false0001498382DEF 14A0001498382ktra:RobertEHoffmannMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatVestedDuringApplicableFyDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToVestingDateMember2022-07-012023-06-3000014983822023-07-012024-06-300001498382ecd:NonPeoNeoMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereOutstandingAndUnvestedAsOfApplicableFyEndDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToApplicableFyEndMember2022-07-012023-06-300001498382ktra:RobertEHoffmannMemberktra:Asc718FairValueOfAwardsGrantedDuringApplicableFyThatVestedDuringApplicableFyDeterminedAsOfVestingDateMember2021-07-012022-06-300001498382ktra:SaiidZarrabianMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatVestedDuringApplicableFyDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToVestingDateMember2021-07-012022-06-300001498382ecd:NonPeoNeoMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereOutstandingAndUnvestedAsOfApplicableFyEndDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToApplicableFyEndMember2021-07-012022-06-300001498382ecd:NonPeoNeoMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatVestedDuringApplicableFyDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToVestingDateMember2021-07-012022-06-300001498382ecd:NonPeoNeoMemberktra:Asc718FairValueOfAwardsGrantedDuringApplicableFyThatRemainUnvestedAsOfApplicableFyEndDeterminedAsOfApplicableFyEndMember2022-07-012023-06-300001498382ecd:NonPeoNeoMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatVestedDuringApplicableFyDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToVestingDateMember2022-07-012023-06-300001498382ktra:RobertEHoffmannMemberktra:Asc718FairValueOfAwardsGrantedDuringApplicableFyThatRemainUnvestedAsOfApplicableFyEndDeterminedAsOfApplicableFyEndMember2022-07-012023-06-300001498382ktra:RobertEHoffmannMemberktra:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableMember2021-07-012022-06-300001498382ktra:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableMemberktra:RobertEHoffmannMember2022-07-012023-06-300001498382ecd:NonPeoNeoMember2021-07-012022-06-300001498382ktra:RobertEHoffmannMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatVestedDuringApplicableFyDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToVestingDateMember2021-07-012022-06-300001498382ktra:RobertEHoffmannMemberktra:IncreaseDeductionForAwardsGrantedDuringPriorFyThatWereOutstandingAndUnvestedAsOfApplicableFyEndDeterminedBasedOnChangeInAsc718FairValueFromPriorFyEndToApplicableFyEndMember2022-07-012023-06-300001498382ecd:NonPeoNeoMember2022-07-012023-06-300001498382ktra:RobertEHoffmannMember2022-07-012023-06-300001498382ktra:RobertEHoffmannMember2021-07-012022-06-300001498382ktra:SaiidZarrabianMemberktra:DeductionOfAsc718FairValueOfAwardsGrantedDuringPriorFyThatWereForfeitedDuringApplicableFyDeterminedAsOfPriorFyEndMember2021-07-012022-06-300001498382ecd:NonPeoNeoMemberktra:DeductionForAmountsReportedUnderTheStockAwardsColumnInTheSummaryCompensationTableMember2022-07-012023-06-300001498382ktra:SaiidZarrabianMember2021-07-012022-06-3000014983822021-07-012022-06-300001498382ktra:RobertEHoffmannMemberktra:Asc718FairValueOfAwardsGrantedDuringApplicableFyThatRemainUnvestedAsOfApplicableFyEndDeterminedAsOfApplicableFyEndMember2021-07-012022-06-3000014983822022-07-012023-06-300001498382ecd:NonPeoNeoMemberktra:DeductionOfAsc718FairValueOfAwardsGrantedDuringPriorFyThatWereForfeitedDuringApplicableFyDeterminedAsOfPriorFyEndMember2021-07-012022-06-30iso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

SCHEDULE 14A

___________________

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (Amendment No.)

|

|

|

Filed by the Registrant ☒ |

|

|

Filed by a Party other than the Registrant ☐ |

|

|

Check the appropriate box:

|

|

|

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material under §240.14a-12 |

KINTARA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

_____________________________________________________________

(Name(s) of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

☒ |

|

No fee required. |

☐ |

|

Fee paid previously with preliminary materials. |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

KINTARA THERAPEUTICS, Inc.

9920 Pacific Heights Blvd, Suite 150

San Diego, California 92121

May 17, 2024

Dear Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of Kintara Therapeutics, Inc., or the Annual Meeting, which will be held on June 20, 2024, at 12:00 p.m., Eastern time. This year’s Annual Meeting will be held via the Internet. Stockholders will be able to listen to the meeting live, submit questions and vote online regardless of location via the Internet at http://www.viewproxy.com/kintara/2024/vm. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/kintara/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. You will not be able to attend the Annual Meeting in person.

The Annual Meeting is being held for the following purposes:

•to elect four directors to the Board of Directors to hold office for the following year until their successors are elected;

•to approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in the proxy statement;

•to vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation (every year, every two years or every three years);

•to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2024; and

•to transact any other business that may properly come before the meeting or any adjournment thereof.

Please complete, sign and return the proxy card whether or not you plan to attend the Annual Meeting. Alternatively, you may vote online at http://www.viewproxy.com/kintara/2024. Your vote is important regardless of the number of shares you own. Voting by proxy will not prevent you from voting at the virtual Annual Meeting (provided you follow the revocation procedures described in the accompanying proxy statement) but will assure that your vote is counted if you cannot attend.

On behalf of the Board of Directors and the employees of Kintara Therapeutics, Inc., we thank you for your continued support and look forward to speaking with you at the Annual Meeting.

|

|

By: |

/s/ Robert E. Hoffman |

|

Robert E. Hoffman |

|

President, Chief Executive Officer, Interim Chief Financial Officer, and Chairman of the Board |

|

|

If you have any questions or require any assistance in voting your shares, please call:

Alliance Advisors LLC

200 Broadacres Drive, 3rd Floor, Bloomfield, NJ 07003

855-600-2576

Notice of Annual Meeting of Stockholders

|

|

|

Date: |

|

June 20, 2024 |

Time: |

|

12:00 p.m., Eastern Time |

Place: |

|

This year’s Annual Meeting will be held via the Internet. Stockholders will be able to listen, vote and submit questions regardless of location via the Internet at http://www.viewproxy.com/kintara/2024/vm. You will be able to attend the Annual Meeting by first registering at http://www.viewproxy.com/kintara/2024. You will receive a meeting invitation by e-mail with your unique join link along with a password prior to the meeting date. |

At our 2024 Annual Meeting, we will ask you:

1.to elect four directors to the Board of Directors to hold office for the following year until their successors are elected;

2.to approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in the proxy statement;

3.to vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation (every year, every two years or every three years);

4.to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2024; and

5.to transact any other business that may properly come before the meeting or any adjournment thereof.

