CarGurus, Inc. (Nasdaq: CARG), the No. 1 visited digital auto

platform for shopping, buying, and selling new and used vehicles1,

today announced financial results for the first quarter ended

March 31, 2024.

“We are pleased with our first quarter results,

as we achieved sustained marketplace revenue acceleration, driven

by double-digit QARSD growth and an increase in the number of

paying dealers,” said Jason Trevisan, Chief Executive Officer at

CarGurus. “In our Digital Wholesale business, we continued to focus

on rebuilding our operations while optimizing our go-to-market

strategy and product-market fit. Across our business, we continued

to deepen our connections with consumers and strengthen our

partnership with dealers, becoming increasingly embedded in their

daily workflow and making our services more valuable.”

First Quarter Financial

Highlights

|

|

|

Three Months

Ended |

|

|

|

|

March 31, 2024 |

|

|

|

|

Results (in millions) |

|

|

Variance from Prior Year |

|

|

Revenue |

|

|

|

|

|

|

|

Marketplace Revenue |

|

$ |

187.2 |

|

|

12 |

% |

| Wholesale

Revenue |

|

|

16.1 |

|

|

(36 |

)% |

| Product

Revenue |

|

|

12.5 |

|

|

(69 |

)% |

|

Total Revenue |

|

$ |

215.8 |

|

|

(7 |

)% |

| |

|

|

|

|

|

|

| Gross

Profit |

|

$ |

175.0 |

|

|

13 |

% |

| %

Margin |

|

|

81 |

% |

|

1426

bps |

|

| Operating

Expenses |

|

$ |

148.7 |

|

|

6 |

% |

| GAAP

Consolidated Net Income |

|

$ |

21.3 |

|

|

80 |

% |

|

|

|

|

|

|

|

|

|

Non-GAAP Consolidated Adjusted EBITDA

(1) |

|

$ |

50.4 |

|

|

24 |

% |

| % Margin

(1) |

|

|

23 |

% |

|

577

bps |

|

| |

|

|

|

|

|

|

| Cash and

Cash Equivalents at period end |

|

$ |

246.3 |

|

|

(21 |

)% |

(1) For more information regarding our use

of non-GAAP Consolidated Adjusted EBITDA and other non-GAAP

financial measures, please see the reconciliations of GAAP

financial measures to non-GAAP financial measures and the section

titled “Non-GAAP Financial Measures and Other Business Metrics”

below.

|

|

|

Three Months

Ended |

|

|

|

|

March 31, 2024 |

|

|

|

|

Results |

|

|

Variance from Prior Year |

|

| Key

Performance Indicators (1) |

|

|

|

|

|

|

|

U.S. Paying Dealers (2) |

|

|

24,419 |

|

|

0 |

% |

|

International Paying Dealers (2) |

|

|

6,756 |

|

|

(2 |

)% |

|

Total Paying Dealers (2) |

|

|

31,175 |

|

|

(0 |

)% |

| |

|

|

|

|

|

|

| U.S. QARSD

(2) |

|

$ |

6,702 |

|

|

13 |

% |

|

International QARSD (2) |

|

$ |

1,882 |

|

|

21 |

% |

|

Consolidated QARSD (2) |

|

$ |

5,664 |

|

|

14 |

% |

| |

|

|

|

|

|

|

|

Transactions |

|

|

10,302 |

|

|

(41 |

)% |

| |

|

|

|

|

|

|

| U.S. Average

Monthly Unique Users (in millions) (3) |

|

|

34.0 |

|

|

6 |

% |

| U.S. Average

Monthly Sessions (in millions) (3) |

|

|

88.3 |

|

|

5 |

% |

| |

|

|

|

|

|

|

|

International Average Monthly Unique Users (in millions) (3) |

|

|

8.6 |

|

|

19 |

% |

|

International Average Monthly Sessions (in millions) (3) |

|

|

19.7 |

|

|

18 |

% |

| |

|

|

|

|

|

|

|

Segment Reporting |

|

|

|

|

|

|

| U.S.

Marketplace Segment Revenue (in millions) |

|

$ |

173.0 |

|

|

11 |

% |

| U.S.

Marketplace Segment Operating Income (in millions) |

|

$ |

34.2 |

|

|

29 |

% |

| Digital

Wholesale Segment Revenue (in millions) |

|

$ |

28.6 |

|

|

(56 |

)% |

| Digital

Wholesale Segment Operating Loss (in millions) |

|

$ |

(10.3 |

) |

|

(8 |

)% |

(1) For more information regarding our use of Key Performance

Indicators, please see the section titled “Non-GAAP Financial

Measures and Other Business Metrics” below.(2) Metrics presented as

of March 31, 2024.(3) CarOffer website is excluded from the metrics

presented for users and sessions.

Second Quarter 2024 Guidance

The table below provides CarGurus’ guidance, which

is based on recent market trends, industry conditions, and

management’s expectations and assumptions as of today.

|

Guidance Metrics |

Values |

| Total

Revenue |

$202 million

to $222 million |

| Marketplace

Revenue |

$189 million

to $194 million |

| Non-GAAP

Consolidated Adjusted EBITDA |

$47 million

to $55 million |

| Non-GAAP

EPS |

$0.29 to

$0.34 |

The second quarter 2024 non-GAAP EPS calculation

assumes 105.5 million diluted weighted-average common shares

outstanding.

