0001710366FALSE00017103662024-02-062024-02-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 6, 2024

CONSOL Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38147 | | 82-1954058 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

275 Technology Drive Suite 101

Canonsburg, Pennsylvania 15317

(Address of principal executive offices)

(Zip code)

Registrant's telephone number, including area code:

(724) 416-8300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | CEIX | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

CONSOL Energy Inc. (the "Company," "we," "us," "our") issued a press release on February 6, 2024 announcing its 2023 fourth quarter results. A copy of the press release is attached to this Form 8-K as Exhibit 99.1.

Please refer to our website at www.consolenergy.com for additional information regarding the Company. For example, periodically during the quarter, we may provide investor presentations, which would appear on our website in the Investors section.

The information in this Current Report and the exhibit hereto are being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Current Report and exhibit hereto shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD

The response to Item 2.02 is incorporated herein by reference to this Item 7.01.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| CONSOL Energy Inc. |

| (Registrant) |

| By: | /s/ MITESHKUMAR B. THAKKAR |

| | Miteshkumar B. Thakkar |

| | Chief Financial Officer and President |

Dated: February 6, 2024

Exhibit 99.1

CONSOL Energy Announces Results for the Fourth Quarter and Full Year 2023

CANONSBURG, PA (February 6, 2024) - Today, CONSOL Energy Inc. (NYSE: CEIX) reported financial and operating results for the fiscal quarter and year ended December 31, 2023.

Fourth Quarter 2023 Highlights Include:

•GAAP net income of $157.1 million and GAAP dilutive earnings per share of $5.05;

•Quarterly adjusted EBITDA1 of $239.9 million;

•Net cash provided by operating activities of $219.1 million;

•Quarterly free cash flow1 of $165.0 million;

•Total revenue and other income of $649.4 million;

•Pennsylvania Mining Complex (PAMC) produced 6.6 million tons and shipped 6.8 million tons;

•Itmann Complex sold 159 thousand tons compared to 123 thousand tons during the third quarter;

•85% of 4Q23 free cash flow1 returned to shareholders via stock repurchases, including a $30.0 million 10b5-1 plan for the month of January 2024;

•PAMC improved its contracted position to 22.0 million tons in 2024 and 13.0 million tons in 2025; and

•Itmann Mining Complex improved its contracted position to 571 thousand tons in 2024.

Full Year 2023 Highlights Include:

•GAAP net income of $655.9 million and GAAP dilutive earnings per share of $19.79;

•Adjusted EBITDA1 of $1,047.7 million;

•Net cash provided by operating activities of $858.0 million;

•Free cash flow1 of $686.9 million;

•Total revenue and other income of $2,568.9 million;

•73% of 2023 free cash flow1 returned to shareholders via stock repurchases and dividends for an aggregate $500.9 million from January 1, 2023 through January 31, 2024;

•Repurchased 5.2 million shares of CEIX common stock at a weighted average price of $75.69 per share;

•Reduced total debt outstanding by $189.0 million, including $99.1 million and $63.6 million to fully retire our Second Lien Notes and Term Loan B, respectively;

•Record annual CONSOL Marine Terminal (CMT) net income of $69.3 million, adjusted EBITDA1 of $80.3 million and throughput of 19.0 million tons, including 15.7 million tons of PAMC coal shipments;

•70% of annual total recurring revenues and other income1 derived from export sales and 60% derived from non-power generation sales;

•Amended and upsized our revolving credit facility to $355 million through 2026; and

•PAMC sales volume of 26.0 million tons, an increase of 8% compared to 2022 and the highest level in the post-COVID era.

Management Comments

“During the fourth quarter of 2023, we delivered a strong operational performance to close out our third consecutive year of production and sales volume growth for CONSOL Energy,” said Jimmy Brock, Chief Executive Officer of CONSOL Energy Inc. “More importantly, we generated over $1 billion dollars in adjusted EBITDA1 and $687 million in free cash flow1 during 2023. The majority of this free cash flow1 was deployed toward returning value to our shareholders. We repurchased more than 5 million shares of our common stock, paid out $75 million in dividends, and made debt repayments

of approximately $190 million during the year, which fully retired our Term Loan B and Second Lien Notes. We executed a significant shift in our coal sales mix toward the export market, which led to record annual throughput volume and revenue at our CONSOL Marine Terminal and 70% of our total recurring revenues and other income1 came from export sales. Looking forward, we expect improving contributions from our Itmann Mining Complex as it moves beyond its mains development and we are able to grow third-party coal sales processed through our preparation plant.”

“On the safety front, our Bailey Preparation Plant and CONSOL Marine Terminal each had ZERO employee recordable incidents for the full year 2023. Our 2023 total recordable incident rate across our coal mining segment was approximately 33% below the national average for underground bituminous coal mines (based on the latest available MSHA data).”