You may vote at the Annual Meeting (or any adjournment or postponement of the Annual Meeting) if you were a stockholder of Kintara Therapeutics, Inc. at the close of business on May 9, 2024 (the “Record Date”). Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting.

|

|

|

By Order of the Board of Directors, |

|

|

|

/s/ Robert E. Hoffman |

|

Robert E. Hoffman |

|

President, Chief Executive Officer, Interim Chief Financial Officer, and Chairman of the Board |

San Diego, California

May 17, 2024

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 20, 2024: The Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders and the Annual Report to Stockholders on Form 10-K for the fiscal year ended June 30, 2023 are available at http://www.viewproxy.com/kintara/2024. You are cordially invited to attend the Annual Meeting via live webcast by visiting http://www.viewproxy.com/kintara/2024/vm. To be sure your vote is counted and assure a quorum is present, it is important that you vote your shares regardless of the number of shares you own. The Board of Directors urges you to vote over the Internet by going to http://www.viewproxy.com/kintara/2024 or by telephone by calling (855) 600-2576 or to sign, date and mark the proxy card promptly and return it to Kintara. Voting over the Internet or by telephone or by returning the proxy card will not prevent you from voting at the virtual Annual Meeting. Under Securities and Exchange Commission rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, and by notifying you of the availability of our proxy materials on the Internet. |

THE MEETING

General

Kintara Therapeutics, Inc., or Kintara, is a Nevada corporation. As used in this proxy statement, “we,” “us,” “our” and the “Company” refer to Kintara. The term “Annual Meeting” as used in this proxy statement refers to the 2024 Annual Meeting of Stockholders and includes any adjournment or postponement of the Annual Meeting.

Pursuant to Securities and Exchange Commission (“SEC”) rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, and by notifying you of the availability of our proxy materials online at http://www.viewproxy.com/kintara/2024, where you can access this proxy statement for the 2024 Annual Meeting, our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 (the “Annual Report”), and our proxy card. In addition, our proxy materials provide instructions on how you may request to receive, at no charge, all future proxy materials in printed form by mail or electronically by email. Your election to receive proxy materials by mail or email will remain in effect until you revoke it. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to stockholders and will reduce the impact of our annual meetings on the environment.

The Board of Directors (the “Board”) is soliciting your proxy to vote at the Annual Meeting. This proxy statement summarizes the information you will need to know to cast an informed vote at the Annual Meeting. You do not need to attend the Annual Meeting to vote your shares. You may simply complete, sign and return the proxy card and your votes will be cast for you at the Annual Meeting or you may vote online at http://www.viewproxy.com/kintara/2024. This process is described below in the section entitled “Voting Rights.”

This proxy statement and the Notice of Annual Meeting are dated May 17, 2024. If you owned shares of common stock or Series C Preferred Stock of Kintara at the close of business on May 9, 2024 (the “Record Date”), you are entitled to vote at the Annual Meeting, as set out below. On the Record Date, there were 55,304,613 shares of common stock and 13,668 shares of Series C Preferred Stock of Kintara outstanding.

Each share of common stock is entitled to one vote per share. Each share of Series C Preferred Stock is convertible into shares of common stock based on the respective conversion prices and is entitled to vote with the common stock on an as-converted basis. The conversion prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $58.00, $60.70, and $57.50, respectively. As of the Record Date, we had outstanding shares of Series C Preferred Stock that were convertible into an aggregate of 235,009 shares of common stock.

This year’s Annual Meeting will be held in a virtual meeting format only. The Annual Meeting will convene on June 20, 2024, at 12:00 p.m. Eastern time. In order to participate in the Annual Meeting live via the Internet, you must register at http://www.viewproxy.com/kintara/2024/vm by 11:59 p.m. Eastern Time by June 19, 2024. If you are a registered holder, you must register using the virtual control number included on your Notice of Internet Availability of proxy materials or your proxy card (if you received a printed copy of the proxy materials). If you hold your shares beneficially through a bank or broker, you must provide a legal proxy from your bank or broker during registration and you will be assigned a virtual control number in order to vote your shares during the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the 2024 Annual Meeting (but will not be able to vote your shares) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at http://www.viewproxy.com/kintara/2024.

On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting by logging in using the event password you received via email in your registration confirmation at http://www.viewproxy.com/kintara/2024/vm.

The Annual Meeting can be accessed by visiting http://www.viewproxy.com/kintara/2024/vm, where you will be able to listen to the meeting live, submit questions and vote online. You will need the virtual control number. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer

questions submitted in writing during the meeting in accordance with the Annual Meeting procedures which are pertinent to the Company and the meeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once.

If you encounter any difficulties accessing the Annual Meeting live audio webcast during the meeting time, please email VirtualMeeting@viewproxy.com or call (866) 612-8937.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance by Internet, telephone or mail so that your vote will be counted even if you later decide not to attend the virtual Annual Meeting.

Purpose Of Annual Meeting

At the Annual Meeting, you will be asked to vote:

•to elect four directors to the Board of Directors to hold office for the following year until their successors are elected (“Proposal 1”);

•to approve, on an advisory basis, the executive compensation of the Company’s named executive officers as described in this proxy statement (“Proposal 2”);

•to vote, on an advisory basis, on how often the Company will conduct an advisory vote on executive compensation (every year, every two years or every three years) (“Proposal 3”);

•to ratify the appointment of Marcum LLP as our independent registered public accounting firm for our fiscal year ending June 30, 2024 (“Proposal 4”); and

•to transact any other business that may properly come before the meeting or any adjournment thereof.

Quorum

A quorum of stockholders is necessary to hold a valid meeting. The holders of at one-third (1/3) of the voting power of the capital stock issued and outstanding and entitled to vote at the Annual Meeting as of the Record Date, represented in person or by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Kintara will include proxies marked as abstentions, withheld votes, and broker non-votes to determine the number of shares present at the Annual Meeting.

Voting Rights

Holders of Kintara’s common stock are entitled to one vote at the Annual Meeting for each share of the common stock that he or she owned as of the Record Date.

Holders of Kintara’s Series C Preferred Stock are entitled to vote on an as-converted basis with the common stock. The conversion prices for the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock are $58.00, $60.70, and $57.50, respectively. Each share of the Series C-1 Preferred Stock, Series C-2 Preferred Stock and Series C-3 Preferred Stock is convertible into 188,412 shares, 14,801 shares, and 32,096 shares, respectively, of common stock as of the Record Date, based on the $1,000 per share stated value and is entitled to the same number of votes per share.

You may vote your shares at the Annual Meeting via live webcast, over the Internet or by proxy. If you wish to vote your shares electronically at the Annual Meeting, there will be a live link provided during the Annual Meeting (you will need the virtual control number assigned to you).

To vote over the Internet, you must go to http://www.viewproxy.com/kintara/2024. To vote by proxy, complete, sign and return the proxy card in the enclosed postage-paid envelope. If you properly complete your proxy card and send it to us in time to vote, your “proxy” (one of the individuals named on your proxy card) will vote your shares as you have directed. If you are a stockholder of record and you return a properly executed proxy card or vote by proxy over the Internet but do not mark the boxes showing how you wish to vote, your proxy will

vote your shares FOR the Board’s nominees for director; FOR the approval of the compensation of our named executive officers on an advisory basis; FOR EVERY THREE YEARS on the frequency of holding an advisory vote on executive compensation on an advisory basis; and FOR the ratification of the appointment of our independent registered public accounting firm for the fiscal year ending June 30, 2024 and, in the discretion of the proxy holders, on any other matters that properly come before the meeting. If any other matter is presented, your proxy will vote your shares as a majority of the Board determines. As of the date of this proxy statement, we know of no other matters that may be presented at the Annual Meeting, other than those listed in the Notice of the Annual Meeting.

