FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of November

, 2017

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

|

|

NBG Group

|

Q3 Results 2017

|

PRESS RELEASE

NBG Group: Q3.17 results highlights

·

NPEs stock declines for a 6

th

consecutive quarter

·

Domestic NPE stock dropped by €0.2bn qoq in Q3.17, reflecting firmly negative NPE formation and fully provided write-offs; total NPE reduction at €3.5bn since YE’15

·

FY.17 SSM NPE reduction target already exceeded

·

Industry leading(1) NPE and 90dpd coverage ratios of 57% and 75% in Greece, combined with the lowest NPE and NPL levels among domestic banks(1)

·

ELA close to elimination

·

The Bank completed the 1

st

covered bond transaction in the Greek market since 2009, raising €750m at 2.90% yield; 85% of the issue went to international investors

·

ELA funding down by €4.6bn ytd to just €1.0bn currently(2); Eurosystem funding at €4.7bn from €12.3bn at end-Q4.16

·

The imminent completion of the agreed capital transactions of Ethniki Insurance, Banca Romaneasca and Vojvodjanska Banka will provide additional liquidity of €1.7bn

·

Domestic deposits up by €0.5bn qoq, summing up to a total of €1.2bn of inflows since the imposition of capital controls

·

Strong liquidity position and low funding cost allow NBG to satisfy future corporate credit demand

·

CET 1 ratio at 16.8%

·

CET 1 ratio at 16.8% and at 16.6% on a CRD IV FL basis, excluding the positive impact from the agreed sales of Ethniki Insurance, Banca Romaneasca, Vojvodjanska Banka and S.A.B.A.

·

The agreed capital actions are expected to complete by early 2018, providing additional capital buffer ahead of upcoming regulatory exercises

·

9M.

17 domestic core PPI up 11% yoy, core PPI margin 36bps higher yoy at 272bps

·

Domestic core PPI at €633m in 9M.17 (+11% yoy) supported by solid performance in net fees (+52% yoy) and strong cost containment (-9% yoy)

·

Domestic 9M.17 NIM improves by 29bps yoy to 306bps, despite the drop in NII to €1,116m (-5% yoy) on sustained loan deleveraging, as well as reduced exposure to high yielding GGBs

·

Net fee growth reflects the elimination of Pillar funding costs and a pick up in retail and other banking-related fee income

·

9M.17 OpEx in Greece at €640m, driven by the 12% yoy reduction in personnel expenses, reflecting the 2016 VES; C:CI at 50% from 55% in 9M.16

·

Q3.17 domestic provisions down 24% qoq to €151m, but remain conservative, with CoR down to 198bps and NPE coverage 40bps higher qoq to 57%

(1) Peer group comparison based on latest available data

(2) Data as at October 26, 2017

Athens, November 22, 2017

1

National Bank of Greece’s results demonstrate increasing balance sheet strength, underscoring the Bank’s comparative advantages ahead of the domestic economic recovery.

NBG was the first Greek Bank to re-access the markets through a covered bond issuance in October; the Bank raised €750 million at 2.9% yield, with the majority of interest coming from international investors. The transaction served NBG’s strategic objective of re-establishing a recurring presence in the international debt capital markets. At the same time, the issue accelerated the path to full disengagement from the ELA, currently at €1 billion. The completion of all agreed divestments will achieve this goal decisively, as well as boost capital significantly.

In terms of asset quality, NPE reduction continued unabated for a sixth consecutive quarter, with the stock of NPEs dropping by a cumulative €3.5 billion since YE’15. Notably, curing contributed more than half of this quarter’s NPE reduction. NPE coverage remains at a sector-high of 57% in Greece, enhanced by 40bps compared to the previous quarter.

Regarding P&L performance, NBG managed to increase domestic core PPI by c11% yoy, despite sustained deleveraging that impacted NII, displaying fee income recovery and solid cost reduction trends.

