TIDMQED TIDMTTM

RNS Number : 2522A

LSREF IV Investments LLC

25 September 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION

For immediate release 25 SEPTEMBER 2015

RECOMMENDED CASH OFFER

by

BAILEY ACQUISITIONS LIMITED

for

QUINTAIN ESTATES AND DEVELOPMENT PLC

Unconditional announcement and, notice of delisting and

cancellation of trading of Quintain Shares

On 29 July 2015, the boards of Quintain Estates and Development

PLC (Quintain) and Bailey Acquisitions Limited (Bidco), an

investment vehicle indirectly controlled by Lone Star Real Estate

Fund IV, announced that they had reached agreement on the terms of

a recommended cash offer to be made by Bidco for the entire issued

and to be issued share capital of Quintain (the Original Offer).

The full terms and conditions and the procedures for acceptance of

the Original Offer are set out in the offer document which was

published and sent to Quintain Shareholders by Bidco on 11 August

2015 (the Original Offer Document).

On 18 September 2015 Bidco announced that it had reduced the

percentage of Quintain Shares required to satisfy the Acceptance

Condition to 75 per cent.

Today Bidco announced an increased cash offer (the Increased

Offer) for the entire issued and to be issued share capital of

Quintain (the Increased Offer Announcement) under which Quintain

Shareholders would receive 141 pence per Quintain Share (the

Increased Offer Price).

Bidco is now pleased to declare the Increased Offer

unconditional in all respects. Further details are set out

below.

Level of acceptances and market purchases

As at 5.00 p.m. (London time) on 24 September 2015, Bidco had

received valid acceptances of the Increased Offer in respect of

377,583,165 Quintain Shares, representing approximately 71.73 per

cent. of the existing issued share capital of Quintain.

Bidco has today acquired 22,614,870 Quintain Shares at the

Increased Offer Price, representing in aggregate approximately 4.30

per cent. of the ordinary share capital of Quintain.

Therefore, Bidco has received valid acceptances of the Increased

Offer in respect of, or has acquired or agreed to acquire,

400,198,035 Quintain Shares representing approximately 76.03 per

cent. of the existing issued share capital of Quintain, which Bidco

may count towards the satisfaction of the Acceptance Condition.

Bidco has decided to waive the Acceptance Condition. As a result,

Bidco is pleased to declare the Increased Offer as unconditional as

to acceptances.

The percentages of Quintain Shares referred to in this

announcement are based upon a figure of 526,394,699 Quintain Shares

in issue.

As the Increased Offer has been declared unconditional as to

acceptances and no other Conditions remain outstanding, the

Increased Offer is now unconditional in all respects.

The Increased Offer will remain open for acceptances until

further notice. At least 14 days' notice will be given before the

closing of the Increased Offer to those Quintain Shareholders who

have not at the date of that notice accepted the Increased

Offer.

Delisting and cancellation of trading

As set out in the Original Offer Document, as the Increased

Offer has become unconditional in all respects and Bidco has by

virtue of its shareholdings and acceptances of the Increased Offer

acquired, or agreed to acquire, Quintain Shares representing at

least 75 per cent. of the voting rights of Quintain, Bidco intends

to procure the making of an application by Quintain for

cancellation, respectively, of the trading in Quintain Shares on

the London Stock Exchange's main market for listed securities (the

Main Market) and of the listing of Quintain Shares on the premium

listing segment of the Official List of the Financial Conduct

Authority (the Official List).

The cancellation of listing of Quintain Shares on the Official

List and admission to trading of Quintain Shares on the Main Market

is expected to take effect on or around 23 October 2015, being 20

Business Days from the date of this announcement. Delisting would

significantly reduce the liquidity and marketability of any

Quintain Shares not assented to the Increased Offer.

