TIDMSDX

RNS Number : 8362J

SDX Energy PLC

22 August 2019

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

SDX TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 ("MAR"). ON THE PUBLICATION OF

THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE ("RIS"),

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

22 August 2019

SDX ENERGY PLC ("SDX" or the "Company")

ANNOUNCES ITS FINANCIAL AND OPERATING RESULTS FOR THE THREE AND

SIX MONTHSED 30 JUNE 2019

SDX Energy Plc (AIM: SDX), the North Africa-focused oil and gas

company, announces its financial and operating results for the

three and six months ended 30 June 2019. All monetary values are

expressed in United States dollars net to the Company unless

otherwise stated.

Summary

Operations

-- H1 2019 production of 3,539 boe/d, net to SDX, an increase of

9% from H1 2018 due to successful drilling in Meseda and increased

gas sales in Morocco. Q2 2019 production of 3,366 boe/d (net) was

9% lower than Q1 2019, primarily the result of an increased water

cut in North West Gemsa.

Egypt

-- Construction of the South Disouq central processing facility

("CPF"), pipeline, and well tie-ins continued in H1 2019 with first

gas expected in Q4 2019. The CPF has cleared customs in Alexandria

and is en route to site at South Disouq, thus achieving the second

of the three key project milestones. The final milestone of first

gas in Q4 2019 remains on track, subject to the successful

installation and hook-up of the CPF, which is scheduled to begin

later in August, with the Company aiming for a gross plateau

production rate of c.50 MMscfe/d by Q1 2020.

-- Discussions continue with our partner relating to the

potential exploration drilling programme in South Disouq. A further

update will be provided when agreement on the drilling programme is

reached.

-- In Meseda, following successful drilling of the Rabul-7

development well, a further development well, MSD-19, was spud in

early August, and the Company will announce the result of this well

in due course. The Company maintains its existing gross production

guidance of 4,000-4,200 bbl/d.

-- In North West Gemsa, 2019 gross production guidance is

maintained at 3,000-3,200 boe/d, with well workovers slowing the

rate of natural field decline.

Morocco

-- Planning for the drilling of 12 wells in Morocco is at an

advanced stage, with the campaign targeted to begin in Q4 2019 and

complete in H1 2020. All long lead items have been ordered and all

key contracts finalised. The programme will be targeting 15bcf of

gross unrisked prospective resources.

-- Morocco gas customers added in late 2018/early 2019 continue

to stabilise consumption rates, underpinning 2019 sales guidance of

an annual average gross rate of 6.0-6.5 MMscf/d.

-- The drilling campaign in Morocco will target sufficient

reserves to satisfy existing customers' forecast demands and test

new play opening areas of prospectivity across the portfolio.

Financial

-- H1 2019 net revenues of US$25 million are 4% higher than in

H1 2018, with higher production compensating for lower net realised

average oil/service fees of US$57/boe, compared to US$62/boe in H1

2018.

-- H1 2019 netback of US$18 million was lower than the US$19

million achieved in H1 2018, mainly because of increased workover

opex activity in H1 2019 and a greater allocation of costs to opex

in H1 2019. These costs were allocated to capex/drilling campaigns

in Morocco and NW Gemsa in H1 2018.

-- Operating cash flow before capex in H1 2019 remained robust

at US$13 million (H1 2018: US$20 million (which was higher as a

result of the unwinding of a larger Egyptian Petroleum Company

("EGPC") debtor in the period)), supporting US$19 million of capex

invested in the period (H1 2018: US$22 million). Of this US$19

million, US$12 million related to the South Disouq CPF, pipeline

and well tie-ins and 3D seismic, US$3 million for customer

connections and 3D seismic in Morocco, US$3 million for workovers

in Meseda and North West Gemsa and US$1 million for drilling and

completion costs at South Ramadan.

-- The Company's drilling and development activities set out

above are fully funded from expected future cash flows and its

existing sources of liquidity.

-- Cash at 30 June 2019 was US$11 million, with the US$10

million EBRD facility remaining undrawn.

Mark Reid, CFO and Interim CEO of SDX, commented:

"The Company continues to make good progress toward achieving

its three medium-term strategic objectives of securing first gas at

South Disouq in Q4 2019, executing an efficient and successful

12-well drilling campaign in Morocco in 2019/20, and continuing

with our potential exploration drilling campaign in South Disouq in

2020.

Production and capex from our operations remains within our

guided ranges and we look forward to updating the market on the

results of our drilling activities in Meseda and Morocco in the

coming months. Our cashflow generation, liquidity position, and

balance sheet remain strong and continue to provide us with the

necessary funding to complete all of these medium-term strategic

objectives.

Achieving first gas at South Disouq in Q4 will be transformative

for the Company, as we will benefit from our 55% share of the

expected production plateau of 50 MMscfe/d from Q1 2020."

