000089369112/292024Q1FALSEA1100———0.0—0.000008936912024-01-012024-03-3100008936912024-05-03xbrli:sharesiso4217:USD00008936912023-01-022023-04-02iso4217:USDxbrli:shares00008936912024-03-3100008936912023-12-3100008936912023-01-010000893691us-gaap:CommonStockMember2023-12-310000893691us-gaap:CommonStockMember2023-01-010000893691us-gaap:CommonStockMember2024-01-012024-03-310000893691us-gaap:CommonStockMember2023-01-022023-04-020000893691us-gaap:CommonStockMember2024-03-310000893691us-gaap:CommonStockMember2023-04-020000893691us-gaap:AdditionalPaidInCapitalMember2023-12-310000893691us-gaap:AdditionalPaidInCapitalMember2023-01-010000893691us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000893691us-gaap:AdditionalPaidInCapitalMember2023-01-022023-04-020000893691us-gaap:AdditionalPaidInCapitalMember2024-03-310000893691us-gaap:AdditionalPaidInCapitalMember2023-04-020000893691us-gaap:RetainedEarningsMember2023-12-310000893691us-gaap:RetainedEarningsMember2023-01-010000893691us-gaap:RetainedEarningsMember2024-01-012024-03-310000893691us-gaap:RetainedEarningsMember2023-01-022023-04-020000893691us-gaap:RetainedEarningsMember2024-03-310000893691us-gaap:RetainedEarningsMember2023-04-020000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-010000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-022023-04-020000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000893691us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-020000893691us-gaap:NoncontrollingInterestMember2023-12-310000893691us-gaap:NoncontrollingInterestMember2023-01-010000893691us-gaap:NoncontrollingInterestMember2024-01-012024-03-310000893691us-gaap:NoncontrollingInterestMember2023-01-022023-04-020000893691us-gaap:NoncontrollingInterestMember2024-03-310000893691us-gaap:NoncontrollingInterestMember2023-04-0200008936912023-04-02door:facilitydoor:country0000893691door:OwensCorningMemberdoor:MasoniteInternationalCorporationMember2024-02-0800008936912024-02-082024-02-080000893691door:OwensCorningMemberdoor:MasoniteInternationalCorporationMember2024-02-082024-02-080000893691door:FleetwoodAluminumProductsLLCMember2023-10-192023-10-190000893691door:FleetwoodAluminumProductsLLCMember2024-03-310000893691door:FleetwoodAluminumProductsLLCMember2023-10-190000893691door:FleetwoodAluminumProductsLLCMember2023-10-192024-03-310000893691door:EPIHoldingsIncMember2023-01-03xbrli:pure0000893691door:EPIHoldingsIncMember2023-01-032023-01-030000893691door:EPIHoldingsIncMember2024-01-012024-03-310000893691door:EPIHoldingsIncMember2023-12-310000893691door:EPIHoldingsIncMember2023-01-032023-12-310000893691door:EPIHoldingsIncMemberus-gaap:CustomerRelationshipsMember2023-01-032023-01-030000893691us-gaap:CustomerRelationshipsMemberdoor:FleetwoodAluminumProductsLLCMember2023-10-192023-10-190000893691door:EPIHoldingsIncMemberus-gaap:TrademarksAndTradeNamesMember2023-01-032023-01-030000893691door:FleetwoodAluminumProductsLLCMemberus-gaap:TrademarksAndTradeNamesMember2023-10-192023-10-190000893691door:EPIHoldingsIncMemberus-gaap:PatentsMember2023-01-032023-01-030000893691us-gaap:PatentsMemberdoor:FleetwoodAluminumProductsLLCMember2023-10-192023-10-190000893691door:EPIHoldingsIncMemberus-gaap:OrderOrProductionBacklogMember2023-01-032023-01-030000893691us-gaap:OrderOrProductionBacklogMemberdoor:FleetwoodAluminumProductsLLCMember2023-10-192023-10-190000893691door:FleetwoodAluminumProductsLLCMember2024-01-012024-03-310000893691door:EPIHoldingsIncMember2023-01-022023-04-020000893691srt:ScenarioForecastMember2024-06-300000893691us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberdoor:TenLargestCustomersMember2024-01-012024-03-31door:Customer0000893691us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMemberdoor:TenLargestCustomersMember2023-01-022023-12-310000893691door:LowesCompaniesInc.Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310000893691door:LowesCompaniesInc.Memberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-022023-12-310000893691door:TheHomeDepotIncMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310000893691door:TheHomeDepotIncMemberus-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMember2023-01-022023-12-310000893691door:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2021-07-260000893691door:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2024-03-310000893691door:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2023-12-310000893691door:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2019-07-250000893691door:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2024-03-310000893691door:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2023-12-310000893691us-gaap:SecuredDebtMemberdoor:AdjustedTermSecuredOvernightFinancingRateSOFRMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2024-03-310000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2023-12-310000893691us-gaap:SeniorNotesMember2024-01-012024-03-310000893691us-gaap:SeniorNotesMember2023-01-022023-04-020000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2022-12-130000893691us-gaap:SecuredDebtMemberdoor:AdjustedBaseRateMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberdoor:PremiumAdjustedTermSecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:SecuredDebtMemberdoor:TermLoanCreditAgreementMemberus-gaap:BaseRateMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:SecuredDebtMemberdoor:ApplicableMarginMemberdoor:TermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2022-12-132022-12-130000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2024Member2019-01-310000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2024Member2022-10-282022-10-280000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2027Member2022-10-280000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2027Member2023-01-032023-01-030000893691us-gaap:RevolvingCreditFacilityMemberdoor:ABLFacility2024Member2024-03-310000893691door:AntitrustLitigationCanadaMember2023-11-032023-11-030000893691us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-022023-12-310000893691door:A2021PlanMemberus-gaap:CommonStockMember2021-03-100000893691door:A2021PlanMemberus-gaap:CommonStockMember2024-03-310000893691us-gaap:StockAppreciationRightsSARSMember2024-01-012024-03-310000893691us-gaap:StockAppreciationRightsSARSMember2023-12-310000893691us-gaap:StockAppreciationRightsSARSMember2023-01-022023-12-310000893691us-gaap:StockAppreciationRightsSARSMember2024-03-310000893691us-gaap:PerformanceSharesMember2024-01-012024-03-310000893691us-gaap:RestrictedStockUnitsRSUMember2023-12-310000893691us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000893691us-gaap:RestrictedStockUnitsRSUMember2024-03-310000893691us-gaap:PerformanceSharesMember2023-12-310000893691us-gaap:PerformanceSharesMember2024-03-310000893691us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000893691us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310000893691srt:MinimumMemberdoor:TwentyTwentyFourRestructuringPlanMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlanMembersrt:MaximumMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMembersrt:MinimumMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMembersrt:MaximumMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlansMemberdoor:NorthAmericanResidentialSegmentMember2024-01-012024-03-310000893691door:EuropeSegmentMemberdoor:TwentyTwentyFourRestructuringPlansMember2024-01-012024-03-310000893691door:TwentyTwentyFourRestructuringPlansMemberdoor:ArchitecturalSegmentMember2024-01-012024-03-310000893691door:TwentyTwentyFourRestructuringPlansMemberus-gaap:CorporateAndOtherMember2024-01-012024-03-310000893691door:TwentyTwentyFourRestructuringPlansMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:NorthAmericanResidentialSegmentMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:EuropeSegmentMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:ArchitecturalSegmentMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberus-gaap:CorporateAndOtherMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMember2024-01-012024-03-310000893691door:NorthAmericanResidentialSegmentMember2024-01-012024-03-310000893691door:EuropeSegmentMember2024-01-012024-03-310000893691door:ArchitecturalSegmentMember2024-01-012024-03-310000893691us-gaap:CorporateAndOtherMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:NorthAmericanResidentialSegmentMember2023-01-022023-04-020000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:ArchitecturalSegmentMember2023-01-022023-04-020000893691door:TwentyTwentyTwoRestructuringPlansMemberus-gaap:CorporateAndOtherMember2023-01-022023-04-020000893691door:TwentyTwentyTwoRestructuringPlansMember2023-01-022023-04-020000893691door:NorthAmericanResidentialSegmentMember2023-01-022023-04-020000893691door:EuropeSegmentMember2023-01-022023-04-020000893691door:ArchitecturalSegmentMember2023-01-022023-04-020000893691us-gaap:CorporateAndOtherMember2023-01-022023-04-020000893691door:TwentyTwentyFourRestructuringPlansMemberdoor:NorthAmericanResidentialSegmentMember2024-03-310000893691door:EuropeSegmentMemberdoor:TwentyTwentyFourRestructuringPlansMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlansMemberdoor:ArchitecturalSegmentMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlansMemberus-gaap:CorporateAndOtherMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlansMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:NorthAmericanResidentialSegmentMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:EuropeSegmentMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberdoor:ArchitecturalSegmentMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberus-gaap:CorporateAndOtherMember2024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMember2024-03-310000893691door:NorthAmericanResidentialSegmentMember2024-03-310000893691door:EuropeSegmentMember2024-03-310000893691door:ArchitecturalSegmentMember2024-03-310000893691us-gaap:CorporateAndOtherMember2024-03-310000893691door:TwentyTwentyFourRestructuringPlansMember2023-12-310000893691door:TwentyTwentyFourRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310000893691us-gaap:FacilityClosingMemberdoor:TwentyTwentyFourRestructuringPlansMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMember2023-12-310000893691door:TwentyTwentyTwoRestructuringPlansMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310000893691door:TwentyTwentyTwoRestructuringPlansMemberus-gaap:FacilityClosingMember2024-01-012024-03-310000893691us-gaap:EmployeeSeveranceMember2024-01-012024-03-310000893691us-gaap:FacilityClosingMember2024-01-012024-03-310000893691us-gaap:StockAppreciationRightsSARSMember2024-01-012024-03-310000893691us-gaap:StockAppreciationRightsSARSMember2023-01-022023-04-02door:authorization00008936912022-02-210000893691door:NorthAmericanResidentialSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000893691door:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000893691door:ArchitecturalSegmentMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000893691us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2024-01-012024-03-310000893691us-gaap:OperatingSegmentsMember2024-01-012024-03-310000893691door:NorthAmericanResidentialSegmentMemberus-gaap:IntersegmentEliminationMember2024-01-012024-03-310000893691door:EuropeSegmentMemberus-gaap:IntersegmentEliminationMember2024-01-012024-03-310000893691door:ArchitecturalSegmentMemberus-gaap:IntersegmentEliminationMember2024-01-012024-03-310000893691us-gaap:IntersegmentEliminationMemberus-gaap:CorporateAndOtherMember2024-01-012024-03-310000893691us-gaap:IntersegmentEliminationMember2024-01-012024-03-310000893691door:NorthAmericanResidentialSegmentMemberus-gaap:OperatingSegmentsMember2023-01-022023-04-020000893691door:EuropeSegmentMemberus-gaap:OperatingSegmentsMember2023-01-022023-04-020000893691door:ArchitecturalSegmentMemberus-gaap:OperatingSegmentsMember2023-01-022023-04-020000893691us-gaap:CorporateAndOtherMemberus-gaap:OperatingSegmentsMember2023-01-022023-04-020000893691us-gaap:OperatingSegmentsMember2023-01-022023-04-020000893691door:NorthAmericanResidentialSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-022023-04-020000893691door:EuropeSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-022023-04-020000893691door:ArchitecturalSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-022023-04-020000893691us-gaap:IntersegmentEliminationMemberus-gaap:CorporateAndOtherMember2023-01-022023-04-020000893691us-gaap:IntersegmentEliminationMember2023-01-022023-04-0200008936912023-01-022023-12-310000893691door:PGTInnovationsInc.Member2023-12-172023-12-170000893691door:PGTInnovationsInc.Member2024-01-16utr:D0000893691door:PGTInnovationsInc.Member2024-01-162024-01-160000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2030Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-03-310000893691us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberdoor:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2024-03-310000893691us-gaap:FairValueInputsLevel2Memberdoor:SeniorNotesDue2030Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000893691us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberdoor:SeniorNotesDue2030Memberus-gaap:SeniorNotesMember2023-12-310000893691door:SeniorNotesDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-03-310000893691door:SeniorNotesDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-03-310000893691door:SeniorNotesDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000893691door:SeniorNotesDue2028Memberus-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310000893691us-gaap:SubsequentEventMembersrt:ScenarioForecastMembersrt:MinimumMember2024-04-012024-06-300000893691us-gaap:SubsequentEventMembersrt:ScenarioForecastMembersrt:MaximumMember2024-04-012024-06-300000893691us-gaap:SubsequentEventMemberdoor:SeniorNotesDue2028Memberus-gaap:SeniorNotesMember2024-04-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 10-Q