Compulsory acquisition

As set out in the Original Offer Document, if Bidco receives

acceptances under the Increased Offer in respect of, and/or

otherwise acquires, not less than 90 per cent. of the Quintain

Shares to which the Increased Offer relates by nominal value and

voting rights attaching to such shares, Bidco intends to exercise

its rights pursuant to section 979 of the Companies Act 2006 to

acquire compulsorily the remaining Quintain Shares.

Actions to be taken

Quintain Shareholders who have not yet accepted the Increased

Offer are urged to do so as soon as possible:

-- If you hold your Quintain Shares in certificated form (that

is, not in CREST), you should complete and return the Form of

Acceptance which accompanied the Original Offer Document or,

alternatively, the revised Form of Acceptance (the Revised Form of

Acceptance) that will accompany the revised offer document (the

Revised Offer Document) to be sent to Quintain Shareholders on 26

September 2015.

-- If you hold your Quintain Shares in uncertificated form (that

is, in CREST), you should ensure that an Electronic Acceptance is

made by you or on your behalf and that settlement occurs. If you

hold your Quintain Shares as a CREST sponsored member, you should

refer to your CREST sponsor as only your CREST sponsor will be able

to send the necessary instruction to Euroclear.

The Original Offer Document and a specimen Form of Acceptance

are, and the Revised Offer Document and Revised Form of Acceptance

will be, available on Bidco's website at

www.baileyacquisitionslimited.com. Further copies of such documents

may be obtained by contacting the Receiving Agent, Computershare

Investor Services PLC on 0370 707 1253 from within the UK or on +44

(0) 370 707 1253 if calling from outside the UK (lines are open

from 8.30 a.m. to 5.30 p.m. (London time) Monday to Friday) or by

submitting a request in writing to Computershare Corporate Actions

Projects, Bristol, BS99 6AH.

Unless otherwise stated, terms used in this announcement have

the same meanings as given to them in the Increased Offer

Announcement.

Enquiries

Morgan Stanley (Financial Adviser to Bidco)

Nick White/Ian Hart/Gwen

Billon +44 (0)20 7425 8000

Headland (Bidco's PR Adviser)

Francesca Tuckett/Howard

Lee +44 (0)20 7367 5222

Important notices relating to financial advisers and brokers

Morgan Stanley & Co. International plc (Morgan Stanley),

which is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and the Prudential

Regulation Authority in the United Kingdom, is acting as exclusive

financial adviser to Bidco and no one else in connection with the

Increased Offer. In connection with such matters, Morgan Stanley,

its affiliates and their respective directors, officers, employees

and agents will not regard any other person as their client, nor

will they be responsible to any other person for providing the

protections afforded to their clients or for providing advice in

relation to the Increased Offer, the contents of this announcement

or any other matter referred to herein.

Further information

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of an

offer to purchase, otherwise acquire, subscribe for, sell or

otherwise dispose of any securities, or the solicitation of any

vote or approval in any jurisdiction, pursuant to the Increased

Offer or otherwise. The Increased Offer will be made solely by

means of the Original Offer Document, the Form of Acceptance, the

Revised Offer Document and the Revised Form of Acceptance, which

will contain the full terms and conditions of the Increased Offer,

including details of how the Increased Offer may be accepted. Any

response to the Increased Offer should be made only on the basis of

information contained in those documents. Quintain Shareholders are

advised to read the formal documentation in relation to the

Increased Offer carefully.

This announcement has been prepared for the purposes of

complying with English law, the rules of the London Stock Exchange

and the Code and the information disclosed may not be the same as

that which would have been disclosed if this announcement had been

prepared in accordance with the laws and regulations of any

jurisdiction outside the United Kingdom.

Overseas jurisdictions

The distribution of this announcement in jurisdictions other

than the United Kingdom or the United States and the ability of

Quintain Shareholders who are not resident in the United Kingdom or

the United States to participate in the Increased Offer may be

affected by the laws of relevant jurisdictions. Therefore any

persons who are subject to the laws of any jurisdiction other than

the United Kingdom or the United States or Quintain Shareholders

who are not resident in the United Kingdom or the United States

will need to inform themselves about, and observe, any applicable

legal or regulatory requirements. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. Further details in

relation to overseas shareholders are contained in the Original

Offer Document and will be contained in the Revised Offer

Document.

