Net Sales Increased 5% and Diluted EPS

Increased to $.91

Organic Net Sales1 Grew 6% and Adjusted

Diluted EPS Increased to $.97

Asia Travel Retail Returned to Net Sales

Growth

Affirms Inflection Point of Net Sales Growth

and Profitability in the Second Half

The Estée Lauder Companies Inc. (NYSE: EL) today reported net

sales of $3.94 billion for its third quarter ended March 31, 2024,

an increase of 5% from $3.75 billion in the prior-year period.

Organic net sales increased 6% primarily due to double-digit growth

in Europe, the Middle East & Africa (“EMEA”), driven by

stronger sales in Asia travel retail. The growth in Asia travel

retail was driven by higher shipments reflecting significant

sequential improvement in retail sales trends and continued

progress in achieving targeted retailer inventory levels as well as

lower shipments in the prior-year period due, in part, to

transitory headwinds. The growth in organic net sales also

reflected increases in several developed and emerging markets in

Asia/Pacific, The Americas and EMEA, including strong double-digit

growth in the Company’s Priority Emerging Markets2. Net sales

increased in nearly all product categories, led by the return to

high-single-digit growth in Skin Care.

The Company reported net earnings of $330 million, compared with

net earnings of $156 million in the prior-year period. The

Company’s reported effective tax rate was 31.1% in the quarter

compared to the elevated rate in the prior-year period of 44.6%.

The decrease in the effective tax rate was primarily driven by a

lower effective tax rate on the Company's foreign operations due to

the timing of the estimated change in the Company's full year

geographical mix of earnings in the current and prior-year periods,

partially offset by the unfavorable impact associated with

previously issued stock-based compensation. Diluted net earnings

per common share was $.91, compared with $.43 reported in the

prior-year period. Excluding restructuring and other charges and

adjustments as detailed on page 2, adjusted diluted net earnings

per common share increased to $.97. The fiscal 2024 third quarter

impact of business disruptions in Israel and other parts of the

Middle East was $.01 dilutive to reported and adjusted net earnings

per common share.

Fabrizio Freda, President and Chief Executive Officer said, “For

the third quarter of fiscal 2024, we delivered our organic sales

outlook, exceeded expectations for profitability and continued to

improve working capital. La Mer, Estée Lauder, Jo Malone London, Le

Labo, and The Ordinary led organic sales growth, driven by beloved

hero products and highly sought innovation. Asia travel retail

returned to organic sales growth, as developed and emerging markets

across Asia/Pacific, EMEA, and Latin America further

contributed.

___________________________________________ 1Organic net sales

represents net sales excluding returns associated with

restructuring and other activities; non-comparable impacts of

acquisitions, divestitures and brand closures; as well as the

impact from foreign currency translation. The Company believes that

the Non-GAAP measure of organic net sales growth provides

year-over-year sales comparisons on a consistent basis. See page 2

for reconciliations to GAAP. 2The Company’s Priority Emerging

Markets by geographic region: The Americas: Brazil and Mexico;

EMEA: India, the Middle East, Turkey and South Africa; and

Asia/Pacific: Thailand, Malaysia, Vietnam, Indonesia and the

Philippines.

During the second half of fiscal 2024, we have strategically

expanded our consumer reach in exciting ways, from Clinique’s debut

on the U.S. Amazon Premium Beauty store, which has greatly exceeded

our retail sales expectations thus far, to striking new flagship

stores in Asia/Pacific for Jo Malone London and Le Labo. We have

also made progress across all work streams for the Profit Recovery

Plan, setting the stage to deliver its $1.1 to $1.4 billion of

incremental operating profit in fiscal years 2025 and 2026 while

also generating funds to reinvest into our brands and

consumer-facing initiatives to accelerate sustainable sales and

profit growth as a faster and leaner organization.”

Freda emphasized, “With our third quarter results and fourth

quarter outlook, we are confident that the second half of fiscal

2024 will prove to be an inflection point for our Company

performance. We expect accelerating momentum in organic sales

growth in the fourth quarter, and for operating margin in the

second half of fiscal 2024 to not only be stronger than the first

half but also to expand from the year-ago period.”

Fiscal 2024 Third Quarter

Results Reported net sales increased 5%, including

royalty revenue from the fiscal 2023 fourth quarter acquisition of

the TOM FORD brand and the impact from foreign currency

translation.

Reconciliation between GAAP

and Non-GAAP Net Sales Growth (Unaudited)

Three Months Ended March 31,

2024(1)

As Reported - GAAP

5.0

%

Impact of royalty revenue from the

acquisition of the TOM FORD brand

(0.4

)

Impact of foreign currency translation

1.4

Returns associated with restructuring and

other activities

(0.1

)

Organic, Non-GAAP

5.9

%

(1)Percentages are calculated on an

individual basis

Adjusted diluted net earnings per common share excludes

restructuring and other charges and adjustments as detailed in the

following table.

Reconciliation between GAAP

and Non-GAAP - Diluted Net Earnings Per Common Share (“EPS”)

(Unaudited)

Three Months Ended

March 31

2024

2023

Growth

As Reported EPS - GAAP

$

.91

$

.43

100

+%

Non-GAAP

Restructuring and other charges

.04

.04

Change in fair value of

acquisition-related stock options (less the portion attributable

to

redeemable noncontrolling interest)

.02

—

Adjusted EPS - Non-GAAP

$

.97

$

.47

100

+%

Impact of foreign currency translation on

earnings per share

.05

Adjusted Constant Currency EPS -

Non-GAAP

$

1.02

$

.47

100

+%

Total reported operating income was $531 million, a 79% increase

from $297 million in the prior-year period. In constant currency,

adjusted operating income increased 83%, primarily reflecting

higher net sales and lower cost of sales, excluding the following

items:

- Fiscal 2024 third quarter: $23 million restructuring and other

charges and adjustments.

- Fiscal 2023 third quarter: $19 million of restructuring and

other charges and adjustments.

- The unfavorable impact of foreign currency translation of $25

million.

During the fiscal 2024 second quarter, the Company identified

and corrected prior-period misclassifications of net sales and

operating income between certain of its product categories. As a

result, product category net sales and operating income have been

adjusted from the amounts previously reported for the three and

nine months ended March 31, 2023 for comparability purposes.

