0001285550FALSE00012855502024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________

FORM 8-K

_________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 7, 2024

_________________________________________

CLEARPOINT NEURO, INC.

(Exact name of registrant as specified in its charter)

_________________________________________

| | | | | | | | |

Delaware | 001-34822 | 58-2394628 |

(State or other jurisdiction of incorporation) | (Commission

File Number) | (I.R.S. Employer Identification Number) |

120 S. Sierra Ave., Suite 100

Solana Beach, CA 92075

(Address of principal executive offices, zip code)

(888) 287-9109

(Registrant’s telephone number, including area code)

_________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | CLPT | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On May 7, 2024, ClearPoint Neuro, Inc. (the “Company”) issued a press release announcing its financial performance for the first fiscal quarter ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in Item 2.02 of this Form 8-K, as well as Exhibit 99.1 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On May 7, 2024, the Company posted an updated investor presentation to its website at http://ir.stockpr.com/clearpointneuro/investor-presentations. A copy of the investor presentation is being furnished herewith as Exhibit 99.2. The Company may use the investor presentation from time to time in conversations with analysts, investors and others.

The information in Item 7.01 of this Form 8-K, as well as Exhibit 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

| | | | | |

| Exhibit 99.1 | |

| |

| Exhibit 99.2 | |

| |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: May 7, 2024 | CLEARPOINT NEURO, INC. |

| | |

| By: | /s/ Danilo D’Alessandro |

| | Danilo D’Alessandro |

| | Chief Financial Officer |

Exhibit 99.1

ClearPoint Neuro Reports First Quarter 2024 Results

First Quarter Revenue Growth +41%; Record Revenue Achieved

SOLANA BEACH, CA, May 7, 2024 – ClearPoint Neuro, Inc. (Nasdaq: CLPT) (the “Company”), a global device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine, today announced financial results for its first quarter ended March 31, 2024.

First Quarter Highlights

•Reported quarterly revenue of $7.6 million, a 41% year-over-year increase;

•Increased biologics and drug delivery revenue to $4.3 million, a 61% year-over-year increase;

•Partner PTC Therapeutics submitted first-ever neuro gene therapy BLA to the FDA;

•Received 510(k) clearance for SmartFrame OR™ Stereotactic System to support expansion into the Operating Room and performed first clinical cases;

•Activated eight new hospital customers in the first quarter, a new Company record for a quarter and bringing our total number of global centers to over 80 sites;

•Operational cash burn reduced to $3.8 million, a 32% year-over-year decrease;

•Completed a public offering of common stock, resulting in net proceeds of approximately $16.2 million;

•Cash and cash equivalents totaled $35.4 million as of March 31, 2024.

“Our ClearPoint Neuro team enjoyed the best operating performance in our Company’s history, with contributions coming from all four of our growth pillars,” commented Joe Burnett, President and CEO at ClearPoint Neuro. “Overall, the company achieved record revenue of $7.6 million or 41% growth, led by 61% growth in biologics and drug delivery revenue, and 255% growth in capital sales and service, which were also both new records. We were thrilled to see not only over 60% growth in the core biologics business, but to see many of our partners progress from a regulatory standpoint including the first neuro gene therapy BLA ever submitted to the FDA, and first patient enrolled in multiple partner IDE trials since the start of the year.”

“Our device business activated eight new sites in the quarter,” continued Burnett, “which was our fastest activation period ever. For perspective, historically our Company would activate about eight new customers in a calendar year, and here we activated eight in the first quarter alone, with a very healthy funnel of additional activations expected this year. These new sites are going through training and are expected to support our case volume and disposable revenue growth starting in the second quarter, both using our legacy MRI guided navigation system as well as our new FDA cleared Operating Room Navigation system, the SmartFrame OR, for which we initiated a limited market release in Q1 and successfully performed our initial clinical cases. We have also placed multiple new Prism laser therapy systems and so far this year released a new software version to improve workflow and performance. We also achieved FDA clearance of a key ancillary bone anchor which will facilitate laser applicators being placed not only with ClearPoint navigation, but with other common operating room navigation and robotic systems. ClearPoint Neuro’s first quarter accomplishments were achieved while keeping our operating expenses relatively flat year over year and reducing our operational cash burn by more than 30%. Our successful capital raise of $16.2 million in net proceeds not only brought new

institutional investors into our Company, but also solidified our balance sheet with $35.4 million in cash and cash equivalents at the end of the quarter. The team is excited to have started 2024 off strong with many more important milestones expected this year.”