The assumptions that are built into guidance for

the second quarter 2024 regarding our pace of paid dealer

acquisition, churn, and expansion activity for the relevant period

are based on recent market trends and industry conditions. Guidance

for the second quarter 2024 excludes macro-level industry issues

that result in dealers and consumers materially changing their

recent market trends or that cause us to enact measures to assist

dealers. Guidance also excludes any potential impact of foreign

currency exchange gains or losses.

CarGurus has not reconciled its guidance of

non-GAAP consolidated adjusted EBITDA to GAAP consolidated net

income or non-GAAP EPS to GAAP EPS because reconciling items

between such GAAP and non-GAAP financial measures, which include,

as applicable, stock-based compensation, amortization of intangible

assets, impairment of long-lived assets, depreciation expenses,

non-intangible amortization, transaction-related expenses, other

income, net, the provision for income taxes, and income tax

effects, cannot be reasonably predicted due to, as applicable, the

timing, amount, valuation, and number of future employee equity

awards and the uncertainty relating to the timing, frequency, and

effect of acquisitions and the significance of the resulting

transaction-related expenses, and therefore cannot be determined

without unreasonable effort.

Conference Call and Webcast

Information

CarGurus will host a conference call and live

webcast to discuss its first quarter 2024 financial results and

business outlook at 5:00 p.m. Eastern Time today, May 9, 2024. To

access the conference call, dial (877) 451-6152 for callers in the

U.S. or Canada, or (201) 389-0879 for international callers. The

webcast will be available live on the Investors section of

CarGurus’ website at https://investors.cargurus.com.

An audio replay of the call will also be

available to investors beginning at approximately 9:00 p.m. Eastern

Time today, May 9, 2024, until 11:59 p.m. Eastern Time on May 23,

2024, by dialing (844) 512-2921 for callers in the U.S. or Canada,

or (412) 317-6671 for international callers, and entering passcode

13745030. In addition, an archived webcast will be available on the

Investors section of CarGurus’ website at

https://investors.cargurus.com.

About CarGurus

CarGurus (Nasdaq: CARG) is a multinational,

online automotive platform for buying and selling vehicles that is

building upon its industry-leading listings marketplace with both

digital retail solutions and the CarOffer online wholesale

platform. The CarGurus platform gives consumers the confidence to

purchase and/or sell a vehicle either online or in person, and it

gives dealerships the power to accurately price, effectively

market, instantly acquire, and quickly sell vehicles, all with a

nationwide reach. The Company uses proprietary technology, search

algorithms, and data analytics to bring trust, transparency, and

competitive pricing to the automotive shopping experience. CarGurus

is the most visited automotive shopping site in the U.S.1

1Source: Similarweb: Traffic Report, Q1 2024,

U.S.

CarGurus also operates online marketplaces under

the CarGurus brand in Canada and the U.K. In the U.S. and the U.K.,

CarGurus also operates the Autolist and PistonHeads online

marketplaces, respectively, as independent brands.

To learn more about CarGurus, visit

www.cargurus.com, and for more information about CarOffer, visit

www.caroffer.com.

CarGurus® is a registered trademark of CarGurus,

Inc., and CarOffer® is a registered trademark of CarOffer, LLC. All

other product names, trademarks and registered trademarks are

property of their respective owners.

© 2024 CarGurus, Inc., All Rights Reserved.

Cautionary Language Concerning

Forward-Looking Statements

This press release includes forward-looking

statements. Other than statements of historical facts, all

statements contained in this press release, including statements

regarding our future financial and business performance for the

second quarter 2024; our business and growth strategy and our plans

to execute on our growth strategy; our ability to grow our business

profitably and efficiently; our expectation that we will continue

to invest in growth initiatives; our ability to quickly make

transformations necessary for our business to achieve long-term

goals; and the impact of macro-level issues on our industry,

business, and financial results, are forward-looking statements.

The words “aim,” “anticipate,” “believe,” “could,” “estimate,”

“expect,” “goal,” “guide,” “guidance,” “intend,” “may,” “might,”

“plan,” “potential,” “predicts,” “projects,” “seeks,” “should,”

“target,” “will,” “would,” and similar expressions and their

negatives are intended to identify forward-looking statements. We

have based these forward-looking statements on our current

expectations and projections about future events and financial

trends that we believe may affect our financial condition, results

of operations, business strategy, short-term and long-term business

operations and objectives and financial needs. You should not rely

upon forward-looking statements as predictions of future

events.

These forward-looking statements are subject to

a number of risks and uncertainties that could cause actual results

to differ materially from those reflected in such statements,

including risks related to our growth and our ability to grow our

revenue; our relationships with dealers; competition in the markets

in which we operate; market growth; our ability to innovate; our

ability to realize benefits from our acquisitions and successfully

implement the integration strategies in connection therewith;

increased inflation and interest rates, global supply chain

challenges, and other macroeconomic issues; the material weakness

identified in our internal controls over financial reporting;

changes in our key personnel; natural disasters, epidemics, or

pandemics; and our ability to operate in compliance with applicable

laws, as well as other risks and uncertainties as may be detailed

from time to time in our Annual Reports on Form 10-K and Quarterly

Reports on Form 10-Q and other reports we file with the U.S.

