TIDMMTVW

RNS Number : 4892U

Mountview Estates PLC

25 June 2009

MOUNTVIEW ESTATES P.L.C.

FINANCIAL HIGHLIGHTS

+----------------------------+------------+------------+------------------+

| | 2009 | 2008 | (Decrease) |

+----------------------------+------------+------------+------------------+

| | GBP | GBP | % |

+----------------------------+------------+------------+------------------+

| Turnover (millions) | 53.6 | 54.3 | (1.2) |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Gross Profit (millions) | 25.9 | 36.0 | (28) |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Profit Before Tax | 13.1 | 29.5 | (55.6) |

| (millions) | | | |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Profit Before Tax | 16.3 | 27.7 | (41.1) |

| excluding investment | | | |

| properties revaluations | | | |

| (millions) | | | |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Shareholders' Funds | 187.5 | 187.7 | (0.1) |

| (millions) | | | |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Earnings per share (pence) | 241.0 | 530.1 | (54.5) |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Net assets per share | 48.1 | 48.2 | (0.2) |

+----------------------------+------------+------------+------------------+

| | | | |

+----------------------------+------------+------------+------------------+

| Dividend per share (pence) | 155 | 155 | - |

+----------------------------+------------+------------+------------------+

Mountview Estates P.L.C. advises its shareholders that, following the issue of

the final results, the relevant dates in respect of the proposed final dividend

payment of 105 pence per share are as follows:

+---------------------------+------------------------------------+

| Ex-dividend date | 15 July 2009 |

| | |

+---------------------------+------------------------------------+

| Record date | 17 July 2009 |

| | |

+---------------------------+------------------------------------+

| Payment date | 17 August 2009 |

| | |

+---------------------------+------------------------------------+

MOUNTVIEW ESTATES P.L.C.

CHAIRMAN'S STATEMENT

First the good news, this company is still making profits. Next more good news,

this company is proposing to maintain its dividends at the record levels reached

last year. At the Annual General Meeting on 12 August 2009, shareholder approval

will be sought for a final dividend of 105 pence per share.

In the worst financial climate in living memory, I consider the achievements

highlighted in the first paragraph to be true success and I congratulate all my

staff and colleagues on their hard work which has happily produced this level of

success. Because of their continuing diligence I am confident that I will again

be able to report profits in twelve months' time although we may yet see an even

more difficult economic climate. The financial highlights opposite show that

despite the various difficulties in the marketplace we have very nearly

maintained the same level of turnover as in the previous year. This has been

achieved by selling about twenty five per cent more properties which explains

why the cost of sales has risen but nevertheless, in such difficult

circumstances, maintaining turnover is a considerable achievement.

In the fifteen months up to the end of June 2008 we had made very substantial

purchases and our borrowings had reached their highest level ever. In normal

circumstances it would be necessary to place an emphasis on the repayment of

those borrowings but in present circumstances it is even more vital. Although

interest rates are presently extraordinarily low, in twelve months' time I

believe they will be significantly higher and the reduction of our borrowings in

the meantime will be prudent. During the twelve months under review our long

term borrowings have decreased by GBP7 million and have continued to decrease

since 31 March 2009 and must continue to decrease in the coming months.

During recent months we have been introducing a new computer system from which

we are already gaining some benefits and this has helped to reduce the

administrative costs of the company. As we continue to integrate the new systems

and take advantage of their full capabilities it should be possible to contain

costs further. Unfortunately a company such as this is ever further burdened by

the increasing bureaucracy which is inflicted upon us and this may sometimes

obscure the greater efficiency with which the core activities are being

administered.

At the Annual General Meeting on 12 August 2009 John Hall will be retiring from

the position of Non-Executive Director which he has occupied with distinction

since December 2000. He was Chief Executive of Brewin Dolphin Holdings PLC from

1987 to September 2007 and we have been fortunate to have the skill and advice

of such an experienced man. He has seen the company grow quite significantly and

we are grateful for all his contributions during this time.

As at 1 January 2009 we welcomed James Laing to the Board as a Non-Executive

Director and he will stand for election at the Annual General Meeting on 12

August 2009. He has been a Senior Partner at Strutt & Parker for many years and

as a Chartered Surveyor I am confident that he will bring a wealth of relevant

experience to the Board.

The company continues on a sound financial basis with tight internal controls

and although we may yet experience greater economic perils I am confident that

in the fullness of time we will reap the benefits of the purchases made in

recent years. My staff and colleagues are ready for the challenges ahead and I

look forward to the day when their efforts will again produce greater profits

and when they can enjoy the financial benefits of those profits and dividends

can once again be increased.

The final dividend of 105 pence per share in respect of the year ended 31 March

2009 recommended by your Board is payable on 17 August 2009 to shareholders on

the Register of Members as at 17 July 2009. This will make a total dividend for

the year ended 31 March 2009 of 155 pence per share which is more than one and a

half times covered by the earnings per share.

