UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

____________________

Filed by the Registrant

Filed by a Party other than the Registrant

Check the appropriate box:

| | | | | |

☐ | Preliminary Proxy Statement |

| |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☑ | Definitive Proxy Statement |

| |

☐ | Definitive Additional Materials |

| |

☐ | Soliciting Material under 240.14a-12 |

| | |

| Smith Micro Software, Inc. |

|

| (Name of Registrant as Specified In Its Charter) |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| | | | | |

| No fee required |

| |

| Fee paid previously with preliminary materials |

| |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

May 9, 2024

Dear Smith Micro Stockholders:

We are pleased to invite you to the 2024 Annual Meeting of Stockholders of Smith Micro Software, Inc. to be held on Tuesday, June 18, 2024, at 11:00 a.m. Eastern Time via live webcast at the virtual meeting site, meetnow.global/MQKLXKG.

We will conduct a virtual online Annual Meeting this year, so our stockholders can participate from any geographic location with Internet connectivity. We believe this will enhance accessibility to our Annual Meeting for all of our stockholders, regardless of geographic location. Stockholders will be able to attend and participate in the Annual Meeting online, vote shares electronically, and submit questions prior to and during the Annual Meeting as described in the enclosed proxy statement. We are pleased to embrace the latest technology to provide expanded access and enable greater stockholder attendance and participation from any location around the world.

The expected actions to be taken at the Annual Meeting, which include the election of three directors, are described in the attached proxy statement and notice of annual meeting of stockholders. In addition to the proxy statement, we are mailing or making available to you a copy of our Annual Report on Form 10-K for the year ended December 31, 2023, which we encourage you to read. Our Annual Report includes our audited financial statements for 2023 and information about our operations, markets and products.

We are mailing to most of our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of the attached proxy statement and our 2023 Annual Report. The Notice contains instructions on how to access those documents over the Internet. The Notice also contains instructions on how to request a paper copy of our proxy materials, including the attached proxy statement, our 2023 Annual Report and a form of proxy card. All stockholders who have previously requested a paper copy of our proxy materials will continue to receive a paper copy of the proxy materials by mail.

Your vote is important. Whether or not you plan to participate in the Annual Meeting, which will be held online this year, you can be sure your shares are represented at the meeting by promptly voting your shares as instructed in the Notice, or by requesting a printed proxy card, if you prefer, and completing, signing, dating and returning the printed proxy card by mail. If you later decide to participate in the Annual Meeting and wish to change your vote, you may do so simply by voting online during the meeting.

To log in to and participate in this year’s virtual Annual Meeting, you will need the stockholder control number located on the Notice, on your proxy card or on the instructions that accompanied your proxy materials. Please keep this information in a safe place so it is available to you for the meeting.

We look forward to having you join us online at the Annual Meeting.

| | | | | |

| Sincerely, |

| |

| William W. Smith, Jr. |

| Chairman of the Board, |

| President & Chief Executive Officer |

| Smith Micro Software, Inc. |

SMITH MICRO SOFTWARE, INC.

5800 Corporate Dr.

Pittsburgh, PA 15237

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 18, 2024

Notice is hereby given that the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Smith Micro Software, Inc. (the “Company”) will be held on Tuesday, June 18, 2024, at 11:00 a.m. Eastern Time, at the virtual meeting site meetnow.global/MQKLXKG . The Annual Meeting will be held solely online, and as such there is no physical address for the Annual Meeting. The Annual Meeting will be held for the following purposes as more fully described in the proxy statement accompanying this notice:

1.Election of Directors. The election of three (3) directors to serve on our Board of Directors until the 2027 Annual Meeting of Stockholders or until their successors are duly elected and qualified.

2.“Say on Pay” Proposal. Non-binding advisory vote to approve the 2023 compensation of named executive officers.

3.Ratification of the Appointment of SingerLewak LLP. Ratification of the appointment of SingerLewak LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

4.Approval of Amended and Restated Omnibus Equity Incentive Plan. Approval of our Amended and Restated Omnibus Equity Incentive Plan.

5.Other Business. Any other business properly brought before the stockholders at the Annual Meeting, or at any adjournment or postponement thereof.

The close of business on April 22, 2024 has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. Only stockholders of record at such time will be so entitled to vote. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by stockholders on the Annual Meeting site at meetnow.global/MQKLXKG .

You are cordially invited to participate in the Annual Meeting. Whether or not you plan to participate in the Annual Meeting online, we urge you to ensure your representation by voting by proxy promptly in accordance with the Notice of Internet Availability of Proxy Materials (the “Notice”) or by requesting a printed proxy card, if you prefer, and completing, signing, dating and returning the proxy card, or the form forwarded by your bank, broker or other holder of record, by mail. If you attend the Annual Meeting online and vote your shares at that time, your proxy will not be used.

A majority of the outstanding shares of Common Stock entitled to vote must be represented at the Annual Meeting in order to constitute a quorum. Please vote your shares in accordance with the Notice or return your proxy card in order to ensure that a quorum is obtained.

| | | | | |

| By Order of the Board of Directors, |

| /s/ Jennifer M. Reinke |

| Jennifer M. Reinke |

| Secretary |

| Pittsburgh, Pennsylvania |

| May 9, 2024 |

Important notice regarding the availability of proxy materials for the stockholder meeting to be held June 18, 2024: The proxy statement and Annual Report are available at www.envisionreports.com/SMSI.

Your vote is very important, regardless of the number of shares you own. In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials to our stockholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a printed copy of the proxy materials unless you request to receive them in accordance with the instructions provided in the Notice. The Notice contains instructions on how to access and review all of the important information contained in the proxy materials over the Internet. The Notice also instructs how you may submit your proxy over the Internet. If you received a Notice and would like to receive a printed copy of our proxy materials, including our Annual Report on Form 10-K, follow the instructions for requesting such materials included in the Notice.

SMITH MICRO SOFTWARE, INC.

PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

Proposal 3: Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Proposal 4: Approval of Amended and Restated Omnibus Equity Incentive Plan | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

SMITH MICRO SOFTWARE, INC.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 18, 2024

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

General

This proxy statement contains information related to the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) of Smith Micro Software, Inc. (“Smith Micro,” the “Company,” “we,” “our” or “us”), which will be held on Tuesday, June 18, 2024, at 11:00 a.m. Eastern Time, and any postponements or adjournments thereof. We will host the Annual Meeting solely online via live webcast this year, so our stockholders can participate from any geographic location with Internet connectivity. We believe this will enhance accessibility to our Annual Meeting for all of our stockholders, regardless of geographic location.

In accordance with Securities and Exchange Commission (“SEC”) rules, instead of mailing a printed copy of our proxy materials to each stockholder of record, we are furnishing proxy materials to our stockholders via the Internet. If you received a Notice of Internet Availability of Proxy Materials (the “Notice”) by mail, you will not receive a printed copy of the proxy materials other than as described below. The Notice contains instructions on how to access and review all of the important information contained in the proxy materials over the Internet. The Notice also instructs how you may submit your proxy over the Internet. If you received a Notice and would like to receive a printed copy of our proxy materials, including our 2023 Annual Report on Form 10-K, follow the instructions for requesting such materials included in the Notice.