Business Outlook

The Company reaffirms its full year 2024 revenue outlook of between $28.0 and $32.0 million.

Financial Results – Quarter Ended March 31, 2024

Total revenue was $7.6 million for the three months ended March 31, 2024, and $5.4 million for the three months ended March 31, 2023, which represents an increase of $2.2 million, or 41%.

Biologics and drug delivery revenue, which includes sales of disposable products and services related to customer-sponsored pre-clinical and clinical trials utilizing our products, increased 61% to $4.3 million for the three months ended March 31, 2024, from $2.7 million for the same period in 2023.

Functional neurosurgery navigation and therapy revenue, decreased 18% to $1.9 million for the three months ended March 31, 2024, from $2.4 million for the same period in 2023. The decrease is driven primarily by lower service revenue of $0.5 million as a result of pausing a co-development program with one of our Brain Computer Interface partners.

Capital equipment and software revenue, consisting of sales of ClearPoint reusable hardware and software, and of related services, increased 255% to $1.4 million for the three months ended March 31, 2024, from $0.4 million for the same period in 2023 due to a large increase in the placements of ClearPoint navigation capital and software and Prism laser units.

Gross margin for the three months ended March 31, 2024, was 59%, in line with gross margin of 59% for the three months ended March 31, 2023.

Operating expenses for the first quarter of 2024 were $8.8 million, compared to $8.9 million for the first quarter of 2023. The decrease was mainly driven by lower product development costs and bad debt expense, partially offset by higher sales and marketing personnel expense.

At March 31, 2024, the Company had cash and cash equivalents totaling $35.4 million as compared to $23.1 million at December 31, 2023, with the increase resulting from the net proceeds from the public offering of common stock of $16.2 million, partially offset by the use of cash in operating activities of $3.8 million.

Teleconference Information

Investors and analysts are invited to listen to a live broadcast review of the Company's 2024 first quarter on Tuesday, May 7, 2024 at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) which may be accessed online here: https://event.choruscall.com/mediaframe/webcast.html?webcastid=8hsthhLn. Investors and analysts who would like to participate in the conference call via telephone may do so at (877) 407-9034, or at (201) 493-6737 if calling from outside the U.S. or Canada.

For those who cannot access the live broadcast, a replay will be available shortly after the completion of the call until June 7, 2024, by calling (877) 660-6853 or (201) 612-7415 if calling from outside the U.S. or Canada, and then entering conference I.D. number 413671. An online archive of the broadcast will be available on the Company's Investor website at https://ir.clearpointneuro.com/.

About ClearPoint Neuro

ClearPoint Neuro is a device, cell, and gene therapy-enabling company offering precise navigation to the brain and spine. The Company uniquely provides both established clinical products as well as pre-clinical development services for controlled drug and device delivery. The Company’s flagship product, the ClearPoint Neuro Navigation System, has FDA clearance and is CE-marked. ClearPoint Neuro is engaged with healthcare

and research centers in North America, Europe, Asia, and South America. The Company is also partnered with the most innovative pharmaceutical/biotech companies, academic centers, and contract research organizations, providing solutions for direct CNS delivery of therapeutics in pre-clinical studies and clinical trials worldwide. To date, thousands of procedures have been performed and supported by the Company’s field-based clinical specialist team, which offers support and services to our customers and partners worldwide. For more information, please visit www.clearpointneuro.com.