Pennsylvania Mining Complex Review and Outlook

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | For the Year Ended |

| | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| | | | | | | | |

| Total Coal Revenue (PAMC Segment) | thousands | $ | 509,007 | | | $ | 516,289 | | | $ | 2,024,610 | | | $ | 1,973,884 | |

| Settlements of Commodity Derivatives | thousands | $ | — | | | $ | (47,742) | | | $ | — | | | $ | (289,228) | |

Realized Coal Revenue1 | thousands | $ | 509,007 | | | $ | 468,547 | | | $ | 2,024,610 | | | $ | 1,684,656 | |

| Operating and Other Costs | thousands | $ | 306,519 | | | $ | 256,254 | | | $ | 1,120,065 | | | $ | 949,222 | |

Total Cash Cost of Coal Sold1 | thousands | $ | 249,283 | | | $ | 215,990 | | | $ | 939,892 | | | $ | 834,405 | |

| Coal Production | million tons | 6.6 | | 6.1 | | 26.1 | | 23.9 |

| Coal Sales | million tons | 6.8 | | 6.2 | | 26.0 | | 24.1 |

Average Realized Coal Revenue per Ton Sold1 | per ton | $ | 74.64 | | | $ | 75.92 | | | $ | 77.74 | | | $ | 69.89 | |

Average Cash Cost of Coal Sold per Ton1 | per ton | $ | 36.28 | | | $ | 34.89 | | | $ | 36.10 | | | $ | 34.56 | |

Average Cash Margin per Ton Sold1 | per ton | $ | 38.36 | | | $ | 41.03 | | | $ | 41.64 | | | $ | 35.33 | |

PAMC Sales and Marketing

CEIX sold 6.8 million tons of PAMC coal during the fourth quarter of 2023, generating realized coal revenue1 of $509.0 million for the PAMC segment and an average realized coal revenue per ton sold1 of $74.64. This compares to 6.2 million tons sold, generating realized coal revenue1 of $468.5 million and an average realized coal revenue per ton sold1 of $75.92 in the year-ago period. The improvement in realized coal revenue1 was driven by the increased sales tonnage during the quarter due to the availability of the fifth longwall in 2023 versus the prior year, which provided increased productive capacity and helped to mitigate the impact of longwall moves.

On the marketing front, demand for our product in the power generation markets rebounded modestly during the fourth quarter compared to the third quarter. Domestically, Henry Hub natural gas spot prices and PJM West day-ahead power prices improved 6% and 9%, respectively, in the fourth quarter compared to 3Q23. Similarly, in the export market, API2 spot prices averaged $125/metric ton during the quarter, a 7% increase versus the third quarter of 2023. As such, 58% of our total recurring revenues and other income1 during the fourth quarter was derived from sales into non-power generation applications, a slight reduction from 64% in 3Q23. We also took advantage of ongoing met coal pricing strength to place 10% of our PAMC volume into the crossover metallurgical market during 4Q23.

Throughout 2023, we leveraged the many end-use markets into which our high-quality PAMC product is sold and pivoted more tons into the export market than at any time in our history. We finished 2023 with 15.7 million tons, or 60%, of Pennsylvania Mining Complex product moving into the export market. From a revenue standpoint, export sales in aggregate accounted for 66% of our total coal revenue during the year with 35% of total coal revenue coming from the export industrial market and 14% from export metallurgical sales. For 2023, 70% of our total recurring revenues and other income1 has been derived from sales into the export markets.

Additionally, during 4Q23, we strengthened our forward contract book at the PAMC and secured an additional 4.7 million tons for delivery through 2028. We now have 22.0 million tons contracted for 2024 and 13.0 million tons contracted for 2025.

Operations Summary

During the fourth quarter of 2023, we produced 6.6 million tons at the Pennsylvania Mining Complex, compared to 6.1 million tons in the year-ago period in which we had only four longwalls operating versus all five currently in operation. This brought total PAMC production to 26.1 million tons in 2023 compared to 23.9 million tons in the prior year.

Total coal revenue for the PAMC segment during the fourth quarter of 2023 was $509.0 million, compared to $516.3 million in the year-ago quarter. After adjusting for the effect of settlements of commodity derivatives, PAMC total realized coal revenue1 in 4Q23 was $509.0 million, compared to $468.5 million in 4Q22. Average cash cost of coal sold per ton1 at the PAMC for the fourth quarter of 2023 was $36.28, compared to $34.89 in the year-ago quarter. The increase was due to ongoing inflationary pressures on costs for supplies, maintenance and contractor labor, partially offset by reduced power costs.

Our full-year 2023 average cash cost of coal sold per ton1 at the PAMC came in at $36.10, compared to $34.56 for full-year 2022. The increase for the year was due to persistent inflationary pressures on supply and maintenance costs and contractor labor.

