false

2024

Q1

--12-31

0001347242

1191809

1067825

11515652

10323843

145880

836857

P10Y

P1Y

P5Y6M3D

P9Y11M15D

P5Y2M8D

P9Y11M15D

P4Y11M8D

P5Y2M1D

P3Y

0001347242

2024-01-01

2024-03-31

0001347242

2024-05-08

0001347242

2024-03-31

0001347242

2023-12-31

0001347242

lipo:GrantrevenuesMember

2024-01-01

2024-03-31

0001347242

lipo:GrantrevenuesMember

2023-01-01

2023-03-31

0001347242

2023-01-01

2023-03-31

0001347242

us-gaap:CommonStockMember

2022-12-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001347242

us-gaap:RetainedEarningsMember

2022-12-31

0001347242

2022-12-31

0001347242

us-gaap:CommonStockMember

2023-12-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2023-12-31

0001347242

us-gaap:RetainedEarningsMember

2023-12-31

0001347242

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001347242

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001347242

us-gaap:CommonStockMember

2024-01-01

2024-03-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2024-01-01

2024-03-31

0001347242

us-gaap:RetainedEarningsMember

2024-01-01

2024-03-31

0001347242

us-gaap:CommonStockMember

2023-03-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001347242

us-gaap:RetainedEarningsMember

2023-03-31

0001347242

2023-03-31

0001347242

us-gaap:CommonStockMember

2024-03-31

0001347242

us-gaap:AdditionalPaidInCapitalMember

2024-03-31

0001347242

us-gaap:RetainedEarningsMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:CommercialPaperMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:CommercialPaperMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:CommercialPaperMember

2024-03-31

0001347242

us-gaap:CommercialPaperMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2024-03-31

0001347242

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:MoneyMarketFundsMember

2024-03-31

0001347242

us-gaap:MoneyMarketFundsMember

2024-03-31

0001347242

us-gaap:FairValueInputsLevel1Member

2024-03-31

0001347242

us-gaap:FairValueInputsLevel2Member

2024-03-31

0001347242

us-gaap:FairValueInputsLevel3Member

2024-03-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:CommercialPaperMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:CommercialPaperMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:CommercialPaperMember

2023-12-31

0001347242

us-gaap:CommercialPaperMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2023-12-31

0001347242

us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel1Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel2Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel3Member

us-gaap:MoneyMarketFundsMember

2023-12-31

0001347242

us-gaap:MoneyMarketFundsMember

2023-12-31

0001347242

us-gaap:FairValueInputsLevel1Member

2023-12-31

0001347242

us-gaap:FairValueInputsLevel2Member

2023-12-31

0001347242

us-gaap:FairValueInputsLevel3Member

2023-12-31

0001347242

us-gaap:LetterOfCreditMember

2024-03-31

0001347242

us-gaap:LetterOfCreditMember

2024-01-01

2024-03-31

0001347242

us-gaap:LetterOfCreditMember

2023-01-01

2023-12-31

0001347242

us-gaap:CommonClassAMember

lipo:StockOptionPlansMember

2024-03-31

0001347242

us-gaap:CommonClassAMember

lipo:StockOptionPlans2008Member

2024-03-31

0001347242

us-gaap:CommonClassAMember

lipo:StockOptionPlans2020Member

2024-03-31

0001347242

lipo:StockOptionPlansMember

2024-01-01

2024-03-31

0001347242

lipo:StockOptionPlansMember

2024-03-31

0001347242

lipo:StockOptionPlansMember

2023-01-01

2023-03-31

0001347242

lipo:StockOptionPlansMember

2024-03-15

0001347242

lipo:StockOptionPlansMember

2024-03-14

2024-03-15

0001347242

2023-01-01

2023-12-31

0001347242

us-gaap:SeriesAPreferredStockMember

2013-06-30

0001347242

2008-09-01

2013-06-30

0001347242

us-gaap:SeriesAPreferredStockMember

srt:MinimumMember

2013-06-30

0001347242

us-gaap:SeriesAPreferredStockMember

srt:MaximumMember

2013-06-30

0001347242

2006-06-01

2008-04-30

0001347242

us-gaap:WarrantMember

2024-03-31

0001347242

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001347242

2022-01-01

2022-12-31

0001347242

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001347242

us-gaap:CommonStockMember

2022-12-08

2022-12-09

0001347242

lipo:CommonStockOneMember

2022-12-31

0001347242

us-gaap:CommonStockMember

us-gaap:IPOMember

2022-12-22

0001347242

us-gaap:IPOMember

2022-12-20

2022-12-22

0001347242

us-gaap:IPOMember

2022-12-22

0001347242

us-gaap:CommonStockMember

2023-09-13

2023-09-15

0001347242

us-gaap:CommonStockMember

2023-11-26

2023-11-28

0001347242

us-gaap:CommonStockMember

2023-01-01

2023-12-31

0001347242

us-gaap:CommonStockMember

2024-01-31

2024-02-02

0001347242

us-gaap:CommonStockMember

2024-03-02

2024-03-04

0001347242

lipo:PurchaseAgreementMember

srt:BoardOfDirectorsChairmanMember

2024-03-12

2024-03-13

0001347242

us-gaap:CommonStockMember

2024-03-12

2024-03-13

0001347242

us-gaap:CommonStockMember

2024-03-13

0001347242

us-gaap:CommonStockMember

us-gaap:PrivatePlacementMember

2023-10-21

2023-10-23

0001347242

us-gaap:WarrantMember

2023-10-21

2023-10-23

0001347242

srt:MinimumMember

2024-03-31

0001347242

srt:MaximumMember

2024-03-31

0001347242

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-05-02

2024-05-03

0001347242

us-gaap:SubsequentEventMember

us-gaap:PrivatePlacementMember

2024-10-13

2024-10-14

0001347242

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-10-14

0001347242

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2024-10-13

2024-10-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

lipo:Number

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended: March 31, 2024

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from to

Commission

File Number: 001-41575

Lipella

Pharmaceuticals Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

20-2388040 |

(State or other jurisdiction

of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| 7800

Susquehanna St., Suite 505 |

| Pittsburgh,

PA 15208 |

(Address

of principal executive offices) (Zip Code) |

| |

| (412)

901-0315 |

| (Registrant’s

telephone number, including area code) |

Securities

registered pursuant to Section 12(b) of the Act

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange on which

registered |

| Common Stock, par

value $0.0001 per share |

|

LIPO |

|

The Nasdaq Stock

Market LLC |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the

registrant was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

|

Emerging growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As

of May 8, there were 7,605,636 shares of common stock, par value $0.0001 per share, of the registrant outstanding.

Lipella

Pharmaceuticals Inc.

Form

10-Q

March

31, 2024

Table

of Contents

References

in this Quarterly Report on Form 10-Q to the “Company,” “Lipella,” “we,” “us,”

or “our” mean Lipella Pharmaceuticals Inc. unless otherwise expressly stated or the context indicates otherwise.

PART

I. FINANCIAL INFORMATION

Item

1. Financial Statements.

Lipella

Pharmaceuticals Inc.