Forward-Looking Statements

Statements in this press release and in the teleconference referenced above concerning the Company’s plans, growth and strategies may include forward-looking statements within the context of the federal securities laws. Statements regarding the Company's future events, developments and future performance, the size of total addressable markets or the market opportunity for the Company’s products and services, the Company’s expectation for revenues, operating expenses, the adequacy of cash and cash equivalent balances to support operations and meet future obligations, as well as management's expectations, beliefs, plans, estimates or projections relating to the future, are forward-looking statements within the meaning of these laws. These forward-looking statements are based on management’s current expectations and are subject to the risks inherent in the business, which may cause the Company's actual results to differ materially from those expressed in or implied by forward-looking statements. Particular uncertainties and risks include those relating to: global and political instability, supply chain disruptions, labor shortages, and macroeconomic and inflationary conditions; future revenue from sales of the Company’s products and services; the Company’s ability to market, commercialize and achieve broader market acceptance for new products and services offered by the Company; the ability of our biologics and drug delivery partners to achieve commercial success, including their use of the Company’s products and services in their delivery of therapies; the Company’s expectations, projections and estimates regarding expenses, future revenue, capital requirements, and the availability of and the need for additional financing; the Company’s ability to obtain additional funding to support its research and development programs; the ability of the Company to manage the growth of its business; the Company’s ability to attract and retain its key employees; and risks inherent in the research, development, and regulatory approval of new products. More detailed information on these and additional factors that could affect the Company’s actual results are described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the Securities and Exchange Commission, and the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024, which the Company intends to file with the Securities and Exchange Commission on or before May 15, 2024. The Company does not assume any obligation to update these forward-looking statements.

Contact:

Media Contact:

Jacqueline Keller, Vice President of Marketing

(888) 287-9109 ext. 4

info@clearpointneuro.com

Investor Relations:

Danilo D’Alessandro, Chief Financial Officer

(888) 287-9109 ext. 3

ir@clearpointneuro.com

CLEARPOINT NEURO, INC.

Consolidated Statements of Operations

(Unaudited)

(in thousands, except for share and per share data)

| | | | | | | | | | | |

| For The Three Months Ended

March 31, |

| 2024 | | 2023 |

| Revenue: | | | |

| Product revenue | $ | 3,635 | | | $ | 2,630 | |

| Service and other revenue | 4,004 | | | 2,803 | |

| Total revenue | 7,639 | | | 5,433 | |

| Cost of revenue | 3,114 | | | 2,231 | |

| Gross profit | 4,525 | | | 3,202 | |

| Research and development costs | 2,625 | | | 3,023 | |

| Sales and marketing expenses | 3,290 | | | 2,933 | |

| General and administrative expenses | 2,841 | | | 2,958 | |

| Operating loss | (4,231) | | | (5,712) | |

| Other expense: | | | |

| Other expense, net | (26) | | | (11) | |

| Interest income, net | 111 | | | 114 | |

| Net loss | $ | (4,146) | | | $ | (5,609) | |

| Net loss per share attributable to common stockholders: | | | |

| Basic and diluted | $ | (0.16) | | | $ | (0.23) | |

| Weighted average shares used in computing net loss per share: | | | |

| Basic and diluted | 25,452,096 | | | 24,583,163 | |

CLEARPOINT NEURO, INC.

Consolidated Balance Sheets

(in thousands, except for share and per share data)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| (Unaudited) | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 35,353 | | | $ | 23,140 | |

| Accounts receivable, net | 2,511 | | | 3,211 | |

| Inventory, net | 7,960 | | | 7,911 | |

| Prepaid expenses and other current assets | 1,746 | | | 1,910 | |

| Total current assets | 47,570 | | | 36,172 | |

| Property and equipment, net | 1,347 | | | 1,389 | |

| Operating lease, right-of-use assets | 3,447 | | | 3,564 | |

| Software license inventory | 237 | | | 386 | |

| Licensing rights | 887 | | | 1,041 | |

| Other assets | 149 | | | 109 | |

| Total assets | $ | 53,637 | | | $ | 42,661 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 844 | | | $ | 393 | |

| Accrued compensation | 1,634 | | | 2,947 | |

| Other accrued liabilities | 986 | | | 1,053 | |

| Operating lease liabilities, current portion | 497 | | | 424 | |

| Deferred product and service revenue, current portion | 1,232 | | | 2,613 | |

| 2020 senior secured convertible note payable, net | 9,964 | | | — | |

| Total current liabilities | 15,157 | | | 7,430 | |

| Operating lease liabilities, net of current portion | 3,438 | | | 3,568 | |

| Deferred product and service revenue, net of current portion | 458 | | | 541 | |

| 2020 senior secured convertible note payable, net | — | | | 9,949 | |

| Total liabilities | 19,053 | | | 21,488 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.01 par value; 25,000,000 shares authorized; none issued and outstanding at March 31, 2024 and December 31, 2023 | — | | | — | |

Common stock, $0.01 par value; 90,000,000 shares authorized at March 31, 2024 and December 31, 2023; 27,416,345 shares issued and outstanding at March 31, 2024; and 24,652,729 issued and outstanding at December 31, 2023 | 274 | | | 247 | |

| Additional paid-in capital | 210,912 | | | 193,382 | |

| Accumulated deficit | (176,602) | | | (172,456) | |

| Total stockholders’ equity | 34,584 | | | 21,173 | |

| Total liabilities and stockholders’ equity | $ | 53,637 | | | $ | 42,661 | |

CLEARPOINT NEURO, INC.