Corporate and financial

-- SDX's key financial metrics for the three and six months ended 30 June 2019 and 2018 are:

Three months Six months ended

ended 30 June

30 June

US$ million, except per unit 2019 2018 2019 2018

amounts

------- ------ ---------- -------

Net revenues 12.7 13.5 25.4 24.4

------- ------ ---------- -------

Netback(1) 9.1 10.3 18.5 19.3

------- ------ ---------- -------

Net realised average oil/service

fees - US$/barrel 60.62 64.23 57.44 61.97

------- ------ ---------- -------

Net realised average Morocco

gas price - US$/mcf 10.31 10.51 10.28 10.27

------- ------ ---------- -------

Netback - US$/boe 29.84 33.00 28.80 32.91

------- ------ ---------- -------

EBITDAX(1) (2) 7.3 8.6 15.1 16.2

------- ------ ---------- -------

Exploration & evaluation expense

("E&E") (0.4) (2.1) (0.6) (5.3)

------- ------ ---------- -------

Depletion, depreciation, and

amortisation ("DD&A") (6.0) (3.7) (11.9) (6.2)

------- ------ ---------- -------

Total comprehensive(loss)/income (0.5) 0.6 (0.4) 1.0

------- ------ ---------- -------

Net cash generated from operating

activities 5.8 9.4 12.8 20.3

------- ------ ---------- -------

Cash and cash equivalents 11.2 25.2 11.2 25.2

------- ------ ---------- -------

Note:

(1) Refer to the "Non-IFRS Measures" section of this release

below for details of Netback and EBITDAX.

(2) EBITDAX for each period presented includes non-cash revenue

relating to the grossing up of Egyptian Corporate Tax on the North

West Gemsa PSC, which is paid by the Egyptian State on behalf of

the Company (Q2 2019: US$0.9 million, Q2 2018: US$1.2 million, H1

2019: US$1.9 million, H1 2018: US$2.2 million)

-- The main components of SDX's comprehensive loss of US$(0.4)

million for the six months ended 30 June 2019 are:

o US$18.5 million netback;

o US$11.9 million of DD&A;

o US$3.3 million of G&A; and

o US$1.1 million of transaction costs covering the re-domicile

of the Company from Canada to the UK, the Company's capital

reduction to improve our ability to pay dividends, and other

business development activities.

-- Netback for the six months ended 30 June 2019 was US$18.5

million, down from US$19.3 million for the six months to 30 June

2018. This decrease has mainly been driven by a 7% reduction in H1

2019 realised average oil prices in Egypt to US$57.44/bbl from

US$61.97/bbl in H1 2018, higher opex resulting from increased

workover activity in H1 2019, and a greater allocation of costs to

opex in the period. These costs were allocated to capex/drilling

campaigns in Morocco and NW Gemsa in H1 2018. These factors were

partly offset by increased production at Meseda and in Morocco.

-- The cash position of US$11.2 million as at 30 June 2019 is

broadly unchanged from the US$11.4m as at 31 March 2019 and US$6.1

million lower than the US$17.3 million as at 31 December 2018.

-- The main components of this H1 2019 cash movement are:

operating cash flows of US$14.1 million, which includes a US$3.0

million improvement in working capital predominantly due to the

continued reduction in Egyptian receivables, an Egyptian

corporation tax payment of US$1.3 and the US$19.3 million capital

investment programme discussed below. The Company's three-year,

US$10.0 million credit facility established in July 2018 with the

EBRD remains undrawn.

-- US$19.3 million of capital expenditure has been invested into

the business during the six months ended 30 June 2019. This is

comprised of:

o US$12.4 million for the South Disouq development, comprising

US$9.8 million for the CPF, pipeline and well tie-ins, and US$2.6

million for the 170km(2) 3D seismic programme;

o US$1.9 million in North West Gemsa for the ongoing well

workover programme;

o US$1.1 million in Meseda for the ongoing electrical

submersible pump ("ESP") and sucker rod pump replacement

programmes;

o US$1.4 million in South Ramadan for the SRM-3 well and

development project, the results of which are currently being

assessed; and

o US$2.5 million in Morocco, comprising US$2.1 million for

customer connections, facilities and studies, and US$0.4 million

relating to the 240km(2) 3D seismic programme in Gharb Centre.

-- Trade and other receivables have reduced to US$21.8 million

as at 30 June 2019, down from US$24.3 million as at 31 December

2018. This reduction is predominantly a result of the continued

recovery of trade receivables which were due from the Egyptian

State and offset against costs owing to Egyptian State contractors

used on the South Disouq development project.

-- Post period end, the Company has collected a further US$5.7

million of trade receivables of which US$3.9 million was collected

from EGPC and US$1.8 million was collected from third-party gas

customers in Morocco. Out of the US$3.9 million from EGPC, US$0.4

million was offset against South Disouq drilling and development

costs and amounts owing to joint venture partners.

