0001810031--12-31false2023-09-30Q3http://fasb.org/us-gaap/2023#LicenseMember0001810031us-gaap:EmployeeStockMember2020-07-310001810031frln:OperatingLeaseAgreementsMember2022-12-310001810031frln:UnvestedOrdinarySharesMember2022-01-012022-09-300001810031us-gaap:RetainedEarningsMember2021-12-310001810031frln:UndesignatedDeferredSharesMember2022-12-310001810031frln:JefferiesLLCMemberfrln:AmericanDepositorySharesMemberfrln:AtTheMarketOfferingsMemberfrln:OpenMarketSaleAgreementMember2021-11-162021-11-170001810031us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-300001810031frln:ForcefieldTherapeuticsLimitedMember2023-03-212023-03-210001810031us-gaap:EquipmentMember2022-12-310001810031frln:EquityIncentivePlanMember2023-01-012023-09-300001810031us-gaap:ConvertibleDebtMemberfrln:AmericanDepositorySharesMemberfrln:SynconaPortfoliosLimitedMemberus-gaap:SubsequentEventMemberfrln:ImplementationAgreementMember2023-11-220001810031us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001810031frln:UndesignatedDeferredSharesMember2022-01-012022-09-300001810031us-gaap:LicenseMemberfrln:SynconaIPHoldcoTwoLimitedMember2023-01-012023-09-300001810031frln:SynconaIPHoldcoTwoLimitedMember2023-03-240001810031frln:EquityIncentivePlanMember2020-07-312020-07-310001810031frln:UndesignatedDeferredShareTwoMember2023-09-300001810031us-gaap:EquipmentMember2023-09-300001810031us-gaap:ConvertibleDebtMemberfrln:SynconaPortfoliosLimitedMemberus-gaap:SubsequentEventMemberfrln:ImplementationAgreementMember2023-11-222023-11-220001810031us-gaap:CommonStockMember2022-09-300001810031us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001810031us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-01-012023-09-300001810031us-gaap:CommonStockMember2022-01-012022-09-300001810031frln:AmericanDepositarySharesMemberfrln:SynconaPortfoliosLimitedMember2022-03-100001810031frln:AmericanDepositorySharesMemberfrln:LincoLnParkCapitalFundsLLCMember2022-03-180001810031us-gaap:EmployeeStockOptionMember2022-12-310001810031us-gaap:CommonStockMember2022-12-310001810031us-gaap:FurnitureAndFixturesMember2022-12-310001810031us-gaap:AdditionalPaidInCapitalMember2021-12-310001810031us-gaap:RestrictedStockUnitsRSUMember2023-09-300001810031frln:FreelineTherapeuticsGmbhMember2023-02-082023-02-080001810031frln:FreelineTherapeuticsGmbhMember2023-02-080001810031frln:TwoThousandTwentyOneEquityInducementPlanAndTwoThousandTwentyEquityIncetivePlanMemberfrln:OptionRepricingMember2023-06-282023-06-280001810031frln:UndesignatedDeferredShareOneMember2023-09-300001810031us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001810031us-gaap:EmployeeStockMember2023-01-012023-09-300001810031frln:UndesignatedDeferredSharesMember2022-09-300001810031us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001810031frln:DeferredSharesOneMember2023-09-300001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001810031frln:BrammerBioMaLlcMember2023-01-012023-09-300001810031frln:UndesignatedDeferredSharesMember2023-09-300001810031frln:FreelineTherapeuticsGmbhMember2022-12-310001810031frln:FreelineTherapeuticsGmbhMember2023-09-300001810031us-gaap:LeaseholdImprovementsMember2023-09-300001810031frln:DeferredSharesTwoMember2022-09-300001810031us-gaap:EmployeeStockOptionMember2023-09-300001810031frln:EquityInducementPlanMember2023-09-300001810031frln:PerformanceAndServiceBasedMember2022-12-3100018100312022-09-300001810031frln:AmericanDepositorySharesMemberfrln:SynconaPortfoliosLimitedMemberus-gaap:SubsequentEventMemberfrln:ImplementationAgreementMember2023-11-220001810031us-gaap:EmployeeStockMember2023-01-012023-01-010001810031frln:UndesignatedDeferredShareOneMember2022-09-300001810031srt:MaximumMemberfrln:AmericanDepositorySharesMemberfrln:LincoLnParkCapitalFundsLLCMember2022-03-182022-03-180001810031us-gaap:RetainedEarningsMember2023-09-300001810031frln:AmericanDepositorySharesMemberfrln:LincoLnParkCapitalFundsLLCMember2022-03-182022-03-180001810031us-gaap:ConvertibleDebtMemberfrln:SynconaPortfoliosLimitedMemberus-gaap:SubsequentEventMemberfrln:ImplementationAgreementMember2023-11-220001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001810031us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001810031frln:UndesignatedDeferredSharesMember2023-01-012023-09-300001810031us-gaap:OfficeEquipmentMember2023-09-3000018100312023-05-120001810031frln:EquityIncentivePlanMember2023-01-012023-01-010001810031frln:ForcefieldTherapeuticsLimitedMember2023-01-012023-09-300001810031frln:DeferredSharesOneMember2022-12-310001810031us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001810031frln:OperatingLeaseAgreementsMember2022-01-012022-12-310001810031us-gaap:AdditionalPaidInCapitalMember2022-09-300001810031frln:OptionRepricingMember2023-06-292023-06-290001810031us-gaap:EmployeeStockMember2020-07-312020-07-310001810031frln:DeferredSharesTwoMember2023-09-300001810031us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001810031srt:MaximumMemberfrln:ForcefieldTherapeuticsLimitedMember2023-03-212023-03-210001810031us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001810031us-gaap:LeaseholdImprovementsMember2022-12-310001810031frln:SynconaIPHoldcoTwoLimitedMember2023-03-242023-03-240001810031us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001810031frln:ManufacturingAndCommercialSupplyAgreementMember2023-01-012023-09-300001810031us-gaap:RetainedEarningsMember2023-01-012023-09-300001810031us-gaap:RestrictedStockUnitsRSUMember2022-12-310001810031frln:UndesignatedDeferredShareTwoMember2022-09-300001810031frln:EquityInducementPlanMember2023-01-012023-09-300001810031frln:UndesignatedDeferredSharesMember2021-12-310001810031frln:AmericanDepositarySharesMemberfrln:SynconaPortfoliosLimitedMember2022-03-102022-03-100001810031frln:UndesignatedDeferredSharesMember2023-09-300001810031frln:EquityIncentivePlanMember2020-07-3100018100312021-12-310001810031us-gaap:AdditionalPaidInCapitalMember2022-12-310001810031frln:JefferiesLLCMemberfrln:AmericanDepositorySharesMemberfrln:OpenMarketSaleAgreementMember2022-01-012022-12-310001810031srt:MinimumMemberfrln:FreelineTherapeuticsGmbhMember2023-02-082023-02-080001810031us-gaap:OfficeEquipmentMember2022-12-310001810031frln:EquityIncentivePlanMember2023-09-300001810031us-gaap:CommonStockMember2021-12-310001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001810031frln:JefferiesLLCMemberfrln:AmericanDepositorySharesMemberfrln:OpenMarketSaleAgreementMember2023-01-012023-09-300001810031us-gaap:CommonStockMember2023-01-012023-09-300001810031frln:BrammerBioMaLlcMember2023-05-182023-05-180001810031frln:UndesignatedDeferredSharesMember2022-12-310001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001810031us-gaap:RetainedEarningsMember2022-09-300001810031frln:PerformanceAndServiceBasedMember2023-01-012023-09-300001810031us-gaap:GeneralAndAdministrativeExpenseMemberfrln:AmericanDepositorySharesMember2023-05-122023-05-120001810031frln:EquityIncentivePlanMember2022-01-012022-01-0100018100312023-01-012023-09-300001810031frln:AmericanDepositorySharesMemberfrln:SynconaPortfoliosLimitedMember2022-03-100001810031frln:EquityInducementPlanMember2021-09-270001810031us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100018100312022-12-310001810031frln:DeferredSharesTwoMember2021-12-310001810031frln:AmericanDepositorySharesMemberfrln:SynconaPortfoliosLimitedMember2022-03-102022-03-1000018100312023-09-300001810031frln:DeferredSharesTwoMember2022-12-310001810031us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-09-300001810031us-gaap:RetainedEarningsMember2022-01-012022-09-300001810031frln:PerformanceAndServiceBasedMember2023-09-3000018100312022-01-012022-09-300001810031us-gaap:AdditionalPaidInCapitalMember2023-09-300001810031us-gaap:FurnitureAndFixturesMember2023-09-300001810031frln:AmericanDepositorySharesMemberfrln:LincoLnParkCapitalFundsLLCMember2023-01-012023-09-300001810031us-gaap:RetainedEarningsMember2022-12-310001810031us-gaap:CommonStockMember2023-09-300001810031us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001810031us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001810031frln:OptionRepricingMember2023-01-012023-09-300001810031us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001810031frln:UnvestedOrdinarySharesMember2023-01-012023-09-300001810031us-gaap:EmployeeStockMember2023-09-30xbrli:purefrln:Employeesxbrli:sharesiso4217:GBPxbrli:sharesiso4217:GBPiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