CET1 ratio stands at 16.8%, excluding the positive impact of the agreed capital actions expected to complete by early 2018. These will provide additional capital buffer that will be utilized in the upcoming regulatory exercises.

Athens, November 22 2017

Leonidas Fragkiadakis

Chief Executive Officer, NBG

2

NPEs stock declines for a 6

th

consecutive quarter

NPE reduction continued in Q3.17, with the stock of domestic NPEs down by €0.2bn qoq, reflecting the recovery in curings, as well as fully provided write-offs. Specifically, the NPE formation settled at -€119m in Q3.17 from -€14m in Q2.17, being the key driver to NPE reduction this quarter. The Bank has already reduced NPEs by €3.5bn since end-Q4.15, exceeding its related FY.17 SSM operational reduction target. The NPE ratio in Greece remained broadly stable qoq at 45.3% in Q3.17, combined with an industry leading NPE coverage of 56.6%(1), increased by 40bps qoq.

On a 9M.17 basis, domestic 90dpd formation dropped sharply to just €151m from €318m in 9M.16, despite the H1 uncertainty in the domestic market.

Q3.17 domestic provisioning run rate decreased to 198ps from 257bps in Q2.17, bringing 9M.17 CoR at 250bps. 90dpd coverage stood at 75.2% in Greece (74.1% at the Group level), the highest among peers(1).

In SE Europe(2), the 90dpd ratio settled at 33.9% on coverage of 55.7%.

Superior liquidity position(1)

Group deposits amounted to €38.8bn in Q3.17 (+1.2% qoq), driven by the 1.3% or €0.5bn qoq increase of domestic deposits. Notably, since the imposition of capital controls the Bank’s deposit base in Greece has increased by €1.2bn. In SE Europe(2) deposits remained broadly flat qoq at €2.1bn.

Aided by the issuance of a 3-year €750m covered bond, Eurosystem funding has declined significantly to €4.7bn in October(3) from €8.4bn at end-Q2.17, with ELA down by €2.8bn over the same period to just €1.0bn. This constitutes by far the lowest exposure in the sector(1), with ELA over assets (excluding EFSF & ESM bonds) standing at just 2%. The cash value of excess collateral amounts to €11.6bn(3). The completion of the agreed transactions of Ethniki Insurance, Banca Romaneasca and Vojvodjanska Banka will generate liquidity to the tune of c€1.7bn, thus allowing NBG to eliminate ELA decisively.

The Bank’s superior liquidity position and funding cost advantage imply that NBG is best positioned to satisfy future corporate credit demand.

Capital position

CET1 ratio stood at 16.8% and at 16.6% on a CRD IV FL basis, excluding the positive impact from the agreed sales of Ethniki Insurance, Banca Romaneasca, Vojvodjanska Banka and South African Bank of Athens (S.A.B.A.).

The agreed capital actions expected to complete by early 2018 will provide additional capital buffer ahead of the upcoming regulatory exercises.

(1) Peer group comparison based on latest available data

(2)

SE Europe includes the Group’s businesses in Cyprus, Albania and the Former Yugoslav Republic of Macedonia

(3) Data as at October 26, 2017

3

Profitability

Greece:

Q3.17 domestic core pre-provision income (PPI) reached €185m from €220m the previous quarter, weighed mainly by the drop in NII (-7.1% qoq) on further balance sheet deleveraging and the one-off pick-up in OpEx (+2.3% qoq).

NII amounted to €352m from €379m in Q2.17, reflecting continuing loan deleveraging, as well as reduced exposure to high yielding GGBs that more than offset the benefit from the further reduction of ELA balances. As a result, NIM settled at 305bps from 309bps in Q2.17.

Net fee and commission income amounted to €51m from €53m the previous quarter on lower brokerage and corporate lending-related fees. That said, 9M.17 net fees reached €158m, up by 52.0% yoy, driven mainly by the elimination of Pillar funding costs. Adjusting for ELA-related fees, fee income grew by 8% yoy, reflecting the 28% yoy increase in fund management, brokerage & other fees, as well as the 5% yoy rise in retail banking fees income.