Operational highlights

-- The Company's entitlement share of production from its

operations for the six months ended 30 June 2019 was 3,539 boe/d

(gross - 9,250 boe/d) split as follows:

o North West Gemsa 1,972 boe/d (gross - 3,944 boe/d)

o Meseda 822 bbl/d (gross - 4,313 bbl/d)

o Morocco 745 boe/d (gross - 993 boe/d)

Egypt

-- In South Disouq (SDX 55% working interest and operator), the

Company was awarded a 25-year development lease on 1 July 2019

covering the Ibn Yunus development area, which together with the

25-year South Disouq development lease granted on 2 January 2019

comprises the South Disouq development project. Gas sales

agreements have been signed for both development leases, with

pricing of US$2.85/Mcf.

-- Development of the South Disouq CPF, pipeline and well

tie-ins continued during H1 2019, with the 12" export line to the

Egyptian national grid now 100% completed and tested, alongside

three of the four 6" flowlines from the discovery wells to the CPF.

The CPF and the compressor both passed factory acceptance tests and

the CPF has cleared Customs in Alexandria and is en route to site

at South Disouq. The installation and hook-up of the CPF is

scheduled to commence later in August and production is expected to

start up in Q4 2019. After a ramp up phase, an initial gross

plateau production rate of c.50 MMscfe/d of conventional natural

gas is being targeted.

-- Interpretation of South Disouq's 170 km(2) 3D seismic survey

that was completed in February 2019 continues, alongside the

re-processing of 300 km(2) 3D seismic data acquired in 2016. During

H2 2019, the Company will review the final results of the composite

3D interpretation, undertake partner discussions on a potential

drilling campaign, and complete an assessment of drilling risk and

capital allocation. Upon conclusion of these activities, a decision

will be made on a future drilling campaign.

-- In Meseda (SDX 50% working interest and joint operator), the

Company completed the Rabul-7 development well, which is

contributing c.400 bbl/d gross to production, and participated in

the workover of five wells during Q2 2019 across the Rabul

(Rabul-2, Rabul-2R) and Meseda (MSD-8, MSD-11 and FADL N-1) fields.

The two Rabul wells were recompleted in additional producing

horizons, the MSD-8 well had an ESP replacement, and the MSD-11 and

FADL N-1 wells had sucker rod pump replacements. These workovers

were part of a wider programme, following on from the four wells

worked over in Q1 2019. During Q1 2019, the MSD-4 well was

converted to a water injector, with the planned Rabul water

injection well deferred pending the results of a subsurface study.

The above activities were all part of the 2019 budgeted capital

expenditure programme supporting the 2019 annual production

guidance of 4,000-4,200 bbl/d.

-- In the remainder of 2019, the partners will complete the

drilling of a further development well, MSD-19, which spud in early

August. The Company will announce the result of this well in due

course.

-- In North West Gemsa (SDX 50% working interest and

non-operator), five workovers were carried out in Q2 2019. The

AASE-25, AASE-18 and AASE-5 wells had ESPs installed, the AASE-6

well had its completion string replaced and the Geyad-1 was

re-entered to replace the ESP and the results of this operation are

currently being reviewed. One well was worked over in Q1 2019.

-- At South Ramadan (SDX 12.75% working interest and

non-operator), the SRM-3 appraisal well was spud on 14 June 2018

and reached a target depth of 15,635 feet. The operator reported

encountering 75 feet of net conventional oil pay in the Matulla

section (primary target), 20 feet of net conventional oil pay in

the Brown Limestone formation, and a further 15 feet of net

conventional oil pay in the Sudr section. The well was completed

and operations continue on the flowline upgrade/replacement so that

the well can be flow-tested. Based on the results of the flow-test,

the Company will decide how best to optimise its position in the

licence.

Morocco

-- The Company's Moroccan acreage (SDX 75% working interest and

operator) consists of five concessions, all of which are located in

the Gharb Basin in northern Morocco: Sebou, Lalla Mimouna Nord,

Gharb Centre, Lalla Mimouna Sud, and Moulay Bouchta Ouest, with the

latter two secured by the Company during H1 2019.

-- In 2018, the Company began selling natural gas to the

following new customers: Peugeot, Extralait, and GPC Kenitra.

During H1 2019, natural gas sales began to three additional

customers: Setexam, Citic Dicastal and Omnium Plastic.

-- The six new customers have been increasing their consumption

rates during H1 2019, with several expected to reach stabilised

rates during the second half of the year. H1 2019 gross production

was 6.0MMscf/d, a 15% increase from the 2018 rate of

5.2MMscf/d.

-- The Moulay Bouchta Ouest exploration concession has been

awarded to SDX for a period of eight years, with a commitment to

reprocess 150 km of 2D seismic data, acquire 100 km(2) of new 3D

seismic, and drill one exploration well within the first three and

a half-year period.

