As

filed with the Securities and Exchange Commission on February 12, 2024.

Registration

No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Beamr

Imaging Ltd.

(Exact name of Registrant as specified in its charter)

Not

Applicable

(Translation of Registrant’s name into English)

| State

of Israel |

|

7372 |

|

Not

Applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

10

HaManofim Street

Herzeliya, 4672561, Israel

Tel: +1-888-520-8735

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Beamr,

Inc.

16185 Los Gatos Blvd

Ste 205

Mailbox 12

Los Gatos, CA 95032

Tel: (650) 961-3098

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Mark Selinger, Esq.

Gary Emmanuel, Esq.

Eyal Peled, Esq.

David Huberman, Esq.

Greenberg Traurig, LLP

One Vanderbilt Avenue

New York, NY 10017-3852

Telephone: 212.801.9221 |

|

Ronen Kantor, Esq.

Doron Tikotzky Kantor Gutman

Nass & Amit Gross Law Offices

BSR 4, 7 Metsada Street

Bnei Brak, Israel 5126112

Telephone: +972.3.6109100 |

|

Oded Har-Even, Esq.

Eric Victorson, Esq.

Sullivan & Worcester LLP

1633 Broadway

New York, NY 10019

Telephone: 212.660.3000 |

|

Reut Alfiah, Adv.

Gal Cohen, Adv.

Sullivan & Worcester Israel

(Har-Even & Co.)

HaArba’a Towers – 28

HaArba’a St.

North Tower, 35th Floor

Tel-Aviv, Israel 6473925

Telephone: +972.74.758.0480 |

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after the effective date hereof.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☒ 333-272257

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging

growth company ☒

If

an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided

pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

†

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting

Standards Board to its Accounting Standards Codification after April 5, 2012.

This

Registration Statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b) promulgated

under the Securities Act.

EXPLANATORY

NOTE AND

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

This

Registration Statement (the “Registration Statement”) is being filed with the Securities and Exchange Commission (the

“Commission”) with respect to the registration of additional ordinary shares, par value NIS 0.05 per share, of Beamr

Imaging Ltd. (the “Registrant”), pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the

“Securities Act”). This Registration Statement incorporates by reference the contents of, including all amendments and

exhibits thereto, the Registration Statement on Form F-1, as amended (File No. 333-272257) (the “Prior Registration

Statement”), which the Commission declared effective on February 12, 2024, and is being filed solely for the purpose of

increasing the aggregate offering price of ordinary shares to be offered in the public offering by $2,443,750, which includes

additional shares that may be sold pursuant to the underwriters’ option to purchase additional ordinary shares. The additional

ordinary shares that are being registered for sale are in an amount and at a price that together represent no more than 20% of the

maximum aggregate offering price set forth in the Filing Fee Table filed as Exhibit 107 in the Prior Registration Statement.

The required opinion and consents are listed on the Exhibit Index attached hereto and filed herewith.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to

believe that it meets all of the requirements for filing on Form F-1 and has duly caused this Registration Statement to be

signed on its behalf by the undersigned, thereunto duly authorized, in Herzeliya, Israel on this 12th day

of February 2024.

| |

Beamr Imaging

Ltd. |

| |

|

| |

By: |

/s/

Sharon Carmel |

| |

|

Sharon Carmel, Chief Executive

Officer |

Pursuant

to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and

on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Sharon Carmel |

|

Chief Executive Officer

and Chairman |

|

February 12, 2024 |

| Sharon Carmel |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| /s/ Danny Sandler |

|

Chief Financial Officer |

|

February 12, 2024 |

| Danny Sandler |

|

(Principal Financial and

Accounting Officer) |

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 12, 2024 |

| Tal Barnoach |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 12, 2024 |

| Lluis Pedragosa |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 12, 2024 |

| Yair Shoham |

|

|

|

|

| |

|

|

|

|

| /s/ * |

|

Director |

|

February 12, 2024 |

| Osnat Michaeli |

|

|

|

|

| |

|

|

|

|

| * /s/ Sharon

Carmel |

|

|

|

|

Sharon Carmel

Attorney in Fact |

|

|

|

|

SIGNATURE

OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States

of Beamr Imaging Ltd., has signed this Registration Statement on this 12th day of February 2024.

| |

Beamr, Inc. |

| |

|

| |

Authorized

U.S. Representative |

| |

|

| |

|

/s/

Sharon Carmel |

| |

Name: |

Sharon Carmel |

| |

Title: |

Authorized Person |

3

Exhibit 5.1

Yaron Tikotzky, Adv. (CPA)*

Eli Doron, Adv. & Notary

Ronen Kantor, Adv.