Q3.17 OpEx amounted to €217m compared with €213m in Q1.17 mainly on higher personnel expenses, incorporating a €2.5m one-off cost. On a 9M.17 basis, operating expenses settled at €640m or 8.6% lower yoy. Cost-to-core income recovered to 50% in 9M.17 from 55% in 9M.16. Personnel expenses declined by 12.4% yoy, incorporating the benefit from the Dec’16 Voluntary Exit Scheme (VES) that involved c10% of the domestic workforce, while G&As also dropped by 2.0% yoy.

Q3.17 domestic losses (after tax) from continued operations amounted to €49m from €58m in Q2.17, incorporating valuation adjustments & other charges of €81m that offset the benefit from the sharp drop in loan impairments (-24.3% qoq to €151m).

SE Europe:

(1)

In SE Europe(1), PAT from continued operations remained broadly stable qoq at €5m in Q3.17, bringing 9M.17 respective figure at €18m from €33m in 9M.16. The latter mainly reflects the pressure in NII (-6.5% qoq) and the increased loan impairments (+54.2% yoy).

(1) SE Europe includes the Group’s businesses in Cyprus, Albania and the Former Yugoslav Republic of Macedonia

4

Annex

P&L |

Group

|

€ m

|

|

9M.17

|

|

9M.16

|

|

yoy

|

|

Q3.17

|

|

Q2.17

|

|

qoq

|

|

|

NII

|

|

1 193

|

|

1 252

|

|

-5

|

%

|

378

|

|

405

|

|

-7

|

%

|

|

Net fees & commissions

|

|

176

|

|

123

|

|

+43

|

%

|

57

|

|

59

|

|

-4

|

%

|

|

Insurance income

|

|

(0

|

)

|

0

|

|

n/m

|

|

(0

|

)

|

(0

|

)

|

n/m

|

|

|

Core income

|

|

1 369

|

|

1 375

|

|

-0

|

%

|

435

|

|

464

|

|

-6

|

%

|

|

Trading & other income

|

|

(155

|

)

|

(96

|

)

|

+61

|

%

|

(81

|

)

|

(73

|

)

|

+11

|

%

|

|

Income

|

|

1 214

|

|

1 279

|

|

-5

|

%

|

354

|

|

391

|

|

-9

|

%

|

|

Operating expenses

|

|

(701

|

)

|

(762

|

)

|

-8

|

%

|

(238

|

)

|

(232

|

)

|

+3

|

%

|

|

Core PPI

|

|

667

|

|

613

|

|

+9

|

%

|

196

|

|

232

|

|

-15

|

%

|

|

PPI

|

|

513

|

|

517

|

|

-1

|

%

|

116

|

|

159

|

|

-27

|

%

|

|

Provisions

|

|

(589

|

)

|

(487

|

)

|

+21

|

%

|

(156

|

)

|

(200

|

)

|

-22

|

%

|

|

Operating profit

|

|

(77

|

)

|

30

|

|

n/m

|

|

(40

|

)

|

(41

|

)

|

-3

|

%

|

|

Other impairments

|

|

(4

|

)

|

(59

|

)

|

-93

|

%

|

2

|

|

(1

|

)

|

n/m

|

|

|

PBT

|

|

(81

|

)

|

(29

|

)

|

>100

|

%

|

(38

|

)

|

(42

|

)

|

-10

|

%

|

|

Taxes

|

|

(23

|

)

|

(11

|

)

|

>100

|

%

|

(6

|

)

|

(10

|

)

|

-41

|

%

|

|

PAT (continuing operations)

|

|

(104

|

)

|

(40

|

)

|

>100

|

%

|

(44

|

)

|

(52

|

)

|

-16

|

%

|

|

PAT (discontinued operations)(1)

|

|

(48

|

)

|

(2 891

|

)

|

-98

|

%

|

19

|

|

(97

|

)

|

n/m

|

|

|

Minorities

|

|

(26

|

)

|

(28

|

)

|

-6

|

%

|

(10

|

)

|

(7

|

)

|

42

|

%

|

|

PAT (reported)

|

|

(178

|

)

|

(2 959

|

)

|

-94

|

%

|

(35

|

)

|

(156

|

)

|

-78

|

%

|

(1)

