UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month

of August 2023

Commission File

Number: 001-41661

JIN MEDICAL INTERNATIONAL

LTD.

No. 33 Lingxiang

Road, Wujin District

Changzhou City,

Jiangsu Province

People’s Republic

of China

(Address of principal

executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934:

Yes ☐

No ☒

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

Explanatory Note

On August 23, 2023, Jin

Medical International Ltd. (the “Company”) reported its financial results for the six months ended March 31, 2023. The Company

hereby furnishes the following documents as exhibits to this report: “Unaudited Financial Results and Statements of Jin Medical

International Ltd. for the Six (6) Months Ended March 31, 2023”; and “Operating and Financial Review and Prospects”.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

JIN MEDICAL INTERNATIONAL LTD. |

| |

|

|

| Date: August 23, 2023 |

By: |

/s/ Erqi Wang |

| |

Name: |

Erqi Wang |

| |

Title: |

Chief Executive Officer |

Exhibit 99.1

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

TABLE OF CONTENTS

JIN

MEDICAL INTERNATIONAL LTD.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

March 31 | | |

September 30 | |

| | |

2023 | | |

2022 | |

| ASSETS | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash | |

$ | 8,684,188 | | |

$ | 4,792,632 | |

| Short-term investments | |

| 4,696,503 | | |

| 2,276,158 | |

| Accounts receivable, net | |

| 3,869,399 | | |

| 3,830,876 | |

| Accounts receivable - related parties | |

| 291,883 | | |

| 253,473 | |

| Inventories | |

| 6,509,349 | | |

| 6,724,415 | |

| Due from related parties | |

| 4,874,422 | | |

| 36,257 | |

| Prepaid expenses and other current assets | |

| 163,356 | | |

| 989,336 | |

| TOTAL CURRENT ASSETS | |

| 29,089,100 | | |

| 18,903,147 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 1,582,650 | | |

| 1,627,962 | |

| Land use right, net | |

| 166,476 | | |

| 163,213 | |

| Deferred tax assets | |

| 184,271 | | |

| 245,212 | |

| TOTAL ASSETS | |

$ | 31,022,497 | | |

$ | 20,939,534 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES: | |

| | | |

| | |

| Short-term bank loan | |

$ | 1,456,000 | | |

$ | - | |

| Accounts payable | |

| 4,614,084 | | |

| 4,113,622 | |

| Accrued liabilities and other payables | |

| 378,097 | | |

| 393,760 | |

| Deferred revenue | |

| 561,146 | | |

| 830,305 | |

| Deferred revenue - a related party | |

| 124,766 | | |

| - | |

| Taxes payable | |

| 341,885 | | |

| 248,090 | |

| Due to a related party | |

| - | | |

| 118,066 | |

| TOTAL CURRENT LIABILITIES | |

| 7,475,978 | | |

| 5,703,843 | |

| TOTAL LIABILITIES | |

| 7,475,978 | | |

| 5,703,843 | |

| | |

| | | |

| | |

| COMMITMENTS AND CONTINGENCIES | |

| | | |

| | |

| | |

| | | |

| | |

| SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Ordinary shares, $0.001 par value, 50,000,000 shares authorized, 7,750,000 shares and 6,750,000 shares were issued and outstanding as of March 31, 2023 and September 30, 2022, respectively* | |

| 7,750 | | |

| 6,750 | |

| Additional paid-in capital | |

| 6,053,131 | | |

| 79,810 | |

| Statutory reserves | |

| 1,827,972 | | |

| 1,651,422 | |

| Retained earnings | |

| 15,998,640 | | |

| 14,408,843 | |

| Accumulated other comprehensive loss | |

| (340,974 | ) | |

| (911,134 | ) |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 23,546,519 | | |

| 15,235,691 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | |

$ | 31,022,497 | | |

$ | 20,939,534 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

JIN

MEDICAL INTERNATIONAL LTD.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| | |

For the Six months ended

March 31, | |

| | |

2023 | | |

2022 | |

| REVENUE | |

| | | |

| | |

| Revenue - third party | |

$ | 9,890,292 | | |

$ | 9,061,177 | |

| Revenue - related party | |

| 362,871 | | |

| 406,444 | |

| Total revenue | |

| 10,253,163 | | |

| 9,467,621 | |

| | |

| | | |

| | |

| COST OF REVENUE AND RELATED TAX | |

| | | |

| | |

| Cost of revenue | |

| 6,620,447 | | |

| 6,255,785 | |

| Business and sales related tax | |

| 101,843 | | |

| 79,314 | |

| Total cost of revenue and related tax | |

| 6,722,290 | | |

| 6,335,099 | |

| GROSS PROFIT | |

| 3,530,873 | | |

| 3,132,522 | |

| | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | |

| Selling expenses | |

| 206,194 | | |

| 201,740 | |

| General and administrative expenses | |

| 922,188 | | |

| 1,021,717 | |

| Research and development expenses | |

| 631,034 | | |

| 892,524 | |

| Total operating expenses | |

| 1,759,416 | | |

| 2,115,981 | |

| INCOME FROM OPERATIONS | |

| 1,771,457 | | |

| 1,016,541 | |

| | |

| | | |

| | |

| OTHER INCOME (EXPENSE) | |

| | | |

| | |

| Interest income, net | |

| 94,571 | | |

| 69,795 | |

| Foreign exchange gain (loss) | |

| (63,253 | ) | |

| 60,461 | |

| Other income, net | |

| 167,625 | | |

| 129,475 | |

| Total other income, net | |

| 198,943 | | |

| 259,731 | |

| | |

| | | |

| | |

| INCOME BEFORE INCOME TAX PROVISION | |

| 1,970,400 | | |

| 1,276,272 | |

| PROVISION FOR INCOME TAXES | |

| 204,053 | | |

| 50,408 | |

| | |

| | | |

| | |

| NET INCOME | |

| 1,766,347 | | |

| 1,225,864 | |

| Foreign currency translation gain | |

| 570,160 | | |

| 268,280 | |

| TOTAL COMPREHENSIVE INCOME | |

$ | 2,336,507 | | |

$ | 1,494,144 | |

| | |

| | | |

| | |

Earnings per common share - basic and diluted | |

$ | 0.26 | | |

$ | 0.18 | |

Weighted average shares - basic and diluted* | |

| 6,760,989 | | |

| 6,750,000 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

JIN MEDICAL INTERNATIONAL LTD.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

FOR THE SIX MONTHS ENDED MARCH 31, 2023 AND 2022

| | |

| | |

| | |

Additional | | |

| | |

| | |

Accumulated Other | | |

| |

| | |

Ordinary Shares* | | |

Paid in | | |

Statutory | | |

Retained | | |

Comprehensive | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Reserves | | |