If you hold your shares through a bank, brokerage firm or other nominee, you should vote your shares in accordance with the steps required by such bank, brokerage firm or other nominee.

Vote Required

Assuming that a quorum is present, the following votes will be required to approve each proposal:

•With respect to the first proposal (election of directors), directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote on the election of directors. The director nominees who receive the greatest number of votes at the Annual Meeting (up to the total number of directors to be elected) will be elected. As a result, withheld votes and “broker non-votes” (see below), if any, will not affect the outcome of the vote on Proposal 1. Consequently, only shares that are voted in favor of a particular nominee will be counted toward such nominee’s achievement of a plurality. You may not vote your shares cumulatively for the election of directors.

•With respect to the third proposal to hold an advisory vote on the frequency of holding an advisory vote on the compensation of our named executive officers, the frequency alternative that receives the highest number of votes cast at the Annual Meeting will be considered the frequency alternative that is preferred by our stockholders. As a result, abstentions, broker non-votes, if any, and any other failure to submit a proxy or vote in person at the meeting will not affect the outcome of the vote of Proposal 3.

•With respect to the second proposal to approve the compensation of our named executive officers on an advisory basis, and the fourth proposal to ratify the appointment of Marcum LLP, as well as the approval of any other matter that may properly come before the Annual Meeting, the affirmative vote of a majority of the total votes cast at the Annual Meeting is required to approve these proposals. As a result, abstentions, broker non-votes, if any, and any other failure to submit a proxy or vote in person at the meeting, will not affect the outcome of the vote of Proposals 2 and 4.

You will not have any dissenters’ rights of appraisal in connection with any of the matters to be voted on at the meeting.

The Board has determined that a vote in favor of the foregoing proposals is in the best interests of Kintara and our stockholders and unanimously recommends a vote “FOR” the Board’s nominees for director; “FOR” the approval of the compensation of our named executive officers on an advisory basis; “FOR” the approval of the advisory vote on executive compensation to be held every three years on an advisory basis; and “FOR” the ratification of the appointment of our independent registered public accounting firm and, in the discretion of the proxy holders, on any other matters that properly come before the meeting.

The Board is not aware of any other matters to be presented for action at the meeting, but if other matters are properly brought before the meeting, shares represented by properly completed proxies received by mail, telephone or the Internet will be voted in accordance with the judgment of the persons named as proxies.

Broker Non-Votes

Banks and brokers acting as nominees are permitted to use discretionary voting authority to vote proxies for proposals that are deemed “routine” by the New York Stock Exchange (the exchange that makes such determinations) but are not permitted to use discretionary voting authority to vote proxies for proposals that are deemed “non-routine” by the New York Stock Exchange. A “broker non-vote” occurs when a proposal is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the matter

being considered and has not received instructions from the beneficial owner. The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this proxy statement has been mailed to you. As such, it is important that you provide voting instructions to your bank, broker or other nominee, if you wish to determine the voting of your shares.

Under the applicable rules governing such brokers, we believe Proposal 4 to ratify the appointment of Marcum LLP as our independent registered public accounting firm is likely to be considered a “routine” item. This means that brokers may vote using their discretion on such proposals on behalf of beneficial owners who have not furnished voting instructions. In contrast, certain items are considered “non-routine”, and a “broker non-vote” occurs when brokers do not receive voting instructions from beneficial owners with respect to such items because the brokers are not entitled to vote such uninstructed shares. We believe Proposal 1 to elect directors, Proposal 2 to hold on advisory vote on compensation of our named executive officers, and Proposal 3 to hold an advisory vote on the frequency of holding an advisory vote on executive compensation, are likely to be considered “non-routine”, which means that brokers cannot vote your uninstructed shares when they do not receive voting instructions from you. Furthermore, if approval of Proposal 4 is deemed by the New York Stock Exchange to be a “non-routine” matter, brokers will not be permitted to vote on Proposal 4 if the broker has not received instructions from the beneficial owner.

If your shares are held of record by a bank, broker, or other nominee, we urge you to give instructions to your bank, broker, or other nominee as to how you wish your shares to be voted so you may participate in the stockholder voting on these important matters.

Changing Your Vote after Voting over the Internet or Revoking Your Proxy

You may change your vote by attending the Annual Meeting and voting online even if you previously voted over the Internet. Alternatively, you may change your vote by contacting Alliance Advisors LLC by phone at (855) 600-2576, or re-voting over the Internet following the instructions provided.

You may revoke your proxy at any time before it is exercised by:

•filing a letter with our Secretary revoking the proxy;

•submitting another signed proxy with a later date; or

•attending the Annual Meeting and voting online, provided you file a written revocation with the Secretary of the Annual Meeting prior to the voting of such proxy.

If your shares are not registered in your own name, you will need appropriate documentation from your stockholder of record to vote at the Annual Meeting. Examples of such documentation include a broker’s statement, letter or other document that will confirm your ownership of shares of Kintara.

Solicitation of Proxies

Kintara will pay the costs of soliciting proxies from our stockholders, directors, officers or employees of Kintara may solicit proxies by mail, telephone or other forms of communication. We will also reimburse banks, brokers, nominees and other fiduciaries for the expenses they incur in forwarding the proxy materials to you.

Kintara has also retained Alliance Advisors LLC to assist it in the solicitation of proxies. Alliance Advisors LLC will solicit proxies on behalf of Kintara from individuals, brokers, bank nominees and other institutional holders in the same manner described above. The fees that will be paid to Alliance Advisors LLC are anticipated to be approximately $14,000, and we will reimburse their out-of-pocket expenses. Kintara has also agreed to indemnify Alliance Advisors LLC against certain claims.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information, as of May 16, 2024, with respect to the beneficial ownership of the outstanding common stock by (i) any holder of more than five (5%) percent; (ii) each of the Company’s named executive officers and directors; and (iii) the Company’s directors and executive officers as a group. Except as otherwise indicated, each of the stockholders listed below has sole voting and investment power over the shares beneficially owned.

|

|

|

|

|

|

Name of Beneficial Owner (1) |

|

Common

Stock

Beneficially

Owned |

|

Percentage of Common Stock (2) |

Directors and Named Executive Officers: |

|

|

|

|

|

Robert E. Hoffman |

|

67,578 |

(3) |

|

* |

Scott Praill |

|

744 |

|

|

* |

Dennis Brown |

|

2,776 |

|

|

* |

Robert J. Toth, Jr. |

|

15,166 |

(4) |

|

* |

Laura Johnson |

|

13,543 |

(5) |

|

* |

Tamara A. Favorito |

|

11,283 |

(6) |

|

* |

All executive officers and directors as a group (4 persons) |

|

111,090 |

|

|

* |

* Less than 1%

(1)Except as otherwise indicated, the address of each beneficial owner is c/o Kintara Therapeutics, Inc., 9920 Pacific Heights Blvd, Suite 150, San Diego, CA 92121.