Includes (a) the impairments on Romania and Serbia reflecting agreements to sell below book in Q2.17 (€151m) and (b) a loss of €3,095m in Q2.16, which reflects the recycling of losses recognized in other comprehensive income in previous periods and relates mainly to foreign currency translation differences from the translation of Finansbank’s assets and liabilities in Euro, in accordance with IFRS. This loss has already been recognized in the Group’s equity and CET1 capital in prior periods, therefore has no impact on the Group’s equity and CET1 capital

Balance Sheet | Group

|

€ m

|

|

Q3.17

|

|

Q2.17

|

|

Q1.17(1)

|

|

Q4.16(1)

|

|

Q3.16(1)

|

|

|

Cash & reserves

|

|

1 208

|

|

1 231

|

|

1 218

|

|

1 182

|

|

1 187

|

|

|

Interbank placements

|

|

1 886

|

|

2 032

|

|

1 975

|

|

2 087

|

|

2 554

|

|

|

Securities

|

|

12 043

|

|

15 369

|

|

16 679

|

|

18 530

|

|

19 921

|

|

|

Loans (Gross)

|

|

43 174

|

|

43 749

|

|

44 482

|

|

45 046

|

|

45 837

|

|

|

Provisions

|

|

(10 900

|

)

|

(10 968

|

)

|

(11 176

|

)

|

(11 301

|

)

|

(11 867

|

)

|

|

Goodwill & intangibles

|

|

123

|

|

123

|

|

115

|

|

117

|

|

113

|

|

|

Tangible assets

|

|

1 076

|

|

1 085

|

|

1 114

|

|

1 111

|

|

1 107

|

|

|

DTA

|

|

4 917

|

|

4 917

|

|

4 918

|

|

4 918

|

|

4 917

|

|

|

Other assets

|

|

6 506

|

|

6 654

|

|

6 772

|

|

7 458

|

|

8 305

|

|

|

Assets held for sale

|

|

5 810

|

|

5 681

|

|

9 459

|

|

9 382

|

|

9 669

|

|

|

Total assets

|

|

65 843

|

|

69 873

|

|

75 557

|

|

78 531

|

|

81 742

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interbank liabilities

|

|

9 855

|

|

13 945

|

|

16 522

|

|

18 167

|

|

17 753

|

|

|

Due to customers

|

|

38 795

|

|

38 324

|

|

38 132

|

|

38 924

|

|

38 071

|

|

|

Debt securities

|

|

461

|

|

523

|

|

550

|

|

663

|

|

1 508

|

|

|

Other liabilities

|

|

5 182

|

|

5 564

|

|

5 862

|

|

6 322

|

|

7 746

|

|

|

Liabilities held for sale

|

|

4 122

|

|

4 095

|

|

6 889

|

|

6 870

|

|

6 857

|

|

|

Minorities

|

|

669

|

|

660

|

|

689

|

|

680

|

|

708

|

|

|

Equity

|

|

6 757

|

|

6 762

|

|

6 913

|

|

6 909

|

|

9 099

|

|

|

Total liabilities and equity

|

|

65 843

|

|

69 873

|

|

75 557

|

|

78 531

|

|

81 742

|

|

(1)

Group Balance Sheet has been adjusted for the agreed sales of Ethniki Insurance, Banca Romaneasca and Vojvodjanska Banka & NBG Leasing that have been classified in Q2.17 as non-current assets held for sale and liabilities associated with non-current assets held for sale