-- The Lalla Mimouna Sud exploration concession has been

re-awarded to SDX for a period of eight years, with a commitment to

acquire 50 km(2) of 3D seismic and drill one exploration well

within the first three-year period.

-- None of these commitments are expected to require funding in the next 12 months.

2019 production and Capex guidance:

-- The Company's H1 2019 production, FY19 production guidance,

and FY19 Capex guidance are shown below:

Gross production Capex (net to

SDX)

Asset Six months FY19 Guidance FY19 Guidance

ended 30 June

2019

--------------- ----------------------- ----------------

NW Gemsa - WI 3,944 boe/d 3,000 - 3,200 boe/d US$2.0 million

50%

--------------- ----------------------- ----------------

Meseda - WI 50% 4,313 bbl/d 4,000 - 4,200 bbl/d US$2.7 million

--------------- ----------------------- ----------------

South Disouq N/A First gas by Q4'19. US$19.5 million

- WI 55% c.50 MMscfe/d plateau

by Q1'20

--------------- ----------------------- ----------------

Morocco - WI 6.0 MMscf/d* 6.0 - 6.5 MMscf/d US$12.0 million

75% 2019 annual average

rate

--------------- ----------------------- ----------------

* Reflects stabilised consumption from four out of eight

customers. The remaining four customers consumed low volumes of gas

in H1 2019 and are expected to increase consumption in H2 2019.

-- Capex guidance is unchanged and comprises:

o North West Gemsa: US$4.0 million (US$2.0 million net to SDX)

consisting of up to 10 well workovers and infrastructure

maintenance.

o Meseda: US$5.4 million (US$2.7 million net to SDX) for two

development wells, ESP replacements and facilities upgrades.

o South Disouq: US$35.5 million (US$19.5 million net to SDX). Of

the Company's share, approximately US$17.0 million relates to South

Disouq development activities and US$2.5 million relates to long

lead items and drilling preparations for two potential exploration

wells in 2020. To date in 2019, the Company has offset US$13.9

million of its accounts receivable due from the EGPC against costs

incurred with Egyptian State contractors on the South Disouq

development. The Company expects to use future accounts receivable

offsets amounting to US$3.2 million to fund its remaining US$4.0

million share of capex to first gas.

o Morocco: US$14.0 million (US$12.0 million net to SDX). Out of

this US$12.0 million, US$3.4 million relates to long lead items for

the 12 wells and US$6.0 million relates to the drilling costs for

up to four wells expected to be drilled by the end of 2019. The

remaining US$2.6 million relates to the Company's share of

facilities and field maintenance capex.

Corporate

-- SDX remains fully funded for all existing and planned activities.

-- Corporate reorganisation completed in May 2019, with

re-domiciliation from Canada to the UK, and delisting from

TSX-V.

-- Completed capital reduction exercise in June 2019 to improve

the ability to pay dividends in the future when the Company deems

it prudent to do so.

-- As part of the Company's strategy, it continues to review and

explore opportunities to expand the asset base in the North Africa

region, including new licencing rounds and acquisitions.

KEY FINANCIAL & OPERATING HIGHLIGHTS

Unaudited interim condensed consolidated financial statements

with Management's Discussion and Analysis for the three and six

months ended 30 June 2019 are now available on the Company's

website at www.sdxenergy.com and on SEDAR at www.sedar.com.

Three months ended Six months ended

Prior Quarter 30 June 30 June

----------------------------------- -------------- --------------------- -------------------

$000s except per unit amounts 2019 2018 2019 2018

----------------------------------- -------------- --------- --------- --------

FINANCIAL

----------------------------------- -------------- --------- --------- --------

Gross revenues 16,690 16,491 18,123 33,181 32,887

Royalties (4,009) (3,759) (4,651) (7,768) (8,455)

Net revenues 12,681 12,732 13,472 25,413 24,432

Operating costs (3,374) (3,589) (3,168) (6,963) (5,162)

Netback (1) 9,307 9,143 10,304 18,450 19,270

EBITDAX (1) 7,808 7,307 8,585 15,116 16,208

Total comprehensive income/(loss) 132 (489) 640 (354) 971

Net income/(loss) per share

- basic 0.001 (0.002) 0.003 (0.002) 0.005

Cash, end of period 11,354 11,195 25,234 11,195 25,234

Working capital (excluding

cash) 10,069 6,409 11,121 6,409 11,121

Capital expenditures 13,041 8,777 14,742 21,818 24,690

Total assets 137,630 140,122 143,419 140,122 143,419

Shareholders' equity 116,491 115,346 116,246 115,346 116,246

Common shares outstanding

(000's) 204,723 204,723 204,493 204,723 204,493

OPERATIONAL

--------- --------- --------

NW Gemsa oil sales (bbl/d) 1,586 1,326 1,665 1,455 1,586

Block-H Meseda production

service fee (bbl/d) 826 818 706 822 633

Morocco gas sales (boe/d) 761 729 656 745 660

Other products sales (boe/d) 542 493 403 517 355

----------------------------------- -------------- ---------- --------- --------- --------