CONSOL Marine Terminal Review

For the fourth quarter of 2023, throughput volume at the CMT was 4.7 million tons, compared to 3.6 million tons in the year-ago period due to the continued shift of PAMC sales volumes into the export market. Terminal revenues and CMT total costs and expenses were $25.4 million and $10.7 million, respectively, compared to $20.9 million and $10.3 million, respectively, during the year-ago period. CMT operating cash costs1 were $6.8 million in 4Q23, compared to $6.4 million in the prior-year period. CONSOL Marine Terminal net income and CONSOL Marine Terminal Adjusted EBITDA1 were $18.3 million and $21.0 million, respectively, in the fourth quarter of 2023 compared to $11.7 million and $14.4 million, respectively, in the year-ago period. The improved financial performance was directly related to the significant increase in throughput volume compared to the prior-year quarter.

For the full year of 2023, CMT achieved multiple records. Terminal revenue came in at $106.2 million, the highest in its history. Additionally, the Terminal set a new throughput tonnage record in 2023, finishing the year with 19.0 million tons. These accomplishments led to record financial results in 2023. CONSOL Marine Terminal net income and CONSOL Marine Terminal Adjusted EBITDA1 were $69.3 million and $80.3 million, respectively, compared to $41.2 million and $52.3 million, respectively, in 2022.

Itmann Update

The Itmann Mining Complex once again increased sales on a quarter-over-quarter basis during the fourth quarter of 2023. The Complex sold 159 thousand tons of Itmann and third-party coal in 4Q23 versus 123 thousand tons in 3Q23. For the full year 2023, the Complex produced 316 thousand tons of coal and sold 515 thousand tons of Itmann and third-party coal in aggregate. During the fourth quarter, long-term mains development continued in all three mining sections which requires cutting additional height and rock and in turn slows the mining rates. We again operated two of the three continuous miner sections as true super sections during the fourth quarter as we continued to work toward fully staffing the mine. Moving forward, we expect to increase our complex sales volume this year compared to 2023, and the Itmann Mining Complex currently has 571 thousand tons contracted for 2024.

Shareholder Returns Update

During the fourth quarter of 2023, CEIX repurchased 1.1 million shares of its common stock in the open market for $111.0 million at a weighted average price of $100.84 per share. Additionally, through a 10b5-1 plan in place for the month of January, CEIX repurchased an additional 307 thousand shares of its common stock for $30.0 million at a weighted average price of $97.73 per share. Therefore, with the free cash flow1 generated during the fourth quarter of 2023, CEIX repurchased 1.4 million shares of its common stock for $141.0 million at a weighted average price of $100.16 per share. As a result, CEIX allocated approximately 85% of its quarterly free cash flow1 toward share repurchases. From the beginning of December 2022 through January 31, 2024, CEIX has repurchased 5.7 million shares of its common stock, or approximately 16% of its public float as of year-end 2022, at a weighted average price of $76.63 per share. Consistent with the Company's previously announced plan to return value to CEIX shareholders through repurchases of CEIX common stock rather than dividends, the Company is not declaring a quarterly dividend at this time.

Debt Repurchases Update

During the fourth quarter of 2023, we made repayments of $6.1 million on our equipment-financed and other debt. This brings our total debt repayments and repurchases for the year to $189.0 million (excluding the premium paid on the Second Lien Notes). Of note during 2023, we fully retired our Term Loan B and Second Lien Notes, and as of December 31, 2023, CEIX had a net cash position, including short-term investments, of $88.4 million.

2024 Guidance and Outlook

Based on our current contracted position, estimated prices and production plans, we are providing the following financial and operating performance guidance for full fiscal year 2024:

•PAMC coal sales volume of 25.0-27.0 million tons

•PAMC average realized coal revenue per ton sold2 expectation of $62.50-$66.50

•PAMC average cash cost of coal sold per ton2 expectation of $36.50-$38.50

•Itmann Mining Complex coal sales volume of 600-800 thousand tons

•Itmann Mining Complex average cash cost of coal sold per ton2 expectation of $120.00-$140.00

•Total capital expenditures: $175-$200 million

Fourth Quarter Earnings Conference Call

A conference call and webcast, during which management will discuss the fourth quarter and full year 2023 financial and operational results, is scheduled for February 6, 2024 at 10:00 AM eastern time. Prepared remarks by members of management will be followed by a question and answer session. Interested parties may listen via webcast on the "Events and Presentations" page of our website, www.consolenergy.com. An archive of the webcast will be available for 30 days after the event.

Participant dial in (toll free) 1-877-226-2859

Participant international dial in 1-412-542-4134

Availability of Additional Information

Please refer to our website, www.consolenergy.com, for additional information regarding the company. In addition, we may provide other information about the company from time to time on our website.

We will also file our Form 10-K with the Securities and Exchange Commission (SEC) reporting our results for the period ended December 31, 2023 on February 9, 2024. Investors seeking our detailed financial statements can refer to the Form 10-K once it has been filed with the SEC.