5

Key Ratios

| Group

|

|

|

9M.17

|

|

H1.17

|

|

Q1.17

|

|

9M.16

|

|

|

Liquidity

|

|

|

|

|

|

|

|

|

|

|

Loans-to-Deposits ratio

|

|

83

|

%

|

86

|

%

|

87

|

%

|

89

|

%

|

|

ELA exposure (€ bn)

|

|

2.3

|

|

3.8

|

|

5.6

|

|

5.2

|

|

|

Profitability

|

|

|

|

|

|

|

|

|

|

|

NIM (bps)

|

|

307

|

|

306

|

|

302

|

|

280

|

|

|

Cost-to-Core income

|

|

51

|

%

|

50

|

%

|

49

|

%

|

55

|

%

|

|

Asset quality

|

|

|

|

|

|

|

|

|

|

|

NPE ratio

|

|

45.2

|

%(1)

|

45.0

|

%

|

44.9

|

%

|

46.6

|

%

|

|

NPE coverage ratio

|

|

55.9

|

%

|

55.7

|

%

|

56.0

|

%

|

55.5

|

%

|

|

Cost of Risk (bps)

|

|

238

|

|

260

|

|

278

|

|

189

|

|

|

Capital

|

|

|

|

|

|

|

|

|

|

|

CET1 phased-in

|

|

16.8

|

%(2)

|

16.5

|

%(2)

|

16.0

|

%(3)

|

16.4

|

%(4)

|

|

CET1 ratio CRD IV FL

|

|

16.6

|

%(2)

|

16.3

|

%(2)

|

15.8

|

%(3)

|

15.9

|

%(4)

|

|

RWAs (€ bn)

|

|

38.5

|

(2)

|

39.0

|

(2)

|

41.3

|

(3)

|

40.3

|

(4)

|

(1) Excluding the deleveraging impact, NPE ratio in 3Q is 59bps lower qoq

(2) Excludes the impact from the agreed sales of Ethniki Insurance, Banca Romaneasca, Vojvodjanska Banka and S.A.B.A.

(3) Excludes the impact from the agreed sales of UBB, Interlease & S.A.B.A.

(4) Excludes CoCos

P&L | Greece

|

€ m

|

|

9M.17

|

|

9M.16

|

|

yoy

|

|

Q3.17

|

|

Q2.17

|

|

qoq

|

|

|

NII

|

|

1 116

|

|

1 169

|

|

-5

|

%

|

352

|

|

379

|

|

-7

|

%

|

|

Net fees & commissions

|

|

158

|

|

104

|

|

+52

|

%

|

51

|

|

53

|

|

-5

|

%

|

|

Insurance income

|

|

(0

|

)

|

0

|

|

n/m

|

|

(0

|

)

|

(0

|

)

|

n/m

|

|

|

Core income

|

|

1 273

|

|

1 273

|

|

-0

|

%

|

403

|

|

432

|

|

-7

|

%

|

|

Trading & other income

|

|

(152

|

)

|

(100

|

)

|

+52

|

%

|

(81

|

)

|

(71

|

)

|

+14

|

%

|

|

Income

|

|

1 121

|

|

1 173

|

|

-5

|

%

|

322

|

|

361

|

|

-11

|

%

|

|

Operating expenses

|

|

(640

|

)

|

(700

|

)

|

-9

|

%

|

(217

|

)

|

(213

|

)

|

+2

|

%

|

|

Core PPI

|

|

633

|

|

573

|

|

+11

|

%

|

185

|

|

220

|

|

-16

|

%

|

|

PPI

|

|

481

|

|

473

|

|

+2

|

%

|

104

|

|

149

|

|

-30

|

%

|

|

Provisions

|

|

(582

|

)

|

(482

|

)

|

+21

|

%

|

(151

|

)

|

(199

|

)

|

-24

|

%

|

|

Operating profit

|

|

(101

|

)

|

(9

|

)

|

>100

|

%

|

(47

|

)

|

(51

|

)

|

-8

|

%

|

|

Other impairments

|

|

(3

|

)

|

(58

|

)