CONDENSED

BALANCE SHEETS

| | |

March 31, 2024

(Unaudited)

| | |

December 31, 2023 | |

| Assets | |

| | |

| |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,105,299 | | |

$ | 3,293,738 | |

| Grants receivable | |

| 68,934 | | |

| 32,286 | |

| Prepaid expenses | |

| 836,857 | | |

| 103,256 | |

| Total Current Assets | |

| 3,011,090 | | |

| 3,429,280 | |

| Property and Equipment | |

| | | |

| | |

| Furniture, fixtures and equipment | |

| 140,294 | | |

| 140,294 | |

| Furniture, fixtures and equipment (Accumulated Depreciation) | |

| (128,265 | ) | |

| (127,544 | ) |

| Furniture and fixtures, net | |

| 12,029 | | |

| 12,750 | |

| Other Assets | |

| | | |

| | |

| Operating lease right of use asset | |

| 114,038 | | |

| 135,144 | |

| Total Assets | |

$ | 3,137,157 | | |

$ | 3,577,174 | |

| Liabilities and Stockholders’ Equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 293,835 | | |

$ | 138,016 | |

| Accrued expenses | |

| 84,929 | | |

| 77,280 | |

| Operating lease liability | |

| 91,705 | | |

| 89,223 | |

| Payroll liability | |

| 81,412 | | |

| 80,836 | |

| Total Current Liabilities | |

| 551,881 | | |

| 385,355 | |

| Operating lease liability, net of current portion | |

| 23,997 | | |

| 47,371 | |

| Total Liabilities | |

$ | 575,878 | | |

$ | 432,726 | |

| Stockholders’ equity: | |

| | | |

| | |

| Convertible preferred stock, $0.0001

par value; 20,000,000

shares authorized; -0-

shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | |

$ | — | | |

$ | — | |

| Common stock, $0.0001

par value; 200,000,000

shares authorized, 7,039,846

and 6,053,956 shares issued and outstanding at March 31, 2024 and

at December 31, 2023, respectively | |

| 704 | | |

| 605 | |

| Additional paid-in capital | |

| 14,076,227 | | |

| 13,467,686 | |

| Accumulated deficit | |

| (11,515,652 | ) | |

| (10,323,843 | ) |

| Total stockholders’ equity | |

| 2,561,279 | | |

| 3,144,448 | |

| Total liabilities and stockholders’ equity | |

$ | 3,137,157 | | |

$ | 3,577,174 | |

The

accompanying notes are an integral part of these condensed financial statements.

Lipella

Pharmaceuticals Inc.

CONDENSED

STATEMENTS OF OPERATIONS

(Unaudited)

| | |

|

|

|

| |

| | |

For the three months ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| Grant revenues | |

$ | 145,880 | | |

$ | 118,048 | |

| Total revenues | |

| 145,880 | | |

| 118,048 | |

| | |

| | | |

| | |

| Cost and expenses | |

| | | |

| | |

| Research and development | |

| 842,600 | | |

| 693,730 | |

| General and administrative | |

| 520,926 | | |

| 508,750 | |

| Total costs and expenses | |

| 1,363,526 | | |

| 1,202,480 | |

| Loss from operations | |

| (1,217,646 | ) | |

| (1,084,432 | ) |

| | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | |

| Interest income, net | |

| 25,837 | | |

| 22,001 | |

| Interest expense related party | |

| — | | |

| (5,394 | ) |

| Total other income

(expense) | |

| 25,837 | | |

| 16,607 | |

| Provision for income taxes | |

| — | | |

| — | |

| Net Loss | |

$ | (1,191,809 | ) | |

$ | (1,067,825 | ) |

| | |

| | | |

| | |

| Loss per common share | |

| | | |

| | |

| Basic | |

| (0.16 | ) | |

| (0.19 | ) |

| Dilutive | |

| (0.16 | ) | |

| (0.19 | ) |

| | |

| | | |

| | |

| Weighted-average of common shares

outstanding: | |

| | | |

| | |

| Basic | |

| 7,292,396 | | |

| 5,743,945 | |

| Dilutive | |

| 7,292,396 | | |

| 5,743,945 | |

The

accompanying notes are an integral part of these condensed financial statements.

Lipella

Pharmaceuticals Inc.

CONDENSED

STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(Unaudited)

| | |

|

|

|

| | |

| | |

| | |

| |

| | |

| | |

Additional | | |

| | |

| |

| | |

Common Stock | | |

paid-in | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

capital | | |

Deficit | | |

Total | |

| Balances, December 31, 2022 | |

| 5,743,945 | | |

$ | 574 | | |

$ | 10,379,900 | | |

$ | (5,704,878 | ) | |

$ | 4,675,596 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (1,067,825 | ) | |

| (1,067,825 | ) |

| Stock-based compensation | |

| — | | |

| — | | |

| 208,639 | | |

| — | | |

| 208,639 | |

| Balances, March 31, 2023 | |

| 5,743,945 | | |

| 574 | | |

| 10,588,539 | | |

| (6,772,703 | ) | |

| 3,816,410 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balances, December 31, 2023 | |

| 6,053,956 | | |

| 605 | | |

| 13,467,686 | | |

| (10,323,843 | ) | |

| 3,144,448 | |

| Net loss | |

| — | | |

| | | |

| — | | |

| (1,191,809 | ) | |

| (1,191,809 | ) |

| Share based compensation | |

| — | | |

| | | |

| 208,640 | | |

| — | | |

| 208,640 | |

| Warrants converted to Common Stock | |

| 500,000 | | |

| 50 | | |

| (50 | ) | |

| — | | |

| — | |

| Issuance of Common Stock | |

| 289,812 | | |

| 29 | | |

| 199,971 | | |

| — | | |

| 200,000 | |

| Shares issued for services | |

| 196,078 | | |

| 20 | | |

| 199,980 | | |

| — | | |

| 200,000 | |

| Balances, March 31, 2024 | |

| 7,039,846 | | |

| 704 | | |

| 14,076,227 | | |

| (11,515,652 | ) | |

| 2,561,279 | |

The

accompanying notes are an integral part of these condensed financial statements.

Lipella

Pharmaceuticals Inc.

CONDENSED

STATEMENTS OF CASH FLOWS

(Unaudited)

| | |

|

|

|

| |

| | |

For the three months ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flow from operating activities: | |

| | | |

| | |

| Net loss | |

$ | (1,191,809 | ) | |

$ | (1,067,825 | ) |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 72 | | |

| — | |

| Shares issued for services | |

| 200,000 | | |

| — | |

| Non-cash stock option expense | |

| 208,640 | | |

| 208,639 | |

| Interest expense related party net (non-cash) | |

| — | | |

| 5,394 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Operating right of use asset | |

| 214 | | |

| (34 | ) |

| Grants receivable | |

| (36,648 | ) | |

| 29,688 | |

| Prepaid expense | |

| (733,601 | ) | |

| 188,605 | |

| Accounts payable | |

| 155,819 | | |

| (235,437 | ) |

| Accrued expenses | |

| 7,649 | | |

| (208,017 | ) |

| Payroll liability | |

| 576 | | |

| 997 | |

| Net cash used in operating activities | |

| (1,388,439 | ) | |

| (1,077,990 | ) |

| Cash flow from investing activities: | |

| — | | |

| — | |

| Cash flow from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock, net of issuance costs | |

| 200,000 | | |

| — | |

| Repayment of notes payable | |

| — | | |

| (25,000 | ) |

| Net cash (used in) provided

by financing activities | |

| 200,000 | | |

| (25,000 | ) |

| Net decrease in cash, cash equivalents | |

| (1,188,439 | ) | |

| (1,102,990 | ) |

| Cash, and cash equivalents at beginning of period | |

| 3,293,738 | | |

| 5,121,743 | |

| Cash, and cash equivalents at end of period | |

| 2,105,299 | | |

$ | 4,018,753 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid | |

$ | 6,234 | | |

$ | — | |

| Income taxes paid | |

$ | — | | |

$ | — | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Issuance of common stock for forgiveness of related party note | |

$ | — | | |

$ | — | |

| Issuance of common stock options for

consulting services | |

$ | — | | |

$ | — | |

The

accompanying notes are an integral part of these condensed financial statements.