Total sales volumes (boe/d) 3,715 3,366 3,430 3,539 3,234

----------------------------------- -------------- --------- --------- --------

Realised oil price (US$/bbl) 58.22 64.98 68.41 61,32 65.77

Realised service fee (US$/bbl) 47.58 53.56 54.37 50.57 52.45

----------------------------------- -------------- --------- --------- --------

Realised oil sales price

and service fees ($/bbl) 54.58 60.62 64.23 57.44 61.97

----------------------------------- -------------- --------- --------- --------

Realised Morocco gas price

(US$/mcf) 10.26 10.31 10.51 10.28 10.27

Royalties ($/boe) 11.99 12.27 14.90 12.12 14.44

Operating costs ($/boe) 10.09 11.72 10.15 10.87 8.82

Netback ($/boe) (1) 27.84 29.84 33.00 28.80 32.91

----------------------------------- -------------- --------- --------- --------

(1) Refer to the "Non-IFRS Measures" section of this release

below and the Company's MD&A for the three and six months ended

30 June 2019 and 2018 for details of netback and EBITDAX.

Consolidated Balance

Sheet

(US$'000s) As at 30 June 2019 As at 31 December

2018

--------------- ------- ---- --- --- ----------------------------------------------------------------- -------------------------------------------------

Assets

Cash and cash equivalents 11,195 17,345

Trade and other receivables 21,764 24,324

Inventory 3,741 5,236

--------------- ------- ---- --- --- ----------------------------------------------------------------- -------------------------------------------------

Current assets 36,700 46,905

Investments 3,479 3,394

Property, plant and 41,652 48,680

equipment

Exploration and evaluation 56,374 39,128

assets

Right-of-use 1,917 -

assets

------------------------ ---- --- --- -------------------------------------------------

Non-current assets 103,422 91,202

Total assets 140,122 138,107

------------------------ ---- --- --- -------------------------------------------------

Liabilities

Trade and other payables 16,018 14,418

Deferred income 491 495

Decommissioning liability 1,125 1,125

Current income taxes 938 1,458

Lease liability 524 -

------------------------ ---- --- --- ----------------------------------------------------------------- -------------------------------------------------

Current liabilities 19,096 17,496

Deferred income - 240

Decommissioning liability 4,080 4,042

Deferred income taxes 290 290

Lease liability 1,310 -

------------------------ ---- --- --- -------------------------------------------------

Non-current liabilities 5,680 4,572

Total liabilities 24,776 22,068

------------------------ ---- --- --- -------------------------------------------------

Equity

Share capital 2,593 88,899

Share-based payment reserve 6,521 6,860

Accumulated other comprehensive (917) (917)

loss

Merger reserve 37,034 -

Retained earnings 70,115 21,197

Total equity 115,346 116,039

------------------------ ---- --- --- -------------------------------------------------

Equity and liabilities 140,122 138,107

------------------------ ---- --- --- -------------------------------------------------

Interim Consolidated Statement of

Comprehensive Income

Three months Six months ended

ended 30 June 30 June

(US$'000s) 2019 2018 2019 2018

------------------- --- --- --- ----------------------- --------------------- --------------------- -----------------------------------------------

Revenue, net of

royalties 12,732 13,472 25,413 24,432

------------------------- --- --- ----------------------- --------------------- --------------------- -----------------------------------------------

Direct operating

expense (3,589) (3,168) (6,963) (5,162)

Gross profit 9,143 10,304 18,450 19,270

Exploration and evaluation

expense (380) (2,064) (615) (5,314)

Depletion, depreciation,

and amortisation (6,047) (3,657) (11,945) (6,190)

Share-based compensation 658 (324) 339 (656)

Share of profit from joint

venture 355 292 724 526

Release of historic operational

tax provision - 300 - 300

Inventory write-off - (490) - (490)

Gain on sale of office

asset - 23 - 23

General and administrative

expenses

- Ongoing general and

administrative

expenses (2,083) (1,520) (3,293) (2,765)

- Transaction

costs (766) - (1,104) -

-------------------- --- --- --- ----------------------- --------------------- --------------------- -----------------------------------------------

Operating

income 880 2,864 2,556 4,704

Net finance expense (105) (33) (246) (54)

Foreign exchange

gain (18) (452) (5) (438)

Loss on acquisition - - - (174)

Income before income

taxes 757 2,379 2,305 4,038

Current income tax

expense (1,246) (1,739) (2,659) (3,067)

Deferred income tax - - - -

expense

-------------------------- --- ---

Total current and deferred

income tax expense (1,246) (1,739) (2,659) (3,067)

Total comprehensive (loss)/income

for the period (489) 640 (354) 971

------------------------------------ --------------------- -----------------------------------------------