Earnings | | |

Income (Loss) | | |

Total | |

| Balance at September 30, 2021 | |

| 6,750,000 | | |

$ | 6,750 | | |

$ | 79,810 | | |

$ | 1,466,920 | | |

$ | 11,886,818 | | |

$ | 588,587 | | |

$ | 14,028,885 | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,225,864 | | |

| - | | |

| 1,225,864 | |

| Statutory reserve | |

| - | | |

| - | | |

| - | | |

| 195,417 | | |

| (195,417 | ) | |

| - | | |

| - | |

| Foreign currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 268,280 | | |

| 268,280 | |

| Balance at March 31, 2022 | |

| 6,750,000 | | |

$ | 6,750 | | |

$ | 79,810 | | |

$ | 1,662,337 | | |

$ | 12,917,265 | | |

$ | 856,867 | | |

$ | 15,523,029 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at September 30, 2022 | |

| 6,750,000 | | |

$ | 6,750 | | |

$ | 79,810 | | |

$ | 1,651,422 | | |

$ | 14,408,843 | | |

$ | (911,134 | ) | |

$ | 15,235,691 | |

| Issuance of ordinary shares in initial public offerings, gross | |

| 1,000,000 | | |

| 1,000 | | |

| 7,999,000 | | |

| - | | |

| - | | |

| - | | |

| 8,000,000 | |

| Cost directly related to the initial public offering | |

| - | | |

| - | | |

| (2,025,679 | ) | |

| - | | |

| - | | |

| - | | |

| (2,025,679 | ) |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,766,347 | | |

| - | | |

| 1,766,347 | |

| Statutory reserve | |

| - | | |

| - | | |

| - | | |

| 176,550 | | |

| (176,550 | ) | |

| - | | |

| - | |

| Foreign currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 570,160 | | |

| 570,160 | |

| Balance at March 31, 2023 | |

| 7,750,000 | | |

$ | 7,750 | | |

$ | 6,053,131 | | |

$ | 1,827,972 | | |

$ | 15,998,640 | | |

$ | (340,974 | ) | |

$ | 23,546,519 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

JIN MEDICAL INTERNATIONAL LTD.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | |

For the Six months ended

March 31, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net income | |

$ | 1,766,347 | | |

$ | 1,225,864 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 114,465 | | |

| 145,695 | |

| Loss on disposition of property and equipment | |

| 523 | | |

| - | |

| Provision for doubtful accounts | |

| 171,522 | | |

| 27,913 | |

| Deferred tax provision (benefits) | |

| 68,561 | | |

| (133,896 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (75,355 | ) | |

| 1,020,725 | |

| Accounts receivable - related parties | |

| (28,932 | ) | |

| 65,931 | |

| Inventories | |

| 447,024 | | |

| (918,838 | ) |

| Advance to suppliers, net - a related party | |

| - | | |

| (13,171 | ) |

| Prepaid expenses and other current assets | |

| 47,501 | | |

| 213,913 | |

| Accounts payable | |

| 348,579 | | |

| (1,114,051 | ) |

| Accrued liabilities and other payables | |

| (29,199 | ) | |

| (179,547 | ) |

| Deferred revenue | |

| (293,968 | ) | |

| (681,591 | ) |

| Deferred revenue - a related party | |

| 122,795 | | |

| - | |

| Taxes payable | |

| 83,630 | | |

| 289,779 | |

| Net cash provided by (used in) operating activities | |

| 2,743,493 | | |

| (51,274 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Additions to property, plant and equipment | |

| (11,014 | ) | |

| (14,128 | ) |

| Proceeds from disposal of property and equipment | |

| 100 | | |

| - | |

| Payments for short-term investments | |

| (3,152,600 | ) | |

| (4,239,000 | ) |

| Redemption of short-term investments | |

| 850,154 | | |

| 3,796,902 | |

| Repayment of (payments of) advances made to related parties | |

| (4,760,469 | ) | |

| 415,410 | |

| Net cash used in investing activities | |

| (7,073,829 | ) | |

| (40,816 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Gross proceeds from initial public offerings | |

| 8,000,000 | | |

| - | |

| Direct costs disbursed from initial public offerings proceeds | |

| (1,212,779 | ) | |

| - | |

| Proceeds from short-term bank loan | |

| 1,433,000 | | |

| - | |

| Repayment of amount due to related parties | |

| (120,333 | ) | |

| (6,468 | ) |

| Net cash provided by (used in) financing activities | |

| 8,099,888 | | |

| (6,468 | ) |

| Effect of exchange rate changes on cash | |

| 122,004 | | |

| 68,353 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 3,891,556 | | |

| (30,205 | ) |

| Cash, beginning of period | |

| 4,792,632 | | |

| 3,672,260 | |

| Cash, end of period | |

$ | 8,684,188 | | |

$ | 3,642,055 | |

| | |

| | | |

| | |

| Supplemental disclosure information: | |

| | | |

| | |

| Cash paid for income tax | |

$ | 13,115 | | |

$ | 28,415 | |

| Deferred IPO cost offset with additional paid-in capital | |

$ | 812,900 | | |

$ | - | |

The

accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 — ORGANIZATION AND BUSINESS DESCRIPTION

JIN MEDICAL INTERNATIONAL LTD. (“Jin Med”

or the “Company”) was established under the laws of the Cayman Islands on January 14, 2020 as a holding company.

Jin Med owns 100% equity interest of Zhongjin

International Limited (“Zhongjin HK”), an entity incorporated on February 25, 2020 in accordance with the laws and regulations

in Hong Kong.

Erhua Medical Technology (Changzhou) Co., Ltd.

(“Erhua Med”) was formed on September 24, 2020, as a Wholly Foreign-Owned Enterprise (“WFOE”) in the People’s

Republic of China (“PRC”). Zhongjin HK owns 100% equity interest of Erhua Med.

Jin Med, Zhongjin HK and Erhua Med are currently

not engaging in any active business operations and merely acting as holding companies.

Changzhou Zhongjin Medical Equipment Co., Ltd.

(“Changzhou Zhongjin”) was incorporated on January 26, 2006 in accordance with PRC laws. Changzhou Zhongjin has two wholly-owned

subsidiaries, Zhongjin Medical Equipment Taizhou Co., Ltd. (“Taizhou Zhongjin”), incorporated on June 17, 2013, and Changzhou

Zhongjin Jing’ao Trading Co., Ltd (“Zhongjin Jing’ao”), incorporated on December 18, 2014 in accordance with PRC

laws. Changzhou Zhongjin, Taizhou Zhongjin and Zhongjin Jing’ao are collectively referred to as the “Zhongjin Operating Companies”

below.

The Company, through its wholly-owned subsidiaries

and entities controlled through contractual arrangements, is primarily engaged in the design, development, manufacturing and sales of

wheelchair and other living aids products to be used by people with disabilities or impaired mobility. The Company’s products are

sold to distributors in both China and in the overseas markets.

Reorganization

A reorganization of the legal structure of the

Company (“Reorganization”) was completed on November 26, 2020. The Reorganization involved the incorporation of Jin Med, Zhongjin

HK and Erhua Med, and signing of certain contractual arrangements (collectively, the “VIE Agreements”) between Zhongjin Technology,

the shareholders of Changzhou Zhongjin and Changzhou Zhongjin. Consequently, the Company became the ultimate holding company of Zhongjin

HK, Erhua Med, and through the contractual arrangements, WFOE, or Erhua Med, became the primary beneficiary of the Variable Interest Entity

(“VIE”), Changzhou Zhongjin, and its subsidiaries. Pursuant to the VIE Agreements, Erhua Med has gained effective control

over Changzhou Zhongjin. Therefore, Changzhou Zhongjin should be treated as a VIE under the Statements of Financial Accounting Standards

Board (“FASB”) Accounting Standards Codification (“ASC”) 810 Consolidation. Since Taizhou Zhongjin and Zhongjin

Jing’ao are wholly-owned subsidiaries of Changzhou Zhongjin, they are further referenced as VIE’s subsidiaries.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 — ORGANIZATION AND BUSINESS DESCRIPTION (continued)

The Company, together with its wholly owned subsidiaries,

the VIE and the VIE’s subsidiaries, are effectively controlled by the same shareholders before and after the Reorganization and

therefore the Reorganization is considered as a recapitalization of entities under common control. The consolidation of the Company, its

subsidiaries, the VIE and the VIE’s subsidiaries has been accounted for at historical cost.