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 MARCH 2009

+-----------------------------------------------+------------+------------+

| | Year | Year |

+-----------------------------------------------+------------+------------+

| | ended | Ended |

+-----------------------------------------------+------------+------------+

| | 31.03.2009 | 31.03.2008 |

+-----------------------------------------------+------------+------------+

| | GBP000 | GBP000 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| REVENUE | 53,599 | 54,338 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Cost of sales | (27,657) | (18,347) |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| GROSS PROFIT | 25,942 | 35,991 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Administrative Expenses | (3,767) | (4,207) |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Operating profit before changes in | 22,175 | 31,784 |

| fair value of investment properties | | |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| (Decrease)/Increase in fair value of | (3,210) | 1,784 |

| investment properties | | |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| PROFIT FROM OPERATIONS | 18,965 | 33,568 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Finance costs | (5,906) | (4,043) |

+-----------------------------------------------+------------+------------+

| Income from investments | 3 | 4 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| PROFIT BEFORE TAXATION | 13,062 | 29,529 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Taxation - current | (4,864) | (8,358) |

+-----------------------------------------------+------------+------------+

| Taxation - deferred | 1,191 | (503) |

+-----------------------------------------------+------------+------------+

| Total taxation | (3,673) | (8,861) |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| PROFIT ATTRIBUTABLE TO EQUITY SHAREHOLDERS | 9,389 | 20,668 |

+-----------------------------------------------+------------+------------+

| | | |

+-----------------------------------------------+------------+------------+

| Basic and diluted earnings per share (pence) | | 530.1p |

| | 241.0p | |

+-----------------------------------------------+------------+------------+

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED BALANCE SHEET

FOR THE YEAR ENDED 31 MARCH 2009

+------------------------------+----------------+----------------+

| | As at | As at |

+------------------------------+----------------+----------------+

| | 31.03.2009 | 31.03.2008 |

+------------------------------+----------------+----------------+

| | GBP000 | GBP000 |

+------------------------------+----------------+----------------+

| Assets | | |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Non-Current Assets | | |

+------------------------------+----------------+----------------+

| Property, plant and | 2,567 | 2,719 |

| equipment | | |

+------------------------------+----------------+----------------+

| Investment properties | 32,195 | 36,203 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| | 34,762 | 38,922 |

+------------------------------+----------------+----------------+

| Current Assets | | |

+------------------------------+----------------+----------------+

| Inventories of trading | 268,806 | 271,361 |

| properties | | |

+------------------------------+----------------+----------------+

| Trade and other receivables | 660 | 1,118 |

+------------------------------+----------------+----------------+

| Cash and cash equivalents | 840 | 802 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| | 270,306 | 273,281 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Total Assets | 305,068 | 312,203 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Equity and Liabilities | | |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Share Capital | 195 | 195 |

+------------------------------+----------------+----------------+

| Capital redemption reserve | 55 | 55 |

+------------------------------+----------------+----------------+

| Capital reserve | 25 | 25 |

+------------------------------+----------------+----------------+

| Other reserves | 56 | 56 |

+------------------------------+----------------+----------------+

| Cash flow hedge reserve | (3,614) | - |

+------------------------------+----------------+----------------+

| Retained earnings | 190,773 | 187,426 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| | 187,490 | 187,757 |

+------------------------------+----------------+----------------+

| Non-Current Liabilities | | |

+------------------------------+----------------+----------------+

| Long-term borrowings | 88,000 | 95,000 |

+------------------------------+----------------+----------------+

| Deferred Tax | 8,506 | 9,697 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| | 96,506 | 104,697 |

+------------------------------+----------------+----------------+

| Current Liabilities | | |

+------------------------------+----------------+----------------+

| Bank overdrafts and loans | 13,026 | 12,685 |

+------------------------------+----------------+----------------+

| Trade and other payables | 2,055 | 3,081 |

+------------------------------+----------------+----------------+

| Current tax payable | 2,377 | 3,983 |

+------------------------------+----------------+----------------+

| Derivative financial | 3,614 | - |

| instruments | | |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| | 21,072 | 19,749 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Total Liabilities | 117,578 | 124,446 |

+------------------------------+----------------+----------------+

| | | |

+------------------------------+----------------+----------------+

| Total Equity and Liabilities | 305,068 | 312,203 |

+------------------------------+----------------+----------------+

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MARCH 2009

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | Capital | Cash | | | |

| | | | | Flow | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | Share | Capital | Redemption | Hedge | Other | Retained | |

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | Capital | Reserve | Reserve | Reserve | Reserves | Earnings | Total |

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 | GBP000 |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Changes in Equity | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| year ended 31 March | | | | | | | |

| 2008 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Balance as at 1 April | 195 | 25 | 55 | 0 | 56 | 172,606 | 172,937 |

| 2007 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Profit for the year | | | | | | 20,668 | 20,668 |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Dividends | | | | | | (5,848) | (5,848) |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Balance as at 31 | 195 | 25 | 55 | 0 | 56 | 187,426 | 187,757 |

| March 2008 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Changes in Equity | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| year ended 31 March | | | | | | | |

| 2009 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Balance as at 1 April | 195 | 25 | 55 | 0 | 56 | 187,426 | 187,757 |

| 2008 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Profit for the year | | | | | | 9,389 | 9,389 |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Dividends | | | | | | (6,042) | (6,042) |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Cash flow hedge | | | | (3,614) | | | (3,614) |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

| Balance as at 31 | 195 | 25 | 55 | (3,614) | 56 | 190,773 | 187,490 |

| March 2009 | | | | | | | |

+-----------------------+---------+---------+------------+----------+----------+----------+---------+