Stockholders of record at the close of business on April 22, 2024 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and any adjournment thereof. It is anticipated that the Notice will first be sent to stockholders, and this proxy statement and the form of proxy relating to our Annual Meeting, are being first mailed or made available to stockholders on or about May 9, 2024. These materials are available for viewing, printing and downloading on the Internet at www.envisionreports.com/SMSI.

Unless otherwise noted in this proxy statement, all share numbers and related price per share presented herein reflect the effects of our 1-for-8 reverse stock split which became effective at 11:59 p.m. Eastern Time on April 10, 2024 (the “Reverse Split”), including those share numbers and prices that predate the Reverse Split.

Purpose of the Meeting

The specific proposals to be considered and acted upon at the Annual Meeting are summarized in the Notice of Annual Meeting of Stockholders accompanying this proxy statement and are described in more detail in this proxy statement. We are not aware of any matter to be presented other than those described in this proxy statement.

How to Participate in the Annual Meeting

The Annual Meeting will be a completely virtual meeting of stockholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held.

You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting meetnow.global/MQKLXKG. You also will be able to vote your shares online by attending the Annual Meeting by webcast. To participate in the Annual Meeting, you will need to enter the control number included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 11:00 a.m., Eastern Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Online access will begin at 10:45 a.m. Eastern Time. Please follow the registration instructions as outlined in this proxy statement.

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call (U.S.) 1-888-724-2416 or (International) +1 781-575-2748.

Registration to Participate in the Annual Meeting

If you are a stockholder of record, as explained below, you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the Notice or proxy card that you received.

If you own shares in “street name,” as explained below, you must register in advance to participate in the Annual Meeting virtually on the Internet. To register to attend the Annual Meeting virtually on the Internet, you must submit proof of your proxy power (legal proxy) reflecting your Company stock holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 13, 2024. You will receive a confirmation of your registration by email after your registration materials have been received.

Requests for registration should be directed to the following:

•By email: Forward the email from your bank, broker, or other intermediary, or attach an image of your legal proxy, to legalproxy@computershare.com

•By mail: Computershare, Smith Micro Software, Inc. Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001

Difference Between a “Stockholder of Record” and a Beneficial Owner of Shares Held in “Street Name”

Stockholder of Record. If your shares are registered directly in your name with our transfer agent, Computershare, then you are considered the “stockholder of record” of those shares. In this case, your Notice or printed proxy materials have been sent to you directly by us. You may vote your shares by proxy prior to the Annual Meeting by following the instructions contained on the Notice or, if you received a printed version of the proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in a brokerage account or by a bank, trust or other nominee or custodian, then you are considered the beneficial owner of those shares, which are held in “street name.” In this case, your proxy materials have been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct that organization as to how to vote the shares held in your account by following the instructions contained on the voting instruction card provided to you by that organization.

Voting

Our outstanding common stock, par value $0.001 per share (the “Common Stock”) is the only class of securities entitled to vote on the proposals presented at the Annual Meeting. Common Stockholders of record on the Record Date are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, there were 9,601,582 shares of Common Stock outstanding and approximately 81 holders of record, according to information provided by our transfer agent. Each share of Common Stock is entitled to one vote on each proposal. Stockholders may not cumulate votes in the election of directors. A majority of the outstanding shares of Common Stock entitled to vote at the Annual Meeting will constitute a quorum. Abstentions and broker non-votes count as present for establishing a quorum but will not be counted as votes cast. If a quorum is not present, the meeting may be adjourned until a quorum is obtained.

All votes will be tabulated by our inspector of elections for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions and “broker non-votes” (i.e., shares held by a broker or other nominee having discretionary power to vote on some matters but not others). Broker non-votes occur when your broker or other nominee submits a proxy for your shares (because the broker or other nominee has received instructions from you on one or more proposals, but not all, or has not received instructions from you but is entitled to vote your shares on a particular “discretionary” or “routine” matter) but does not indicate a vote for a particular proposal because the broker or other nominee either does not have the authority to vote on that proposal and has not received voting instructions from you, or

has discretionary authority but chooses not to exercise it. Abstentions and broker non-votes are counted as present for purposes of determining the presence or absence of a quorum for the transaction of business.

Vote Required for Each Proposal

The voting requirements for each of the Proposals under consideration at the Annual Meeting to be approved, and the effect of abstentions and broker non-votes on each Proposal, are as follows:

| | | | | | | | | | | |

| Proposal | Voting Approval Standard | Effect of Abstentions | Effect of Broker Non-Votes (1) |

1: Election of Directors | The three nominees receiving the highest number of votes will be elected | No effect – not counted as a vote | No effect – not counted as a vote |

2: “Say on Pay” (2) | Majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote | Same effect as a vote against | No effect – not counted as a vote |

3: Ratification of the Appointment of SingerLewak LLP | Majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote | Same effect as a vote against | Routine matter – brokers will have discretionary authority to vote |

4: Approval of Amended and Restated Omnibus Equity Incentive Plan | Majority of votes cast on such proposal | No effect – not counted as a vote | No effect – not counted as a vote |

(1)Brokers are permitted to vote their customers’ shares on routine matters when the brokers have not received voting instructions from their customers. Proposal 3 is a routine matter on which brokers may vote in this way. Brokers may not vote their customers’ shares on non-routine matters, unless they have received voting instructions from their customers. Proposals 1, 2 and 4 are non-routine matters. Shares that are not voted by brokers on non-routine matters because their customers have not provided instructions are called broker non-votes.

(2)With respect to Proposal 2, the advisory vote on this proposal is non-binding on the Company; however, the Compensation Committee, which is responsible for designing and administering our executive compensation program, values the opinions expressed by our stockholders and will consider the outcome of these votes when making future compensation decisions.

How to Vote

The manner in which your shares may be voted depends on how your shares are held. If you are a stockholder of record, meaning that your shares are represented by certificates or book entries in your name so that you appear as a stockholder on the records of Computershare, our stock transfer agent, you may vote by proxy, meaning you authorize the individuals named on your proxy card or Notice to vote your shares. If you choose to vote by proxy, you may do so by telephone, via the Internet or by mail. Each of these methods is explained below. If you hold your shares of Common Stock in multiple accounts, you should vote your shares as described in each set of proxy materials you receive. If no direction is made on your proxy and it is otherwise properly executed, your proxy will be voted FOR the election of the three director nominees, and will be voted FOR each of the other proposals at the Annual Meeting. You also may participate in and vote during the Annual Meeting.

Voting by proxy. You may vote your shares by proxy by telephone, via the Internet or by mail:

•By Telephone. You may transmit your proxy voting instructions by calling the telephone number specified on the Notice, or if you received a printed version of the proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card. You will need to have the Notice or proxy card in hand when you call. If you choose to vote by telephone, you do not have to return a proxy card by mail.

•Via the Internet. You may transmit your proxy voting instructions via the Internet by accessing the website specified on the Notice, or if you received a printed version of the proxy materials by mail, by following the instructions provided with your proxy materials and on your proxy card. You will need to have the Notice or

proxy card in hand when you access the website. If you choose to vote via the Internet, you do not have to return a proxy card by mail.