Amit Gross, Adv. & Notary

Giora Gutman, Adv.

Rachel (Goren) Cavallero, Adv.

Gil Mor, Adv. & Notary**

Sharon Fishman, Adv. & Notary

Moti Hoffman, Adv. & Notary

Efrat Hamami, Adv.

Tamir Kalderon, Adv.

Asaf Gershgoren, Adv. & economist

Efi Ohana, Adv. & economist

Asaf Hofman, Adv. & economist

Ron Soulema, Adv.

Moti Philip, Adv.

Sagiv Bar Shalom, Adv.

Ori Perel, Adv.

David Rozen, Adv.

Israel Mark, Adv.

Amir Bar Dayan, Adv.

Sandrine Dray, Adv. & Notary***

Nahi Hamud, Adv.

Shmulik Cohen, Adv.

Yair Messalem, Adv.

Maayan Peled, Adv.

Igal Rosenberg, Adv.

Gili Yasu, Adv. & Notary

Tmoora Detsch Kaufman, Adv.

Lilach Cohen-Shamir, Adv.

Orly Pharan, Adv.

Rotem Nissim, Adv.

Orit Peper, Adv.

Rivka Mangoni, Adv.

Israel Asaraf, Adv. & Notary

Jossef Prins, Adv.

Shay Almakies, Adv. & Notary

Yael Porat Kotzer, Adv.

Gali Ganoni, Adv.

Hadas Garoosi Wolfsthal, Adv.

Odelia Cohen-Schondorf, Adv.

Hasan Hasan, Adv.

Yana Shapiro Orbach, Adv.

Ronit Rabinovich, Adv.

Nidal Siaga, Adv.

Avi Cohen, Adv.

Amit Moshe Cohen, Adv.

Sonny Knaz, Adv.

Bat-El Ovadia, Adv.

Aharon Eitan, Adv.

Rania Elime, Adv.

Sivan Kaufman, Adv.

Mor Rozenson, Adv.

Iris Borcom, Adv.

Inbal Naim, Adv.

Sivan Feldhamer, Adv.

Meital Graff, Adv.

Amir Keren, Adv.

Ariel Regev, Adv.

Michal Zamir-Polani, Adv.

Inbal Harel Gershon, Adv.

Hezi Sidon, Adv.

Shirli Rahmani, Adv.

Omer Katzir, Adv. & economist

Hadar Weizner, Adv. & economist

Yaniv Levi, Adv.

Noy Keren, Adv.

Avi Kababgian, Adv.

Or Yahal Asbag, Adv.

Eli Kulas. Adv. Notary & Mediator - Counselor

Jan Robinsohn, M.Jur. Adv. & Notary - Counselor****

Giora Amir, Adv. Notary - Counselor

* Member of the New

York State Bar

** Member of the Law Society in England & Wales

*** Accredited by the consulate of France

**** Honorary

Consul Of The Republic Of Poland (ret.)

mail@dtkgglaw.com

www.dtkgglaw.com

www.dt-law.co.il |

|

|

|

|

| |

|

|

| Bnei

Brak, February 12, 2024 |

| |

|

|

| Beamr Imaging Ltd. |

|

| 10 Hamanofim Street, |

|

| Herzeliya, |

|

| Israel |

|

| |

|

|

| Dear Sir and Madam: |

|

| |

|

|

| Re: REGISTRATION STATEMENT ON FORM F-1 |

| |

|

|

|

We are acting as Israeli counsel for Beamr Imaging Ltd., an Israeli

company (the “Company”), in connection with the preparation of (A) a Registration Statement on Form F-1 (the “Initial

Registration Statement”) under the Securities Act of 1933, as amended (the “Securities Act”), pertaining

to the registration and proposed maximum aggregate offering of up to US$12,218,750.00 of (i) ordinary shares, par value NIS 0.05 per shares

(the “Ordinary Shares”); (ii) warrants (the “Warrants”) to purchase Ordinary Shares; and (iii) the

