Two words on the stock market simultaneously provoke feelings of fear and opportunism: crisis and bubble. S&P 500, NASDAQ, Dow Jones, Dax30 together with the prices for Gold and Palladium are literally swollen.

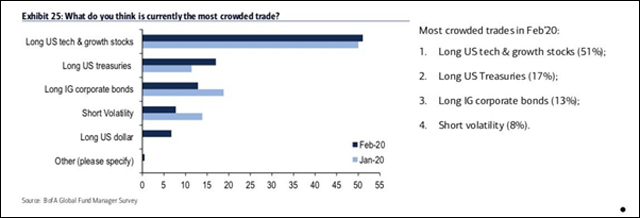

The shares of the top five American technological firms rose by 52% over the past 12 months. The increase in the firms’ combined value, of almost $2trn (roughly equivalent to Germany’s entire stock market). The problem here is that investors are creating a speculative bubble. The five companies, worth $5.6trn, represent almost a fifth of the value of the S&P 500. Thus if one of them falls, it will affect the whole market. The last time the market was so concentrated was before the 2001 dotcom crisis.

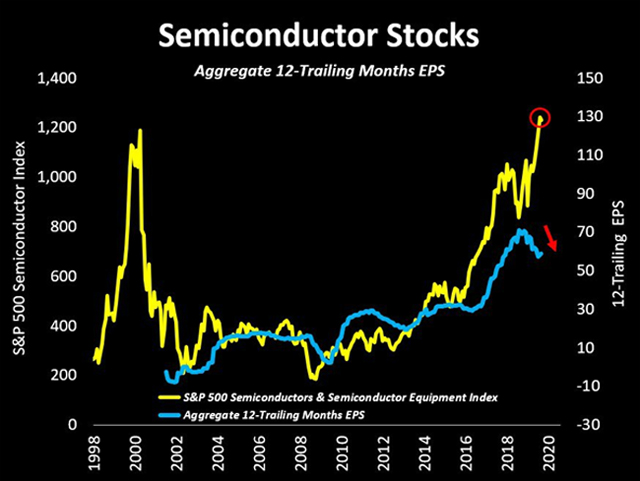

Even semiconductor companies stocks continue to reach new highs, despite a certain decrease in their earnings per share.

In addition, low-interest rates are making it harder for banks to earn from loans. Commerzbank, Deutsche Bank, HSBC, and Santander have cut thousands of jobs across the continent. Last week, HSBC announced 35,000 job cuts in the context of a major restructuring. Royal Bank of Scotland announced it would make major cuts to its investment banking business. However, this situation creates an opportunity for big banks – mergers and acquisitions. On February 18, Interesa Sanpaolo, an Italian banking group, has launched €4,9 billion bid to acquire smaller rival UBI Banca. Besides that, investment bank Morgan Stanley announced the purchase of E-trade. Thus, in the recent future, we will probably hear about new merges or new job cuts…

Talking about mergers and acquisitions, the French railway company Alstom agreed to pay $7 billion to take control of the train business from Canada’s Bombardier. L Brands, the owner of Victoria’s Secret, in turn, announced about his plans to sell a major stake in the company to private equity firm Sycamore Partners amid months of scandal. “Majority 55% Interest in Victoria’s Secret Lingerie, Victoria’s Secret Beauty and Pink to be Acquired by Sycamore Partners, With L Brands Retaining 45% Minority Stake, at a Total Enterprise Value of $1.1 Billion”.

Does it mean that the bubble is going to burst soon?

Not yet, for one simple reason – central banks will continue implementing Quantitative Easing by purchasing assets to stimulate the economy. That is not only the Fed but also ECB, PBOC, BOJ, and many others. Thus, the bubble will continue to grow until banks begin to crack, inflation goes wild or they raise interest rates.

The previous week in the markets

- Existing home sales decreased3% m/m in January to a seasonally adjusted annual rate of 5.46 million units. Total sales were up 9.6% year-over-year

- Index of leading indicators rose8% w/o/w, above the expected increase of 0.3%

- Initial claims increased by 4,000 to a still-low 210,000. Continuing claims increased by 25,000 to 1.726 million

- Same-store sales rose7% w/o/w, higher than the previous increase of 4.8%

- Home mortgage apps fell 3.0% w/o/w after last week’s 6.0% decrease

- The Conference Board’s Leading Economic Index (LEI) increased8% in January after decreasing 0.3% in December

- The key takeaway from the report is that it showed positive contributions from almost all components after the headline reading decreased in four out of the last five months

- The Philadelphia Fed Index for February catapulted to 36.7 from 17.0 in January

- Eurozone’s January CPI decreased0% m/m. Flash February Manufacturing PMI increased to 49.1, meanwhile flash February Services PMI improved to 52.8

- Germany’s flash February Manufacturing PMI grew to 47.8

- K.’s flash February Manufacturing PMI reached 51.9

- France’s flash February Manufacturing PMI fell to 49.7

- Japan’s January National CPI 0.0% m/m, Flash February Manufacturing PMI 47.6 (last 48.8) and flash February Services PMI 46.7 (last 51.0)