•By Mail. If you received printed proxy materials, you may vote by proxy by completing, signing and dating the proxy card enclosed with your printed proxy materials and returning it in the enclosed prepaid envelope.

Voting online during the Annual Meeting: Stockholders who elect to participate in the Annual Meeting may vote online during the Annual Meeting by following the instructions provided. Even if you plan to attend the Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting so that if you should become unable to attend the Annual Meeting your shares will still be voted in accordance with your direction.

Telephone and Internet voting for stockholders of record will be available up until the conclusion of the Annual Meeting, and mailed proxy cards must be received by June 17, 2024 in order to be counted at the Annual Meeting. If the Annual Meeting is adjourned or postponed, this deadline may be extended.

The voting deadlines and availability of telephone and Internet voting for beneficial owners of shares held in “street name” will depend on the voting processes of the organization that holds your shares. Therefore, we urge you to carefully review and follow the voting instruction card and any other materials that you receive from that organization.

Revoking a Proxy; Changing Your Vote

If you are a stockholder of record, you may revoke your proxy before the vote is taken at the meeting:

•by submitting a new proxy with a later date before the Annual Meeting either signed and returned by mail or transmitted using the telephone or Internet voting procedures described in the “How to Vote” section above;

•by voting online at the virtual meeting site; or

•by filing a written revocation with our corporate Secretary.

If your shares are held in “street name,” you may submit new voting instructions by contacting your broker or other organization holding your account. You may also vote online at the Annual Meeting, which will have the effect of revoking any previously submitted voting instructions, if you obtain a legal proxy from the organization that holds your shares as described in the “How to Vote” section above.

Your attendance alone at the Annual Meeting will not automatically revoke your proxy.

Solicitation

The proxies being solicited for the Annual Meeting as described in this proxy statement are being solicited by the Company’s Board of Directors. We will pay all of the costs of soliciting proxies. We will provide copies of our proxy materials to brokerage firms, fiduciaries and custodians for forwarding to beneficial owners who request printed copies of these materials and will reimburse these persons for their costs of forwarding these materials. Our directors, officers and employees may also solicit proxies by telephone, facsimile or personal solicitation; however, we will not pay them additional compensation for any of these services.

Deadlines for Receipt of Stockholder Proposals and Director Nominations

Stockholders may present proposals for action at a future meeting only if they comply with the requirements of the proxy rules established by the Securities and Exchange Commission (“SEC”) and our Bylaws. For stockholder proposals submitted pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) to be presented at and included in our proxy statement for our 2025 Annual Meeting of Stockholders (the “2025 Annual Meeting”), such proposals must be submitted to and received by the Company’s corporate Secretary no later than January 9, 2025. Pursuant to our Bylaws, any stockholder intending to present a proposal for action at an annual meeting must give written notice to the Company’s corporate Secretary not less than 30 days and not more than 60 days prior to the date of the annual meeting, except that if less than 40 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, then the deadline for submitting a stockholder proposal is the close of business on the tenth day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made. Under our Bylaws, the deadline for submitting a nomination for a director to be included in our proxy materials for an annual meeting is 60 days prior to the date of the annual meeting. In addition to satisfying the requirements under our Bylaws, to

comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information as required by Rule 14a-19 under the Exchange Act no later than April 21, 2025. Please note that these rules are separate from the SEC’s requirements that a stockholder must meet in order to have a stockholder proposal included in our proxy statement pursuant to Rule 14a-8, as discussed above. The proxy solicited by the Board of Directors for the 2025 Annual Meeting will confer discretionary authority to vote on any stockholder proposal presented at that meeting, unless we receive notice of such proposal no later than March 25, 2025, which is 45 calendar days prior to the anniversary date of the mailing of this proxy statement. Stockholder proposals and nominations must be in writing and should be addressed to our corporate Secretary at our principal executive offices located at 5800 Corporate Drive, 5th Floor, Pittsburgh, PA 15237. The Chairman of the Annual Meeting reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements, including conditions set forth in our Bylaws and conditions established by the Securities and Exchange Commission.

We have not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year’s Annual Meeting. Your proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the Annual Meeting that is not included in this proxy statement.

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL 1:

ELECTION OF DIRECTORS

Our Amended and Restated Certificate of Incorporation and Bylaws provide for our Board of Directors (the “Board”) to be divided into three classes. Each class of directors serves for a three-year term, with one class being elected by the Company’s stockholders at each annual meeting. Our Board currently has eight directors: Andrew Arno, Thomas G. Campbell, Steven L. Elfman, Samuel Gulko, Asha Keddy, Chetan Sharma, William W. Smith, Jr. and Gregory J. Szabo. Mr. Campbell, Mr. Elfman and Ms. Keddy serve as directors with terms expiring at this year’s Annual Meeting. Messrs. Arno and Gulko serve as directors with terms expiring at the 2025 annual meeting of stockholders, and Messrs. Sharma, Smith and Szabo serve as directors with terms expiring at the 2026 annual meeting of stockholders.

Three directors will be elected at the Annual Meeting to serve three-year terms expiring on the date of the annual meeting of stockholders to be held in 2027 (the “2027 Annual Meeting”) or until their respective successors shall have been elected and qualified. The Governance and Nominating Committee of the Board of Directors has recommended to the Board for nomination, and the Board has nominated, Mr. Campbell, Mr. Elfman and Ms. Keddy as its nominees for election to the Board at the Annual Meeting. Your proxy will be voted, unless authority is withheld or the proxy is revoked, FOR the election of Mr. Campbell, Mr. Elfman and Ms. Keddy to hold office until the date of our 2027 Annual Meeting or until their respective successors have been duly elected and qualified or until in either case they earlier resign, become disqualified or disabled, or are otherwise removed. Each returned proxy cannot be voted for a greater number of persons than the nominees named on the proxy. In the unanticipated event that a nominee becomes unable or declines to serve at the time of the Annual Meeting, the proxies will be voted for a substitute person recommended by the Governance and Nominating Committee and approved by the Board. Mr. Campbell, Mr. Elfman and Ms. Keddy have agreed to serve if elected, and the Board has no reason to believe that they will be unavailable to serve.

DIRECTORS AND NOMINEES

Provided below is certain information with respect to each nominee for election as a director and each continuing director.

