0001469443false00014694432024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 09, 2024 |

Arcadia Biosciences, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37383 |

81-0571538 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

5950 Sherry Lane Suite 215 |

|

Dallas, Texas |

|

75225 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 214 974-8921 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common |

|

RKDA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024 Arcadia Biosciences, Inc. (the “Company”) issued a press release announcing financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished as Exhibit 99.1, and the Company's annual financial information tables are furnished as Exhibit 99.2, to this Current Report on Form 8-K and are incorporated herein by reference.

The information furnished in this Form 8-K, the press release attached as Exhibit 99.1, and the financial information attached as Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02, in the press release attached as Exhibit 99.1, and in the financial information attached as Exhibit 99.2, shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ARCADIA BIOSCIENCES, INC. |

|

|

|

|

Date: |

May 9, 2024 |

By: |

/s/ THOMAS J. SCHAEFER |

|

|

|

Thomas J. Schaefer, Chief Financial Officer |

Exhibit 99.1

Arcadia Biosciences (RKDA) Announces First Quarter 2024

Financial Results and Business Highlights

– Revenues increase sequentially and year-over-year –

– Loss from continuing operations is at lowest level in 6 years –

DALLAS, Texas (May 9, 2024) – Arcadia Biosciences, Inc.® (Nasdaq: RKDA), a producer and marketer of innovative, plant-based health and wellness products, today released its financial and business results for the first quarter of 2024.

“Arcadia continued its positive trajectory in the first quarter of 2024,” said Stan Jacot, president and CEO. “Revenue continues to grow, both sequentially and year-over-year, and we have transitioned the topline to high-quality revenue that generates gross profit across multiple sources. Operating expenses continued to decline at a double-digit pace versus last year, and this is now our fifth straight quarter of gross profit margins greater than 30 percent.

“Our GoodWheatTM is in more than 3,500 stores in three categories, and Zola® coconut water is positioned for double-digit growth with new flavors and distribution. And finally, we remain focused on monetizing our IP and accelerating delivery of cashflow positive results,” he added.

Q1 2024 Key Operating and Business Highlights

•GoodWheat Continues Distribution Expansion. The GoodWheat brand continued to expand in Q1, adding a couple hundred stores of distribution for pancake and waffle mixes. GoodWheat Mac & Cheese launched nationwide on Amazon in Q1 2024 with three varieties: Classic Cheddar, White Cheddar and Three Cheese. And Amazon recently selected GoodWheat Three Cheese Mac & Cheese as an “Amazon’s Choice: New Arrival Pick” based on its high ratings, pricing and availability.

•Zola Coconut Water Increases Store Count. Zola added nearly 200 new stores in Q1 and will ship to approximately 1,300 new stores in Q2. Arcadia expects Zola to be a key driver in 2024 for both revenue and gross profit, with the upcoming launch of new Pineapple and Lime flavors and increasing distribution.

Arcadia Biosciences, Inc.

Financial Snapshot

(Unaudited)

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2024 |

2023 |

Favorable / (Unfavorable) |

|

|

|

|

|

|

$ |

% |

Total Revenues |

1,255 |

|

1,232 |

|

23 |

|

2% |

Total Operating Expenses |

4,319 |

|

5,099 |

|

780 |

|

15% |

Loss From Continuing Operations |

(3,064) |

|

(3,867) |

|

803 |

|

21% |

Net Loss Attributable to Common Stockholders |

(2,423) |

|

(9,384) |

|

6,961 |

|

74% |

Certain previously reported financial information has been reclassified to conform to the current year presentation. Reclassifications are related to the presentation of the financial results of our former body care brands as discontinued operations. The financial information above and narrative that follows relate to continuing operations unless stated otherwise.

More detailed financial statements are included in the Form 8-K filed today, available in the Investors section of the company’s website under SEC Filings.

Revenues

Revenues increased slightly during the first quarter of 2024 compared to the same period in 2023 driven by GoodWheat and Zola sales, partially offset by higher costs associated with new distribution.