Presentation of product category net sales and operating income for

the fiscal years ended June 30, 2023 and 2022, will also be

adjusted to reflect the misclassifications arising in those periods

for comparability purposes within the prospective filing. The

misclassifications had no impact on the current-period or

prior-period consolidated statements of earnings, consolidated

statements of comprehensive income, consolidated balance sheets, or

the consolidated statements of cash flows, and the Company

determined that the impact on its current-period and previously

issued financial statements for the respective periods was not

material. See the Q2 Quarterly Earnings section of the Company’s

website for supplemental information relating to the impacts of

these misclassifications.

Results by Product Category

(Unaudited)

Three Months Ended March

31

Net Sales

Percentage Change(1)

Operating Income

(Loss)

Percentage Change

($ in millions)

2024

2023

Reported Basis

Impact of Royalty Revenue from

the Acquisition of the TOM FORD Brand

Impact of Foreign Currency

Translation

Organic Net Sales

(Non-GAAP)

2024

2023

Reported Basis

Skin Care

$

2,060

$

1,915

8

%

—

%

2

%

9

%

$

468

$

269

74

%

Makeup

1,136

1,104

3

—

1

4

66

(5

)

100

+

Fragrance

575

577

—

—

1

1

29

66

(56

)

Hair Care

143

148

(3

)

—

(1

)

(4

)

(25

)

(24

)

(4

)

Other

26

11

100

+

(100

+)

9

—

11

9

22

Subtotal

$

3,940

$

3,755

5

%

—

%

1

%

6

%

$

549

$

315

74

%

Returns/charges

associated with

restructuring and

other activities

—

(4

)

(18

)

(18

)

Total

$

3,940

$

3,751

5

%

—

%

1

%

6

%

$

531

$

297

79

%

Non-GAAP Adjustments to As Reported

Operating Income:

Returns/charges associated with

restructuring and other activities

18

18

Skin Care - Changes in fair value of

acquisition-related stock options

5

1

Adjusted Operating Income -

Non-GAAP

$

554

$

316

75

%

(1)Percentages are calculated on an

individual basis. Refer to the Reconciliation between GAAP and

Non-GAAP Net Sales Growth on page 2 for additional detail on the

organic impacts to reported net sales.

The product category net sales commentary below reflects organic

performance, which excludes the negative (positive) impacts

reflected in the preceding table.

Skin Care

- Skin Care net sales increased 9%, due to growth in every

geographic region. Double-digit growth in EMEA was driven by

stronger sales in Asia travel retail. The growth in Asia travel

retail was driven by higher shipments reflecting significant

sequential improvement in retail sales trends and continued

progress in achieving targeted retailer inventory levels as well as

lower shipments in the prior-year period due, in part, to

transitory headwinds.

- Net sales from La Mer rose strong double digits globally,

driven by double-digit growth in EMEA and Asia/Pacific, benefiting

from continued strength from hero products, including The Treatment

Lotion, Crème de la Mer and The Concentrate, and new product

innovation, such as The Moisturizing Fresh Cream.

- Estée Lauder net sales grew mid-single digits, primarily due to

the Advanced Night Repair and Revitalizing Supreme product

franchises and benefiting from new product innovation, including

Re-Nutriv Ultimate Diamond Transformative Brilliance Soft Creme

Moisturizer primarily in mainland China.

- Skin Care operating income increased, primarily reflecting the

growth in net sales as well as the decrease in obsolescence charges

compared to the prior-year period primarily due to less inventory

on hand reflecting the Company’s progress to reduce excess.

Makeup

- Makeup net sales increased 4%, primarily benefiting from growth

in the Company’s travel retail business as well as strong

double-digit growth in Latin America and Korea. Partially

offsetting these increases was a benefit in the prior-year period

as a result of changes to M·A·C’s take-back loyalty program.

- Estée Lauder net sales grew strong double digits, reflecting

growth across all geographic regions and continued success from the

Double Wear product franchise.

- Net sales from Clinique rose double digits globally, with

growth across all geographic regions, benefiting from continued

strength across the eye, face and lip subcategories.

- Makeup operating results increased, primarily reflecting net

sales growth and disciplined expense management.

Fragrance

- Fragrance net sales grew 1%. Net sales from the Company’s

luxury brands increased mid-single digits, reflecting growth across

all geographic regions, partially offset by a decline from Estée

Lauder.

- Jo Malone London net sales increased high-single digits, led by

strong double-digit growth in EMEA and The Americas, primarily

driven by hero product franchises, including English Pear and Wood

Sage & Sea Salt and new product innovation, such as Red

Hibiscus.

- Net sales from Le Labo rose strong double digits globally and

in Asia/Pacific, primarily driven by continued success of hero

product franchises, such as Santal 33 and Another 13, and benefited

from targeted expanded consumer reach globally.

- Estée Lauder net sales declined, primarily due to softer retail

sales during holiday and key shopping moments that led to lower

shipments for replenishment orders compared to the prior-year

period.

- Fragrance operating income declined, primarily driven by

strategic investments, including for targeted expanded consumer

reach globally as well as advertising and promotional activities,

to support growth of the Company’s luxury brands.

Hair Care

- Hair Care net sales decreased 4%, primarily driven by Aveda

reflecting softness in the Company’s North America salon

channel.

- Hair Care operating results decreased, driven by the decline in

net sales, partially offset by disciplined expense management.

Results by Geographic

Region (Unaudited)

Three Months Ended March

31

Net Sales

Percentage Change(1)

Operating Income

(Loss)

Percentage

Change

($ in millions)

2024

2023

Reported Basis

Impact of Royalty

Revenue

from the Acquisition of the

TOM FORD Brand

Impact of Foreign Currency

Translation

Organic Net Sales

(Non-GAAP)

2024

2023

Reported Basis

The Americas

$

1,117

$

1,089

3

%

(1

)%

—

%

1

%

$

(6

)

$

(93

)

94

%

Europe, the

Middle East &

Africa

1,647

1,474

12

—

—

12

302

176

72

Asia/Pacific

1,176

1,192

(1

)

—

5

3

253

232

9

Subtotal

$

3,940

$

3,755

5

%

—

%

1

%

6

%

$

549

$

315

74

%

Returns/charges

associated with

restructuring and

other activities

—

(4

)

(18

)

(18

)

Total

$

3,940

$

3,751

5

%

—

%

1

%

6

%

$

531

$

297

79

%

Non-GAAP Adjustments to As Reported

Operating Income:

Returns/charges associated with

restructuring and other activities

18

18

The Americas - Changes in fair value of

acquisition-related stock options

5

1

Adjusted Operating Income -

Non-GAAP

$

554

$

316

75

%

(1)Percentages are calculated on an

individual basis. Refer to the Reconciliation between GAAP and

Non-GAAP Net Sales Growth on page 2 for additional detail on the

organic impacts to reported net sales.

