UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of

May 2024

Commission File Number 000-20181

SAPIENS INTERNATIONAL CORPORATION N.V.

(Translation of Registrants name into English)

Azrieli Center

26 Harokmim St.

Holon, 5885800 Israel

(Address of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

CONTENTS

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Sapiens International Corporation N.V. |

| |

|

| Date: May 8, 2024 |

By: |

/s/ Roni Giladi |

| |

|

Name: |

Roni Giladi |

| |

|

Title: |

Chief Financial Officer |

Exhibit Index

The following exhibit is

furnished as part of this Form 6-K:

3

Exhibit

99.1

Sapiens

Reports First Quarter 2024 Financial Results

Rochelle Park, NJ, May

8, 2024 – Sapiens International Corporation, (NASDAQ and TASE: SPNS), a leading global provider of software solutions for the

insurance industry, today announced its financial results for the first quarter ended March 31, 2024.

Summary

Results for First Quarter 2024 (USD in millions, except per share data)

| | |

GAAP | | |

| | |

Non-GAAP | | |

| |

| | |

Q1 2024 | | |

Q1 2023 | | |

% Change | | |

Q1 2024 | | |

Q1 2023 | | |

% Change | |

| Revenue | |

$ | 134.2 | | |

$ | 124.7 | | |

| 7.6 | % | |

$ | 134.2 | | |

$ | 124.8 | | |

| 7.6 | % |

| Gross Profit | |

$ | 57.6 | | |

$ | 53.0 | | |

| 8.5 | % | |

$ | 60.9 | | |

$ | 56.4 | | |

| 8.0 | % |

| Gross Margin | |

| 42.9 | % | |

| 42.5 | % | |

| 40 bps | | |

| 45.4 | % | |

| 45.2 | % | |

| 20 bps | |

| Operating Income | |

$ | 20.5 | | |

$ | 18.9 | | |

| 8.6 | % | |

$ | 24.3 | | |

$ | 22.5 | | |

| 7.8 | % |

| Operating Margin | |

| 15.3 | % | |

| 15.1 | % | |

| 20 bps | | |

| 18.1 | % | |

| 18.0 | % | |

| 10 bps | |

| Net Income (*) | |

$ | 17.4 | | |

$ | 14.2 | | |

| 22.3 | % | |

$ | 20.4 | | |

$ | 17.3 | | |

| 18.4 | % |

| Diluted EPS | |

$ | 0.31 | | |

$ | 0.26 | | |

| 19.2 | % | |

$ | 0.36 | | |

$ | 0.31 | | |

| 16.1 | % |

| (*) | | Attributable

to Sapiens’ shareholders |

Roni Al-Dor, President and CEO of Sapiens, stated,

“Sapiens delivered a solid first quarter, with year-over-year growth of 7.6% on total revenue of $134 million. The first quarter

was highlighted by an impressive 9.5% year-over-year revenue growth in North America. Annualized recurring revenue (ARR) grew year-over-year

by 12.7% to $168 million. Operating profit in the first quarter reached $24 million, representing an operating margin of 18.1%.”

Mr. Al-Dor continued, “New sales are being structured and priced in a SaaS model while we continue to transition current

customers to SaaS. Our pivotal partnership with Microsoft, which is unique to the insurance

sector, underpins our SaaS strategy and enables the infusion of GenAI capabilities into our solutions, a key differentiator in the industry.”

“We are well-positioned to continue

our positive momentum from the first quarter throughout the remainder of the year,” concluded Mr. Al-Dor. “We are reiterating

our 2024 guidance for non-GAAP revenues in a range of $550 million to $555 million and for non-GAAP operating margin in a range of 18.1%-18.5%.”

Quarterly

Results Conference Call

Management

will host a conference call and webcast on May 8, 2024, at 9:30 a.m. Eastern Time (4:30 p.m. in Israel) to review and discuss Sapiens’

results. Please call the following numbers (at least 10 minutes before the scheduled time) to participate:

| ● | North

America (toll-free): 1-888-642-5032 |

| ● | International:

972-3-918-0644 |

The

live webcast of the call can be viewed on Sapiens’ website at: veidan.activetrail.biz/sapiensq1-2024.