____________________________

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to _____

Commission File Number: 001-11796

____________________________

Masonite International Corporation

(Exact name of registrant as specified in its charter)

____________________________ | | | | | | | | |

| British Columbia, Canada | | 98-0377314 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2771 Rutherford Road

Concord, Ontario L4K 2N6 Canada

(Address of principal executive offices)

(800) 895-2723

(Registrant's telephone number, including area code)

____________________________ | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock (no par value) | DOOR | New York Stock Exchange |

| (Title of class) | (Trading symbol) | (Name of exchange on which registered) |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☑ | | Accelerated filer | | ☐ |

| | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | |

| Emerging growth company | | ☐ | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

The registrant had outstanding 21,983,958 shares of Common Stock, no par value, as of May 3, 2024.

MASONITE INTERNATIONAL CORPORATION

INDEX TO QUARTERLY REPORT ON FORM 10-Q

March 31, 2024

| | | | | | | | | | | |

| |

| PART I | | | Page |

| Item 1 | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Item 2 | | | |

| Item 3 | | | |

| Item 4 | | | |

| PART II | | | |

| Item 1 | | | |

| Item 1A | | | |

| Item 2 | | | |

| Item 3 | | | |

| Item 4 | | | |

| Item 5 | | | |

| Item 6 | | | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains "forward-looking statements" within the meaning of the federal securities laws, including, without limitation, statements concerning the conditions in our industry, our operations, our economic performance and financial condition, including, in particular, statements relating to our business and growth strategy and product development efforts under "Management's Discussion and Analysis of Financial Condition and Results of Operations." Forward-looking statements include all statements that do not relate solely to historical or current facts and can be identified by the use of words such as "may," "might," "could," "will," "would," "should," "expect," "believes," "outlook," "predict," "forecast," "objective," "remain," "anticipate," "estimate," "potential," "continue," "plan," "project," "targeting," and other similar expressions. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates. These forward-looking statements are based on estimates and assumptions by our management that, although we believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. These risks and uncertainties include, without limitation, those identified under "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2023, subsequent reports on Form 10-Q and elsewhere in this Quarterly Report.