Net (loss)/income

per share

Basic $(0.002) $0.003 $(0.002) $0.005

Diluted $(0.002) $0.003 $(0.002) $0.005

------------------- --- --- --- --------------------- -----------------------------------------------

Consolidated Statement of Changes in

Equity

Six months ended 30 June

(US$'000s) 2019 2018

----------------------------------- --------------------------------- ----------------------------------

Share capital

Balance, beginning

of period 88,899 88,785

Share-for-share

exchange - old (88,899) -

Share-for-share

exchange - new 51,865 -

Capital reduction (49,272) -

Balance, end of period 2,593 88,785

Share-based payment reserve

Balance, beginning of

period 6,860 5,666

Share-based compensation for

the period (339) 656

-------------------------------------- --------------------------------- ----------------------------------

Balance, end of period 6,521 6,322

Accumulated other comprehensive

loss

Balance, beginning of

period (917) (917)

Balance, end of period (917) (917)

Merger reserve

Balance, beginning of period - -

Share-for-share exchange 37,034 -

-------------------------------------- --------------------------------- ----------------------------------

Balance, end of period 37,034 -

Retained earnings

Balance, beginning of

period 21,197 21,085

Capital reduction 49,272 -

Total comprehensive (loss)/income for

the period (354) 971

--------------------------------------- --------------------------------- ----------------------------------

Balance, end of period 70,115 22,056

Total equity 115,346 116,246

------------------------------------ ----------------------------------

Consolidated Statement

of Cash Flows

Three months ended 30 Six months ended 30

June June

(US$'000s) 2019 2018 2019 2018

-------------------- ---------------------------------- ----------------------------------------- ---------------------------------- ------------------------------------

Cash flows generated

from/(used

in) operating

activities

Income before income

taxes 757 2,379 2,305 4,038

Adjustments for:

Depletion,

depreciation,

and amortisation 6,047 3,657 11,945 6,190

Exploration and

evaluation

expense - 1,783 - 5,033

Finance expense 105 33 246 54

Share-based

compensation (658) 324 (339) 656

Loss on acquisition - - - 174

Foreign exchange

loss/(gain) (73) 269 (190) (58)

Gain on sale

of office asset - (23) - (23)

Release of historic

operational

tax provision - (300) - (300)

Inventory write-off - 490 - 490

Amortisation of

deferred

income (122) (365) (243) (489)

Tax paid by state (921) (1,192) (1,901) (2,167)

Share of profit from

joint venture (355) (292) (724) (526)

---------------------- ---------------------------------- ----------------------------------------- ---------------------------------- ------------------------------------

Operating cash flow

before

working capital

movements 4,780 6,763 11,099 13,072

(Increase)/decrease in

trade

and other receivables (112) 1,070 2,317 8,342

Increase in trade and

other

payables 2,701 2,819 1,543 778

Payments for inventory (227) (180) (854) (769)

Cash generated from

operating activities 7,142 10,472 14,105 21,423

Income taxes

paid (1,303) (1,091) (1,303) (1,091)

--------------------- ----------------------------------------- ---------------------------------- ------------------------------------

Net cash generated from

operating

activities 5,839 9,381 12,802 20,332

Cash flows generated

from/(used

in) investing

activities:

Property, plant, and

equipment

expenditures (3,007) (7,726) (4,811) (13,203)

Exploration and

evaluation

expenditures (3,430) (5,946) (14,494) (8,311)

Dividends received 639 525 639 525

Net cash used in

investing

activities (5,798) (13,147) (18,666) (20,989)

Cash flows used in

financing activities:

Payments of lease

liabilities (243) - (418) -

Finance costs (30) (8) (58) (11)

paid

--------------------- ---------------------------------- ----------------------------------------- ---------------------------------- ------------------------------------

Net cash used in (273) (8) (476) (11)

financing

activities

Decrease in cash and

cash equivalents (232) (3,774) (6,340) (668)

Effect of foreign

exchange

on cash and cash

equivalents 73 (269) 190 58

Cash and cash

equivalents,

beginning of period 11,354 29,277 17,345 25,844

----------------------- ---------------------------------- ----------------------------------------- ---------------------------------- ------------------------------------

Cash and cash

equivalents,

end of period 11,195 25,234 11,195 25,234

---------------------- ----------------------------------------- ------------------------------------

About SDX

SDX is an international oil and gas exploration, production and

development company, headquartered in London, England, UK, with a

principal focus on North Africa. In Egypt, SDX has a working

interest in two producing assets (50% North West Gemsa & 50%

Meseda) located onshore in the Eastern Desert, adjacent to the Gulf

of Suez. In Morocco, SDX has a 75% working interest in the Sebou

concession, situated in the Gharb Basin. These producing assets are

characterised by exceptionally low operating costs, making them

particularly resilient in a low oil price environment. SDX's

portfolio also includes high impact exploration opportunities in

both Egypt and Morocco.