The unaudited condensed consolidated financial

statements of the Company include the following entities:

| Name of Entity |

|

Date of

Incorporation |

|

Place of

Incorporation |

|

% of

Ownership |

|

Principal Activities |

| Jin Med |

|

January 14, 2020 |

|

Cayman Island |

|

Parent |

|

Investment holding |

| |

|

|

|

|

|

|

|

|

| Zhongjin HK |

|

February 25, 2020 |

|

Hong Kong |

|

100% |

|

Investment holding |

| |

|

|

|

|

|

|

|

|

| Erhua Med |

|

September 24, 2020 |

|

PRC |

|

100% |

|

WFOE, Investment holding |

| |

|

|

|

|

|

|

|

|

| Changzhou Zhongjin |

|

January 26, 2006 |

|

PRC |

|

VIE |

|

Design, development, manufacturing and sales of wheelchair and other mobility products |

| |

|

|

|

|

|

|

|

|

| Taizhou Zhongjin |

|

June 17, 2013 |

|

PRC |

|

100% controlled subsidiary of the VIE |

|

Design, development, manufacturing and sales of wheelchair and other mobility products |

| |

|

|

|

|

|

|

|

|

| Zhongjin Jing’ao |

|

December 18, 2014 |

|

PRC |

|

100% controlled subsidiary of the VIE |

|

Design, development, manufacturing and sales of wheelchair and other mobility products |

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 — ORGANIZATION AND BUSINESS DESCRIPTION (continued)

The VIE contractual arrangements

The Company’s main

operating entities, Changzhou Zhongjin and its subsidiaries Taizhou Zhongjin and Zhongjin Jing’ao (or the “Zhongjin Operating

Companies” as referred above), are controlled through contractual arrangements in lieu of direct equity ownership by the Company.

A VIE is an entity which

has a total equity investment that is insufficient to finance its activities without additional subordinated financial support, or whose

equity investors lack the characteristics of a controlling financial interest, such as through voting rights, right to receive the expected

residual returns of the entity or obligation to absorb the expected losses of the entity. The variable interest holder, if any, that has

a controlling financial interest in a VIE is deemed to be the primary beneficiary of, and must consolidate, the VIE, because it met the

condition under the accounting principles generally accepted in the United States of America (“U.S. GAAP”) to consolidate

the VIE.

Erhua Med, is deemed to have a controlling financial

interest in and be the primary beneficiary of the Zhongjin Operating Companies because it has both of the following characteristics:

| ● | The power to direct activities

of the Zhongjin Operating Companies that most significantly impact such entities’ economic performance, and |

| ● | The right to receive benefits

from, the Zhongjin Operating Companies that could potentially be significant to such entities. |

Pursuant to these contractual arrangements, the

Zhongjin Operating Companies shall pay service fees equal to all of their net profits after tax payments to Erhua Med. At the same time,

Erhua Med has the right to receive substantially all of their economic benefits for accounting purposes. Such contractual arrangements

are designed so that the operations of the Zhongjin Operating Companies are solely for the benefit of Erhua Med and ultimately, the Company,

and therefore the Company must consolidate the Zhongjin Operating Companies under U.S. GAAP.

Risks associated with the VIE structure

The Company believes that the contractual arrangements

with the VIE and the shareholders of the VIE are in compliance with PRC laws and regulations and are legally enforceable. However, uncertainties

in the PRC legal system could limit the Company’s ability to enforce the contractual arrangements. If the legal structure and contractual

arrangements were found to be in violation of PRC laws and regulations, the PRC government could:

| |

● |

revoke the business and operating licenses of the Company’s PRC subsidiary and VIE; |

| |

● |

discontinue or restrict the operations of any related-party transactions between the Company’s PRC subsidiary and VIE; |

| |

● |

limit the Company’s business expansion in China by way of entering into contractual arrangements; |

| |

● |

impose fines or other requirements with which the Company’s PRC subsidiary and VIE may not be able to comply; |

| |

● |

require the Company or the Company’s PRC subsidiary and VIE to restructure the relevant ownership structure or operations; or |

| |

● |

restrict or prohibit the Company’s use of the proceeds from public offering to finance the Company’s business and operations in China. |

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 — ORGANIZATION AND BUSINESS DESCRIPTION (continued)

The Company’s ability to conduct its businesses

may be negatively affected if the PRC government were to carry out of any of the aforementioned actions. In such case, the Company may

not be able to consolidate the VIE and the VIE’s subsidiaries in its consolidated financial statements as it may lose the ability

to exert effective control over the VIE and its shareholders and it may lose the ability to receive economic benefits from the VIE and

the VIE’s subsidiaries for accounting purposes under U.S. GAAP. The Company, however, does not believe such actions would result

in the liquidation or dissolution of the Company, its PRC subsidiary and the VIE and the VIE’s subsidiaries.

The Company, Zhongjin HK and Erhua Med are essentially

holding companies and do not have active operations as of March 31, 2023 and September 30, 2022. As a result, total assets and liabilities

presented on the unaudited condensed consolidated balance sheets and revenue, expenses, and net income presented on the unaudited condensed

consolidated statement of comprehensive income as well as the cash flows from operating, investing and financing activities presented

on the unaudited condensed consolidated statement of cash flows are substantially the financial position, operation results and cash flows

of the VIE and the VIE’s subsidiaries. The Company has not provided any financial support to the VIE and the VIE’s subsidiaries

during the six months ended March 31, 2023 and 2022. Additionally, pursuant to the VIE Agreements, Erhua Med has the right to receive

service fees equal to the VIE’s net profits after tax payments. None of these fees were paid to Erhua Med as of March 31, 2023.

Accordingly, as of March 31, 2023 and September 30, 2022, Erhua Med had $6,455,936 and $4,501,169 consulting fee receivables due from

the VIE and the VIE’s subsidiaries, respectively. These receivables were fully eliminated upon the consolidation.

The following financial statement amounts and

balances of the VIE and VIE’s subsidiaries were included in the accompanying unaudited condensed consolidated financial statements

after elimination of intercompany transactions and balances:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Current assets | |

$ | 22,301,879 | | |

$ | 18,903,147 | |

| Non-current assets | |

| 1,933,397 | | |

| 2,036,387 | |

| Total assets | |

$ | 24,235,276 | | |

$ | 20,939,534 | |

| Current liabilities | |

$ | 7,475,978 | | |

$ | 5,703,843 | |

| Non-current liabilities | |

| - | | |

| - | |

| Total liabilities | |

$ | 7,475,978 | | |

$ | 5,703,843 | |

| | |

For the Six Months Ended

March 31, | |

| | |

2023 | | |

2022 | |

| Net revenue | |

$ | 10,253,163 | | |

$ | 9,467,621 | |

| Net income | |

$ | 1,766,347 | | |

$ | 1,225,864 | |

| | |

For the Six Months Ended

March 31, | |

| | |

2023 | | |

2022 | |

| Net cash provided by (used in) operating activities | |

$ | 2,743,493 | | |

$ | (51,274 | ) |

| Net cash used in investing activities | |

$ | (7,073,829 | ) | |

$ | (40,816 | ) |

| Net cash provided by (used in) financing activities | |

$ | 1,312,667 | | |

$ | (6,468 | ) |

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 1 — ORGANIZATION AND BUSINESS DESCRIPTION (continued)

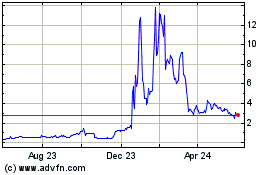

Initial Public Offering

On March 30, 2023, the Company closed its initial

public offering (the “Offering”) of 1,000,000 ordinary shares (the “Ordinary Shares”) at a public offering price

of $ 8.00 per share. In addition, the Company granted the underwriters a 45-day option to purchase up to an additional 150,000 Ordinary

Shares at the public offering price, less underwriting discounts, to cover over-allotment, if any. On April 6, 2023, the underwriter partially

exercised the over-allotment option to purchase an additional 47,355 ordinary shares. The Company’s Ordinary Shares began trading

on the Nasdaq Capital Market under the symbol “ZJYL” on March 28, 2023.