The Increased Offer is not being, and will not be, made

available, directly or indirectly, in or into or by the use of the

mails of, or by any other means or instrumentality of interstate or

foreign commerce of, or any facility of a national state or other

securities exchange of any Restricted Jurisdiction, and will not be

capable of acceptance by any such use, means, instrumentality or

facility from within any Restricted Jurisdiction.

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 07:30 ET (11:30 GMT)

Accordingly, copies of this announcement and all documents

relating to the Increased Offer are not being, and must not be,

directly or indirectly, mailed, transmitted or otherwise forwarded,

distributed or sent in, into or from any Restricted Jurisdiction

and persons receiving this announcement (including, without

limitation, agents, nominees, custodians and trustees) must not

distribute, send or mail it in, into or from such jurisdiction. Any

person (including, without limitation, any agent, nominee,

custodian or trustee) who has a contractual or legal obligation, or

may otherwise intend, to forward this announcement and/or the

Original Offer Document and/or the Revised Offer Document and/or

any other related document to a jurisdiction outside the United

Kingdom or the United States should inform themselves of, and

observe, any applicable legal or regulatory requirements of their

jurisdiction and must not mail, send or otherwise forward or

distribute them in, into or from any Restricted Jurisdiction.

Notes to US holders of Quintain Shares

The Increased Offer will be made in the United States pursuant

to Section 14(e) of, and Regulation 14E under, the US Exchange Act,

and otherwise in accordance with the requirements of the Code.

Accordingly, the Increased Offer will be subject to disclosure and

other procedural requirements, including with respect to withdrawal

rights, offer timetable, settlement procedures and timing of

payments that are different from those applicable under US domestic

tender offer procedures and law.

The Increased Offer is being made for the securities of an

English company with a listing on the London Stock Exchange. The

Increased Offer is subject to UK disclosure requirements, which are

different from certain United States disclosure requirements. The

financial information on Quintain included in the Original Offer

Document and, if applicable, the Revised Offer Document has been

prepared in accordance with IFRS and may therefore not be

comparable to financial information of US companies or companies

whose financial statements are prepared in accordance with

generally accepted accounting principles in the United States.

The receipt of cash pursuant to the Increased Offer by a US

holder of Quintain Shares may be a taxable transaction for US

federal income tax purposes and under applicable US state and

local, as well as foreign and other, tax laws. Each Quintain

Shareholder is urged to consult his independent professional

adviser immediately regarding the tax consequences of accepting the

Increased Offer. Furthermore, the payment and settlement procedure

with respect to the Increased Offer will comply with the relevant

United Kingdom rules, which differ from the United States payment

and settlement procedures, particularly with regard to the date of

payment of consideration.

The Increased Offer will be made (including in the United

States) by Bidco and no one else. Neither Morgan Stanley nor any of

its affiliates, will be making the Increased Offer in (or outside)

the United States.

It may be difficult for US holders of Quintain Shares to enforce

their rights and any claim arising out of US federal securities

laws, since Bidco is incorporated under the laws of Jersey and

Quintain is incorporated under the laws of England and Wales and

some or all of their officers and directors are residents of non-US

jurisdictions. In addition, most of the assets of Bidco and

Quintain are located outside the United States. US holders of

Quintain Shares may not be able to sue a non-US company or its

officers or directors in a non-US court for violations of US

securities laws. Further, it may be difficult to compel a non-US

company and its affiliates to subject themselves to a US court's

judgment.