(2)Applicable percentage ownership is based on 55,304,613 shares of common stock outstanding as of May 16, 2024, together with securities exercisable or convertible into shares of common stock within 60 days of May 16, 2024, for each stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock that are currently exercisable or exercisable within 60 days of May 16, 2024, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

(3) Includes 64,478 shares issuable upon the exercise of vested stock options exercisable within 60 days of May 16, 2024. Excludes 65,802 Restricted Stock Units (“RSU”).

(4) Includes 15,134 shares issuable upon exercise of vested stock options exercisable within 60 days of May 16, 2024.

(5) Includes 13,483 shares issuable upon exercise of vested stock options exercisable within 60 days of May 16, 2024.

(6) Includes 11,283 shares issuable upon exercise of vested stock options exercisable within 60 days of May 16, 2024.

PAY VERSUS PERFORMANCE

Pay Versus Performance Table

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between executive compensation for our principal executive officers (“PEOs”) and non-PEO named executive officers (“NEOs”) and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Summary

Compensation

Table Total for

Mr. Hoffman(1) |

|

Summary

Compensation

Table Total for

Mr. Zarrabian(2) |

|

|

Compensation

Actually Paid to

Mr. Hoffman(4) |

Compensation

Actually Paid to

Mr. Zarrabian(4) |

|

Average

Summary

Compensation

Table Total for

Non-PEO NEOs(3) |

|

|

Average

Compensation

Actually Paid to

Non-PEO

NEOs(4) |

|

|

Value of

Initial Fixed

$100

Investment

Based On

Total

Shareholder

Return

(“TSR”)(5) |

|

|

Net Income

(Loss)

(millions)(6) |

|

(a) |

|

(b(1)) |

|

(b(2)) |

|

|

(c) |

(c) |

|

(d) |

|

|

(e) |

|

|

(f) |

|

|

(g) |

|

2023 |

|

|

1,184,363 |

|

- |

|

|

559,020 |

- |

|

|

|

332,173 |

|

|

|

262,974 |

|

|

|

3.82 |

|

|

|

(15) |

|

2022 |

|

|

3,161,028 |

|

682,827 |

|

|

1,208,847 |

(37,000) |

|

|

|

340,655 |

|

|

|

(125,878) |

|

|

|

12.09 |

|

|

|

(23) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

|

The dollar amounts reported in column (b(1)) are the amounts of total compensation reported for Robert E. Hoffman (our current Chief Executive Officer) for each corresponding year in the “Total” column of the Summary Compensation Table. Refer to “Executive Compensation—Summary Compensation Table.” |

|

|

|

(2) |

|

The dollar amounts reported in column (b(2)) are the amounts of total compensation reported for Saiid Zarrabian (our former Chief Executive Officer who served in such capacity during the fiscal year ended June 30, 2022 until Mr. Hoffman’s appointment as our Chief Executive Officer, effective November 8, 2021) for the fiscal year ended June 30, 2022 in the “Total” column of the Summary Compensation Table in the Proxy Statement for our 2023 Annual Meeting, filed with the SEC on March 31, 2023. |

|

|

|

(3) |

|

The dollar amounts reported in column (d) represent the average of the amounts reported for our named executive officers as a group (excluding Mr. Hoffman and Mr. Zarrabian) in the “Total” column of the Summary Compensation Table in each applicable year. The names of each of the named executive officers (excluding Mr. Hoffman and Mr. Zarrabian) included for purposes of calculating the average amounts in each applicable year are as follows: for 2023, Dennis Brown and Scott Praill, and for 2022, Dennis Brown (our former Chief Scientific Officer), Scott Praill (our former Chief Financial Officer) and John Liatos (our former Senior Vice President of Business Development). |

|

|

|

(4) |

|

Compensation actually paid to the named executive officers represents the “Total” compensation reported in the Summary Compensation Table for the applicable fiscal year, as adjusted as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

2022 |

|

Adjustments |

|

Mr. Hoffman ($) |

|

|

Mr. Zarrabian ($) |

Average Other

NEOs ($) |

|

|

Mr. Hoffman ($) |

|

|

Mr. Zarrabian ($) |

Average Other

NEOs ($) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deduction for amounts reported under the stock awards column in the summary compensation table |

|

|

(416,383) |

|

|

- |

|

(92,291) |

|

|

|

(2,622,597) |

|

|

- |

|

- |

|

|

ASC 718 Fair Value of Awards Granted during Applicable FY that Remain Unvested as of Applicable FY End, determined as of Applicable FY End |

|

|

356,018 |

|

|

- |

|

46,004 |

|

|

|

792,880 |

|

|

- |

|

- |

|

|

ASC 718 Fair Value of Awards Granted during Applicable FY that Vested during Applicable FY, determined as of Vesting Date |

|

|

- |

|

|

- |

|

- |

|

|

|

28,198 |

|

|

- |

|

- |

|

|

Increase/deduction for Awards Granted during Prior FY that were Outstanding and Unvested as of Applicable FY End, determined based on change in ASC 718 Fair Value from Prior FY End to Applicable FY End |

|

|

(355,918) |

|

|

- |

|

(4,212) |

|

|

|

- |

|

|

- |

|

(268,033) |

|

|

Increase/deduction for Awards Granted during Prior FY that Vested During Applicable FY, determined based on change in ASC 718 Fair Value from Prior FY End to Vesting Date |

|

|

(209,061) |

|

|

- |

|

(18,700) |

|

|

|

150,662 |

|

|

270,248 |

|

(105,123) |

|

|

Deduction of ASC 718 Fair Value of Awards Granted during Prior FY that were Forfeited during Applicable FY, determined as of Prior FY End |

|

|

- |

|

|

- |

|

- |

|

|

|

- |

|

|

(990,075) |

|

(93,377) |

|

|

TOTAL ADJUSTMENTS |

|

|

(625,343) |

|

|

- |

|

(69,199) |

|

|

|

(1,952,181) |

|

|

(719,827) |

|

(466,533) |

|

|

|

|

(5) |

Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the price per share of our common stock at the end and the beginning of the measurement period by the price per share of our common stock at the beginning of the measurement period. |

|

|

(6) |

The dollar amounts reported represent the amount of net income (loss) reflected in our consolidated audited financial statements for the applicable year. |

Analysis of the Information Presented in the Pay Versus Performance Table

We generally seek to incentivize long-term performance, and therefore do not specifically align our performance measures with “compensation actually paid” (as computed in accordance with Item 402(v) of Regulation S-K) for a particular year. In accordance with Item 402(v) of Regulation S-K, we are providing the following descriptions of the relationships between information presented in the Pay Versus Performance table.

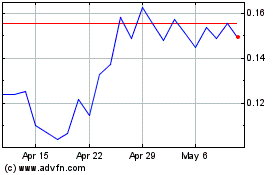

Compensation Actually Paid and Net Income (Loss)

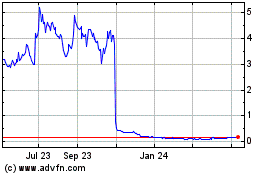

Compensation Actually Paid and Cumulative TSR

While we are required by SEC rules to disclose the relationship between our net income and compensation actually paid to our named executive officers, this is not a metric our Compensation Committee currently uses in evaluating our named executive officers’ compensation as we are a clinical stage, biopharmaceutical company that has not generated any revenues from the sale of products.

