Molins PLC - Interim Results

September 06 1999 - 3:30AM

UK Regulatory

RNS No 9625d

MOLINS PLC

6 September 1999

1999 INTERIM RESULTS

Molins PLC, the international specialist engineering company, announces its

results for the six months ended 30 June 1999.

1999 1998

Half Half Year

Year #m

#m

Turnover 59.1 101.4

Operating profit before exceptional items 1.9 5.0

Profit/(loss) before taxation 2.0 (11.3)

Net cash/(borrowings) 9.6 (13.7)

Earnings/(loss) per share 3.7p (43.0)p

Dividend per share 2.5p 6.5p

Peter Byrom, Chairman, commented:

"These results are in line with our expectations. The packaging machinery

businesses are developing well. The tobacco machinery business is undergoing

radical restructuring in response to very low levels of original equipment

demand and the consolidation and rationalisation of the major international

cigarette manufacturers. This process is not complete and we are taking

actions to improve the return on capital employed in the tobacco machinery

business."

Enquiries:

Peter Byrom, Chairman Molins PLC Tel: 0171 638 9571

Peter Grant, Chief Executive

Issued by:

Margaret George Citigate Dewe Rogerson Tel: 0171 638 9571

CHAIRMAN'S STATEMENT

The Packaging Machinery division achieved growth in orders,

sales and profits. The tobacco machinery business faces a

difficult international market as a result of the consolidation

and restructuring of the cigarette manufacturers around the

world.

Six months turnover (continuing operations)

1999 1998

#m #m

Tobacco Machinery 35.8 52.2 -31.4%

Packaging Machinery 23.3 19.6 +18.9%

_________ _________

59.1 71.8 -17.7%

_________ _________

Tobacco Machinery

Demand for tobacco machinery has declined by more than 60% over

the last three years. The cost base of the Tobacco Machinery

division has already been reduced by some #50 million per annum

at a one-off cost of #35 million. The numbers employed will be

about 800 at the end of this year compared with 2,000 in June

1997. Internationally the demand for original equipment is very

low and in recent months the company has experienced a reduction

in spares demand from certain customers which themselves are

undergoing consolidation and rationalisation.

Restructuring is continuing within the provisions already made.

The transfer of the spares business from Peterborough to

Saunderton was effected at the end of last year and integration

into the Saunderton site has been a major focus in the first

half. Work is in progress to improve manufacturing efficiencies

at Saunderton. Key technical skills have been retained to

ensure that Molins is in a position to take advantage of any

upturn in demand.

We are developing the aftermarket opportunities arising from the

substantial installed base of Molins machinery throughout the

world. Molins intends to play a key role working in partnership

with its customers to prolong the life and enhance the

performance of existing machinery, supported by continuing

product development.

We are focused on providing our customers with world class

quality and service from our spares and service operations and

are re-organising our management structure and strengthening the

management team to achieve this.

Packaging Machinery

The increase in sales mainly reflects higher shipments at Langen

and Langenpac. The senior management teams of both Langen and

Langenpac have been strengthened in the first half of this year.

Both companies have full order books for the remainder of the

year and Langen won a major contract with a pharmaceutical group

for delivery next year. Sandiacre continued to show good growth

in North America but sales were slightly down overall due to

lower activity in Europe. Molins Food Machinery and the

International Technology Centre continued to make progress with

customer-funded, innovative teabag machinery projects.

Operating results

Operating profits of the Packaging Machinery division increased

from #1.4 million to #1.8 million (up 28%). Operating profits

of the Tobacco Machinery division declined from #3.0 million to

#0.1 million. Group profit before tax was #2.0 million,

compared with #3.9 million (before exceptional items) for

continuing operations in the first half of last year. Earnings

per share were 3.7p compared with 8.1p (before exceptional

items) last year.

Shareholders' funds and cash

Group shareholders' funds were #71.7 million at 30 June 1999

(1998: #67.1 million) compared with #70.4 million at 31 December

1998.

Net cash amounted to #9.6 million compared with #10.9 million at

31 December 1998.

The net cash inflow from operating activities in the first half

was #0.1 million (1998: outflow #1.3 million), after disbursing

#3.9 million (1998: #3.5 million) in respect of exceptional

restructuring costs charged against profits last year.