For further information, please see the Company's website at

www.sdxenergy.com or the Company's filed documents at

www.sedar.com.

Competent Persons Statement

In accordance with the guidelines of the AIM Market of the

London Stock Exchange the technical information contained in the

announcement has been reviewed and approved by Rob Cook, VP

Subsurface of SDX. Dr. Cook, has over 25 years of oil and gas

industry experience, is the qualified person as defined in the

London Stock Exchange's Guidance Note for Mining and Oil and Gas

companies. Dr. Cook holds a BSc in Geochemistry and a PhD in

Sedimentology from the University of Reading, UK. He is a Chartered

Geologist with the Geological Society of London (Geol Soc) and a

Certified Professional Geologist (CPG-11983) with the American

Institute of Professional Geologists (AIPG).

For further information:

SDX Energy Plc

Mark Reid

Chief Financial Officer and Interim

Chief Executive Officer

Tel: +44 203 219 5640

Stifel Nicolaus Europe Limited (Nominated Adviser and Joint Broker)

Callum Stewart

Nicholas Rhodes

Ashton Clanfield

Tel: +44 (0) 20 7710 7600

Cantor Fitzgerald Europe (Joint Broker)

David Porter

Tel: +44 207 7894 7000

GMP FirstEnergy (Joint Broker)

Jonathan Wright

Tel: +44 207 448 0200

Celicourt (PR)

Mark Antelme/Jimmy Lea/Ollie Mills

Tel: +44 208 434 2754

Glossary

"bbl" stock tank barrel

"boepd" & "boe/d" barrels of oil equivalent per

day

------------------------------

"bopd" & "bbl/d" barrels of oil per day

------------------------------

"Mcf" thousands of cubic feet

------------------------------

"MMscf/d" million standard cubic feet

per day

------------------------------

"MMscfe/d" million standard cubic feet

equivalent per day

------------------------------

Forward-Looking Information

Certain statements contained in this press release may

constitute "forward-looking information" as such term is used in

applicable Canadian securities laws. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions or future

events or are not statements of historical fact should be viewed as

forward-looking information. In particular, statements regarding

the Company's plans, the timing of completion of the South Disouq

CPF, the timing of completion of the export pipelines and well

tie-ins, production targets, future drilling, seismic work, new gas

sales customers, ESP replacement, field facility upgrades, well

workovers, and the timing and costs thereof, as well as capital

expenditures, operational expenditures, the reduction in Egyptian

receivables, prospective opportunities, and business development

activity, should all be regarded as forward-looking

information.

The forward-looking information contained in this document is

based on certain assumptions and although management considers

these assumptions to be reasonable based on information currently

available to them, undue reliance should not be placed on the

forward-looking information because SDX can give no assurances that

they may prove to be correct. This includes, but is not limited to,

assumptions related to, among other things, commodity prices and

interest and foreign exchange rates; planned synergies, capital

efficiencies and cost-savings; applicable tax laws; future

production rates; receipt of necessary permits; the sufficiency of

budgeted capital expenditures in carrying out planned activities

and the availability and cost of labour and services.

All timing given in this announcement, unless stated otherwise

is indicative and while the Company endeavours to provide accurate

timing to the market, it cautions that, due to the nature of its

operations and reliance on third parties, this is subject to

change, often at little or no notice. If there is a delay or change

to any of the timings indicated in this announcement, the Company

shall update the market without delay.

Forward-looking information is subject to certain risks and

uncertainties (both general and specific) that could cause actual

events or outcomes to differ materially from those anticipated or

implied by such forward-looking statements. Such risks and other

factors include, but are not limited to, political, social, and

other risks inherent in daily operations for the Company, risks

associated with the industries in which the Company operates, such

as: operational risks; delays or changes in plans with respect to

growth projects or capital expenditures; costs and expenses;

health, safety and environmental risks; commodity price, interest

rate and exchange rate fluctuations; environmental risks;

competition; permitting risks; the ability to access sufficient

capital from internal and external sources; and changes in

legislation, including but not limited to tax laws and

environmental regulations. Readers are cautioned that the foregoing

list of risk factors is not exhaustive and are advised to refer to

SDX's Management's Discussion & Analysis for the three and six

months ended 30 June 2019, which can be found on SDX's SEDAR

profile at www.sedar.com, for a description of additional risks and

uncertainties associated with SDX's business, including its

exploration activities.

The forward-looking information contained in this press release

is as of the date hereof and SDX does not undertake any obligation

to update publicly or to revise any of the included

forward--looking information, except as required by applicable law.

The forward--looking information contained herein is expressly

qualified by this cautionary statement.

Non-IFRS Measures

This news release contains the terms "Netback," and "EBITDAX",

which are not recognised measures under IFRS and may not be

comparable to similar measures presented by other issuers. The

Company uses these measures to help evaluate its performance.

