FALSE000089369100008936912023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 6, 2024

________________________________________

Masonite International Corporation

(Exact name of registrant as specified in its charter)

________________________________________ | | | | | | | | | | | | | | |

British Columbia, Canada | | 001-11796 | | 98-0377314 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

2771 Rutherford Road

Concord, Ontario L4K 2N6 Canada

(Address of principal executive offices)

(800) 895-2723

(Registrant’s telephone number, including area code)

NOT APPLICABLE

(Former name or former address, if changed since last report)

________________________________________

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Common Stock (no par value) | DOOR | New York Stock Exchange |

| (Title of class) | (Trading symbol) | (Name of exchange on which registered) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

| ☐ | Emerging growth company |

| |

| ☐ | If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On May 6, 2024, Masonite International Corporation (the "Company") issued a press release announcing its financial results for the three months ended March 31, 2024. A copy of the press release is being furnished as Exhibit 99.1 and is hereby incorporated herein by reference.

The information furnished pursuant to this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to liabilities under that section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | | | | |

| Exhibit No. | | Description | |

| | |

| | Press release issued by Masonite International Corporation on May 6, 2024 |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| MASONITE INTERNATIONAL CORPORATION |

| | |

| Date: | May 6, 2024 | By: | | /s/ James C. Pelletier |

| | Name: | | James C. Pelletier |

| | Title: | | Senior Vice President, General Counsel and Corporate Secretary |

PRESS RELEASE

_________________________________________________________________________________

Masonite International Corporation Reports First Quarter Results

(Tampa, FL, May 6, 2024) - Masonite International Corporation ("Masonite" or the "Company") (NYSE: DOOR) today announced results for the three months ended March 31, 2024.

| | | | | | | | | | | | | | | | | | | | | | | |

| ($ in millions, except per share amounts) | 1Q24 | | 1Q23 | | % Change | | | | | | |

| Net sales | $668 | | $726 | | (8%) | | | | | | |

| Net income attributable to Masonite | $61 | | $38 | | +59% | | | | | | |

| % of net sales | 9.1% | | 5.3% | | +380 bps | | | | | | |

| Diluted earnings per share | $2.74 | | $1.71 | | +60% | | | | | | |

| Adjusted EPS* | $1.29 | | $1.88 | | (31%) | | | | | | |

| Adjusted EBITDA* | $97 | | $106 | | (9%) | | | | | | |

| % of net sales | 14.5% | | 14.6% | | (10 bps) | | | | | | |

| | | | | | | | | | | |

“Although end-market conditions remain choppy, we saw a sequential improvement in performance as we moved through the quarter,” said Howard Heckes, President and CEO. “Disciplined price-cost management continues to benefit margins in our North American Residential segment and the integration of the Fleetwood acquisition is progressing according to plan. Subsequent to the quarter end we announced the pending sale of the Architectural business segment, which further sharpens our focus on capturing opportunities in our residential end markets. Now that our shareholders have approved the pending acquisition by Owens Corning, we look forward to closing the transaction and becoming part of the larger, combined entity.”

* See "Non-GAAP Financial Measures and Related Information" for definition and reconciliation of non-GAAP measures.

First Quarter 2024 Discussion

(All references to percent increase or decrease in the discussion below compare first quarter 2024 results to results from the first quarter of 2023 unless otherwise noted.)

Consolidated net sales were $668 million in the first quarter of 2024, an 8% decrease resulting from a 10% decline in volume, a 1% decrease in average unit price (AUP) and a 1% decrease in sales of door components, partially offset by a 4% increase from the Fleetwood acquisition.

Total Company gross profit was $165 million in the first quarter of 2024, down 3% as positive contributions from price-cost management initiatives and the Fleetwood acquisition were more than offset by impacts of lower volumes. Gross profit as a percentage of net sales, however, increased 130 basis points to 24.8%.

