180 Degree Capital Corp. Reports Net Asset Value per Share (“NAV”) of $5.16 as of March 31, 2024

May 13 2024 - 4:05PM

180 Degree Capital Corp. (NASDAQ:TURN) (“180 Degree Capital” and

the “Company”), today reported its financial results as of March

31, 2024, and noted additional developments from the second quarter

of 2024. The Company also published a letter to shareholders that

can be viewed at https://ir.180degreecapital.com/financial-results.

“The first quarter of 2024 continued overall

positive trends both in terms of increases of our net asset value

per share (“NAV”) and microcapitalization-focused indices,” said

Kevin M. Rendino, Chief Executive Officer of 180 Degree Capital.

“Our +4.7% gross total return in our public portfolio was the

primary contributor to the growth of NAV from $5.02 to $5.16. As we

noted in our press release on May 1, 2024, the pressure on

microcapitalization stocks that began in mid-March 2024 has

continued through the second quarter of 2024 to date in the face of

strong reports by many of our portfolio companies. We are actively

using this period of market softness to align our portfolio with

those companies that we believe are in the best positions to

perform during this period and to create outsized value for

stockholders as capital returns to risk assets. We are also

expanding our constructive activism engagements to help our

companies be prepared for a favorable market environment for

microcapitalization stocks, while making sure that their businesses

are well-managed and well-positioned during the current market

softness.”

“We continue to view the dislocation between

large capitalization stocks and microcapitalization stocks as an

opportunity for long-term value creation for TURN’s stockholders,”

added Daniel B. Wolfe, President of 180 Degree Capital. “Our

permanent capital provides the ability to take advantage of such

periods where other funds may be forced to sell due to redemptions

and/or lack of inflows of capital. We have used such periods in the

past to double-down on those positions that we believe have

outsized risk/reward profiles. TURN is a unique investment

opportunity for those investors interested in a concentrated

portfolio of approximately 10-15 microcapitalization companies

overlaid with our constructive activism. We do not believe there is

another publicly traded entity that has this combination of

attributes.”

The table below summarizes 180’s performance

over periods of time through the end of Q1 20241:

|

|

Quarter |

1 Year |

3 Year |

5 Year |

Inception to Date |

|

|

Q1 2024 |

Q1 2023- Q1 2024 |

Q1 2021- Q1 2024 |

Q1 2019- Q1 2024 |

Q4 2016- Q1 2024 |

|

TURN Public Portfolio Gross Total Return (Excluding SMA Carried

Interest) |

4.7% |

-8.1% |

-36.4% |

39.6% |

196.3% |

|

TURN Public Portfolio Gross Total Return (Including SMA Carried

Interest) |

4.7% |

-8.1% |

-34.7% |

48.9% |

215.7% |

|

|

|

|

|

|

|

|

Change in NAV |

2.8% |

-20.9% |

-51.3% |

-37.7% |

-26.5% |

|

|

|

|

|

|

|

|

Change in Stock Price |

4.6% |

-14.7% |

-42.0% |

-23.1% |

3.6% |

|

|

|

|

|

|

|

|

Russell Microcap Index |

4.7% |

17.8% |

-14.0% |

39.4% |

55.2% |

|

Russell Microcap Growth Index |

6.0% |

13.3% |

-32.2% |

17.8% |

36.3% |

|

Russell Microcap Value Index |

3.5% |

19.6% |

-0.2% |

54.6% |

67.8% |

|

Russell 2000 Index |

5.2% |

19.7% |

-0.4% |

47.4% |

72.3% |

Mr. Rendino and Mr. Wolfe will host a conference

call tomorrow, Tuesday, May 14, 2024, at 9am Eastern Time, to

discuss the results from Q1 2024 and developments to date during Q2

2024. The call can be accessed by phone at (609) 746-1082 passcode

415049 or via the web at

https://www.freeconferencecall.com/wall/180degreecapital.

Additionally, slides that will be referred to during the

presentation can be found on 180 Degree Capital’s investor

relations website at

https://ir.180degreecapital.com/ir-calendar.

About 180 Degree Capital

Corp.

180 Degree Capital Corp. is a publicly traded

registered closed-end fund focused on investing in and providing

value-added assistance through constructive activism to what we

believe are substantially undervalued small, publicly traded

companies that have potential for significant turnarounds. Our goal

is that the result of our constructive activism leads to a reversal

in direction for the share price of these investee companies, i.e.,

a 180-degree turn. Detailed information about 180 Degree Capital

and its holdings can be found on its website at

www.180degreecapital.com.

Press Contact:Daniel B. Wolfe180 Degree Capital

Corp.973-746-4500ir@180degreecapital.com

Mo ShafrothRF

Bindermorrison.shafroth@rfbinder.com

Forward-Looking Statements

This press release may contain statements of a

forward-looking nature relating to future events. These

forward-looking statements are subject to the inherent

uncertainties in predicting future results and conditions. These

statements reflect the Company's current beliefs, and a number of

important factors could cause actual results to differ materially

from those expressed in this press release. Please see the

Company's securities filings filed with the Securities and Exchange

Commission for a more detailed discussion of the risks and

uncertainties associated with the Company's business and other

significant factors that could affect the Company's actual results.

Except as otherwise required by Federal securities laws, the

Company undertakes no obligation to update or revise these

forward-looking statements to reflect new events or uncertainties.

The reference and link to the website www.180degreecapital.com has

been provided as a convenience, and the information contained on

such website is not incorporated by reference into this press

release. 180 Degree Capital is not responsible for the contents of

third-party websites.

1. Past performance is not an indication or

guarantee of future performance. Gross unrealized and realized

total returns of 180 Degree Capital's cash and securities of

publicly traded companies are compounded on a quarterly basis, and

intra-quarter cash flows from investments in or proceeds received

from privately held investments are treated as inflows or outflows

of cash available to invest or withdrawn, respectively, for the

purposes of this calculation. 180 Degree Capital is an internally

managed registered closed-end fund that has a portion of its assets

in legacy privately held companies that are fair valued on a

quarterly basis by the Valuation Committee of its Board of

Directors, and 180 Degree Capital does not have an external manager

that is paid fees based on assets and/or returns. Please see 180

Degree Capital's filings with the SEC, including its 2023 Annual

Report on Form N-CSR for information on its expenses and expense

ratios.

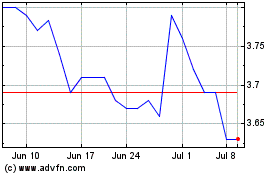

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From Apr 2024 to May 2024

180 Degree Capital (NASDAQ:TURN)

Historical Stock Chart

From May 2023 to May 2024