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES

Basis of consolidation

The accompanying unaudited condensed consolidated

financial statements have been prepared in accordance with U.S. GAAP for interim financial information and pursuant to the rules and regulations

of the Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and footnotes required

by U.S. GAAP for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation

have been included in the Company’s unaudited condensed consolidated financial statement. The unaudited condensed consolidated financial

statements should be read in conjunction with the Company’s consolidated financial statements and the notes for the years ended

September 30, 2022 and 2021 included in the Company’s Registration Statement on Form 424B4.The accompanying unaudited condensed

consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries, and entities it controlled

through VIE agreements. All inter-company balances and transactions are eliminated upon consolidation.

Uses of estimates

In preparing the unaudited condensed consolidated

financial statements in conformity with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets

and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. These estimates are based on information as of the date of the unaudited condensed

consolidated financial statements. Significant estimates required to be made by management include, but are not limited to, the valuation

of accounts receivable and inventories, useful lives of property, plant and equipment and land use right, the recoverability of long-lived

assets, and realization of deferred tax assets. Actual results could differ from those estimates.

Cash

Cash includes currency on hand and deposits held

by banks that can be added or withdrawn without limitation. The Company maintains most of its bank accounts in the PRC. Cash balances

in bank accounts in PRC are not insured by the Federal Deposit Insurance Corporation or other programs. As of March 31, 2023 and

September 30, 2022, the Company does not have any cash equivalents.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Short-term investment

The Company’s short-term investments consist

of wealth management financial products purchased from PRC banks or financial institution with maturities within one year. The banks or

financial institution invest the Company’s funds in certain financial instruments including money market funds, bonds or mutual

funds, with rates of return on these investments ranging from 3.4% to 7.0% per annum. The carrying values of the Company’s short-term

investments approximate fair value because of their short-term maturities. The interest earned is recognized in the unaudited condensed

consolidated statements of comprehensive income over the contractual term of these investments.

The Company had short-term investments of $4,696,503

and $2,276,158 as of March 31, 2023 and September 30, 2022, respectively. The Company recorded interest income of $69,840 and $53,516

for the six months ended March 31, 2023 and 2022, respectively.

Accounts receivable, net

Accounts receivable are presented net of allowance

for doubtful accounts.

The Company determines the adequacy of reserves

for doubtful accounts based on individual account analysis and historical collection trend. The Company establishes a provision for doubtful

receivables when there is objective evidence that the Company may not be able to collect amounts due. The allowance is based on management’s

best estimate of specific losses on individual exposures, as well as a provision on historical trends of collections. Actual amounts received

may differ from management’s estimate of credit worthiness and the economic environment. Delinquent account balances are written-off

against the allowance for doubtful accounts after management has determined that the likelihood of collection is not probable. As of March

31, 2023 and September 30, 2022, allowance for doubtful accounts amounted to $185,289 and $114,486 respectively.

Inventories

Inventories are stated at lower of cost or net

realizable value using the weighted average method. Costs include the cost of raw materials, freight, direct labor and related production

overhead. Net realizable value is the estimated selling price in the normal course of business less any costs to complete and sell products.

Write-down is recorded when future estimated net realizable value is less than cost, which is recorded in cost of revenue in the unaudited

condensed consolidated statements of comprehensive income. The Company periodically evaluates inventories against their net realizable

value, and reduces the carrying value of those inventories that are obsolete or in excess of the forecasted usage to their estimated net

realizable value based on various factors including aging and future demand of each type of inventories.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Fair value of financial instruments

Fair value is defined as the price that would

be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement

date. A three-level fair value hierarchy prioritizes the inputs used to measure fair value. The hierarchy requires entities to maximize

the use of observable inputs and minimize the use of unobservable inputs. The three levels of inputs used to measure fair value are as

follows:

| |

● |

Level 1 — inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| |

● |

Level 2 — inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, quoted market prices for identical or similar assets in markets that are not active, inputs other than quoted prices that are observable and inputs derived from or corroborated by observable market data. |

| |

● |

Level 3 — inputs to the valuation methodology are unobservable. |

Unless otherwise disclosed, the fair value of

the Company’s financial instruments, including cash, short-term investments, accounts receivable, due from related parties, short-term

bank loan, accounts payable, due to related parties, accrued liabilities and other payable, and taxes payable, approximate the fair value

of the respective assets and liabilities as of March 31, 2023 and September 30, 2022 based upon the short-term nature of the assets and

liabilities.

Leases

On October 1, 2022, the Company adopted ASC 842,

Leases. The adoption of this standard did not have a material impact on the Company’s unaudited condensed consolidated financial

statements. Therefore, no adjustments to opening retained earnings were necessary. The Company leases administrative office and dome,

which is classified as operating leases in accordance with Topic 842. Under Topic 842, lessees are required to recognize the following

for all leases (with the exception of short-term leases, usually with an initial term of 12 months or less) on the commencement date:

(i) lease liability, which is a lessee’s obligation to make lease payments arising from a lease, measured on a discounted basis;

and (ii) right-of-use (“ROU”) asset, which is an asset that represents the lessee’s right to use, or control the use

of, a specified asset for the lease term.

At the commencement date, the Company recognizes

the lease liability at the present value of the lease payments not yet paid, discounted using the interest rate implicit in the lease

or, if that rate cannot be readily determined, the Company’s incremental borrowing rate for the same term as the underlying lease.

The ROU asset is recognized initially at cost, which primarily comprises the initial amount of the lease liability, plus any initial direct

costs incurred, consisting mainly of brokerage commissions, less any lease incentives received. All ROU assets are reviewed for impairment

annually. The Company also established a capitalization threshold of $10,000 for lease to be recognized as ROU and lease liability. As

the amount of the Company’s ROU and lease liability are both below the threshold, no ROU nor lease liability is recorded on the

Company’s unaudited condensed consolidated balance sheets as of March 31, 2023.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Property, plant and equipment, net

Property, plant and equipment are stated at cost

less accumulated depreciation and amortization. Depreciation and amortization of property and equipment is provided using the straight-line

method over their expected useful lives, as follows:

| | |

Useful life |

| Property and buildings | |

20–25 years |

| Leasehold improvement | |

Lesser of useful life and lease term |

| Machinery and equipment | |

5–10 years |

| Automobiles | |

3–5 years |

| Office and electric equipment | |

3–5 years |

Expenditures for maintenance and repairs, which

do not materially extend the useful lives of the assets, are charged to expense as incurred. Expenditures for major renewals and betterments

which substantially extend the useful life of assets are capitalized. The cost and related accumulated depreciation of assets retired

or sold are removed from the respective accounts, and any gain or loss is recognized in the unaudited condensed consolidated statements

of comprehensive income.

