false

0001417926

0001417926

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported) May 15, 2024

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

5582

Broadcast Court

Sarasota,

FL 34240

(Address

of principal executive offices, including zip code)

(978)

878-9505

(Registrant’s

telephone number, including area code)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

INVO |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

May 15, 2024, INVO Bioscience, Inc. (the “Company”) issued a press release announcing financial results for the period ended

March 31, 2024. The text of the press release is furnished as Exhibit 99.1 to this current report.

The

information in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for the purposes of or otherwise subject

to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless expressly

incorporated into a filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, the information contained

in this Item 2.02 and Exhibit 99.1 hereto shall not be incorporated by reference into any Company filing, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

| Item

9.01. |

Financial

Statements and Exhibits. |

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

May 15, 2024 |

INVO

BIOSCIENCE, INC. |

| |

|

| |

/s/

Steven Shum |

| |

Steven

Shum |

| |

Chief

Executive Officer |

Exhibit

99.1

INVO

Reports Record First Quarter 2024 Financial Results

353%

Revenue Growth with improvement in Adjusted EBITDA

SARASOTA,

Fla., May 15, 2024 — INVO Bioscience, Inc. (Nasdaq: INVO) (“INVO” or the “Company”), a healthcare services

fertility company focused on expanding access to advanced treatment worldwide through the establishment and acquisition of fertility

clinics, and with the intravaginal culture (“IVC”) procedure enabled by its INVOcell® medical device, today

announced financial results for the first quarter of 2024 and provided a business update.

Q1

2024 Financial Highlights (all metrics compared to Q1 2023 unless otherwise noted)

| ● |

Revenue

was $1,576,286, an increase of 353% compared to $348,025. |

| ● |

Clinic

revenue increased 417% to $1,537,199, compared to $297,381. All reported clinic revenue is derived from the Company’s INVO

Center in Atlanta, Georgia, and its IVF clinic in Madison, Wisconsin, which are consolidated in the Company’s financial statements. |

| ● |

Revenue

from all clinics, inclusive of both those accounted for as consolidated and under the equity method, was $1,869,513, an increase

of 189% compared to $646,707. |

| ● |

Total

operating expenses were $2.5 million, a $0.1 million decrease compared to $2.6 million. Included in the Q1 2024 operating expenses

were approximately $80,000 pertaining to the definitive merger agreement with NAYA Biosciences, Inc. (“NAYA”) to acquire

NAYA in an all-stock transaction. |

| ● |

Reported

Net loss was $(1.6) million compared to $(2.6) million. |

| ● |

Adjusted

EBITDA (see table included) was $(0.5) million, including the transaction costs related to the potential merger, compared to $(1.7)

million in the prior year. |

Management

Commentary

“We

are pleased with the progress we have made at INVO, reporting record first quarter 2024 revenue with of growth of 353% compared to the

first quarter of 2023, and a substantial $1.2 million improvement in our adjusted EBITDA,” commented Steve Shum, CEO of INVO. “The

strategic initiatives we have implemented to capture a greater share of the total fertility cycle revenue and profit through the transformation

of INVO from a medical device company into an innovative healthcare services company are starting to bear fruit. The growth in revenue,

coupled with careful management of our operating expenses demonstrates that we are potentially on track to achieve our stated goals of

reaching break-even or profitability with our current operations (excluding the proposed merger with NAYA) in 2024. We also remain excited

about our position in the fertility market, the opportunities we have to acquire additional clinics and to open new INVO Centers, and

our ongoing efforts to make advanced fertility care more accessible and inclusive to people around the world.”

Definitive

Merger Agreement

On

October 23, 2023, INVO and NAYA, a company dedicated to increasing patient access to breakthrough treatments in oncology and regenerative

medicine, jointly announced that they had entered into a definitive merger agreement (the “Merger”) for INVO to acquire NAYA

Biosciences in an all-stock transaction. Under the terms of the agreement, NAYA Biosciences’ shareholders would receive 7.3333

shares of INVO for each share of NAYA Biosciences at closing, for a total of approximately 18,150,000 shares of INVO. Following the closing

of the Merger, the combined company is expected to operate under the name “NAYA Biosciences.”

As

described in greater detail in the Company’s SEC filings and press releases, the Merger remains subject to certain closing conditions

including shareholder approval, the sale of $5,000,000 of our Series A Preferred Stock plus sufficient funding, as agreed, to adequately

support INVO’s current operations and business plan through the closing of the Merger and for an additional twelve months after

closing, including a catch-up on INVO’s accrued payables. To date, NAYA has provided approximately $906,000 in financing through

the purchase of Series A Preferred Stock at a price of $5.00 per share.

“As

reflected in the recent merger amendment and subject to meeting all agreed terms, INVO and NAYA remain committed to completing the merger

between our two companies, creating a company uniquely positioned in both the fertility and oncology space,” commented Shum. “We

are working on an update to our Proxy S-4 and plan on scheduling the related stockholders’ meeting as soon as possible, and once

the SEC’s review of our filing is complete.”