Selling, general and administration (SG&A) expenses were $153 million in the first quarter of 2024, an increase of 50% due primarily to an increase in acquisition and due diligence-related costs, including those related to our previously contemplated acquisition of PGTI, as well as incremental acquired SG&A from Fleetwood. SG&A as a percentage of net sales increased 880 basis points to 23% compared to the first quarter of 2023.

Net income attributable to Masonite was $61 million in the first quarter of 2024, an increase of 59% primarily driven by an increase in other income related to receipt of the PGTI termination fee, partially offset by acquisition and due diligence costs, as well as higher income tax expense.

Adjusted EBITDA* was $97 million in the first quarter of 2024, a decrease of 9% driven primarily by the impact of volume declines. Diluted earnings per share were $2.74, an increase of 60% compared to $1.71 in the comparable 2023 period. Diluted adjusted earnings per share* were $1.29 compared to $1.88 in the comparable 2023 period.

2

* See "Non-GAAP Financial Measures and Related Information" for definition and reconciliation of non-GAAP measures.

Balance Sheet, Cash Flow and Capital Allocation

At the end of the first quarter, total available liquidity was $507 million, inclusive of $230 million in unrestricted cash and $277 million of availability under our ABL Facility and AR Sales Program.

Cash provided by operations was $133 million for the three months ended March 31, 2024, as compared to $56 million in the prior year period. Capital expenditures were $26 million for the three months ended March 31, 2024, a decrease from $28 million in the comparable period of 2023.

During the first quarter, Masonite did not repurchase any shares of stock.

Acquisition by Owens Corning

On February 8, 2024, Masonite and Owens Corning entered into a definitive agreement under which Owens Corning will acquire all of the outstanding shares of Masonite for $133.00 per share in cash. On April 25, 2024 Masonite shareholders voted to approve the combination and the transaction is anticipated to close in May 2024, subject to satisfaction of the remaining customary closing conditions.

In light of this pending transaction, Masonite does not plan to hold a live conference call to discuss first quarter results. Additional information on the Company's results can be found on our Form 10-Q to be filed with the Securities and Exchange Commission on May 7, 2024.

About Masonite

Masonite International Corporation is a leading global designer, manufacturer, marketer and distributor of interior and exterior doors, door system components and door systems for the new construction and repair, renovation and remodeling sectors of the residential and non-residential building construction markets. Since 1925, Masonite has provided its customers with innovative products and superior service at compelling values. Masonite currently serves approximately 6,600 customers globally. Additional information about Masonite can be found at www.masonite.com.

Forward-looking Statements

This press release contains forward-looking information and other forward-looking statements within the meaning of applicable Canadian and/or U.S. securities laws, including the integration of the Fleetwood acquisition, statements regarding the proposed disposition of our architectural business segment, statements regarding the proposed transaction between us and Owens Corning (the “Acquisition”), including statements regarding the expected timetable for completing the Acquisition, the ability to complete the Acquisition and the expected benefits of the Acquisition. When used in this press release, such forward-looking statements may be identified by the use of such words as "may," "might," "could," "will," "would," "should," "expect," "believes," "outlook," "predict," "forecast," "objective," "remain," "anticipate," "estimate," "progressing," "potential," "continue," "plan," "project," "showing," "yielding," "targeting," or the negative of these terms or other similar terminology.

Forward-looking statements involve significant known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of Masonite, or industry results, to be materially different from any future plans, goals, targets, objectives, results, performance or achievements expressed or implied by such forward-looking statements. As a result, such forward-looking statements should not be read as guarantees of future performance or results, should not be unduly relied upon, and will not necessarily be accurate indications of whether or not such results will be achieved. Factors that could cause actual results to differ materially from the results discussed in the forward-looking statements include,

3

* See "Non-GAAP Financial Measures and Related Information" for definition and reconciliation of non-GAAP measures.