Land use rights, net

Under the PRC law, all land in the PRC is owned

by the government and cannot be sold to an individual or company. The government grants individuals and companies the right to use parcels

of land for specified periods of time. Land use rights are stated at cost less accumulated amortization. Land use rights are amortized

using the straight-line method with the following estimated useful lives:

| |

|

Useful life |

| Land use rights |

|

46 years |

Impairment of long-lived assets

Long-lived assets with finite lives, primarily

property, plant and equipment and land use right are reviewed for impairment whenever events or changes in circumstances indicate that

the carrying amount of an asset may not be recoverable. If the estimated cash flows from the use of the asset and its eventual disposition

are below the asset’s carrying value, then the asset is deemed to be impaired and written down to its fair value. There were no

impairments of these assets as of March 31, 2023 and September 30, 2022.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Revenue recognition

The Company generates its revenues primarily through

sales of its products and recognizes revenue in accordance with ASC 606. ASC 606 establishes principles for reporting information about

the nature, amount, timing and uncertainty of revenue and cash flows arising from the entity’s contracts to provide goods or services

to customers. The core principle requires an entity to recognize revenue to depict the transfer of goods or services to customers in an

amount that reflects the consideration that it expects to be entitled to receive in exchange for those goods or services recognized as

performance obligations are satisfied.

ASC 606 requires the use of a new five-step model

to recognize revenue from customer contracts. The five-step model requires that the Company (i) identify the contract with the customer,

(ii) identify the performance obligations in the contract, (iii) determine the transaction price, including variable consideration to

the extent that it is probable that a significant future reversal will not occur, (iv) allocate the transaction price to the respective

performance obligations in the contract, and (v) recognize revenue when (or as) the Company satisfies the performance obligation. The

application of the five-step model to the revenue streams compared to the prior guidance did not result in significant changes in the

way the Company records its revenue.

In accordance to ASC 606, the Company recognizes

revenue when it transfers goods to customers in an amount that reflects the consideration to which the Company expects to be entitled

in such exchange. The Company accounts for the revenue generated from sales of its products on a gross basis as the Company is acting

as a principal in these transactions, is subject to inventory risk, has latitude in establishing prices, and is responsible for fulfilling

the promise to provide customers the specified goods. All of the Company’s contracts have one single performance obligation as the

promise is to transfer the individual goods to customers, and there is no other separately identifiable promises in the contracts. The

Company’s revenue streams are recognized at a point in time when the control of goods is transferred to customer, which generally

occurs at delivery. The Company’s products are sold with no right of return and the Company does not provide other credits or sales

incentive to customers. Revenue is reported net of all value added taxes (“VAT”).

The Company generally offers 10 years warranty

for the frame of its wheelchairs, and one year warranty for other parts of wheelchairs, except for “wear items”, i.e. those

parts that wear out, such as tires or brake pads, which are covered under a warranty for six months. Historically, warranty costs incurred

was immaterial, and the warranty costs for the six months ended March 31, 2023 and 2022 were both $nil.

Contract Assets and Liabilities

Payment terms are established on the Company’s

pre-established credit requirements based upon an evaluation of customers’ credit quality. The Company did not have contract assets

as of March 31, 2023 and September 30, 2022. Contract liabilities are recognized for contracts where payment has been received in advance

of delivery of the products. The contract liability balance can vary significantly depending on the timing when cash is received and when

shipment or delivery occurs. As of March 31, 2023 and September 30, 2022, other than deferred revenue, the Company had no other contract

liabilities or deferred contract costs recorded on its unaudited condensed consolidated balance sheets, and the Company had no material

incremental costs for obtaining a contract. Costs of fulfilling customers’ purchase orders, such as shipping, handling and delivery,

which occur prior to the transfer of control, are recognized in selling, general and administrative expense when incurred.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Disaggregation of Revenues

The Company disaggregates its revenue from contracts

by product types and geographic areas, as the Company believes it best depicts how the nature, amount, timing and uncertainty of the revenue

and cash flows are affected by economic factors. The Company’s disaggregation of revenues for the six months ended March 31, 2023

and 2022 are as the following:

Revenue recognition (continued)

Geographic information

The summary of the Company’s total revenues

by geographic market for the six months ended March 31, 2023 and 2022 was as follows:

| | |

For the Six Months Ended

March 31, | |

| | |

2023 | | |

2022 | |

| China domestic market | |

$ | 1,634,219 | | |

$ | 1,264,539 | |

| Overseas market | |

| 8,618,944 | | |

| 8,203,082 | |

| Total revenue | |

$ | 10,253,163 | | |

$ | 9,467,621 | |

Revenue by product categories

The summary of the Company’s total revenues

by product categories for the six months ended March 31, 2023 and 2022 was as follows:

| | |

For the Six Months Ended

March 31, | |

| | |

2023 | | |

2022 | |

| Wheelchair | |

$ | 8,381,323 | | |

$ | 7,949,623 | |

| Wheelchair components and others | |

| 1,871,840 | | |

| 1,517,998 | |

| Total revenue | |

$ | 10,253,163 | | |

$ | 9,467,621 | |

Research and development expenses

In connection with the design and development

of wheelchair and other living aids products, the Company expense all internal research costs as incurred, which primarily comprise employee

costs, internal and external costs related to execution of studies, manufacturing costs, facility costs of the research center, and amortization

of land use right, depreciation for property, plant and equipment used in the research and development activities. For the six months

ended March 31, 2023 and 2022, research and development expenses were $631,034 and $892,524, respectively.

Income taxes

The Company accounts for current income taxes

in accordance with the laws of the relevant tax authorities. Deferred income taxes are recognized when temporary differences exist between

the tax bases of assets and liabilities and their reported amounts in the unaudited condensed consolidated financial statements. Deferred

tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized

in income in the period including the enactment date. Valuation allowances are established, when necessary, to reduce deferred tax assets

to the amount expected to be realized.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Income taxes (continued)

An uncertain tax position is recognized as a benefit

only if it is “more likely than not” that the tax position would be sustained in a tax examination. The amount recognized

is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the

“more likely than not” test, no tax benefit is recorded. Penalties and interest incurred related to underpayment of income

tax are classified as income tax expense in the period incurred. No significant penalties or interest relating to income taxes have been

incurred during the six months ended March 31, 2023 and 2022. The Company does not believe there was any uncertain tax provision at March

31, 2023 and September 30, 2022.

The Company’s subsidiary, VIE and VIE’s

subsidiaries in China are subject to the income tax laws of the PRC. No income was generated outside the PRC for the six months ended

March 31, 2023 and 2022. As of March 31, 2023, all of the Company’s tax returns of its PRC Subsidiaries remain open for statutory

examination by PRC tax authorities.

Value added tax (“VAT”)

Sales revenue is reported net of VAT. The VAT

is based on gross sales price and VAT rates range up to 13% in the six months ended March 31, 2023 and 2022, depending on the type of

products sold. The VAT may be offset by VAT paid by the Company on purchased raw materials and other materials included in the cost of

producing or acquiring its finished products. The Company recorded a VAT payable or receivable net of payments in the accompanying unaudited

condensed consolidated financial statements. For domestic sales of wheelchairs, VAT is exempted. Further, when exporting goods, the exporter

is entitled to some or all of the refunds of the VAT paid or assessed when the Company completes all the required tax filing procedures.

All of the VAT returns filed for the Company have been and remain subject to examination by the tax authorities for five years from the

date of filing. VAT tax refunds associated with export sales amounted to $526,779 and $537,225 for the six months ended March 31, 2023

and 2022, respectively.

