UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C.

20549

_____________________

FORM 6-K

_____________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2021

Commission File Number: 333-258926

_____________________

Argo Blockchain plc

(Translation

of registrant’s name into English)

_____________________

9th Floor

16

Great Queen Street

London WC2B 5DG

England

(Address of

principal executive office)

_____________________

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F

☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBIT INDEX

|

Exhibit

No.

1

|

Description

Proposed

Public Offering dated 08 November 2021

|

Press release

8 November 2021

Argo Blockchain PLC

("Argo"

or "the Company")

Argo Announces Proposed Public Offering of 8.75% Senior Notes Due

2026

Argo Blockchain, a global leader in cryptocurrency

mining (LSE: ARB; NASDAQ: ARBK), announced today that it has filed

a registration statement on Form F-1 with the United States

Securities and Exchange Commission (the "SEC") relating to its proposed public offering (the

"Offering") of 8.75% Senior Notes due 2026 (the

"Notes"). Argo plans to offer the Notes in minimum

denominations of $25.00 and integral multiples of $25.00 in excess

thereof. The Company intends to use the net proceeds from

this Offering for general corporate purposes, the construction of,

and purchase of mining machines for, its Texas cryptocurrency

mining facility and potentially acquisitions of, or investments in,

complementary businesses in the cryptocurrency and blockchain

technology industries.

In connection with the Offering, Argo has applied

to list the Notes on the Nasdaq Global Select Market

("Nasdaq") under the symbol "ARBKL." If approved for

listing, trading on Nasdaq is expected to commence within 30

business days after the Notes are first

issued.

The

Company and this issuance of Notes received a "B" rating from

Egan-Jones Ratings Company, an independent, unaffiliated rating

agency.

B.

Riley Securities, Inc., D.A. Davidson & Co., Ladenburg Thalmann

& Co. Inc. and William Blair & Co., L.L.C. will act as

joint book-running managers for the Offering. EF Hutton, division

of Benchmark Investments, LLC will act as lead manager for the

Offering. Aegis Capital Corp., Alexander Capital L.P., Colliers

Securities LLC, Northland Securities, Inc., Revere Securities LLC,

Wedbush Securities Inc. and B.C. Ziegler & Company will act as

co-managers for the Offering.

This press release does not constitute an offer to

sell or a solicitation of an offer to buy the securities described

herein, nor shall there be any sale of these securities in any

state or other jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. The Notes may only be

offered and sold under the Company's registration statement on Form

F-1, which has been filed with the Securities and Exchange

Commission ("SEC") but has not yet become effective. The Notes may

not be sold nor may offers to buy be accepted prior to the time the

registration statement becomes effective. A copy of the

registration statement is available on the SEC's website

at www.sec.gov.

When available, copies of the preliminary prospectus related to the

Offering may be obtained from the offices of B. Riley Securities,

Inc. at 1300 North 17th Street, Suite 1400, Arlington, VA 22209, by

calling (703) 312‐9580 or by

emailing prospectuses@brileyfin.com.

This

announcement contains inside information for the purposes of

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310.

For

further information please contact:

|

Argo Blockchain

|

|

|

Peter Wall

Chief Executive

|

via Tancredi +44 203 434 2334

|

|

finnCap Ltd

|

|

|

Corporate Finance

|

+44 207 220 0500

|

|

Jonny Franklin-Adams

|

|

|

Tim Harper

|

|

|

Joint Corporate Broker

|

|

|

Sunila de Silva

|

|

|

Tennyson Securities

|

|

|

Joint Corporate Broker

|

+44 207 186 9030

|

|

Peter Krens

|

|

|

OTC Markets

|

|

|

Jonathan Dickson

|

+44 204 526 4581

|

|

jonathan@otcmarkets.com

|

+44 7731 815 896

|

|

Tancredi Intelligent Communication

UK & Europe Media Relations

|

|

|

Emma Valgimigli

|

+44 7727 180 873

|

|

Emma Hodges

|

+44 7861 995 628

|

|

Salamander Davoudi

|

+44 7957 549 906

|

|

argoblock@tancredigroup.com

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements contained in this news release constitute

"forward-looking statements" within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, including statements regarding the proposed

Offering and use of proceeds thereof. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the Company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. These forward-looking statements

are identified by their use of terms and phrases such as "may,"

"expect," "estimate," "project," "plan," "believe," "intend,"

"achievable," "anticipate," "will," "continue," "potential,"

"should," "could," and similar terms and phrases. These statements

are based on certain assumptions made by the Company based on

management's experience and perception of historical trends,

current conditions, anticipated future developments and other

factors believed to be appropriate. Such statements are subject to

a number of assumptions, risks and uncertainties, many of which are

beyond the control of the Company, which may cause actual results

to differ materially from those implied or expressed by the

forward-looking statements, including the uncertainties related to

market conditions and the completion of the public offering on the

anticipated terms or at all as well as the ability and extent to

which the Company can acquire mining machines on acceptable terms,

the Company's build out of its Texas cryptocurrency mining facility

or the Company's ability to identify acquisition and investment

targets. Any forward-looking statement speaks only as of the date

on which such statement is made, and the Company undertakes no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

About Argo:

Argo Blockchain plc is a global leader in cryptocurrency mining

with one of the largest and most efficient operations powered by

clean energy. The Company is headquartered in London, UK and its

shares are listed on the Main Market of the London Stock Exchange

under the ticker: ARB and on the Nasdaq Global Select Market in the

United States under the ticker: ARBK.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

Date:

08 November, 2021

|

ARGO BLOCKCHAIN PLC

By:

Name:

Peter Wall

Title:

Chief Executive Officer

Name:

Davis Zaffe

Title:

General Counsel

|

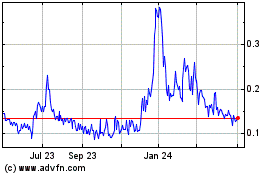

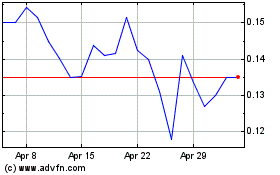

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Aug 2024 to Sep 2024

Argo Blockchain (PK) (USOTC:ARBKF)

Historical Stock Chart

From Sep 2023 to Sep 2024