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| For The Three Months Ended

March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (4,146) | | | $ | (5,609) | |

| Adjustments to reconcile net loss to net cash flows from operating activities: | | | |

| Allowance for credit losses (recoveries) | (146) | | | 171 | |

| Depreciation and amortization | 243 | | | 129 | |

| Share-based compensation | 1,504 | | | 1,307 | |

| Amortization of debt issuance costs and original issue discounts | 15 | | | 14 | |

| Amortization of lease right-of-use, net of accretion in lease liabilities | 231 | | | 142 | |

| Accretion of discounts on short-term investments | — | | | (69) | |

| Increase (decrease) in cash resulting from changes in: | | | |

| Accounts receivable | 846 | | | (184) | |

| Inventory, net | 53 | | | (578) | |

| Prepaid expenses and other current assets | 165 | | | (42) | |

| Other assets | (39) | | | — | |

| Accounts payable and accrued expenses | (931) | | | (959) | |

| | | |

| Lease liabilities | (171) | | | (146) | |

| Deferred revenue | (1,464) | | | 144 | |

| Net cash flows from operating activities | (3,840) | | | (5,680) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | — | | | (138) | |

| Net cash flows from investing activities | — | | | (138) | |

| Cash flows from financing activities: | | | |

| Proceeds from public offering of common stock, net of offering costs | 16,183 | | | — | |

| Proceeds from stock option exercises | 21 | | | — | |

| Payments for taxes related to net share settlement of equity awards | (151) | | | (5) | |

| Net cash flows from financing activities | 16,053 | | | (5) | |

| Net change in cash and cash equivalents | 12,213 | | | (5,823) | |

| Cash and cash equivalents, beginning of period | 23,140 | | | 27,615 | |

| Cash and cash equivalents, end of period | $ | 35,353 | | | $ | 21,792 | |

| | | |

| SUPPLEMENTAL CASH FLOW INFORMATION | | | |

| Cash paid for: | | | |

| Income taxes | $ | — | | | $ | — | |

| Interest | $ | 185 | | | $ | 179 | |

© 2 0 2 4 C L E A R P O I N T N E U R O 1

© 2 0 2 4 C L E A R P O I N T N E U R O 2 This presentation and discussion contain forward-looking statements within the context of the federal securities laws, including the Company’s expectation for revenues, gross margin, the adequacy of cash and cash equivalent balances to support operations and meet future obligations, the future market of its products and services, and other performance and results. These forward looking statements are based on management’s current expectations and are subject to the risks inherent in the business, which may cause the Company's actual results to differ materially from those expressed in or implied by forward-looking statements. Particular uncertainties and risks include those relating to: global and political instability, supply chain disruptions, labor shortages, and macroeconomic and inflationary conditions; future revenue from sales of the Company’s products and services; the Company’s ability to market, commercialize and achieve broader market acceptance for new products and services offered by the Company; the ability of our biologics and drug delivery partners to achieve commercial success, including their use of the Company’s products and services in their delivery of therapies; the Company’s expectations, projections and estimates regarding expenses, future revenue, capital requirements, and the availability of and the need for additional financing; the Company’s ability to obtain additional funding to support its research and development programs; the ability of the Company to manage the growth of its business; the Company’s ability to attract and retain its key employees; and risks inherent in the research, development, and regulatory approval of new products. More detailed information on these and additional factors that could affect the Company’s actual results are described in the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the Securities and Exchange Commission, and the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2024, which the Company intends to file with the Securities and Exchange Commission on or before May 15, 2024. The Company does not assume any obligation to update these forward looking statements.