All information provided above under the “Pay Versus Performance” heading will not be deemed to be incorporated by reference in any of our filings under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board is currently composed of four directors. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors or by the sole remaining director. A director elected by the Board to fill a vacancy, including vacancies created by an increase in the number of directors, shall serve for the remainder of the full term of that director for which the vacancy was created and until the director’s successor is duly elected and qualified.

Each of the four nominees listed below are incumbent directors. If elected at the Annual Meeting, each of these nominees would serve until the next annual meeting and until his or her successor has been duly elected and qualified, or, if sooner, until the director’s death, resignation or removal. Because the number of nominees properly nominated for the Annual Meeting is the same as the number of directors to be elected, the election of directors at this Annual Meeting is uncontested.

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. In accordance with our Amended and Restated Bylaws (the “Bylaws”) and Nevada law, a stockholder entitled to vote for the election of directors may withhold authority to vote for certain nominees for directors or may withhold authority to vote for all nominees for directors. Withheld votes and broker non-votes will not be treated as a vote for or against any particular director nominee and will not affect the outcome of the election. Stockholders may not vote, or submit a proxy, for a greater number of nominees than the four nominees named below. The director nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the four director nominees named below. If any director nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by our Board. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve.

Nominees for Election Until the Next Annual Meeting

The following table sets forth the name, age, position and tenure of each of the nominees at the Annual Meeting:

|

|

|

|

|

|

|

Name |

|

Age |

|

Position(s) Held With

Kintara |

|

Director

Since |

Robert E. Hoffman |

|

58 |

|

President, Chief Executive Officer, Interim Chief Financial Officer, and Chairman of the Board |

|

2018 |

Robert J. Toth, Jr. |

|

60 |

|

Director |

|

2013 |

Laura Johnson |

|

59 |

|

Director |

|

2020 |

Tamara A. Favorito |

|

65 |

|

Director |

|

2021 |

The following includes a brief biography of each of the nominees standing for election to the Board of Directors at the Annual Meeting, based on information furnished to us by each director nominee, with each biography including information regarding the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the applicable nominee should serve as a member of our Board.

Robert E. Hoffman has served as our director since April 2018, as our Chairman since June 2018, as our Chief Executive Officer and President since November 2021, and as Interim Chief Financial Officer since June 2023. He has served as a member of board of directors of ASLAN Pharmaceuticals, Inc., a publicly-held, clinical-stage immunology focused biopharmaceutical company, since October 2018, and as a member of the board of directors of FibroGenesis, a clinical-stage regenerative medicine company, since April 2021. He has also served as a member of board of directors, on the Audit Committee, and on the Human Resources and Compensation Committee of Antibe Therapeutics Inc. (“Antibe”), a publicly-held clinical-stage biotechnology company, from November 2020 to April

2024, and as Chairman of Antibe’s board of directors from May 2022 to April 2024. Mr. Hoffman served as Senior Vice President and Chief Financial Officer of Heron Therapeutics, Inc., a publicly-held pharmaceutical company, from April 2017 to October 2020. From July 2015 to September 2016, Mr. Hoffman served as Chief Financial Officer of AnaptysBio, Inc., a publicly-held biotechnology company. From June 2012 to July 2015, Mr. Hoffman served as the Senior Vice President, Finance and chief Financial Officer of Arena pharmaceuticals, Inc. (“Arena”), a biopharmaceutical company, prior to its acquisition by Pfizer Inc. in March 2022. From August 2011 to June 2012 and previously from December 2005 to March 2011, he served as Arena’s Vice President, Finance and Chief Financial Officer and in a number of various roles of increasing responsibility from 1997 to December 2005. Mr. Hoffman formerly served as a member of the board of directors of Saniona AB, a biopharmaceutical company, from September 2021 to May 2022, and as a member of the board of directors of Kura Oncology, Inc., a cancer research company, from March 2015 to August 2021. He also previously served as a member of the board of directors of CombiMatrix Corporation, a molecular diagnostics company, MabVax Therapeutics Holdings, Inc., a biopharmaceutical company, and Aravive, Inc., a clinical stage biotechnology company. Mr. Hoffman serves as a member of the steering committee of the Association of Bioscience Financial Officers. Mr. Hoffman formerly served as a director and President of the San Diego Chapter of Financial Executives International and was an advisor to the Financial Accounting Standard Board (FASB) for 10 years (2010 to 2020) advising the United States accounting rulemaking organization on emerging issues and new financial guidance. Mr. Hoffman holds a B.B.A. from St. Bonaventure University. Mr. Hoffman’s financial and executive business experience qualifies him to serve on our Board of Directors.

Robert J. Toth, Jr. has served as our director since August 2013 and serves as Chair of our Compensation Committee. Since 2005, Mr. Toth has primarily been managing his personal investment portfolio. From 2004-2005, Mr. Toth served as a consulting analyst to Narragansett Asset Management, a New York-based healthcare-focused hedge fund, where he advised the firm on biotechnology investments. From 2001-2003, he was the Senior Portfolio Manager for San Francisco-based EGM Capital’s Medical Technology hedge fund, where he was responsible for managing and maintaining a dedicated medical technology portfolio. Mr. Toth began his Wall Street career in 1996 as an Equity Research Associate for Vector Securities International, a healthcare-focused brokerage firm. From 1997-1999 he served as Senior Biotechnology Analyst. He joined Prudential Securities as Senior Vice President and Biotechnology Analyst where he served from 1999-2001 following Prudential’s acquisition of Vector. His responsibilities included the analysis of commercial, clinical and scientific fundamentals of oncology and genomics-based biotechnology companies on behalf of institutional investors. Mr. Toth was named to the Wall Street Journal’s Allstar List for stock picking in 1999. Mr. Toth received an MBA from the University of Washington and Bachelor of Science degrees in Biological Sciences and Biochemistry from California Polytechnic State University, San Luis Obispo. Mr. Toth’s financial and biotechnology industry knowledge and experience qualify him to serve on our Board of Directors.

Laura Johnson has served as our director since June 2020 and serves as Chair of our Nominating and Corporate Governance Committee. Ms. Johnson currently serves as the President and Chief Executive Officer of Next Generation Clinical Research, a contract research organization that Ms. Johnson founded in 1999. Additionally, Ms. Johnson is the President and Chief Executive Officer of Eufaeria Biosciences, Inc., a development biotechnology company that she founded in 2016. Ms. Johnson is also a founder and former member of the board of directors of SB Bancorp, Inc., a financial holding company, and Settlers Bank, Inc., a Wisconsin chartered business bank. In addition, Ms. Johnson has served as a member of the board of directors of Harmony Hill Farm Sanctuary, a 501(c)(3) nonprofit organization, since 2019. Ms. Johnson previously served as a member of the board of directors of La Jolla Pharmaceutical Company, a biopharmaceutical company, from 2013 to 2022, Odonate Therapeutics, a biopharmaceutical company, from 2018 to 2022, and Agrace HospiceCare from 2013 to 2016. In 2008 and 2010, she was honored as a biotechnology entrepreneur by the national organization, Women in Bio, and in 2008 received the Rising Star Award by the Wisconsin Biotech and Medical Device Association. Most recently, she was the recipient of the Wisconsin Biohealth Business Award at the BioForward Annual Biohealth Summit in October 2019. Ms. Johnson holds a nursing degree from The University of the State of New York-Albany. Ms. Johnson’s biotechnology industry and executive knowledge and experience qualify her to serve on our Board of Directors.