Warrant accounting

The Company

accounts for warrants as either equity-classified or liability-classified instruments based on an assessment of the warrant’s specific

terms and applicable authoritative guidance in ASC 480, “Distinguishing Liabilities from Equity” (“ASC 480”)

and ASC Topic 815, “Derivatives and Hedging” (“ASC 815”). The assessment considers whether the warrants

are freestanding financial instruments pursuant to ASC 480, meet the definition of a liability pursuant to ASC 480, and whether the warrants

meet all of the requirements for equity classification under ASC 815, including whether the warrants are indexed to the Company’s

own ordinary shares and whether the warrant holders could potentially require “net cash settlement” in a circumstance outside

of the Company’s control, among other conditions for equity classification. This assessment, which requires the use of professional

judgment, is conducted at the time of warrant issuance and as of each subsequent interim period end date while the warrants are outstanding.

For issued

or modified warrants that meet all of the criteria for equity classification, the warrants are required to be recorded as a component

of equity at the time of issuance. For issued or modified warrants that do not meet all the criteria for equity classification, the warrants

are required to be recorded as liabilities at their initial fair value on the date of issuance, and each balance sheet date thereafter.

Changes in the estimated fair value of the warrants are recognized as a non-cash gain or loss on the statements of comprehensive loss.

As the warrants

issued upon the initial public offering meet the criteria for equity classification under ASC 815, therefore, the warrants are classified

as equity.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Earnings per share

The Company computes earnings per share (“EPS”)

in accordance with ASC 260, “Earnings per Share” (“ASC 260”). ASC 260 requires companies with complex capital

structures to present basic and diluted EPS. Basic EPS is measured as net income divided by the weighted average common shares outstanding

for the period. Diluted presents the dilutive effect on a per share basis of potential common shares (e.g., convertible securities, options

and warrants), using the treasury stock method, as if they had been converted at the beginning of the periods presented, or issuance date,

if later. In computing diluted EPS, the treasury stock method assumes that outstanding potential common shares are exercised and the proceeds

are used to purchase common share at the average market price during the period. Potential common shares may have a dilutive effect under

the treasury stock method only when the average market price of the common share during the period exceeds the exercise price of the potential

common shares. Potential common shares that have an anti-dilutive effect (i.e., those that increase income per share or decrease loss

per share) are excluded from the calculation of diluted EPS. As of March 31, 2023 and September 30, 2022, there were no dilutive shares.

Risks and uncertainties

The main operation of the Company is located in

the PRC. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by political, economic,

and legal environments in the PRC, as well as by the general state of the PRC economy. The Company’s results may be adversely affected

by changes in the political, regulatory and social conditions in the PRC. Although the Company has not experienced losses from these situations

and believes that it is in compliance with existing laws and regulations including its organization and structure disclosed in Note 1,

this may not be indicative of future results.

The Company’s business, financial condition

and results of operations may also be negatively impacted by risks related to natural disasters, extreme weather conditions, health epidemics

and other catastrophic incidents, which could significantly disrupt the Company’s operations.

In December 2019, a novel strain of coronavirus

(COVID-19) was first reported in Wuhan, China and then spread globally. On March 11, 2020, the World Health Organization categorized COVID-19

as a global pandemic. Due to a resurgence of the COVID-19 pandemic in March 2022 (“2022 Outbreak”) in China, there

have been delays in the purchase of raw material supplies and delivery of products to domestic customers in China on a timely basis as

a consequence of travel restrictions. Shipments and customer clearance for overseas sales were also delayed due to the stricter border

control protocols. Although the situation has eased since mid-May 2022, the number of orders placed by the customers were affected

as the business of those customers were negatively impacted by the 2022 Outbreak. Therefore, the 2022 Outbreak negatively affected the

Company’s business operations and financial results for the year ended September 30, 2022. In early December 2022, China announced

a nationwide loosening of its zero-covid policy, and most of the travel restrictions and quarantine requirements were lifted since December

2022. Although there were significant surges of COVID-19 cases in many cities in China after

the lifting of these restrictions, the spread of the COVID-19 was slowed down and it was

successfully under control since January 2023, and the Company’s business operations have been recovered to the level prior to the

COVID-19 pandemic. Our revenue and net income (excluding the impact of foreign currency translation) increased by 18.7% and 57.9% in terms

of RMB, respectively. However, the increase was partially offset by the depreciation of the RMB against U.S. dollars of 8.7%, which caused

an increase in revenue and net income by 12.7% and 44.1% in terms of USD, respectively, during the six months ended March 31, 2023 as

compared to the same period last year. Due to the dynamic nature of the circumstances and the uncertainty around the potential resurgence

of COVID-19 cases in China, the continual spread of the virus globally especially in Japan, the Company’s major international market,

and the instability of local and global government policies and restrictions, the COVID-19 impact over the Company’s business in

the future cannot be reasonably estimated at this time. If COVID-19 cases resurge in the area the Company conducted its business and local

governments implemented new restrictions in the effort to contain the spread or certain other foreign governments such as Japan imposed

new import restrictions, it is expected the Company’s business will be negatively impacted.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Risks and uncertainties (continued)

Additionally, since February, 2022, the global

markets are experiencing volatility and disruption following the escalation of geopolitical tensions and the start of the military conflict

between Russia and Ukraine. The Company’s operation has not been impacted by the ongoing military conflict, however, due to the

significant uncertainties around the further development of the conflict, the potential additional sanctions and other volatilities that

could be brought to the global market, it is impossible to predict the extent to which the Company’s operation and business may

be impacted.

Foreign currency translation

The functional currency for Jin Med is U.S Dollar

(“US$”). Zhongjin HK uses Hong Kong dollar as its functional currency. However, Jin Med and Zhongjin HK currently only serve

as holding companies and do not have active operation as of the date of this report. The Company’s functional currency for its PRC

subsidiaries is the Chinese Yuan (“RMB”). The Company’s unaudited condensed consolidated financial statements have been

translated into the reporting currency of U.S. Dollars (“US$”). Assets and liabilities of the Company are translated at the

exchange rate at each reporting period end date. Equity is translated at historical rates. Income and expense accounts are translated

at the average rate of exchange during the reporting period. The resulting translation adjustments are reported under other comprehensive

income. Gains and losses resulting from foreign currency transactions are reflected in the results of operations.

The RMB is not freely convertible into foreign

currency and all foreign exchange transactions must take place through authorized institutions. No representation is made that the RMB

amounts could have been, or could be, converted into US$ at the rates used in translation.

The following table outlines the currency exchange

rates that were used in creating the unaudited condensed consolidated financial statements in this report:

| |

|

For the Six Months

Ended March 31, |

|

For the Year Ended

September 30, |

| |

|

2023 |

|

2022 |

|

2022 |

| Period-end spot rate |

|

US$1=RMB 6.8681 |

|

US$1=RMB 6.3431 |

|

US$1=RMB 7.1135 |

| Average rate |

|

US$1=RMB 6.9784 |

|

US$1=RMB 6.3712 |

|

US$1=RMB 6.5532 |

Comprehensive income

Comprehensive income consists of two components,

net income and other comprehensive income. The foreign currency translation gain or loss resulting from translation of the financial statements

expressed in RMB to US$ is reported in other comprehensive income in the unaudited condensed consolidated statements of comprehensive

income.