The following list represents some, but not necessarily all, of the factors that could cause actual results to differ from historical results or those anticipated or predicted by these forward-looking statements:

•restrictions during the pendency of the Acquisition (as defined herein) that may impact our ability to pursue certain business opportunities or strategic transactions;

•risks related to diverting management’s attention from ongoing business operations and disrupting our relationships with third-parties and employees during the pendency of the Acquisition;

•the risk that the Acquisition may not be completed in a timely manner or at all, which may adversely affect our business and the price of our common stock;

•the outcome of any legal proceedings that may be instituted against us related to the Arrangement Agreement (as defined herein) or the Acquisition;

•downward trends in our end markets and in economic conditions;

•reduced levels of residential new construction; residential repair, renovation and remodeling; and non-residential building construction activity due to increases in mortgage rates, changes in mortgage interest deductions and related tax changes and reduced availability of financing;

•competition;

•the continued success of, and our ability to maintain relationships with, certain key customers in light of customer concentration and consolidation;

•our ability to accurately anticipate demand for our products;

•impacts on our business from weather and climate change;

•our ability to successfully consummate and integrate mergers, acquisitions and dispositions, including the pending disposition of our Architectural reporting segment;

•our inability to remediate an identified material weakness on a timely basis;

•changes in prices of raw materials and fuel;

•tariffs and evolving trade policy and friction between the United States and other countries, including China, and the impact of anti-dumping and countervailing duties;

•increases in labor costs, the availability of labor or labor relations (i.e., disruptions, strikes or work stoppages);

•our ability to manage our operations including potential disruptions, manufacturing realignments (including related restructuring charges) and customer credit risk;

•product liability claims and product recalls;

•our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations, including our obligations under our senior notes, our term loan credit agreement (the "Term Loan Facility") and our asset-based revolving credit facility (the "ABL Facility");

•limitations on operating our business as a result of covenant restrictions under our existing and future indebtedness, including our senior notes, the Term Loan Facility and the ABL Facility;

•fluctuating foreign exchange and interest rates;

•the continuous operation of our current information technology and enterprise resource planning ("ERP") systems, implementation of new ERPs and management of potential cyber security threats and attacks and data privacy requirements;

•political, economic and other risks that arise from operating a multinational business;

•retention of key management personnel;

•environmental and other government regulations, including the United States Foreign Corrupt Practices Act ("FCPA"), and any changes in such regulations;

•the scale and scope of public health issues and their impact on our operations, customer demand and supply chain; and

•our ability to replace our expiring patents and to innovate and keep pace with technological developments.

We caution you that the foregoing list of important factors is not all-inclusive. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this Quarterly Report may not in fact occur. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

The Company may use its website and/or social media outlets, such as LinkedIn, as distribution channels of material Company information. Financial and other important information regarding the Company is routinely posted on and accessible through the Company’s website at http://investor.masonite.com and its LinkedIn page at https://www.linkedin.com/company/masonitedoors/mycompany/. In addition, you may automatically receive email alerts and other information about the Company when you enroll your email address by visiting the “Email Alerts” section at http://investor.masonite.com.

PART I – FINANCIAL INFORMATION

Item 1. Unaudited Financial Statements

MASONITE INTERNATIONAL CORPORATION

Condensed Consolidated Statements of Income and Comprehensive Income

(In thousands of U.S. dollars, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, 2024 | | April 2, 2023 | | | | |

| Net sales | $ | 668,339 | | | $ | 725,984 | | | | | |

| Cost of goods sold | 502,869 | | | 555,493 | | | | | |

| Gross profit | 165,470 | | | 170,491 | | | | | |

| Selling, general and administration expenses | 152,644 | | | 101,705 | | | | | |

| Restructuring costs | 1,394 | | | 3,678 | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 11,432 | | | 65,108 | | | | | |

| Interest expense, net | 12,022 | | | 14,252 | | | | | |

| | | | | | | |

| Other (income) expense, net | (85,250) | | | 52 | | | | | |

| Income before income tax expense | 84,660 | | | 50,804 | | | | | |

| Income tax expense | 23,278 | | | 11,360 | | | | | |

| Net income | 61,382 | | | 39,444 | | | | | |

| Less: net income attributable to non-controlling interests | 327 | | | 953 | | | | | |

| Net income attributable to Masonite | $ | 61,055 | | | $ | 38,491 | | | | | |

| | | | | | | |

| Basic earnings per common share attributable to Masonite | $ | 2.79 | | | $ | 1.74 | | | | | |

| Diluted earnings per common share attributable to Masonite | $ | 2.74 | | | $ | 1.71 | | | | | |

| | | | | | | |

| Comprehensive income: | | | | | | | |

| Net income | $ | 61,382 | | | $ | 39,444 | | | | | |

| Other comprehensive (loss) income: | | | | | | | |

| Foreign currency translation (loss) gain | (4,907) | | | 8,949 | | | | | |

| | | | | | | |

| | | | | | | |

| Amortization of actuarial net losses | 218 | | | 191 | | | | | |

| Income tax expense related to other comprehensive (loss) income | (9) | | | (45) | | | | | |

| Other comprehensive (loss) income, net of tax: | (4,698) | | | 9,095 | | | | | |

| Comprehensive income | 56,684 | | | 48,539 | | | | | |

| Less: comprehensive income attributable to non-controlling interests | 172 | | | 945 | | | | | |

| Comprehensive income attributable to Masonite | $ | 56,512 | | | $ | 47,594 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to the condensed consolidated financial statements.

MASONITE INTERNATIONAL CORPORATION

Condensed Consolidated Balance Sheets

(In thousands of U.S. dollars, except share amounts)

(Unaudited) | | | | | | | | | | | |

| ASSETS | March 31, 2024 | | December 31, 2023 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 230,441 | | | $ | 137,414 | |

| Restricted cash | 12,426 | | | 11,926 | |

| Accounts receivable, net | 336,472 | | | 326,224 | |

| Inventories, net | 383,866 | | | 391,199 | |

| Prepaid expenses and other assets | 60,168 | | | 60,092 | |

| Income taxes receivable | 27,928 | | | 26,544 | |

| Total current assets | 1,051,301 | | | 953,399 | |

| Property, plant and equipment, net | 743,900 | | | 747,970 | |

| Operating lease right-of-use assets | 235,408 | | | 202,806 | |

| Investment in equity investees | 21,360 | | | 20,378 | |

| Goodwill | 294,846 | | | 294,710 | |

| Intangible assets, net | 391,913 | | | 402,941 | |

| Deferred income taxes | 10,420 | | | 26,658 | |

| Other assets | 37,570 | | | 36,517 | |

| Total assets | $ | 2,786,718 | | | $ | 2,685,379 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 151,392 | | | $ | 113,208 | |

| Accrued expenses | 225,500 | | | 240,476 | |

| Income taxes payable | 11,281 | | | 3,400 | |

| Current portion of long-term debt | 37,500 | | | 37,500 | |

| Total current liabilities | 425,673 | | | 394,584 | |

| Long-term debt | 1,040,536 | | | 1,049,384 | |

| | | |

| Long-term operating lease liabilities | 226,058 | | | 186,647 | |

| Deferred income taxes | 116,348 | | | 120,278 | |

| Other liabilities | 58,049 | | | 75,158 | |

| Total liabilities | 1,866,664 | | | 1,826,051 | |

Commitments and Contingencies (Note 7) | | | |

| Equity: | | | |

Share capital: unlimited shares authorized, no par value, 21,976,156 and 21,835,474 shares issued and outstanding as of March 31, 2024, and December 31, 2023, respectively | 538,746 | | | 525,232 | |

| Additional paid-in capital | 223,442 | | | 231,332 | |

| Retained earnings | 272,936 | | | 211,881 | |

| Accumulated other comprehensive loss | (124,735) | | | (120,192) | |

| Total equity attributable to Masonite | 910,389 | | | 848,253 | |

| Equity attributable to non-controlling interests | 9,665 | | | 11,075 | |

| Total equity | 920,054 | | | 859,328 | |

| Total liabilities and equity | $ | 2,786,718 | | | $ | 2,685,379 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See accompanying notes to the condensed consolidated financial statements.