The geographic region net sales commentary below reflects

organic performance, which excludes the negative/(positive) impacts

reflected in the preceding table.

The Americas

- Net sales increased 1%. In Latin America, net sales grew double

digits and were flat in North America.

- In Latin America, net sales continued to be fueled by strong

double-digit growth in Mexico and Brazil, particularly in

Makeup.

- Net sales performance in North America reflected growth in

Fragrance, led by the Company’s luxury brands, and in Skin Care,

led by Estée Lauder and The Ordinary, offset by declines in Makeup,

attributed to a benefit in the prior-year period as a result of

changes to M·A·C’s take-back loyalty program, and in Hair Care, due

to Aveda softness as previously mentioned. The performance in North

America also reflected double-digit growth in specialty-multi,

partially offset by declines in other channels of distribution,

primarily department stores. Online net sales in the fiscal 2024

third quarter benefited from Clinique’s launch on the U.S. Amazon

Premium Beauty store.

- Operating results in The Americas increased, primarily

reflecting $86 million of higher intercompany royalty income due to

the increase in income from the Company’s travel retail business

and higher net sales, partially offset by strategic investments in

advertising and promotional activities to accelerate growth. The

increase also reflects an unfavorable year-over-year comparison in

adjustments to stock-based compensation expense related to the

Company’s performance share awards.

Europe, the Middle East &

Africa

- Net sales increased 12%, primarily due to the Company’s travel

retail business, reflecting double-digit growth in Skin Care and

Makeup.

- Travel retail net sales increased strong double digits, led by

double-digit growth in Skin Care and Makeup, driven by stronger

sales in Asia travel retail. The growth in Asia travel retail was

driven by higher shipments reflecting significant sequential

improvement in retail sales trends and continued progress in

achieving targeted retailer inventory levels as well as lower

shipments in the prior-year period due, in part, to transitory

headwinds.

- Net sales in the Company’s Priority Emerging Markets in the

region increased strong double digits, while net sales growth was

flat in the developed markets, reflecting increases in Nordic,

Italy and Germany, offset by declines in other markets, led by the

United Kingdom.

- Operating income increased, driven by higher net sales and

disciplined expense management, partially offset by $86 million of

higher intercompany royalty expense due to the increase in income

from the Company’s travel retail business.

Asia/Pacific

- Net sales increased 3%, led by Hong Kong SAR, mainland China

and Japan, reflecting growth in Skin Care and Fragrance.

- In Hong Kong SAR, net sales rose strong double digits, led by

Skin Care, driven by the increase in traveling consumers compared

to the prior-year period. This increase led to growth in the

Company’s freestanding stores that more than doubled.

- Mainland China net sales grew low single digits, due to strong

double-digit growth in January 2024 compared to the prior-year

period, which was challenged by a rise in COVID-19 cases. This

growth was partially offset by the ongoing softness in overall

prestige beauty in mainland China reflecting subdued consumer

confidence and softness during holiday and key shopping

moments.

- Net sales in Japan increased double digits, led by double-digit

growth in Fragrance, driven by domestic and traveling consumers,

which fueled growth in nearly all channels of distribution, led by

freestanding stores.

- Operating income increased, primarily driven by disciplined

expense management, partially offset by strategic investments to

support distribution expansion of the Company’s freestanding

stores.

Nine-Months Results

- For the nine months ended March 31, 2024, the Company reported

net sales of $11.74 billion, a 5% decrease compared with $12.30

billion in the prior-year period. Organic net sales decreased 5%,

primarily driven by Asia travel retail and mainland China.

- The Company’s reported effective tax rate was 33.9% for the

nine months ended March 31, 2024, compared to 27.9% in the

prior-year period. The increase in rate reflects a higher effective

tax rate on the Company’s foreign operations, due to the change in

the Company’s geographical mix of earnings for fiscal 2024, as well

as the unfavorable impact from previously issued stock-based

compensation.

- Net earnings were $674 million, and diluted net earnings per

common share was $1.87. In the prior-year nine months, the Company

reported net earnings of $1,039 million and diluted net earnings

per common share of $2.88.

- During the nine months ended March 31, 2024, the Company

recorded restructuring and other charges and change in fair value

of acquisition-related stock options, that, combined, resulted in

an unfavorable impact of $36 million ($29 million less the portion

attributable to redeemable noncontrolling interest and net of tax),

equal to $.08 per diluted share, as detailed on page 15. The

cybersecurity incident disclosed in July 2023 was dilutive to

fiscal 2024 year-to-date net earnings per common share by $.08. The

prior-year period results include restructuring and other charges,

other intangible asset impairments, and change in fair value of

acquisition-related stock options, that, combined, resulted in an

unfavorable impact of $238 million ($182 million less the portion

attributable to redeemable noncontrolling interest and net of tax),

equal to $.50 per diluted share.

- Excluding restructuring and other charges and adjustments

referred to in the previous bullet, adjusted diluted net earnings

per common share for the nine months ended March 31, 2024 was

$1.95, and declined 40% in constant currency. For the nine months

ended March 31, 2024, the unfavorable impact of foreign currency

translation on adjusted diluted net earnings per common share was

$.08.

Cash Flows

- For the nine months ended March 31, 2024, net cash flows

provided by operating activities were $1.47 billion, compared with

$1.02 billion in the prior-year period. This increase reflects

lower working capital, primarily due to the improvement in

inventory, partially offset by lower earnings before taxes.

- Capital Expenditures increased to $702 million from $652

million in the prior-year period primarily due to timing of

payments relating to the manufacturing facility in Japan as it

nears completion.

- The Company ended the quarter with $3.70 billion in cash and

cash equivalents and paid dividends of $0.71 billion.

- In February 2024, the Company completed a public offering of

$650 million aggregate principal amount of its 5.000% Senior Notes.

The Company intends to use the net proceeds from this offering for

general corporate purposes, which may include funding a portion of

the purchase price for the remaining interest in DECIEM.