Ordinary Shares underlying the Warrants, as may be sold by the Company under the Registration Statement; and (B) a Registration Statement

on Form F-1 that is to be filed with the Securities and Exchange Commission pursuant to Rule 462(b) of Regulation C promulgated under

the Securities Act (the “Rule 462(b) Registration Statement” and together with the Initial Registration Statement,

the “Registration Statements”). Pursuant to Rule 416 under the Securities Act, the Ordinary Shares being registered

thereunder include such number of Ordinary Shares as may be issuable with respect to the shares being registered thereunder as a result

of stock splits, stock dividends, or similar transactions.

|

| |

|

|

| As counsel to the Company in Israel, we have examined copies of the

Articles of Association, as amended, of the Company and such corporate records, instruments, and other documents relating to the Company

and such matters of law as we have considered necessary or appropriate for the purpose of rendering this opinion. In such examination,

we have assumed inter alia the genuineness of each signature (other than the signatures of the officers of the Company),

the completeness of each document submitted to us, the authenticity of each document reviewed by us as an original, the conformity to

the original of each document reviewed by us as a copy and the authenticity of the original of each document received by us as a copy

and the accuracy on the date stated in all governmental certifications of each statement as to each factual matter contained in such governmental

certifications. |

| |

|

|

Based upon and subject to the foregoing, we are of the opinion that

the Ordinary Shares and the Ordinary Shares issued upon the exercise of the Warrants, when issued pursuant to the terms of the Registration

Statements, and the terms of any agreements relating to such issuance, will be upon receipt of consideration as the case may be, validly

issued, fully paid and non-assessable.

|

| |

Haifa & Northern:

7 Palyam Blvd. Haifa,

(Phoenix House) 7th Floor, 3309510

Tel. +972-4-8147500 | Fax 972-4-8555976

Banking & Collection, 6th Floor

Tel. 972-4-8353700 | Fax 972-4-8702477

Romania: 7 Franklin, 1st District,

Bucharest

Cyprus: 9 Zenonos Kitieos St., 2406

Engomi, Nicosia |

|

Central: B.S.R. Tower 4, 33th Floor,

7 metsada St. Bnei Brak, 5126112

Tel. 972-3-6109100 | Fax +972-3-6127449

Tel. 972-3-6133371 | Fax +972-3-6133372

Tel. 972-3-7940700 | Fax +972-3-7467470

SRFK Manhattan:

New York, Broadway 61, NY 10006TLV1 626314015v1

|

We are members of the Bar

of the State of Israel, we express no opinion as to any matter relating to the laws of any jurisdiction other than the laws of the State

of Israel as the same are in force on the date hereof and we have not, for the purpose of giving this opinion, made any investigation

of the laws of any other jurisdiction. Special rulings of authorities administering any of such laws or opinions of other counsel have

not been sought or obtained by us in connection with rendering the opinions expressed herein. In addition, we express no opinion as to

any documents, agreements or arrangements other than those subject to the laws of the State of Israel, if any.

This opinion is intended solely

for the benefit and use of the Company and other persons who are entitled to rely on the Registration Statements, and is not to be used,

released, quoted, or relied upon by anyone else for any purpose (other than as required by law), without our prior written consent.

We hereby consent to the filing of this opinion as Exhibit 5.1 to the

Registration Statements, and to the use of our name wherever appearing in the Registration Statements in connection with Israeli law.

In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the

Act or the rules and regulations of the Securities and Exchange Commission promulgated thereunder.

Very truly yours,

/s/ Doron, Tikotzky, Kantor, Gutman, Nass, Amit

Gross & Co.

Doron, Tikotzky, Kantor, Gutman, Nass, Amit Gross

& Co.

Advocates and Notaries

Exhibit 5.2

February 12, 2024

Beamr Imaging Ltd.

10 HaManofim Street

Herzeliya, 4672561 Israel

Re: Registration Statement on Form F-1

Ladies and Gentlemen:

This opinion is furnished

to you in connection with a Registration Statement on Form F-1 to be filed with the Commission pursuant to Rule 462(b) of Regulation C

(the “Rule 462(b) Registration Statement”) promulgated under the Securities Act of 1933, as amended (the “Securities

Act”) and the initial Registration Statement on Form F-1 (Registration Statement No. 333-272257) (the “Initial

Registration Statement” and together with the Rule 462(b) Registration Statement, the “Registration Statements”)

filed by Beamr Imaging Ltd., an Israeli company (the “Company”), with the Securities and Exchange Commission (the “Commission”)

under the Securities Act, for the registration and proposed maximum aggregate offering of up to $12,218,750.00 of (i) ordinary shares,

par value NIS 0.05 per shares (the “Ordinary Shares”); (ii) warrants (the “Warrants”) to purchase

Ordinary Shares; and (iii) the Ordinary Shares underlying the Warrants. The Ordinary Shares and Warrants are being registered by the Company,

which has engaged ThinkEquity LLC. To act as the underwriter (the “Underwriter”) in connection with the offering of

the Company’s Ordinary Shares and Warrants (the “Offering”).