Footnotes:

1 "Adjusted EBITDA", "Free Cash Flow", "CONSOL Marine Terminal Adjusted EBITDA", "CMT Operating Cash Costs", “Realized Coal Revenue”, "Total Recurring Revenues and Other Income" and "Total Cash Cost of Coal Sold" are non-GAAP financial measures and “Average Realized Coal Revenue per Ton Sold”, "Average Cash Cost of Coal Sold per Ton" and "Average Cash Margin per Ton Sold" are operating ratios derived from non-GAAP financial measures, each of which are reconciled to the most directly comparable GAAP financial measures below, under the caption “Reconciliation of Non-GAAP Financial Measures".

2 CEIX is unable to provide a reconciliation of PAMC Average Realized Coal Revenue per Ton Sold, PAMC Average Cash Cost of Coal Sold per Ton and Itmann Mining Complex Average Cash Cost of Coal Sold per Ton guidance, which are operating ratios derived from non-GAAP financial measures, due to the unknown effect, timing and potential significance of certain income statement items.

About CONSOL Energy Inc.

CONSOL Energy Inc. (NYSE: CEIX) is a Canonsburg, Pennsylvania-based producer and exporter of high-Btu bituminous thermal coal and metallurgical coal. It owns and operates some of the most productive longwall mining operations in the Northern Appalachian Basin. CONSOL’s flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year and is comprised of 3 large-scale underground mines: Bailey Mine, Enlow Fork Mine, and Harvey Mine. CONSOL recently developed the Itmann Mine in the Central Appalachian Basin, which has the capacity when fully operational to produce roughly 900 thousand tons per annum of premium, low-vol metallurgical coking coal. The company also owns and operates the CONSOL Marine Terminal, which is located in the port of Baltimore and has a throughput capacity of approximately 20 million tons per year. In addition to the ~584 million reserve tons associated with the Pennsylvania Mining Complex and the ~28 million reserve tons associated with the Itmann Mining Complex, the company controls approximately 1.3 billion tons of greenfield thermal and metallurgical coal reserves and resources located in the major coal-producing basins of the eastern United States. Additional information regarding CONSOL Energy may be found at www.consolenergy.com.

Contacts:

Investor:

Nathan Tucker, (724) 416-8336

nathantucker@consolenergy.com

Media:

Erica Fisher, (724) 416-8292

ericafisher@consolenergy.com

Condensed Consolidated Statements of Income

The following table presents a condensed consolidated statement of income for the three months and years ended December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | For the Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Revenue and Other Income: | | | | | | | | |

| Coal Revenue | | $ | 532,270 | | | $ | 536,994 | | | $ | 2,106,366 | | | $ | 2,018,662 | |

| Terminal Revenue | | 25,411 | | | 20,899 | | | 106,166 | | | 78,915 | |

| Freight Revenue | | 76,668 | | | 51,022 | | | 294,103 | | | 182,441 | |

| Gain (Loss) on Commodity Derivatives, net | | — | | | 19,547 | | | — | | | (237,024) | |

| Other Income | | 15,090 | | | 8,689 | | | 62,242 | | | 58,943 | |

| Total Revenue and Other Income | | 649,439 | | | 637,151 | | | 2,568,877 | | | 2,101,937 | |

| | | | | | | | |

| Costs and Expenses: | | | | | | | | |

| Operating and Other Costs | | 306,519 | | | 256,254 | | | 1,120,065 | | | 949,222 | |

| Depreciation, Depletion and Amortization | | 58,446 | | | 58,271 | | | 241,317 | | | 226,878 | |

| Freight Expense | | 76,668 | | | 51,022 | | | 294,103 | | | 182,441 | |

| General and Administrative Costs | | 23,712 | | | 21,777 | | | 103,470 | | | 116,696 | |

| Loss on Debt Extinguishment | | — | | | 1,262 | | | 2,725 | | | 5,623 | |

| Interest Expense | | 5,246 | | | 13,205 | | | 29,325 | | | 52,640 | |

| Total Costs and Expenses | | 470,591 | | | 401,791 | | | 1,791,005 | | | 1,533,500 | |

| | | | | | | | |

| Earnings Before Income Tax | | 178,848 | | | 235,360 | | | 777,872 | | | 568,437 | |

| Income Tax Expense | | 21,781 | | | 42,343 | | | 121,980 | | | 101,458 | |

| Net Income | | $ | 157,067 | | | $ | 193,017 | | | $ | 655,892 | | | $ | 466,979 | |

| | | | | | | | |

| Earnings per Share: | | | | | | | | |

| Basic | | $ | 5.09 | | | $ | 5.54 | | | $ | 19.91 | | | $ | 13.41 | |

| Dilutive | | $ | 5.05 | | | $ | 5.39 | | | $ | 19.79 | | | $ | 13.07 | |

Condensed Consolidated Balance Sheets

The following table presents a condensed consolidated balance sheet as of December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| ASSETS | | | | |