Director Nominees for Terms Ending at the 2027 Annual Meeting of Stockholders

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with the Company |

| Thomas G. Campbell (1) | | 73 | | Director |

| Steven L. Elfman (2) | | 68 | | Director |

| Asha Keddy (3) | | 50 | | Director |

(1)Member of the Audit, Compensation, and Governance and Nominating Committees

(2)Member of the Compensation, Governance and Nominating, and Mergers and Acquisitions Committees

(3)Member of the Audit Committee

Mr. Campbell became a director in 1995. From 1999 until his retirement in October 2021, he served as the Executive Vice President of King Printing, Inc., a book printing and manufacturing company. Mr. Campbell currently serves in volunteer roles for the grant program of Cummings Foundation, which seeks to support nonprofits in eastern Massachusetts, where he has served since February 2021, and for Rivier University, a private university where he has served since September 2023. From 1996 to 1999, he was the Vice President of Operations of Complete Concepts, Ltd., a manufacturer and distributor of women’s accessories. From 1995 to 1996, Mr. Campbell was an independent management consultant specializing in corporate turnarounds, and prior to that served during 1995 as the Chief Operating Officer of Laser Atlanta Optics, Inc. From 1985 to 1995, he served in several senior management positions at Hayes Microcomputer Products, Inc., including Vice President of Operations and Business Development and as Chief Operating Officer and a member of the Board of Directors of Practical Peripherals, a Hayes subsidiary. Prior to 1985, Mr. Campbell was employed by Digital Equipment Corporation. Mr. Campbell attended Boston University. Mr. Campbell brings to our Board extensive executive management experience in the retail and consumer products industries, along with particular strengths with respect to leadership, management, financial, international business and corporate governance skills.

Mr. Elfman became a director in 2014. He is the former President of Network Operations and Wholesale at Sprint, a telecommunications company and leading wireless carrier prior to its acquisition by T-Mobile in 2020, having had

responsibility for product, technology development, network, wholesale operations, value-added services, procurement and real estate, and digital. Mr. Elfman joined the Sprint senior leadership team in 2008 from mobile data technology services company, Infospace, where he was Executive Vice President of Infospace Mobile, then President and Chief Operating Officer of Motricity following the acquisition of Infospace Mobile. He also has held leadership positions at Terabeam, as Executive Vice President of Operations, and at AT&T Wireless, where he was Chief Information Officer. Mr. Elfman was the CIO at GE Capital (Fleet Services Company) as well as head of IT at 3M Company for international operations. Mr. Elfman graduated from the University of Western Ontario in Canada with a degree in computer science and business. He previously served on the board of directors of Syntonic Limited, a software company and provider of mobile software solutions, where he served as non-executive chairman and as a member of the compensation committee of the board of directors. Mr. Elfman also previously served on the boards of Affirmed Networks, Inc., a mobile network solutions company, CollabIP, Inc., a communications intelligence platform provider, Competitor Carrier Association, Bethany College and Clearwire. Mr. Elfman brings to our Board extensive knowledge of the telecommunications and wireless data and cellular industries, particularly with respect to large wireless providers.

Ms. Keddy joined the Board in April 2022. She has more than 28 years of industry experience, including senior executive roles, having served for more than 23 years in various roles at Intel Corporation, a Fortune 50 company, most recently serving as Intel’s Corporate Vice President and General Manager, Next Generation Systems and Standards from 2019 until her retirement from the company in March 2023. Ms. Keddy is a business innovation leader, technology futurist and patent-holder. Ms. Keddy has spent her career building enterprise and consumer systems and defining policies to transform working and living environments. Ms. Keddy served as a pivotal force, including serving as Intel’s 5G Executive Sponsor, in leading the creation of 5G and Wi-Fi market opportunities for Intel using incubation efforts, product development, industry forums, standards creation, ecosystem enablement, and policy governance. Ms. Keddy is a highly networked industry thought leader, and a global spokesperson providing insights to government agencies, the media, analysts, academia, and investors. She has served as a representative before Congress and other international government agencies, including testimonies to the U.S. Senate on 5G. Ms. Keddy helped establish Intel as a leader within key wireless, industrial, and edge standards bodies, and multiple industry fora, such as the 3GPP, IEEE, Wi-Fi Alliance, ETSI and Open-RAN. Ms. Keddy brings to the Smith Micro Board extensive industry expertise and in-depth insight into the wireless industry across the entire ecosystem, spanning a near three-decade career of technology, business, and operational leadership experience including in consumer, enterprise, and IOT markets.

Vote Required for Approval and Recommendation of Board of Directors

The affirmative vote of the holders of a plurality of the outstanding shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote is required for approval of the election of directors standing for election at the 2024 Annual Meeting.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE NOMINEES NAMED ABOVE OR THEIR SUBSTITUTES AS SET FORTH HEREIN.

Continuing Directors with Terms Ending at the 2025 Annual Meeting of Stockholders:

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with the Company |

| Andrew Arno (1) | | 64 | | Director |

| Samuel Gulko (2) | | 92 | | Director |

(1)Member of the Governance and Nominating and Mergers and Acquisitions Committees

(2)Member of Audit and Compensation Committees

Mr. Arno joined our Board of Directors in 2011 and has more than 30 years of experience working with emerging growth companies. Since June 2023, Mr. Arno has served as a managing member of Unterberg Legacy LLC, a family office, which he co-founded. From 2015 until February 2023, he served as Vice Chairman of Special Equities Group, LLC (SEG), a privately held investment banking firm. SEG is affiliated with Dawson James Securities Inc., and was previously affiliated with Bradley Woods & Co. Ltd., and prior thereto Chardan Capital Markets, LLC. From 2013 until 2015 he served as Managing Director of Emerging Growth Equities, an investment bank, and Vice President of Sabr, Inc., a family investment group. He previously served as President of LOMUSA Limited, an investment banking firm. Earlier in his career, Mr. Arno served as Vice Chairman and Chief Marketing Officer of Unterberg Capital, LLC, an investment advisory firm that he co-founded, and he served as Vice Chairman and Head of Equity Capital Markets of Merriman Capital LLC, an investment banking firm, where he also served on the board of its parent company, Merriman Holdings, Inc. Mr. Arno

currently serves on the boards of Oncocyte Corporation, a biotechnology company, Independa Inc., a software company, 22nd Century Group, a biotechnology company, and Comhear Inc., an audio technology research and development company. Mr. Arno brings to the Board valuable understanding of public markets, significant experience in investment matters, and a keen understanding of stockholder perspectives as it relates to enhancing value for our stakeholders.

Mr. Gulko became a director in 2004. Since 2002, he has provided tax and consulting services on a part-time basis to a limited number of clients. From 1996 until his retirement in 2002, Mr. Gulko served as the Chief Financial Officer, and as the Vice President of Finance, Secretary and Treasurer of Neotherapeutics, Inc., a publicly traded biotechnology company (now known as Spectrum Pharmaceuticals, Inc.). During this same period, he also served as a member of the board of directors of Neotherapeutics, Inc. Earlier in his career, Mr. Gulko was self-employed as a certified public accountant and business consultant, as well as the part time chief financial officer of several privately-owned companies, and previously served as a partner in the audit practice of Ernst & Young LLP, an accounting and business services firm. Mr. Gulko holds a Bachelor of Science degree in Accounting from the University of Southern California. Mr. Gulko brings to our Board extensive qualifications and experience in finance and public accounting, including his prior service as an audit partner at Ernst & Young LLP and as the CFO of a publicly-traded company.