This announcement does not constitute an offer of securities for

sale in the United States or an offer to acquire securities in the

United States. No offer to acquire securities or to exchange

securities for other securities has been made, or will be made,

directly or indirectly, in or into, or by the use of the mails of,

or by any means or instrumentality of interstate or foreign

commerce or any facilities of a national securities exchange of,

the United States or any other country in which such offer may not

be made other than: (i) in accordance with the tender offer

requirements under the US Exchange Act, or the securities laws of

such other country, as the case may be, or: (ii) pursuant to an

available exemption from such requirements.

Neither the US Securities and Exchange Commission nor any US

state securities commission has approved or disapproved the

Increased Offer, passed comment upon the fairness or merits of the

Increased Offer or passed comment upon the adequacy or completeness

of this announcement, the Original Offer Document or the Revised

Offer Document. Any representation to the contrary is a criminal

offence in the United States.

To the extent permitted by applicable law, in accordance with,

and to the extent permitted by, the Code and normal UK market

practice, Bidco or its nominees or brokers (acting as agents) or

their respective affiliates may from time to time make certain

purchases of, or arrangements to purchase, shares or other

securities in Quintain, other than pursuant to the Increased Offer,

at any time prior to completion of the Increased Offer. These

purchases may occur either in the open market at prevailing prices

or in private transactions at negotiated prices. Any such

purchases, or arrangements to purchase, will comply with all

applicable UK rules, including the Code, the rules of the London

Stock Exchange and Rule 14e-5 under the Exchange Act to the extent

applicable. In addition, in accordance with, and to the extent

permitted by, the Code and normal UK market practice, Morgan

Stanley and its affiliates will continue to act as exempt principal

traders in Quintain Shares on the London Stock Exchange and engage

in certain other purchasing activities consistent with their

respective normal and usual practice and applicable law. To the

extent required by the applicable law (including the Code), any

information about such purchases will be disclosed on a next day

basis to the Panel and a Regulatory Information Service including

the Regulatory News Service on the London Stock Exchange website,

www.londonstockexchange.com. To the extent that such information is

made public in the United Kingdom, this information will also be

deemed to be publicly disclosed in the United States.

Notice to Australian holders of Quintain Shares

The Increased Offer is being made for the securities of a

English company with a listing on the London Stock Exchange and is

regulated primarily by UK laws. Accordingly, the Increased Offer is

not made under or regulated by Chapter 6 of the Corporations Act

2001 (Cth). The content of this announcement, the Original Offer

Document and the Revised Offer Document is subject to UK disclosure

requirements which are different from the disclosure requirements

under Australian law. Neither the Australian Securities and

Investments Commission nor the Australian Securities Exchange has:

(i) approved or disapproved of the Increased Offer; (ii) passed

judgment over the merits or fairness of the Increased Offer; or

(iii) passed judgment upon the adequacy or accuracy of the

disclosure in this announcement, the Original Offer Document nor

the Revised Offer Document.

Disclosure requirements of the Code

Under Rule 8.3(a) of the Code, any person who is interested in 1

per cent. or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1 per cent. or more of any class of relevant

securities of the offeree company or of any securities exchange

offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any securities

exchange offeror. A Dealing Disclosure must contain details of the

dealing concerned and of the person's interests and short positions

in, and rights to subscribe for, any relevant securities of each of

(i) the offeree company and (ii) any securities exchange

offeror(s), save to the extent that these details have previously

been disclosed under Rule 8. A Dealing Disclosure by a person to

whom Rule 8.3(b) applies must be made by no later than 3.30 pm

(London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

(MORE TO FOLLOW) Dow Jones Newswires

September 25, 2015 07:30 ET (11:30 GMT)

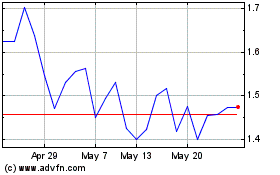

Quadrise (LSE:QED)

Historical Stock Chart

From Jun 2024 to Jul 2024

Quadrise (LSE:QED)

Historical Stock Chart

From Jul 2023 to Jul 2024