Operating Expenses

Operating expenses decreased $780,000 during the first quarter of 2024 compared to the same period in 2023 primarily driven by a decrease in selling, general and administrative (SG&A) expenses related to rightsizing the organization and marketing investment.

Net Loss Attributable to Common Stockholders

Net loss attributable to common stockholders for the first quarter of 2024 was $2.4 million, or $1.78 per share, a $7.0 million improvement from the $9.4 million, or $10.86 per share, net loss for the first quarter of 2023. The improvement in net loss attributable to common stockholders for the first quarter of 2024 compared to the same period in 2023 was primarily driven by the valuation loss related to the March 2023 financing transaction.

Conference Call and Webcast

The company has scheduled a conference call for 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss first-quarter results and key strategic achievements. Interested participants can join the conference call using the following numbers:

U.S. Toll-Free Dial-In: +1 (800) 715-9871

International Dial-In: +1 (646) 307-1963

Passcode: 1615939

A live webcast of the conference call will be available on the Investors section of Arcadia’s website at www.arcadiabio.com. Following completion of the call, a recorded replay will be available on the company’s investor website.

About Arcadia Biosciences, Inc.

Since 2002, Arcadia Biosciences (Nasdaq: RKDA) has been innovating crops to provide high-value, healthy ingredients to meet consumer demands for healthier choices. With its roots in agricultural innovation, Arcadia cultivates next-generation wellness products that make every body feel good. The company’s food and beverage products include GoodWheat™ pasta, pancake mixes and mac & cheese and Zola® coconut water. For more information, visit www.arcadiabio.com.

Safe Harbor Statement

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 about the company and its products, including statements relating to the company’s growth, cash position, operating costs, financial performance, commercialization of products, monetization of intellectual property, and the growth, distribution, revenue and gross profit of the company’s Zola coconut water. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. These risks and uncertainties include, but are not limited to, the risks set forth in filings that the company makes with the Securities and Exchange Commission from time to time, including in Arcadia’s Annual Report on Form 10-K for the year ended December 31, 2023 and other filings. These forward-looking statements speak only as of the date hereof, and Arcadia Biosciences, Inc. disclaims any obligation to update these forward-looking statements.

Arcadia Biosciences Contact:

T.J. Schaefer

ir@arcadiabio.com

# # #

Exhibit 99.2

Arcadia Biosciences, Inc.

Consolidated Balance Sheets

(Unaudited)

(In thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

3,317 |

|

|

$ |

6,518 |

|

Short-term investments |

|

|

5,184 |

|

|

|

5,124 |

|

Accounts receivable and other receivables, net of allowance for doubtful accounts of

