RNS Number:5600O

Mountview Estates PLC

12 December 2001

CHAIRMAN'S STATEMENT

Herewith are the unaudited Accounts for the six months ended on 30 September

2001. Profit on ordinary activities before taxation fell only slightly, but

such is the incidence of taxation that profit on ordinary activities after

taxation shows a modest increase and earnings per share are up from 134.5

pence to 136.2 pence. These results have been achieved despite a 77% increase

in interest charges consequent upon the rise in our borrowings chiefly caused

by the acquisition at the beginning of May of seventy flats in prime central

London locations.

The highlight of our activities during these six months might well have been

the acquisition of the London flats, the benefits of which are yet to accrue,

but everything has been overshadowed by the atrocities of 11 September. House

prices were already rising more slowly and buyers were showing less urgency in

completing deals, but since 11 September downward economic trends have been

accelerated and we must necessarily be cautious about the coming months

because whilst low interest rates are helping to sustain the housing market we

cannot expect to escape all the consequences of a world economic downturn, nor

can we expect to be exempt from whatever may afflict other sectors of the

British economy.

The most significant recent move that we have been able to make on behalf of

our shareholders occurred after 30 September 2001. It took place at the EGM on

12 November 2001 when shareholders voted in favour of the resolution to buy

back for cancellation 14.99% of the Company's shares then held by BPT plc. The

manner in which the buy back has been financed is such that the Company should

not be inhibited in making purchases and developing the business in the short

and medium term. Indeed we are confident that in the long term the benefits of

this transaction will accrue to all continuing shareholders.

The buy-back has already enabled us to raise the interim dividend from 30

pence per share to 36 pence per share (an increase of 20%) at an additional

cost of less than #30,000. Indeed, although nominal earnings per share for the

six months ended on 30 September 2001 have risen to 136.2 pence (an increase

of 1%), the amount attributable to each share would have been 160.2 pence (an

increase of 19%) had the share capital as reduced on 12 November been in place

for all of the first half.

Whilst the buy back of 14.99% of the Company's shares caused an increase in

the percentage of shares held by the Sinclair family concert party, the

placing of the balance of the BPT holding, which had taken place on 11 October

2001, introduced a significant number of new shareholders, all of whom we

welcome to Mountview Estates.

The interim dividend of 36 pence per share will be payable on 25 March 2002 to

shareholders on the register at 22 February 2002.

12 December 2001

Consolidated Profit and Loss Account (unaudited).

Notes Half Year Half Year Full Year

ended ended ended

30.09.2001 30.09.2000 31.03.2001

# # #

Turnover 2 17,838,646.00 18,490,604.00 36,492,741.00

Cost of Sales (6,153,004.00) (7,331,529.00) (12,867,278.00)

Gross Profit 11,685,642.00 11,159,075.00 23,625,463.00

Administrative Expenses (1,341,376.00) (1,347,267.00) (1,942,055.00)

Operating Profit 10,344,266.00 9,811,808.00 21,683,408.00

Interest Payable (1,402,006.00) (791,715.00) (1,675,020.00)

Profit on ordinary activities 8,942,260.00 9,020,093.00 20,008,388.00

before taxation

Tax on ordinary activities (2,695,969.00) (2,848,893.00) (6,008,861.00)

Profit on ordinary 3 6,246,291.00 6,171,200.00 13,999,527.00

activities

after taxation

Dividends 4 (1,403,645.00) (1,376,123.00) (3,577,919.00)

Retained Profit for the period 4,842,646.00 4,795,077.00 10,421,608.00

Earnings per Share 5 136.2.p 134.5p 305.2p

Consolidated Balance Sheet (unaudited)

As at As at As at

30.09.2001 30.09.2000 31 .3.2001

# # #

Fixed Assets

Intangible assets 221,511.00 310,116.00 265,814.00

Tangible Assets 25,819,481 20,426,797 25,320,266.00

26,040,992.00 20,736,913.00 25,586,080.00

Current Assets

Stocks 130,002,697.00 98,266,376.00 106,078,226.00

Debtors:

due within one year 218,301.00 600,451.00 416,775.00

due after one year 0.00 0.00

Cash at Bank and in hand 77,091.00 126,892.00 261,706.00

130,298,089.00 98,993,719.00 106,756,707.00

Creditors: amounts failing due (29,909,158.00) (24,368,387.00) (26,825,511.00)

within one year

Net Current Assets 100,388,931.00 74,625,332.00 79,931,196.00

Total Assets less Current 126,429,923.00 95,362,245.00 105,517,276.00

Liabilities

Creditors: Amounts failing due

after more than one year (22,000,000.00) (4,890,000.00) (5,930,000.00)

104,429,923.00 90,472,245.00 99,587,276.00

Capital and Reserves

Called up share capital 229,354.00 229,354.00 229,354.00

Revaluation Reserve 5,846,215.00 2,357,715.00 5,846,215.00

Capital Redemption Reserve 20,646.00 20,646.00 20,646.00

Capital Reserve 24,660.00 24,660.00 24,660.00

Other Reserves 56,000.00 56,000.00 56,000.00

Profit and Loss Account 98,253,048.00 87,783,870.00 93,410,401.00

104,429,923.00 90,472,245.00 99,587,276.00

Consolidated Cash Flow Statement

Half year ended Half year ended Full Year ended

30.09.2001 30.09.2000 30.09.2001

Cash (outflow) Inflow from (12,930,405.00) 4,658,069.00 8,633,695.00

operating activities

Returns on Investment and (1,390,098.00) (792,960.00) (1,672,997.00)

servicing of finance

Taxation (2,495,718.00) (2,263,114.00) (6,339,859.00)

Capital expenditure and (552,727.00) (17,916.00) (1,494,675.00)

financial investment

Equity dividend paid (2,201,796.00) (2,285,527.00) (3,466,955.00)

Cash ( outflow)/ inflow before (19,570,744.00) (701,448.00) (4,340,791.00)

use of liquid

resources and financing

Financing 20,070,000.00 800,000.00 1,840,000.00

Increase/(decrease) in cash 499,256.00 98,552.00 (2,500,791.00)

flow for the period

Reconciliation of Net Cash flow

movement in Net Debt

Increase (Decrease) in cash in 499,256.00 98,552.00 (2,500,791.00)

the period

Change in Net Debt resulting 499,256.00 98,552.00 (2,500,791.00)

from Cash Flow

New Loans due within one year (4,000,000.00)

New Loans falling due after (16,070,000.00) (800,000.00) (1,840,000.00)

more than one year

Net debt at the beginning of (25,124,314.00) (20,783,523.00) (20,783,523.00)

the period

Net debt at the end of the (44,695,058.00) (21,484,971.00) (25,124,314.00)

period

For further information:

Frank Malcolm, Brewin Dolphin Securities Limited (brokers to Mountview Estates)

Tel: 0131 529 0311

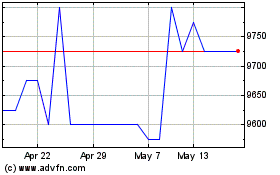

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Sep 2024 to Oct 2024

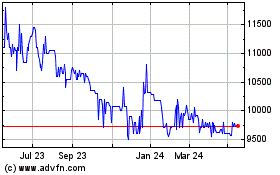

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Oct 2023 to Oct 2024