Current Report Filing (8-k)

April 13 2022 - 5:21PM

Edgar (US Regulatory)

0001688126

false

0001688126

2022-04-07

2022-04-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): April 7, 2022

The

Crypto Company

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-55726 |

|

46-4212105 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 23823

Malibu Road, #50477, Malibu, CA |

|

90265 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(424)

228-9955

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

April 7, 2022, The Crypto Company (the “Company”) borrowed funds pursuant to the terms of a Securities Purchase Agreement

(the “April SPA”) entered into with Efrat Investments LLC (“Efrat”) and issued a Promissory Note in the principal

amount of $220,000 to Efrat (the “Efrat Note”) in a private transaction for a purchase price of $198,000 (giving effect to

an original issue discount). After payment of the fees and costs, the net proceeds from the Efrat Note will be used by the Company for

working capital and other general corporate purposes.

The

maturity date of the Efrat Note is September 7, 2022, although the maturity date may be extended for six months upon the consent of Efrat

and the Company. The Efrat Note bears interest at 10% per year, and principal and accrued interest is due on the maturity date. The Company

may prepay the Efrat Note at any time without penalty. Any failure by the Company to make required payments under the Efrat Note or to

comply with various covenants, among other matters, would constitute an event of default. Upon an event of default under the April SPA

or the Efrat Note, the Efrat Note will bear interest at 18%, Efrat may immediately accelerate the Efrat Note due date, Efrat may convert

the amount outstanding under the Efrat Note into shares of Company common stock at a discount to the market price of the stock, and Efrat

will be entitled to its costs of collection, among other penalties and remedies.

The

Company provided various representations, warranties, and covenants to Efrat in the April SPA. Any breach by the Company of any representation

or warranty, or failure to comply with the covenants would constitute an event of default. Also pursuant to the April SPA, the Company

paid Efrat a commitment fee of 58,201 unregistered shares of the Company’s common stock (the “commitment fee shares”).

If, after the sixth month anniversary of closing and before the thirty-sixth month anniversary of closing, Efrat has been unable to sell

the commitment fee shares for $110,000, then the Company may be required to issue additional shares or pay cash in the amount of the

shortfall. However, if the Company pays the April Note off before its maturity date, then the Company may redeem 29,101 of the commitment

fee shares for one dollar. Pursuant to the April SPA, the Company also issued to Efrat a common stock purchase warrant (the “warrant”)

to purchase 146,667 shares of the Company’s common stock for $5.25 per share. The warrant expires on April 7, 2025. The warrant

also includes various covenants of the Company for the benefit of the warrant holder and includes a beneficial ownership limitation on

the holder that, in certain circumstances, may serve to restrict the holder’s right to exercise the warrant. The Company also entered

into a Security Agreement with Efrat pursuant to which the Company granted to Efrat a security interest in substantially all of the Company’s

assets to secure the Company’ obligations under the Efrat SPA, Efrat Note and warrant, although such security interest is subordinate

to the rights of another third party lender.

The

offer and sale of the Efrat Note and the warrant was made in a private transaction exempt from the registration requirements of the Securities

Act of 1933, as amended (the “Securities Act”), in reliance on exemptions afforded by Section 4(a)(2) of the Securities Act

and Rule 506(b) of Regulation D promulgated thereunder.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 is incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities

The

information set forth under Item 1.01 with respect to the Efrat Note and the warrant is incorporated herein by reference.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

THE

CRYPTO COMPANY |

| Date:

April 13, 2022 |

|

|

| |

By: |

/s/

Ron Levy |

| |

Name: |

Ron

Levy |

| |

Title: |

Chief

Executive Officer, Chief Operating

Officer and Secretary |

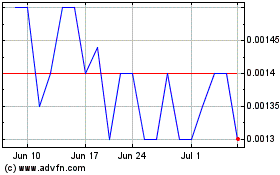

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Aug 2024 to Sep 2024

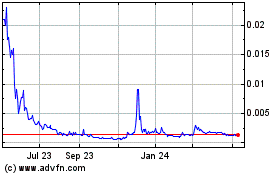

Crypto (PK) (USOTC:CRCW)

Historical Stock Chart

From Sep 2023 to Sep 2024