A replay of the call will be available one business day following the completion of the event, at the same link for 90 days.

Non-GAAP

Financial Measures

This

press release contains the following non-GAAP financial measures: non-GAAP revenue, ARR, non-GAAP gross profit, non-GAAP gross margin,

non-GAAP operating income, non-GAAP operating margin, non-GAAP net income attributed to Sapiens shareholders, non-GAAP basic and diluted

earnings per share, Adjusted EBITDA and Adjusted Free Cash-Flow.

Sapiens

believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial

and business trends relating to Sapiens’ financial condition and results of operations. The Company’s management uses these non-GAAP

measures to compare the Company’s performance to that of prior periods for trend analyses, for purposes of determining executive and

senior management incentive compensation and for budgeting and planning purposes. These measures are used in financial reports prepared

for management and in quarterly financial reports presented to the Company’s board of directors. The Company believes that the use of

these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends,

and in comparing the Company’s financial measures with other software companies, many of which present similar non-GAAP financial measures

to investors.

Non-GAAP

financial measures consist of GAAP financial measures adjusted to exclude: Valuation adjustment on acquired deferred revenue, amortization

of capitalized software development and other intangible assets, capitalization of software development, stock-based compensation, compensation

related to acquisition and acquisition-related costs, restructuring and cost reduction costs, and tax adjustments related to non-GAAP

adjustments.

Management

of the Company does not consider these non-GAAP measures in isolation, or as an alternative to financial measures determined in accordance

with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are

required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations, as they

reflect the exercise of judgment by management about which expenses and income are excluded or included in determining these non-GAAP

financial measures.

To

compensate for these limitations, management presents non-GAAP financial measures in connection with GAAP results. Sapiens urges investors

to review the reconciliation of its non-GAAP financial measures to the comparable GAAP financial measures, which it includes in press

releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate

the Company’s business.

Reconciliation

tables of the most comparable GAAP financial measures to the non-GAAP financial measures used in this press release are included with

the financial tables of this release.

The

Company defines Annual Recurring Revenue (“ARR”) as the annualized value of our revenue from customer subscriptions, term

licenses, maintenance, application maintenance, and cloud solutions. The ARR run rate is equal to the product of (i) the sum of these

revenues in our most recently completed fiscal quarter, multiplied by (ii) four.

The

Company defines Adjusted EBITDA as net profit, adjusted to eliminate valuation adjustment on acquired deferred revenue, stock-based compensation

expense, depreciation and amortization, capitalization of software development costs, compensation expenses related to acquisition and

acquisition-related costs, restructuring and cost reduction costs, financial expense (income), provision for income taxes and other income

(expenses). These amounts are often excluded by other companies as well, in order to help investors understand the operational performance

of their business.

The

Company uses Adjusted EBITDA as a measurement of its operating performance, because it assists in comparing the operating performance

on a consistent basis by removing the impact of certain non-cash and non-operating items. Adjusted EBITDA reflects an additional way

of viewing aspects of the operations that the Company believes, when viewed with the GAAP results and the accompanying reconciliations

to corresponding GAAP financial measures, provide a more complete understanding of factors and trends affecting its business. The Company

uses Adjusted Free Cash-Flow as a measurement of its operating performance, and reconciles cash-flow from operating activities to Adjusted

Free Cash-Flow, while reducing the amounts for capitalization of software development costs and capital expenditures. The Company adds

back cash payments made for former acquisitions in respect of future performance targets and retention criteria as determined upon acquisition

date of the respective acquired company, which were included in the cash-flow from operating activities. We believe that Adjusted Free

Cash-Flow is useful in evaluating our business, because Adjusted Free Cash-Flow reflects the cash surplus available to fund the expansion

of our business.