but are not limited to, restrictions during the pendency of the Acquisition that may impact our ability to pursue certain business opportunities or strategic transactions; risks related to diverting management’s attention from ongoing business operations and disrupting our relationships with third-parties and employees during the pendency of the Acquisition; the risk that the Acquisition may not be completed in a timely manner or at all, which may adversely affect our business and the price of our common stock; the outcome of any legal proceedings that may be instituted against us related to the Acquisition or the agreement pursuant to which the Acquisition would be effected, downward trends in our end markets and in economic conditions; volatility and uncertainty in general business, economic conditions or financial markets, including the impact on the building product industries and housing markets; challenges pertaining to financing and the impact on reduced levels of residential new construction, residential repair, renovation and remodeling, and non-residential building construction activity due to increases in mortgage rates, changes in mortgage interest deductions and related tax changes and reduced availability of financing; the impact of energy and transportation price fluctuations; competition; the continued success of, and our ability to maintain relationships with, certain key customers in light of customer concentration and consolidation; our ability to innovate and accurately anticipate demand for our products; availability of raw materials, price fluctuations and supply chain disruptions; impacts on our business from weather and climate change; our ability to successfully consummate and integrate mergers, acquisitions and dispositions, including the pending disposition of our Architectural reporting segment; increases in labor costs, the availability of labor, or labor relations (i.e., disruptions, strikes or work stoppages); our ability to manage our operations including potential disruptions and manufacturing realignments (including related restructuring charges); product liability claims and product recalls; retention of key management personnel; the continuous operation of our information technology and enterprise resource planning systems and management of potential cyber security threats and attacks and data privacy requirements; our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations, including our obligations under our senior notes, our term loan credit agreement (the "Term Loan Facility") and our asset-based revolving credit facility (the "ABL Facility"); limitations on operating our business as a result of covenant restrictions under our existing and future indebtedness, including our senior notes, the Term Loan Facility and the ABL Facility; fluctuating foreign exchange and interest rates; environmental and other government regulations, including the United States Foreign Corrupt Practices Act ("FCPA"), and any changes in such regulations; tariffs and evolving trade policy and friction between the United States and other countries, including China, and the impact of anti-dumping and countervailing duties; our ability to replace our expiring patents and to innovate and keep pace with technological developments. For additional information on identifying factors that may cause actual results to vary materially from those stated in the forward-looking statements, see Masonite’s reports on Forms 10-K, 10-Q and 8-K filed with or furnished to the SEC from time to time. Masonite undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Non-GAAP Financial Measures and Related Information

Our management reviews net sales and Adjusted EBITDA (as defined below) to evaluate segment performance and allocate resources. Net assets are not allocated to the reportable segments. Adjusted EBITDA is a non-GAAP financial measure which does not have a standardized meaning under GAAP and is unlikely to be comparable to similar measures used by other companies. Adjusted EBITDA should not be considered as an alternative to either net income or operating cash flows determined in accordance with GAAP. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow for management's discretionary use, as it does not include certain cash requirements such as interest payments, tax payments and debt service requirements. Adjusted EBITDA is defined as net income attributable to Masonite

adjusted to exclude the following items, as applicable: depreciation; amortization; share based compensation expense; loss (gain) on disposal of property, plant and equipment; registration and listing fees; restructuring costs; asset impairment; loss (gain) on disposal of subsidiaries; interest expense (income), net; loss on extinguishment of debt; other expense (income), net; income tax expense (benefit); other items; loss (income) from discontinued operations, net of tax; and net income (loss) attributable to non-controlling interest. This definition of Adjusted EBITDA differs from the definitions of EBITDA contained in the indentures governing the 2028 and 2030 Notes and the credit agreements governing the ABL Facility and Term Loan Facility. Adjusted EBITDA, as calculated under our ABL Facility or senior notes would also include, among other things, additional add-backs for amounts related to: cost savings projected by us in good faith to be realized as a result of actions taken or expected to be taken prior to or during the relevant period; fees and expenses in connection with certain plant closures and layoffs; and the amount of any restructuring charges, integration costs or other business optimization expenses or reserve deducted in the relevant period in computing consolidated net income, including any one-time costs incurred in connection with acquisitions. Adjusted EBITDA is used to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation. Intersegment sales are recorded using market prices. We believe that Adjusted EBITDA, from an operations standpoint, provides an appropriate way to measure and assess segment performance. Our management team has established the practice of reviewing the performance of each segment based on the measures of net sales and Adjusted EBITDA. We believe that Adjusted EBITDA is useful to users of the consolidated financial statements because it provides the same information that we use internally to evaluate and compare the performance of the segments and it is one of the primary measures used to determine employee incentive compensation.