Securities and Exchange Commission. Moreover, we operate in very

competitive and rapidly changing environments. New risks emerge

from time to time. It is not possible for our management to predict

all risks, nor can we assess the impact of all factors on our

business or the extent to which any factor, or combination of

factors, may cause actual results to differ materially from those

contained in any forward-looking statements we may make. In light

of these risks, uncertainties, and assumptions, we cannot guarantee

that future results, levels of activity, performance, achievements,

or events and circumstances reflected in the forward-looking

statements will occur. We are under no duty to update any of these

forward-looking statements after the date of this press release to

conform these statements to actual results or revised expectations,

except as required by law. You should, therefore, not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

Investor Contact:Kirndeep

SinghVice President, Head of Investor

Relationsinvestors@cargurus.com

Media Contact: Maggie Meluzio

Director, Public Relations and External Communications

pr@cargurus.com

Unaudited Condensed Consolidated Balance

Sheets (in thousands, except share and per share data)

|

|

|

As of March 31,

2024 |

|

|

As of December 31,

2023 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

246,342 |

|

|

$ |

291,363 |

|

|

Short-term investments |

|

|

— |

|

|

|

20,724 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $610

and $610, respectively |

|

|

44,298 |

|

|

|

39,963 |

|

|

Inventory |

|

|

391 |

|

|

|

331 |

|

|

Prepaid expenses, prepaid income taxes and other current

assets |

|

|

18,893 |

|

|

|

25,152 |

|

|

Deferred contract costs |

|

|

11,106 |

|

|

|

11,095 |

|

|

Restricted cash |

|

|

2,786 |

|

|

|

2,563 |

|

| Total

current assets |

|

|

323,816 |

|

|

|

391,191 |

|

| Property and

equipment, net |

|

|

108,143 |

|

|

|

83,370 |

|

| Intangible

assets, net |

|

|

21,131 |

|

|

|

23,056 |

|

|

Goodwill |

|

|

157,566 |

|

|

|

157,898 |

|

| Operating

lease right-of-use assets |

|

|

153,711 |

|

|

|

169,682 |

|

| Deferred tax

assets |

|

|

82,392 |

|

|

|

73,356 |

|

| Deferred

contract costs, net of current portion |

|

|

13,015 |

|

|

|

12,998 |

|

| Other

non-current assets |

|

|

11,029 |

|

|

|

7,376 |

|

| Total

assets |

|

$ |

870,803 |

|

|

$ |

918,927 |

|

|

Liabilities, redeemable noncontrolling interest and

stockholders’ equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

46,471 |

|

|

$ |

47,854 |

|

|

Accrued expenses, accrued income taxes and other current

liabilities |

|

|

38,353 |

|

|

|

33,718 |

|

|

Deferred revenue |

|

|

21,432 |

|

|

|

21,322 |

|

|

Operating lease liabilities |

|

|

10,063 |

|

|

|

12,284 |

|

| Total

current liabilities |

|

|

116,319 |

|

|

|

115,178 |

|

| Operating

lease liabilities |

|

|

181,052 |

|

|

|

182,106 |

|

| Deferred tax

liabilities |

|

|

42 |

|

|

|

58 |

|

| Other

non–current liabilities |

|

|

5,028 |

|

|

|

4,733 |

|

| Total

liabilities |

|

|

302,441 |

|

|

|

302,075 |

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $0.001 par value per share; 10,000,000 shares

authorized; no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Class A common stock, $0.001 par value per share; 500,000,000

shares authorized; 89,075,845 and 92,175,243 shares issued and

outstanding at March 31, 2024 and December 31, 2023,

respectively |

|

|

89 |

|

|

|

92 |

|

|

Class B common stock, $0.001 par value per share; 100,000,000

shares authorized; 15,999,173 and 15,999,173 shares issued and

outstanding at March 31, 2024 and December 31, 2023,

respectively |

|

|

16 |

|

|

|

16 |

|

|

Additional paid-in capital |

|

|

194,309 |

|

|

|

263,498 |

|

|

Retained earnings |

|

|

375,448 |

|

|

|

354,147 |

|

|

Accumulated other comprehensive loss |

|

|

(1,500 |

) |

|

|

(901 |

) |

| Total

stockholders’ equity |

|

|

568,362 |

|

|

|

616,852 |

|

| Total

liabilities, redeemable noncontrolling interest and stockholders’