MASONITE INTERNATIONAL CORPORATION

Condensed Consolidated Statements of Changes in Equity

(In thousands of U.S. dollars, except share amounts)

(Unaudited) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, 2024 | | April 2, 2023 | | | | |

| Total equity, beginning of period | $ | 859,328 | | | $ | 742,782 | | | | | |

| Share capital: | | | | | | | |

| Beginning of period | 525,232 | | | 520,003 | | | | | |

| Common shares issued for delivery of share based awards | 12,504 | | | 12,372 | | | | | |

| Common shares issued under employee stock purchase plan | 1,010 | | | 806 | | | | | |

| Common shares repurchased | — | | | (4,025) | | | | | |

| End of period | 538,746 | | | 529,156 | | | | | |

| Additional paid-in capital: | | | | | | | |

| Beginning of period | 231,332 | | | 226,514 | | | | | |

| Share based compensation expense | 6,930 | | | 6,054 | | | | | |

| Common shares issued for delivery of share based awards | (12,504) | | | (12,372) | | | | | |

| Common shares withheld to cover income taxes payable due to delivery of share based awards | (2,094) | | | (1,960) | | | | | |

| Common shares issued under employee stock purchase plan | (222) | | | (226) | | | | | |

| | | | | | | |

| End of period | 223,442 | | | 218,010 | | | | | |

| Retained earnings: | | | | | | | |

| Beginning of period | 211,881 | | | 127,826 | | | | | |

| Net income attributable to Masonite | 61,055 | | | 38,491 | | | | | |

| Common shares repurchased | — | | | (10,692) | | | | | |

| End of period | 272,936 | | | 155,625 | | | | | |

| Accumulated other comprehensive loss: | | | | | | | |

| Beginning of period | (120,192) | | | (142,224) | | | | | |

| Other comprehensive (loss) income attributable to Masonite, net of tax | (4,543) | | | 9,103 | | | | | |

| End of period | (124,735) | | | (133,121) | | | | | |

| Equity attributable to non-controlling interests: | | | | | | | |

| Beginning of period | 11,075 | | | 10,663 | | | | | |

| Net income attributable to non-controlling interests | 327 | | | 953 | | | | | |

| Other comprehensive loss attributable to non-controlling interests, net of tax | (155) | | | (8) | | | | | |

| Dividends to non-controlling interests | (1,582) | | | (554) | | | | | |

| End of period | 9,665 | | | 11,054 | | | | | |

| Total equity, end of period | $ | 920,054 | | | $ | 780,724 | | | | | |

| | | | | | | |

| Common shares outstanding: | | | | | | | |

| Beginning of period | 21,835,474 | | | 22,155,035 | | | | | |

| Common shares issued for delivery of share based awards | 130,179 | | | 142,943 | | | | | |

| Common shares issued under employee stock purchase plan | 10,503 | | | 8,827 | | | | | |

| Common shares repurchased | — | | | (168,523) | | | | | |

| End of period | 21,976,156 | | | 22,138,282 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes to the condensed consolidated financial statements.

MASONITE INTERNATIONAL CORPORATION

Condensed Consolidated Statements of Cash Flows

(In thousands of U.S. dollars)

(Unaudited) | | | | | | | | | | | |

| Three Months Ended |

| Cash flows from operating activities: | March 31, 2024 | | April 2, 2023 |

| Net income | $ | 61,382 | | | $ | 39,444 | |

| Adjustments to reconcile net income to net cash flow provided by operating activities: | | | |

| | | |

| | | |

| Depreciation | 27,568 | | | 21,485 | |

| Amortization | 10,876 | | | 7,421 | |

| Share based compensation expense | 6,930 | | | 6,054 | |

| Deferred income taxes | 12,196 | | | 885 | |

| Unrealized foreign exchange gain | (234) | | | (97) | |

| Share of income from equity investees, net of tax | (838) | | | (748) | |

| | | |

| Pension and post-retirement funding, net of expense | (683) | | | (509) | |

| Non-cash accruals and interest | 1,420 | | | 1,445 | |

| Loss on sale of property, plant and equipment | 1,068 | | | 1,038 | |

| | | |

| Changes in assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (6,692) | | | (5,457) | |

| Inventories | 6,494 | | | 34,024 | |

| Prepaid expenses and other assets | (197) | | | (7,730) | |

| Accounts payable and accrued expenses | 8,362 | | | (33,223) | |

| Other assets and liabilities | 5,670 | | | (7,685) | |

| Net cash flow provided by operating activities | 133,322 | | | 56,347 | |

| Cash flows from investing activities: | | | |

| Additions to property, plant and equipment | (25,764) | | | (27,827) | |

| Acquisition of businesses, net of cash acquired | (392) | | | (353,618) | |

| | | |

| Proceeds from sale of property, plant and equipment | — | | | 4 | |

| Proceeds from repayment of note receivable | — | | | 12,000 | |

| Other investing activities | (455) | | | (3,511) | |

| Net cash flow used in investing activities | (26,611) | | | (372,952) | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | — | | | 250,000 | |

| Repayments of long-term debt | (9,375) | | | — | |

| | | |

| Payment of debt issuance costs | — | | | (3,628) | |

| Proceeds from borrowings on revolving credit facilities | — | | | 100,000 | |

| Repayments of borrowings on revolving credit facilities | — | | | (100,000) | |

| Tax withholding on share based awards | (2,094) | | | (1,960) | |

| Distributions to non-controlling interests | (1,582) | | | (554) | |

| Repurchases of common shares | — | | | (14,717) | |

| Net cash flow (used in) provided by financing activities | (13,051) | | | 229,141 | |

| Net foreign currency translation adjustment on cash | (133) | | | 855 | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 93,527 | | | (86,609) | |

| Cash, cash equivalents and restricted cash, beginning of period | 149,340 | | | 308,921 | |

| Cash, cash equivalents and restricted cash, at end of period | $ | 242,867 | | | $ | 222,312 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See accompanying notes to the condensed consolidated financial statements.

MASONITE INTERNATIONAL CORPORATION

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Business Overview and Significant Accounting Policies

Unless we state otherwise or the context otherwise requires, references to "Masonite," "we," "our," "us" and the "Company" in these notes to the condensed consolidated financial statements refer to Masonite International Corporation and its subsidiaries.

Description of Business

Masonite International Corporation is a leading global designer, manufacturer, marketer and distributor of interior and exterior doors and door solutions for the residential and non-residential building construction markets' new construction and repair, renovation and remodeling sectors. Masonite operates 64 manufacturing locations in seven countries and sells doors to customers throughout the world, including the United States, Canada and the United Kingdom.

Basis of Presentation

We prepare these unaudited condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States of America ("GAAP") and applicable rules and regulations of the U.S. Securities and Exchange Commission ("SEC") regarding interim financial reporting. Accordingly, they do not include all of the information and notes required by GAAP for annual financial statements. In the opinion of management, all adjustments consisting of normal and recurring entries considered necessary for a fair presentation of the results for the interim periods presented have been included. All significant intercompany balances and transactions have been eliminated. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts in the financial statements and accompanying notes. These estimates are based on information available as of the date of the unaudited condensed consolidated financial statements; therefore, actual results could differ from those estimates. Interim results are not necessarily indicative of the results for a full year.

These unaudited condensed consolidated financial statements should be read in conjunction with the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as filed with the SEC (the "Annual Report"). Our fiscal year is the 52- or 53-week period ending on the Sunday closest to December 31. In a 52-week year, each fiscal quarter consists of 13 weeks. For ease of disclosure, the 13-week periods are referred to as three-month periods and the 52- or 53-week periods are referred to as a year.

Changes in Accounting Standards and Policies

There have been no changes in the significant accounting policies from those that were disclosed in the fiscal year 2023 audited consolidated financial statements, other than as noted below.

Adoption of Recent Accounting Pronouncements

In October 2021, the FASB issued ASU 2021-08, "Accounting for Contract Assets and Contract Liabilities from Contracts with Customers," which clarifies that an acquirer of a business should recognize and measure contract assets and contract liabilities in a business combination in accordance with ASU 2014-09, "Revenue from Contracts with Customers" as if the entity had originated the contracts. We adopted the new guidance as of January 1, 2023, the beginning of fiscal year 2023, and the adoption did not have a material impact on our financial statements.