| Cash and Cash Equivalents | | $ | 199,371 | | | $ | 273,070 | |

| Trade Receivables, net | | 147,612 | | | 158,127 | |

| Other Current Assets | | 254,023 | | | 167,286 | |

| Total Current Assets | | 601,006 | | | 598,483 | |

| Total Property, Plant and Equipment - Net | | 1,903,123 | | | 1,960,082 | |

| Total Other Assets | | 170,874 | | | 145,812 | |

| TOTAL ASSETS | | $ | 2,675,003 | | | $ | 2,704,377 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Total Current Liabilities | | $ | 443,724 | | | $ | 448,798 | |

| Total Long-Term Debt | | 186,067 | | | 355,335 | |

| Total Other Liabilities | | 701,770 | | | 734,418 | |

| Total Equity | | 1,343,442 | | | 1,165,826 | |

| TOTAL LIABILITIES AND EQUITY | | $ | 2,675,003 | | | $ | 2,704,377 | |

Condensed Consolidated Statements of Cash Flows

The following table presents a condensed consolidated statement of cash flows for the three months and years ended December 31, 2023 and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | For the Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash Flows from Operating Activities: | (Unaudited) | | (Unaudited) | | (Unaudited) | | (Unaudited) |

| Net Income | $ | 157,067 | | | $ | 193,017 | | | $ | 655,892 | | | $ | 466,979 | |

| Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: | | | | | | | |

| Depreciation, Depletion and Amortization | 58,446 | | | 58,271 | | | 241,317 | | | 226,878 | |

| Other Non-Cash Adjustments to Net Income | 14,731 | | | (28,402) | | | 19,961 | | | (11,699) | |

| Changes in Working Capital | (11,113) | | | (71,582) | | | (59,221) | | | (31,168) | |

| Net Cash Provided by Operating Activities | 219,131 | | | 151,304 | | | 857,949 | | | 650,990 | |

| Cash Flows from Investing Activities: | | | | | | | |

| Capital Expenditures | (50,042) | | | (37,050) | | | (167,791) | | | (171,506) | |

| Proceeds from Sales of Assets | (1,985) | | | 1,764 | | | 4,255 | | | 21,538 | |

| Other Investing Activity | (11,682) | | | 9,423 | | | (95,896) | | | 7,790 | |

| Net Cash Used in Investing Activities | (63,709) | | | (25,863) | | | (259,432) | | | (142,178) | |

| Cash Flows from Financing Activities: | | | | | | | |

| Net Payments on Long-Term Debt, Including Fees | (6,097) | | | (82,257) | | | (191,738) | | | (294,362) | |

| Repurchases of Common Stock | (121,997) | | | — | | | (399,379) | | | — | |

| Dividends | — | | | (36,615) | | | (75,474) | | | (71,486) | |

| Other Financing Activities | (54) | | | (265) | | | (15,610) | | | (14,218) | |

| Net Cash Used in Financing Activities | (128,148) | | | (119,137) | | | (682,201) | | | (380,066) | |

| Net Increase (Decrease) in Cash and Cash Equivalents and Restricted Cash | 27,274 | | | 6,304 | | | (83,684) | | | 128,746 | |

| Cash and Cash Equivalents and Restricted Cash at Beginning of Period | 215,994 | | | 320,648 | | | 326,952 | | | 198,206 | |

| Cash and Cash Equivalents and Restricted Cash at End of Period | $ | 243,268 | | | $ | 326,952 | | | $ | 243,268 | | | $ | 326,952 | |

Reconciliation of Non-GAAP Financial Measures

We evaluate our cost of coal sold and cash cost of coal sold on an aggregate basis by segment, and our average cash cost of coal sold per ton on a per-ton basis. Cost of coal sold includes items such as direct operating costs, royalty and production taxes, direct administration costs, and depreciation, depletion and amortization costs on production assets. Cost of coal sold excludes any indirect costs and other costs not directly attributable to the production of coal. The cash cost of coal sold includes cost of coal sold less depreciation, depletion and amortization costs on production assets. We define average cash cost of coal sold per ton as cash cost of coal sold divided by tons sold. The GAAP measure most directly comparable to cost of coal sold, cash cost of coal sold and average cash cost of coal sold per ton is operating and other costs.