$0 as of March 31, 2024 and December 31, 2023 |

|

|

760 |

|

|

|

514 |

|

Inventories — current |

|

|

1,831 |

|

|

|

1,958 |

|

Assets held for sale |

|

|

15 |

|

|

|

51 |

|

Prepaid expenses and other current assets |

|

|

535 |

|

|

|

807 |

|

Total current assets |

|

|

11,642 |

|

|

|

14,972 |

|

Property and equipment, net |

|

|

328 |

|

|

|

384 |

|

Right of use asset |

|

|

695 |

|

|

|

792 |

|

Inventories — noncurrent |

|

|

3,178 |

|

|

|

3,354 |

|

Intangible assets, net |

|

|

39 |

|

|

|

39 |

|

Other noncurrent assets |

|

|

164 |

|

|

|

164 |

|

Total assets |

|

$ |

16,046 |

|

|

$ |

19,705 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

1,732 |

|

|

$ |

2,410 |

|

Amounts due to related parties |

|

|

75 |

|

|

|

58 |

|

Operating lease liability — current |

|

|

801 |

|

|

|

852 |

|

Other current liabilities |

|

|

270 |

|

|

|

270 |

|

Total current liabilities |

|

|

2,878 |

|

|

|

3,590 |

|

Operating lease liability — noncurrent |

|

|

21 |

|

|

|

155 |

|

Common stock warrant and option liabilities |

|

|

664 |

|

|

|

1,257 |

|

Other noncurrent liabilities |

|

|

2,000 |

|

|

|

2,000 |

|

Total liabilities |

|

|

5,563 |

|

|

|

7,002 |

|

Commitments and contingencies (Note 13) |

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

Common stock, $0.001 par value—150,000,000 shares authorized as

of March 31, 2024 and December 31, 2023; 1,362,840 and 1,285,337 shares issued

and outstanding as of March 31, 2024 and December 31, 2023, respectively |

|

|

65 |

|

|

|

65 |

|

Additional paid-in capital |

|

|

284,658 |

|

|

|

284,515 |

|

Accumulated other comprehensive income |

|

|

161 |

|

|

|

101 |

|

Accumulated deficit |

|

|

(274,263 |

) |

|

|

(271,840 |

) |

Total stockholders’ equity |

|

|

10,621 |

|

|

|

12,841 |

|

Non-controlling interest |

|

|

(138 |

) |

|

|

(138 |

) |

Total stockholders' equity |

|

|

10,483 |

|

|

|

12,703 |

|

Total liabilities and stockholders’ equity |

|

$ |

16,046 |

|

|

$ |

19,705 |

|

Arcadia Biosciences, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited)

(In thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

Product |

|

$ |

1,255 |

|

|

$ |

1,232 |

|

Total revenues |

|

|

1,255 |

|

|

|

1,232 |

|

Operating expenses (income): |

|

|

|

|

|

|

Cost of revenues |

|

|

820 |

|

|

|

688 |

|

Research and development |

|

|

272 |

|

|

|

359 |

|

Loss (Gain) on sale of property and equipment |

|

|

2 |

|

|

|

(19 |

) |

Impairment of property and equipment |

|

|

36 |

|

|

|

— |

|

Selling, general and administrative |

|

|

3,189 |

|

|

|

4,071 |

|

Total operating expenses |

|

|

4,319 |

|

|

|

5,099 |

|

Loss from continuing operations |

|

|

(3,064 |

) |

|

|

(3,867 |

) |

Interest income |

|

|

45 |

|

|

|

198 |

|

Other income, net |

|

|

3 |

|

|

|

32 |

|

Valuation loss on March 2023 PIPE |

|

|

— |

|

|

|

(6,076 |

) |

Change in fair value of common stock warrant and option liabilities |

|

|

593 |

|

|

|

940 |

|

Issuance and offering costs allocated to liability classified options |

|

|

— |

|

|

|

(430 |

) |

Net loss from continuing operations |

|

|

(2,423 |

) |

|

|

(9,203 |

) |

Net loss from discontinued operations |

|

|

— |

|

|

|

(181 |

) |

Net loss attributable to common stockholders |

|

$ |

(2,423 |

) |

|

$ |

(9,384 |

) |

Net loss per share attributable to common stockholders: |

|

|

|

|

|

|

Basic and diluted from continuing operations |

|

$ |

(2 |

) |

|

$ |

(10.65 |

) |

Basic and diluted from discontinued operations |

|

$ |

— |

|

|

$ |

(0.21 |

) |

Net loss per basic and diluted share attributable to common stockholders |

|

$ |

(1.78 |

) |

|

$ |

(10.86 |

) |

Weighted-average number of shares used in per share

calculations: |

|

|

|

|

|

|

Basic and diluted |

|

|

1,361,657 |

|

|

|

864,391 |

|

Other comprehensive income, net of tax |

|

|

|

|

|

|

Unrealized gains on available-for-sale securities |

|

$ |

60 |

|

|

$ |

— |

|

Other comprehensive income |

|

$ |

60 |

|

|

$ |

— |

|

Comprehensive loss attributable to common stockholders |

|

$ |

(2,363 |

) |

|

$ |

(9,384 |

) |

Arcadia Biosciences, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net loss |