Netback is a non-IFRS measure that represents sales net of all

operating expenses and government royalties. Management believes

that netback is a useful supplemental measure to analyse operating

performance and provide an indication of the results generated by

the Company's principal business activities prior to the

consideration of other income and expenses. Management considers

netback an important measure as it demonstrates the Company's

profitability relative to current commodity prices. Netback may not

be comparable to similar measures used by other companies. See

Netback reconciliation to operating income/(loss) in the Company's

Interim Consolidated Financial Statements for the three and six

months ended 30 June 2019 and 2018.

EBITDAX is a non-IFRS measure that represents earnings before

interest, tax, depreciation, amortisation, exploration expense and

impairment. EBITDAX is calculated by taking operating income/(loss)

and adjusted for the add-back of depreciation and amortisation,

exploration expense and impairment of property, plant and equipment

(if applicable). EBITDAX is presented in order for the users of the

financial statements to understand the cash profitability of the

Company, which excludes the impact of costs attributable to

exploration activity, which tend to be one-off in nature, and the

non-cash costs relating to depreciation, amortisation and

impairments. EBITDAX may not be comparable to similar measures used

by other companies. See EBITDAX reconciliation to operating

income/(loss) in the Company's Interim Consolidated Financial

Statements for the three and six months ended 30 June 2019 and

2018.

Oil and Gas Advisory

Estimates of reserves have been made, assuming the development

of each property in which the estimate is made will actually occur,

without regard to the likely availability to the Company of funding

required for the development of such reserves.

Certain disclosure in this news release constitute "anticipated

results" for the purposes of National Instrument 51-101 - Standards

for Oil and Gas Activities of the Canadian Securities

Administrators because the disclosure in question may, in the

opinion of a reasonable person, indicate the potential value or

quantities of resources in respect of the Company's resources or a

portion of its resources. Without limitation, the anticipated

results disclosed in this news release include estimates of volume,

flow rate, production rates, porosity and pay thickness

attributable to the resources of the Company. Such estimates have

been prepared by management of the Company and have not been

prepared or reviewed by an independent qualified reserves evaluator

or auditor. Anticipated results are subject to certain risks and

uncertainties, including those described above and various

geological, technical, operational, engineering, commercial, and

technical risks. In addition, the geotechnical analysis and

engineering to be conducted in respect of such resources is not

complete. Such risks and uncertainties may cause the anticipated

results disclosed herein to be inaccurate. Actual results may vary,

perhaps materially.

Prospective Resources

The prospective resource estimates disclosed herein have been

prepared by an independent qualified reserves evaluator, ERC

Equipoise Limited, in accordance with the Canadian Oil and Gas

Evaluation Handbook. The prospective resources disclosed herein

have an effective date of 1 January 2019. Prospective resources are

those quantities of gas, estimated as of the given date, to be

potentially recoverable from undiscovered accumulations through

future development projects. As prospective resources, there is no

certainty that any portion of the resources will be discovered. The

chance that an exploration project will result in a discovery is

referred to as the "chance of discovery" as defined by the

management of the Company. There is no certainty that it will be

commercially viable to produce any portion of the resources

discussed herein; though any discovery that is commercially viable

would be tied back to the Company's pipeline in Morocco and then

connected to customers' facilities within 9 to 12 months of

discovery. Based upon the economic analysis undertaken on any

discovery, management has attributed an associated chance of

development of 100%. Anticipated results are subject to certain

risks and uncertainties, including various geological, technical,

operational, engineering, commercial and technical risks. In

addition, the geotechnical analysis and engineering to be conducted

in respect of such resources is not complete. Such risks and

uncertainties may cause the anticipated results disclosed herein to

be inaccurate. Actual results may vary, perhaps materially.

There are uncertainties associated with the volume estimates of

the prospective resources disclosed herein, due to the level of

information available on prospective resources, but ranges are

defined based on data from the Company's nearby existing analogous

wells. Some of the risk and uncertainties are outlined below:

-- Petrophysical parameters of the sand/reservoir;

-- Fluid composition, especially heavy end hydrocarbons;

-- Accurate estimation of reservoir conditions (pressure and temperature);

-- Reservoir drive mechanism;

-- Potential well deliverability; and

-- The thickness and lateral extent of the reservoir section,

currently based on 3D seismic data.

Use of the term "boe" or the term "MMscf" may be misleading,

particularly if used in isolation. A "boe" conversion ratio of 6

Mcf: 1 bbl and a "Mcf" conversion ratio of 1bbl: 6 Mcf are based on

an energy equivalency conversion method primarily applicable at the

burner tip and does not represent a value equivalency at the

wellhead.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR UARNRKWAWUAR

(END) Dow Jones Newswires

August 22, 2019 02:00 ET (06:00 GMT)

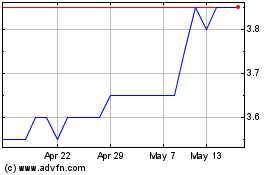

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024