The following table presents a reconciliation for the PAMC segment of cash cost of coal sold, cost of coal sold and average cash cost of coal sold per ton to operating and other costs, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands, except per ton information).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | For the Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Operating and Other Costs | $ | 306,519 | | | $ | 256,254 | | | $ | 1,120,065 | | | $ | 949,222 | |

| Less: Other Costs (Non-Production and non-PAMC) | (57,236) | | | (40,264) | | | (180,173) | | | (114,817) | |

| Cash Cost of Coal Sold | $ | 249,283 | | | $ | 215,990 | | | $ | 939,892 | | | $ | 834,405 | |

| Add: Depreciation, Depletion and Amortization (PAMC Production) | 49,611 | | | 49,104 | | | 190,962 | | | 189,857 | |

| Cost of Coal Sold | $ | 298,894 | | | $ | 265,094 | | | $ | 1,130,854 | | | $ | 1,024,262 | |

| Total Tons Sold (in millions) | 6.8 | | 6.2 | | 26.0 | | 24.1 |

| Average Cost of Coal Sold per Ton | $ | 43.83 | | | $ | 42.96 | | | $ | 43.42 | | | $ | 42.49 | |

| Less: Depreciation, Depletion and Amortization Costs per Ton Sold | 7.55 | | | 8.07 | | | 7.32 | | | 7.93 | |

| Average Cash Cost of Coal Sold per Ton | $ | 36.28 | | | $ | 34.89 | | | $ | 36.10 | | | $ | 34.56 | |

We evaluate our average realized coal revenue per ton sold and average cash margin per ton sold on a per-ton basis. We define realized coal revenue as total coal revenue, net of settlements of commodity derivatives. We define average realized coal revenue per ton sold as total coal revenue, net of settlements of commodity derivatives divided by tons sold. We define average cash margin per ton sold as average realized coal revenue per ton sold, net of average cash cost of coal sold per ton. The GAAP measure most directly comparable to realized coal revenue, average realized coal revenue per ton sold and average cash margin per ton sold is total coal revenue.

The following table presents a reconciliation for the PAMC segment of realized coal revenue, average realized coal revenue per ton sold and average cash margin per ton sold to total coal revenue, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands, except per ton information).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | For the Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total Coal Revenue (PAMC Segment) | $ | 509,007 | | | $ | 516,289 | | | $ | 2,024,610 | | | $ | 1,973,884 | |

| Less: Settlements of Commodity Derivatives | — | | | (47,742) | | | — | | | (289,228) | |

| Realized Coal Revenue | 509,007 | | | 468,547 | | | 2,024,610 | | | 1,684,656 | |

| Operating and Other Costs | 306,519 | | | 256,254 | | | 1,120,065 | | | 949,222 | |

| Less: Other Costs (Non-Production and non-PAMC) | (57,236) | | | (40,264) | | | (180,173) | | | (114,817) | |

| Cash Cost of Coal Sold | $ | 249,283 | | | $ | 215,990 | | | $ | 939,892 | | | $ | 834,405 | |

| Total Tons Sold (in millions) | 6.8 | | 6.2 | | 26.0 | | 24.1 |

| Average Realized Coal Revenue per Ton Sold | $ | 74.64 | | | $ | 75.92 | | | $ | 77.74 | | | $ | 69.89 | |

| Less: Average Cash Cost of Coal Sold per Ton | 36.28 | | | 34.89 | | | 36.10 | | | 34.56 | |

| Average Cash Margin per Ton Sold | $ | 38.36 | | | $ | 41.03 | | | $ | 41.64 | | | $ | 35.33 | |

We define CMT operating costs as operating and other costs related to throughput tons. CMT operating costs exclude any indirect costs and other costs not directly attributable to throughput tons. CMT operating cash costs include CMT operating costs, less depreciation, depletion and amortization costs on throughput assets. The GAAP measure most directly comparable to CMT operating costs and CMT operating cash costs is operating and other costs.

The following table presents a reconciliation of CMT operating costs and CMT operating cash costs to operating and other costs, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | For the Year Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Operating and Other Costs | $ | 306,519 | | | $ | 256,254 | | | $ | 1,120,065 | | | $ | 949,222 | |

| Less: Other Costs (Non-Throughput) | (298,651) | | | (248,818) | | | (1,088,579) | | | (920,195) | |

| CMT Operating Costs | $ | 7,868 | | | $ | 7,436 | | | $ | 31,486 | | | $ | 29,027 | |

| Less: Depreciation, Depletion and Amortization (Throughput) | (1,045) | | | (1,018) | | | (4,227) | | | (4,269) | |

| CMT Operating Cash Costs | $ | 6,823 | | | $ | 6,418 | | | $ | 27,259 | | | $ | 24,758 | |

We define adjusted EBITDA as (i) net income (loss) plus income taxes, interest expense and depreciation, depletion and amortization, as adjusted for (ii) certain non-cash items, such as stock-based compensation, loss on debt extinguishment and fair value adjustments of commodity derivative instruments. The GAAP measure most directly comparable to adjusted EBITDA is net income (loss).