equity |

|

$ |

870,803 |

|

|

$ |

918,927 |

|

Unaudited Condensed Consolidated Income

Statements (in thousands, except share and per share

data)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Revenue |

|

|

|

|

|

|

|

Marketplace |

|

$ |

187,219 |

|

|

$ |

167,127 |

|

|

Wholesale |

|

|

16,125 |

|

|

|

25,186 |

|

|

Product |

|

|

12,452 |

|

|

|

39,650 |

|

|

Total revenue |

|

|

215,796 |

|

|

|

231,963 |

|

| Cost of

revenue (1) |

|

|

|

|

|

|

|

Marketplace |

|

|

14,385 |

|

|

|

15,533 |

|

|

Wholesale |

|

|

14,224 |

|

|

|

22,068 |

|

|

Product |

|

|

12,226 |

|

|

|

39,382 |

|

|

Total cost of revenue |

|

|

40,835 |

|

|

|

76,983 |

|

| Gross

profit |

|

|

174,961 |

|

|

|

154,980 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

Sales and marketing |

|

|

82,274 |

|

|

|

75,577 |

|

|

Product, technology, and development |

|

|

35,545 |

|

|

|

36,607 |

|

|

General and administrative |

|

|

28,066 |

|

|

|

24,919 |

|

|

Depreciation and amortization |

|

|

2,792 |

|

|

|

3,818 |

|

|

Total operating expenses |

|

|

148,677 |

|

|

|

140,921 |

|

| Income from

operations |

|

|

26,284 |

|

|

|

14,059 |

|

| Other

income, net: |

|

|

|

|

|

|

|

Interest income |

|

|

3,906 |

|

|

|

3,743 |

|

|

Other (expense) income, net |

|

|

(505 |

) |

|

|

595 |

|

|

Total other income, net |

|

|

3,401 |

|

|

|

4,338 |

|

| Income

before income taxes |

|

|

29,685 |

|

|

|

18,397 |

|

| Provision

for income taxes |

|

|

8,384 |

|

|

|

6,531 |

|

| Consolidated

net income |

|

|

21,301 |

|

|

|

11,866 |

|

| Net loss

attributable to redeemable noncontrolling interest |

|

|

— |

|

|

|

(4,266 |

) |

| Net income

attributable to common stockholders |

|

|

21,301 |

|

|

|

16,132 |

|

| Net income

per share attributable to common stockholders: |

|

|

|

|

|

|

| Basic |

|

$ |

0.20 |

|

|

$ |

0.14 |

|

| Diluted |

|

$ |

0.20 |

|

|

$ |

0.10 |

|

|

Weighted-average number of shares of common stock used in computing

net income per share attributable to common stockholders: |

|

|

|

|

|

|

| Basic |

|

|

107,174,812 |

|

|

|

115,358,475 |

|

| Diluted |

|

|

108,632,159 |

|

|

|

115,915,737 |

|

(1) Includes depreciation and amortization

expense for the three months ended March 31, 2024 and 2023 of

$4,689 and $7,758, respectively.

Unaudited Segment Revenue (in

thousands)

|

|

|

Three Months

Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

2023 |

| Segment

Revenue: |

|

|

|

|

|

U.S. Marketplace |

|

$ |

172,988 |

|

$ |

155,621 |

|

Digital Wholesale |

|

|

28,577 |

|

|

64,836 |

|

Other |

|

|

14,231 |

|

|

11,506 |

|

Total |

|

$ |

215,796 |

|

$ |

231,963 |

Unaudited Segment (Loss) Income from

Operations (in thousands)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

| Segment

Income (Loss) from Operations: |

|

|

|

|

|

|

|

U.S. Marketplace |

|

$ |

34,217 |

|

|

$ |

26,539 |

|

|

Digital Wholesale |

|

|

(10,340 |

) |

|

|

(11,225 |

) |

|

Other |

|

|

2,407 |

|

|

|

(1,255 |

) |

|

Total |

|

$ |

26,284 |

|

|

$ |

14,059 |

|

Unaudited Condensed Consolidated

Statements of Cash Flows (in thousands)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Operating Activities |

