Filed Pursuant to Rule

424(b)(3)

Registration No. 333-276877

PROSPECTUS SUPPLEMENT NO. 1

(TO PROSPECTUS DATED FEBRUARY 5, 2024)

This

prospectus supplement updates and supplements the prospectus dated February 5, 2024 (the “Prospectus”), which forms a part

of our registration statement on Form F-1 (No. 333-276877). This prospectus supplement is being filed to update and supplement the information

in the Prospectus with information contained in our Current Report on Form 6-K filed with the Securities and Exchange Commission on March

4, 2024 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

This Prospectus

and prospectus supplement relate to the resale, from time to time, by the selling shareholders named in the Prospectus (the “Selling

Shareholders”) of an aggregate of up to 45,000,000 of our Ordinary Shares, US$0.01 par value per Ordinary Share (the “Ordinary

Shares”), reserved for issuance (i) upon the conversion of currently outstanding 4% discount convertible promissory notes (the “Notes”)

held by the Selling Shareholders (the “Conversion Shares”) and (ii) upon exercise of currently outstanding warrants (the “Warrants”)

held by the Selling Shareholders (the “Warrant Shares”). The Notes and Warrants were issued to the Selling Shareholders on

January 9, 2024 (the “Closing Date”).

We registered the resale of up to an aggregate

of 45,000,000 Conversion Shares and Warrant Shares as required by the Registration Rights Agreement, dated as of July 11, 2023, as amended

(the “Registration Rights Agreement”), by and among us and the Selling Shareholders.

The Conversion Shares include Ordinary Shares

issuable upon conversion of $10,000,000.00 in aggregate principal amount of the Notes and in accruing interest which may be paid by the

Company in Conversion Shares with the written consent of the Selling Shareholders (including Ordinary Shares reserved for potential issuance

in the event of possible future default or dilution adjustments). The Notes are convertible at a conversion price of (i) $4.00 per Ordinary

Share (the “Fixed Conversion Price”), or (ii) 92% of the lowest daily variable-weighted average price (the “VWAP”)

per Ordinary Share during the 10 trading days preceding the conversion (the “Variable Conversion Price”). The Variable Conversion

Price has a floor of $0.55 per Ordinary Share (the “Floor Conversion Price”). The Fixed Conversion Price has a one-time reset

on the 6-month anniversary following the Closing Date to the lower of (x) the initial Fixed Conversion Price, (y) the initial Variable

Conversion Price, or (z) 130% of the daily VWAP per Ordinary Share on the trading day prior to the reset date. The Notes provide for adjustment

of the Fixed Conversion Price for, inter alia, stock dividends, stock splits, stock combinations, rights offerings, pro rata

distributions of assets, reclassifications of Ordinary Shares, exchanges of Ordinary Shares or substitutions of Ordinary Shares, dilutive

issuances, certain option issuances and issuances of convertible securities. At the Floor Conversion Price, the Notes are convertible

into an aggregate of 19,636,364 Ordinary Shares.

The Warrant Shares include Ordinary Shares issuable

upon exercise of the Warrants (including Ordinary Shares reserved for potential issuance in the event of possible future default or dilution

adjustments). The Warrants are exercisable, immediately upon issuance at the option of the holders, at an exercise price per Ordinary

Share equal to initial Fixed Conversion Price for the Notes ($4.00 per Ordinary Share), subject to a one-time reset on the 6-month anniversary

of the Closing Date to 120% of the daily VWAP per Ordinary Share on the trading day prior to the reset date. Pursuant to the Purchase

Agreement, on the Closing Date, the Selling Shareholders were issued the Initial Warrants to purchase up to an aggregate of 2,288,678

Ordinary Shares.

To the extent that Conversion Shares and/or Warrant

Shares are issued by the Company under the terms of the Notes and Warrants, substantial amounts of Ordinary Shares could be issued and

resold, which would cause dilution and may impact the Company’s stock price. See “Risk Factors” and “Convertible

Note Financing” in the Prospectus for additional information.

We are not selling any securities under this Prospectus

and will not receive any of the proceeds from the sale of our Conversion Shares or Warrant Shares by the Selling Shareholders. However,

we may receive proceeds from the exercise of the Warrants, which, if exercised in full for an aggregate of 2,288,678 Ordinary Shares and

for cash at the current $4.00 exercise price per Ordinary Share, would result in gross proceeds to us of approximately $9,154,712.00.

There is no assurance that the Selling Shareholders will elect to exercise any of the Warrants for cash and, accordingly, no assurance

that we will receive any proceeds from the exercise of the Warrants.