(Commission File No. 001-39431)

Freeline Therapeutics Holdings plc

(Exact Name of Registrant as Specified in Its Charter)

Sycamore House

Gunnels Wood Road

Stevenage, Hertfordshire SG1 2BP

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

This Report on Form 6-K (other than the information contained in the press release furnished as Exhibit 99.1 to this Report on Form 6-K) shall be deemed to be incorporated by reference into the registration statement on Form F-3 (File No. 333-259444) and registration statements on Form S-8 (File Nos. 333-242129, 333-242133, 333-259852 and 333-265634) of Freeline Therapeutics Holdings plc and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

The information contained in the press release furnished as Exhibit 99.1 to this Report on Form 6-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, except as shall be expressly set forth by specific reference in any such filing.

INDEX

FREELINE THERAPEUTICS HOLDINGS PLC

Unaudited Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29,452 |

|

|

$ |

47,279 |

|

Prepaid expenses and other current assets |

|

|

4,544 |

|

|

|

6,235 |

|

Assets held for sale |

|

|

— |

|

|

|

14,113 |

|

Total current assets |

|

|

33,996 |

|

|

|

67,627 |

|

Non-current assets: |

|

|

|

|

|

|

Property and equipment, net |

|

|

8,625 |

|

|

|

9,007 |

|

Operating lease right of use assets |

|

|

3,926 |

|

|

|

6,014 |

|

Other non-current assets |

|

|

2,672 |

|

|

|

3,993 |

|

Total assets |

|

$ |

49,219 |

|

|

$ |

86,641 |

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

7,778 |

|

|

$ |

10,058 |

|

Accrued expenses and other current liabilities |

|

|

7,413 |

|

|

|

7,908 |

|

Operating lease liabilities, current |

|

|

2,286 |

|

|

|

2,663 |

|

Liabilities related to assets held for sale |

|

|

— |

|

|

|

10,337 |

|

Total current liabilities |

|

|

17,477 |

|

|

|

30,966 |

|

Non-current liabilities: |

|

|

|

|

|

|

Operating lease liabilities, non-current |

|

|

1,702 |

|

|

|

3,261 |

|

Total liabilities |

|

|

19,179 |

|

|

|

34,227 |

|

Commitments and contingencies (Note 12) |

|

|

|

|

|

|

Shareholders’ equity: |

|

|

|

|

|

|

Ordinary shares, £0.00001 par value, 400,000,000 shares authorized

as of September 30, 2023 and December 31, 2022; 65,369,206 and

65,113,575 issued and outstanding as of September 30, 2023 and

December 31, 2022, respectively |

|

|

— |

|

|

|

— |

|

Deferred shares, £0.00001 par value; 37,613 and 24,812 shares

authorized, issued and outstanding as of September 30, 2023 and

December 31, 2022, respectively |

|

|

— |

|

|

|

— |

|

Deferred shares, £100,000 par value; 1 authorized, issued and outstanding

as of September 30, 2023 and December 31, 2022 |

|

|

137 |

|

|

|

137 |

|

Additional paid-in capital |

|

|

503,756 |

|

|

|

500,781 |

|

Accumulated other comprehensive loss |

|

|

(1,567 |

) |

|

|

(3,151 |

) |

Accumulated deficit |

|

|

(472,286 |

) |

|

|

(445,353 |

) |

Total shareholders’ equity |

|

|

30,040 |

|

|

|

52,414 |

|

Total liabilities and shareholders' equity |

|

$ |

49,219 |

|

|

$ |

86,641 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-1

FREELINE THERAPEUTICS HOLDINGS PLC

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

2023 |

|

|

2022 |

|

License revenue |

$ |

622 |

|

|

$ |

— |

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

25,508 |

|

|

|

53,561 |

|

General and administrative |

|

24,001 |

|

|

|

25,009 |

|

Gain on legal settlement |

|

(2,227 |

) |

|

|

— |

|

Restructuring expense |

|

1,339 |

|

|

|

— |

|

Total operating expenses |

|

48,621 |

|

|

|

78,570 |

|

Loss from operations: |

|

(47,999 |

) |

|

|

(78,570 |

) |

Other income, net: |

|

|

|

|

|

Gain on sale of Freeline Therapeutics GmbH |

|

20,279 |

|

|

|

— |

|

Gain on lease termination |

|

— |

|

|

|

5,307 |

|

Other income, net |

|

39 |

|

|

|

5,451 |

|

Interest income, net |

|

338 |

|

|

|

631 |

|

Benefit from R&D tax credit |

|

619 |

|

|

|

1,304 |

|

Total other income, net |

|

21,275 |

|

|

|

12,693 |

|

Net loss before income taxes |

|

(26,724 |

) |

|

|

(65,877 |

) |

Income tax expense |

|

(209 |

) |

|

|

(96 |

) |

Net loss |

$ |

(26,933 |

) |

|

$ |

(65,973 |

) |

Net loss per share attributable to ordinary

shareholders—basic and diluted |

|

(0.41 |

) |

|

|

(1.15 |

) |

Weighted average ordinary shares outstanding—basic

and diluted |

|

65,217,110 |

|

|

|

57,384,985 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-2

FREELINE THERAPEUTICS HOLDINGS PLC

Unaudited Condensed Consolidated Statements of Comprehensive Loss

(in thousands)