The tables below set forth a reconciliation of net income (loss) attributable to Masonite to Adjusted EBITDA for the periods indicated.

Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. Management believes this measure provides supplemental information on how successfully we operate our business.

Adjusted EPS is diluted earnings per common share attributable to Masonite (EPS) less restructuring costs, asset impairment charges, loss (gain) on disposal of subsidiaries, loss on extinguishment of debt and other items, if any, that do not relate to Masonite’s underlying business performance (each net of related tax expense (benefit)). Management uses this measure to evaluate the overall performance of the Company and believes this measure provides investors with helpful supplemental information regarding the underlying performance of the Company from period to period. This measure may be inconsistent with similar measures presented by other companies.

Certain amounts in the Condensed Consolidated Financial Statements and associated tables may not foot due to rounding. All percentages have been calculated using unrounded amounts.

MASONITE INTERNATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands of U.S. dollars, except share and per share amounts)

(Unaudited) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| March 31, 2024 | | April 2, 2023 | | | | |

| Net sales | $ | 668,339 | | | $ | 725,984 | | | | | |

| Cost of goods sold | 502,869 | | | 555,493 | | | | | |

| Gross profit | 165,470 | | | 170,491 | | | | | |

| Gross profit as a % of net sales | 24.8 | % | | 23.5 | % | | | | |

| | | | | | | |

| Selling, general and administration expenses | 152,644 | | | 101,705 | | | | | |

| Selling, general and administration expenses as a % of net sales | 22.8 | % | | 14.0 | % | | | | |

| | | | | | | |

| Restructuring costs | 1,394 | | | 3,678 | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income | 11,432 | | | 65,108 | | | | | |

| Interest expense, net | 12,022 | | | 14,252 | | | | | |

| | | | | | | |

| Other (income) expense, net | (85,250) | | | 52 | | | | | |

| Income before income tax expense | 84,660 | | | 50,804 | | | | | |

| Income tax expense | 23,278 | | | 11,360 | | | | | |

| Net income | 61,382 | | | 39,444 | | | | | |

| Less: net income attributable to non-controlling interests | 327 | | | 953 | | | | | |

| Net income attributable to Masonite | $ | 61,055 | | | $ | 38,491 | | | | | |

| | | | | | | |

| Basic earnings per common share attributable to Masonite | $ | 2.79 | | | $ | 1.74 | | | | | |

| Diluted earnings per common share attributable to Masonite | $ | 2.74 | | | $ | 1.71 | | | | | |

| | | | | | | |

| Shares used in computing basic earnings per share | 21,891,366 | | | 22,183,068 | | | | | |

| Shares used in computing diluted earnings per share | 22,322,748 | | | 22,480,233 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

MASONITE INTERNATIONAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of U.S. dollars, except share amounts)

(Unaudited) | | | | | | | | | | | |

| ASSETS | March 31, 2024 | | December 31, 2023 |

| Current assets: | | | |

| Cash and cash equivalents | $ | 230,441 | | | $ | 137,414 | |

| Restricted cash | 12,426 | | | 11,926 | |

| Accounts receivable, net | 336,472 | | | 326,224 | |

| Inventories, net | 383,866 | | | 391,199 | |

| Prepaid expenses and other assets | 60,168 | | | 60,092 | |

| Income taxes receivable | 27,928 | | | 26,544 | |

| Total current assets | 1,051,301 | | | 953,399 | |

| Property, plant and equipment, net | 743,900 | | | 747,970 | |

| Operating lease right-of-use assets | 235,408 | | | 202,806 | |

| Investment in equity investees | 21,360 | | | 20,378 | |

| Goodwill | 294,846 | | | 294,710 | |

| Intangible assets, net | 391,913 | | | 402,941 | |

| Deferred income taxes | 10,420 | | | 26,658 | |

| Other assets | 37,570 | | | 36,517 | |

| Total assets | $ | 2,786,718 | | | $ | 2,685,379 | |

| | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 151,392 | | | $ | 113,208 | |

