Disney Slashes Streaming Losses, UBS shoots up 9% as profit triples expectations, and More in Earnings

May 07 2024 - 7:46AM

IH Market News

Walt Disney (NYSE:DIS) – In the fiscal second

quarter, Disney exceeded analysts’ earnings estimates, thanks to

reduced losses from its streaming services. The company reported a

17% increase in operating income for the segment, with Disney+ and

Hulu turning a profit for the first time. Disney reported an

adjusted earnings per share of $1.21, surpassing the expected

$1.10. Total revenue amounted to $22.08 billion, slightly below the

projected $22.11 billion. Disney+ subscribers rose to 117.6

million, while Hulu’s grew by 1%. U.S. park revenues increased by

7% and international sales by 29%. Shares fell -1.4% in pre-market

trading.

UBS Group AG (NYSE:UBS) – UBS revealed a

first-quarter net profit of $1.8 billion, nearly tripling analysts’

expectations and boosting shares by 9.0% in pre-market trading. UBS

is increasing its capital reserves by about $20 billion,

integrating Credit Suisse’s businesses. CEO Sergio Ermotti stated

that additional new Swiss regulatory requirements might demand

another $20 billion in additional capital as the country seeks to

strengthen its banking system. Despite Swiss government proposals

that could increase its capital requirements, the bank maintains

its stock repurchase plans.

Palantir Technologies (NYSE:PLTR) – Palantir’s

shares fell 10.2% in pre-market trading after the company projected

lower-than-expected annual and quarterly revenues. Adjusted

earnings for the first quarter met market forecasts at 8 cents per

share. The revenue for the period was $634 million, exceeding the

predicted $625 million. For the next quarter, Palantir expects

revenue between $649 million and $653 million, slightly below the

expected $653 million. For the full year, the revenue forecast is

$2.68 billion to $2.69 billion, below the anticipated $2.71

billion.

Jones Lang LaSalle (NYSE:JLL) – In the first

quarter, JLL reported revenue of $5.1 billion, a 9% increase from

the previous year, beating estimates of $4.675 billion. Net profit

reached $66.1 million, reversing a previous loss of $9.2 million,

surpassing estimates of $46.42 million. Earnings per share were

$1.37, compared to a loss of $0.19 last year, exceeding the

anticipated $0.84. The CEO of JLL highlighted the growing interest

in data centers, driven by the adoption of artificial intelligence

by businesses in the U.S. While commercial real estate markets face

challenges, the demand for data centers reflects rare optimism,

highlighting the intersection between technology and real

estate.

Microchip Technology (NASDAQ:MCHP) –

Microchip’s shares fell 3.7% in pre-market trading after the

company projected revenue for the first quarter between $1.22

billion and $1.26 billion, below the analysts’ expectations of

$1.34 billion, according to LSEG. The company also forecasts

adjusted earnings of 48 to 56 cents per share for the period, which

falls short of the anticipated 59 cents by analysts. In the fourth

quarter, the company reported earnings per share of $0.57 and

revenue of $1.33 billion, aligning with analysts’ projections.

Axon Enterprise (NASDAQ:AXON) – Axon Enterprise

raised its annual revenue projections, now expecting revenue

between $1.94 billion and $1.99 billion in 2024, compared to the

previous forecast of $1.88 billion to $1.94 billion. In the first

quarter, adjusted earnings per share were $1.15 on revenue of $461

million, surpassing analyst estimates of 94 cents EPS and revenue

of $441.6 million. Shares are stable in pre-market trading.

Reddit (NYSE:RDDT) – Reddit will present its

first results post-IPO, focusing on revenue growth. Analysts

anticipate a loss of $8.75 per share and sales of $214 million.

Bank of America expects revenue of $212 million, while Raymond

James projects $215-240 million.

Air Lease Corp (NYSE:AL) – Air Lease Corp faced

delays in plane deliveries from Boeing and Airbus, resulting in a

quarterly profit below expectations at 87 cents per share, compared

to the anticipated 91 cents. Its revenue of $663.3 million fell

short of the forecast of $677.2 million.