(expressed in U.S. Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Net loss |

|

$ |

(26,933 |

) |

|

$ |

(65,973 |

) |

Other comprehensive loss: |

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

1,429 |

|

|

|

(18,324 |

) |

Comprehensive loss |

|

$ |

(25,504 |

) |

|

$ |

(84,297 |

) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-3

FREELINE THERAPEUTICS HOLDINGS PLC

Unaudited Condensed Consolidated Statements of Shareholders’ Equity

(in thousands, except share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary

£0.00001

Par Value |

|

Deferred

Shares £0.00001

Par Value |

|

Deferred

Shares £0.001

Par Value |

|

Deferred

Shares £100,000

Par Value |

|

Additional

Paid-in

Capital |

|

Accumulated

other

comprehensive gain (loss) |

|

Accumulated |

|

TOTAL

SHAREHOLDERS' |

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Amount |

|

Amount |

|

Deficit |

|

Equity |

|

Balance at December 31, 2021 |

|

35,854,591 |

|

$ |

— |

|

|

112,077 |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

1 |

|

$ |

137 |

|

$ |

467,213 |

|

$ |

9,472 |

|

$ |

(356,381 |

) |

$ |

120,441 |

|

Shares issued under employee share purchase plan |

|

149,254 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

110 |

|

|

— |

|

|

— |

|

|

110 |

|

Vesting of restricted share units |

|

34,063 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Forfeiture of ordinary shares |

|

(5,477 |

) |

|

— |

|

|

5,477 |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Issuance of ordinary shares, net of issuance cost of $2,600 |

|

28,848,968 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

28,291 |

|

|

— |

|

|

— |

|

|

28,291 |

|

Cancellation of deferred shares |

|

— |

|

|

— |

|

|

(93,451 |

) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

Non-cash share-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

4,037 |

|

|

— |

|

|

— |

|

|

4,037 |

|

Unrealized loss on foreign currency translation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(18,324 |

) |

|

— |

|

|

(18,324 |

) |

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(65,973 |

) |

|

(65,973 |

) |

Balance at September 30, 2022 |

|

64,881,399 |

|

$ |

— |

|

|

24,103 |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

1 |

|

$ |

137 |

|

$ |

499,651 |

|

$ |

(8,852 |

) |

$ |

(422,354 |

) |

$ |

68,582 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2022 |

|

65,113,575 |

|

$ |

— |

|

|

24,812 |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

1 |

|

$ |

137 |

|

$ |

500,781 |

|

$ |

(3,151 |

) |

$ |

(445,353 |

) |

$ |

52,414 |

|

Shares issued under employee share purchase plan |

|

217,755 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

32 |

|

|

— |

|

|

— |

|

|

32 |

|

Vesting of restricted share units |

|

50,677 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Forfeiture of ordinary shares |

|

(12,801 |

) |

|

— |

|

|

12,801 |

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Non-cash share-based compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,943 |

|

|

— |

|

|

— |

|

|

2,943 |

|

Release of cumulative foreign currency translation adjustment, upon sale of Freeline Therapeutics GmbH |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

155 |

|

|

— |

|

|

155 |

|

Unrealized gain on foreign currency translation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,429 |

|

|

— |

|

|

1,429 |

|

Net loss |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(26,933 |

) |

|

(26,933 |

) |

Balance at September 30, 2023 |

|

65,369,206 |

|

$ |

— |

|

|

37,613 |

|

$ |

— |

|

|

— |

|

$ |

— |

|

|

1 |

|

$ |

137 |

|

$ |

503,756 |

|

$ |

(1,567 |

) |

$ |

(472,286 |

) |

$ |

30,040 |

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-4

FREELINE THERAPEUTICS HOLDINGS PLC

Unaudited Condensed Consolidated Statements of Cash Flows

(in thousands)

(expressed in U.S. Dollars, unless otherwise stated)

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(26,933 |

) |

|

$ |

(65,973 |

) |

Adjustments to reconcile net loss to net cash used in operating activities |

|

|

|

|

|

|

Depreciation and amortization |

|

|

1,139 |

|

|

|

1,426 |

|

Non-cash share-based compensation expense |

|

|

2,943 |

|

|

|

4,037 |

|

(Gain) loss on disposal of property and equipment |

|

|

(47 |

) |

|

|

238 |

|

Gain on sale of Freeline Therapeutics GmbH |

|

|

(20,279 |

) |

|

|

— |

|

Gain on legal settlement |

|

|

(2,227 |

) |

|

|

— |

|

Gain on lease termination |

|

|

— |

|

|

|

(5,307 |

) |

Changes in components of operating assets and liabilities |

|

|

|

|

|

|

Prepaids and other current assets |

|

|

916 |

|

|

|

(1,917 |

) |

Other non-current assets |

|

|

— |

|

|

|

(162 |

) |

Operating lease right of use assets |

|

|

2,180 |

|

|

|

46,594 |

|

Accounts payable |

|

|

518 |

|

|

|

5,217 |

|

Accrued expenses and other current liabilities |

|

|

(440 |

) |

|

|

(4,110 |

) |

Operating lease liabilities, net |

|

|

(2,162 |

) |

|

|

(38,416 |

) |

Net cash used in operating activities |

|

|

(44,392 |

) |

|

|

(58,373 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(654 |

) |

|

|

(3,117 |

) |

Proceeds from the sale of equipment |

|

|

62 |

|

|

|

— |

|

Proceeds from the sale of Freeline Therapeutics GmbH, net of cash transferred with sale of $1,015 |

|

|

24,203 |

|

|

|

— |

|

Net cash provided by (used in) investing activities |

|

|

23,611 |

|

|

|

(3,117 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of ordinary shares |

|

|

— |

|

|

|

27,328 |

|

Proceeds from employee share purchase plan |

|

|

32 |

|

|

|

107 |

|

Net cash provided by financing activities |

|

|

32 |

|

|

|

27,435 |

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

|

|

1,292 |

|

|

|

(17,949 |

) |

Net decrease in cash, cash equivalents and restricted cash |

|

|

(19,457 |

) |

|

|

(52,004 |

) |

Cash, cash equivalents and restricted cash |

|

|

|

|

|

|

Beginning of period |

|

|

48,909 |

|

|

|

119,063 |

|

End of period |

|

$ |

29,452 |

|

|

$ |

67,059 |

|

Supplemental disclosure of non-cash flow information: |

|

|

|

|

|

|

Commitment shares issued to Lincoln Park Capital Fund, LLC |

|

|

— |

|

|

|

963 |

|

Property and equipment unpaid and accrued |

|

|

35 |

|

|

|

1,221 |

|

The following table provides a reconciliation of the cash, cash equivalents and restricted cash balances as of each of the periods shown above:

F-5

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Cash and cash equivalents |

|

$ |

29,452 |

|

|

$ |

65,848 |

|

Long-term restricted cash |

|

|

— |

|

|

|

1,211 |

|

Total cash, cash equivalents and restricted cash |

|

$ |

29,452 |

|

|

$ |

67,059 |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

F-6

FREELINE THERAPEUTICS HOLDINGS PLC

Notes to Unaudited Condensed Consolidated Financial Statements

Freeline Therapeutics Holdings plc (the “Company”) is a clinical-stage biotechnology company developing transformative adeno-associated virus (“AAV”) vector-mediated gene therapies for patients suffering from chronic debilitating diseases. The Company is headquartered in the United Kingdom (“U.K.”) and has operations in the United States (“U.S.”). The Company is a public limited company incorporated pursuant to the laws of England and Wales.

Going Concern

In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2014-15, Disclosure of Uncertainties about an Entity’s Ability to Continue as a Going Concern (Subtopic 205-40), the Company has evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern.

The Company is subject to risks and uncertainties common to early-stage companies in the biotechnology industry, including, but not limited to, the ability to secure additional capital to fund operations, development by competitors of new technological innovations, dependence on key personnel, protection of proprietary technology, and compliance with government regulations. Product candidates currently under development require significant additional research and development efforts, including clinical testing and regulatory approval, prior to any commercialization. These efforts require significant amounts of capital, adequate personnel and infrastructure and extensive compliance-reporting capabilities. Even if the Company’s product development efforts are successful, it is uncertain when, if ever, the Company will realize revenue from any product sales.

The Company has funded its operations primarily with proceeds from the sale of its equity securities. As of September 30, 2023, the Company had unrestricted cash and cash equivalents of $29.5 million. The Company has incurred recurring losses since its inception including net losses of $26.9 million and $66.0 million for the nine months ended September 30, 2023 and 2022, respectively. In addition, the Company had an accumulated deficit of $472.3 million as of September 30, 2023.

Net cash used in operating and investing activities was $20.8 million for the nine months ended September 30, 2023. The Company expects to continue to incur significant expenses and generate operating losses for the foreseeable future. These conditions indicate that there is substantial doubt regarding the Company's ability to continue as a going concern for at least 12 months from the issuance date of these unaudited condensed consolidated financial statements.

As a result, the Company will need additional funding to support its continuing operations. There can be no assurances, however, that additional funding will be available on favorable terms, or at all. If adequate funds are not available, the Company will be required to further reduce headcount as well as spending and potentially delay, limit, reduce or terminate its product research and development efforts in order to enable it to meet its obligations as they fall due for the foreseeable future.

The accompanying unaudited condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Accordingly, the unaudited condensed consolidated financial statements have been prepared on a basis that assumes the Company will continue as a going concern and which contemplates the realization of assets and satisfaction of liabilities and commitments in the ordinary course of business.

2.Summary of Significant Accounting Policies

The Company’s significant accounting policies are described in Note 2, Summary of Significant Accounting Policies, to the consolidated financial statements as of and for the year ended December 31, 2022 in the Annual Report on Form 20-F. There have been no material changes to the significant accounting policies during the nine months ended September 30, 2023, except as described below.

F-7

License Revenue

The Company accounts for its revenues pursuant to the provisions of ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”).

The Company has no products approved for commercial sale and has not generated any revenue from commercial product sales. The revenue earned to date has been generated solely from an out-licensing agreement.

In determining the appropriate amount of revenue to be recognized as the Company fulfills its obligations under the arrangement within the scope of ASC 606, the Company performs the following steps: (i) identification of the promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations, including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint on variable consideration; (iv) allocation of the transaction price to the performance obligations based on estimated selling prices; and (v) recognition of revenue when (or as) the Company satisfies each performance obligation.

License Fees and Multiple Element Arrangements

If a license to the Company’s intellectual property is determined to be distinct from the other performance obligations identified in the arrangement, the Company recognizes revenues from non-refundable, upfront fees allocated to the license at such time as the license is transferred to the licensee and the licensee is able to use, and benefit from, the license. For licenses that are bundled with other promises, the Company utilizes judgment to assess the nature of the combined performance obligations to determine whether the combined performance obligations are satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress for purposes of recognizing revenue from non-refundable, upfront fees. The Company evaluates the measure of progress each reporting period and, if necessary, adjusts the measure of performance and related revenue recognition.

Appropriate methods of measuring progress include output methods and input methods. In determining the appropriate method for measuring progress, the Company considers the nature of service that the Company promises to transfer to the customer. When the Company decides on a method of measurement, the Company will apply that single method of measuring progress for each performance obligation satisfied over time and will apply that method consistently to similar performance obligations and in similar circumstances.

Contingent Research Milestone Payments

ASC 606 constrains the amount of variable consideration included in the transaction price in that either all, or a portion, of an amount of variable consideration should be included in the transaction price. The variable consideration amount should be included only to the extent that it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. The assessment of whether variable consideration should be constrained is largely a qualitative one that has two elements: the likelihood of a change in estimate, and the magnitude thereof. Variable consideration is not constrained if the potential reversal of cumulative revenue recognized is not significant.

If the consideration in a contract includes a variable amount, the Company will estimate the amount of consideration in exchange for transfer of promised goods or services. The consideration also can vary if the Company’s entitlement to the consideration is contingent on the occurrence or non-occurrence of a future event. The Company considers contingent research milestone payments to fall under the scope of variable consideration, which should be estimated for revenue recognition purposes at the inception of the contract and reassessed ongoing at the end of each reporting period. If the Company determines that variable consideration should be constrained, the variable consideration is not included as part of the transaction price. This includes an assessment of the probability that all or some of the milestone revenue could be reversed when the uncertainty around whether or not the achievement of each milestone is resolved, and the amount of reversal could be significant.