About

Sapiens

Sapiens

International Corporation (NASDAQ and TASE: SPNS) empowers the financial sector, with a focus on insurance, to transform and become digital,

innovative, and agile. With more than 40 years of industry expertise, Sapiens’ cloud-based SaaS insurance platform offers

pre-integrated, low-code capabilities across core, data and digital domains to accelerate our customers’ digital transformation.

Serving over 600 customers in 30 countries, Sapiens offers insurers across property and casualty, workers’ compensation, and life insurance markets

the most comprehensive set of solutions, from core to complementary, including Reinsurance, Financial & Compliance, Data & Analytics,

Digital, and Decision Management. For more information visit www.sapiens.com or follow us on LinkedIn.

Investor and Media Contact

Yaffa Cohen-Ifrah

Chief Marketing Officer and Head of Investor Relations, Sapiens

Yaffa.cohen-ifrah@sapiens.com

+1 917-533-4782

|

|

Investors Contact

Brett Maas

Managing Partner, Hayden IR

+1 646-536-7331

Brett.Maas@HaydenIR.com

Kimberly Rogers

Managing Director, Hayden IR

+1 541-904-5075

kim@HaydenIR.com |

Forward Looking Statements

Certain matters discussed in this press release

are forward-looking statements within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the safe harbor

provisions of the U.S. Private Securities Litigation Reform Act of 1995, and are based on our beliefs, assumptions and expectations, as

well as information currently available to us. Such forward-looking statements may be identified by the use of the words “anticipate,”

“believe,” “estimate,” “expect,” “may,” “will,” “plan” and similar

expressions. Such statements reflect our current views with respect to future events and are subject to certain risks and uncertainties.

There are important factors that could cause our actual results, levels of activity, performance or achievements to differ materially

from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements, including, but

not limited to: the degree of our success in our plans to leverage our global footprint to grow our sales; the degree of our success

in integrating the companies that we have acquired through the implementation of our M&A growth strategy; the lengthy development

cycles for our solutions, which may frustrate our ability to realize revenues and/or profits from our potential new solutions; our

lengthy and complex sales cycles, which do not always result in the realization of revenues; the degree of our success in retaining

our existing customers or competing effectively for greater market share; difficulties in successfully planning and managing changes

in the size of our operations; the frequency of the long-term, large, complex projects that we perform that involve complex estimates

of project costs and profit margins, which sometimes change mid-stream; the challenges and potential liability that heightened privacy

laws and regulations pose to our business; occasional disputes with clients, which may adversely impact our results of operations

and our reputation; various intellectual property issues related to our business; potential unanticipated product vulnerabilities

or cybersecurity breaches of our or our customers’ systems; risks related to the insurance industry in which our clients operate;

risks associated with our global sales and operations, such as changes in regulatory requirements, wide-spread viruses and epidemics like

the recent novel coronavirus pandemic, which adversely affected our results of operations, or fluctuations in currency exchange rates;

and risks related to our principal location in Israel and our status as a Cayman Islands company. While we believe such forward-looking

statements are based on reasonable assumptions, should one or more of the underlying assumptions prove incorrect, or these risks or uncertainties

materialize, our actual results may differ materially from those expressed or implied by the forward-looking statements. Please read the

risks discussed under the heading “Risk Factors” in our most recent Annual Report on Form 20-F, which we filled with the SEC

on March 31, 2022, in order to review conditions that we believe could cause actual results to differ materially from those contemplated

by the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Although we believe

that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity,

performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required

by law, we undertake no obligation to update publicly any forward-looking statements for any reason, to conform these statements to actual

results or to changes in our expectations.