© 2 0 2 4 C L E A R P O I N T N E U R O 3

• • • • • • • • • • • *Including owned and licensed patents 4

5© 2 0 2 4 C L E A R P O I N T N E U R O

ClearPoint Neuro Navigation Software v.2.2.1 With Integrated ClearPoint Maestro® Brain Model SmartFrame Array® Software v.1.2 ClearPoint Maestro® Brain Model Inflexion® Head Fixation Frame ClearPoint Prism® Neuro Laser Therapy System MRI Monitor Multi-Positional Head Fixation Frame Accessory Kit (4Fr, 5Fr, and 7Fr Available) SmartFrame Array® Kit Components Capital Hardware and Software Disposables 6© 2 0 2 4 C L E A R P O I N T N E U R O SmartFlow® Cannula ClearPoint Prism® Neuro Laser Fibers SmartFrame® XG Kit Components

7 (A) (B) (B,D) © 2 0 2 4 C L E A R P O I N T N E U R O (A) Estimated and subject to revision (B) Unaudited as of, and for the quarter ended, March 31, 2024 (C) Including owned and licensed patents (D) For the Trailing Twelve Months (TTM) (C) Revenue Guidance $7.4 $11.2 $12.8 $16.3 $20.6 $24.0 $28.0 - $32.0 2018 2019 2020 2021 2022 2023 2024 CAGR > 25%

© 2 0 2 1 C L E A R P O I N T N E U R O 8 • 1,500 sq. ft Class 8 Clean Room with Expansion Capability • 1,300 sq. ft Dedicated R&D Lab Space • ISO 13485/MDSAP/EU MDR Certified Quality System • Successful Audit Outcomes from Global Regulatory Bodies and Pharma • Training Facility with over 100 Surgeons and Pharma Scientist Visitors 8© 2 0 2 4 C L E A R P O I N T N E U R O

© 2 0 2 4 C L E A R P O I N T N E U R O 9

© 2 0 2 4 C L E A R P O I N T N E U R O 10 VISUALASE ClearPoint Navigation is Compatible with all Major Diagnostic and Intraoperative MRI Scanners …with 50+ industry and academic partners *In approved clinical trials and preclinical studies.

Parkinson’s Disease 1,000,0001 60,0001 • $270 M - $1.35 B Drug Resistant Epilepsy 900,0002 11,0003 • $49.5 M - $198 M Refractory Essential Tremor 3,500,0004 60,0005 $180 M - $1.08 B Brain Tumors (n=3)6 35,0007,8 13,3007,8 $33.3 M - $300 M Severe Obsessive-Compulsive Disorder 500,0009,10 10,0009,10 $45 M - $75 M Dystonia 250,00011 8,00012 $36 M - $60 M Rare Genetic/Lysosomal (n=7)13 36,50014-18 3,00014,19,20 $13.5 M - $67.5 M Paralysis / Spinal Cord (n=15)21,22 331,00022-24 17,90023 $80.6 M - $403 M Huntington’s Disease 30,00025 4,00025 $18 M - $90 M Alzheimer’s Disease 6,000,00026 500,00026 $1.5 B - $11.3 B Severe Major Depressive Disorder 1,000,00010 20,00010,27 $90 M - $150 M Stroke Rehabilitation 2,000,00028 610,00028 $1.83 B - $5.49 B Frontotemporal Dementia 60,00029 12,00029 $54 M – $270 M $4.2 B - $20.8 B 11 *Citations & footnotes on next slide Indication Patient Population Annual Incidence Pillar 2: DBS & BCI Pillar 3: Laser Therapy Pillar 1: Drug/Cell Delivery Incremental Revenue from Annual Incidence Pillar 4: Global Expansion Commercial U.S or EU ClearPoint procedures today ~2 X U.S. Revenue Active clinical trial Pre-clinical study/testing © 2 0 2 4 C L E A R P O I N T N E U R O