We will pay the expenses of registering the Conversion

Shares and Warrant Shares offered by this Prospectus, but all selling and other expenses incurred by the Selling Shareholders will be

paid by the Selling Shareholders. The Selling Shareholders may sell the Conversion Shares and the Warrant Shares offered by this Prospectus

from time to time on terms to be determined at the time of sale through ordinary brokerage transactions or through any other means described

in this Prospectus under “Plan of Distribution.” The prices at which the Selling Shareholders may sell the Conversion Shares

or the Warrant Shares will be determined by the prevailing market price for our Ordinary Shares or in negotiated transactions.

Our Ordinary Shares are listed on the Nasdaq Capital

Market under the ticker symbol “LAES.” The last reported sale price of our Ordinary Shares on the Nasdaq Capital Market

on March 4, 2024 was $1.93 per share.

This prospectus supplement should be read in conjunction

with, and delivered with, the Prospectus and is qualified by reference to the Prospectus except to the extent that the information in

this prospectus supplement supersedes the information contained in the Prospectus. This prospectus supplement is not complete without,

and may not be delivered or utilized except in connection with, the Prospectus, including any amendments or supplements to it.

Investing in our Ordinary Shares involves risks.

See “Risk Factors” beginning on page 19 of the Prospectus for a discussion of information that should be considered in connection

with an investment in our Ordinary Shares.

Neither the U.S. Securities and Exchange Commission

(“SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy

of this Prospectus Supplement No. 1. Any representation to the contrary is a criminal offense.

The date

of this Prospectus Supplement is March 5, 2024.

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC

20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

Date of Report: For the month of March

2024

Commission File Number: 001-41709

SEALSQ CORP

(Exact Name of Registrant as Specified in Charter)

N/A

(Translation of Registrant’s name into

English)

| British Virgin Islands |

Avenue Louis-Casaï 58

1216 Cointrin, Switzerland

|

Not Applicable |

| (State or other jurisdiction of incorporation or organization) |

(Address of principal executive office) |

(I.R.S. Employer Identification No.) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Description of the

Transaction

As

previously reported, on July 11, 2023, SEALSQ Corp, a company with limited liability organized under the law of the British Virgin Islands

(the “Company”), entered into a Securities Purchase Agreement (the “Initial Securities Purchase Agreement”)

with certain investors (collectively, the “Investors”) pursuant to which it sold (i) 4% Senior Original Issue Discount

Convertible Notes due 2025 in an aggregate principal amount of $10,000,000.00 (the “First Tranche Notes”) and (ii)

warrants with a 5-year maturity (the “First Tranche Warrants”), to purchase an aggregate of 245,816 number of Ordinary

Shares (the “First Tranche Closing”).

Also

as previously reported, on January 9, 2024 (the “Second Tranche

Closing Date”), the Company entered into an Amendment to the Securities Purchase Agreement (the “Second Tranche Amendment

to Purchase Agreement”), and closed a $10 million second tranche (the “Second Tranche”) of the offering,

resulting in the issuance to the Investors of (i) 4% Senior Original Issue Discount Convertible Notes due 2026

in an aggregate principal amount of $10,000,000.00 (the “Second Tranche Notes”) convertible into a number of the Company’s

Ordinary Shares (the “Ordinary Shares”), and (ii) warrants with a 5-year maturity (the “Second Tranche Warrants”)

to purchase an aggregate of 2,288,678 Ordinary Shares.

On

March 1, 2024 (the “Third Tranche Closing Date”), the Company entered into an Amendment to the Securities Purchase

Agreement (the “Third Tranche Amendment to Purchase Agreement,” and together with the Initial Securities Purchase Agreement,

as amended by the Second Tranche Amendment to Purchase Agreement and by the Third Tranche Amendment to Purchase Agreement, the “Purchase

Agreement”), and closed a $10 million third tranche (the “Third Tranche”) of the offering, resulting in the

issuance to the Investors of (i) 2.5% Senior Original Issue Discount Convertible Notes due 2026 in an aggregate principal amount of $10,000,000.00

(the “Third Tranche Notes”) convertible into a number of the Company’s Ordinary Shares, and (ii) warrants with

a 5-year maturity (the “Third Tranche Warrants”) to purchase an aggregate of 1,537,358 Ordinary Shares.

A

fourth and fifth tranche issuance of notes and warrants (the “Fourth Tranche” and “Fifth Tranche,”

respectively) is subject to the mutual consent of the parties, and may be provided for up to a total of $10 million in principal amount

of notes in each of the Fourth Tranche and the Fifth Tranche. Such Fourth and Fifth Tranches would close only after the effective date

of the Third Tranche Registration Statement (as defined below) and upon the satisfaction (or waiver) of the respective closing conditions

for such Fourth Tranche and Fifth Tranche specified in the Purchase Agreement.