At the Annual General Meeting shareholders approved a resolution

giving the Company authority to purchase up to 10% of its own

share capital. During the first half year a total of 200,000

shares (0.56% of the shares in issue) were purchased by the

Company for cancellation, at an average cost of 126.5p per

share.

Post balance sheet event

On 26 August 1999 the Group entered into an agreement with its

former business, Langston, which was sold in 1998, to accept

early repayment, at a discount, of the subordinated loan note

which formed part of the proceeds of sale. At the same time a

number of other Langston related assets have been realised and

various obligations have been discharged. These transactions

have an overall cash benefit to the Group of some #4.0 million,

of which #2.5 million has since been received.

Dividend

The directors have declared an interim dividend of 2.5p per

ordinary share (1998:6.5p), the reduction being in line with

the reduced level of final dividend declared in March this year

and the stated intention to redress the balance between the

interim and final dividends. The interim dividend will be

payable on 28 October 1999 to shareholders on the register on 24

September 1999 and is covered 1.5 times by earnings.

Board

The Board was pleased to announce on 4 May 1999 the appointment

of Dr Amar Sabberwal as a non-executive director. A former

director of T&N plc, Dr Sabberwal brings a wealth of

international experience in manufacturing industry.

Outlook

Given the very low levels of demand for original equipment and

the softening in demand for spares in recent months, it will be

a challenge for the Tobacco Machinery division to achieve a

result in the second half of 1999 which is any better than that

achieved in the first half.

The benefits of the actions now being taken in the Tobacco

Machinery division to improve manufacturing efficiencies and the

return on capital employed will be seen progressively but will

have little impact on the financial results this year. In the

medium term, the actions being taken to reposition the tobacco

machinery business to serve its aftermarket are expected to

restore growth, even if demand for original equipment remains at

a low ebb for some time.

The flow of orders for the Packaging Machinery division

continues to be encouraging and the division is expected to show

good progress in 1999 compared with last year.

Peter Byrom

Chairman

6 September 1999

Group profit and loss account

6 months to 30 June 1998

6 months Before

to 30 June exceptional Exceptional

1999 items items Total

Note #m #m #m #m

Turnover

- Continuing operations 59.1 71.8 - 71.8

- Discontinued operations - 29.6 - 29.6

----- ----- ----- -----

1 59.1 101.4 - 101.4

===== ===== ===== =====

Operating profit/(loss)

- Continuing operations 1.9 4.4 (16.0) (11.6)

- Discontinued operations - 0.6 - 0.6

----- ----- ----- -----

1.9 5.0 (16.0) (11.0)

Profit on sale of

discontinued operations - - 0.2 0.2

Net interest

receivable/(payable) 0.1 (0.5) - (0.5)

----- ----- ----- -----

Profit/(loss)on ordinary

activities before taxation 2.0 4.5 (15.8) (11.3)

Taxation (0.7) (1.6) (2.4) (4.0)

----- ----- ----- -----

Profit/(loss) for the

period 1.3 2.9 (18.2) (15.3)

Dividends

(including non-equity) 8&9 (0.9) (2.3) - (2.3)

----- ----- ----- -----

Retained profit/(loss)

for the period 0.4 0.6 (18.2) (17.6)

===== ===== ===== =====

Earnings/(loss) per

ordinary share 7 3.7p 8.1p (51.1)p (43.0)p

----- ----- ----- -----

Dividend per

ordinary share 9 2.5p 6.5p - 6.5p

----- ----- ----- -----

12 months to 31 December 1998

Before

exceptional Exceptional

items items Total

Note #m #m #m

Turnover

- Continuing operations 140.6 - 140.6

- Discontinued operations 29.6 - 29.6

----- ----- -----

1 170.2 - 170.2

===== ===== =====

Operating profit/(loss)

- Continuing operations 8.5 (16.0) (7.5)

- Discontinued operations 0.6 - 0.6

----- ----- -----

9.1 (16.0) (6.9)

Profit on sale of

discontinued operations - 0.2 0.2

Net interest

receivable/(payable) 0.1 - 0.1

----- ----- -----

Profit/(loss) on ordinary

activities before taxation 9.2 (15.8) (6.6)

Taxation (3.4) (2.9) (6.3)

----- ----- -----

Profit/(loss) for the

period 5.8 (18.7) (12.9)