© 2 0 2 4 C L E A R P O I N T N E U R O 12 1. “Parkinson’s Disease Statistics,” Parkinson’s News Today, https://parkinsonsnewstoday.com/parkinsons-disease-statistics/#:~:text=An%20estimated%20seven%20to%2010,who%20are%2080%20and%20older 2. Neurona Therapeutics. (2024 April 15). Neurona Therapeutics Presents Positive Clinical Update from NRTX-1001 Cell Therapy Trial in Adults with Drug-resistant Focal Epilepsy at American Academy of Neurology (AAN) 2024 Annual Meeting [Press release] https://www.neuronatherapeutics.com/news/press-releases/041524/ 3. Asadi-Pooya AA, Stewart GR, Abrams DJ, Sharan A. Prevalence and Incidence of Drug-Resistant Mesial Temporal Lobe Epilepsy in the United States. World Neurosurg. 2017;99:662-666. 4. Zesiewicz TA, Chari A, Jahan I, Miller AM, Sullivan KL. Overview of essential tremor. Neuropsychiatr Dis Treat. 2010;6:401-408. Published 2010 Sep 7. 5. Diaz NL, Louis ED. Survey of medication usage patterns among essential tremor patients: movement disorder specialists vs. general neurologists. Parkinsonism Relat Disord. 2010;16(9):604-607. 6. Includes: Glioblastoma, Diffuse Intrinsic Pontine Glioma and deep small eloquent brain tumors. 7. “Glioblastoma Multiforme,” American Association of Neurological Surgeons, https://www.aans.org/en/Patients/Neurosurgical-Conditions-and-Treatments/Glioblastoma-Multiforme 8. “About DIPG/DMG,” DIPG/DMG Registry, https://dipgregistry.org/patients-families/about-dipg-dmg/ 9. Medtronic Clinical Summary – Reclaim DBS for Chronic Extreme OCD M947128A001. 10. Mantovani A, Lisanby SH. Brain stimulation in the treatment of anxiety disorders. In: Simpson HB, Neria Y, Lewis-Fernández R, Schneier F, eds. Anxiety Disorders: Theory, Research and Clinical Perspectives. Cambridge: Cambridge University Press; 2010:323-335. 11. https://www.aans.org/en/Patients/Neurosurgical-Conditions-and-Treatments/Dystonia 12. Medtronic DBS Therapy for Dystonia - Clinical Summary 2015. M944810A002 Rev A 13. Includes: AADC deficiency, Friedreich’s ataxia, Sanfilippo syndrome, multiple system atrophy, metachromatic leukodystrophy, and spinocerebellar ataxia type 3. 14. "Multiple System Atrophy," Medscape, https://emedicine.medscape.com/article/1154583-overview#a6 15. PTC Therapeutics November 30, 2021 Corporate Presentation, https://ir.ptcbio.com/static-files/0fd5d54f-55b8-416b-8006-4eb4c0d82f45 16. “Spinocerebellar ataxia type 3,” Orphanet, https://www.orpha.net/consor/cgi-bin/OC_Exp.php?lng=EN&Expert=98757 17. Lysogene Corporate Presentation at 38th Annual J.P. Morgan Healthcare Conference on Jan 13, 2020, http://www.lysogene.com/wp-content/uploads/2020/01/jpm-2020-corporate-presentation_final.pdf 18. “Metachromatic Leukodystrophy,” National Organization of Rare Disorders, https://rarediseases.org/rare-diseases/metachromatic-leukodystrophy/ 19. “Aromatic L’Amino Acid Decarboxylase Deficiency,” National Organization for Rare Disorders, https://rarediseases.org/rare-diseases/aromatic-l-amino-acid-decarboxylase-deficiency/ 20. Puckett Y, Mallorga-Hernández A, Montaño AM. Epidemiology of mucopolysaccharidoses (MPS) in United States: challenges and opportunities. Orphanet J Rare Dis. 2021;16(1):241. Published 2021 May 29. 21. Includes: stroke, spinal cord injury, multiple sclerosis, cerebral palsy, other (traumatic brain injury, complications from surgery, amyotrophic lateral sclerosis, neurofibromatosis, Chiari malformation, syringomyelia, postpolio syndrome, spinal muscular atrophy, Friedreich’s ataxia, transverse myelitis, and spina bifida). 22. Armour BS, Courtney-Long EA, Fox MH, Fredine H, Cahill A. Prevalence and Causes of Paralysis-United States, 2013. Am J Public Health. 2016;106(10):1855-1857. 23. Wyndaele M, Wyndaele JJ. Incidence, prevalence and epidemiology of spinal cord injury: what learns a worldwide literature survey?. Spinal Cord. 2006;44(9):523-529. 24. National Spinal Cord Injury Statistical Center (NSCISC): 2020 Annual Report and 2021 Facts and Figures. https://www.nscisc.uab.edu/ 25. “Huntington’s Disease,” Mov Disord. 2019 Jun; 34(6): 858–865. 26. “Alzheimer’s Disease: Facts & Figures,” Brightfocus Foundation, https://www.brightfocus.org/alzheimers/article/alzheimers-disease-facts-figures 27. Goodman WK, Alterman RL. Deep brain stimulation for intractable psychiatric disorders. Annu Rev Med. 2012;63:511-524. 28. “Stroke Facts,” Center for Disease Control and Prevention, https://www.cdc.gov/stroke/facts.htm 29. Onyike CU, Diehl-Schmid J. The epidemiology of frontotemporal dementia. Int Rev Psychiatry. 2013;25(2):130-137.