|

$ |

(2,423 |

) |

|

$ |

(9,384 |

) |

Adjustments to reconcile net loss to cash used in operating activities: |

|

|

|

|

|

|

Change in fair value of common stock warrant and option liabilities |

|

|

(593 |

) |

|

|

(940 |

) |

Issuance and offering costs allocated to liability classified options |

|

|

— |

|

|

|

430 |

|

Valuation loss on March 2023 PIPE |

|

|

— |

|

|

|

6,076 |

|

Depreciation |

|

|

51 |

|

|

|

71 |

|

Lease amortization |

|

|

177 |

|

|

|

180 |

|

Loss (Gain) on disposal of property and equipment |

|

|

2 |

|

|

|

(19 |

) |

Stock-based compensation |

|

|

138 |

|

|

|

212 |

|

Write-down of inventories |

|

|

— |

|

|

|

23 |

|

Impairment of property and equipment |

|

|

36 |

|

|

|

— |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable and other receivables |

|

|

(246 |

) |

|

|

80 |

|

Inventories |

|

|

303 |

|

|

|

(37 |

) |

Prepaid expenses and other current assets |

|

|

275 |

|

|

|

203 |

|

Accounts payable and accrued expenses |

|

|

(678 |

) |

|

|

(149 |

) |

Amounts due to related parties |

|

|

17 |

|

|

|

(33 |

) |

Other current liabilities |

|

|

— |

|

|

|

12 |

|

Operating lease liabilities |

|

|

(269 |

) |

|

|

(191 |

) |

Net cash used in operating activities |

|

|

(3,210 |

) |

|

|

(3,466 |

) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

17 |

|

|

|

30 |

|

Purchases of property and equipment |

|

|

(13 |

) |

|

|

— |

|

Proceeds from sale of Verdeca — earn-out received |

|

|

— |

|

|

|

285 |

|

Net cash provided by investing activities |

|

|

4 |

|

|

|

315 |

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of common stock, pre-funded warrants and

preferred investment options from March 2023 PIPE |

|

|

— |

|

|

|

5,997 |

|

Payments of offering costs relating to March 2023 PIPE |

|

|

— |

|

|

|

(497 |

) |

Proceeds from ESPP purchases |

|

|

5 |

|

|

|

5 |

|

Net cash provided by financing activities |

|

|

5 |

|

|

|

5,505 |

|

Net (decrease) increase in cash and cash equivalents |

|

|

(3,201 |

) |

|

|

2,354 |

|

Cash and cash equivalents — beginning of period |

|

|

6,518 |

|

|

|

20,644 |

|

Cash and cash equivalents — end of period |

|

$ |

3,317 |

|

|

$ |

22,998 |

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

|

|

|

|

|

|

NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

Accrued legal and accounting fees included in offering

costs related to March 2023 PIPE |

|

$ |

— |

|

|

$ |

51 |

|

Common stock options issued to placement agent and included in offering

costs related to March 2023 PIPE |

|

$ |

— |

|

|

$ |

212 |

|

Proceeds from sale of property and equipment in accounts receivable and other receivables |

|

$ |

12 |

|

|

$ |

— |

|

Purchases of property and equipment in accounts payable and accrued expenses |

|

$ |

13 |

|

|

$ |

— |

|

Warrant and option modifications included in Valuation loss on March

2023 PIPE |

|

$ |

— |

|

|

$ |

404 |

|

Proceeds from sale of Verdeca in accounts receivable and other receivables |

|

$ |

— |

|

|

$ |

285 |

|

# # #

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

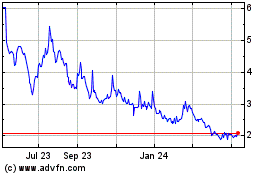

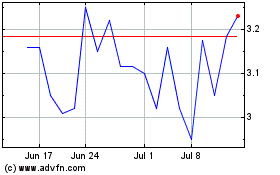

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From Apr 2024 to May 2024

Arcadia Biosciences (NASDAQ:RKDA)

Historical Stock Chart

From May 2023 to May 2024