In November 2023, the FASB issued ASU 2023-07, "Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures," which improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The guidance is effective for fiscal years beginning after December 15, 2023, with early application permitted. We adopted the new guidance as of January 1, 2024, the beginning of fiscal year 2024, and the adoption did not have a material impact on our financial statements.

Other Recent Accounting Pronouncements not yet Adopted

In December 2023, the FASB issued ASU 2023-09, "Income Taxes (Topic 740) - Improvements to Income Tax Disclosures," which requires public business entities to annually disclose specific categories in the rate reconciliation and

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

provide additional information for reconciling items that meet a quantitative threshold. The guidance is effective for fiscal years beginning after December 15, 2024, with early application permitted. We did not early adopt and believe the adoption of this new guidance will not have a material impact on our financial statements.

2. Acquisitions and Divestitures

Arrangement Agreement with Owens Corning

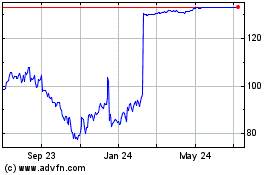

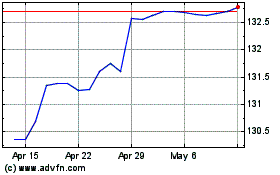

On February 8, 2024, we entered into an Arrangement Agreement (the “Arrangement Agreement”) with Owens Corning (“Owens Corning”), a Delaware corporation, and MT Acquisition Co LLC (“Purchaser”), a British Columbia unlimited liability company and a wholly owned subsidiary of Owens Corning. Subject to the terms and conditions of the Arrangement Agreement, Owens Corning, through Purchaser, agreed to acquire the Company for $133.00 per issued and outstanding share of our common stock, no par value (the “Shares”), in an all-cash transaction. Pursuant to the Arrangement Agreement, following consummation of implementation of a court-approved plan of arrangement under the Business Corporations Act (British Columbia) (the “Transaction”), the Company will be a wholly owned subsidiary of Owens Corning.

Pursuant to the terms of the Arrangement Agreement, and subject to the terms and conditions set forth therein, at the effective time of the Transaction (the “Effective Time”), each Share (other than any Share that is held by Owens Corning or any of its subsidiaries or any Share as to which dissent rights have been properly exercised by the holder thereof in accordance with British Columbia law) issued and outstanding immediately prior to the Effective Time will be cancelled and automatically converted into the right to receive $133.00 in cash, without interest.

If the Arrangement Agreement is terminated under certain specified circumstances, we or Owens Corning will be required to pay a termination fee. We will be required to pay Owens Corning a termination fee of $75.0 million under specified circumstances, including (a) termination of the Arrangement Agreement in connection with our entry into an agreement with respect to a Superior Proposal (as defined in the Arrangement Agreement) prior to us receiving stockholder approval of the Transaction, (b) termination by Owens Corning upon an Adverse Recommendation Change (as defined in the Arrangement Agreement), or (c) termination in certain circumstances by either Owens Corning or us upon failure to obtain Masonite Shareholder Approval (as defined in the Arrangement Agreement) or by Owens Corning if we breach our representations, warranties or covenants in a manner that would result in a failure of an applicable closing condition to be satisfied and, if curable, we fail to cure such breach during specific time periods, in each case, if certain other conditions are met. Owens Corning will be required to pay us a reverse termination fee under specified circumstances, including termination of the Arrangement Agreement due to a permanent injunction arising from Competition Laws (as defined in the Arrangement Agreement) when we are not then in material breach of any provision of the Arrangement Agreement and if certain other conditions are met, in an amount equal to $150.0 million.

The consummation of the Transaction is subject to customary closing conditions, including, among others, (1) the adoption of a resolution approving the Transaction by at least two-thirds of the votes cast by our shareholders represented in person or by proxy at the special meeting, (2) the issuance of interim and final orders by the Supreme Court of British Columbia approving the Transaction, (3) the expiration or termination of any applicable waiting period or periods under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), and the receipt of certain required regulatory clearances and approvals in other jurisdictions under applicable antitrust and foreign direct investment laws and regulations, including in Canada, Mexico and the United Kingdom, and (4) the absence of any law, injunction, order or other judgment prohibiting, rendering illegal or permanently enjoining the consummation of the Transaction, certain of which are still pending. On April 25, 2024, Masonite shareholders approved the Transaction at a special meeting of shareholders and the applicable waiting period under the HSR Act expired at 11:59 p.m. on April 26, 2024. Each of Masonite’s and Owens Corning’s obligation to consummate the Transaction is also subject to the accuracy of the other party’s representations and warranties contained in the Arrangement Agreement (subject, with specified exceptions, to materiality or “Material Adverse Effect” standards), the other party’s performance of its covenants and agreements in the Arrangement Agreement in all material respects, and in the case of Purchaser’s obligation to consummate the Transaction, the absence of any “Material Adverse Effect” relating to us. The Transaction is currently expected to close by mid-2024, subject to the satisfaction (or waiver, if applicable) of each closing condition.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

Acquisitions

Fleetwood

On October 19, 2023, the Company completed the acquisition of all of the issued and outstanding limited liability company interests of Fleetwood Aluminum Products, LLC (“Fleetwood”). The total consideration for this acquisition amounted to approximately $279.5 million, inclusive of $26.2 million designated for potential purchase price adjustments and indemnification claims and which is currently held in an escrow account controlled by a third party. The total consideration was funded with a combination of cash on hand and borrowings under the ABL Facility. Fleetwood is a leading designer and manufacturer of premium, aluminum-framed glass door and window solutions for luxury homes. Their products include multi-slide and pocket glass patio doors, pivot and hinged glass entry doors and folding glass door wall systems, as well as accompanying premium window products. The acquisition aligns with the Doors That Do MoreTM strategy focused on bringing differentiated door systems to the residential market.

The Company has accounted for the acquisition as a business combination and allocated the preliminary estimated purchase price to the estimated fair values of assets acquired and liabilities assumed utilizing various valuation methods including replacement cost, market values and the income approach. The Company has not yet completed its evaluation and determination of the value of certain assets acquired and liabilities assumed, primarily involving (i) certain historical information used in the final valuation of intangible assets, and (ii) the final assessment and valuation of inventory and deferred income taxes, which could impact goodwill during the measurement period. The $73.9 million excess purchase price over the fair value of tangible and intangible assets acquired was allocated to goodwill. Goodwill represents the estimated future economic benefits arising from other assets acquired that could not be individually identified and separately recognized, such as the delivery of luxury products, which supports our Doors That Do MoreTM strategy. This goodwill is deductible for tax purposes and relates to the North American Residential segment.

The allocation of the purchase price to assets acquired and liabilities assumed is as follows:

| | | | | | | | | | | |

| (In thousands) | Initial Purchase Price Allocation | Measurement Period Adjustments | Purchase Price Allocation |

| Cash acquired | $ | 5,169 | | $ | — | | $ | 5,169 | |

| Accounts receivable, net | 5,584 | | — | | 5,584 | |

| Inventories, net | 39,248 | | — | | 39,248 | |

| Prepaid expenses and other | 957 | | — | | 957 | |

| Property, plant and equipment, net | 8,072 | | — | | 8,072 | |

| Right-of-use asset | 16,009 | | — | | 16,009 | |

| Intangible assets | 163,900 | | — | | 163,900 | |

| Total assets acquired | 238,939 | | — | | 238,939 | |

| | | |

| Accounts payable and accrued expenses | (20,773) | | — | | (20,773) | |

| Operating lease liability | (12,546) | | — | | (12,546) | |

| Total liabilities assumed | (33,319) | | — | | (33,319) | |

| | | |

| Goodwill | 73,464 | | 392 | | 73,856 | |

| Total purchase price | $ | 279,084 | | $ | 392 | | $ | 279,476 | |

| | | |

| | | |

| | | |

| | | |

| | | |

The fair values of intangible assets acquired are based on management's estimates and assumptions including the income approach, the cost approach and the market approach. Customer relationships and patents acquired are not expected to have any residual value. The gross contractual value of acquired trade receivables was $5.6 million.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