| Accrued expenses | 225,500 | | | 240,476 | |

| Income taxes payable | 11,281 | | | 3,400 | |

| Current portion of long-term debt | 37,500 | | | 37,500 | |

| Total current liabilities | 425,673 | | | 394,584 | |

| Long-term debt | 1,040,536 | | | 1,049,384 | |

| | | |

| Long-term operating lease liabilities | 226,058 | | | 186,647 | |

| Deferred income taxes | 116,348 | | | 120,278 | |

| Other liabilities | 58,049 | | | 75,158 | |

| Total liabilities | 1,866,664 | | | 1,826,051 | |

| Commitments and Contingencies | | | |

| Equity: | | | |

Share capital: unlimited shares authorized, no par value, 21,976,156 and 21,835,474 shares issued and outstanding as of March 31, 2024, and December 31, 2023, respectively | 538,746 | | | 525,232 | |

| Additional paid-in capital | 223,442 | | | 231,332 | |

| Retained earnings | 272,936 | | | 211,881 | |

| Accumulated other comprehensive loss | (124,735) | | | (120,192) | |

| Total equity attributable to Masonite | 910,389 | | | 848,253 | |

| Equity attributable to non-controlling interests | 9,665 | | | 11,075 | |

| Total equity | 920,054 | | | 859,328 | |

| Total liabilities and equity | $ | 2,786,718 | | | $ | 2,685,379 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

MASONITE INTERNATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of U.S. dollars, except share amounts)

(Unaudited) | | | | | | | | | | | |

| Three Months Ended |

| Cash flows from operating activities: | March 31, 2024 | | April 2, 2023 |

| Net income | $ | 61,382 | | | $ | 39,444 | |

| Adjustments to reconcile net income to net cash flow provided by operating activities: | | | |

| | | |

| | | |

| Depreciation | 27,568 | | | 21,485 | |

| Amortization | 10,876 | | | 7,421 | |

| Share based compensation expense | 6,930 | | | 6,054 | |

| Deferred income taxes | 12,196 | | | 885 | |

| Unrealized foreign exchange gain | (234) | | | (97) | |

| Share of income from equity investees, net of tax | (838) | | | (748) | |

| | | |

| Pension and post-retirement funding, net of expense | (683) | | | (509) | |

| Non-cash accruals and interest | 1,420 | | | 1,445 | |

| Loss on sale of property, plant and equipment | 1,068 | | | 1,038 | |

| | | |

| Changes in assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (6,692) | | | (5,457) | |

| Inventories | 6,494 | | | 34,024 | |

| Prepaid expenses and other assets | (197) | | | (7,730) | |

| Accounts payable and accrued expenses | 8,362 | | | (33,223) | |

| Other assets and liabilities | 5,670 | | | (7,685) | |

| Net cash flow provided by operating activities | 133,322 | | | 56,347 | |

| | | |

| Cash flows from investing activities: | | | |

| Additions to property, plant and equipment | (25,764) | | | (27,827) | |

| Acquisition of businesses, net of cash acquired | (392) | | | (353,618) | |

| | | |

| Proceeds from sale of property, plant and equipment | — | | | 4 | |

| Proceeds from repayment of note receivable | — | | | 12,000 | |

| Other investing activities | (455) | | | (3,511) | |

| Net cash flow used in investing activities | (26,611) | | | (372,952) | |

| | | |

| Cash flows from financing activities: | | | |

| Proceeds from issuance of long-term debt | — | | | 250,000 | |

| Repayments of long-term debt | (9,375) | | | — | |

| | | |

| Payment of debt issuance costs | — | | | (3,628) | |

| Proceeds from borrowings on revolving credit facilities | — | | | 100,000 | |

| Repayments of borrowings on revolving credit facilities | — | | | (100,000) | |