Continuing Directors with Terms Ending at the 2026 Annual Meeting of Stockholders:

| | | | | | | | | | | | | | |

| Name | | Age | | Present Position with the Company |

| Chetan Sharma (1) | | 54 | | Director |

| William W. Smith, Jr. | | 76 | | Chairman of the Board, President and Chief Executive Officer |

| Gregory J. Szabo (2) | | 76 | | Director |

(1)Member of the Mergers and Acquisitions Committee

(2)Member of the Audit and Mergers and Acquisitions Committees

Mr. Sharma joined the Board in April 2022. Since 2000, Mr. Sharma has served as the Chief Executive Officer and founder of Chetan Sharma Consulting, a management consulting and strategic advisory firm serving the mobile, media, and technology industries. Prior to founding his firm, Mr. Sharma served as director of the Emerging Solutions and Wireless practices at Luminant Worldwide, a global provider of strategic consulting and professional services, and earlier in his career held roles in systems engineering and product management at Cellular Technical Services, a start-up company focused on preventing fraud in wireless networks. Mr. Sharma holds a Bachelor of Science degree in Electrical Engineering from Indian Institute of Technology and a Master of Science degree in Electrical and Computer Engineering from Kansas State University. Mr. Sharma brings to the Board more than 20 years of experience in providing strategic advisory services to leading companies in the wireless technology industry, and offers the Board valuable insight into strategic and operational issues important to the Company’s success.

Mr. Smith co-founded Smith Micro and has served as our Chairman of the Board, President and Chief Executive Officer since the Company’s inception in 1982. Mr. Smith was employed by Rockwell International Corporation in a variety of technical and management positions from 1975 to 1984. Mr. Smith served with Xerox Data Systems from 1972 to 1975 and RCA Computer Systems Division from 1969 to 1972 in mainframe sales and pre-sale technical roles. Mr. Smith received a Bachelor of Arts degree in Business Administration from Grove City College. As co-founder and the most senior executive of our Company, Mr. Smith provides the Board with valuable insight into the Company’s business operations, opportunities and challenges, as well as his extensive knowledge of the telecommunications and wireless industries, garnered during his 40 years of service with our Company. Mr. Smith also possesses particular strengths with respect to leadership and management skills.

Mr. Szabo re-joined the Board in 2011 after previously serving from 2001 to 2010. Mr. Szabo has over 30 years of wireless communications senior management experience from his career with AirTouch's and Vodafone’s wireless communications operations, which were merged with Verizon Wireless in 2000. As Senior Vice President-Network Services, he directed AirTouch’s engineering and operations for the company's cellular systems in the eastern United States, and later served as Executive Director, Global Technology for AirTouch Vodafone. Mr. Szabo previously held managerial positions with Motorola and Martin Marietta (now Lockheed Martin). He also co-founded Ertek Inc., which designed manufacturing systems for RFID (Radio Frequency IDentification) tag antennas. Mr. Szabo received both a Bachelor of Science Degree and Master of Science Degree in Electrical Engineering from Ohio University. He brings to our Board substantial market knowledge and in-depth insight into the worldwide telecommunications and wireless data and cellular industries.

PROPOSAL 2:

“SAY ON PAY” PROPOSAL

ADVISORY VOTE TO APPROVE COMPENSATION OF NAMED EXECUTIVE OFFICERS

Section 14A of the Exchange Act requires that we provide our stockholders with the opportunity to vote to approve, on a non-binding and advisory basis, the compensation of our named executive officers as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (the “SEC”). At our 2023 Annual Meeting of Stockholders, our Board of Directors recommended, and our stockholders voted on an advisory basis, to conduct this vote annually. Since the vote on this compensation program is advisory in nature, it will not affect any compensation already awarded to any named executive officer and will not be binding on or overrule any decisions made by the Compensation Committee or the Board with respect to compensation to be awarded in the future. The vote on this resolution is not intended to address any specific element of compensation. Rather, this vote relates to the compensation of our named executive officers as a whole, as described in this proxy statement.

The Compensation Committee annually reviews named executive officer compensation. As discussed in the narrative under the heading “Executive Compensation” beginning on page 27 of this proxy statement, our compensation program is designed to align executive pay with Company performance, and we seek to closely align the interests of our named executive officers with the interests of our stockholders. The Compensation Committee and the Board will consider the results of this advisory vote when formulating future executive compensation policy. As such, your vote will serve as an additional tool to guide the Compensation Committee and the Board in continuing to align the Company’s executive compensation program with the interests of the Company and its stockholders. Your vote will also guide the Compensation Committee and the Board to ensure that our executive compensation program is consistent with our commitment to high standards of corporate governance.

We ask our stockholders to vote on the following resolution at the 2024 Annual Meeting:

"RESOLVED, that the Company’s stockholders approve on an advisory basis the compensation of the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 2024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative disclosure contained therein."

Vote Required for Approval and Recommendation of the Board of Directors

Approval of this non-binding, advisory resolution requires the affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

PROPOSAL 3:

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

SingerLewak LLP has been engaged as the Company’s independent registered public accounting firm since 2005. The Audit Committee has selected SingerLewak LLP as the Company’s independent auditors for the fiscal year ending December 31, 2024 and has further directed that the selection of the independent auditors be submitted for ratification by the stockholders at the Annual Meeting.

Stockholder ratification of the selection of SingerLewak LLP as the Company’s independent auditors is not required by the Company’s Bylaws or otherwise. However, the Board of Directors is submitting the selection of SingerLewak LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain SingerLewak LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders. Representatives of SingerLewak LLP are not expected to be present at the Annual Meeting, and accordingly will not have an opportunity to make a statement or be available to respond to questions from stockholders.

Principal Accounting Fees and Services

The following is a summary of the fees billed to Smith Micro by SingerLewak LLP for professional services rendered for the fiscal years ended December 31, 2022 and December 31, 2023:

| | | | | | | | | | | |

| Fee Category | Fiscal 2022 Fees | | Fiscal 2023 Fees |

| Audit Fees | $ | 360,253 | | | $ | 374,816 | |

| Audit-Related Fees | $ | — | | | $ | — | |

| Tax Fees | $ | — | | | $ | — | |

| All Other Fees | $ | — | | | $ | — | |

Audit Fees: This category consists of fees billed for professional services rendered for the audit of our consolidated annual financial statements, review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by our independent registered public accounting firm in connection with statutory and regulatory filings or engagements.

Audit-Related Fees: This category consists of assurance and related services that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.”

Tax Fees: This category consists of fees billed for professional services rendered for tax compliance, tax advice and tax planning.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee pre-approves all audit and permissible non-audit services provided by our independent registered public accounting firm. These services may include audit services, audit-related services, tax services and other services. The Audit Committee has adopted a policy for the pre-approval of services provided by the independent registered public accounting firm. Under the policy, pre-approval is generally provided for up to one year and any pre-approval is detailed as to the particular service or category of services and is subject to a specific budget. In addition, the Audit Committee may also pre-approve particular services on a case-by-case basis. For each proposed service, the independent registered public accounting firm is required to provide detailed back-up documentation at the time of approval. The Audit Committee may delegate pre-approval authority to one or more of its members. Such a member must report any decisions to the Audit Committee at the next scheduled meeting.