The Company considers all relevant factors in accordance with U.S. GAAP when assessing whether variable consideration should be constrained and no one factor is determinative.

F-8

Royalty Revenue

For arrangements that include sales-based royalties, including milestone payments based on the level of sales, and in which the license is deemed to be the predominant item to which the royalties relate, the Company recognizes revenue at the later of (i) when the related sales occur, or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied (or partially satisfied).

3.Sale of Freeline Therapeutics GmbH

On February 8, 2023, the Company sold its German subsidiary, Freeline Therapeutics GmbH, and certain intellectual property rights to Ascend Gene & Cell Therapies Limited ("Ascend") pursuant to a definitive agreement entered into in November 2022 for an aggregate cash purchase price of $25.0 million, subject to purchase price adjustments, and a license back of certain intellectual property rights assigned to Ascend (the "Subsidiary Sale"). The Subsidiary Sale did not meet the criteria for reporting discontinued operations as there was not a strategic shift that has had, or will have, a major effect on the Company's operations. The Company recognized a gain on the Subsidiary Sale of $20.3 million in its unaudited condensed consolidated statement of operations during the nine months ended September 30, 2023. Upon the closing of the Subsidiary Sale, the cumulative foreign currency translation losses totaling $0.2 million were released to earnings and included in the gain on the Subsidiary Sale.

In connection with the Subsidiary Sale, the Company and Ascend also entered into a transition services agreement (the "Transition Services Agreement"), pursuant to which Ascend will provide certain services in the area of development and manufacturing to the Company. As part of the Transition Services Agreement, the Company agreed to utilize no fewer than 15 full-time employee equivalents ("FTEs") per annum for a guaranteed period of 18 months following the Transition Services Agreement’s effective date of February 8, 2023. The Company also agreed to pay Ascend a guaranteed minimum of approximately $7.9 million in respect of FTE costs during such period, of which $2.6 million has been paid through September 30, 2023. The Company will make minimum guaranteed payments to Ascend of $2.2 million and $3.1 million for the years ending December 31, 2023 and 2024, respectively. The Transition Services Agreement will terminate three years after its effective date, unless earlier terminated by Freeline with 90 days' written notice, effective from the end of the 18-month guarantee period at the earliest, in accordance with its terms.

Concurrently with the closing of the Subsidiary Sale, the Company and Ascend entered into an intellectual property deed of assignment and license (the "IP Agreement"), pursuant to which the Company assigned certain intellectual property rights pertaining to the business of Freeline Therapeutics GmbH to Ascend, including certain patents and know-how related to chemistry, manufacturing and controls capabilities and technologies. Ascend granted a non-exclusive, royalty-free, perpetual, irrevocable, worldwide license back to the Company of the assigned rights necessary to develop or commercialize its then-current product candidates. There was no value assigned or recorded for the license back to the Company as the license is considered in-process research and development and had no alternative future use.

F-9

The table below sets forth the book value of the Freeline Therapeutics GmbH assets and liabilities sold along with the calculation of the gain on sale based on the cash consideration received.

|

|

|

|

|

|

|

(in thousands) |

|

Book value of assets sold |

|

|

|

Cash and cash equivalents |

|

$ |

1,015 |

|

Prepaid expenses and other current assets |

|

|

414 |

|

Property and equipment, net |

|

|

5,470 |

|

Operating lease right of use assets |

|

|

8,455 |

|

Other non-current assets |

|

|

3 |

|

Amounts attributable to assets sold |

|

|

15,357 |

|

Book value of liabilities sold |

|

|

|

Accounts payable |

|

|

230 |

|

Accrued expenses and other current liabilities |

|

|

1,430 |

|

Operating lease liabilities, current |

|

|

869 |

|

Operating lease liabilities, non-current |

|

|

8,044 |

|

Amounts attributable to liabilities sold |

|

|

10,573 |

|

Total identifiable net assets sold |

|

|

4,784 |

|

Less: accumulated other comprehensive loss |

|

|

(155 |

) |

Consideration, inclusive of cash transferred |

|

|

25,218 |

|

Gain on sale of Freeline Therapeutics GmbH |

|

$ |

20,279 |

|

On March 24, 2023, the Company entered into an exclusive patent and know-how out-license agreement (the "Syncona Agreement") with Syncona IP Holdco (2) Limited ("Syncona Holdco"), a company controlled by Syncona Limited. Under the terms of the Syncona Agreement, the Company granted Syncona Holdco an exclusive license under certain patent rights related to an immune-modifying protein (the "Patent"), an exclusive license under certain patent rights related to an assay (the "Assay Patent"), and a non-exclusive license to certain know-how (the "Assay Know-How") to develop and commercialize the technology other than in respect of liver-directed gene therapies. Upon execution of the Syncona Agreement, the Company made available the licensed intellectual property to Syncona Holdco for an upfront non-refundable payment of £0.5 million or $0.6 million. The Company has no further material performance obligations related to the Syncona Agreement.

The Company identified the following material promises relating to the Syncona Agreement. The Company determined that the licenses of the Patent, Assay Patent and Assay Know-How were not individually distinct because Syncona Holdco can only benefit from the licensed intellectual property rights when bundled together as one performance obligation. Based on these determinations, the Company identified one distinct performance obligation at the inception of the contract.

The Company further determined that the upfront license fee payable constitutes the transaction price at contract inception, which was allocated to one performance obligation. The amount of the transaction price allocated to the performance obligation is recognized as or when the Company satisfies the performance obligation. The Company determined that the performance obligation was recognized at a point-in-time, upon the delivery of the licenses to Syncona Holdco. The Company recognized total license revenue of £0.5 million or $0.6 million, related to the Syncona Agreement for the nine months ended September 30, 2023.

F-10

The Company may receive further payments up to £12.5 million or $15.6 million upon the achievement of certain development and regulatory milestones, as well as low-single-digit percentage royalty payments based on net sales of certain licensed products covered by the licensed intellectual property. Future potential milestone payments have not been recognized as revenue due to the risk of significant revenue reversal related to these amounts has not yet been resolved as of September 30, 2023. The achievement of the future potential milestones is not within the Company’s control and is subject to certain research and development success or regulatory approvals and therefore carries significant uncertainty. The Company will reevaluate the likelihood of achieving future milestones at the end of each reporting period. As all performance obligations will have been satisfied in advance of the achievement of the milestone events, if the risk of significant revenue reversal is resolved, any future milestone revenue from the arrangement will be added to the transaction price (and thereby recognized as revenue) in the period the risk is resolved.

The Company further granted to Syncona Holdco the option to take an assignment of the licensed intellectual property (the "Option"). Upon exercise of the Option, Syncona Holdco granted the Company a worldwide exclusive fully-paid up royalty free license to the assigned intellectual property. The Company determined that the Option is not considered a material right and does not give rise to a separate performance obligation. Syncona Holdco exercised the Option in July 2023.

