ý |

|

No fee required |

| o |

|

Fee paid previously with preliminary materials |

| o |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

1847 HOLDINGS LLC

590 Madison Avenue, 21st Floor, New York, NY 10022

SUPPLEMENT TO PROXY STATEMENT

FOR SPECIAL MEETING OF SHAREHOLDERS

On September 8, 2023,

1847 Holdings LLC (the “Company”, “we”, “us” and “our”) filed its definitive proxy statement

(the “Proxy Statement”) for a special meeting of shareholders initially held on October 10, 2023 (the “Special Meeting”).

As disclosed in a Current Report on Form 8-K filed on October 16, 2023, there was not a sufficient number of common shares present or

represented by proxy at the Special Meeting in order to a constitute quorum, so the Company adjourned the Special Meeting without transacting

any business. The Special Meeting will resume at 2:00 p.m. Eastern Time on November 9, 2023 and will continue to be held virtually via

live audio-only webcast at https://agm.issuerdirect.com/efsh.

As also disclosed in the

Current Report on Form 8-K, on October 16, 2023, the Second Amended and Restated Operating Agreement of the Company was amended to reduce

the quorum required for a meeting of shareholders from a majority of the shares outstanding to one-third of the shares outstanding.

On October 19, 2023, the

Company engaged Alliance Advisors, LLC to act as proxy solicitor for the Special Meeting.

The Company is filing

this supplement to the Proxy Statement (this “Supplement”) to (i) amend disclosures regarding the quorum requirement in accordance

with the amendment described above, (ii) add disclosures regarding the engagement of Alliance Advisors, LLC and (iii) correct an error

in the description of the matters considered routine or non-routine under New York Stock Exchange rules.

This Supplement should

be read in conjunction with the Proxy Statement. Except as specifically supplemented by the information contained herein, this Supplement

does not modify any other information set forth in the Proxy Statement. To the extent the information set forth herein differs from or

updates information contained in the Proxy Statement, the information set forth herein shall supersede or supplement the information in

the Proxy Statement. The terms used below, unless otherwise defined, have the meanings set forth in the Proxy Statement.

The following subsections

of the section titled “Information About The Proxy Process and Voting” contained in the Proxy Statement are hereby amended

and restated in their entirety to read as follows:

Who is soliciting my vote?

The Board, on behalf of

the Company, is soliciting your proxy to vote your shares on all matters scheduled to come before the Special Meeting, whether or not

you attend virtually. By completing, signing, dating and returning the Proxy Card or Voting Instruction Form, or by submitting your proxy

and voting instructions over the Internet or by telephone, you are authorizing the persons named as proxies to vote your shares at the

Special Meeting as you have instructed. Proxies will be solicited on behalf of the Board by our directors and certain executive officers

and other employees of the Company.

Additionally, we have

retained Alliance Advisors, LLC (“Alliance Advisors”), a proxy solicitation firm, which may solicit proxies on the Board’s

behalf. You may also be solicited by press releases issued by us, postings on our corporate website or other websites or otherwise. Unless

expressly indicated otherwise, information contained on our corporate website is not part of the Proxy Statement. In addition, none of

the information on the other websites, if any, listed in the Proxy Statement is part of the Proxy Statement. Such website addresses are

intended to be inactive textual references only.

Which ballot measures are considered “routine” or

“non-routine?”

New York Stock Exchange

rules determine whether proposals are routine or non-routine. If a proposal is routine, a broker holding shares for an owner in street

name may vote on the proposal without voting instructions. Both Proposals are considered non-routine under applicable rules. A broker

or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on both Proposals.

What is the quorum requirement?

A quorum of shareholders

is necessary to hold a valid Special Meeting. A quorum will be present if shareholders holding one-third of the outstanding common shares

entitled to vote are present at the Special Meeting or represented by proxy. On the Record Date, there were 76,416,456 common shares outstanding

and entitled to vote. If there is no quorum, either the Chairman or a majority of the shares present or represented by proxy at the Special

Meeting may adjourn the Special Meeting to another time or place.

How are abstentions and broker non-votes treated?

Abstentions are included

in the determination of the number of shares present at the Special Meeting for determining a quorum at the meeting. An abstention is

not an “affirmative vote”, but an abstaining shareholder is considered “entitled to vote” at the Special Meeting.

Accordingly, an abstention will have the same effect as a vote “AGAINST” both of the Proposals.

Broker non-votes will

be included in the determination of the number of shares present at the Special Meeting for determining a quorum at the meeting. As noted

above, both Proposals are considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on

non-routine matters, and therefore there may be broker non-votes on both Proposals.

Delaware law provides

that if broker non-votes occur in connection with the vote on a matter, the shares for which the broker non-votes occur are not deemed

present and entitled to vote on such matter. Accordingly, broker non-votes, if any, will have no effect on either Proposal since both

Proposals require the affirmative vote of a majority of the shares present or represented by proxy and entitled to vote at the Special

Meeting.

Who will pay for the solicitation of proxies?

We will bear the entire

cost of solicitation of proxies, including preparation, assembly and mailing of the Proxy Statement, this Supplement, the Proxy Card,

the Notice and any additional information furnished to shareholders. Copies of solicitation materials will be furnished to banks, brokerage

houses, fiduciaries and custodians holding our common shares in their names that are beneficially owned by others to forward to those

beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to

the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation

by our directors, officers or staff members. No general class of employee of the Company will be employed to solicit shareholders in connection

with this proxy solicitation. However, in the course of their regular duties, employees may be asked to perform clerical or ministerial

tasks in furtherance of this solicitation. No additional compensation will be paid to our directors, officers or staff members for such

services.

We have also retained

Alliance Advisors to act as a proxy solicitor in conjunction with the Special Meeting. We have agreed to pay Alliance Advisors up to $15,000

plus reasonable out-of-pocket expenses for proxy solicitation services. The parties’ engagement letter contains confidentiality,

indemnification and other provisions that we believe are customary for this type of engagement.

Whom should I call if I have questions about the Special Meeting?

Alliance Advisors is assisting

us with our effort to solicit proxies. If you have any questions concerning the business to be conducted at the Special Meeting, would

like additional copies of the Proxy Statement or this Supplement or need help submitting a proxy for your shares, please contact Alliance

Advisors:

Alliance Advisors, LLC

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Tel: 833-786-6483

Email: EFSH@allianceadvisors.com

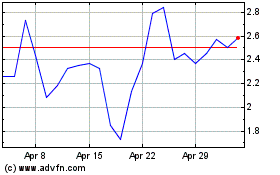

1847 (AMEX:EFSH)

Historical Stock Chart

From Dec 2024 to Jan 2025

1847 (AMEX:EFSH)

Historical Stock Chart

From Jan 2024 to Jan 2025