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF INCOME

U.S. dollars in thousands (except per share amounts)

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| | |

| | |

| |

| Revenue | |

| 134,249 | | |

| 124,721 | |

| Cost of revenue | |

| 76,689 | | |

| 71,692 | |

| Gross profit | |

| 57,560 | | |

| 53,029 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development, net | |

| 16,521 | | |

| 15,617 | |

| Selling, marketing, general and administrative | |

| 20,517 | | |

| 18,519 | |

| Total operating expenses | |

| 37,038 | | |

| 34,136 | |

| | |

| | | |

| | |

| Operating income | |

| 20,522 | | |

| 18,893 | |

| | |

| | | |

| | |

| Financial and other expenses (income), net | |

| (1,092 | ) | |

| 1,197 | |

| Taxes on income | |

| 4,113 | | |

| 3,330 | |

| Net income | |

| 17,501 | | |

| 14,366 | |

| | |

| | | |

| | |

| Attributable to non-controlling interest | |

| 141 | | |

| 170 | |

| | |

| | | |

| | |

| Net income attributable to Sapiens’ shareholders | |

| 17,360 | | |

| 14,196 | |

| Basic earnings per share | |

| 0.31 | | |

| 0.26 | |

| | |

| | | |

| | |

| Diluted earnings per share | |

| 0.31 | | |

| 0.26 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Weighted average number of shares outstanding used to compute basic earnings per share (in thousands) | |

| 55,744 | | |

| 55,156 | |

| | |

| | | |

| | |

| Weighted average number of shares outstanding used to compute diluted earnings per share (in thousands) | |

| 55,981 | | |

| 55,570 | |

SAPIENS INTERNATIONAL CORPORATION N.V. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

U.S. dollars in thousands (except per share amounts)

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| | |

| | |

| |

| GAAP revenue | |

| 134,249 | | |

| 124,721 | |

| Valuation adjustment on acquired deferred revenue | |

| - | | |

| 55 | |

| Non-GAAP revenue | |

| 134,249 | | |

| 124,776 | |

| | |

| | | |

| | |

| GAAP gross profit | |

| 57,560 | | |

| 53,029 | |

| Revenue adjustment | |

| - | | |

| 55 | |

| Amortization of capitalized software | |

| 1,545 | | |

| 1,431 | |

| Amortization of other intangible assets | |

| 1,779 | | |

| 1,848 | |

| Non-GAAP gross profit | |

| 60,884 | | |

| 56,363 | |

| | |

| | | |

| | |

| GAAP operating income | |

| 20,522 | | |

| 18,893 | |

| Gross profit adjustments | |

| 3,324 | | |

| 3,334 | |

| Capitalization of software development | |

| (1,717 | ) | |

| (1,658 | ) |

| Amortization of other intangible assets | |

| 1,233 | | |

| 1,076 | |

| Stock-based compensation | |

| 772 | | |

| 863 | |

| Acquisition-related costs (*) | |

| 129 | | |

| 6 | |

| Non-GAAP operating income | |

| 24,263 | | |

| 22,514 | |

| | |

| | | |

| | |

| GAAP net income attributable to Sapiens’ shareholders | |

| 17,360 | | |

| 14,196 | |

| Operating income adjustments | |

| 3,741 | | |

| 3,621 | |

| Taxes on income | |

| (680 | ) | |

| (564 | ) |

| Non-GAAP net income attributable to Sapiens’ shareholders | |

| 20,421 | | |

| 17,253 | |

| (*) | Acquisition-related costs pertain to charges on behalf of M&A

agreements related to future performance targets and retention criteria, as well as third-party services, such as tax, accounting and

legal rendered until the acquisition date. |

Adjusted EBITDA Calculation

U.S. dollars in

thousands

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| GAAP operating profit | |

| 20,522 | | |

| 18,893 | |

| | |

| | | |

| | |

| Non-GAAP adjustments: | |

| | | |

| | |

| Valuation adjustment on acquired deferred revenue | |

| - | | |

| 55 | |

| Amortization of capitalized software | |

| 1,545 | | |

| 1,431 | |

| Amortization of other intangible assets | |

| 3,012 | | |

| 2,924 | |

| Capitalization of software development | |

| (1,717 | ) | |

| (1,658 | ) |

| Stock-based compensation | |

| 772 | | |

| 863 | |

| Compensation related to acquisition and acquisition-related costs | |

| 129 | | |

| 6 | |

| Non-GAAP operating profit | |

| 24,263 | | |

| 22,514 | |

| Depreciation | |

| 1,097 | | |

| 1,055 | |

| Adjusted EBITDA | |

| 25,360 | | |

| 23,569 | |

Summary of NON-GAAP

Financial Information

U.S. dollars in thousands (except per share amounts)