Outlook for Fiscal 2024 Fourth Quarter

and Full Year The Company remains focused on

re-establishing sustainable, profitable long-term growth across

regions, product categories, brands and channels. Given the

Company’s fiscal 2024 third quarter results and fourth quarter

outlook, it remains confident in its renewed net sales and profit

growth trajectory. For the full-year fiscal 2024 outlook, amid

ongoing macroeconomic headwinds, including continued softness in

overall prestige beauty in mainland China, and geopolitical

volatility in some areas around the world, the Company is reducing

its organic net sales outlook range and both increasing and

tightening its adjusted diluted net earnings per common share

range, partially offset by an expected unfavorable impact from

foreign currency translation. With these revisions, the Company is

maintaining its adjusted full-year operating margin outlook.

The Company plans to continue to strategically invest in

consumer-facing activities in areas to support sales growth, share

gains and long-term profitable growth. These investments include

innovation, advertising, growth of its emerging markets and the

completion of its first manufacturing facility in Asia, located in

Japan, to support the development of the regionalization of the

supply chain in the Asia/Pacific region.

Leveraging the progress the Company has made through the fiscal

2024 third quarter, its full year outlook reflects the following

assumptions and expectations:

- Acceleration of organic net sales growth in the fiscal 2024

fourth quarter and high-single-digit growth in the second

half.

- In Asia travel retail, a continuation of net sales growth in

the fiscal 2024 fourth quarter, as well as investments to drive

retail sales, following meaningful progress made through the third

quarter.

- Clinique doubling down in Active Derma with new campaigns in

the United States and the United Kingdom in the second half of

fiscal 2024.

- Gross margin expansion in the second half of fiscal 2024

compared to the prior-year period.

- Stronger operating margin in the second half of fiscal 2024

compared to the first half, with expansion compared to the

prior-year period.

- Full year effective tax rate of approximately 35%, largely due

to the estimated geographical mix of earnings in fiscal 2024.

- Improvements in the Company’s inventory balance and days to

sell for fiscal year 2024.

Fiscal 2025 and 2026 Profit Recovery Plan The Company is

in the initial stages of executing its Profit Recovery Plan to

rebuild stronger, more sustainable profitability, support sales

growth acceleration and increase speed and agility. The plan is

designed to improve gross margin, lower the cost base, and reduce

overhead expenses, while increasing investments in key

consumer-facing activities. Upon completion of this plan, the

Company expects to have improved its gross margin and expense base

to drive greater operating leverage for the future.

The Company continues to expect to drive incremental operating

profit through the initiatives in the Profit Recovery Plan of $1.1

billion to $1.4 billion, including net benefits from the

restructuring program. The plan is anticipated to enable the

realization of nearly all of the expected benefits in fiscal years

2025 and 2026, slightly more than half of which is expected to

benefit fiscal 2025 operating profitability.

The Company remains optimistic about the long-term prospects and

future growth opportunities in global prestige beauty. As part of

this plan, the Company expects to increase its investments in the

strong equity and desirability of its brands to drive sustainable

growth, and believes it is well-positioned to drive better

diversified growth across its portfolio.

The Company continues to monitor the effects of the global macro

environment, including the risk of recession; currency volatility;

inflationary pressures; supply chain challenges; social and

political issues; regulatory matters, including the imposition of

tariffs and sanctions; geopolitical tensions; and global security

issues. The Company is also mindful of inflationary pressures on

its cost base and is monitoring the impact on consumer

preferences.

Fourth Quarter Fiscal 2024

Sales Outlook

- Reported net sales are forecasted to increase between 5% and 9%

versus the prior-year period.

- Currency exchange rates are volatile and difficult to predict.

Using March 29, 2024 spot rates for the fourth quarter of fiscal

2024, the Company expects a 1% headwind due to foreign currency

translation.

- Organic net sales are forecasted to increase between 6% and

10%.

Earnings per Share Outlook

- Reported diluted net earnings per common share are projected to

be between $.11 and $.22. Excluding restructuring and other charges

and adjustments, diluted net earnings per common share are

projected to be between $.18 and $.28.

- The combined impact from the increases in the Company’s net

interest expense and effective tax rate is expected to dilute net

earnings per common share by $.21.

- The Company expects to take charges associated with previously

approved restructuring and other activities. For the Restructuring

Program Component of the Profit Recovery Plan, the charges are

estimated to be between approximately $25 million to $30 million,

equal to $.05 to $.06 per diluted common share.

- The potential risks of further business disruptions in Israel

and other parts of the Middle East are expected to have a dilutive

impact to net earnings per common share of $.03.

- Adjusted diluted net earnings per common share are expected to

increase over 100% and range between $.19 and $.29 on a constant

currency basis.

- Currency exchange rates are volatile and difficult to predict.

Using March 29, 2024 spot rates for fiscal 2024, the foreign

currency translation impact equates to about $.01 of dilution to

earnings per common share.

Full Year Fiscal 2024

Sales Outlook

- Reported net sales are forecasted to decrease between 3% and 2%

versus the prior-year period.

- Currency exchange rates are volatile and difficult to predict.

Using March 29, 2024 spot rates for the full year, the Company

expects a 1% headwind due to foreign currency translation.

- Organic net sales are forecasted to decrease between 2% and

1%.

Earnings per Share Outlook

- Reported diluted net earnings per common share are projected to

be between $1.96 and $2.09. Excluding restructuring and other

charges and adjustments, diluted net earnings per common share are

projected to be between $2.14 and $2.24.

- The combined impact from the increases in the Company’s net

interest expense and effective tax rate is expected to dilute net

earnings per common share by $.48.

- The Company expects to take charges associated with previously

approved restructuring and other activities. For the Restructuring

Program Component of the Profit Recovery Plan, the charges are

estimated to be between approximately $45 million to $55 million,

equal to $.10 to $.12 per diluted common share.

- The potential risks of further business disruptions in Israel

and other parts of the Middle East are expected to have a dilutive

impact to net earnings per common share of $.06.

- Adjusted diluted net earnings per common share are expected to

decrease between 36% and 33% on a constant currency basis.

- Currency exchange rates are volatile and difficult to predict.

Using March 29, 2024 spot rates for fiscal 2024, the foreign

currency translation impact equates to about $.09 of dilution to

earnings per common share.