Endura

On January 3, 2023, we completed the acquisition of 100% of the outstanding equity of EPI Holdings, Inc. ("Endura"), for total consideration of approximately $403.3 million, including an $18.0 million holdback which is payable 24 months after the acquisition date and was recorded in the consolidated balance sheets as a component of other liabilities. The total consideration was funded with borrowings under our Term Loan Facility and ABL Facility. Endura is a leading innovator and manufacturer of high-performance door frames and door system components in the United States. Endura’s product offerings include engineered frames, self-adjusting sill systems, weather sealing, multi-point locks and installation accessories used by builders and contractors in residential new construction as well as repair and remodeling applications. The acquisition is intended to accelerate our Doors That Do MoreTM strategy and maximize our growth potential. The $181.2 million excess purchase price over the fair value of tangible and intangible assets acquired was allocated to goodwill. The goodwill principally represents anticipated synergies to be gained from the integration into our existing business and acquisition of the assembled workforce. This goodwill is not deductible for tax purposes and relates to the North American Residential segment.

The Company has accounted for the acquisition as a business combination and allocated the estimated purchase price to the estimated fair values of assets acquired and liabilities assumed utilizing various valuation methods including replacement cost, market values and the income approach.

The allocation of the purchase price to assets acquired and liabilities assumed is as follows:

| | | | | | | | | | | |

| (In thousands) | Initial Purchase Price Allocation | Measurement Period Adjustments | Purchase Price Allocation |

| Cash acquired | $ | 32,501 | | $ | (100) | | $ | 32,401 | |

| Accounts receivable, net | 7,871 | | 290 | | 8,161 | |

| Inventories, net | 44,183 | | 35 | | 44,218 | |

| Property, plant and equipment, net | 54,373 | | 10,520 | | 64,893 | |

| Intangible assets | 135,800 | | (7,400) | | 128,400 | |

| Other assets and liabilities, net | 2,868 | | (38) | | 2,830 | |

| Total assets acquired | 277,596 | | 3,307 | | 280,903 | |

| | | |

| Accounts payable and accrued expenses | (15,088) | | (190) | | (15,278) | |

| Deferred income taxes | (44,345) | | 849 | | (43,496) | |

| Total liabilities assumed | (59,433) | | 659 | | (58,774) | |

| | | |

| Goodwill | 189,938 | | (8,780) | | 181,158 | |

| Total purchase price | $ | 408,101 | | $ | (4,814) | | $ | 403,287 | |

| | | |

| | | |

| | | |

| | | |

| | | |

The fair values of intangible assets acquired are based on management's estimates and assumptions including the income approach, the cost approach and the market approach. The intangible assets acquired are not expected to have any residual value. The gross contractual value of acquired trade receivables was $8.3 million.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

Intangible assets acquired from the 2023 acquisitions consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands, except useful life amounts) | Endura | | Expected Useful Life (Years) | | Fleetwood | | Expected Useful Life (Years) |

| Customer relationships | $ | 108,600 | | | 15 | | $ | 112,100 | | | 12 |

| Trademarks and trade names | 6,600 | | | 10 | | 25,200 | | | Indefinite |

| Patents | 13,200 | | | 12 | | 22,600 | | | 10 |

| Backlog | — | | | | | 4,000 | | | 1 |

| Total intangible assets acquired | $ | 128,400 | | | | | $ | 163,900 | | | |

The following schedule represents the amounts of net sales and net income (loss) attributable to Masonite from the 2023 acquisitions that have been included in the consolidated statements of income and comprehensive income for the periods indicated subsequent to the acquisition date.

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| (In thousands) | Endura | | Fleetwood | | Total 2023 Acquisitions |

| Net sales | $ | 53,434 | | | $ | 27,303 | | | $ | 80,737 | |

| Net income attributable to Masonite | 3,440 | | | 1,682 | | | 5,122 | |

For the three months ended April 2, 2023, Endura had $59.8 million in net sales and $4.5 million in net loss attributable to Masonite.

Pro Forma Information

The following unaudited pro forma financial information represents the consolidated financial information as if the Fleetwood acquisition had been included in our consolidated results beginning on the first day of the fiscal year prior to the acquisition date. The pro forma results have been calculated after adjusting the results of the acquired entity to remove intercompany transactions and to reflect the additional depreciation, amortization and interest expense that would have been charged assuming the fair value adjustments to property, plant and equipment and intangible assets and the additional debt incurred to fund the acquisition had been applied on the first day of the fiscal year prior to the acquisition date, together with the consequential tax effects. The pro forma results do not reflect any cost savings or revenue enhancements that the combined companies may achieve as a result of the acquisition; the costs to combine the companies' operations; or the costs necessary to achieve these costs savings and revenue enhancements. As a result, the pro forma information below does not purport to represent actual results had the acquisition been consummated on the date indicated and it is not necessarily indicative of future results of operations.

| | | | | | | |

| Three Months Ended | | |

| (In thousands, except per share information) | April 2, 2023 | | |

| Net sales | $ | 780,584 | | | |

| Net income attributable to Masonite | 49,174 | | | |

| | | |

| Basic earnings per common share attributable to Masonite | $ | 2.22 | | | |

| Diluted earnings per common share attributable to Masonite | $ | 2.19 | | | |

Divestitures

On April 23, 2024, we entered into an agreement to sell our Architectural reporting segment for a purchase price of approximately $75 million subject to customary post-closing adjustments. We expect to complete the transaction in the second quarter of 2024. Refer to Note 16. Subsequent Events for additional information.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

3. Accounts Receivable

Our customers consist mainly of retailers, distributors and contractors. Our ten largest customers accounted for 62.5% and 65.2% of total accounts receivable as of March 31, 2024, and December 31, 2023, respectively. Each of our two largest customers, The Home Depot, Inc. and Lowe's Companies, Inc., accounted for more than 10% of the consolidated gross accounts receivable balance as of March 31, 2024, and December 31, 2023. The allowance for doubtful accounts balance was $1.8 million and $3.1 million as of March 31, 2024, and December 31, 2023, respectively.

We maintain an accounts receivable sales program with a third party (the "AR Sales Program"). Under the AR Sales Program, we can transfer ownership of eligible trade accounts receivable of certain customers. Receivables are sold outright to a third party who assumes the full risk of collection, without recourse to us in the event of a loss. Transfers of receivables under this AR Sales Program are accounted for as sales. Proceeds from the transfers reflect the face value of the accounts receivable less a discount. Receivables sold under the AR Sales Program are excluded from trade accounts receivable in the condensed consolidated balance sheets and are included in cash flows from operating activities in the condensed consolidated statements of cash flows. The discounts on the sales of trade accounts receivable sold, if any, under the AR Sales Program were not material for any of the periods presented and were recorded in selling, general and administration expenses within the condensed consolidated statements of income and comprehensive income.

In most countries we pay and collect Value Added Tax ("VAT") when procuring goods and services within the normal course of business. VAT receivables are established in jurisdictions where VAT paid exceeds VAT collected and are recoverable through the filing of refund claims.

Certain wood moldings and millwork products being imported into the U.S. are subject to anti-dumping and countervailing duties. Duty deposits are paid to the government at time of entry into the U.S. and may later be adjusted through an administrative review process.