| | |

Q1 2024 | | |

Q4 2023 | | |

Q3 2023 | | |

Q2 2023 | | |

Q1 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

| 134,249 | | |

| 130,914 | | |

| 130,760 | | |

| 128,354 | | |

| 124,776 | |

| Gross profit | |

| 60,884 | | |

| 59,370 | | |

| 59,260 | | |

| 57,992 | | |

| 56,363 | |

| Operating income | |

| 24,263 | | |

| 24,152 | | |

| 24,058 | | |

| 23,417 | | |

| 22,514 | |

| Adjusted EBITDA | |

| 25,360 | | |

| 25,267 | | |

| 24,777 | | |

| 24,393 | | |

| 23,569 | |

| Net income to Sapiens’ shareholders | |

| 20,421 | | |

| 20,081 | | |

| 19,080 | | |

| 18,610 | | |

| 17,253 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Diluted earnings per share | |

| 0.36 | | |

| 0.36 | | |

| 0.34 | | |

| 0.33 | | |

| 0.31 | |

Annual Recurring Revenue (“ARR”)

U.S. dollars in thousands

| | |

Three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| |

| 167,646 | | |

| 148,729 | |

Non-GAAP Revenues by Geographic Breakdown

U.S. dollars in thousands

| | |

Q1 2024 | | |

Q4 2023 | | |

Q3 2023 | | |

Q2 2023 | | |

Q1 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| North America | |

| 55,158 | | |

| 54,882 | | |

| 54,848 | | |

| 52,116 | | |

| 50,371 | |

| Europe | |

| 68,727 | | |

| 65,239 | | |

| 64,662 | | |

| 62,960 | | |

| 64,572 | |

| Rest of the World | |

| 10,364 | | |

| 10,793 | | |

| 11,250 | | |

| 13,278 | | |

| 9,833 | |

| Total | |

| 134,249 | | |

| 130,914 | | |

| 130,760 | | |

| 128,354 | | |

| 124,776 | |

Non-GAAP Revenue breakdown

U.S. dollars in thousands

| | |

Q1 2024 | | |

% | | |

Q1 2023 | | |

% | |

| | |

| | |

| | |

| | |

| |

| Software products and re-occurring post-production services (*) | |

| 94,242 | | |

| 70.2 | % | |

| 81,842 | | |

| 65.6 | % |

| Pre-production implementation services (**) | |

| 40,007 | | |

| 29.8 | % | |

| 42,934 | | |

| 34.4 | % |

| Total Revenues | |

| 134,249 | | |

| 100 | % | |

| 124,776 | | |

| 100 | % |

| | |

Q1 2024 | | |

Q1 2023 | |

| | |

| | |

| |

| Software products and re-occurring post-production services (*) | |

| 50,340 | | |

| 44,849 | |

| Pre-production implementation services (**) | |

| 10,544 | | |

| 11,514 | |

| Total Gross profit | |

| 60,884 | | |

| 56,363 | |

| | |

Q1 2024 | | |

Q1 2023 | |

| | |

| | |

| |

| Software products and re-occurring post-production services (*) | |

| 53.4 | % | |

| 54.8 | % |

| Pre-production implementation services (**) | |

| 26.4 | % | |

| 26.8 | % |

| Gross margin | |

| 45.4 | % | |

| 45.2 | % |

| (*) | Software products and re-occurring post-production services

include mainly subscription, term license, maintenance, application maintenance, cloud solutions and post-production services. This

revenue stream is a mix of recurring and re-occurring in nature.. |

| (**) | Pre-production implementation services include mainly implementation services before go-live,