Pursuant

to the Registration Rights Agreement, dated July 11, 2023, as amended (the “Registration Rights Agreement”), with the

Investors, the Company is obligated to file a registration statement (the “Third Tranche Registration Statement”) with

the U.S. Securities and Exchange Commission no later than 30 trading days after the Third Tranche Closing Date covering the resale of

the Ordinary Shares issuable upon conversion of the Third Tranche Notes and the exercise of the Third Tranche Warrants. The Company intends

to cause the Third Tranche Registration Statement to be declared effective as soon as practicable after the filing thereof.

The

terms of the Third Tranche Amendment to Purchase Agreement, the Third Tranche Notes and the Third Tranche Warrants are summarized below.

The following description of the Third Tranche Amendment to Purchase Agreement, the Third Tranche Notes and the Third Tranche Warrants

is a summary only and does not purport to be complete and is qualified in its entirety by reference to the full text of such documents,

the forms of which is attached hereto as Exhibits 10.1, 10.2 and 10.3 respectively, and incorporated herein by reference.

The

Third Tranche Notes and the Third Tranche Warrants described above were offered and sold in reliance upon an exemption from registration

pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended, and/or Regulation D thereunder.

Summary

Terms of the Third Tranche Amendment to Purchase Agreement

The

Third Tranche Amendment to Purchase Agreement modifies the Original Securities Purchase Agreement, as amended by the Second Tranche Amendment

to Purchase Agreement, and the terms of the other transaction documents as follows:

Fixed

Conversion Price and Exercise Price. All references in the applicable transaction documents for the Third Tranche to the Fixed Conversion

Price and the Exercise Price was changed from $4.00 to $5.50.

Floor

Price. All references in the applicable transaction documents for the Third Tranche to the Floor Price is $0.55.

Fourth

Tranche and Fifth Tranche Closings. The parties agreed to provide for a Fourth Tranche closing and a Fifth Tranche closing (subject

to the mutual consent of the parties and other closing conditions) and may be provided for up to a total of $10 million in principal amount

of additional notes for each of the Fourth Tranche and the Fifth Tranche, with terms similar to the Third Tranche Notes (the “Fourth

Tranche Notes” and “Fifth Tranche Notes,” respectively). The number of Ordinary Shares underlying the additional

warrants issuable in the Fourth Tranche and Fifth Tranche, which warrants shall have substantially identical terms to the Third Tranche

Warrants, will be determined by dividing 30% of the principal amount of Fourth Tranche Notes, or the Fifth Tranche Notes, as applicable,

by the VWAP as of the closing date of Fourth Tranche or Fifth Tranche, as applicable.

Registration

Rights Agreement. The parties agreed to amend the Registration Rights Agreement to require the Company to file the Third Tranche Registration

Statement covering all of the registrable securities issuable under the Third Tranche within 30 trading days after such closing. The parties

also agreed to amend the Registration Rights Agreement to require the Company to file a registration statement covering all of the registrable

securities issuable under the Fourth Tranche and Fifth Tranche within 20 trading days after each such closing.

Investor

Resale Limitation. Provided that no event of default has occurred, and subject to the waiver by the Company, each Investor has agreed

that it shall use its commercially reasonable efforts to not sell converted Ordinary Shares from the Third Tranche Notes or Third Tranche

Warrants in a weekly quantity in excess of 10% of the average weekly trading volume of the Ordinary Shares on the Nasdaq Capital Market

in the current calendar week. This provision shall not apply to any conversion Ordinary Shares received by a holder pursuant to any prepayment

conversion rights or mandatory prepayments under the Third Tranche Notes for the 20 trading day period following the receipt of any such

conversion Ordinary Shares.

Waiver.

Solely with respect to the Third Tranche, the Investors have agreed to waive the Company’s compliance with the following covenant:

The Company shall not incur any indebtedness other than (x) indebtedness under the First Tranche Notes and Second Tranche Notes, (y) indebtedness

up to $2,000,000.00 payable to Cisco System, Inc., (z) any loans provided by affiliates of the Company (not including indebtedness under

(x) above); provided that no such indebtedness in the aggregate may exceed 15% of the average market capitalization of the Company’s

outstanding Ordinary Shares (adjusted for the outstanding number of F Shares at the five F Share to one Ordinary Share redemption ratio

as provided for under the Company’s charter documents) as reported by the trading market for the immediately preceding 10 trading

days.