5.Prepaid Expenses and Other Current Assets

Prepaid expenses and other current assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

U.K. R&D tax credit |

|

$ |

1,847 |

|

|

$ |

1,230 |

|

VAT receivable |

|

|

976 |

|

|

|

1,373 |

|

Insurance |

|

|

20 |

|

|

|

1,702 |

|

Prepaid clinical research organization costs |

|

|

748 |

|

|

|

1,535 |

|

Other current assets |

|

|

953 |

|

|

|

395 |

|

|

|

$ |

4,544 |

|

|

$ |

6,235 |

|

6.Property and Equipment, Net

Property and equipment, net consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Office equipment and computers |

|

$ |

929 |

|

|

$ |

751 |

|

Furniture & Fixtures |

|

|

2,586 |

|

|

|

2,584 |

|

Laboratory equipment |

|

|

3,278 |

|

|

|

3,140 |

|

Leasehold improvements |

|

|

7,887 |

|

|

|

7,549 |

|

|

|

|

14,680 |

|

|

|

14,024 |

|

Less: accumulated depreciation |

|

|

(6,055 |

) |

|

|

(5,017 |

) |

|

|

$ |

8,625 |

|

|

$ |

9,007 |

|

Depreciation and amortization expense was $1.1 million and $1.4 million for the nine months ended September 30, 2023 and 2022, respectively.

F-11

7.Other Non-current Assets

Other non-current assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Deferred offering costs |

|

$ |

2,149 |

|

|

$ |

2,133 |

|

Restricted cash |

|

|

— |

|

|

|

1,327 |

|

Deferred tax asset |

|

|

523 |

|

|

|

533 |

|

|

|

$ |

2,672 |

|

|

$ |

3,993 |

|

Restricted cash consisted of collateral deposits for the office space leased by the Company's former wholly owned subsidiary, Freeline Therapeutics GmbH. This collateral was released upon the sale of Freeline Therapeutics GmbH in the nine months ended September 30, 2023.

8.Accrued Expenses and Other Liabilities

Accrued expenses and other liabilities consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Employee compensation and benefits costs |

|

$ |

2,743 |

|

|

$ |

4,178 |

|

Research and development expenses |

|

|

3,036 |

|

|

|

1,923 |

|

Consulting and professional services |

|

|

1,351 |

|

|

|

1,215 |

|

Other liabilities |

|

|

283 |

|

|

|

592 |

|

|

|

$ |

7,413 |

|

|

$ |

7,908 |

|

Ordinary Shares

As of September 30, 2023, the Company’s authorized capital consisted of 400,000,000 ordinary shares with a par value of £0.00001 per share.

Each holder of ordinary shares is entitled to one vote per ordinary share and to receive dividends when and if such dividends are recommended by the board of directors and approved by the shareholders. As of September 30, 2023, the Company has not declared any dividends.

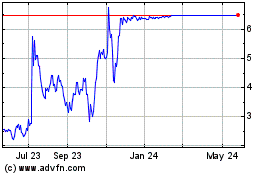

ADS Ratio Change

On May 12, 2023, the Company changed the ratio of its American Depositary Shares ("ADSs") to its ordinary shares (the "ADS Ratio") from the previous ADS Ratio of one ADS to one ordinary share to a new ADS Ratio of one ADS to fifteen ordinary shares. The change in the ADS Ratio had the same effect as a one-for-fifteen reverse ADS split and enabled the Company to regain compliance with the Nasdaq minimum bid price requirement. As all financial statement and disclosure information is presented in ordinary share amounts, not ADSs, there was no impact to the unaudited condensed consolidated financial statements and footnote disclosures. The Company paid depositary fees of $2.0 million in connection with the ADS Ratio change which is recorded within general and administrative expenses on the Company’s unaudited condensed consolidated statements of operations during the nine months ended September 30, 2023.

Registered Direct Offering

On March 10, 2022, the Company entered into a purchase agreement with its majority shareholder, Syncona Portfolio Limited, a subsidiary of Syncona Limited, and certain other existing shareholders providing for the issuance and sale by the Company of ADSs representing 24,857,144 ordinary shares at a price of $1.05 per ordinary share for total gross proceeds of $26.1 million, in a registered direct offering. The offering closed on March 15, 2022. The Company received net proceeds of approximately $24.2 million from the offering, after deducting offering expenses payable by the Company.

F-12

Lincoln Park Capital

On March 18, 2022, the Company entered into a purchase agreement with Lincoln Park Capital Fund, LLC (“Lincoln Park”) under which the Company may at its discretion, sell to Lincoln Park up to $35.0 million of its ADSs over a 36-month period, subject to certain daily limits, applicable prices, and conditions. In addition, under the purchase agreement, the Company issued ADSs representing 954,208 ordinary shares as commitment shares to Lincoln Park as consideration for its commitment to purchase ADSs under the purchase agreement (the “Commitment Shares”). The Commitment Shares were valued using the closing price of the Company’s ADSs on the date of the purchase agreement resulting in a fair market value of approximately $1.0 million. The fair value of the Commitment Shares as well as issuance costs of $0.2 million associated with the purchase agreement are classified as other non-current assets in the accompanying unaudited condensed consolidated balance sheet. As the Company’s ADSs are sold in accordance with the purchase agreement, the fair value of the Commitment Shares and issuance costs will be reclassified to additional paid-in capital on the Company’s condensed consolidated balance sheet. During the nine months ended September 30, 2023, the Company did not issue any additional ADSs pursuant to the purchase agreement.

Open Market Sale AgreementSM

On November 17, 2021, the Company entered into an Open Market Sale AgreementSM (the "Sales Agreement") with Jefferies LLC ("Jefferies") pursuant to which the Company may issue and sell ADSs having aggregate offering sales proceeds of up to $75.0 million, from time to time, in “at-the-market” offerings pursuant to which Jefferies will act as sales agent and/or principal. During the year ended December 31, 2022, the Company issued ADSs representing 3,037,616 ordinary shares pursuant to the Sales Agreement, raising approximately $3.2 million in net proceeds. During the nine months ended September 30, 2023, the Company did not issue any additional ADSs pursuant to the Sales Agreement.

Deferred Shares

Deferred shares are a unit of equity that confer to their holder effectively no economic rights or any voting rights. The Company, without the consent of the shareholder, may transfer deferred shares at any time for nil consideration.

In the nine months ended September 30, 2023, unvested Employee Shares were forfeited upon termination of employment, classified as additional deferred shares of £0.00001 each on the balance sheet and will be subsequently cancelled (see Note 10).

Deferred shares are not included in the Company’s potentially dilutive securities as they are not ordinary shares and have no conversion rights.

The table below reflects the number of ordinary shares and deferred shares issued and outstanding at September 30, 2023 and December 31, 2022.