Lipella

Pharmaceuticals Inc.

NOTES

TO CONDENSED FINANCIAL STATEMENTS

(Unaudited)

Note

1. Description of Business and Basis of Presentation

Nature

of Business

Lipella

Pharmaceuticals Inc. (the “Company”, “we”, “us” or “our”) is a clinical-stage

biotechnology company focused on developing new drugs by reformulating the active agents in existing generic drugs and optimizing

these reformulations for new applications. Our operations consist of research, preclinical development and clinical development

activities, and our most advanced program is in Phase 2 clinical development. Since our inception in 2005, we have historically

financed our operations through a combination of federal grant revenue, licensing revenue, manufacturing revenue, as well as equity

and debt financing. On December 19, 2022, a reverse stock split (hereafter, the “Stock Split”) was effected, with

a 2.5 to 1 share conversion ratio for all shares of common stock, par value $0.0001 per share (“Common Stock”), outstanding.

The Company’s outstanding share and per share amounts in these financial statements have been adjusted to give effect to

the Stock Split, for all periods presented. For more information, see Note 11, “Common Stock.”

Basis

of Presentation

The

Company’s unaudited condensed financial statements have been prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). Any reference in these notes to applicable guidance is meant to refer to the authoritative GAAP

as found in the Accounting Standards Codification (“ASC”) and Accounting Standards Updates (“ASU”) of

the Financial Accounting Standards Board (“FASB”).

In

the opinion of management, the accompanying unaudited condensed financial statements include all adjustments, consisting of normal

recurring adjustments, which are necessary to present fairly the Company’s financial position, results of operations, and

cash flows. The interim results of operations are not necessarily indicative of the results that may occur for the full fiscal

year. Certain information and footnote disclosure normally included in the financial statements prepared in accordance with GAAP

have been condensed or omitted pursuant to instructions, rules, and regulations prescribed by the United States Securities and

Exchange Commission (“SEC”). The unaudited condensed interim financial statements should be read in conjunction with

the audited financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31,

2023 that was filed with the SEC on February 27, 2024 (our “Annual Report”).

Note

2. Going Concern

The

accompanying condensed financial statements have been prepared in conformity with GAAP, which contemplate continuation of the

Company as a going concern. The Company has not established a source of revenues sufficient to cover its operating costs and will

require significant additional capital to continue its research and development programs, including progressing clinical product

candidates to commercialization and preparing for commercial-scale manufacturing and sales.

The

Company’s net loss for the three months ended March 31, 2024 and fiscal year ended December 31, 2023 was $1,191,809 and

$4,618,965, respectively. Since inception, the Company has incurred historical losses and has an accumulated deficit of $11,515,652

at March 31, 2024 and $10,323,843 at December 31, 2023, respectively. At March 31, 2024, the Company had available cash and cash

equivalents of $2,105,299 and net working capital of $2,459,209. The Company anticipates operating losses to continue for the

foreseeable future due to, among other things, costs related to: research, development of product candidates, conducting preclinical

studies and clinical trials, and administrative organization. These funds, and our funds available under existing government contracts,

may not be sufficient to enable us to meet our obligations as they come due at least for the next twelve months from the issuance

date of these financial statements.

If

we are unable to obtain additional capital (which is not assured at this time), our long-term business plan may not be accomplished,

and we may be forced to curtail or cease operations. These factors individually and collectively raise substantial doubt about

our ability to continue as a going concern. The accompanying unaudited condensed financial statements do not include any adjustments

that may result from this uncertainty.

Note

3. Summary of Significant Accounting Policies

The

Company’s significant accounting policies are described in Note 2, “Summary of Significant Accounting Policies,”

in the Company’s Annual Report on Form 10-K filed with the SEC on February 27, 2024. There have been no material changes

to the significant accounting policies during the three-month period ended March 31, 2024, except for items mentioned below.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of these financial

statements. Actual results could differ from those estimates.

Adoption

of New Accounting Pronouncements

During

the three months ended March 31, 2024, no new accounting pronouncement was issued or became effective, that had or is expected

to have, a material impact on our Financial Statements.

Concentration

of Credit Risk

The

Company’s grant revenues and grant receivables are from the National Institute of Health (the “NIH”). The NIH

is an agency of the United States Department of Health & Human Services, and the Company believes amounts are fully collectible

from this agency. Contract revenues were $145,880 for the three months ended March 31, 2024, and $118,048 for the three months

ended March 31, 2024.

Earnings

Per Share

Basic

net loss per share of Common Stock is computed by dividing the net loss for the period by the weighted-average number of shares

of Common Stock outstanding during the period. Diluted net loss per common share is computed giving effect to all dilutive Common

Stock equivalents, consisting of stock options and warrants. Diluted net loss per share of Common Stock for the three months ended

March 31, 2024 and 2023 is the same as basic net loss per share, as the Common Stock equivalents were anti-dilutive due to the

net loss.

At

March 31, 2024 and 2023 the Common Stock equivalent shares were, as follows:

| | |

| | |

| |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Shares of Common Stock issuable under equity incentive plans outstanding | |

| 2,893,000 | | |

| 2,054,000 | |

| Shares of Common Stock issuable upon exercise of warrants | |

| 2,124,257 | | |

| 143,994 | |

| Shares of Common Stock issuable upon conversion of Series A Preferred Stock | |

| — | | |

| — | |

| Common Stock equivalent shares excluded from diluted net loss per share | |

| 5,017,257 | | |

| 2,197,994 | |

Note

4. Fair Value Measurements and Marketable Debt Securities

In

accordance with ASC 820, “Fair Value Measurements and Disclosures” (“ASC 820”), the Company measures

its assets and liabilities at fair value. We apply the three-level valuation hierarchy as described in ASC 820, which is based

upon the transparency of input as of the measurement date. The three levels of inputs as defined are:

Level

1 - Inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level

2 - Inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs

that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial

instruments.

Level

3 - Inputs to the valuation methodology are unobservable and significant to the fair value measurement.

At

March 31, 2024 and December 31, 2023, the Company’s financial instruments consist primarily of: cash and cash equivalents,

accounts payable and accrued liabilities. For cash equivalents, accounts payable and accrued liabilities, the carrying amounts

of these financial instruments as of March 31, 2024 and December 31, 2023 were considered representative of their fair values

due to their short term to maturity.