|

|

|

|

|

|

|

Consolidated net income |

|

$ |

21,301 |

|

|

$ |

11,866 |

|

| Adjustments

to reconcile consolidated net income to net cash provided by

operating activities: |

|

|

|

|

|

|

| Depreciation

and amortization |

|

|

7,481 |

|

|

|

11,576 |

|

| Gain on sale

of property and equipment |

|

|

— |

|

|

|

(460 |

) |

| Currency

loss (gain) on foreign denominated transactions |

|

|

384 |

|

|

|

(198 |

) |

| Deferred

taxes |

|

|

(9,052 |

) |

|

|

(11,921 |

) |

| Provision

(Recoveries) for doubtful accounts |

|

|

290 |

|

|

|

(300 |

) |

| Stock-based

compensation expense |

|

|

15,822 |

|

|

|

14,904 |

|

| Amortization

of deferred financing costs |

|

|

129 |

|

|

|

129 |

|

| Amortization

of deferred contract costs |

|

|

3,258 |

|

|

|

2,737 |

|

| Impairment

of long-lived assets |

|

|

— |

|

|

|

175 |

|

| Changes in

operating assets and liabilities: |

|

|

|

|

|

|

|

Accounts receivable |

|

|

(4,182 |

) |

|

|

6,858 |

|

|

Inventory |

|

|

(319 |

) |

|

|

3,645 |

|

|

Prepaid expenses, prepaid income taxes, and other assets |

|

|

5,974 |

|

|

|

4,652 |

|

|

Deferred contract costs |

|

|

(3,326 |

) |

|

|

(5,138 |

) |

|

Accounts payable |

|

|

707 |

|

|

|

10,268 |

|

|

Accrued expenses, accrued income taxes, and other liabilities |

|

|

681 |

|

|

|

4,542 |

|

|

Deferred revenue |

|

|

120 |

|

|

|

8,557 |

|

|

Lease obligations |

|

|

12,696 |

|

|

|

4,453 |

|

| Net cash

provided by operating activities |

|

|

51,964 |

|

|

|

66,345 |

|

|

Investing Activities |

|

|

|

|

|

|

| Purchases of

property and equipment |

|

|

(28,665 |

) |

|

|

(2,398 |

) |

|

Capitalization of website development costs |

|

|

(5,465 |

) |

|

|

(3,489 |

) |

| Purchases of

short-term investments |

|

|

(494 |

) |

|

|

— |

|

| Sale of

short-term investments |

|

|

21,218 |

|

|

|

— |

|

| Advance

payments to customers, net of collections |

|

|

259 |

|

|

|

— |

|

| Net cash

used in investing activities |

|

|

(13,147 |

) |

|

|

(5,887 |

) |

|

Financing Activities |

|

|

|

|

|

|

| Proceeds

from issuance of common stock upon exercise of stock options |

|

|

11 |

|

|

|

19 |

|

| Payment of

withholding taxes on net share settlements of restricted stock

units |

|

|

(5,115 |

) |

|

|

(2,066 |

) |

| Repurchases

of common stock |

|

|

(77,442 |

) |

|

|

(69,024 |

) |

| Payment of

finance lease obligations |

|

|

(18 |

) |

|

|

(17 |

) |

| Payment of

tax distributions to redeemable noncontrolling interest

holders |

|

|

— |

|

|

|

(28 |

) |

| Change in

gross advance payments received from third-party transaction

processor |

|

|

(474 |

) |

|

|

(2,122 |

) |

| Net cash

used in financing activities |

|

|

(83,038 |

) |

|

|

(73,238 |

) |

| Impact of

foreign currency on cash, cash equivalents, and restricted

cash |

|

|

(577 |

) |

|

|

329 |

|

| Net decrease

in cash, cash equivalents, and restricted cash |

|

|

(44,798 |

) |

|

|

(12,451 |

) |

| Cash, cash

equivalents, and restricted cash at beginning of period |

|

|

293,926 |

|

|

|

484,132 |

|

| Cash, cash

equivalents, and restricted cash at end of period |

|

$ |

249,128 |

|

|

$ |

471,681 |

|

Unaudited Reconciliation of GAAP

Consolidated Net Income to Non-GAAP Consolidated Net Income and

Non-GAAP Net Income Attributable to Common Stockholders

(in thousands, except per share data)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

GAAP consolidated net income |

|

$ |

21,301 |

|

|

$ |

11,866 |

|

| Stock-based

compensation expense |

|

|

15,822 |

|

|

|

14,977 |

|

| Amortization

of intangible assets |

|

|

1,882 |

|

|

|

7,534 |

|

|

Transaction-related expenses |

|

|

811 |

|

|

|

— |

|

| Income tax

effects and adjustments |

|

|

(5,018 |

) |

|

|

(5,366 |

) |

| Non-GAAP

consolidated net income |

|

$ |

34,798 |

|

|

$ |

29,011 |

|

| Non-GAAP net

loss attributable to redeemable noncontrolling interest |

|

|

— |

|

|

|

(1,271 |

) |

| Non-GAAP net

income attributable to common stockholders |

|

$ |

34,798 |

|

|

$ |

30,282 |

|

| Non-GAAP net

income per share attributable to common stockholders: |

|

|

|

|

|

|

|

Basic |

|

$ |

0.32 |

|

|

$ |

0.26 |

|

|

Diluted |

|

$ |

0.32 |

|

|

$ |

0.26 |

|

| Shares used

in Non-GAAP per share calculations |

|

|

|

|

|

|

|

Basic |

|

|

107,175 |

|

|

|

115,358 |

|

|

Diluted |

|

|

108,632 |

|

|

|

115,916 |

|

Unaudited Reconciliation of GAAP Net Loss

Attributable to Redeemable Noncontrolling Interest to Non-GAAP Net

Loss Attributable to Redeemable Noncontrolling Interest

(in thousands)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

GAAP net loss attributable to redeemable noncontrolling

interest |

|

$ |

— |

|

|

$ |

(4,266 |

) |

| Stock-based

compensation expense(1) |

|

|

— |

|

|

|

221 |

|

| Amortization

of intangible assets(1) |

|

|

— |

|

|

|

2,774 |

|

| Non-GAAP net

loss attributable to redeemable noncontrolling interest |

|

$ |

— |

|

|

$ |

(1,271 |

) |

(1) These exclusions are adjusted to reflect

the noncontrolling interest of 38% for the period prior to our

acquisition of the remaining minority equity interests in CarOffer,

LLC in December 2023 (the "2023 CarOffer Transaction").

Unaudited Reconciliation of GAAP

Consolidated Net Income to Non-GAAP Consolidated Adjusted EBITDA

and Non-GAAP Adjusted EBITDA (in thousands)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

GAAP consolidated net income |

|

$ |

21,301 |

|

|

$ |

11,866 |

|

| Depreciation

and amortization |

|

|

7,481 |

|

|

|

11,576 |

|

| Impairment

of long-lived assets |

|

|

— |

|

|

|

175 |

|

| Stock-based

compensation expense |

|

|

15,822 |

|

|

|

14,977 |

|

|

Transaction-related expenses |

|

|

811 |

|

|

|

— |

|

| Other

income, net |

|

|

(3,401 |

) |

|

|

(4,338 |

) |

| Provision

for income taxes |

|

|

8,384 |

|

|

|

6,531 |

|

| Non-GAAP

consolidated adjusted EBITDA |

|

|

50,398 |

|

|

|

40,787 |

|

| Non-GAAP

adjusted EBITDA attributable to redeemable noncontrolling

interest |

|

|

— |

|

|

|

(677 |

) |

| Non-GAAP

adjusted EBITDA |

|

$ |

50,398 |

|

|

$ |

41,464 |

|

| |

|

|

|

|

|

|

| Non-GAAP

consolidated adjusted EBITDA margin |

|

|

23 |

% |

|

|

18 |

% |

Unaudited Reconciliation of GAAP Net Loss

Attributable to Redeemable Noncontrolling Interest to Non-GAAP

Adjusted EBITDA Attributable to Redeemable Noncontrolling

Interest (in thousands)

| |

|

Three Months

Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

GAAP net loss attributable to redeemable noncontrolling

interest |

|

$ |

— |

|

|

$ |

(4,266 |

) |

| Depreciation

and amortization (1) |

|

|

— |

|

|

|

2,948 |

|

| Impairment

of long-lived assets (1) |

|

|

— |

|

|

|

67 |

|

| Stock-based

compensation expense (1) |

|

|

— |

|

|

|

221 |

|

| Other

expense, net (1) |

|

|

— |

|

|

|

348 |

|

| Provision

for income taxes (1) |

|

|

— |

|

|

|

5 |

|

| Non-GAAP

adjusted EBITDA attributable to redeemable noncontrolling

interest |

|

$ |

— |

|

|

$ |

(677 |

) |

(1) These exclusions are adjusted to reflect

the noncontrolling interest of 38% for the period prior to the 2023

CarOffer Transaction.