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Ordinary shares |

|

|

65,369,206 |

|

|

|

65,113,575 |

|

Deferred shares of £0.00001 |

|

|

37,613 |

|

|

|

24,812 |

|

Deferred shares of £100,000 |

|

|

1 |

|

|

|

1 |

|

Total ordinary and deferred shares |

|

|

65,406,820 |

|

|

|

65,138,388 |

|

F-13

10.Non-Cash Share-Based Compensation

2020 Equity Incentive Plan

On July 31, 2020, the Company adopted an equity incentive plan (the “2020 Plan”). The 2020 Plan provides for the grant of options, share appreciation rights (“SARs”), restricted shares, dividend equivalents, restricted share units (“RSUs”), and other share-based awards. The maximum number of equity awards originally authorized under the 2020 Plan was 5,898,625 shares. Additionally, the number of ordinary shares reserved for issuance under the 2020 Plan automatically increases on January 1st of each year, for a period of not more than ten years, by an amount equal to the lesser of (i) 4% of the total number of ordinary shares outstanding on December 31st of the prior calendar year or (ii) such fewer number of ordinary shares as the board of directors may designate prior to the applicable January 1st date. On January 1, 2023 and 2022, the number of shares reserved automatically increased by 2,596,620 and 1,434,184 shares, respectively. As of September 30, 2023, 2,252,316 shares are available for future issuance under the 2020 Plan.

The Company has typically granted equity awards under the 2020 Plan that vest over a four-year service period, with 25% of the award vesting on the first anniversary of the vesting commencement date, with the balance generally vesting periodically over the remaining three years. During the nine months ended September 30, 2023, the Company granted equity awards under the 2020 Plan that vest over a three-year service period, subject to vesting acceleration upon achievement of two distinct milestones related to progression of the Company’s FLT201 product candidate for the treatment of Gaucher disease Type 1 toward initiation of a Phase 3 clinical trial. See Note 15, Subsequent Events regarding achievement of performance milestones.

2021 Equity Inducement Plan

On September 27, 2021, the Company adopted an equity inducement plan (the “Inducement Plan”). The purpose of the Inducement Plan is to enhance the Company’s ability to attract employees who are expected to make important contributions to the Company by providing these individuals with equity ownership opportunities. Awards under the Inducement Plan are granted as an inducement material to employees entering into employment with the Company. The Inducement Plan provides for the grant of options, SARs, restricted shares, dividend equivalents, RSUs, and other share-based awards. The maximum number of equity awards authorized under the Inducement Plan is 3,400,000 shares. Any equity awards granted under the Inducement Plan that expire, lapse, or are terminated, exchanged for cash, surrendered, repurchased or cancelled, without having been fully exercised, or forfeited, will be added back to shares issuable under the Inducement Plan, subject to certain conditions. As of September 30, 2023, 1,677,200 shares are available for future issuance under the Inducement Plan. There were no inducement grants issued under the Inducement Plan during the nine months ended September 30, 2023.

2020 Employee Share Purchase Plan

On July 31, 2020, the Company adopted an employee share purchase plan (the “ESPP”). The purpose of the ESPP is to provide employees the opportunity to purchase ordinary shares or ADSs at 85% of the fair market value of the ADSs on the offering date or the exercise date, whichever is lower, for up to 15% of such employee’s compensation for each pay period. The Company reserved 347,447 ordinary shares for the ESPP. The ESPP provides for an annual increase beginning on January 1, 2022 in an amount equal to the least of (i) 347,447 ordinary shares, (ii) 1% of the total number of ordinary shares outstanding on December 31st of the prior calendar year or (iii) such fewer number of ordinary shares as the board of directors may designate prior to the applicable January 1st date. On January 1, 2023, the reserve automatically increased by 347,447 shares. During the nine months ended September 30, 2023, 217,755 shares were purchased under the ESPP. As of September 30, 2023, 393,278 shares are available for future issuance under the ESPP.

The numbers of Employee Shares, share options and RSUs, the weighted average grant date fair values per Employee Share, share option and RSU, and the weighted average exercise prices are all shown below on a per ordinary share basis.

F-14

Option Repricing

On June 28, 2023, the Company's shareholders approved the amendment of the exercise price of each outstanding option granted to an employee on or after June 1, 2021 with an exercise price greater than or equal to $0.42 per ordinary share (or $6.27 per ADS) under the 2021 Equity Inducement Plan and 2020 Equity Incentive Plan (the "In-Scope Options") to a new replacement exercise price per ADS equal to $2.42, the closing sales price for ADSs as quoted on the Nasdaq Capital Market on June 29, 2023 (the "Repricing"). The Repricing was effective on June 30, 2023 (the "Repricing Date"). Share options held by the Company's non-executive directors were not included in the Repricing. The Repricing was deemed to be a Type I modification event under ASC 718, Compensation-Stock Compensation. No other terms of the In-Scope Options were modified, and the In-Scope Options will continue to vest according to their original vesting schedules and will retain their original expiration dates. The Repricing resulted in incremental share-based compensation expense of $0.4 million, of which $0.1 million related to vested share option awards and was expensed on the Repricing Date and $0.3 million related to unvested share option awards and will be amortized on a ratable basis over the remaining weighted-average vesting period of those awards.

Employee Shares

The Company measures all non-cash share-based awards using the fair value on the date of grant and recognizes compensation expense for those awards over the requisite service period, which is generally the vesting period of the respective award. Prior to the Company’s initial public offering (“IPO”), the Company granted share-based compensation in the form of ordinary shares, collectively referred to as Employee Shares, to employees and non-employees with both performance and service-based vesting conditions. The Company records expense for these awards using the straight-line method.

A summary of the changes in the Employee Shares from December 31, 2022 through September 30, 2023 is as follows:

|

|

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Weighted

Average

Grant Date

Fair Value |

|

Unvested balance as of December 31, 2022 |

|

|

16,309 |

|

|

$ |

11.33 |

|

Granted |

|

|

— |

|

|

|

— |

|

Vested |

|

|

(3,864 |

) |

|

|

11.07 |

|

Forfeited |

|

|

(11,642 |

) |

|

|

11.91 |

|

Unvested balance as of September 30, 2023 |

|

|

803 |

|

|

$ |

13.05 |

|

As of September 30, 2023, there was less than $0.1 million of unrecognized compensation cost related to unvested Employee Shares outstanding, which is expected to be recognized over a weighted-average period of 1.0 years. Unvested Employee Shares are forfeited upon termination of employment, classified as deferred shares on the balance sheet and are subsequently cancelled.