Reconciliation between GAAP

and Non-GAAP - Net Sales Growth (Unaudited)

Three Months Ending

Twelve Months Ending

June 30, 2024(F)

June 30, 2024(F)

As Reported - GAAP

5% - 9

%

(3%) - (2

%)

Impact of royalty revenue from the

acquisition of the TOM FORD brand

—

—

Impact of foreign currency translation

1

1

Returns associated with restructuring and

other activities

—

—

Organic, Non-GAAP

6% - 10

%

(2%) - (1

%)

(F)Represents forecast

Reconciliation between GAAP

and Non-GAAP - Diluted Net Earnings Per Common Share (“EPS”)

(Unaudited)

Three Months Ending

Twelve Months Ending

June 30

June 30

2024(F)

2023

Growth

2024(F)

2023

Growth

Forecasted/As Reported EPS -

GAAP

$.11 - $.22

$

(.09

)

100

+%

$1.96 - $2.09

$

2.79

(30%) - (25

%)

Non-GAAP

Restructuring and other charges

.06 - .07

.11

.12 - .15

.18

Change in fair value of

acquisition-related

stock options (less the portion

attributable

to redeemable noncontrolling interest)

—

.05

.03

.05

Other intangible asset impairments

—

—

—

.44

Forecasted/Adjusted EPS -

Non-GAAP

$.18 - $.28

$

.07

100

+%

$2.14 - $2.24

$

3.46

(38%) - (35

%)

Impact of foreign currency translation

.01

.09

Forecasted/Adjusted Constant

Currency

EPS - Non-GAAP

$.19 - $.29

$

.07

100

+%

$2.23 - $2.33

$

3.46

(36%) - (33

%)

(F)Represents forecast

Conference Call The Estée

Lauder Companies will host a conference call at 9:30 a.m. (ET)

today, May 1, 2024 to discuss its results. The dial-in

number for the call is 877-883-0383 in the U.S. or 412-902-6506

internationally (conference ID number: 1189173). The call will also

be webcast live at

http://www.elcompanies.com/investors/events-and-presentations.

Cautionary Note Regarding

Forward-Looking Statements

Statements in this press release, in particular those in

“Outlook,” as well as remarks by the CEO and other members of

management, may constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements may address the Company’s expectations regarding

sales, earnings or other future financial performance and

liquidity, other performance measures, product introductions, entry

into new geographic regions, information technology initiatives,

new methods of sale, the Company’s long-term strategy,

restructuring and other charges and resulting cost savings, and

future operations or operating results. These statements may

contain words like “expect,” “will,” “will likely result,” “would,”

“believe,” “estimate,” “planned,” “plans,” “intends,” “may,”

“should,” “could,” “anticipate,” “estimate,” “project,”

“projected,” “forecast,” and “forecasted” or similar expressions.

Although the Company believes that its expectations are based on

reasonable assumptions within the bounds of its knowledge of its

business and operations, actual results may differ materially from

the Company’s expectations.

Factors that could cause actual results to differ from expectations

include, without limitation:

(1)

increased competitive activity from

companies in the skin care, makeup, fragrance and hair care

businesses;

(2)

the Company’s ability to develop, produce

and market new products on which future operating results may

depend and to successfully address challenges in the Company’s

business;

(3)

consolidations, restructurings,

bankruptcies and reorganizations in the retail industry causing a

decrease in the number of stores that sell the Company’s products,

an increase in the ownership concentration within the retail

industry, ownership of retailers by the Company’s competitors or

ownership of competitors by the Company’s customers that are

retailers and the Company’s inability to collect receivables;

(4)

destocking and tighter working capital

management by retailers;

(5)

the success, or changes in timing or

scope, of new product launches and the success, or changes in

timing or scope, of advertising, sampling and merchandising

programs;

(6)

shifts in the preferences of consumers as

to where and how they shop;

(7)

social, political and economic risks to

the Company’s foreign or domestic manufacturing, distribution and

retail operations, including changes in foreign investment and

trade policies and regulations of the host countries and of the

United States;

(8)

changes in the laws, regulations and

policies (including the interpretations and enforcement thereof)

that affect, or will affect, the Company’s business, including

those relating to its products or distribution networks, changes in

accounting standards, tax laws and regulations, environmental or

climate change laws, regulations or accords, trade rules and

customs regulations, and the outcome and expense of legal or

regulatory proceedings, and any action the Company may take as a

result;

(9)

foreign currency fluctuations affecting

the Company’s results of operations and the value of its foreign

assets, the relative prices at which the Company and its foreign

competitors sell products in the same markets and the Company’s

operating and manufacturing costs outside of the United States;

(10)

changes in global or local conditions,

including those due to volatility in the global credit and equity

markets, natural or man-made disasters, real or perceived

epidemics, supply chain challenges, inflation, or increased energy

costs, that could affect consumer purchasing, the willingness or

ability of consumers to travel and/or purchase the Company’s

products while traveling, the financial strength of the Company’s

customers, suppliers or other contract counterparties, the

Company’s operations, the cost and availability of capital which

the Company may need for new equipment, facilities or acquisitions,

the returns that the Company is able to generate on its pension

assets and the resulting impact on funding obligations, the cost

and availability of raw materials and the assumptions underlying

the Company’s critical accounting estimates;

(11)

impacts attributable to the COVID-19

pandemic, including disruptions to the Company’s global

business;

(12)

shipment delays, commodity pricing,

depletion of inventory and increased production costs resulting

from disruptions of operations at any of the facilities that

manufacture the Company’s products or at the Company’s distribution

or inventory centers, including disruptions that may be caused by

the implementation of information technology initiatives, or by

restructurings;

(13)

real estate rates and availability, which

may affect the Company’s ability to increase or maintain the number

of retail locations at which the Company sells its products and the

costs associated with the Company’s other facilities;

(14)

changes in product mix to products which

are less profitable;

(15)

the Company’s ability to acquire, develop

or implement new information technology, including operational

technology and websites, on a timely basis and within the Company’s

cost estimates; to maintain continuous operations of its new and

existing information technology; and to secure the data and other

information that may be stored in such technologies or other

systems or media;

(16)

the Company’s ability to capitalize on

opportunities for improved efficiency, such as publicly-announced

strategies and restructuring and cost-savings initiatives, and to

integrate acquired businesses and realize value therefrom;

(17)

consequences attributable to local or

international conflicts around the world, as well as from any

terrorist action, retaliation and the threat of further action or

retaliation;

(18)

the timing and impact of acquisitions,

investments and divestitures; and

(19)

additional factors as described in the

Company’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

June 30, 2023.

The Company assumes no responsibility to update

forward-looking statements made herein or otherwise.