NEW THERAPY DEVICES NEURO NAVIGATION FOR DBS BIOLOGICS & DRUG DELIVERY 20252024 4 Pillar Growth Strategy by 2025 Development Pipeline Over the Next Two Years Full Market Release for PRISM Neuro Laser Integrate Tumor Segmentation Software Activate Maestro Ablation Coverage & A.I. Predictive Modeling ACHIEVE GLOBAL SCALE Expand Global Footprint to 100+ Centers Perform Procedures w/ Remote Clinical Support Achieve 60%+ Margins & Operational Cashflow Breakeven © 2 0 2 4 C L E A R P O I N T N E U R O 13 Expand Neuro Pre-Clinical CRO Services and Capacity Including GLP Capability Expand Partnerships to Include Co-Development, Pass Through Sales, Drug Clinical Milestones & Royalty Based Agreements Execute on Development Pipeline for Drug Infusion Monitoring/Modelling, Intracranial Cell Therapy and Spinal Routes of Administration Expand into the Operating Room w/ ClearPoint OR Show Compatibility with Existing Third-Party Navigation w/ SmartFrame OR Launch Maestro CT, Non-Rigid Fusion, Area-of-Activation and DTI Harmony Software

© 2 0 2 4 C L E A R P O I N T N E U R O 14 Radially Branching Cell therapy Devices ClearPoint Orchestra Head Fixation Frame Spinal Infusion Anchoring Devices PRISM 3.0 T & 1.5 T Compatible Systems (1.5 T Compatibility not yet FDA Cleared) Array 1.2 Parallel Trajectory Tumor Feature *Biologics & Drug Delivery Programs are for use in pre-clinical and clinical trials only ClearPoint 2.2 Software with Embedded ClearPoint Maestro® ClearPointer and SmartFrame OR

© 2 0 2 4 C L E A R P O I N T N E U R O 15 • FDA Cleared, Shape Constrained, triangular mesh model enables point-based correspondence across multiple subjects • Auto-Segmentation for Device Targeting • Direct Navigation in Clinical Trials for Drug Delivery • Longitudinal Comparison for Pharma Trial follow-up • Platform Engine for future navigation tools for Drug Delivery, DBS, BCI, Biopsy and Laser Therapy • Expandable to CT Guidance in the Operating Room *The ClearPoint Maestro® Brain Model is only available in the United States.

© 2 0 2 4 C L E A R P O I N T N E U R O 16 Unique platform technology with 10+ years of commercial experience enabling Precision MRI-Guided and OR- based Therapies to restore quality of life for some of the most debilitating disorders Large, growing number of customer and partner sites of 80+ leading Neurosurgery and research centers worldwide, on pace to be in 100+ by 2025 Expandable Platform through advanced A.I. and machine learning software applications and strategic partnerships Pipeline of new revenue streams through the expansion into the Operating Room, Launch of our own PRISM Laser Therapy, Maestro Brain Model Deployment and addition of pre-clinical services and capacity including GLP Total potential addressable market > $12B for our products, pipeline and partnerships A growing and passionate team of embedded scientists and specialists

v3.24.1.u1

Cover

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

CLEARPOINT NEURO, INC

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34822

|

| Entity Tax Identification Number |

58-2394628

|

| Entity Address, Address Line One |

120 S. Sierra Ave., Suite 100

|

| Entity Address, City or Town |

Solana Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92075

|

| City Area Code |

(888)

|

| Local Phone Number |

287-9109

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

CLPT

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001285550

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

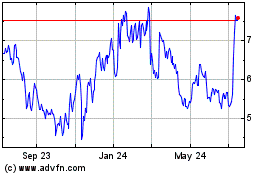

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From Apr 2024 to May 2024

ClearPoint Neuro (NASDAQ:CLPT)

Historical Stock Chart

From May 2023 to May 2024