Vote Required for Approval and Recommendation of the Board of Directors

The affirmative vote of a majority of shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal is being sought to ratify the appointment of SingerLewak LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF SINGERLEWAK LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

PROPOSAL 4

APPROVAL OF AMENDED AND RESTATED OMNIBUS EQUITY INCENTIVE PLAN

We are asking stockholders to approve an amendment and restatement of the Company’s 2015 Omnibus Equity Incentive Plan, which will be renamed the “Amended and Restated Omnibus Equity Incentive Plan,” in order to (i) increase the maximum number of shares authorized and available for issuance under the plan by 3 million shares, (ii) remove the provision related to the annual individual share award limits, (iii) add a limit on awards for non-employee directors and (iv) extend the termination date to the ten (10) year anniversary of the effective date of the amendment and restatement of the plan. Our Board of Directors has adopted and approved the Amended and Restated Omnibus Equity Incentive Plan (the “Restated Plan”). If approved by the stockholders at the Annual Meeting, the Restated Plan will become effective on June 18, 2024. The Restated Plan is a comprehensive incentive compensation plan under which we can grant equity-based and other incentive awards to officers, employees and directors of, and consultants and advisers to, the Company and its subsidiaries. The purpose of the Restated Plan is to help us attract, motivate and retain such persons and thereby enhance shareholder value. A copy of the Restated Plan is attached to this Proxy Statement as Appendix A.

The Company’s existing 2015 Omnibus Equity Incentive Plan (as amended, the “2015 Plan”) is due to expire on April 24, 2025, but if this proposal is approved by the stockholders, the 2015 Plan will be amended and restated as contemplated herein, with any unused shares remaining in the Restated Plan, and all outstanding awards previously granted under the 2015 Plan will remain outstanding in accordance with their terms.

Summary of Principal Amendments of Restated Plan

The 2015 Plan, as amended to date, provides for a total of 1,578,125 shares reserved and available for issuance pursuant to awards thereunder, subject to adjustment as permitted by the 2015 Plan. As of April 29, 2024, there were a total of 99,171 remaining shares available for issuance under the 2015 Plan.

The Restated Plan, as proposed, would amend Section 5.1(a) of the 2015 Plan to increase the maximum aggregate number of shares which may be issued under the 2015 Plan by three million shares. The Company’s Board of Directors believes that it is essential to have a sufficient number of reserved shares available for issuance under the Restated Plan to compensate and incentivize the Company’s officers, other employees, non-employee directors, and consultants, and believes that the proposed increase will provide a sufficient number of available shares for future granting needs to help the Company achieve the purposes of the Restated Plan.

The Restated Plan will provide that no awards may be granted under the Restated Plan following the ten year anniversary of the effective date of the Restated Plan, or June 18, 2034.

Due to certain changes in the deductibility of performance based compensation under the Code (as discussed below in “Certain U.S. Federal Income Tax Consequences of Restated Plan”), the individual limitation on grants of Awards has been eliminated. The Restated Plan, as proposed, will add a limitation on grants to non-employee Directors, such that the maximum value of Awards granted during any fiscal year to any non-employee Director, taken together with any cash fees paid to that Director during the fiscal year, will not exceed $500,000 (based on the fair value of the Award as of the Grant Date). Awards granted to Directors upon their initial election to the Board will not count toward the limit, and the Board may make exceptions to the limit in extraordinary circumstances for individual Directors; provided that the Director receiving such additional compensation may not participate in the decision to award such compensation.

The following table sets forth certain information about awards outstanding under our 2015 Plan, which is our only active equity compensation plan as of the date of this Proxy Statement. In addition, there are stock options outstanding under our prior 2005 Stock Option/Stock Issuance Plan with respect to a total of 2,882 shares with exercise prices ranging from $30.08 to $33.92.

| | | | | | | | |

| 2015 Omnibus Equity Incentive Plan | | As of April 29, 2024 |

| Total Stock Options Outstanding | | 7,062 |

| Total Restricted Stock Awards Outstanding (unvested shares remaining) | | 434,358 |

| Weighted-Average Exercise Price of Stock Options Outstanding | | $24.76 |

| Weighted-Average Remaining Duration (yrs) of Stock Options Outstanding | | 4.7 |

| Total Shares Available for Grant under the Plan | | 99,171 |

| Total Common Stock Outstanding | | 9,601,582 |

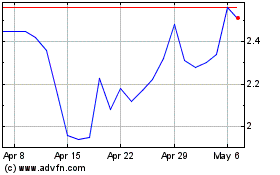

The closing price of the Company’s common stock on April 29, 2024 was $2.48 per share.

Vote Required for Approval and Recommendation of the Board of Directors

Approval of the Amended and Restated Omnibus Equity Incentive Plan proposal requires the affirmative vote of a majority of votes cast on such proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF THE AMENDED AND RESTATED OMNIBUS EQUITY INCENTIVE PLAN AS DESCRIBED HEREIN.

Summary of Material Features of the Restated Plan

Administration. Upon effectiveness, the Restated Plan will be administered by the Compensation Committee of the Board of Directors (the “Plan Committee”) consisting of persons who are each (i) “Outside Directors” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), (ii) “Non-Employee Directors” within the meaning of Rule 16b-3 of the Exchange Act, and (iii) “independent” for purposes of any applicable listing requirements. The Board of Directors or the Plan Committee may delegate to a committee of one or more members of the Board of Directors who are (x) not Outside Directors, the authority to grant awards to eligible persons who are not (A) then “covered employees” within the meaning of Section 162(m) of the Code and are not expected to be “covered employees” at the time of recognition of income resulting from such award, or (B) persons with respect to whom we wish to comply with the requirements of Section 162(m) of the Code, and/or (y) Non-Employee Directors, the authority to grant awards to eligible persons who are not then subject to the requirements of Section 16 of the Exchange Act. If a member of the Plan Committee is eligible to receive an award under the Restated Plan, such Plan Committee member shall have no authority with respect to his or her own award. Among other things, the Plan Committee has complete discretion, subject to the terms of the Restated Plan, to determine the employees, non-employee directors and non-employee consultants to be granted awards under the Restated Plan, the type of awards to be granted, the number of shares subject to each award, the exercise price under each option and the base price for each stock appreciation right (“SAR”), the term of each award, the vesting schedule for an award, the value of the shares underlying the award, and the required withholdings, if any. The Plan Committee is also authorized to construe the award agreements, and may prescribe rules relating to the Restated Plan.

Grant of Awards; Shares Available for Awards. The Restated Plan provides for the grant of awards which are incentive stock options (“ISOs”), non-qualified stock options (“NQSOs”), unrestricted shares, restricted shares, restricted stock units (“RSUs”), performance stock and units, SARs, tandem stock appreciation rights, distribution equivalent rights, or any combination of the foregoing, to employees, non-employee directors, and non-employee consultants of the Company or any of its subsidiaries (each a “participant”) (however, solely Company employees or employees of the Company’s subsidiaries are eligible for ISO awards). A total of 4,578,125 shares will be reserved for issuance under the Restated Plan (inclusive of 1,578,125 shares previously reserved under the 2015 Plan as amended to date). Shares awarded as restricted stock, RSUs, performance stock, or dividend equivalent rights, which convey the full value of the shares subject to the award, are counted as 1.2 shares for every one share awarded, while options and SARs count as one share for every share awarded. To the extent that an award (or portion of an award) lapses, expires, is canceled, is terminated unexercised or ceases to be exercisable for any reason, or the rights of its holder terminate, any shares subject to such

award shall be deemed not to have been issued for purposes of determining the maximum aggregate shares which may be issued under the Restated Plan and shall again be available for the grant of a new award. However, shares not issued or delivered as a result of the net settlement of an SAR or option, shares used to pay the exercise price or withholding taxes related to an award and shares repurchased on the open market with the proceeds from the exercise of any option will not be available for future issuance under the Restated Plan.