The Estée Lauder Companies Inc. is one of the world’s leading

manufacturers, marketers and sellers of quality skin care, makeup,

fragrance and hair care products, and is a steward of luxury and

prestige brands globally. The Company’s products are sold in

approximately 150 countries and territories under brand names

including: Estée Lauder, Aramis, Clinique, Lab Series, Origins,

M·A·C, La Mer, Bobbi Brown Cosmetics, Aveda, Jo Malone London,

Bumble and bumble, Darphin Paris, TOM FORD, Smashbox, AERIN Beauty,

Le Labo, Editions de Parfums Frédéric Malle, GLAMGLOW, KILIAN

PARIS, Too Faced, Dr.Jart+, and the DECIEM family of brands,

including The Ordinary and NIOD.

ELC-F ELC-E

CONSOLIDATED STATEMENT OF

EARNINGS (Unaudited)

Three Months Ended

March 31

Percentage

Change

Nine Months Ended March

31

Percentage Change

($ in millions, except per share data)

2024

2023

2024

2023

Net sales(A)

$

3,940

$

3,751

5

%

$

11,737

$

12,301

(5

)%

Cost of sales(A)

1,107

1,159

(4

)

3,331

3,401

(2

)

Gross profit

2,833

2,592

9

8,406

8,900

(6

)

Gross margin

71.9

%

69.1

%

71.6

%

72.4

%

Operating expenses

Selling, general and administrative(B)

2,284

2,281

—

7,177

7,155

—

Restructuring and other charges(A)

18

14

29

26

24

8

Impairment of other intangible

assets(C)

—

—

—

—

207

(100

)

Total operating expenses

2,302

2,295

—

7,203

7,386

(2

)

Operating expense margin

58.4

%

61.2

%

61.4

%

60.0

%

Operating income

531

297

79

1,203

1,514

(21

)

Operating income margin

13.5

%

7.9

%

10.2

%

12.3

%

Interest expense

94

58

62

287

156

84

Interest income and investment income,

net

45

37

22

126

78

62

Other components of net periodic benefit

cost

(4

)

(4

)

—

(9

)

(9

)

—

Earnings before income taxes

486

280

74

1,051

1,445

(27

)

Provision for income taxes

151

125

21

356

403

(12

)

Net earnings

335

155

100

+

695

1,042

(33

)

Net loss (earnings) attributable to

redeemable noncontrolling interest

(5

)

1

(100

+)

(21

)

(3

)

(100

+)

Net earnings attributable to The Estée

Lauder

Companies Inc.

$

330

$

156

100

+%

$

674

$

1,039

(35

)%

Net earnings attributable to The Estée

Lauder

Companies Inc. per common share

Basic

$

.92

$

.44

100

+%

$

1.88

$

2.90

(35

)%

Diluted

$

.91

$

.43

100

+%

$

1.87

$

2.88

(35

)%

Weighted-average common shares

outstanding

Basic

359.1

357.9

358.8

357.8

Diluted

360.8

361.2

360.4

360.9

(A)As a component of the Profit Recovery

Plan communicated on November 1, 2023, on February 5, 2024, we

announced a two-year restructuring program. The restructuring

program’s main focus includes the reorganization and rightsizing of

certain areas of our business as well as simplification and

acceleration of processes. We plan to substantially complete

specific initiatives under the restructuring program through fiscal

2026. We expect that the restructuring program will result in

restructuring and other charges totaling between $500 million and

$700 million, before taxes, consisting of employee-related costs,

contract terminations, asset write-offs and other costs associated

with implementing these initiatives.

The Company approved specific initiatives

under the Post-COVID Business Acceleration Program (the “PCBA

Program”) through fiscal 2022 and has substantially completed those

initiatives through fiscal 2023. Additional information about the

PCBA Program is included in the notes to consolidated financial

statements in the Company’s Annual Report on Form 10-K for the

fiscal year ended June 30, 2023.

(B)For the three and nine months ended

March 31, 2024, the Company recorded $5 million ($5 million, less

the portion attributable to redeemable noncontrolling interest and

net of tax) and $8 million ($7 million, less the portion

attributable to redeemable noncontrolling interest and net of tax),

respectively, of expense related to the change in fair value of

acquisition-related stock options related to DECIEM, and recorded

$1 million ($1 million, less the portion attributable to redeemable

noncontrolling interest and net of tax), and $(2) million ($(2)

million, less the portion attributable to redeemable noncontrolling

interest and net of tax) of expense (income) for the three and nine

months ended March 31, 2023, respectively.

(C)During the fiscal 2023 second quarter,

given the lower-than-expected results in the overall business, the

Company revised the internal forecasts relating to its Smashbox

reporting unit. The Company concluded that the changes in

circumstances in the reporting unit triggered the need for an

interim impairment review of its trademark intangible asset. The

remaining carrying value of the trademark intangible asset was not

recoverable and the Company recorded an impairment charge of $21

million reducing the carrying value to zero.

During the fiscal 2023 second quarter, the

Dr.Jart+ reporting unit experienced lower-than-expected growth

within key geographic regions and channels that continue to be

impacted by the spread of COVID-19 variants, resurgence in cases,

and the potential future impacts relating to the uncertainty of the

duration and severity of COVID-19 impacting the financial

performance of the reporting unit. In addition, due to

macro-economic factors, Dr.Jart+ has experienced

lower-than-expected growth within key geographic regions. The Too

Faced reporting unit experienced lower-than-expected results in key

geographic regions and channels coupled with delays in future

international expansion to areas that continue to be impacted by

COVID-19. As a result, the Company revised the internal forecasts

relating to its Dr.Jart+ and Too Faced reporting units.

Additionally, there were increases in the weighted average cost of

capital for both reporting units as compared to the prior year

annual goodwill and other indefinite-lived intangible asset

impairment testing as of April 1, 2022.