The

Company held no marketable securities at March 31, 2024 and December 31, 2023. For cash equivalents at March 31, 2024 and December

31, 2023, the fair value input levels are summarized below:

| March 31, 2024 | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Cash Equivalents (maturity less than 90 days) | |

| | | |

| | | |

| | | |

| | |

| Commercial Paper | |

$ | — | | |

| — | | |

| — | | |

$ | — | |

| U.S. Government | |

| — | | |

| — | | |

| — | | |

| — | |

| Money market funds | |

| 1,975,063 | | |

| — | | |

| — | | |

| 1,975,063 | |

| Total Cash equivalents | |

| 1,975,063 | | |

| | | |

| | | |

| 1,975,063 | |

| | |

| | | |

| | | |

| | | |

| | |

| Marketable Securities | |

| — | | |

| — | | |

| — | | |

| — | |

| Total Cash Equivalents and Marketable Securities | |

$ | 1,975,063 | | |

$ | — | | |

$ | — | | |

$ | 1,975,063 | |

| December 31, 2023 | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Cash Equivalents (maturity less than 90 days) | |

| | | |

| | | |

| | | |

| | |

| Commercial Paper | |

$ | — | | |

| — | | |

| — | | |

$ | — | |

| U.S. Government | |

| — | | |

| — | | |

| — | | |

| — | |

| Money market funds | |

| 3,052,648 | | |

| — | | |

| — | | |

| 3,052,648 | |

| Total Cash equivalents | |

| 3,052,648 | | |

| | | |

| | | |

| 3,052,648 | |

| | |

| | | |

| | | |

| | | |

| | |

| Marketable Securities | |

| — | | |

| — | | |

| — | | |

| — | |

| Total Cash Equivalents and Marketable Securities | |

$ | 3,052,648 | | |

$ | — | | |

$ | — | | |

$ | 3,052,648 | |

Note

5. Prepaid Expenses

At

March 31, 2024, prepaid expenses consisted primarily of prepaid insurance of $85,891, prepaid costs of issuance of $112,548, an advance deposit with our clinical trial management partner of $372,208, and

$266,210 in other prepaid expenses related primarily to professional services. At December 31, 2023, prepaid expenses consisted

of $88,554 of prepaid insurance, and $14,702 of prepaid expenses.

Note

6. Accrued Expenses

At

March 31, 2024, accrued expenses were $84,929, consisting of $19,575 of accrued clinical expenses and $65,354 of unbilled

legal expenses. At December 31, 2023, accrued expenses totaled $77,280 and consisted of $19,575 in clinical expenses, $52,050

in franchise tax expense, and $5,655 in unbilled professional services expenses.

Note

7. Notes Payable – Related Party

There

were no notes payable outstanding at March 31, 2024 or December 31, 2023.

Note

8. Letter of Credit

The

Company has a letter of credit with a bank for an aggregate available amount of $50,000 due upon demand. The letter of credit

is collateralized by substantially all of the Company’s assets and personally guaranteed by Dr. Jonathan Kaufman, the Company’s

Chief Executive Officer. The outstanding advances under the line of credit bear interest at the lending bank’s prime rate

plus 3.10%. The outstanding balance was $0 at March 31, 2024 and December 31, 2023, respectively.

Note

9. Stock Options

The

Company has two stock incentive plans (each, a “Stock Option Plan” and collectively, the “Stock Option

Plans”), each of which provides for the grant of both incentive stock options and non-qualified stock options. Under

the terms of the Stock Option Plans, the maximum number of shares of Common Stock for which incentive and/or non-qualified

stock options may be issued is 3,078,000 shares. This number comprises 1,078,000 stock options already issued and outstanding

(non-expired) from the 2008 stock option plan, and 2,400,000 shares of Common Stock underlying option awards that may be

issuable under the 2020 stock option plan. Incentive stock options are granted with an exercise price determined by the

Company’s board of directors (the “Board”). The terms of the vesting of such options, including

termination, are as set forth in the Stock Option Plans and their respective award agreements. Such stock options generally

expire 10 years from the date of the grant. Subject to certain exceptions for grants made to employees who are large

stockholders, stock options granted under the Stock Option Plans have an exercise price not less than the fair market value

of the underlying Common Stock on the date of such grant. If an employee leaves the Company prior to fully vesting their

option awards and the remaining unvested portion is considered forfeited, the earlier recognition of the unvested shares is

reversed during the period of forfeiture. As of March 31, 2024, there were $540,759 in unrecognized compensation costs

related to non-vested share-based compensation arrangements granted to be recognized over the remaining vesting period of

less than one year.

The

Company recognized $208,640 of compensation costs for the three months ended March 31, 2024 and $208,639 for the three months

ended March 31, 2023 related to the vesting of stock options.

The

following is an analysis of options to purchase shares of Common Stock issued and outstanding as of March 31, 2024 and December

31, 2023:

| |

|

Shares |

|

|

Weighted

Average

Exercise

Price Per

Share ($) |

|

|

Weighted

Average

Remaining

Contractual

Term

(in Years) |

|

|

Aggregate

intrinsic

value ($) |

|

| Outstanding as of December

31, 2022 |

|

|

2,054,000 |

|

|

|

2.84 |

|

|

|

5.51 |

|

|

|

605,687 |

|

| Granted |

|

|

424,000 |

|

|

|

2.19 |

|

|

|

9.96 |

|

|

|

|

|

| Expired |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancelled |

|

|

(25,000 |

) |

|

|

2.19 |

|

|

|

|

|

|

|

|

|

| Exercised |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding as of December 31, 2023 |

|

|

2,453,000 |

|

|

|

2.73 |

|

|

|

5.19 |

|

|

$ |

— |

|

| Granted |

|

|

440,000 |

|

|

|

0.77 |

|

|

|

9.96 |

|

|

|

|

|

| Expired |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cancelled |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercised |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Outstanding as of March 31, 2024 |

|

|

2,893,000 |

|

|

|

2.73 |

|

|

|

4.94 |

|

|

$ |

— |

|

| Vested as of March 31, 2024 |

|

|

2,346,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercisable as of March 31, 2024 |

|

|

2,346,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exercisable as of December 31, 2023 |

|

|

2,272,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

A

summary of status of the Company’s non-vested stock options (exercisable for shares of Common Stock on a one-to-one basis)

as of, and changes during, the three months ended March 31, 2024 and 2023 is presented below:

| |

|

Number

of

Stock Options |

|

|

Weighted-

Average Fair

Value Grant

Date |

|

| Nonvested at December 31,

2022 |

|

|

434,667 |

|

|

$ |

2.82 |

|

| Granted |

|

|

— |

|

|

|

2.84 |

|

| Vested |

|

|

(74,000 |

) |

|

|

2.83 |

|

| Expired |

|

|

— |

|

|

|

0.00 |

|

| Nonvested at March 31, 2023 |

|

|

360,667 |

|

|

$ |

2.82 |

|

| |

|

|

|

|

|

|

|

|

| Nonvested at December 31, 2023 |

|

|

180,667 |

|

|

$ |

2.81 |

|

| Granted |

|

|

440,000 |

|

|

|

0.55 |

|

| Vested |

|

|

(74,000 |

) |

|

|

1.13 |

|

| Expired |

|

|

— |

|

|

|

— |

|

| Nonvested at March 31, 2024 |

|

|

546,667 |

|

|

$ |

0.66 |

|

There

were no options granted in the three months ended March 31, 2023. In the three months ended March 31, 2024, the Company granted

options as described below.