Share Options Valuation

The assumptions used in the Black-Scholes option pricing model to determine the fair value of the share options granted to employees and directors during the nine months ended September 30, 2023 were as follows:

|

|

|

|

|

|

|

For the Nine Months

Ended September 30, |

|

|

|

2023 |

|

Expected option life (years) |

|

|

5.8 |

|

Expected volatility |

|

|

71.8 |

% |

Risk-free interest rate |

|

|

3.6 |

% |

Expected dividend yield |

|

|

— |

|

F-15

Share Options

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of

Shares |

|

|

Weighted

Average

Exercise Price |

|

|

Weighted Average Remaining Contractual Term (in years) |

|

|

Aggregate Intrinsic Value (in thousands) |

|

Outstanding as of December 31, 2022 |

|

|

7,918,500 |

|

|

$ |

4.76 |

|

|

|

8.40 |

|

|

$ |

— |

|

Granted |

|

|

4,031,696 |

|

|

|

0.20 |

|

|

|

— |

|

|

|

457 |

|

Exercised |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Expired |

|

|

(665,081 |

) |

|

|

13.67 |

|

|

|

— |

|

|

|

— |

|

Canceled or Forfeited |

|

|

(1,789,783 |

) |

|

|

2.86 |

|

|

|

— |

|

|

|

— |

|

Outstanding as of September 30, 2023 |

|

|

9,495,332 |

|

|

$ |

1.80 |

|

|

|

8.17 |

|

|

$ |

995 |

|

Exercisable as of September 30, 2023 |

|

|

3,017,640 |

|

|

|

4.48 |

|

|

|

6.53 |

|

|

|

211 |

|

Vested and expected to vest as of September 30, 2023 |

|

|

9,495,332 |

|

|

$ |

1.80 |

|

|

|

8.17 |

|

|

$ |

995 |

|

The aggregate intrinsic value of share options is calculated as the difference between the exercise price of the share options and the fair value of the Company’s ordinary shares for those share options that had exercise prices lower than the fair value of the Company’s ordinary shares.

The weighted-average grant-date fair value for the share options granted during the nine months ended September 30, 2023 and 2022 was $0.20 per share and $0.73 per share, respectively. The weighted-average grant-date fair value for the share options vested during the nine months ended September 30, 2023 and 2022 was $2.81 per share and $7.30 per share, respectively.

As of September 30, 2023, there was $5.5 million of unrecognized compensation cost related to unvested share options outstanding, which is expected to be recognized over a weighted-average period of 2.2 years.

Restricted Share Units

The Company has granted (i) RSUs that generally vest over a period of three or four years from the date of grant and (ii) RSUs to certain new employees in order to compensate them for equity awards forfeited to their previous employers which generally vest over a period of less than one year from the date of grant. The Company granted share options and RSUs as its annual equity incentive awards to employees during the nine months ended September 30, 2023. The following table summarizes the activity related to RSUs from December 31, 2022, through September 30, 2023:

|

|

|

|

|

|

|

|

|

|

|

Number of

RSUs |

|

|

Weighted

Average

Grant Date

Fair Value |

|

Outstanding as of December 31, 2022 |

|

|

445,590 |

|

|

$ |

0.98 |

|

Granted |

|

|

1,165,939 |

|

|

|

0.59 |

|

Vested and settled |

|

|

(89,277 |

) |

|

|

1.09 |

|

Canceled or forfeited |

|

|

(351,821 |

) |

|

|

0.85 |

|

Outstanding as of September 30, 2023 |

|

|

1,170,431 |

|

|

$ |

0.62 |

|

|

|

|

|

|

|

|

As of September 30, 2023, there was $0.6 million of unrecognized compensation cost related to unvested RSUs, which is expected to be recognized over a weighted-average period of 2.6 years.

F-16

Share-based Compensation Expense

Non-cash share-based compensation expense recorded as research and development and general and administrative expenses is as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

For the Nine Months Ended September 30, |

|

|

|

2023 |

|

|

2022 |

|

Research and development |

|

$ |

792 |

|

|

$ |

1,675 |

|

General and administrative |

|

|

2,151 |

|

|

|

2,362 |

|

|

|

$ |

2,943 |

|

|

$ |

4,037 |

|

Basic and diluted net loss per share attributable to ordinary shareholders was calculated as follows (in thousands, except share and per share amounts):

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

Numerator |

|

|

|

|

|

|

Net loss |

|

$ |

(26,933 |

) |

|

$ |

(65,973 |

) |

Net loss attributable to ordinary shareholders—basic and diluted |

|

$ |

(26,933 |

) |

|

$ |

(65,973 |

) |

Denominator |

|

|

|

|

|

|

Weighted-average number of ordinary shares used in net loss per share - basic and diluted |

|

|

65,217,110 |

|

|

|

57,384,985 |

|

Net loss per share attributable to ordinary shareholders— basic and diluted |

|

$ |

(0.41 |

) |

|

$ |

(1.15 |

) |

The Company used the treasury stock method to determine the number of dilutive shares. The Company excluded the following potential ordinary shares, presented based on amounts outstanding at each period end, from the computation of diluted net loss per share attributable to ordinary shareholders for the nine months ended September 30, 2023 and 2022 because including them would have had an anti-dilutive effect:

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

2023 |

|

|

2022 |

|

Unvested ordinary shares |

|

|

803 |

|

|

|

21,493 |

|

Share options |

|

|

9,495,332 |

|

|

|

8,171,164 |

|

Restricted share units |

|

|

1,170,431 |

|

|

|

459,450 |

|

Total |

|

|

10,666,566 |

|

|

|

8,652,107 |

|

12.Commitments and Contingencies

Legal Proceedings

From time to time, the Company may be a party to litigation or arbitration or subject to claims incident to the ordinary course of business. Regardless of the outcome, litigation and arbitration are subject to inherent uncertainties and could adversely impact the Company’s reputation, operations, and its operating results or overall financial condition. As of September 30, 2023, except as set forth below, there were no pending material legal proceedings to which the Company was a party or to which any of its property was subject, and the Company did not have contingency reserves established for any liabilities as of September 30, 2023 and December 31, 2022. When appropriate in management’s estimation, the Company will record adequate reserves in its financial statements for pending litigation or arbitration.

F-17

In June 2020, the Company entered into a dedicated manufacturing and commercial supply agreement (the “Manufacturing Agreement”) with Brammer Bio MA, LLC (“Brammer”) pursuant to which Brammer was obligated to reserve certain amounts of manufacturing capacity in its manufacturing facility to supply the Company with its product candidate FLT180a for the treatment of hemophilia B. As consideration for the reserved manufacturing capacity, the Company was required to pay Brammer an annual capacity access fee of $10.0 million, subject to inflationary annual increases, excluding any purchase commitment or other fees.

The Company committed to an annual minimum purchase commitment equivalent to $6.0 million throughout the term of the Manufacturing Agreement. The term of the Manufacturing Agreement was effective as of June 30, 2020 and was to continue until December 31, 2027.