The Company concluded that the changes in

circumstances in the reporting units, along with increases in the

weighted average cost of capital, triggered the need for interim

impairment reviews of their trademarks and goodwill. These changes

in circumstances were also an indicator that the carrying amounts

of Dr.Jart+’s and Too Faced’s long-lived assets, including customer

lists, may not be recoverable. Accordingly, the Company performed

interim impairment tests for the trademarks and a recoverability

test for the long-lived assets as of November 30, 2022. The Company

concluded that the carrying value of the trademark intangible

assets exceeded their estimated fair values, which were determined

utilizing the relief-from-royalty method to determine discounted

projected future cash flows and recorded an impairment charge of

$100 million for Dr.Jart+ and $86 million for Too Faced. The

Company concluded that the carrying amounts of the long-lived

assets were recoverable. After adjusting the carrying values of the

trademarks, the Company completed interim quantitative impairment

tests for goodwill. As the estimated fair value of the Dr.Jart+ and

Too Faced reporting units were in excess of their carrying values,

the Company concluded that the carrying amounts of the goodwill

were recoverable and did not record a goodwill impairment charge

related to these reporting units. The fair values of these

reporting units were based upon an equal weighting of the income

and market approaches, utilizing estimated cash flows and a

terminal value, discounted at a rate of return that reflects the

relative risk of the cash flows, as well as valuation multiples

derived from comparable publicly traded companies that are applied

to operating performance of the reporting units. The significant

assumptions used in these approaches include revenue growth rates

and profit margins, terminal values, weighted average cost of

capital used to discount future cash flows and royalty rates for

trademarks. The most significant unobservable input used to

estimate the fair values of the Dr.Jart+ and Too Faced trademark

intangible assets was the weighted average cost of capital, which

was 11% and 13%, respectively.

For the nine months ended March 31, 2023,

other intangible asset impairment charges were $207 million ($159

million, net of tax), with an impact of $.44 per common share.

Returns and Charges Associated

With Restructuring and Other Activities and Other Adjustments

(Unaudited)

Three Months Ended March 31,

2024

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

PCBA Program

$

—

$

—

$

—

$

1

$

1

$

1

$

—

Restructuring Program Component of

Profit

Recovery Plan

—

—

6

11

17

13

.04

Change in fair value of

acquisition-related

stock options

—

—

—

5

5

5

.02

Total

$

—

$

—

$

6

$

17

$

23

$

19

$

.06

Nine Months Ended March 31,

2024

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

PCBA Program

$

1

$

1

$

4

$

5

$

11

$

9

$

.02

Restructuring Program Component of

Profit

Recovery Plan

—

—

6

11

17

13

.04

Change in fair value of

acquisition-related

stock options

—

—

—

8

8

7

.02

Total

$

1

$

1

$

10

$

24

$

36

$

29

$

.08

Three Months Ended March 31,

2023

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

—

$

3

$

1

$

4

$

4

$

.01

PCBA Program

4

—

6

4

14

10

.03

Change in fair value of

acquisition-related

stock options

—

—

—

1

1

1

—

Total

$

4

$

—

$

9

$

6

$

19

$

15

$

.04

Nine Months Ended March 31,

2023

Sales Returns

Cost of Sales

Operating Expenses

Total

After Redeemable

Noncontrolling Interest and Tax

Diluted EPS

(In millions, except per share data)

Restructuring Charges

Other Charges/

Adjustments

Leading Beauty Forward

$

—

$

—

$

1

$

4

$

5

$

5

$

.01

PCBA Program

10

(1

)

12

7

28

20

.06

Change in fair value of

acquisition-related

stock options

—

—

—

(2

)

(2

)

(2

)

(.01

)

Other intangible asset impairments

—

—

—

207

207

159

.44

Total

$

10

$

(1

)

$

13

$

216

$

238

$

182

$

.50

Results by Product Category

(Unaudited)

Nine Months Ended March

31

Net Sales

Percentage Change(1)

Operating Income

(Loss)

Percentage Change

($ in millions)

2024

2023

Reported Basis

Impact of Royalty Revenue from

the Acquisition of the TOM FORD Brand

Impact of Foreign Currency

Translation

Organic Net Sales

(Non-GAAP)

2024

2023

Reported Basis

Skin Care

$

5,873

$

6,454

(9

)%

—

%

1

%

(8

)%

$

920

$

1,238

(26

)%

Makeup

3,365

3,424

(2

)

—

—

(2

)

56

(9

)

100

+

Fragrance

1,948

1,907

2

—

—

2

267

343

(22

)

Hair Care

464

488

(5

)

—

(1

)

(6

)

(50

)

(32

)

(56

)

Other

88

38

100

+

(100

+)

—

8

38

7

100

+

Subtotal

$

11,738

$

12,311

(5

)%

—

%

—

%

(5

)%

$

1,231

$

1,547

(20

)%

Returns/charges

associated with

restructuring and

other activities

(1

)

(10

)

(28

)

(33

)

Total

$

11,737

$

12,301

(5

)%

—

%

—

%

(5

)%

$

1,203

$

1,514

(21

)%

Non-GAAP Adjustments to As Reported

Operating Income:

Returns/charges associated with

restructuring and other activities

28

33

Skin Care - Changes in fair value of

acquisition-related stock options

8

(2

)

Skin Care - Other intangible asset

impairments

—

100

Makeup - Other intangible asset

impairments

—

107

Adjusted Operating Income -

Non-GAAP

$

1,239

$

1,752

(29

)%

(1)Percentages are calculated on an

individual basis

Results by Geographic Region

(Unaudited)

Nine Months Ended March

31

Net Sales

Percentage Change(1)

Operating Income

(Loss)

Percentage Change

($ in millions)

2024

2023

Reported Basis

Impact of Royalty Revenue from

the Acquisition of the TOM FORD Brand

Impact of Foreign Currency

Translation

Organic Net Sales

(Non-GAAP)

2024

2023

Reported Basis

The Americas

$

3,567

$

3,447

3

%

(1

)%

—

%

2

%

$

(243

)

$

(53

)

(100

+%)

Europe, the

Middle East &

Africa

4,488

4,972

(10

)

—

(1

)

(11

)

825

919

(10

)

Asia/Pacific

3,683

3,892

(5

)

—

3

(3

)

649

681

(5

)

Subtotal

$

11,738

$

12,311

(5

)%

—

%

—

%

(5

)%

$

1,231

$

1,547

(20

)%

Returns/charges

associated with

restructuring and

other activities

(1

)

(10

)

(28

)

(33

)

Total

$

11,737

$

12,301

(5

)%

—

%

—

%

(5

)%

$

1,203

$

1,514

(21

)%

Non-GAAP Adjustments to As Reported

Operating Income:

Returns/charges associated with

restructuring and other activities

28

33

The Americas - Changes in fair value of

acquisition-related stock options

8

(2

)