|

-95

|

%

|

3

|

|

0

|

|

>100

|

%

|

|

PBT

|

|

(104

|

)

|

(67

|

)

|

55

|

%

|

(44

|

)

|

(50

|

)

|

-13

|

%

|

|

Taxes

|

|

(17

|

)

|

(6

|

)

|

>100

|

%

|

(5

|

)

|

(8

|

)

|

-39

|

%

|

|

PAT (continuing operations)

|

|

(122

|

)

|

(73

|

)

|

+67

|

%

|

(49

|

)

|

(58

|

)

|

-17

|

%

|

|

PAT (discontinued operations)

|

|

52

|

|

17

|

|

>100

|

%

|

18

|

|

22

|

|

-20

|

%

|

|

Minorities

|

|

(25

|

)

|

(26

|

)

|

-4

|

%

|

(10

|

)

|

(7

|

)

|

+46

|

%

|

|

PAT (reported)

|

|

(94

|

)

|

(82

|

)

|

+16

|

%

|

(40

|

)

|

(43

|

)

|

-5

|

%

|

6

|

Name

|

|

Abbreviation

|

|

Definition

|

|

Common Equity / Book Value

|

|

BV

|

|

Equity attributable to NBG shareholders less minorities (non-controlling interests) and contingent convertible securities (CoCos) that were repaid at end-Q4.16

|

|

Common Equity Tier 1 Ratio

|

|

CET1 ratio

|

|

CET1 capital, as defined by Regulation No 575/2013 and based on the transitional rules over RWAs

|

|

Common Equity Tier 1 Ratio Fully Loaded

|

|

CET1 ratio, CRD IV FL

|

|

CET1 capital as defined by Regulation No 575/2013, without the application of the transitional rules over RWAs

|

|

Core Income

|

|

CI

|

|

Net Interest Income (“NII”) + Net fee and commission income + Earned premia net of claims and commissions

|

|

Core Operating Result (Profit / (Loss))

|

|

—

|

|

Core income less operating expenses and provisions (credit provisions and other impairment charges)

|

|

Core Pre-Provision Income

|

|

Core PPI

|

|

Core Income less operating expenses

|

|

Cost of Risk / Provisioning Rate

|

|

CoR

|

|

Credit provisions of the period annualized over average net loans

|

|

Cost-to-Core Income Ratio

|

|

C:CI

|

|

Operating expenses over core Income

|

|

Cost-to-Income Ratio

|

|

C:I

|

|

Operating expenses over total income

|

|

Funding cost

|

|

—

|

|

The blended cost of deposits, ECB refinancing, repo transactions and ELA funding

|

|

Gross Loans

|

|

—

|

|

Loans and advances to customers before allowance for impairment, excluding the loan to the Greek State of €6.0bn

|

|

Loans-to-Deposits Ratio

|

|

L:D

|

|

Net loans over total deposits, period end

|

|

Net Interest Margin

|

|

NIM

|

|

NII annualized over average interest earning assets. The latter include all assets with interest earning potentials and includes cash and balances with central banks, due from banks, financial assets at fair value through profit or loss (excluding Equity securities and mutual funds units), loans and advances to customers and investment securities (excluding equity securities and mutual funds units).

|

|

Net Loans

|

|

—

|

|

Loans and advances to customers, excluding the loan to the Greek State of €6.0bn

|

|

Net Profit / (Loss)

|

|

—

|

|

Profit / (loss) for the period attributable to NBG equity shareholders

|

|

Non-Performing Exposures

|

|

NPEs

|

|

Non-performing exposures are defined according to EBA ITS technical standards on Forbearance and Non-Performing Exposures as exposures that satisfy either or both of the following criteria: (a) material exposures which are more than 90 days past due, (b) the debtor is assessed as unlikely to pay its credit obligations in full without realization of collateral, regardless of the existence of any past due amount or of the number of days past due