Financial

Tables

Included

in this press release is a reconciliation of Adjusted EBITDA. All additional financial tables are included in the Company’s 10-Q,

which can be found on the Company’s website at https://www.invobioscience.com/sec-filings/ or at https://www.sec.gov/.

Use

of Non-GAAP Measure

Adjusted

EBITDA is a non-GAAP measure. This measure is not intended to be a substitute for those financial measures reported in accordance with

GAAP. Adjusted EBITDA has been included because management believes that, when considered together with the GAAP figures, it provides

meaningful information related to our operating performance and liquidity and can enhance an overall understanding of financial results

and trends. Adjusted EBITDA may be calculated by us differently than other companies that disclose measures with the same or similar

terms. See our attached financials for a reconciliation of this non-GAAP measure to the nearest GAAP measure.

About

INVO Bioscience

We

are a healthcare services fertility company dedicated to expanding access to fertility care around the world. Our commercial strategy

is primarily focused on operating fertility-focused clinics, which include the opening of “INVO Centers” dedicated primarily

to offering the intravaginal culture (“IVC”) procedure enabled by our INVOcell® medical device and the acquisition of

US-based, profitable in vitro fertilization (“IVF”) clinics. Our proprietary technology, INVOcell®, is a revolutionary

medical device that allows fertilization and early embryo development to take place in vivo within the woman’s body. This treatment

solution is the world’s first intravaginal culture technique for the incubation of oocytes and sperm during fertilization and early

embryo development. This technique, designated as “IVC”, provides patients a more natural, intimate, and more affordable

experience in comparison to other ART treatments. We believe the IVC procedure can deliver comparable results at a fraction of the cost

of traditional IVF and is a significantly more effective treatment than intrauterine insemination (“IUI”). For more information,

please visit www.invobio.com.

Safe

Harbor Statement

This

release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The Company invokes the protections of the Private Securities Litigation Reform

Act of 1995. All statements regarding our expected future financial position, results of operations, cash flows, financing plans, business

strategies, products and services, competitive positions, growth opportunities, plans and objectives of management for future operations,

as well as statements that include words such as “anticipate,” “if,” “believe,” “plan,”

“estimate,” “expect,” “intend,” “may,” “could,” “should,” “will,”

and other similar expressions are forward-looking statements. All forward-looking statements involve risks, uncertainties, and contingencies,

many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from anticipated

results, performance, or achievements. Factors that may cause actual results to differ materially from those in the forward-looking statements

include those set forth in our filings at www.sec.gov. We are under no obligation to (and expressly disclaim any such obligation

to) update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise.

Adjusted

EBITDA

| | |

Three Months Ended | |

| | |

March 31 | |

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net loss attributable to Invo Bioscience, Inc. | |

$ | (1,596,513 | ) | |

$ | (2,550,879 | ) |

| Interest expense | |

| 83,257 | | |

| 38,209 | |

| Amortization of debt discount | |

| 98,038 | | |

| 178,380 | |

| Tax expense | |

| 1,836 | | |

| - | |

| Stock-based compensation | |

| 142,542 | | |

| 196,403 | |

| Stock option expense | |

| 71,301 | | |

| 325,834 | |

| Non cash compensation for services | |

| 45,000 | | |

| 45,000 | |

| Foreign currency exchange loss | |

| - | | |

| 135 | |

| Loss on disposal of fixed assets | |

| 561,663 | | |

| - | |

| Gain on lease termination | |

| (94,551 | ) | |

| - | |

| Depreciation and amortization | |

| 226,960 | | |

| 19,087 | |

| Adjusted EBITDA | |

$ | (460,467 | ) | |

$ | (1,747,831 | ) |

| | |

| | | |

| | |

| Proforma net loss | |

$ | (1,596,513 | ) | |

$ | (2,088,428 | ) |

| Interest expense | |

| 83,257 | | |

| 38,209 | |

| Amortization of debt discount | |

| 98,038 | | |

| 178,380 | |

| Tax expense | |

| 1,836 | | |

| - | |

| Stock-based compensation | |

| 142,542 | | |

| 196,403 | |

| Stock option expense | |

| 71,301 | | |

| 325,834 | |

| Non-cash compensation for services | |

| 45,000 | | |

| 45,000 | |

| Foreign currency exchange loss | |

| - | | |

| 135 | |

| Loss on disposal of fixed assets | |

| 561,663 | | |

| - | |

| Gain on lease termination | |

| (94,551 | ) | |

| - | |

| Depreciation and amortization | |

| 226,960 | | |

| 19,087 | |

| Proforma adjusted EBITDA | |

$ | (460,467 | ) | |

$ | (1,285,380 | ) |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

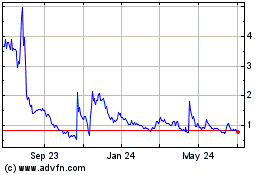

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Feb 2025 to Mar 2025

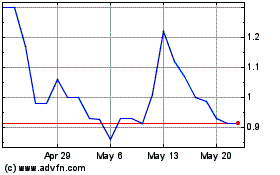

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Mar 2024 to Mar 2025