The Americas - Other intangible asset

impairments

—

107

Asia/Pacific - Other intangible asset

impairments

—

100

Adjusted Operating Income -

Non-GAAP

$

1,239

$

1,752

(29

)%

(1)Percentages are calculated on an

individual basis

This earnings release includes some non-GAAP financial measures

relating to charges associated with restructuring and other

activities and adjustments, as well as organic net sales. Included

herein are reconciliations between the non-GAAP financial measures

and the most directly comparable GAAP measures for certain

consolidated statements of earnings accounts before and after these

items. The Company uses certain non-GAAP financial measures, among

other financial measures, to evaluate its operating performance,

which represent the manner in which the Company conducts and views

its business. Management believes that excluding certain items that

are not comparable from period-to-period, or do not reflect the

Company’s underlying ongoing business, provides transparency for

such items and helps investors and others compare and analyze

operating performance from period-to-period. In the future, the

Company expects to incur charges or adjustments similar in nature

to those presented herein; however, the impact to the Company’s

results in a given period may be highly variable and difficult to

predict. The Company’s non-GAAP financial measures may not be

comparable to similarly titled measures used by, or determined in a

manner consistent with, other companies. While the Company

considers the non-GAAP measures useful in analyzing its results,

they are not intended to replace, or act as a substitute for, any

presentation included in the consolidated financial statements

prepared in conformity with GAAP.

The Company operates on a global basis, with the majority of its

net sales generated outside the United States. Accordingly,

fluctuations in foreign currency exchange rates can affect the

Company’s results of operations. Therefore, the Company presents

certain net sales, operating results and diluted net earnings per

common share information excluding the effect of foreign currency

rate fluctuations to provide a framework for assessing the

performance of its underlying business outside the United States.

Constant currency information compares results between periods as

if exchange rates had remained constant period-over-period. The

Company calculates constant currency information by translating

current-period results using prior-year period monthly average

foreign currency exchange rates and adjusting for the

period-over-period impact of foreign currency cash flow hedging

activities.

Reconciliation of Certain

Consolidated Statements of Earnings Accounts Before and After

Returns, Charges and Other Adjustments (Unaudited)

Three Months Ended March

31

2024

2023

% Change

($ in millions, except per share data)

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Impact of Foreign Currency

Translation

Non- GAAP, Constant

Currency

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Non- GAAP

Non- GAAP, Constant

Currency

Net sales

$

3,940

$

—

$

3,940

$

51

$

3,991

$

3,751

$

4

$

3,755

5%

6%

Gross profit

2,833

—

2,833

40

2,873

2,592

4

2,596

9%

11%

Operating income

531

23

554

25

579

297

19

316

75%

83%

Diluted EPS

$

.91

$

.06

$

.97

$

.05

$

1.02

$

.43

$

.04

$

.47

100+%

100+%

Nine Months Ended March

31

2024

2023

% Change

($ in millions, except per share data)

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Impact of Foreign Currency

Translation

Non- GAAP, Constant

Currency

As Reported

Returns/ Charges/

Adjustments

Non- GAAP

Non- GAAP

Non- GAAP, Constant

Currency

Net sales

$

11,737

$

1

$

11,738

$

54

$

11,792

$

12,301

$

10

$

12,311

(5)%

(4)%

Gross profit

8,406

2

8,408

43

8,451

8,900

9

8,909

(6)%

(5)%

Operating income

1,203

36

1,239

40

1,279

1,514

238

1,752

(29)%

(27)%

Diluted EPS

$

1.87

$

.08

$

1.95

$

.08

$

2.03

$

2.88

$

.50

$

3.38

(42)%

(40)%

CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited, except where noted)

March 31, 2024

June 30, 2023

(Audited)

March 31, 2023

($ in millions)

ASSETS

Cash and cash equivalents

$

3,701

$

4,029

$

5,531

Accounts receivable, net

1,854

1,452

1,904

Inventory and promotional merchandise

2,307

2,979

3,097

Prepaid expenses and other current

assets

672

679

715

Total current assets

8,534

9,139

11,247

Property, plant and equipment, net

3,133

3,179

3,026

Operating lease right-of-use assets

1,836

1,797

1,843

Other assets

9,197

9,300

6,599

Total assets

$

22,700

$

23,415

$

22,715

LIABILITIES AND EQUITY

Current debt

$

505

$

997

$

2,243

Accounts payable

1,197

1,670

1,520

Operating lease liabilities

363

357

357

Other accrued liabilities

3,351

3,216

3,580

Total current liabilities

5,416

6,240

7,700

Long-term debt

7,265

7,117

5,128

Long-term operating lease liabilities

1,707

1,698

1,734

Other noncurrent liabilities

1,728

1,943

1,457

Total noncurrent liabilities

10,700

10,758

8,319

Redeemable noncontrolling

interest

840

832

819

Total equity

5,744

5,585

5,877

Total liabilities and equity

$

22,700

$

23,415

$

22,715

SELECT CASH FLOW DATA

(Unaudited)

Nine Months Ended March

31

($ in millions)

2024

2023

Net earnings

$

695

$

1,042

Adjustments to reconcile net earnings to

net cash flows from operating activities:

Depreciation and amortization

614

548

Deferred income taxes

(165

)

(70

)

Impairment of other intangible assets

—

207

Other items

265

273

Changes in operating assets and

liabilities:

Increase in accounts receivable, net

(404

)

(254

)

Decrease (increase) in inventory and

promotional merchandise

653

(154

)

Decrease (increase) in other assets,

net

19

(69

)

Decrease in accounts payable and other

liabilities, net

(206

)

(506

)

Net cash flows provided by operating

activities

$

1,471

$

1,017

Other Investing and Financing Sources

(Uses):

Capital expenditures

$

(702

)

$

(652

)

Settlement of net investment hedges

(25

)

138

Payments to acquire treasury stock

(34

)

(258

)

Dividends paid

(710

)

(687

)

Proceeds (repayments) of current debt,

net

(215

)

2,228

Proceeds from issuance of long-term debt,

net

649

—

Repayments of commercial paper (maturities

after three months)

(785

)

—

Repayments and redemptions of long-term

debt, net

(7

)

(261

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501219688/en/

Investors: Rainey Mancini rmancini@estee.com

Media: Jill Marvin jimarvin@estee.com

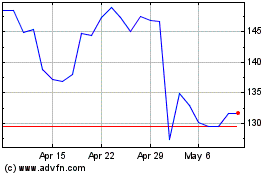

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From Apr 2024 to May 2024

Estee Lauder Companies (NYSE:EL)

Historical Stock Chart

From May 2023 to May 2024