Future

Financing Participation Right. Subject to certain exceptions, for a period of one (1) year from

the date of the Initial Securities Purchase Agreement, each Investor shall have the right to participate in up to 7.5% of future financings

of the Company undertaken during that period.

Share

Reserve. The Company shall maintain a reserve of 40,000,000 Ordinary Shares from its duly authorized Ordinary Shares for issuance

under the Third Tranche.

Summary Terms of

the Third Tranche Notes

Original

Issuance Discount. The Third Tranche Notes carry a 2.5% original issue discount, resulting in proceeds before expenses to the Company

from the issuance of the Third Tranche Notes of approximately $9,750,000.00. The Third Tranche Notes were issued on March 1, 2024 (the

“Third Tranche Issuance Date”).

Voluntary Conversion.

The Third Tranche Notes will be convertible, immediately upon issuance at the option of the holders, at a conversion price of the lesser

of (i) $5.50 per Ordinary Share (the “Third Tranche Fixed Conversion Price”), or (ii) 93% of the lowest VWAP per Ordinary

Share during the 10 trading days preceding the conversion (the “Third Tranche Variable Conversion Price”). The Third

Tranche Variable Conversion Price shall have a floor of $0.55 per Ordinary Share (the “Third Tranche Floor Conversion Price”).

The Third Tranche Floor Conversion Price can be lowered by mutual consent of the Company and the Investors. With the consent of the Investors,

the Company may pay the interest on the Third Tranche Notes in the form of Ordinary Shares at the applicable conversion price then in

effect. In addition, the conversion prices are subject to adjustment for anti-dilution protections.

Provided that no event

of default under the Third Tranche Notes has occurred, and subject to the waiver by the Company, each Investor has agreed that it shall

use its commercially reasonable efforts to not sell converted shares from Third Tranche Notes or Third Tranche Warrants in a weekly quantity

in excess of 10% of the average weekly trading volume of the Ordinary Shares on the Nasdaq Capital Market in the current calendar week.

This provision shall not apply to any conversion shares received by a holder pursuant to any prepayment conversion rights or mandatory

prepayments under the Third Tranche Notes for the 20 trading day period following the receipt of any such conversion shares.

The other material terms

of the Third Tranche Notes are substantially similar to the material terms of the First and Second Tranche Notes.

Summary Terms of

the Third Tranche Warrants

The

Third Tranche Warrants will be exercisable, immediately upon issuance at the option of the holders, at an exercise price per Ordinary

Share equal to Third Tranche Fixed Conversion Price for the Notes ($5.50 per Ordinary Share). Pursuant to the Purchase Agreement, on the

Third Tranche Closing Date, the Investors were issued the Third Tranche Warrants to purchase up to 1,537,358 Ordinary Shares. The Third

Tranche Warrants are exercisable via “cashless” exercise if, after the six-month anniversary of the Third Tranche Closing

Date, there is not an effective Third Tranche Registration Statement (as defined above) covering resale of the Ordinary Share under the

Third Tranche Warrants.

The

other material terms of the Third Tranche Warrants are substantially similar to the material terms of the First Tranche Notes and Second

Tranche Warrants.

First and Second Tranche

Conversions

As of the date hereof, the

Investors have converted all of the First Tranche Notes into an aggregate of 9,717,438 Ordinary Shares. As of the date hereof, the Investors

have converted $5,100,000 of the Second Tranche Notes into an aggregate of 3,069,970 Ordinary Shares. The total number of outstanding

Ordinary Shares of the Company is currently 20,297,092.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: March 4, 2024

|

SEALSQ CORP |

| |

|

|

| |

By: |

/s/ Carlos Moreira |

| |

|

Name: Carlos Moreira |

| |

|

Title: Chief Executive Officer |

| |

|

|

| |

By: |

/s/ John O’Hara |

| |

|

Name: John O’Hara |

| |

|

Title: Chief Financial Officer |

6

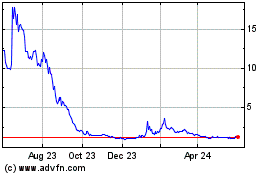

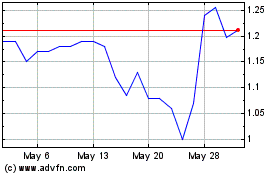

SEALSQ (NASDAQ:LAES)

Historical Stock Chart

From Apr 2024 to May 2024

SEALSQ (NASDAQ:LAES)

Historical Stock Chart

From May 2023 to May 2024