We are acting as U.S. securities

counsel for the Company in connection with the Registration Statement. We have examined signed copies of the Registration Statement and

have also examined and relied upon minutes of meetings of the Board of Directors of the Company as provided to us by the Company, and

such other documents as we have deemed necessary for purposes of rendering the opinion hereinafter set forth.

In our examination of the

foregoing documents, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals,

the conformity to original documents of all documents submitted to us as copies, the authenticity of the originals of such latter documents

and the legal competence of all signatories to such documents. Other than our examination of the documents indicated above, we have made

no other examination in connection with this opinion. Because the agreements governing the Warrants contains a provision stating that

they are to be governed by the laws of the State of New York, we are rendering this opinion as to New York law. We are admitted to practice

in the State of New York, and we express no opinion as to any matters governed by any law other than the law of the State of New York.

In particular, we do not purport to pass on any matter governed by the laws of Israel. You are separately reviewing an opinion from Doron,

Tikotzky, Kantor, Gutman, Nass, Amit Gross & Co. filed as Exhibit 5.1 to the Registration Statements with respect to the corporate

proceedings and due authorization relating to the issuance of the Ordinary Shares and the Ordinary Shares underlying the Warrants under

the laws of Israel. For purposes of our opinion, we have assumed that the Ordinary Shares and the Ordinary Shares underlying the Warrants

have been duly authorized and that the Ordinary Shares and the Ordinary Shares underlying the Warrants have been duly and validly issued,

fully paid and non-assessable.

Based upon and subject to

the foregoing, we are of the opinion that, when the Registration Statements has become effective under the Securities Act, the Warrants,

if and when issued and paid for in accordance with the terms of the Offering, will be valid and binding obligations of the Company enforceable

against the Company in accordance with their terms.

The opinion set forth herein

is rendered as of the date hereof, and we assume no obligation to update such opinion to reflect any facts or circumstances which may

hereafter come to our attention or any changes in the law which may hereafter occur (which may have retroactive effect). In addition,

the foregoing opinions are qualified to the extent that (a) enforceability may be limited by and be subject to general principles of equity,

regardless of whether such enforceability is considered in a proceeding in equity or at law (including, without limitation, concepts of

notice and materiality), and by bankruptcy, insolvency, reorganization, moratorium and other similar laws affecting creditors’ and

debtors’ rights generally (including, without limitation, any state or federal law in respect of fraudulent transfers); and (b)

no opinion is expressed herein as to compliance with or the effect of federal or state securities or blue sky laws.

This opinion is rendered to

you in connection with the Registration Statement. This opinion may not be relied upon for any other purpose, or furnished to, quoted

or relied upon by any other person, firm or corporation for any purpose, without our prior written consent, except that (A) this opinion

may be furnished or quoted to judicial or regulatory authorities having jurisdiction over you, and (B) this opinion may be relied upon

by holders of the Warrants currently entitled to rely on it pursuant to applicable provisions of federal securities law.

We hereby consent to the filing

of this opinion as Exhibit 5.2 to the Rule 462(b) Registration Statement and to the reference to this firm under the caption “Legal

Matters” in the Registration Statements. In giving such consent, we do not admit that we are in the category of persons whose consent

is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ Greenberg Traurig, P.A. |

| |

Greenberg Traurig, P.A. |

| Greenberg Traurig, P.A. | Attorneys at Law |

| Azrieli Center, Round Tower | 132 Menachem Begin Road, 30th Floor | Tel Aviv, Israel 6701101 | T +1 +972 (0) 3 636 6000 | F +1 +972 (0) 3 636 6010 |

| www.gtlaw.com |

Exhibit 23.1

| |

Fahn Kanne & Co. |

| |

Head Office |

| |

32 Hamasger Street |

| |

Tel-Aviv 6721118, ISRAEL |

| |

PO Box 36172, 6136101 |

| |

|

| |

T +972 3 7106666 |

| |

F +972 3 7106660 |

| |

www.gtfk.co.il |

CONSENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our report

dated April 24, 2023, with respect to the financial statements of Beamr Imaging Ltd. contained in the Registration Statement and Prospectus.