Statement of cash flows

In accordance with ASC 230, “Statement of

Cash Flows”, cash flows from the Company’s operations are formulated based upon the local currencies. As a result, amounts

related to assets and liabilities reported on the statements of cash flows will not necessarily agree with changes in the corresponding

balances on the balance sheets.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (continued)

Deferred initial public offering (‘IPO’) costs

The Company complies with the requirement of the

ASC 340-10-S99-1 and SEC Staff Accounting Bulletin (“SAB”) Topic 5A — “Expenses of Offering”. Deferred offering

costs consist of underwriting, legal, accounting and other expenses incurred through the balance sheet date that are directly related

to the intended IPO. Deferred offering costs was charged to shareholders’ equity upon the completion of the IPO. As of March 31,

2023 and September 30, 2022, deferred IPO costs were $nil and $701,396, respectively.

Employee benefit expenses

The Company’s subsidiary, VIE and VIE’s

subsidiaries in the PRC participate in a government-mandated employer social insurance plan pursuant to which certain social security

benefits, work-related injury benefits, maternity leave insurance, medical insurance, unemployment benefit and housing fund are provided

to eligible full-time employees. The relevant labor regulations require the Company’s subsidiaries in the PRC to pay the local labor

and social welfare authorities monthly contributions based on the applicable benchmarks and rates stipulated by the local government.

The contributions to the plan are expensed as incurred. Employee social security and welfare benefits included as expenses in the unaudited

condensed consolidated statements of comprehensive income amounted to $162,598 and $178,802 for the six months ended March 31, 2023 and

2022, respectively.

Recent accounting pronouncements

The Company considers the applicability and impact

of all accounting standards updates (“ASUs”). Management periodically reviews new accounting standards that are issued.

In June 2016, the FASB issued ASU 2016-13, Financial

Instruments-Credit Losses (Topic 326), which requires entities to measure all expected credit losses for financial assets held at the

reporting date based on historical experience, current conditions, and reasonable and supportable forecasts. This replaces the existing

incurred loss model and is applicable to the measurement of credit losses on financial assets measured at amortized cost. ASU 2016-13

was subsequently amended by Accounting Standards Update 2018-19, Codification Improvements to Topic 326, Financial Instruments—Credit

Losses, Accounting Standards Update 2019-04 Codification Improvements to Topic 326, Financial Instruments—Credit

Losses, Topic 815, Derivatives and Hedging, and Topic 825, Financial Instruments, and Accounting Standards Update 2019-05, Targeted

Transition Relief. For public entities, ASU 2016-13 and its amendments are effective for fiscal years, and interim periods within

those fiscal years, beginning after December 15, 2019. For all other entities, this guidance and its amendments will be effective for

fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. Early application will be permitted

for all entities for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. In November 2019,

the FASB issued ASU 2019-10, “Financial Instruments—Credit Losses (Topic 326), Derivatives and Hedging (Topic 815), and Leases

(Topic 842)” (“ASU 2019-10”). ASU 2019-10 (i) provides a framework to stagger effective dates for future major accounting

standards and (ii) amends the effective dates for certain major new accounting standards to give implementation relief to certain types

of entities. Specifically, ASU 2019-10 changes some effective dates for certain new standards on the following topics in the FASB Accounting

Standards Codification (ASC): (a) Derivatives and Hedging (ASC 815) – now effective for fiscal years beginning after December 15,

2020 and interim periods within fiscal years beginning after December 15, 2021; (b) Leases (ASC 842) - now effective for fiscal years

beginning after December 15, 2020 and interim periods within fiscal years beginning after December 15, 2021; (c) Financial Instruments

— Credit Losses (ASC 326) - now effective for fiscal years beginning after December 15, 2022, including interim periods within those

fiscal years; and (d) Intangibles — Goodwill and Other (ASC 350) - now effective for fiscal years beginning after December 15, 2022,

including interim periods within those fiscal years. The Company plans to adopt this guidance effective October 1, 2023 and the adoption

of this ASU is not expected to have a material impact on its consolidated financial statements.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 3 — ACCOUNTS RECEIVABLE, NET

Accounts receivable, net consist of the following:

| Third Parties | |

March 31,

2023 | | |

September 30,

2022 | |

| Accounts receivable - third-party customers | |

$ | 4,054,688 | | |

$ | 3,945,362 | |

| Less: allowance for doubtful accounts | |

| (185,289 | ) | |

| (114,486 | ) |

| Accounts receivable – third-party customers, net | |

$ | 3,869,399 | | |

$ | 3,830,876 | |

The Company’s accounts receivable primarily

includes balances due from customers when the Company’s wheelchair and living aids products have been sold and delivered to customers,

the Company’s contracted performance obligations have been satisfied, amount billed and the Company has an unconditional right to

payment, which has not been collected as of the balance sheet dates.

For accounts receivable from third-party customers,

approximately 88.8%, or $3.4 million of the March 31, 2023 balance have been subsequently

collected. The remaining balance of approximately $0.5 million is expected to be collected before

September 30, 2023.

Allowance for doubtful accounts movement is as

follows:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Beginning balance | |

$ | 114,486 | | |

$ | 96,688 | |

| Additions | |

| 171,522 | | |

| 28,943 | |

| Less: write-off | |

| (105,843 | ) | |

| - | |

| Foreign currency translation adjustments | |

| 5,124 | | |

| (11,145 | ) |

| Ending balance | |

$ | 185,289 | | |

$ | 114,486 | |

NOTE 4 — INVENTORIES

Inventories consisted of the following:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Raw materials | |

$ | 3,022,440 | | |

$ | 3,274,744 | |

| Work-in-progress | |

| 2,003,823 | | |

| 1,399,074 | |

| Finished goods | |

| 1,483,086 | | |

| 2,050,597 | |

| Inventories | |

$ | 6,509,349 | | |

$ | 6,724,415 | |

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 5 — PREPAID EXPENSES AND OTHER CURRENT ASSETS

Prepaid expenses and other current assets consisted of the following:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Other receivable (1) | |

$ | 74,122 | | |

$ | 131,449 | |

| Advance to suppliers (2) | |

| 89,234 | | |

| 156,491 | |

| Deferred initial public offering costs | |

| - | | |

| 701,396 | |

| Prepaid expenses and other current assets | |

$ | 163,356 | | |

$ | 989,336 | |

NOTE 6 — PROPERTY, PLANT AND EQUIPMENT, NET

Property, plant and equipment, net, consist of the following:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Buildings | |

$ | 2,545,101 | | |

$ | 2,457,701 | |

| Machinery and equipment | |

| 1,871,011 | | |

| 1,801,904 | |

| Automobiles | |

| 168,633 | | |

| 162,842 | |

| Office and electric equipment | |

| 602,474 | | |

| 576,185 | |

| Leasehold improvements | |

| 298,296 | | |

| 288,052 | |

| Subtotal | |

| 5,485,515 | | |

| 5,286,684 | |

| Less: accumulated depreciation | |

| (3,902,865 | ) | |

| (3,658,722 | ) |

| Property, plant and equipment, net | |

$ | 1,582,650 | | |

$ | 1,627,962 | |

Depreciation expense was $111,964 and $142,954

for the six months ended March 31, 2023 and 2022, respectively.

In connection with the Company’s bank borrowings

from Bank of Jiangsu, Changzhou Zhongjin pledged a building of 11,205.83 square meters with a carrying value of RMB 16.7 million (approximately

$2.4 million) as collateral (see Note 8).