Tamara A. Favorito has served as our director since April 2021 and serves as Chair of our Audit Committee. Ms. Favorito has more than 30 years of life sciences industry experience including 20 years as a chief financial officer. She currently serves as a board member, audit committee chair, and member of the compensation committee of Artelo Biosciences, Inc., a publicly-traded clinical-development stage company, and as Chair of the board and audit committee chair of Zevra Therapeutics (f/k/a KemPharm, Inc.), a publicly-traded commercial-stage

rare disease therapeutics company. Ms. Favorito served on the board of directors of Beacon Discovery, Inc. from 2018 until its acquisition in 2021. Ms. Favorito was Interim Chief Financial Officer of Immunic, Inc., a publicly-traded clinical-stage drug development company in 2019. She served as Chief Financial Officer of Signal Genetics, Inc., a publicly-traded molecular diagnostics company, from 2014 to 2017, HemaQuest Pharmaceuticals, Inc., a venture-backed clinical-stage drug development company, from 2010 to 2014 and Favrille, Inc., a previously publicly-traded clinical-stage drug development company, from 2001 to 2009. While at these companies, she led multiple private and public financings, including Favrille’s IPO. In addition, she was instrumental in M&A transactions and led the finance, investor relations, human resources, administration and managed care and payor reimbursement functions. Ms. Favorito is a Certified Public Accountant (inactive). She received an MBA, with an emphasis in Finance, from Georgia State University, and a bachelor’s degree in Business Administration, with an emphasis in Accounting from Valdosta State University. Ms. Favorito also participated in an executive management program at Kellogg Graduate School of Management at Northwestern University. Ms. Favorito’s professional experience and financial expertise qualify her to serve on our Board of Directors.

Board Membership Diversity

In accordance with the Board Diversity Rules (Rule 5605(f) and Rule 5606) promulgated by The Nasdaq Stock Market LLC (“Nasdaq”), the following Board Diversity Matrix presents our Board diversity statistics. The minimum diversity requirement for smaller reporting companies listed on The Nasdaq Capital Market prior to August 6, 2021 with a board of five or fewer directors is one diverse director who self-identifies as either female, an underrepresented minority or LGBTQ+. “Underrepresented Minority” means an individual who self-identifies as one or more of the following: Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander, or Two or More Races or Ethnicities. “Two or More Races or Ethnicities” means a person who identifies with more than one of the following categories: White (not of Hispanic or Latinx origin), Black or African American, Hispanic or Latinx, Asian, Native American or Alaska Native, Native Hawaiian or Pacific Islander.

Board Diversity Matrix (As of May 16, 2024)

|

|

|

|

|

|

|

|

|

|

Total Number of Directors |

4 |

|

Female |

Male |

Non-Binary |

Did Not Disclose Gender |

Part I: Gender Identity |

|

|

|

|

Directors |

2 |

2 |

0 |

0 |

Part 2: Demographic Background |

|

|

|

|

African American or Black |

0 |

0 |

0 |

0 |

Alaskan Native or Native American |

0 |

0 |

0 |

0 |

Asian |

0 |

0 |

0 |

0 |

Hispanic or Latinx |

0 |

0 |

0 |

0 |

Native Hawaiian or Pacific Islander |

0 |

0 |

0 |

0 |

White |

2 |

2 |

0 |

0 |

Two or More Races or Ethnicities |

0 |

0 |

0 |

0 |

LGBTQ+ |

0 |

|

|

Did Not Disclose Demographic Background |

0 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL OF THE NOMINEES FOR ELECTION AS DIRECTORS.

CORPORATE GOVERNANCE

Board of Directors Operations and Meetings

Our Board currently consists of four members. Our directors are appointed for a one-year term to hold office until their successors have been elected and qualified or until the earlier of their resignation or removal.

We have no formal policy regarding board diversity. Our priority in selection of board members is identification of members who will further the interests of our stockholders through their established record of professional accomplishment, the ability to contribute positively to the collaborative culture among board members, knowledge of our business and understanding of the competitive landscape.

Our Board met seven (7) times and acted by written consent four (4) times in fiscal year 2023. Each of the directors attended at least 75% of the aggregate of (i) the total number of meetings of our Board (held during the period for which such directors served on the Board), and (ii) the total number of meetings of all committees of our Board on which the director served (during the periods for which the director served on such committee or committees). Two members of our Board serving at the time attended our 2023 annual meeting of stockholders.

The Board oversees our business and monitors the performance of our management. In accordance with our corporate governance procedures, the Board does not involve itself in the day-to-day operations of Kintara. Our executive officers and management oversee our day-to-day operations. Our directors fulfill their duties and responsibilities by attending meetings of the Board, which are usually held on at least a quarterly basis. Our directors also discuss business and other matters with other key executives and our principal external advisers (legal counsel, auditors, financial advisors and other consultants).

Independent Directors

Our Board has determined that Robert J. Toth, Jr., Laura Johnson, and Tamara A. Favorito are qualified to serve as independent directors. The standards relied on by the Board in affirmatively determining whether a director is “independent,” in compliance with Nasdaq’s rules, are comprised of those objective standards set forth in the rules promulgated by Nasdaq. The Board is responsible for ensuring that independent directors do not have a relationship that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Nasdaq’s rules, as well as SEC rules, impose additional independence requirements for all members of the Audit Committee. Specifically, in addition to the “independence” requirements discussed above, “independent” audit committee members must: (1) not accept, directly or indirectly, any consulting, advisory, or other compensatory fees from Kintara or any subsidiary of Kintara other than in the member’s capacity as a member of the Board and any Board committee; (2) not be an affiliated person of Kintara or any subsidiary of Kintara; and (3) not have participated in the preparation of the financial statements of Kintara or any current subsidiary of Kintara at any time during the past three years. In addition, Nasdaq’s rules require that all audit committee members be able to read and understand fundamental financial statements, including Kintara’s balance sheet, income statement, and cash flow statement. The Board believes that the current members of the Audit Committee meet these additional standards.

Audit Committee

The Board has formed an Audit Committee, which currently consists of Tamara A. Favorito, Chair, Robert J. Toth, Jr., and Laura Johnson. Each member of the Audit Committee is “independent” as that term is defined under the applicable rules of the SEC and Nasdaq. The Board has determined that each Audit Committee member has

sufficient knowledge in financial and auditing matters to serve on the Audit Committee. In addition, our Board has determined that Ms. Favorito qualifies as an audit committee financial expert within the meaning of SEC regulations and the Nasdaq Marketplace Rules. The Audit Committee met four (4) times and acted by written consent one (1) time in fiscal year 2023.