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2009

+------------------------------------------------+------------+------------+

| | Year | Year |

+------------------------------------------------+------------+------------+

| | ended | ended |

+------------------------------------------------+------------+------------+

| | 31.03.2009 | 31.03.2008 |

+------------------------------------------------+------------+------------+

| | GBP000 | GBP000 |

+------------------------------------------------+------------+------------+

| Cash flow from operating activities | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Operating Profit | 18,965 | 33,568 |

+------------------------------------------------+------------+------------+

| Adjustments for: | | |

+------------------------------------------------+------------+------------+

| Depreciation | 192 | 190 |

+------------------------------------------------+------------+------------+

| Loss on disposal of property, plant & | 145 | 21 |

| equipment | | |

+------------------------------------------------+------------+------------+

| Decrease/(Increase) in fair value of | 3,210 | (1,784) |

| investment properties | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Cash flow from operations before changes in | 22,512 | 31,995 |

| working capital | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Decrease/(Increase) in inventories | 2,555 | (87,472) |

+------------------------------------------------+------------+------------+

| Decrease/(Increase) in receivables | 459 | (57) |

+------------------------------------------------+------------+------------+

| (Decrease)/Increase in payables | (1,053) | 128 |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Cash generated from operations | 24,473 | (55,406) |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Interest paid | (5,906) | (4,043) |

+------------------------------------------------+------------+------------+

| Income taxes paid | (6,443) | (10,901) |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Net cash inflow/(outflow) from operating | 12,124 | (70,350) |

| activities | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Investing activities | | |

+------------------------------------------------+------------+------------+

| Interest received | 3 | 4 |

+------------------------------------------------+------------+------------+

| Proceeds from disposal of investment | 1,005 | - |

| properties | | |

+------------------------------------------------+------------+------------+

| Proceeds from disposal of property, plant and | 15 | 60 |

| equipment | | |

+------------------------------------------------+------------+------------+

| Purchase of property, plant and equipment | (58) | (382) |

+------------------------------------------------+------------+------------+

| Capital expenditure on investment properties | (350) | (339) |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Net cash inflow/(outflow) from investing | 615 | (657) |

| activities | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Cash flows from financing activities | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Increase in borrowings | - | 67,411 |

+------------------------------------------------+------------+------------+

| Repayment of borrowings | (9,110) | - |

+------------------------------------------------+------------+------------+

| Equity dividend paid | (6,042) | (5,848) |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Net cash inflow/(outflow) from financing | (15,152) | 61,563 |

| activities | | |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Net (decrease) in cash and cash equivalents | (2,413) | (9,444) |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Opening cash and cash equivalents | (8,798) | 646 |

+------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------+------------+------------+

| Closing cash and cash equivalents | (11,211) | (8,798) |

+------------------------------------------------+------------+------------+

Notes to the Preliminary Announcement

+----+-------------------------------------------------------------------+

| 1. | Financial Information |

+----+-------------------------------------------------------------------+

| | The financial information contained in this report does not |

| | constitute statutory accounts within the meaning of section |

| | 240 of the Companies Act 1985. The full accounts for the year |

| | ended 31 March 2008, which were prepared in accordance with |

| | International Financial Reporting Standards as adopted by the |

| | European Union ("IFRS") and which received an unqualified |

| | audit report and did not contain a statement under s237(2) or |

| | (3) of the Companies Act 1985, have been filed with the |

| | Registrar of Companies. |

| | |

+----+-------------------------------------------------------------------+

| | Financial statements for the year ended 31 March 2009 will |

| | be presented to the Members at the Annual General Meeting on |

| | 12 August 2009. The auditors have indicated that their |

| | report on these Financial Statements will be unqualified. |

| | |

+----+-------------------------------------------------------------------+

| 2. | Basis |

| | of |

| | Preparation |

+----+-------------------------------------------------------------------+

| | The preliminary announcement has been prepared in accordance |

| | with International Financial Reporting Standards as adopted |

| | by the European Union ("IFRS") but does not contain |

| | sufficient information to comply fully with IFRS. The |

| | Financial Statements to be presented to Members at the 2009 |

| | AGM are expected to comply fully with IFRS. |

| | |

+----+-------------------------------------------------------------------+

The preliminary announcement has been prepared under the historical cost

convention as modified by the revaluation of investment properties.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UVSWRKRRNURR

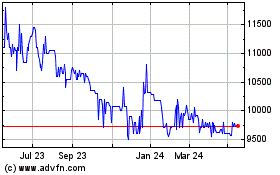

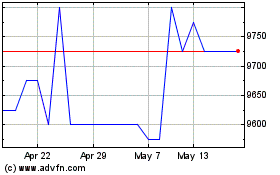

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Sep 2024 to Oct 2024

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Oct 2023 to Oct 2024