Unaudited Reconciliation of GAAP Gross

Profit to Non-GAAP Gross Profit and GAAP Gross Profit Margin to

Non-GAAP Gross Profit Margin (in thousands, except

percentages)

| |

|

Three Months

Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

Revenue |

|

$ |

215,796 |

|

|

$ |

231,963 |

|

| Cost of

revenue |

|

|

40,835 |

|

|

|

76,983 |

|

| GAAP gross

profit |

|

|

174,961 |

|

|

|

154,980 |

|

| Stock-based

compensation expense included in Cost of revenue |

|

|

231 |

|

|

|

143 |

|

| Amortization

of intangible assets included in Cost of revenue |

|

|

875 |

|

|

|

5,266 |

|

|

Transaction-related expenses included in Cost of revenue |

|

|

92 |

|

|

|

— |

|

| Non-GAAP

gross profit |

|

$ |

176,159 |

|

|

$ |

160,389 |

|

| |

|

|

|

|

|

|

| GAAP gross

profit margin |

|

|

81 |

% |

|

|

67 |

% |

| Non-GAAP

gross profit margin |

|

|

82 |

% |

|

|

69 |

% |

Unaudited Reconciliation of GAAP Expense

to Non-GAAP Expense (in thousands)

| |

|

Three Months

Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

GAAP expense |

|

|

Stock-based compensation

expense |

|

|

Amortization of intangible

assets |

|

|

Transaction-related expenses |

|

|

Non-GAAP expense |

|

|

GAAP expense |

|

|

Stock-based compensation

expense |

|

|

Amortization of intangible

assets |

|

|

Transaction-related expenses |

|

|

Non-GAAP expense |

|

|

Cost of revenue |

|

$ |

40,835 |

|

|

$ |

(231 |

) |

|

$ |

(875 |

) |

|

$ |

(92 |

) |

|

$ |

39,637 |

|

|

$ |

76,983 |

|

|

$ |

(143 |

) |

|

$ |

(5,266 |

) |

|

$ |

— |

|

|

$ |

71,574 |

|

| Sales and

marketing |

|

|

82,274 |

|

|

|

(2,874 |

) |

|

|

— |

|

|

|

(394 |

) |

|

|

79,006 |

|

|

|

75,577 |

|

|

|

(3,084 |

) |

|

|

— |

|

|

|

— |

|

|

|

72,493 |

|

| Product,

technology, and development |

|

|

35,545 |

|

|

|

(5,977 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

29,567 |

|

|

|

36,607 |

|

|

|

(6,289 |

) |

|

|

— |

|

|

|

— |

|

|

|

30,318 |

|

| General and

administrative |

|

|

28,066 |

|

|

|

(6,740 |

) |

|

|

— |

|

|

|

(324 |

) |

|

|

21,002 |

|

|

|

24,919 |

|

|

|

(5,461 |

) |

|

|

— |

|

|

|

— |

|

|

|

19,458 |

|

| Depreciation

& amortization |

|

|

2,792 |

|

|

|

— |

|

|

|

(1,007 |

) |

|

|

— |

|

|

|

1,785 |

|

|

|

3,818 |

|

|

|

— |

|

|

|

(2,268 |

) |

|

|

— |

|

|

|

1,550 |

|

| Operating

expenses(1) |

|

$ |

148,677 |

|

|

$ |

(15,591 |

) |

|

$ |

(1,007 |

) |

|

$ |

(719 |

) |

|

$ |

131,360 |

|

|

$ |

140,921 |

|

|

$ |

(14,834 |

) |

|

$ |

(2,268 |

) |

|

$ |

— |

|

|

$ |

123,819 |

|

| Total cost

of revenue and operating expenses |

|

$ |

189,512 |

|

|

$ |

(15,822 |

) |

|

$ |

(1,882 |

) |

|

$ |

(811 |

) |

|

$ |

170,997 |

|

|

$ |

217,904 |

|

|

$ |

(14,977 |

) |

|

$ |

(7,534 |

) |

|

$ |

— |

|

|

$ |

195,393 |

|

(1) Operating expenses include sales and

marketing, product, technology, and development, general and

administrative, and depreciation & amortization.

Unaudited Reconciliation of GAAP Net Cash

and Cash Equivalents Provided by Operating Activities to Non-GAAP

Free Cash Flow (in thousands)

|

|

|

Three Months

Ended |

|

|

|

|

March 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

GAAP net cash and cash equivalents provided by operating

activities |

|

$ |

51,964 |

|

|

$ |

66,345 |

|

| Purchases of

property and equipment |

|

|

(28,665 |

) |

|

|

(2,398 |

) |

|

Capitalization of website development costs |

|

|

(5,465 |

) |

|

|

(3,489 |

) |

| Non-GAAP

free cash flow |

|

$ |

17,834 |

|

|

$ |

60,458 |

|

Non-GAAP Financial Measures and Other

Business Metrics

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

Generally Accepted Accounting Principles in the U.S. ("GAAP"), we

provide investors with certain non-GAAP financial measures and

other business metrics, which we believe are helpful to our

investors. We use these non-GAAP financial measures and other

business metrics for financial and operational decision-making

purposes and as a means to evaluate period-to-period comparisons.