Stock

Option Grants - On March 15, 2024, the Company granted 440,000 stock options at a $0.77 strike price, vesting as follows:

one third of such grant vests on April 1, 2024, one third of such grant vests on July 1, 2024, and one third of such grant vests

on October 1, 2024.

The

weighted-average fair value of stock options on the date of grant and the assumptions used to estimate the fair value of stock

options granted during the three months ended March 31, 2024 using the Black-Scholes option-pricing model are as follows:

| Three months ended March 31, 2024 | |

2024 | | |

2023 | |

| Weighted-average fair value of options granted | |

$ | 0.55 | | |

| — | |

| Expected volatility | |

| 86.17 | % | |

| — | % |

| Expected life (in years) | |

| 5.17 | | |

| — | |

| Risk-free interest rate (range) | |

| 4.33 | % | |

| — | % |

| Expected dividend yield | |

$ | — | | |

| — | |

Note

10. Preferred Stock

The

Company’s Series A Convertible Preferred Stock, par value $0.0001 per share (the “Series A Preferred Stock”),

ranks prior, with respect to dividend rights and rights upon a liquidation event, to all Common Stock and any other series of

preferred stock which is junior to Series A Preferred Stock. Upon any matter submitted to the shareholders of the Company for

a vote, each holder of Series A Preferred Stock is entitled to the number of votes as is equal to the number of shares of Common

Stock into which such shares of Series A Preferred Stock are convertible at the time of such vote. The Series A Preferred Stock

is not entitled to any mandatory dividends.

The

Company issued 1,592,447 shares of Series A Preferred Stock at $0.60 per share over a period beginning September 2008 through

June 2013, for gross proceeds of $833,188. The implied price of the Series A Preferred Stock issuance, $0.5232 per share, is $0.0768

per share less than the $0.60 offering price. This difference is associated with the conversion terms of three debt instruments

issued from June 2006 through April 2008 that had a total face value of $351,500, and converted into a total of 789,634 of the

1,592,447 shares, which imputes the additional $122,280 to interest and/or conversion discounts. In addition, $351,500 in face

value of the debt instruments had associated warrants. All consideration upon the issuance of convertible debt plus warrants was

imputed to the debt component leaving the associated warrants having no value. All note-associated warrants have expired.

In

the year ended December 31, 2022, all 1,592,447 outstanding shares of Series A Preferred Stock were converted to Common Stock

on a 1:1 basis. After giving effect to the Stock Split, this conversion resulted in 636,979 shares of Common Stock. There were

no shares of Series A Preferred Stock outstanding at December 31, 2023 or March 31, 2024.

Note

11. Common Stock

The

Company’s second amended and restated certificate of incorporation, as amended, authorizes the issuance of 200,000,000 shares

of Common Stock. On December 19, 2022, the Company effected the Stock Split, at a 2.5 for 1 ratio for all shares of Common Stock

outstanding. The Company’s outstanding share and per share amounts in these unaudited condensed financial statements have

been adjusted to give effect to the Stock Split, for all periods presented. There were 7,039,846 shares of Common Stock outstanding

as of March 31, 2024 and 6,053,956 shares outstanding as of December 31, 2023.

During

the year ended December 31, 2022, the Company issued 22,950 shares of Common Stock in forgiveness of two related party notes.

The aggregate principal and interest of the notes was $138,810. On December 22, 2022, we completed an initial public offering

(“IPO”) and listing on the Nasdaq Capital Market (“Nasdaq”) of our Common Stock at a price to the public

of $5.75 per share, which resulted in the issuance of an additional 1,217,391 shares of Common Stock. The aggregate net proceeds

from the IPO were approximately $5,000,000, after deducting underwriting discounts and commissions of $630,000 and offering expenses

of approximately $1,160,000.

On

September 15, 2023, the Company issued 60,000 shares of Common Stock in exchange for services rendered by a third party.

On

November 28, 2023, we issued 250,000 shares of Common Stock for the exercise of the same number of pre-funded warrants. See Note

12 for details of the pre-funded warrants. During the year end December 31, 2023, the Company also issued 60,000 shares of Common

Stock in exchange for services rendered by a third party.

On

February 2, 2024, we issued 196,078 shares of Common Stock in exchange for services rendered by a third party. On March 4, 2024,

500,000 shares of Common Stock were issued for the exercise of the same number of pre-funded warrants. On March 13, 2024, the Company entered into Affiliate Stock Purchase Agreements with each of Jonathan H. Kaufman, the Company's Chief Executive Officer and Chairman of its board of directors, and Michael B. Chancellor, the Company's Chief Medical Officer and a member of its board of directors, pursuant to which each of Drs. Kaufman and Chancellor purchased $100,000 of shares of common stock of the Company, in cash from the Company at $0.6901 per share, based on the official closing price of The Nasdaq Stock Market LLC for the Common Stock on March 13, 2024, resulting in the issuance of 144,906 shares of Common Stock to each of Drs. Kaufman and Chancellor.

The

Common Stock is subject to and qualified by the rights of the Series A Preferred Stock. Upon the dissolution or liquidation of

the Company, the holders of Common Stock will be entitled to receive all assets of the Company available for distribution to its

stockholders, subject to any preferential rights of any then outstanding Series A Preferred Stock.

Note

12. Warrants

No

warrants were issued in the three months ended March 31, 2024. On October 23, 2023, the Company entered into a securities purchase

agreement (the “Purchase Agreement”) with an institutional investor for the issuance and sale in a private placement

(the “Private Placement”) of pre-funded common stock purchase warrants (“Pre-Funded Warrants”) to purchase

up to 1,315,790 shares of Common Stock, with an exercise price of $0.001 per share, and common stock purchase warrants (the “Warrants”)

to purchase up to 1,315,790 shares of Common Stock, with an exercise price of $1.40 per share. The gross proceeds to the Company

from the Private Placement were approximately $2.0 million, before deducting placement agent fees and expenses and offering expenses

payable by the Company. The Warrants and the Pre-Funded Warrants are immediately exercisable for three years from issuance and

are subject to 4.99% and 9.99% beneficial ownership limitations (as applicable). The combined purchase price for one Pre-Funded

Warrant and one accompanying Warrant was $1.519. The closing of the Private Placement contemplated by the Purchase Agreement occurred

on October 25, 2023. The Company had no warrant liabilities at March 31, 2024 and December 31, 2023.

Note

13. Commitment and Contingencies

Operating

Leases

Operating

leases are recorded as ROU assets and lease liabilities on the balance sheet. ROU assets represent our right to use the leased

assets for the lease term, and lease liabilities represent our obligation to make lease payments. Operating lease ROU assets and

liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the

Company’s leases do not provide an implicit rate, the Company uses its estimated incremental borrowing rate at the commencement

date to determine the present value of lease payments. The operating lease ROU assets also include any lease payments made and

exclude lease incentives.

The

Company entered into a lease agreement beginning July 1, 2020, for the Company’s principal headquarters on the fifth floor

of 7800 Susquehanna Street, Pittsburgh, Pennsylvania, which includes office space and sterile manufacturing operations (the “Lease”).