which are one-time in nature. |

Adjusted Free Cash-Flow

U.S. dollars in thousands

| | |

Q1 2024 | | |

Q4 2023 | | |

Q3 2023 | | |

Q2 2023 | | |

Q1 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| Cash-flow from operating activities | |

| 18,488 | | |

| 38,646 | | |

| 3,988 | | |

| 14,603 | | |

| 22,188 | |

| Increase in capitalized software development costs | |

| (1,717 | ) | |

| (1,543 | ) | |

| (1,638 | ) | |

| (1,679 | ) | |

| (1,658 | ) |

| Capital expenditures | |

| (466 | ) | |

| (421 | ) | |

| (696 | ) | |

| (775 | ) | |

| (634 | ) |

| Free cash-flow | |

| 16,305 | | |

| 36,682 | | |

| 1,654 | | |

| 12,149 | | |

| 19,896 | |

| Cash payments attributed to acquisition-related costs(*) (**) | |

| 751 | | |

| 221 | | |

| - | | |

| - | | |

| 30 | |

| Adjusted free cash-flow | |

| 17,056 | | |

| 36,903 | | |

| 1,654 | | |

| 12,149 | | |

| 19,926 | |

| (*) | Included in cash-flow from operating activities |

| (**) | Acquisition-related payments pertain

to payments on behalf of M&A agreements related to future performance targets and retention criteria, as well as third-party

services, such as, tax, accounting and legal rendered until the acquisition date. |

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

U.S. dollars in thousands

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| | |

| | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash and cash equivalents | |

| 116,689 | | |

| 126,716 | |

| Short-term bank deposit | |

| 79,200 | | |

| 75,400 | |

| Trade receivables, net and unbilled receivables | |

| 103,735 | | |

| 90,273 | |

| Other receivables and prepaid expenses | |

| 19,741 | | |

| 22,514 | |

| Total current assets | |

| 319,365 | | |

| 314,903 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS | |

| | | |

| | |

| Property and equipment, net | |

| 11,989 | | |

| 12,661 | |

| Severance pay fund | |

| 3,381 | | |

| 3,605 | |

| Goodwill and intangible assets, net | |

| 311,178 | | |

| 317,352 | |

| Operating lease right-of-use assets | |

| 21,524 | | |

| 23,557 | |

| Other long-term assets | |

| 16,362 | | |

| 17,546 | |

| Total long-term assets | |

| 364,434 | | |

| 374,721 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

| 683,799 | | |

| 689,624 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Trade payables | |

| 9,767 | | |

| 6,291 | |

| Current maturities of Series B Debentures | |

| 19,796 | | |

| 19,796 | |

| Accrued expenses and other liabilities | |

| 97,497 | | |

| 77,873 | |

| Current maturities of operating lease liabilities | |

| 6,091 | | |

| 6,623 | |

| Deferred revenue | |

| 40,608 | | |

| 38,541 | |

| Total current liabilities | |

| 173,759 | | |

| 149,124 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES | |

| | | |

| | |

| Series B Debentures, net of current maturities | |

| 19,756 | | |

| 39,543 | |

| Deferred tax liabilities | |

| 9,156 | | |

| 10,820 | |

| Other long-term liabilities | |

| 11,474 | | |

| 11,538 | |

| Long-term operating lease liabilities | |

| 18,784 | | |

| 21,084 | |

| Accrued severance pay | |

| 7,368 | | |

| 7,568 | |

| Total long-term liabilities | |

| 66,538 | | |

| 90,553 | |

| | |

| | | |

| | |

| EQUITY | |

| 443,502 | | |

| 449,947 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND EQUITY | |

| 683,799 | | |

| 689,624 | |

SAPIENS INTERNATIONAL CORPORATION N.V. AND ITS SUBSIDIARIES

CONSOLIDATED STATEMENT OF CASH FLOW

U.S. dollars in thousands

| | |

For the three months ended March 31, | |

| | |

2024 | | |

2023 | |

| | |

(unaudited) | | |

(unaudited) | |

| Cash flows from operating activities: | |

| | |

| |

| Net income | |

| 17,501 | | |

| 14,366 | |

| Reconciliation of net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 5,654 | | |