We believe that these non-GAAP financial measures and other

business metrics provide useful information about our operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to metrics used by our management in its

financial and operational decision-making.

The presentation of non-GAAP financial

information and other business metrics is not meant to be

considered in isolation or as a substitute for the directly

comparable financial measures prepared in accordance with GAAP.

While our non-GAAP financial measures and other business metrics

are an important tool for financial and operational decision-making

and for evaluating our own operating results over different periods

of time, we urge investors to review the reconciliation of these

financial measures to the comparable GAAP financial measures

included above, and not to rely on any single financial measure to

evaluate our business.

While a reconciliation of non-GAAP guidance

measures to corresponding GAAP measures is not available on a

forward-looking basis without unreasonable effort due to, as

applicable, the timing, amount, valuation, and number of future

employee equity awards and the uncertainty relating to the timing,

frequency, and effect of acquisitions and the significance of the

resulting transaction-related expenses, we have provided a

reconciliation of non-GAAP financial measures and other business

metrics to the nearest comparable GAAP measures in the accompanying

financial statement tables included in this press release.

We monitor operating measures of certain

non-GAAP items including non-GAAP gross profit, non-GAAP gross

margin, non-GAAP expense, non-GAAP consolidated net income,

non-GAAP net income attributable to common stockholders, and

non-GAAP net income per share attributable to common stockholders.

These non-GAAP financial measures exclude the effect of stock-based

compensation expense, amortization of intangible assets, and

transaction related-expenses. Non-GAAP consolidated net income,

non-GAAP net income attributable to common stockholders, and

non-GAAP net income per share attributable to common stockholders

also exclude certain income tax effects and adjustments. Non-GAAP

net income attributable to common stockholders and non-GAAP net

income per share attributable to common stockholders also exclude

non-GAAP net loss attributable to redeemable noncontrolling

interest. We define non-GAAP net loss attributable to redeemable

noncontrolling interest as net loss attributable to redeemable

noncontrolling interest, adjusted to exclude: stock-based

compensation expense and amortization of intangible assets. These

exclusions are adjusted for redeemable noncontrolling interest, as

applicable. Our calculations of non-GAAP net income per share

attributable to common stockholders utilize applicable GAAP share

counts as included in the accompanying financial statement tables

included in this press release. In addition, we evaluate our

non-GAAP gross profit in relation to our revenue. We refer to this

as non-GAAP gross profit margin and define it as non-GAAP gross

profit divided by total revenue. We believe that these non-GAAP

financial measures provide useful information about our operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to metrics used by our management in its

financial and operational decision-making.

We define Consolidated Adjusted EBITDA as

consolidated net income, adjusted to exclude: depreciation and

amortization, impairment of long-lived assets, stock‑based

compensation expense, transaction-related expenses, other income,

net, and provision for income taxes. We define Adjusted EBITDA as

Consolidated Adjusted EBITDA adjusted to exclude Adjusted EBITDA

attributable to redeemable noncontrolling interest. We define

Adjusted EBITDA attributable to redeemable noncontrolling interest

as net loss attributable to redeemable noncontrolling interest,

adjusted to exclude: depreciation and amortization, impairment of

long-lived assets, stock‑based compensation expense, other expense,

net, and provision for income taxes. These exclusions are adjusted

for redeemable noncontrolling interest of 38% by taking the

noncontrolling interest's full financial results and multiplying

each line item in the reconciliation by 38%. We note that we use

38%, versus 49%, to allocate the share of loss because it

represents the portion attributable to the redeemable

noncontrolling interest. The 38% is exclusive of CO Incentive

Units, Subject Units, and 2021 Incentive Units (as each term is

defined in Note 2 to the consolidated financial statements included

in the Company's Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the U.S. Securities and Exchange

Commission on February 26, 2024), which are liability-classified

awards that do not participate in the share of loss. Adjusted

EBITDA attributable to redeemable noncontrolling interest is

reflective of the 2023 CarOffer Transaction. Following the 2023

CarOffer Transaction, there was no redeemable noncontrolling

interest as of December 1, 2023, and as a result, Consolidated

Adjusted EBITDA is equivalent to Adjusted EBITDA for the three

months ended March 31, 2024.

In addition, we evaluate our Adjusted EBITDA in

relation to our revenue. We refer to this as Adjusted EBITDA margin

and define it as Adjusted EBITDA divided by total revenue.

We have presented Consolidated Adjusted EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin, because they are key

measures used by our management and Board of Directors to

understand and evaluate our operating performance, generate future

operating plans, and make strategic decisions regarding the

allocation of capital. In particular, we believe that the exclusion

of certain items in calculating Consolidated Adjusted EBITDA,

Adjusted EBITDA and Adjusted EBITDA margin can produce a useful

measure for period‑to‑period comparisons of our business. We have

presented Adjusted EBITDA attributable to redeemable noncontrolling

interest because it is used by our management to reconcile

Consolidated Adjusted EBITDA to Adjusted EBITDA. It represents the

portion of Consolidated Adjusted EBITDA that is attributable to our

redeemable noncontrolling interest. Adjusted EBITDA attributable to

redeemable noncontrolling interest is not intended to be reviewed

on its own.