The Restated Plan will continue in effect, unless sooner terminated, until the tenth (10th) anniversary of the date on which it was approved by the stockholders (except as to awards outstanding on that date). The Board of Directors in its discretion may terminate the Restated Plan at any time with respect to any shares for which awards have not theretofore been granted; provided, however, that the Restated Plan’s termination shall not materially and adversely impair the rights of a holder, without the consent of the holder, with respect to any award previously granted. The maximum value of awards that may be granted under the Restated Plan to any non-employee director during any fiscal year is $500,000, subject to certain limited exceptions.

Future new hires, non-employee directors and additional non-employee consultants are eligible to participate in the Restated Plan as well. The number of awards to be granted to officers, non-employee directors, employees and non-employee consultants cannot be determined at this time as the grant of awards is dependent upon various factors such as hiring requirements and job performance.

Options. The term of each stock option shall be as specified in the option agreement; provided, however, that no option shall be exercisable after the expiration of ten (10) years from the date of its grant (five (5) years for an employee who is a ten percent stockholder). The Restated Plan expressly prohibits the re-pricing of options (including the cancellation and re-grant of outstanding options) without prior stockholder approval. The Restated Plan also requires a minimum vesting period of one year before any portion of an award will be vested. The price at which a share may be purchased upon exercise of a stock option shall not be less than the fair market value of a share on the date such stock option is granted, and shall be subject to adjustment as provided in the Restated Plan. The Plan Committee or the Board of Directors shall determine the time or times at which, or the circumstances under which, a stock option may be exercised in whole or in part, the time or times at which options shall cease to be or become exercisable following termination of the stock option holder’s employment or upon other conditions, the methods by which such exercise price may be paid or deemed to be paid, the form of such payment, and the methods by or forms in which shares will be delivered or deemed to be delivered to participants who exercise stock options. Options which are ISOs shall comply in all respects with Section 422 of the Code.

Unrestricted Stock Awards. Pursuant to the terms of the applicable unrestricted stock award agreement, an unrestricted stock award is the award or sale of shares to employees, non-employee directors or non-employee consultants, which are not subject to transfer restrictions in consideration for past services rendered to the Company or any of its subsidiaries or for other valid consideration.

Restricted Stock Awards. Restricted stock awards shall include such restrictions on transferability, risk of forfeiture and other restrictions, if any, as the Plan Committee or the Board of Directors may impose, which restrictions may lapse separately or in combination at such times, under such circumstances (including based on achievement of performance goals and/or future service requirements), in such installments or otherwise, as the Plan Committee or the Board of Directors may determine at the date of grant or purchase or thereafter. If provided for under the restricted stock award agreement, a participant who is granted or has purchased restricted stock shall have all of the rights of a stockholder, including the right to vote the restricted stock and the right to receive dividends thereon (subject to any mandatory reinvestment or other requirement imposed by the Plan Committee or the Board of Directors or in the award agreement). During the restricted period applicable to the restricted stock, subject to certain exceptions, the restricted stock may not be sold, transferred, pledged, exchanged, hypothecated, or otherwise disposed of by the participant.

Restricted Stock Unit Awards. A restricted stock unit (“RSU”) award provides for a grant of shares or a cash payment to be made to the holder upon the satisfaction of predetermined individual service-related vesting requirements, based on the number of units awarded to the holder. The Plan Committee shall set forth in the applicable RSU award agreement the individual service-based vesting requirements which the holder would be required to satisfy before the holder would become entitled to payment and the number of units awarded to the holder. The Plan Committee has discretion to prescribe additional terms and conditions or restrictions. The holder of a RSU shall be entitled to receive a cash payment equal to the fair market value of a share, or one (1) share, as determined and as set forth in the RSU award agreement, for each RSU subject to such RSU award, if and to the extent the holder satisfies the applicable vesting requirements. Such payment or distribution shall be made no later than by the fifteenth (15th) day of the third

(3rd) calendar month next following the end of the calendar year in which the RSU first becomes vested, unless otherwise structured to comply with Code Section 409A.

Performance Stock Awards. A performance stock award provides for the distribution of shares (or cash equal to the fair market value of shares) to the holder upon the satisfaction of predetermined individual and/or Company goals or objectives. The Plan Committee shall set forth in the applicable performance stock award agreement the performance goals and objectives (and the period of time to which such goals and objectives shall apply) required to be satisfied before the holder would become entitled to the receipt of shares (or cash equal to the fair market value of shares) pursuant to such holder’s performance stock award and the number of shares of shares subject to such performance stock award. The vesting restrictions under any performance stock award shall constitute a “substantial risk of forfeiture” under Section 409A of the Code and, if such goals and objectives are achieved, the distribution of such shares shall be made no later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of our fiscal year to which such goals and objectives relate, unless otherwise structured to comply with Code Section 409A. At the time of such award, the Plan Committee may, in its sole discretion, prescribe additional terms and conditions or restrictions. The holder of a performance stock award shall have no rights as a stockholder until such time, if any, as the holder actually receives shares pursuant to the performance stock award.

Performance Unit Awards. A performance unit award provides for a cash payment to be made to the holder upon the satisfaction of predetermined individual and/or Company (or affiliate) performance goals or objectives based on selected performance criteria, based on the number of units awarded to the holder. The Plan Committee shall set forth in the applicable performance unit award agreement the performance goals and objectives (and the period of time to which such goals and objectives shall apply) which the holder and/or Company would be required to satisfy before the holder would become entitled to payment, the number of units awarded to the holder and the dollar value assigned to each such unit. At the time of such award, the Plan Committee may, in its sole discretion, prescribe additional terms and conditions or restrictions. The holder of a performance unit shall be entitled to receive a cash payment equal to the dollar value assigned to such unit under the applicable performance unit award agreement if the holder and/or the Company satisfies (or partially satisfies, if applicable under the applicable performance unit award agreement) the performance goals and objectives set forth in such performance unit award agreement. If achieved, such payment shall be made no later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of the Company’s fiscal year to which such performance goals and objectives relate, unless otherwise structured to comply with Code Section 409A.