|

|

Non-Performing Exposures Coverage Ratio

|

|

NPE coverage

|

|

Stock of provisions (allowance for impairment for loans and advances to customers) over non-performing exposures, period end

|

|

Non-Performing Exposures Formation

|

|

NPE formation

|

|

Net increase / (decrease) of NPEs, before write-offs

|

|

Non-Performing Exposures Ratio

|

|

NPE ratio

|

|

Non-performing exposures over gross loans, period end

|

|

Non-Performing Loans

|

|

NPLs

|

|

Loans and advances to customers in arrears for 90 days or more

|

|

90 Days Past Due Coverage Ratio

|

|

90dpd coverage

|

|

Stock of provisions over loans and advances to customers in arrears for 90 days or more, period end

|

|

90 Days Past Due Formation

|

|

90dpd formation

|

|

Net increase / (decrease) of loans and advances to customers in arrears for 90 days or more, before write-offs and after restructurings

|

|

90 Days Past Due Ratio

|

|

90dpd ratio

|

|

Loans and advances to customers in arrears for 90 days or more over gross loans, period end

|

|

Operating Expenses

|

|

OpEx, costs

|

|

Personnel expenses + General, administrative and other operating expenses (“G&As”) + Depreciation and amortisation on investment property, property & equipment and software & other intangible assets

|

|

Operating Profit / (Loss)

|

|

—

|

|

Total income less operating expenses and provisions (credit provisions and other impairment charges)

|

|

Pre-Provision Income

|

|

PPI

|

|

Total income less operating expenses, before provisions (credit provisions and other impairment charges)

|

|

Profit / (loss) after tax

|

|

PAT (cont. ops)

|

|

Profit / (loss) for the period from continuing operations

|

|

Risk Weighted Assets

|

|

RWAs

|

|

Assets and off-balance-sheet exposures, weighted according to risk factors based on Regulation (EU) No 575/2013

|

|

Tangible Equity / Book Value

|

|

TBV

|

|

Common equity less goodwill & intangibles (goodwill, software and other intangible assets)

|

|

Total deposits

|

|

—

|

|

Due to customers

|

7

Disclaimer

No representation or warranty, express or implied, is or will be made in relation to, and no responsibility is or will be accepted by National Bank of Greece (the “Group”) as to the accuracy or completeness of the information contained in this announcement and nothing in this announcement shall be deemed to constitute such a representation or warranty.

Although the statements of fact and certain industry, market and competitive data in this announcement have been obtained from and are based upon sources that are believed to be reliable, their accuracy is not guaranteed and any such information may be incomplete or condensed. All opinions and estimates included in this announcement are subject to change without notice. The Group is under no obligation to update or keep current the information contained herein.

In addition, certain of these data come from the Group’s own internal research and estimates based on knowledge and experience of management in the market in which it operates. Such research and estimates and their underlying methodology have not been verified by any independent source for accuracy or completeness. Accordingly, you should not place undue reliance on them.

Certain statements in this announcement constitute forward-looking statements. Such forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially. These risks and uncertainties include, among other factors, changing economic, financial, business or other market conditions. As a result, you are cautioned not to place any reliance on such forward-looking statements. Nothing in this announcement should be construed as a profit forecast and no representation is made that any of these statement or forecasts will come to pass. Persons receiving this announcement should not place undue reliance on forward-looking statements and are advised to make their own independent analysis and determination with respect to the forecast periods, which reflect the Group’s view only as of the date hereof.

8

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: November 22

nd

, 2017

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: November 22

nd

, 2017

|

|

|

|

|

|

|

Director, Financial Division

|

9

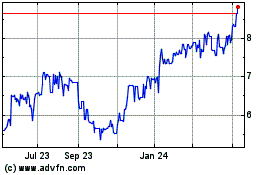

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2024 to May 2024

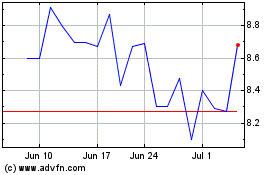

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From May 2023 to May 2024