| Tax withholding on share based awards | (2,094) | | | (1,960) | |

| Distributions to non-controlling interests | (1,582) | | | (554) | |

| Repurchases of common shares | — | | | (14,717) | |

| Net cash flow (used in) provided by financing activities | (13,051) | | | 229,141 | |

| | | |

| Net foreign currency translation adjustment on cash | (133) | | | 855 | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 93,527 | | | (86,609) | |

| Cash, cash equivalents and restricted cash, beginning of period | 149,340 | | | 308,921 | |

| Cash, cash equivalents and restricted cash, at end of period | $ | 242,867 | | | $ | 222,312 | |

MASONITE INTERNATIONAL CORPORATION

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

TO GAAP FINANCIAL MEASURES

(In thousands of U.S. dollars, except share and per share amounts)

(Unaudited) | | | | | | | | | | | | | | | |

| Three Months Ended | | |

| (In thousands) | March 31, 2024 | | April 2, 2023 | | | | |

| Net income attributable to Masonite | $ | 61,055 | | $ | 38,491 | | | | |

| | | | | | | |

| Add: Adjustments to net income attributable to Masonite: | | | | | | | |

| Restructuring costs (benefit) | 1,394 | | 3,678 | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other (income) expense, net (1) | (85,250) | | — | | | | |

Other items (2) | 37,832 | | 1,381 | | | | |

| Income tax impact of adjustments | 13,838 | | (1,316) | | | | |

| Adjusted net income attributable to Masonite | $ | 28,869 | | $ | 42,234 | | | | |

| | | | | | | |

| Diluted earnings per common share attributable to Masonite ("EPS") | $ | 2.74 | | $ | 1.71 | | | | |

| Diluted adjusted earnings per common share attributable to Masonite ("Adjusted EPS") | $ | 1.29 | | $ | 1.88 | | | | |

| | | | | | | |

| Shares used in computing EPS and Adjusted EPS | 22,322,748 | | 22,480,233 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

____________

(1) Other expense (income), net includes $85,250 in income primarily related to the PGTI termination fee in the three months ended March 31, 2024.

(2) Other items include $37,832 and $1,381 in acquisition and due diligence related costs in the three months ended March 31, 2024 and April 2, 2023, respectively, and were recorded in selling, general and administration expenses within the condensed consolidated statements of income and comprehensive income.

The weighted average number of shares outstanding utilized for the diluted EPS and diluted Adjusted EPS calculation contemplates the exercise of all currently outstanding SARs and the conversion of all RSUs. The dilutive effect of such equity awards is calculated based on the weighted average share price for each fiscal period using the treasury stock method. For all periods presented, common shares issuable for stock instruments which would have had an anti-dilutive impact under the treasury stock method have been excluded from the computation of diluted earnings per share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| (In thousands) | North American Residential | | Europe | | Architectural | | Corporate & Other | | Total |

| Net income (loss) attributable to Masonite | $ | 83,282 | | $ | (4,286) | | $ | 1,595 | | $ | (19,536) | | | $ | 61,055 |

| Plus: | | | | | | | | | |

| Depreciation | 15,392 | | 2,285 | | 3,070 | | 6,821 | | | 27,568 |

| Amortization | 7,137 | | 2,836 | | 185 | | 718 | | | 10,876 |

| Share based compensation expense | — | | — | | — | | 6,930 | | | 6,930 |

| Loss (gain) on disposal of property, plant and equipment | 95 | | 7 | | (34) | | 1,000 | | | 1,068 |

| Restructuring costs (benefits) | 450 | | 961 | | — | | (17) | | | 1,394 |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense, net | — | | — | | — | | 12,022 | | | 12,022 |