4. Inventories

The amounts of inventory on hand were as follows as of the dates indicated: | | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| Raw materials | $ | 284,818 | | | $ | 296,747 | |

| Finished goods | 112,647 | | | 106,919 | |

| Provision for obsolete or aged inventory | (13,599) | | | (12,467) | |

| Inventories, net | $ | 383,866 | | | $ | 391,199 | |

| | | |

| | | |

5. Accrued Expenses

The details of our accrued expenses were as follows as of the dates indicated: | | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 |

| Accrued payroll | $ | 61,581 | | | $ | 81,004 | |

| Accrued rebates | 38,137 | | | 51,457 | |

| Current portion of operating lease liabilities | 30,353 | | | 32,299 | |

| Accrued interest | 8,428 | | | 18,296 | |

| | | |

| Other accruals | 87,001 | | | 57,420 | |

| Total accrued expenses | $ | 225,500 | | | $ | 240,476 | |

| | | |

| | | |

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

6. Long-Term Debt | | | | | | | | | | | | |

| (In thousands) | March 31, 2024 | | December 31, 2023 | |

Senior unsecured notes, interest rate of 3.50%, due 2030 | $ | 375,000 | | | $ | 375,000 | | |

Senior unsecured notes, interest rate of 5.375%, due 2028 | 500,000 | | | 500,000 | | |

Term Loan Facility, interest rate of SOFR plus 2.25%, due 2027 | 212,500 | | | 221,875 | | |

| | | | |

| | | | |

| Debt issuance costs | (9,464) | | | (9,991) | | |

| Total debt (including current portion) | 1,078,036 | | | 1,086,884 | | |

| Less: debt due within one year | (37,500) | | | (37,500) | | |

| Total long-term debt (excluding current portion) | $ | 1,040,536 | | | $ | 1,049,384 | | |

| | | | |

| | | | |

Interest expense related to our consolidated indebtedness under our senior unsecured notes, Term Loan Facility and ABL Facility was $12.1 million and $15.4 million for the three months ended March 31, 2024 and April 2, 2023, respectively.

3.50% Senior Notes due 2030

On July 26, 2021, we issued $375.0 million aggregate principal senior unsecured notes (the "2030 Notes"). The 2030 Notes bear interest at 3.50% per annum, payable in cash semiannually in arrears on February 15 and August 15 of each year and are due February 15, 2030. The 2030 Notes were issued at par.

Information concerning obligations under the 2030 Notes and the indenture governing them are described in detail in our Annual Report. As of March 31, 2024, we were in compliance with all covenants under the indenture governing the 2030 Notes.

5.375% Senior Notes due 2028

On July 25, 2019, we issued $500.0 million aggregate principal senior unsecured notes (the "2028 Notes"). The 2028 Notes bear interest at 5.375%, payable in cash semiannually in arrears on February 1 and August 1 of each year and are due February 1, 2028. The 2028 Notes were issued at par.

Information concerning obligations under the 2028 Notes and the indenture governing them are described in detail in our Annual Report. As of March 31, 2024, we were in compliance with all covenants under the indenture governing the 2028 Notes.

Term Loan Facility

On December 13, 2022, we and certain of our subsidiaries entered into a new delayed-draw term loan credit agreement (the "Term Loan Credit Agreement") maturing on December 12, 2027 (the "Term Loan Maturity Date"). The Term Loan Credit Agreement provides for a senior secured five-year delayed-draw term loan facility of $250.0 million (the "Term Loan Facility"). Loans under the Term Loan Facility (the "Term Loans") will bear interest at a rate equal to, at our option, (1) the Adjusted Term SOFR Rate (as defined in the Term Loan Credit Agreement) plus an applicable margin of 2.25% or (2) an alternate base rate equal to the greatest of (i) the "Prime Rate" in the U.S. last quoted by The Wall Street Journal, (ii) 0.50% above the greater of the federal funds rate and the rate comprised of both overnight federal funds and overnight Eurodollar transactions denominated in U.S. dollars, (iii) 1.00% above the Adjusted Term SOFR Rate for a one month interest period and (iv) 1.00%, plus, in each case, an applicable margin of 1.25%, subject to, in each of cases (1) and (2), an agreed interest rate floor. The Term Loans are repayable in equal quarterly installments for an annual aggregate amortization payment equal to 15% of the aggregate principal amount of the Term Loans, with the balance of the principal being due on the Term Loan Maturity Date.

Obligations under the Term Loan Credit Agreement are fully and unconditionally guaranteed, jointly and severally, by us and by certain of our directly or indirectly wholly owned subsidiaries organized in the United States and are secured by the equity in, and substantially all the assets of, such subsidiaries. The Term Loans were funded in an amount of $250.0 million and applied to finance a portion of the consideration payable in connection with the consummation of the Endura acquisition on January 3, 2023. We received net proceeds of $246.4 million after deducting

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

$3.6 million of debt issuance costs. The debt issuance costs were capitalized as a reduction to the carrying value of debt and are being accreted to interest expense over the term of the Term Loan using the effective interest method.

The Term Loan Credit Agreement contains various customary representations, warranties by us and covenants that are described in detail in our Annual Report. As of March 31, 2024, we were in compliance with all covenants under the indenture governing the Term Loan Credit Agreement.

ABL Facility

On January 31, 2019, we and certain of our subsidiaries entered into a $250.0 million asset-based revolving credit facility (the "ABL Facility") maturing on January 31, 2024, which replaced the previous facility. On October 28, 2022, we and certain of our subsidiaries entered into an amendment which, among other things, (i) increased the revolving credit commitments available thereunder by $100.0 million to an aggregate amount of $350.0 million and (ii) replaced the LIBOR-based interest rate applicable to borrowings thereunder in U.S. dollars with an interest rate based on the sum of (x) a "Term SOFR" rate published by the CME Group Benchmark Administration Limited (CBA) plus (y) 10 basis points ("Adjusted Term SOFR"). Additionally, on December 12, 2022, we entered into an amendment to the ABL Facility, which, among other things, extended the maturity of the ABL Facility from January 31, 2024 to December 12, 2027. The terms of the ABL Facility remained otherwise substantially unchanged and are described in detail in our Annual Report. On January 3, 2023, we borrowed $100.0 million under our ABL Facility in order to fund a portion of the cash consideration paid for the acquisition of Endura. During the first quarter of 2023, we repaid all amounts outstanding under the ABL Facility.

The ABL Facility contains various customary representations, warranties by us and covenants that are described in detail in our Annual Report. As of March 31, 2024, we were in compliance with all covenants under the credit agreement governing the ABL Facility. We had availability of $249.1 million under our ABL Facility, and there were no amounts outstanding as of March 31, 2024.

Debt Maturities

The following table summarizes the stated debt maturities and scheduled amortization payments for all outstanding debt as of March 31, 2024:

| | | | | |

| (In thousands) | Scheduled Amortization Payments |

| Fiscal year: | |

| 2024 (remainder) | $ | 28,125 | |

| 2025 | 37,500 | |

| 2026 | 37,500 | |

| 2027 | 109,375 | |

| 2028 | 500,000 | |

| Thereafter | 375,000 | |

| Total aggregated principal value | $ | 1,087,500 | |

7. Commitments and Contingencies

We may become involved from time-to-time in litigation and regulatory compliance matters incidental to our business, including employment and wage and hour claims, antitrust, tax, product liability, environmental, health and safety, commercial disputes, intellectual property, contracts and other matters arising out of the normal conduct of our business. Since litigation is inherently unpredictable and unfavorable resolutions can occur, assessing contingencies is highly subjective and requires judgments about future events. We regularly review and accrue for contingencies related to litigation and regulatory compliance matters, if it is probable that a liability has been incurred and the amount of the loss can be reasonably estimated. Based on current information, in the opinion of management, the ultimate resolution of

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

these matters, individually or in the aggregate, will not have a material adverse effect on our financial condition, results of operations or cash flows.

Antitrust Class Action Proceedings - Canada

On May 19, 2020, an intended class proceeding was commenced in the Province of Québec, Canada naming as defendants Masonite Corporation, Corporation Internationale Masonite, JELD-WEN, Inc., JELD-WEN Holding, Inc. and JELD-WEN of Canada, Ltd. The plaintiff alleges that the Masonite and JELD-WEN defendants engaged in anticompetitive conduct, including price-fixing involving interior molded doors. The intended class proceeding seeks damages, punitive damages, and other relief. On December 22, 2020, the parties filed a motion with the court seeking to stay the proceeding.