The Lease has a five-year term and includes an option for renewal, which is not reasonably certain and is excluded from the right

of use calculation. On July 26, 2023, the Company entered a second lease for additional space on the fourth floor of the same

building (the “Fourth Floor Lease”), commencing August 1, 2023 and co-terminating with the existing Lease on June

30, 2025. Subsequently effective January 1, 2024, the Company terminated the Fourth Floor Lease early at no penalty upon mutual

agreement with the landlord and replaced it with a lease of additional space that had become available immediately adjacent to

our existing offices (the “Suite 504 Lease”, and together with the “Lease”, “the Leases”).

The Suite 504 Lease term co-terminates with the Lease. Future minimum rent payments under the Leases as of March 31,

2024 are as follows:

| Year ending | |

| |

| 2024 (nine months remaining) | |

$ | 72,316 | |

| 2025 | |

$ | 48,519 | |

| Total minimum lease payments | |

$ | 120,835 | |

| Less: amount representing interest | |

$ | (5,133 | ) |

| Present value of minimum lease payments | |

$ | 115,702 | |

The

Leases are accounted for as a ROU asset and liability. As of March 31, 2024, the Company had $114,038 of an operating lease ROU

asset, and $91,705 and 23,997 of current and non-current lease liabilities, respectively, recorded on the balance sheets. As of

December 31, 2023, the Company had an ROU asset of $135,144 and current and non-current operating lease liabilities of $89,223

and $47,371, respectively. The lease expense for the three months ended March 31, 2024 and March 31, 2023 was $24,438 and $16,368,

respectively. Cash paid for the amounts included in the measurement of lease liabilities for the three months ended March 31,

2024 and 2023 was $23,797 and $16,402, respectively. The payments are included in the operating activities in the accompanying

statement of cash flows. The discount rates used for our right-of-use leases range from 6.25% to 7.25%.

Contract

Commitments

The

Company enters into contracts in the normal course of business with contract research organizations (“CROs”), contract

manufacturing organizations, universities, and other third parties for preclinical research studies, clinical trials and

testing and manufacturing services. These contracts generally do not contain minimum purchase commitments and are cancelable by

us upon prior written notice although, purchase orders for clinical materials are generally non-cancelable. Payments due upon

cancellation consist only of payments for services provided or expenses incurred, including non-cancelable obligations of our

service providers, up to the date of cancellation or upon the completion of a manufacturing run.

Note

14. Income Taxes

The

provision for income taxes for the three months ended March 31, 2024 and 2023 was $0, resulting in an effective income tax rate

of 0% for each period. The Company’s effective tax rate for the three months ended March 31, 2024 and 2023 was primarily

due to the full valuation allowance against the Company’s net deferred tax assets.

The

Company regularly evaluates the realizability of its deferred tax assets and establishes a valuation allowance if it is more likely

than not that some or all of the deferred tax assets will not be utilized. Because of our cumulative losses, substantially all

of the deferred tax assets have been fully offset by a valuation allowance as of March 31, 2024 and December 31, 2023. We have

not paid income taxes for the year ended December 31, 2023. The income tax provision attributable to loss before income tax benefit for the three months ended March 31, 2024 differed from the amounts computed by applying the U.S. federal statutory rate of 21% as a result of the following:

Schedule of income tax provision attributable to loss before income tax benefit

| | |

| | |

| Statutory federal income tax rate | |

| 21.00 | % |

| State taxes, net of federal benefit | |

| 7.11 | % |

| Change in valuation allowance | |

| -28.11 | % |

| Effective tax rate | |

| 0.00 | % |

The

Company’s 2019 through 2023 tax years remain subject to examination by the Internal Revenue Service for federal tax purposes

and the Commonwealth of Pennsylvania for state tax purposes.

Note

15. Subsequent Events

Subsequent

events have been evaluated through the date on which the unaudited condensed financial statements were issued.

On

April 10, 2024, the Company eliminated the Series A Preferred Stock, of which there were no shares outstanding.

On

May 3, 2024, the Company issued 565,790 shares of Common Stock in conversion of the same number of pre-funded warrants.

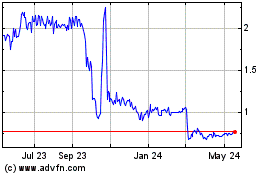

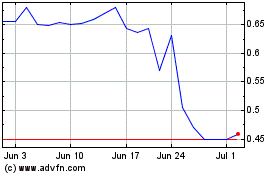

Notice of Failure to Satisfy Nasdaq Minimum

Bid Price Requirement

As disclosed in our

Current Report on Form 8-K filed with the SEC on April 19, 2024, on April 17, 2024, we received a written notification (the “Nasdaq

Letter”) from The Nasdaq Stock Market LLC (“Nasdaq”) notifying us that, based upon the closing bid price of

the Common Stock for the last 30 consecutive business days, the Company was not in compliance with the requirement to maintain

a minimum bid price of $1.00 per share of its Common Stock, as set forth in Nasdaq Listing Rule 5550(a)(2) (the “Minimum

Bid Price Requirement”). The Nasdaq Letter had no immediate effect on the listing of the Common Stock, which continues to

trade on the Nasdaq Capital Market under the symbol “LIPO” at this time.

Pursuant

to Nasdaq Listing Rule 5810(c)(3)(A), the Company has been given 180 calendar days, or until October 14, 2024, to regain

compliance with the Minimum Bid Price Requirement. If at any time before October 14, 2024, the bid price of the Common Stock

closes at $1.00

per share or more for a minimum of 10

consecutive business days, the Nasdaq staff will provide written confirmation that the Company has regained compliance with

the Minimum Bid Price Requirement and the matter will be closed.

If

the Company does not regain compliance with the Minimum Bid Price Requirement, the Company may be eligible for an additional

180-calendar day grace period. To qualify, the Company will be required to meet the continued listing requirement for market

value of publicly held shares and all other initial listing standards for the Nasdaq Capital Market, with the exception of

the Minimum Bid Price Requirement, and will need to provide written notice of its intention to cure the deficiency during the

second compliance period. If the Company does not regain compliance with the Minimum Bid Price Requirement by October 14,

2024, and is otherwise not eligible for such additional 180-day grace period to regain such compliance, the Nasdaq staff will

provide written notice to the Company that the Common Stock will be subject to delisting. At that time, the Company may

appeal any such delisting determination to a Nasdaq hearings panel.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The

following discussion and analysis of our financial condition and results of operations for the three and three months ended March

31, 2024 should be read together with our unaudited condensed financial statements and related notes included in Item 1 of Part

I of this Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024 (this “Form 10-Q”), as well

as the audited financial statements, the related notes thereto and management’s discussion and analysis of financial condition

and results of operations for the year ended December 31, 2023 contained in our Annual Report on Form 10-K for the year ended

December 31, 2023, that was filed with the SEC on February 27, 2024 (our “Annual Report”), and all risk factors disclosed

herein and therein. Such discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), as well as information relating to our business that reflect our management’s current views,

expectations and assumptions concerning our business, strategies, products, future results and events and financial performance,

which are subject to risks and uncertainties that may cause our, or our industry’s, actual results, levels of activity,

performance or achievements to be materially different from any future results, levels of activity, performance or achievements

expressed or implied by such forward-looking statements. Such forward-looking statements speak only as of the date of this Form

10-Q. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity or achievements or that our underlying assumptions will prove to be correct. Except as required

by applicable law, including the securities laws of the United States, we expressly disclaim any obligation or undertaking to

disseminate any update or revisions to any such forward-looking statement to reflect any change in our expectations with regard

thereto or to conform such forward-looking statements to actual results. Statements made in this Form 10-Q, other than statements

of historical fact, addressing operating performance, events, or developments which our management expects or anticipates will

or may occur in the future, and also statements related to expected or anticipated growth, revenues, profitability, new products,

adequacy of funds from operations, statements expressing general optimism about future operating results, and other non-historical

information, are forward-looking statements. In particular, the words “may,” “will,” “expects,”

“anticipates,” “aims,” “potential,” “future,” “intends,” “plans,”

believes,” “estimates,” “continue,” “likely to,” and variations of such words and similar

expressions identify forward-looking statements, but such words are not the exclusive means of identifying such forward-looking

statements, and their absence does not necessarily mean that such statement is not forward-looking.