The following tables present a reconciliation of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| | PAMC | | CONSOL Marine Terminal | | Other | | Total Company |

| Net Income (Loss) | $ | 183,181 | | | $ | 18,272 | | | $ | (44,386) | | | $ | 157,067 | |

| | | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 21,781 | | | 21,781 | |

| Add: Interest Expense | — | | | 1,521 | | | 3,725 | | | 5,246 | |

| Less: Interest Income | (700) | | | — | | | (3,495) | | | (4,195) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 182,481 | | | 19,793 | | | (22,375) | | | 179,899 | |

| | | | | | | | |

| Add: Depreciation, Depletion & Amortization | 50,531 | | | 1,158 | | | 6,757 | | | 58,446 | |

| | | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 233,012 | | | $ | 20,951 | | | $ | (15,618) | | | $ | 238,345 | |

| | | | | | | | |

| Adjustments: | | | | | | | |

| Add: Stock-Based Compensation | $ | 1,330 | | | 48 | | | $ | 207 | | | $ | 1,585 | |

| | | | | | | |

| | | | | | | |

| Total Pre-tax Adjustments | 1,330 | | | 48 | | | 207 | | | 1,585 | |

| | | | | | | | |

| Adjusted EBITDA | $ | 234,342 | | | $ | 20,999 | | | $ | (15,411) | | | $ | 239,930 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| PAMC | | CONSOL Marine Terminal | | Other | | Total Company |

| Net Income (Loss) | $ | 247,800 | | | $ | 11,654 | | | $ | (66,437) | | | $ | 193,017 | |

| | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 42,343 | | | 42,343 | |

| Add: Interest Expense | (205) | | | 1,527 | | | 11,883 | | | 13,205 | |

| Less: Interest Income | (553) | | | — | | | (1,169) | | | (1,722) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 247,042 | | | 13,181 | | | (13,380) | | | 246,843 | |

| | | | | | | |

| Add: Depreciation, Depletion & Amortization | 50,583 | | | 1,148 | | | 6,540 | | | 58,271 | |

| | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 297,625 | | | $ | 14,329 | | | $ | (6,840) | | | $ | 305,114 | |

| | | | | | | |

| Adjustments: | | | | | | | |

| Add: Stock-Based Compensation | $ | 1,005 | | | $ | 48 | | | $ | 143 | | | $ | 1,196 | |

| Add: Loss on Debt Extinguishment | — | | | — | | | 1,262 | | | 1,262 | |

| Less: Fair Value Adjustment of Commodity Derivative Instruments | (67,289) | | | — | | | — | | | (67,289) | |

| Total Pre-tax Adjustments | (66,284) | | | 48 | | | 1,405 | | | (64,831) | |

| | | | | | | |

| Adjusted EBITDA | $ | 231,341 | | | $ | 14,377 | | | $ | (5,435) | | | $ | 240,283 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Year Ended December 31, 2023 |

| PAMC | | CONSOL Marine Terminal | | Other | | Total Company |

| Net Income (Loss) | $ | 810,234 | | | $ | 69,253 | | | $ | (223,595) | | | $ | 655,892 | |

| | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 121,980 | | | 121,980 | |

| Add: Interest Expense | — | | | 6,097 | | | 23,228 | | | 29,325 | |

| Less: Interest Income | (2,344) | | | | | (11,253) | | | (13,597) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 807,890 | | | 75,350 | | | (89,640) | | | 793,600 | |

| | | | | | | |

| Add: Depreciation, Depletion & Amortization | 202,833 | | | 4,671 | | | 33,813 | | | 241,317 | |

| | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 1,010,723 | | | $ | 80,021 | | | $ | (55,827) | | | $ | 1,034,917 | |

| | | | | | | |

| Adjustments: |

| | | |

| |

|

| Add: Stock-Based Compensation | $ | 8,438 | | | $ | 301 | | | $ | 1,307 | | | $ | 10,046 | |

| Add: Loss on Debt Extinguishment | — | | | — | | | 2,725 | | | 2,725 | |

| | | | | | | |

| | | | | | | |

| Total Pre-tax Adjustments | 8,438 | | | 301 | | | 4,032 | | | 12,771 | |

| | | | | | | |

| Adjusted EBITDA | $ | 1,019,161 | | | $ | 80,322 | | | $ | (51,795) | | | $ | 1,047,688 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Year Ended December 31, 2022 |

| PAMC | | CONSOL Marine Terminal | | Other | | Total Company |

| Net Income (Loss) | $ | 620,208 | | | $ | 41,223 | | | $ | (194,452) | | | $ | 466,979 | |

| | | | | | | |

| Add: Income Tax Expense | — | | | — | | | 101,458 | | | 101,458 | |

| Add: Interest Expense | — | | | 6,116 | | | 46,524 | | | 52,640 | |

| Less: Interest Income | (1,857) | | | — | | | (4,174) | | | (6,031) | |

| Earnings (Loss) Before Interest & Taxes (EBIT) | 618,351 | | | 47,339 | | | (50,644) | | | 615,046 | |