On October 2, 2020, an intended class proceeding was commenced in the Federal Court of Canada naming as defendants Masonite International Corporation, Masonite Corporation, JELD-WEN, Inc., JELD-WEN Holding, Inc. and JELD-WEN of Canada, Ltd. The plaintiff alleges that the Masonite and JELD-WEN defendants engaged in anticompetitive conduct, including price-fixing involving interior molded doors. The intended class proceeding seeks damages, punitive damages, and other relief. The plaintiff served its certification record on March 31, 2021.

On November 3, 2023, the Company entered into a preliminary settlement agreement with the plaintiff class that would result in the resolution of all the plaintiffs’ underlying claims and lawsuits in exchange for a payment by the Company of approximately $0.9 million. As a result, for the year ended December 31, 2023, we paid approximately $0.9 million and recorded a charge in selling, general and administrative expense in the condensed consolidated statement of income and comprehensive income in connection with this matter. The preliminary settlement agreement is subject to court approval. A settlement approval hearing date has not yet been set.

8. Share Based Compensation Plans

Share based compensation expense was $6.9 million and $6.1 million for the three months ended March 31, 2024 and April 2, 2023, respectively. As of March 31, 2024, the total remaining unrecognized compensation expense related to share based compensation amounted to $41.4 million, which will be amortized over the weighted average remaining requisite service period of 1.8 years.

Equity Incentive Plans

Our equity incentive plans under the 2021 Equity Plan and 2012 Plan are described in detail and defined in our Annual Report. The aggregate number of common shares that can be issued with respect to equity awards under the 2021 Equity Plan cannot exceed 880,000 shares; plus the number of shares reserved for the 2012 Plan that is in excess of the number of shares related to outstanding grants; plus the number of shares subject to existing grants under the 2012 Plan that may expire or be forfeited or cancelled. As of March 31, 2024, there were 649,363 shares of common stock available for future issuance under the 2021 Equity Plan.

Deferred Compensation Plan

We offer to certain of our employees and directors a Deferred Compensation Plan, which is further described and defined in our Annual Report. As of March 31, 2024, the liability and asset relating to deferred compensation had a fair value of $9.8 million and $8.2 million, respectively. As of March 31, 2024, participation in the deferred compensation plan is limited and no restricted stock awards have been deferred into the deferred compensation plan. All plan investments are categorized as having Level 1 valuation inputs as established by the FASB’s Fair Value Framework.

Stock Appreciation Rights

We have granted Stock Appreciation Rights ("SARs") to certain employees, which entitle the recipient to the appreciation in value of granted common shares over the exercise price over a period of time, each as specified in the applicable award agreement. The exercise price of any SAR granted may not be less than the fair market value of our common shares on the date of grant. The compensation expense for the SARs is measured based on the fair value of the SARs at the date of grant and is recognized over the requisite service period. The SARs vest over a maximum of three

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

years, have a life of ten years and settle in common shares. It is assumed that all time-based SARs will vest. We recognize forfeitures of SARs in the period in which they occur.

The total fair value of SARs vested was $0.8 million during the three months ended March 31, 2024. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | Stock Appreciation Rights | | Aggregate Intrinsic Value (in thousands) | | Weighted Average Exercise Price | | Average Remaining Contractual Life (Years) |

| Outstanding, beginning of period | 199,838 | | | $ | 2,365 | | | $ | 77.09 | | | 6.4 |

| Granted | — | | | | | — | | | |

| Exercised | (2,211) | | | 11 | | | 87.50 | | | |

| Cancelled and forfeited | (892) | | | | | 107.68 | | | |

| Outstanding, end of period | 196,735 | | | $ | 10,745 | | | $ | 76.83 | | | 6.3 |

| | | | | | | |

| Exercisable, end of period | 166,359 | | | $ | 9,447 | | | $ | 74.66 | | | 5.9 |

| | | | | | | |

The value of SARs granted is determined using the Black-Scholes-Merton valuation model, and the corresponding expense is expected to be recognized over the average requisite service period of 2.0 years. Expected volatility is based upon the historical volatility of our common shares amongst other considerations. The expected term is calculated based upon historical employee exercise behavior and the contractual term of the SAR amongst other considerations. As of March 31, 2024, there were no SARs granted.

Restricted Stock Units

We have granted Restricted Stock Units ("RSUs") to directors and certain employees under the 2021 Equity Plan and the 2012 Plan. The RSUs confer the right to receive shares of our common stock at a specified future date or when certain conditions are met. The compensation expense for the RSUs granted is based on the fair value of the RSUs at the date of grant, which is equal to the stock price on the date of grant and is recognized over the requisite service period. The RSUs vest over a maximum of three years and call for the underlying shares to be delivered no later than 30 days following the vesting date unless the participant is subject to a blackout period. In such case, the shares are to be delivered once the blackout restriction has been lifted. It is assumed that all time-based RSUs will vest. We recognize forfeitures of RSUs in the period in which they occur. | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | Total Restricted Stock Units Outstanding | | Weighted Average Grant Date Fair Value |

| Outstanding, beginning of period | 340,024 | | | $ | 91.02 | |

| Granted | 187,840 | | | 127.64 | |

| | | |

| Delivered | (108,335) | | | 93.54 | |

Withheld to cover (1) | (8,033) | | | |

| Forfeited | (4,417) | | | 95.27 | |

| Outstanding, end of period | 407,079 | | | $ | 107.15 | |

| | | |

___________ (1) A portion of the vested RSUs delivered were net shares settled to cover statutory requirements for income and other employment taxes. We remit the equivalent cash to the appropriate taxing authorities. These net share settlements had the effect of share repurchases by us as we reduced and retired the number of shares that would have otherwise been issued as a result of the vesting.

RSUs granted during the three months ended March 31, 2024, vest at specified future dates with only service requirements. The value of RSUs granted in the three months ended March 31, 2024, was $24.0 million and is being recognized over the weighted average requisite service period of 2.0 years. During the three months ended March 31, 2024, 116,368 RSUs vested at a fair value of $10.9 million.

Performance-based Restricted Stock Units

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

We have granted certain Performance-based Restricted Stock Units ("PRSUs") under the 2021 Equity Plan and the 2012 Plan. These PRSUs are settled with payouts ranging from zero to 200% of the target award value depending on performance goal achievement. The compensation expense for the PRSUs awarded is based on the fair value of the PRSUs at the date of grant, which is equal to the stock price on the date of grant, and is recognized over the requisite service period. In 2023, we granted certain PRSUs with an additional condition measured by Relative Total Shareholder Return ("TSR"). The compensation expense for these PRSUs is determined using the Monte Carlo simulation method. The PRSUs vest over a maximum of three years and call for the underlying shares to be delivered no later than 30 days following the vesting date unless the participant is subject to a blackout period. In such case, the shares are to be delivered once the blackout restriction has been lifted.

| | | | | | | | | | | |

| Three Months Ended March 31, 2024 | Total Performance Restricted Stock Units Outstanding | | Weighted Average Grant Date Fair Value |

| Outstanding, beginning of period | 319,221 | | | $ | 95.55 | |

| Granted | — | | | — | |

Performance adjustment (1) | — | | | — | |

| Delivered | (21,730) | | | 109.25 | |

Withheld to cover (2) | (8,077) | | | |

| Forfeited | (15,553) | | | 108.72 | |

| Outstanding, end of period | 273,861 | | | $ | 93.31 | |

| | | |

___________(1) PRSUs are presented as outstanding, granted and forfeited in the table above assuming targets are met and the awards pay out at 100%. Certain awards are settled with payouts ranging from zero to 200% of the target award value depending on achievement. The performance adjustment represents the difference in shares ultimately awarded due to performance attainment above or below target.