| 5,410 | |

| Accretion of discount on series B debentures | |

| 9 | | |

| 14 | |

| Capital gain from sale of property and equipment | |

| (1 | ) | |

| (10 | ) |

| Stock-based compensation related to options issued to employees | |

| 772 | | |

| 863 | |

| | |

| | | |

| | |

| Net changes in operating assets and liabilities, net of amount acquired: | |

| | | |

| | |

| Increase in trade receivables, net and unbilled receivables | |

| (14,703 | ) | |

| (2,039 | ) |

| Increase (decrease) in deferred tax liabilities, net | |

| (776 | ) | |

| 25 | |

| Decrease in other operating assets | |

| 3,737 | | |

| 1,257 | |

| Increase (decrease) in trade payables | |

| 3,547 | | |

| (7,014 | ) |

| Increase in other operating liabilities | |

| 721 | | |

| 1,197 | |

| Increase in deferred revenues | |

| 1,968 | | |

| 7,936 | |

| Increase in accrued severance pay, net | |

| 59 | | |

| 183 | |

| Net cash provided by operating activities | |

| 18,488 | | |

| 22,188 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Purchase of property and equipment | |

| (470 | ) | |

| (653 | ) |

| Investment in deposits | |

| (3,291 | ) | |

| (45,004 | ) |

| Proceeds from sale of property and equipment | |

| 4 | | |

| 19 | |

| Capitalized software development costs | |

| (1,717 | ) | |

| (1,658 | ) |

| Acquisition of intellectual property | |

| - | | |

| (177 | ) |

| Net cash used in investing activities | |

| (5,474 | ) | |

| (47,473 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| | |

| | | |

| | |

| Repayment of series B debenture | |

| (19,796 | ) | |

| (19,796 | ) |

| Acquisition of non-controlling interest | |

| (3,098 | ) | |

| - | |

| Dividend to non-controlling interest | |

| - | | |

| (47 | ) |

| Net cash used in financing activities | |

| (22,894 | ) | |

| (19,843 | ) |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (147 | ) | |

| 1,497 | |

| | |

| | | |

| | |

| Increase (Decrease) in cash and cash equivalents | |

| (10,027 | ) | |

| (43,631 | ) |

| Cash and cash equivalents at the beginning of period | |

| 126,716 | | |

| 160,285 | |

| | |

| | | |

| | |

| Cash and cash equivalents at the end of period | |

| 116,689 | | |

| 116,654 | |

Debentures Covenants

As of March 31, 2024, Sapiens was in compliance

with all of its financial covenants under the indenture for the Series B Debentures, based on having achieved the following in its consolidated

financial results:

Covenant 1

| § | Target shareholders’ equity (excluding non-controlling interest):

above $120 million. |

| § | Actual shareholders’ equity (excluding non-controlling

interest) equal to $443.5 million. |

Covenant 2

| § | Target ratio of net financial indebtedness to net capitalization

(in each case, as defined under the indenture for the Company’s Series B Debentures) below 65%. |

| § | Actual ratio of net financial indebtedness to net capitalization

equal to (54.35)%. |

Covenant 3

| § | Target ratio of net financial indebtedness to EBITDA (accumulated

calculation for the four last quarters) is below 5.5. |

| § | Actual ratio of net financial indebtedness to EBITDA (accumulated

calculation for the four last quarters) is equal to (1.56). |

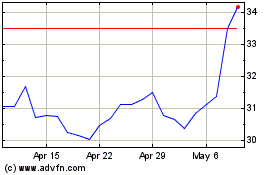

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From Apr 2024 to May 2024

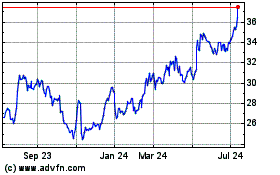

Sapiens International Co... (NASDAQ:SPNS)

Historical Stock Chart

From May 2023 to May 2024