We consent to the use of the aforementioned report in this Registration Statement and Prospectus, and to the use of our name as it appears

under the caption “Experts.”

/s/ FAHN KANNE & CO. GRANT THORNTON ISRAEL

FAHN KANNE & CO. GRANT THORNTON ISRAEL

Tel-Aviv, Israel

February 12, 2024

Certified Public Accountants

Fahn Kanne & Co. is the Israeli member firm of Grant Thornton International

Ltd.

Exhibit 107

Calculation of Filing Fee Tables

…………..

(Form Type)

……………………………………………………..

Beamr Imaging Ltd.

Table 1: Newly Registered and Carry

Forward Securities

| | |

Security

Type | |

Security

Class

Title | |

Fee

Calculation

or Carry

Forward Rule | |

Maximum

Aggregate

Offering

Price(1)(2)(3)(4) | | |

Fee

Rate | | |

Amount of

Registration

Fee

(6) | | |

Carry

Forward

Form

Type | | |

Carry

Forward

File

Number | | |

Carry

Forward

Initial

effective

date | | |

Filing Fee

Previously

Paid In

Connection

with

Unsold

Securities

to be

Carried

Forward | |

| Newly Registered Securities | |

| Fees

to Be Paid | |

Equity | |

Ordinary shares, NIS 0.05 par value per share | |

457(o) | |

$ | 2,300,000 | | |

| 0.0001476 | | |

$ | 339.48 | | |

| | | |

| | | |

| | | |

| | |

| Fees to Be

Paid | |

Other | |

Representative’s warrants (4) | |

457(o)

457(g) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fees to Be

Paid | |

Equity | |

Ordinary shares upon exercise of Representative’s warrants (5) | |

457(o)

457(g) | |

$ | 143,750.00 | | |

| 0.0001476 | | |

$ | 21.22 | | |

| | | |

| | | |

| | | |

| | |

| Carry Forward Securities | |

| Carry Forward

Securities | |

| |

| |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Total Offering Amounts | |

$ | 2,443,750

| | |

| | | |

$ | 360.70 | | |

| | | |

| | | |

| | | |

| | |

| | |

Total Fees Previously Paid | |

| | | |

| | | |

$ | - | | |

| | | |

| | | |

| | | |

| | |

| | |

Total Fee Offsets | |

| | | |

| | | |

| - | | |

| | | |

| | | |

| | | |

| | |

| | |

Net Fee Due | |

| - | | |

| | | |

$ | 360.70

| | |

| | | |

| | | |

| | | |

| | |

| (1) | This registration statement also includes an indeterminate number of

ordinary shares that may become offered, issuable or sold to prevent dilution resulting from stock splits, stock dividends and similar

transactions, which are included pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act. |

| (2) | Estimated solely for the purpose of calculating the registration fee

pursuant to Rule 457(o) under the Securities Act. |

| (3) | Includes the offering price of additional shares that the underwriters

have the option to purchase to cover over-allotments, if any. |

| (4) | In accordance with Rule 457(g) under the Securities Act, because the

ordinary shares of the registrant underlying the Representative’s warrants are registered hereby, no separate registration fee is

required with respect to the warrants registered hereby. |

| (5) | Estimated solely for the purpose of calculating the registration fee

pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 125% of the public

offering price. As estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act,

the proposed maximum aggregate offering price of the Representative’s warrants is equal to 125% of 115,000 (which is equal to 5%

of $2,300,000).

|

| (6) | Calculated pursuant to Rule 457(o) based on an estimate of the proposed

maximum aggregate offering price. The registrant previously registered an aggregate of $12,218,750.00 of securities on the Registration

Statement on Form F-1, as amended (File No. 333-272257), which the Commission declared effective on February 12, 2024, for which

a filing fee of $1,359.97 was previously paid. |

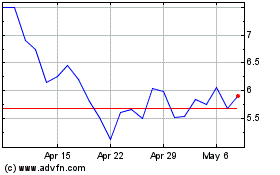

Beamr Imaging (NASDAQ:BMR)

Historical Stock Chart

From Apr 2024 to May 2024

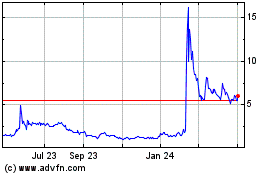

Beamr Imaging (NASDAQ:BMR)

Historical Stock Chart

From May 2023 to May 2024