| | | | | | | | | |

Other expense (income), net (1) | 11 | | 138 | | — | | (85,399) | | | (85,250) |

| Income tax expense | — | | — | | — | | 23,278 | | | 23,278 |

Other items (2) | 145 | | — | | — | | 37,687 | | | 37,832 |

| Net income attributable to non-controlling interest | 289 | | — | | — | | 38 | | | 327 |

| Adjusted EBITDA | $ | 106,801 | | $ | 1,941 | | $ | 4,816 | | $ | (16,458) | | | $ | 97,100 |

| | | | | | | | | |

| Net sales | $ | 530,643 | | | $ | 58,392 | | | $ | 75,539 | | | $ | 3,765 | | | $ | 668,339 | |

| Adjusted EBITDA margin | 20.1 | % | | 3.3 | % | | 6.4 | % | | nm | | 14.5 | % |

| | | | | | | | | |

| | | | | | | | | |

____________

(1) Other expense (income), net include $85,250 in income primarily related to the PGTI termination fee in the three months ended March 31, 2024.

(2) Other items include $37,832 in acquisition and due diligence related costs in the three months ended March 31, 2024, and were recorded in selling, general and administration expenses within the condensed consolidated statements of income and comprehensive income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended April 2, 2023 |

| (In thousands) | North American Residential | | Europe | | Architectural | | Corporate & Other | | Total |

| Net income (loss) attributable to Masonite | $ | 86,755 | | $ | 203 | | $ | 1,465 | | $ | (49,932) | | | $ | 38,491 |

| Plus: | | | | | | | | | |

| Depreciation | 13,232 | | 2,204 | | 2,957 | | 3,092 | | | 21,485 |

| Amortization | 3,790 | | 2,808 | | 252 | | 571 | | | 7,421 |

| Share based compensation expense | — | | — | | — | | 6,054 | | | 6,054 |

| Loss (gain) on disposal of property, plant and equipment | 1,040 | | (3) | | (13) | | 14 | | | 1,038 |

| Restructuring costs | 2,380 | | — | | 684 | | 614 | | | 3,678 |

| | | | | | | | | |

| | | | | | | | | |

| Interest expense, net | — | | — | | — | | 14,252 | | | 14,252 |

| | | | | | | | | |

| Other (income) expense, net | (28) | | (61) | | — | | 141 | | | 52 |

| Income tax expense | — | | — | | — | | 11,360 | | | 11,360 |

| Other items (1) | — | | — | | 5 | | 1,376 | | | 1,381 |

| Net income attributable to non-controlling interest | 712 | | — | | — | | 241 | | | 953 |

| Adjusted EBITDA | $ | 107,881 | | $ | 5,151 | | $ | 5,350 | | $ | (12,217) | | | $ | 106,165 |

| | | | | | | | | |

| Net sales | $ | 569,039 | | $ | 63,694 | | $ | 87,902 | | $ | 5,349 | | | $ | 725,984 |

| Adjusted EBITDA margin | 19.0 | % | | 8.1 | % | | 6.1 | % | | nm | | 14.6 | % |

| | | | | | | | | |

| | | | | | | | | |

____________

(1) Other items include $1,381 in acquisition and due diligence related costs in the three months ended April 2, 2023, and were recorded in selling, general and administration expenses within the condensed consolidated statements of income and comprehensive income

Richard Leland

VP, FINANCE AND TREASURER

rleland@masonite.com

813.739.1808

Marcus Devlin

DIRECTOR, INVESTOR RELATIONS

mdevlin@masonite.com

813.371.5839

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

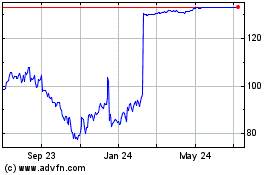

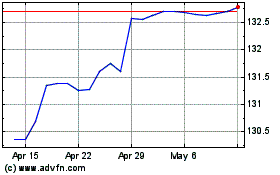

Masonite (NYSE:DOOR)

Historical Stock Chart

From Apr 2024 to May 2024

Masonite (NYSE:DOOR)

Historical Stock Chart

From May 2023 to May 2024