| | | | | | | |

| Add: Depreciation, Depletion & Amortization | 200,320 | | | 4,604 | | | 21,954 | | | 226,878 | |

| | | | | | | |

| Earnings (Loss) Before Interest, Taxes and DD&A (EBITDA) | $ | 818,671 | | | $ | 51,943 | | | $ | (28,690) | | | $ | 841,924 | |

| | | | | | | |

| Adjustments: | | | | | | | |

| Add: Stock-Based Compensation | $ | 6,628 | | | $ | 316 | | | $ | 946 | | | $ | 7,890 | |

| Add: Loss on Debt Extinguishment | — | | | — | | | 5,623 | | | 5,623 | |

| Add: Equity Affiliate Adjustments | — | | | — | | | 3,500 | | | 3,500 | |

| Less: Fair Value Adjustment of Commodity Derivative Instruments | (52,204) | | | — | | | — | | | (52,204) | |

| Total Pre-tax Adjustments | (45,576) | | | 316 | | | 10,069 | | | (35,191) | |

| | | | | | | |

| Adjusted EBITDA | $ | 773,095 | | | $ | 52,259 | | | $ | (18,621) | | | $ | 806,733 | |

We define total recurring revenues and other income as total revenue and other income, less fair value adjustments of commodity derivatives and gains/losses on sales of assets. The GAAP measure most directly comparable to total recurring revenues and other income is total revenue and other income. The following table presents a reconciliation of total recurring revenues and other income to total revenue and other income, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | For the Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total Revenue and Other Income | $ | 649,439 | | | $ | 637,151 | | | $ | 2,568,877 | | | $ | 2,101,937 | |

| Less: Fair Value Adjustments of Commodity Derivatives | — | | | (67,289) | | | — | | | (52,204) | |

| Less: Gain on Sale of Assets | (1,899) | | | (1,495) | | | (8,981) | | | (34,589) | |

| Total Recurring Revenues and Other Income | $ | 647,540 | | | $ | 568,367 | | | $ | 2,559,896 | | | $ | 2,015,144 | |

Free cash flow is a non-GAAP financial measure, defined as net cash provided by operating activities plus proceeds from sales of assets less capital expenditures and investments in mining-related activities. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations and non-core asset sales after taking into consideration capital expenditures due to the fact that these expenditures are considered necessary to maintain and expand CONSOL’s asset base and are expected to generate future cash flows from operations. It is important to note that free cash flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The following table presents a reconciliation of free cash flow to net cash provided by operations, the most directly comparable GAAP financial measure, on a historical basis, for each of the periods indicated (in thousands).

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Three Months Ended | | For the Year Ended | | For the Year Ended |

| | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net Cash Provided by Operations | $ | 219,131 | | | $ | 151,304 | | | $ | 857,949 | | | $ | 650,990 | |

| | | | | | | |

| Capital Expenditures | (50,042) | | | (37,050) | | | (167,791) | | | (171,506) | |

| Proceeds from Sales of Assets | (1,985) | | | 1,764 | | | 4,255 | | | 21,538 | |

| Investments in Mining-Related Activities | (2,115) | | | — | | | (7,481) | | | — | |

| Free Cash Flow | $ | 164,989 | | | $ | 116,018 | | | $ | 686,932 | | | $ | 501,022 | |

Cautionary Statement Regarding Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” within the meaning of the federal securities laws. With the exception of historical matters, the matters discussed in this press release are forward-looking statements (as defined in Section 21E of the Securities Exchange Act of 1934, as amended) that involve risks and uncertainties that could cause actual results to differ materially from results projected in or implied by such forward-looking statements. Accordingly, investors should not place undue reliance on forward-looking statements as a prediction of actual results. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects and our future production, revenues, income and capital spending. When we use the words “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “should,” “will,” “would,” “target,” or their negatives, or other similar expressions, the statements which include those words are usually forward-looking statements. When we describe our expectations with respect to the Itmann Mine or any other strategy that involves risks or uncertainties, we are making forward-looking statements. We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Specific risks, contingencies and uncertainties are discussed in more detail in our filings with the Securities and Exchange Commission. The forward-looking statements in this press release speak only as of the date of this press release and CEIX disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law.

Source: CONSOL Energy Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

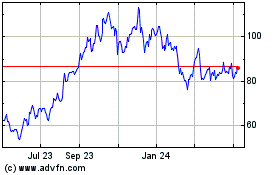

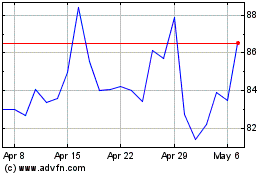

CONSOL Energy (NYSE:CEIX)

Historical Stock Chart

From Apr 2024 to May 2024

CONSOL Energy (NYSE:CEIX)

Historical Stock Chart

From May 2023 to May 2024