Lucid Group (NASDAQ:LCID) – The electric

vehicle manufacturer Lucid saw its shares fall 8.5% in pre-market

trading after disclosing first-quarter 2024 results. The company

reported a loss of 30 cents per share and sales of $173 million,

exceeding Wall Street expectations, which had forecast a loss of 25

cents per share and sales of $154 million. The previous year, Lucid

had recorded a loss of 43 cents per share on sales of $149 million.

Moreover, the company reaffirmed its target to produce about 9,000

vehicles in 2024.

BP plc (NYSE:BP) – BP reported a 40% drop in

first-quarter profit to $2.7 billion, below the previous $3 billion

and the expected $2.9 billion, due to lower energy prices and

disruptions at U.S. refineries. Earnings per share fell short of

estimates, maintaining the dividend and the $3.5 billion share

buyback program for the first half of 2024. Shares dropped 1.8% in

pre-market trading.

Simon Property Group (NYSE:SPG) – Simon

Property Group’s shares are stable in pre-market trading after

reporting earnings per share of $1.44 in the first quarter, beating

analyst expectations by $0.08, who had projected $1.36. The

quarter’s revenue reached $1.44 billion, surpassing the consensus

forecast of $1.31 billion. For the fiscal year 2024, Simon Property

forecasts earnings per share between $7.38 and $7.53, significantly

surpassing analysts’ expectation of $6.13.

International Flavors & Fragrances

(NYSE:IFF) – International Flavors & Fragrances disclosed

first-quarter revenue of $2.9 billion, surpassing the $2.78 billion

estimated by analysts from LSEG. The company also exceeded Wall

Street’s projections with an adjusted earnings per share of $1.13,

surpassing the consensus of $0.86 by $0.27. For 2024, IFF projects

revenue between $10.8 billion and $11.1 billion, with the midpoint

slightly below the expectations of $11.05 billion.

Coty (NYSE:COTY) – Coty exceeded Wall Street’s

expectations for third-quarter revenue, reaching $1.39 billion, an

increase of 7.5%. Adjusted net profit was $43.8 million, or 5

cents, compared to $168.1 million, or 19 cents, in the same period

last year. Its online revenue growth was nearly 20%. Adjusted gross

margin rose to 64.8%. The company expects sales growth of 9% to 11%

in the fiscal year 2024, with adjusted earnings per share between

44 cents and 47 cents.

Hims & Hers Health (NYSE:HIMS) – The

telehealth platform recorded a 14.3% jump in pre-market, driven by

a revenue forecast for the second quarter that exceeded analysts’

expectations. In the first quarter, the company announced a net

profit of $11.1 million, or 5 cents per share, reversing a loss of

$10.1 million, or 5 cents per share, from the previous year.

Earnings exceeded FactSet’s forecast of 1 cent per share. Revenue

grew 46% year-over-year, reaching $278.2 million, surpassing

FactSet’s projection of $270 million. The subscriber count

increased by 41%, reaching about 1.71 million. For the next

quarter, Hims & Hers forecasts revenues between $292 million

and $297 million, above analysts’ expectations of $288 million from

LSEG.

Vertex Pharmaceuticals (NASDAQ:VRTX) – Vertex

reported adjusted earnings of $4.76 per share and revenue of $2.69

billion in the first quarter. These results exceeded analysts’

expectations, who had anticipated earnings of $4.06 per share and

revenue of $2.58 billion, according to LSEG. Vertex reiterated its

financial forecast for 2024, projecting product revenue between

$10.55 billion and $10.75 billion, aligning with the analysts’

consensus of $10.718 billion.

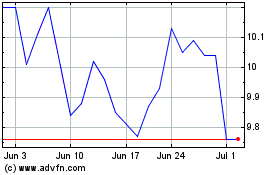

Coty (NYSE:COTY)

Historical Stock Chart

From Apr 2024 to May 2024

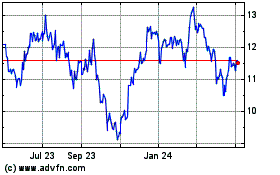

Coty (NYSE:COTY)

Historical Stock Chart

From May 2023 to May 2024