We define Free Cash Flow as cash flow from

operations, adjusted to include purchases of property and equipment

and capitalization of website development costs. We have presented

Free Cash Flow because it is a measure of our financial performance

that represents the cash that we are able to generate after

expenditures required to maintain or expand our asset base.

We define a paying dealer as a dealer account

with an active, paid marketplace subscription at the end of a

defined period. The number of paying dealers we have is important

to us and we believe it provides valuable information to investors

because it is indicative of the value proposition of our

marketplace products, as well as our sales and marketing success

and opportunity, including our ability to retain paying dealers and

develop new dealer relationships.

We define QARSD, which is measured at the end of

a fiscal quarter, as the marketplace revenue primarily from

subscriptions to our Listings packages, Real-time Performance

Marketing, our digital advertising suite, and other digital add-on

products during that trailing quarter divided by the average number

of paying dealers in that marketplace during the quarter. We

calculate the average number of paying dealers for a period by

adding the number of paying dealers at the end of such period and

the end of the prior period and dividing by two. This information

is important to us, and we believe it provides useful information

to investors, because we believe that our ability to grow QARSD is

an indicator of the value proposition of our products and the

return on investment that our paying dealers realize from our

products. In addition, increases in QARSD, which we believe reflect

the value of exposure to our engaged audience in relation to

subscription cost, are driven in part by our ability to grow the

volume of connections to our users and the quality of those

connections, which result in increased opportunity to upsell

package levels and cross-sell additional products to our paying

dealers.

For each of our websites (excluding the CarOffer

website), we define a monthly unique user as an individual who has

visited any such website within a calendar month, based on data as

measured by Google Analytics. We calculate average monthly unique

users as the sum of the monthly unique users of each of our

websites in a given period, divided by the number of months in that

period. We count a unique user the first time a computer or mobile

device with a unique device identifier accesses any of our websites

during a calendar month. If an individual accesses a website using

a different device within a given month, the first access by each

such device is counted as a separate unique user. If an individual

uses multiple browsers on a single device and/or clears their

cookies and returns to our website within a calendar month, each

such visit is counted as a separate unique user. We view our

average monthly unique users as a key indicator of the quality of

our user experience, the effectiveness of our advertising and

traffic acquisition, and the strength of our brand awareness.

Measuring unique users is important to us and we believe it

provides useful information to our investors because our

marketplace revenue depends, in part, on our ability to provide

dealers with connections to our users and exposure to our

marketplace audience. We define connections as interactions between

consumers and dealers on our marketplace through phone calls,

email, managed text and chat, and clicks to access the dealer’s

website or map directions to the dealership.

We define monthly sessions as the number of

distinct visits to our websites (excluding the CarOffer website)

that take place each month within a given time frame, as measured

and defined by Google Analytics. We calculate average monthly

sessions as the sum of the monthly sessions in a given period,

divided by the number of months in that period. A session is

defined as beginning with the first page view from a computer or

mobile device and ending at the earliest of when a user closes

their browser window, after 30 minutes of inactivity, or each night

at midnight (i) Eastern Time for our U.S. and Canada websites,

other than the Autolist website, (ii) Pacific Time for the Autolist

website, and (iii) Greenwich Mean Time for our U.K. websites. A

session can be made up of multiple page views and visitor actions,

such as performing a search, visiting vehicle detail pages, and

connecting with a dealer. We believe that measuring the volume of

sessions in a time period, when considered in conjunction with the

number of unique users in that time period, is an important

indicator to us of consumer satisfaction and engagement with our

marketplace, and we believe it provides useful information to our

investors because the more satisfied and engaged consumers we have,

the more valuable our service is to dealers.

We define Transactions within the Digital

Wholesale segment as the number of vehicles processed from car

dealers, consumers, and other marketplaces through the CarOffer

website within the applicable period. Transactions consists of each

unique vehicle (based on vehicle identification number) that

reaches "sold and invoiced" status on the CarOffer website within

the applicable period, including vehicles sold to car dealers,

vehicles sold at third-party auctions, vehicles ultimately sold to

a different buyer, and vehicles that are returned to their owners

without completion of a sale transaction. We exclude vehicles

processed within CarOffer's intra-group trading solution (Group

Trade) from the definition of Transactions, and we only count any

unique vehicle once even if it reaches sold status multiple times.

Digital Wholesale includes Dealer-to-Dealer transactions and IMCO

transactions. We view Transactions as a key business metric, and we

believe it provides useful information to investors, because it

provides insight into growth and revenue for the Digital Wholesale

segment. Transactions drive a significant portion of Digital

Wholesale segment revenue. We believe growth in Transactions

demonstrates consumer and dealer utilization and our market share

penetration in the Digital Wholesale segment.

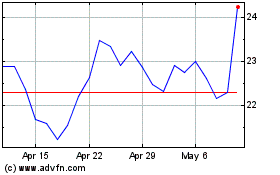

CarGurus (NASDAQ:CARG)

Historical Stock Chart

From Apr 2024 to May 2024

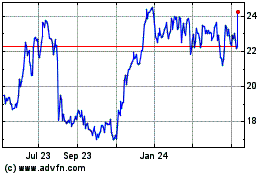

CarGurus (NASDAQ:CARG)

Historical Stock Chart

From May 2023 to May 2024