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 7 —

LAND USE RIGHT, NET

Land use right, net, consisted of the following:

| | |

March 31,

2023 | | |

September 30,

2022 | |

| Land use rights | |

$ | 233,828 | | |

$ | 225,798 | |

| Less: accumulated amortization | |

| (67,352 | ) | |

| (62,585 | ) |

| Land use right, net | |

$ | 166,476 | | |

$ | 163,213 | |

Amortization expense was $2,501 and $2,741 for

the six months ended March 31, 2023 and 2022, respectively.

In connection with the Company’s bank borrowings

from Bank of Jiangsu, Changzhou Zhongjin pledged land use right of 16,595.64 square meters with a carrying value of RMB 1.6 million (approximately

$0.2 million) as collateral (see Note 8).

Estimated future amortization expense for land

use rights is as follows:

| Years ending March 31, | |

| |

| 2024 | |

$ | 5,083 | |

| 2025 | |

| 5,083 | |

| 2026 | |

| 5,083 | |

| 2027 | |

| 5,083 | |

| 2028 | |

| 5,083 | |

| Thereafter | |

| 141,061 | |

| | |

$ | 166,476 | |

NOTE 8 — SHORT-TERM BANK LOAN

On March 31, 2023, Changzhou Zhongjin signed a

loan agreement with Bank of Jiangsu to borrow RMB 10.0 million ($1,456,000) as working capital for one year, with a maturity date of March

28, 2024. The loan had a fixed interest rate of 3.65% per annum.

In connection with the above-mentioned borrowings

with Bank of Jiangsu, Changzhou Zhongjin signed a maximum pledge agreement with Bank of Jiangsu and agreed to pledge a building property

of 11,205.83 square meters with carrying value of RMB 16.7 million (approximately $2.4 million) and land use right of 16,595.64 square

meters with carrying value of RMB 1.6 million (approximately $0.2 million) as collateral to guarantee loans that the Company may borrow

from Bank of Jiangsu. In addition, a related party, the Company’s major shareholder Mr. Erqi Wang, signed a maximum guarantee agreement

with Bank of Jiangsu to provide personal credit guarantees for loans that the Company may borrow from Bank of Jiangsu. Another related

party, Changzhou Zhongjian Kanglu Information Technology Co., Ltd, also signed a maximum guarantee agreement with Bank of Jiangsu and

a maximum pledge agreement with Bank of Jiangsu and agreed to pledge its properties with a value of RMB 33.0 million (approximately $4.8

million) as collateral to guarantee loans that the Company may borrow from Bank of Jiangsu. The short-term bank loan was fully repaid

by the Company in May 2023.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 9 — RELATED PARTY TRANSACTIONS

| a. |

Accounts receivable - related parties |

Accounts receivable - related parties consists

of the following:

| Name | |

Related party relationship | |

March 31,

2023 | | |

September 30,

2022 | |

| Jiangsu Zhongjin Kanglu Information Technology Co., Ltd. | |

An entity controlled by the CEO | |

$ | 210,317 | | |

$ | 162,024 | |

| Zhongjin Hongkang Medical Technology (Shanghai) Co., Ltd. | |

An entity controlled by the CEO | |

| 70,782 | | |

| 55,187 | |

| Zhongjin Jingau Rehabilitation Equipment (Beijing) Co. Ltd. | |

An entity controlled by the CEO | |

| 1,520 | | |

| 1,468 | |

| Zhongjiankanglu Industrial Development (Shanghai) Co., Ltd. | |

An entity controlled by the CEO | |

| 9,264 | | |

| 34,794 | |

| Subtotal | |

| |

| 291,883 | | |

| 253,473 | |

| Less: allowance for doubtful accounts | |

| |

| - | | |

| - | |

| Total accounts receivable, net - related parties | |

| |

$ | 291,883 | | |

$ | 253,473 | |

For accounts receivable due from related parties,

approximately 72.1%, or $0.2 million of the March 31, 2023 balances have been subsequently

collected. The remaining balance is expected to be collected before September 30, 2023.

| b. |

Due from related parties |

Due from related parties consists of the following:

| Name | |

Related party relationship | |

March 31,

2023 | | |

September 30,

2022 | |

| Jiangsu Zhongjin Kanglu Information Technology Co., Ltd. (“Zhongjin Kanglu”) (1) | |

An entity controlled by the CEO | |

$ | 4,835,861 | | |

$ | - | |

| Huaniaoyuan Catering Management (Changzhou) Co. Ltd. | |

An entity controlled by the CEO | |

| 31,628 | | |

| 33,285 | |

| Other | |

Director of the Company | |

| 6,933 | | |

| 2,972 | |

| Total due from related parties | |

| |

$ | 4,874,422 | | |

$ | 36,257 | |

Advances due from related parties were non-interest

bearing and due upon demand. Approximately 98.6%, or $4.8 million of the March 31, 2023 balances have been subsequently collected. The

remaining balance is expected to be collected before September 30, 2023.

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 9 — RELATED PARTY TRANSACTIONS (continued)

| c. |

Deferred revenue – a related party |

Deferred revenue – a related party consists of the following:

| Name | |

Related party relationship | |

March 31,

2023 | | |

September 30,

2022 | |

| Jin Med Medical (Korea) Co., Ltd. | |

An entity controlled by the CEO | |

$ | 124,766 | | |

$ | - | |

| Total deferred revenue – a related party | |

| |

$ | 124,766 | | |

$ | - | |

| d. |

Due to a related party |

Due to a related party consists of the following:

| Name | |

Related party relationship | |

March 31,

2023 | | |

September 30,

2022 | |

| Jiangsu Zhongjin Kanglu Information Technology Co., Ltd. | |

An entity controlled by the CEO | |

$ | - | | |

$ | 118,066 | |

| Total due to a related party | |

| |

$ | - | | |

$ | 118,066 | |

The balance due to a related party was mainly

comprised of advances from entities controlled by the Company’s CEO and used for working capital during the Company’s normal

course of business. These advances are non-interest bearing and due on demand.

| e. |

Revenue from related parties |

Revenue from related parties consists of the following:

| | |

| |

For the Six Months Ended

March 31, | |

| Name | |

Related party relationship | |

2023 | | |

2022 | |

| Jiangsu Zhongjin Kanglu Information Technology Co., Ltd. | |

An entity controlled by the CEO | |

$ | 333,106 | | |

$ | 387,200 | |

| Zhongjiankanglu Industrial Development (Shanghai) Co., Ltd. | |

An entity controlled by the CEO | |

| 17,381 | | |

| 5,335 | |

| Zhongjin Jingau Rehabilitation Equipment (Beijing) Co. Ltd. | |

An entity controlled by the CEO | |

| 12,384 | | |

| 13,909 | |

| Total revenue from related parties | |

| |

$ | 362,871 | | |

$ | 406,444 | |

| f. |

Loan guarantee provided by related parties |

In connection with the Company’s bank borrowings

from Bank of Jiangsu, the Company’s major shareholder, Mr. Erqi Wang and Changzhou Zhongjian Kanglu Information Technology Co.,

Ltd. provided credit guarantee and signed pledge agreements (see Note 8).

JIN MEDICAL INTERNATIONAL LTD. AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

NOTE 10 — TAXES

| (a) |

Corporate Income Taxes (“CIT”) |

The Company is subject to income taxes on an entity

basis on income arising in or derived from the tax jurisdiction in which each entity is domiciled.

Cayman Islands

Under the current laws of the Cayman Islands,

the Company is not subject to tax on income or capital gain. In addition, no Cayman Islands withholding tax will be imposed upon the payment