Overview

We

are a clinical-stage biotechnology company focused on developing new drugs by reformulating the active agents in existing generic

drugs and optimizing these reformulations for new applications. We believe that this strategy combines many of the cost efficiencies

and risk abatements derived from using existing generic drugs with potential patent protections for our proprietary formulations;

this strategy allows us to expedite, protect, and monetize our product candidates. Additionally, we maintain a therapeutic focus

on diseases with significant, unaddressed morbidity and mortality where no approved drug therapy currently exists. We believe

that this focus can potentially help reduce the cost, time and risk associated with obtaining marketing approval.

LP-10

is the development name of our reformulation of tacrolimus (an approved generic active agent) specifically optimized for topical

deposition to the internal surface of the urinary bladder lumen using a proprietary drug delivery platform that we have developed

and that we refer to as our metastable liposome drug delivery platform (our “Platform”). We are developing LP-10 and

our Platform to be, to our knowledge, the first drug candidate and drug delivery technology that could be successful in treating

cancer survivors who acquire hemorrhagic cystitis. We have received U.S. Food and Drug Administration (“FDA”) “orphan

drug” designation covering LP-10 and plan to apply for additional regulatory designations in the event we achieve qualifying

results in the current phase 2a clinical trial for LP-10. Market data exclusivity may be available in the U.S. and other jurisdictions

in which regulatory approval is obtained for the Company’s product, regardless of patent status.

The

safety and efficacy of LP-10 was evaluated in a 13-subject, open-label, multi-center, dose-escalation, phase 2a clinical trial

in patients experiencing complications associated with a rare but highly morbid disease called “radiation-induced hemorrhagic

cystitis” or “radiation cystitis.” This phase 2a clinical trial commenced on February 15, 2021, and we reported

the trial’s summary results in the first quarter of 2023. We met with the FDA in the fourth quarter of 2023 regarding the

LP-10 clinical trial results, and expect to receive their response to our proposed phase 2b trial design in the second quarter

of 2024. There is currently no FDA approved drug therapy available for radiation cystitis patients, who are all cancer survivors

who received pelvic radiation therapy to treat solid pelvic tumors, including prostate and ovarian cancers, and who are now dealing

with therapy-associated complications, including urinary bleeding (a radiation cystitis symptom). LP-10’s active ingredient,

tacrolimus, which has a well-known pharmacology and toxicology, addresses a reduction (or cessation) of uncontrolled urinary bleeding.

In

the fourth quarter of 2023, we received IND approval from the FDA for LP-310, our product for the treatment of oral lichen planus

(“OLP”). We have begun the clinical trial process for LP-310, and expect to initiate the first clinical site in the

second quarter of 2024 and treat the first patient by the third quarter of 2024. OLP is a chronic, T-cell-mediated, autoimmune

oral mucosal disease, and LP-310 contains tacrolimus which inhibits T-lymphocyte activation. To date, upon review of relevant

FDA public data resources on approved drugs and biologics, we are not aware of any other liposomal products developed to treat

such disease.

In

the first quarter of 2024, we received IND approval from the FDA for LP-410, our phase-1/2a product, for the treatment of oral

graft-versus-host disease (“GVHD”). LP-410 is an oral rinse, similar to LP-310, but will have a different containment

system. Hematopoietic cell transplantation (“HCT”) is used to treat a wide range of malignancies, hematologic and

immune deficiency states, and autoimmune diseases. GVHD is a clinical syndrome where donor-derived immunocompetent T-cells react

against patient tissues directly or through exaggerated inflammatory responses following HCT. Lipella has developed LP-410 for

the topical delivery directly to the mouth surface. LP-410 targets the underlying mechanisms of oral GVHD, potentially providing

a safe and effective treatment option for affected individuals. Lipella received “orphan drug” designation approval

on November 11, 2023 for tacrolimus for the treatment of oral GVHD. An IND application for LP-410’s treatment of oral GVHD

was submitted to the FDA on January 30, 2024.

Since

our inception in 2005, we have focused primarily on business planning and progressing our lead product candidates, including progressing

LP-10 through clinical development, raising capital, organizing and staffing the Company. On December 22, 2022, we completed our

initial public offering (the “IPO”) and issued an aggregate of 1,217,391 shares of Common Stock at a price of $5.75

per share. The aggregate net proceeds from the IPO were approximately $5.0 million after deducting underwriting discounts and

commissions of approximately $630,000 and offering expenses of approximately $1.16 million.

Recent

Developments

On

April 3, 2024, the FDA granted a Type C meeting request to discuss the Company’s proposed Phase-2b clinical trial design

for the evaluation of LP-10. Lipella expects to meet with the FDA on May 21, 2024.

Results

of Operations

Comparison

of the Three Months Ended March 31, 2024 and 2023

The

following table summarizes our results of operations for the three months ended March 31, 2024 and 2023 (in thousands):

| | |

For the three months ended | | |

| |

| | |

March 31, | | |

Increase | |

| | |

2024 | | |

2023 | | |

(Decrease) | |

| (in thousands) | |

| | |

| | |

| |

| Revenue | |

$ | 146 | | |

| 118 | | |

$ | 28 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development (“R&D”) | |

| 843 | | |

| 694 | | |

| 149 | |

| General and administrative | |

| 521 | | |

| 509 | | |

| 12 | |

| Total operating expenses | |

| 1,363 | | |

| 1,202 | | |

| 161 | |

| Loss from operations | |

| (1,218 | ) | |

| (1,084 | ) | |

| (134 | ) |

| Other income | |

| 26 | | |

| 16 | | |

| 10 | |

| Net loss | |

$ | (1,192 | ) | |

$ | (1,068 | ) | |

$ | (124 | ) |

Grants

and Other Revenue

We

have not yet commercialized any products and we do not expect to generate revenue from sales of any product candidates for several

years. For the three months ended March 31, 2024 and 2023, we recognized revenue from a grant awarded by the National Institutes

of Health (“NIH”) in September of 2022 (the “2022 NIH Grant”), which was an award of an aggregate of $673,000.

NIH approved an additional year of funding under the 2022 NIH Grant in June 2023, increasing the total funding provided under

the 2022 NIH Grant to $1,353,000.

We

recognize revenue from grants when the related costs are incurred and the right to payment is realized. For the three months ended

March 31, 2024, we earned $146,000 in connection with the 2022 NIH Grant, recognized as revenue, compared with $118,000 revenue

in the three months ended March 31, 2023. The increase in annual grant revenue from 2023 to 2024 is related to the award and the

extension of the 2022 NIH Grant.