The Audit Committee oversees and monitors our financial reporting process and internal control system, reviews and evaluates the audit performed by our registered independent public accountants and reports to our Board any substantive issues found during the audit. The Audit Committee will be directly responsible for the appointment, compensation and oversight of the work of our registered independent public accountants. The Audit Committee reviews and approves all transactions with affiliated parties. The Board has adopted a written charter for the Audit Committee.

A copy of the Audit Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Compensation Committee

The Board has formed a Compensation Committee which consists of Robert J. Toth, Jr., Chair, Laura Johnson, and Tamara A. Favorito, all of whom are independent (as that term is defined under the Nasdaq Marketplace Rules). The Compensation Committee assists the Board in fulfilling its oversight responsibilities relating to (i) corporate governance practices and policies and (ii) compensation matters, including compensation of the directors and senior management of the Company and the administration of compensation plans of the Company. The Compensation Committee did not meet and acted by written consent one (1) time in fiscal year 2023.

The Board has adopted a written charter for the Compensation Committee. A copy of the Compensation Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

The Compensation Committee has engaged Anderson Pay Advisors LLC as our independent compensation consultant. In 2023, Anderson Pay Advisors LLC reviewed both executive and director compensation and did not provide us any other services. Anderson Pay Advisors LLC reported directly to the Compensation Committee and provided guidance on trends in executive and non-employee director compensation, the development of specific executive compensation programs, the composition of our compensation peer group and other matters as directed by the Compensation Committee.

Nominating and Corporate Governance Committee

The Board has formed a Nominating and Corporate Governance Committee, which currently consists of Laura Johnson, Chair, Robert J. Toth, Jr., and Tamara A. Favorito. The Nominating and Corporate Governance Committee assesses potential candidates to fill perceived needs on the Board for required, skills, expertise, independence and other factors. The Nominating and Corporate Governance Committee did not meet and acted by written consent one (1) time in fiscal year 2023.

The Board has adopted a written charter for the Nominating and Corporate Governance Committee. A copy of the Nominating and Corporate Governance Committee Charter is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Nomination of Directors

The Nominating and Corporate Governance Committee of the Board assesses potential candidates to fill perceived needs on the Board of Directors for required skills, expertise, independence and other factors. A director candidate recommended by our stockholders will be considered in the same manner as a nominee recommended by a Board member, management or other sources. Stockholders wishing to recommend a candidate for nomination should contact our Secretary in writing at the Secretary of Kintara at 9920 Pacific Heights Blvd Suite 150 San Diego, CA 92121. Our Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors.

Board Leadership Structure and Role in Risk Oversight

Periodically, our Board will assess the roles of Chairman and Chief Executive Officer, and the Board leadership structure to ensure the interests of Kintara and our stockholders are best served. Our Board believes the current combination of the two roles is satisfactory at present. Mr. Hoffman, as our President, Chief Executive Officer and Chairman, has extensive knowledge of all aspects of Kintara and our business. We have no policy requiring the combination or separation of leadership roles and our governing documents do not mandate a particular structure. This has allowed, and will continue to allow, our Board the flexibility to establish the most appropriate structure for the Company at any given time.

Our Board is primarily responsible for overseeing our risk management processes. The Board receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding the Company’s assessment of risks. The Board focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also ensures that risks undertaken by the Company are consistent with the Board’s risk strategy. While the Board oversees the Company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Related Party Transactions

Other than compensation arrangements for our named executive officers and directors, which are described in the section entitled “Executive Compensation,” since July 1, 2022, there have been no transactions or series of similar transactions to which we were a party or will be a party, in which:

•the amount involved exceeds the lesser of $120,000 or one percent (1%) of the average of our total assets at the end of our two most recently completed fiscal years; and

•any of our directors, executive officers or holders of more than 5% of our capital stock, or any member of the immediate family of the foregoing persons, had or will have a direct or indirect material interest.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our executive officers, financial and accounting officers, our directors, our financial managers and all of our employees. The Board is committed to a high standard of corporate governance practices and, through its oversight role, encourages and promotes a culture of ethical business conduct. A copy of our Code of Business Conduct and Ethics is posted under the “Investors” tab on our website, which is located at www.kintara.com.

Stockholder Communication with the Board of Directors and Attendance at Annual Meetings

The Board maintains a process for stockholders to communicate with the Board and its committees. Stockholders of Kintara and other interested persons may communicate with the Board or the chair of the Audit Committee, Compensation Committee, and the Nominating and Corporate Governance Committee by writing to the Secretary of Kintara at 9920 Pacific Heights Blvd Suite 150 San Diego, CA 92121. All communications that relate to matters that are within the scope of the responsibilities of the Board will be presented to the Board no later than the next regularly scheduled meeting. Communications that relate to matters that are within the responsibility of one of the Board committees will be forwarded to the chair of the appropriate committee. Communications that relate to ordinary business matters that are not within the scope of the Board’s responsibilities will be forwarded to the appropriate officer. Solicitations, junk mail and obviously frivolous or inappropriate communications will not be forwarded, but will be made available to any director who wishes to review them.

Executive Officers

The following table sets forth certain information regarding our current executive officers:

|

|

|

|

|

|

|

|

|

|

Name of Individual |

|

Age |

|

Position(s) Held With

Kintara |

Robert E. Hoffman |

|

58 |

|

Chief Executive Officer, President, Interim Chief Financial Officer, and Chairman of the Board |

Robert E. Hoffman, see Mr. Hoffman’s biography under “Proposal 1”.

EXECUTIVE COMPENSATION

The Board has formed a Compensation Committee. The Compensation Committee is responsible for reviewing and approving management compensation, including salaries, bonuses, and equity compensation. We seek to provide competitive compensation arrangements that attract and retain key talent necessary to achieve our business objectives. At our 2021 annual meeting of stockholders, stockholders voted, on an advisory, non-binding basis, to approve the compensation paid to the Company’s named executive officers, as disclosed in the proxy statement for the 2021 annual meeting. Our stockholders also voted at our 2018 annual meeting of stockholders, on an advisory, non-binding basis, that such votes on named executive officer compensation should be held every three years. The next advisory, non-binding vote to approve named executive officer compensation will occur in connection with this Annual Meeting.