Stock Appreciation Rights. A stock appreciation right (“SAR”) provides the participant to whom it is granted the right to receive, upon its exercise, cash or shares equal to the excess of (A) the fair market value of the number of shares subject to the SAR on the date of exercise, over (B) the product of the number of shares subject to the SAR multiplied by the base value for the SAR, as determined by the Plan Committee or the Board of Directors. The Plan Committee shall set forth in the applicable SAR award agreement the terms and conditions of the SAR, including the base value for the SAR (which shall not be less than the fair market value of a share on the date of grant), the number of shares subject to the SAR and the period during which the SAR may be exercised and any other special rules and/or requirements which the Plan Committee imposes on the SAR. No SAR shall be exercisable after the expiration of ten (10) years from the date of grant, and each SAR shall have a minimum vesting period of one year before any portion of an award will be vested. A tandem SAR is a SAR granted in connection with a related option, the exercise of some or all of which results in termination of the entitlement to purchase some or all of the shares under the related option. If the Plan Committee grants a SAR which is intended to be a tandem SAR, the tandem SAR shall be granted at the same time as the related option and additional restrictions apply. The Restated Plan expressly prohibits the re-pricing of SARs (including the cancellation and re-grant of outstanding SARs) without prior stockholder approval.

Distribution Equivalent Rights. A distribution equivalent right entitles the holder to receive bookkeeping credits, cash payments and/or share distributions equal in amount to the distributions that would be made to the holder had the holder held a specified number of shares during the period the holder held the distribution equivalent rights. The Plan Committee shall set forth in the applicable distribution equivalent rights award agreement the terms and conditions, if any, including whether the holder is to receive credits currently in cash, is to have such credits reinvested (at fair market value determined as of the date of reinvestment) in additional shares or is to be entitled to choose among such alternatives. Such receipt shall be subject to a “substantial risk of forfeiture” under Section 409A of the Code and, if such award becomes vested, the distribution of such cash or shares shall be made no later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of the Company’s fiscal year in which the holder’s interest in the award vests, unless otherwise structured to comply with Code Section 409A. Distribution equivalent rights awards may be settled in cash or in shares, as set forth in the applicable distribution equivalent rights award agreement. A distribution equivalent rights award may, but need not be, awarded in tandem with another award (but not an option or SAR award), whereby, if

so awarded, such distribution equivalent rights award shall expire, terminate or be forfeited by the holder, as applicable, under the same conditions as under such other award. The distribution equivalent rights award agreement for a distribution equivalent rights award may provide for the crediting of interest on a distribution equivalent rights award to be settled in cash at a future date (but in no event later than by the fifteenth (15th) day of the third (3rd) calendar month next following the end of the Company’s fiscal year in which such interest was credited and vested), at a rate set forth in the applicable distribution equivalent rights award agreement, on the amount of cash payable thereunder.

Recapitalization or Reorganization. Subject to certain restrictions, the Restated Plan provides for the adjustment of shares underlying awards previously granted if, and whenever, prior to the expiration or distribution to the holder of shares underlying an award theretofore granted, the Company shall effect a subdivision or consolidation of our shares or the payment of a stock dividend on shares without receipt of consideration by the Company. If the Company recapitalizes or otherwise changes its capital structure, thereafter upon any exercise or satisfaction, as applicable, of a previously granted award, the holder shall be entitled to receive (or entitled to purchase, if applicable) under such award, in lieu of the number of shares then covered by such award, the number and class of shares and securities to which the holder would have been entitled pursuant to the terms of the recapitalization if, immediately prior to such recapitalization, the holder had been the holder of record of the number of shares then covered by such award. The Restated Plan also provides for the adjustment of shares underlying awards previously granted in the event of changes to the outstanding shares by reason of an extraordinary cash dividend, reorganization, merger, consolidation, combination, split-up, spin-off, exchange or other relevant change in capitalization occurring after the date of the grant of any award, subject to certain restrictions.

Amendment and Termination. The Restated Plan shall continue in effect, unless sooner terminated pursuant to its terms, until the tenth (10th) anniversary of the effective date of the Restated Plan (except as to awards outstanding on that date). The Board of Directors may terminate the Restated Plan at any time with respect to any shares for which awards have not theretofore been granted; provided, however, that the Restated Plan’s termination shall not materially and adversely impair the rights of a holder with respect to any award theretofore granted without the consent of the holder. The Board of Directors shall have the right to alter or amend the Restated Plan or any part thereof from time to time; provided, however, that without the approval by a majority of the votes cast at a meeting of our stockholders at which a quorum representing a majority of our shares entitled to vote generally in the election of directors is present in person or by proxy, no amendment or modification of the Restated Plan may (i) materially increase the benefits accruing to holders, (ii) except as otherwise expressly provided in the Restated Plan, materially increase the number of shares subject to the Restated Plan or the individual award agreements, (iii) materially modify the requirements for participation, or (iv) amend, modify or suspend certain re-pricing prohibitions or amendment and termination provisions as specified therein. In addition, no change in any award theretofore granted may be made which would materially and adversely impair the rights of a holder with respect to such award without the consent of the holder (unless such change is required in order to cause the benefits under the Restated Plan to qualify as “performance-based” compensation within the meaning of Section 162(m) of the Code or to cause the Restated Plan and/or Award to be exempt from or comply with Section 409A of the Code).

The foregoing summary is qualified in its entirety by reference to the full text of the Restated Plan, as proposed, which is attached hereto as Appendix A.

Certain U.S. Federal Income Tax Consequences of the Restated Plan

The following is a general summary of certain U.S. federal income tax consequences under current tax law to the Company (to the extent it is subject to U.S. federal income taxation on its net income) and to participants in the Restated Plan who are individual citizens or residents of the United States for federal income tax purposes (“U.S. Participants”) of stock options which are ISOs, or stock options which are NQSOs, unrestricted stock, restricted stock, RSU, performance stock, performance units, SARs, and dividend equivalent rights. This summary does not purport to cover all of the special rules that may apply, including special rules relating to limitations on our ability to deduct certain compensation, special rules relating to deferred compensation, golden parachutes, U.S. Participants subject to Section 16(b) of the Exchange Act or the exercise of a stock option with previously-acquired shares. This summary assumes that U.S. Participants will hold their shares as capital assets within the meaning of Section 1221 of the Code. In addition, this summary does not address the foreign, state or local or other tax consequences, or any U.S. federal non-income tax consequences, inherent in the acquisition, ownership, vesting, exercise, termination or disposition of an award under the Restated Plan, or shares issued pursuant thereto. Participants are urged to consult with their own tax advisors concerning the tax consequences to them of an award under the Restated Plan or shares issued thereunder pursuant to the Restated Plan.

A U.S. Participant generally does not recognize taxable income upon the grant of a NQSO. Upon the exercise of a NQSO, the U.S. Participant generally recognizes ordinary compensation income in an amount equal to the excess, if any,

of the fair market value of the shares acquired on the date of exercise over the exercise price thereof, and the Company generally will be entitled to a deduction for such amount at that time. If the U.S. Participant later sells shares acquired pursuant to the exercise of a NQSO, the U.S. Participant recognizes a long-term or short-term capital gain or loss, depending on the period for which the shares were held. The capital gain (or loss) will be short-term if the common stock is disposed of within one year after the NQSO is exercised and long-term if the common stock was held more than 12 months as of the sale date. A long-term capital gain is generally subject to more favorable tax treatment than ordinary income or a short-term capital gain. The deductibility of capital losses is subject to certain limitations.