Operating

Expenses

Our

operating expenses consist of (i) R&D expenses and (ii) general and administrative expenses.

Research

and Development Expenses

R&D

costs primarily consist of direct costs associated with consultants and materials, biologic storage, third party CRO costs and

contract development and manufacturing expenses, salaries and other personnel-related expenses. R&D costs are expensed as

incurred. More specifically, these costs include:

| |

● |

costs of funding

research performed by third parties that conduct research and development and nonclinical and clinical activities on our behalf; |

| |

● |

costs of manufacturing

drug supply and drug product; |

| |

● |

costs of conducting

nonclinical studies and clinical trials of our product candidates; |

| |

● |

consulting and professional

fees related to research and development activities, including equity-based compensation to non-employees; |

| |

● |

costs related to

compliance with clinical regulatory requirements; and |

| |

● |

employee-related

expenses, including salaries, benefits and stock-based compensation expense for our research and development personnel. |

Costs

for certain activities are recognized based on an evaluation of the progress to completion of specific tasks using data, such

as information provided to us by our vendors, and analyzing the progress of our nonclinical and clinical studies or other services

performed. Significant judgment and estimates are made in determining the accrued expense balances at the end of any reporting

period. Advance payments that we make for goods or services to be received in the future for use in R&D activities are recorded

as prepaid expenses. Such amounts are recognized as an expense as the goods are delivered or the related services are performed,

or until it is no longer expected that the goods will be delivered or the services rendered.

We

expect that our R&D expenses will increase substantially in connection with our clinical development activities for our LP-10

and LP-310 programs. At this time, we cannot accurately estimate or know the nature, timing and costs of the efforts that will

be necessary to complete the clinical development of, or obtain regulatory approval for, any of our current or future product

candidates. This is due to the numerous risks and uncertainties associated with product development and commercialization, including

the specific factors set forth in the section of our Annual Report titled “Risk Factors.” If any events described

in the applicable risk factors included in the section of our Annual Report titled “Risk Factors” occur, then the

costs and timing associated with the development of any of our product candidates could significantly change. We may never succeed

in obtaining regulatory approval for, of commercialization of, LP-10, LP-310, or any of our other product candidates.

R&D

expenses increased by approximately $149,000, from $694,000 for the three months ended March 31, 2023 to $843,000 for the three

months ended March 31, 2024. The increase in R&D expenses was primarily attributable to an increase in outside services of

$58,000 for clinical study trials. Indirect costs related to operational overhead and employee benefits increased $105,000, and

legal patent costs decreased $8,000.

General

and Administrative Expenses

General

and administrative expenses consist primarily of management and business consultants and other related costs, including stock-based

compensation. General and administrative expenses also include board of directors’ expenses and professional fees for legal,

patent, consulting, accounting, auditing, tax services and insurance costs.

General

and administrative expenses were $521,00 for the three months ended March 31, 2024, compared to $509,000 for the three months

ended March 31, 2023, an increase of $12,000. These increases were primarily related to payment of salaries and outside services,

including investor relations expense.

Net

Other Income (Expense)

Net

other income for the three months ended March 31, 2024 was $26,000, as compared to $16,000 for the three months ended March 31,

2023. There was a $3,000 increase in interest income on the Company’s short term investment portfolio. It was offset by

a reduction in interest expense of $5,000. Interest expense on related party notes decreased during the three months ended March

31, 2024, as the Company had no outstanding debt during such period, as compared to the same period for the prior year, when the

Company had $250,000 of notes outstanding. See Note 7 of the notes to our financial statements in our Annual Report for details

of such related party notes and accrued interest at the prior period.

Liquidity

and Capital Resources

Sources

of Liquidity

We

have not yet commercialized any products, and we do not expect to generate revenue from sales of any product candidates for several

years, if at all. Cash and cash equivalents totaled $2.1 million as of March 31, 2024. We consider all highly liquid investments

that mature in 90 days or less when purchased to be cash equivalents.

We

have incurred operating losses and experienced negative operating cash flows for the three months ended March 31, 2024 and the

year ended December 31, 2023, and we anticipate that we will continue to incur losses for the foreseeable future. Our net loss

totaled $1,191,809 and $1,067,825 for the three months ended March 31, 2024 and 2023 respectively, and $4,618,965 for the

year ended December 31, 2023.

Historically,

we have financed our operations through a combination of grant revenue and equity financing, however our goals for the foreseeable

future will likely require significant equity financing. Our ability to achieve significant profitability depends on our ability

to successfully complete the development of, and obtain the regulatory approvals necessary to commercialize, LP-10 and/or our

other product candidates, which may not occur for several years, if ever. The net losses we incur may fluctuate significantly

from quarter to quarter.

Cash

Flows

The

following table provides information regarding our cash flows for each of the periods presented (in thousands):

| |

|

For

the three months ended |

|

| |

|

March

31, |

|

| Dollars

in thousands |

|

2024 |

|

|

2023 |

|

| |

|

|

|

|

|

|

| Net

cash (used) provided in operating activities |

|

$ |

(1,388 |

) |

|

|

(1,078 |

) |

| Net cash provided

in financing activities |

|

|

200 |

|

|

|

(25 |

) |

| Net

increase(decrease) in cash and cash equivalents |

|

$ |

(1,188 |

) |

|

|

(1,103 |

) |

Net

Cash (Used) Provided in Operating Activities

Net

cash used in operating activities for the three months ended March 31, 2024 was approximately $1,388,000. This comprised a net

loss for the period of approximately $1,192,000, and decreased operating liabilities of $164,000, offset by increases in the following

assets: grants receivable of $37,000 and prepaid expenses (primarily insurance policies and clinical trial operations services)

of $733,000. There were also noncash adjustments to net loss of $208,000 in stock option expense and $200,000 in shares of Common

Stock issued for services.

Net

cash used in operating activities for the three months ended March 31, 2023 was approximately $1,078,000. This comprised a net

loss for the period of approximately $1,068,000, and decreased prepaid expenses of $189,000, partially offset by changes in operating

assets and liabilities of $443,000 and noncash adjustments to net loss of $209,000 in stock option expense and $5,000

in non-cash interest expense.

Net

Cash Used in Financing Activities

Net

cash provided by financing activities for the three months ended March 31, 2024 was $200,000, received for the issuance of Common

Stock. Net cash used in financing activities for the three months ended March 31, 2023 was $25,000 in cash, which was used to

repay a $25,000 line of credit.

Funding

Requirements

We

expect our expenses to increase substantially in connection with our ongoing R&D activities, particularly as we continue R&D,

advance clinical trials of LP-10 and advance the preclinical development of our other programs, including LP-310. In addition,

we expect to incur additional costs associated with operating as a public company. As a result, we expect to incur substantial

operating losses and negative operating cash flows for the foreseeable future.

Based

on our current operating plan, we believe that our existing cash and cash equivalents will be sufficient to fund our operations

and capital expenses through the end of 2024. However, we have based this estimate on assumptions that may prove to

be wrong, and we could exhaust our capital resources sooner than we expect.

Because

of the numerous risks and uncertainties associated with research, development and commercialization of LP-10, LP-310 and our other