Summary Compensation Table

The following table presents information regarding the total compensation awarded to, earned by, or paid to each person serving as our Chief Executive Officer during the fiscal year ended June 30, 2023, the two most highly-compensated executive officers (other than the Chief Executive Officer) who were serving as executive officers during the fiscal year ended June 30, 2023, and up to two additional individuals for whom disclosure would have been provided but for the fact that such individuals were not serving as an executive officer as of June 30, 2023 for services rendered in all capacities to us for the fiscal years ended June 30, 2023 and June 30, 2022. These individuals were our named executive officers for fiscal 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position |

|

Year |

|

Salary

($) |

|

|

Bonus

($) |

|

|

Stock

Awards

($) |

|

|

Option

Awards

($) |

|

|

Total

($) |

|

Robert E. Hoffman, President, Chief Executive Officer and Interim Chief Financial Officer(1) |

|

2023 |

|

|

589,600 |

|

|

|

178,380 |

|

|

|

255,923 |

|

|

|

160,460 |

|

|

|

1,184,363 |

|

|

|

2022 |

|

|

356,619 |

|

|

|

181,811 |

|

|

|

— |

|

|

|

2,622,597 |

|

|

|

3,161,028 |

|

Dennis Brown, Former Chief Scientific Officer(2) |

|

2023 |

|

|

329,900 |

|

|

|

69,279 |

|

|

|

42,177 |

|

|

|

96,260 |

|

|

|

537,616 |

|

|

|

2022 |

|

|

206,000 |

|

|

|

41,277 |

|

|

|

— |

|

|

|

— |

|

|

|

247,277 |

|

Scott Praill, Former Chief Financial Officer(3) |

|

2023 |

|

|

320,467 |

|

|

|

— |

|

|

|

42,177 |

|

|

|

96,260 |

|

|

|

458,903 |

|

|

|

2022 |

|

|

312,000 |

|

|

|

127,920 |

|

|

|

— |

|

|

|

— |

|

|

|

439,920 |

|

(1)On November 8, 2021, Mr. Hoffman, the Chairman of the Board, was appointed President and Chief Executive Officer. Also on November 8, 2021, we entered into an employment agreement with Mr. Hoffman pursuant to which Mr. Hoffman will receive an annual base salary of $551,000 (which may be adjusted on an annual basis in the discretion of the board of directors) and will be eligible to receive a fiscal year target bonus of up to 50% of base salary (which may be adjusted by the board of directors to up to 75% of base salary based on overachievement of bonus targets or other performance criteria). The employment agreement may be terminated by us with or without cause (as defined therein). In the event we terminate the employment agreement without cause, we will be required to pay Mr. Hoffman continued payment of his base salary for 12 months, a prorated bonus for the year of termination based on performance through the date of termination, an additional six months of vesting credit for any outstanding options, and continued health coverage during

the severance period. In the event that an involuntary termination occurs during a period beginning sixty days before a definitive corporate transaction agreement is entered into that would result in a change in control (as defined therein), or within twelve months following a change in control, the severance period will increase to eighteen months’ severance, Mr. Hoffman will receive 100% of his target bonus, and his options will be fully vested.

On August 1, 2022, Mr. Hoffman was issued 8,022 RSUs and 24,012 stock options. The stock options were issued at $8.79 per share. In addition, he was issued 59,800 RSUs on June 1, 2023. Also on June 1, 2023, Mr. Hoffman was appointed our Interim Chief Financial Officer. Effective June 1, 2023, Mr. Hoffman’s annual salary was reduced by $60,000. On August 30, 2023, Mr. Hoffman was issued 23,142 stock options. The stock options were issued at $4.655 per share.

On November 20, 2023, the Compensation Committee of the Board and the Board agreed to pay Mr. Hoffman an additional retention payment of $30,000 per month for his service as the Company’s Chief Executive Officer, effective as of November 1, 2023.

On April 2, 2024, the Board approved a one-time special bonus to Mr. Hoffman in the amount of $327,030 for his service as our Chief Executive Officer.

(2) On January 1, 2015, we entered into a consulting agreement with Dr. Dennis Brown, our former chief scientific officer. Subsequent to this agreement, it has been amended and is now renewed on an annual basis. As a result of cost-cutting measures adopted by Kintara, on November 20, 2023, Dr. Brown was terminated from his position as the Company’s Chief Scientific Officer, with Dr. Brown continuing as a consultant to Kintara. The consulting agreement with Dr. Brown does not specify the amount of time Dr. Brown is required to devote to us but does require that Dr. Brown provide us with the full benefit of his knowledge, expertise and ingenuity, and prohibits Dr. Brown from engaging in any business, enterprise or activity contrary to or that would detract from our business.

On August 1, 2022, Dr. Brown was issued 4,801 RSU and 14,405 stock options. The stock options were issued at $8.79 per share.

On August 30, 2023, Dr. Brown was issued 10,175 stock options. The stock options were issued at $4.655 per share.

On November 20, 2023, Dr. Brown was terminated from his position as the Company’s Chief Scientific Officer.

(3) On February 9, 2017, we entered into an employment agreement with Scott Praill, our former Chief Financial Officer. Pursuant to the employment agreement, Mr. Praill agreed to serve as our Chief Financial Officer for an indefinite period until termination of the employment agreement in accordance with its terms. Pursuant to his employment agreement, we paid Mr. Praill an annual base salary of $200,000 and Mr. Praill was also eligible to participate in any bonus plan and long-term incentive plan established for our senior executives.

On August 1, 2022, Mr. Praill was issued 4,801 RSU and 14,405 stock options. The stock options were issued at $8.79 per share.

Effective May 31, 2023, Mr. Praill resigned as our Chief Financial Officer but remained as a consultant at $5,000 per month until August 15, 2023. As a result of his resignation, his employment agreement was terminated. On January 1, 2024, Mr. Praill was retained as a consultant at a rate of $250 per hour through December 31, 2024.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth outstanding equity awards to our named executive officers as of June 30, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option Awards |

|

Stock Awards |

|

Name |

|

Number of securities underlying unexercised options

Exercisable

(#) |

|

|

Number of securities underlying unexercised options

Unexercisable

(#) |

|

|

Equity incentive plan awards: number of securities underlying unexercised unearned options

(#) |

|

|

Option exercise price

($) |

|

|

Option

expiration

date |

|

|

Number of shares, or units of stock that have not vested

(#) |

|

|

Market value of shares of units of stock that have not vested

($) |

|

|

Equity incentive plan awards: Number of unearned shares, units or other rights that have not vested

(#) |

|

|

Equity

incentive

plan awards:

Market or

payout value

of unearned

shares, units

or other rights

that have

not vested

($) |

|

Robert E. Hoffman |

|

|

72 |

|

|

|

— |

|

|

|

— |

|

|

|

530.00 |

|

|

April 13, 2028 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

80 |

|

|

|

— |

|

|

|

— |

|

|

|

304.95 |

|

|

November 8, 2028 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

1,499 |

|

|

|

— |

|

|

|

— |

|

|

|

30.50 |

|

|

September 5, 2029 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

2,400 |

|

|

|

— |

|

|

|

— |

|

|

|

85.00 |

|

|

September 15, 2030 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

2,000 |

|

|

|

— |

|

|

|

— |

|

|

|

62.00 |

|

|

September 22, 2031 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

27,860 |

|

(1) |

|

42,523 |

|

|

|

— |

|

|

|

48.00 |

|

|

November 8, 2031 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

(2) |

|

24,012 |

|

|

|

— |

|

|

|

8.79 |

|

|

August 1, 2032 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

67,802 |

|

(5) |

|

255,923 |

|

Scott Praill(7) |

|

|

175 |

|

|

|

— |

|

|

|

— |

|

|

|

2,100.00 |

|

|

August 16, 2023 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

74 |

|

|

|

— |

|

|

|

— |

|

|

|

2,475.00 |