Dividends

(including non-equity) 8 & 9 (2.9) - (2.9)

----- ----- -----

Retained profit/(loss)

for the period 2.9 (18.7) (15.8)

===== ===== =====

Earnings/(loss) per

ordinary share 7 16.3p (52.5)p (36.2)p

----- ----- -----

Dividend per

ordinary share 9 8.0p - 8.0p

----- ----- -----

Group balance sheet

30 30 31

June June Dec

1999 1998 1998

#m #m #m

Fixed assets

Tangible assets 28.9 30.3 29.4

Investments 1.9 2.1 1.9

----- ----- -----

30.8 32.4 31.3

===== ===== =====

Current assets

Stocks 35.1 42.2 38.1

Debtors - due within one year 36.1 50.1 36.9

Debtors - due after more than one year 19.9 18.1 18.8

Business sale proceeds - cash - 24.4 -

Cash at bank and in hand 11.8 3.2 13.7

----- ----- -----

102.9 138.0 107.5

Creditors - amounts falling due

within one year

Borrowings (1.8) (6.5) (2.4)

Other creditors (53.1) (64.4) (55.4)

Proposed dividend (0.9) (2.3) (0.5)

----- ----- -----

(55.8) (73.2) (58.3)

----- ----- -----

Net current assets 47.1 64.8 49.2

----- ----- -----

Total assets less current

liabilities 77.9 97.2 80.5

Creditors - amounts falling due

after more than one year

Borrowings (0.4) (10.4) (0.4)

Other creditors (0.3) (0.3) (0.3)

----- ----- -----

(0.7) (10.7) (0.7)

Provisions for liabilities and

charges (5.5) (19.2) (9.2)

----- ----- -----

Net assets 71.7 67.3 70.6

===== ===== =====

Capital and reserves

Called up share capital 9.7 9.8 9.8

Share premium account 25.6 25.6 25.6

Capital redemption reserve 0.1 - -

Revaluation reserve 17.8 16.1 17.7

Profit and loss account 18.5 15.6 17.3

----- ----- -----

Shareholders' funds

(including non-equity interests) 71.7 67.1 70.4

Minority interests - 0.2 0.2

----- ----- -----

71.7 67.3 70.6

===== ===== =====

Net assets per share 200p 186p 196p

Group cash flow statement

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

Net cash inflow/(outflow) from

operating activities 0.1 (1.3) 5.6

Returns on investments and servicing

of finance

Net interest received/(paid) 0.1 (0.6) (0.2)

----- ----- -----

Net cash inflow/(outflow) for returns

on investments and servicing of finance 0.1 (0.6) (0.2)

Taxation (0.7) (1.4) (6.0)

Capital expenditure (net of sale proceeds) (0.4) 0.2 0.3

Acquisitions and disposals

Investment in joint venture - (0.3) (0.3)

Sale of businesses 0.2 - 24.4

----- ----- -----

Net cash inflow/(outflow) for

acquisitions and disposals 0.2 (0.3) 24.1

Equity dividends paid (0.6) (3.0) (5.4)

----- ----- -----

Net cash (outflow)/inflow before

management of liquid resources

and financing (1.3) (6.4) 18.4

Management of liquid resources 2.5 - (4.6)

Financing

Issue of ordinary share capital - 0.1 0.1

Redemption of ordinary share capital (0.1) - -

Decrease in loans and finance lease

obligations - (0.4) (14.6)

----- ----- -----

Net cash outflow from financing (0.1) (0.3) (14.5)

----- ----- -----

Increase/(decrease) in cash

in the period 1.1 (6.7) (0.7)

===== ===== =====

Closing net funds/(debt) 9.6 (13.7) 10.9

===== ===== =====

Reconciliation of operating

profit/(loss) to net cash flow

from operating activities

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

Operating profit/(loss) 1.9 (11.0) (6.9)

Depreciation 1.7 3.4 5.8

Movements in restructuring and

rationalisation provisions

New provisions created - 16.0 16.0

Cash movements (3.9) (3.5) (10.1)

Working capital movements 0.4 (6.2) 0.8

----- ----- -----

Net cash inflow/(outflow) from

operating activities 0.1 (1.3) 5.6

===== ===== =====

Reconciliation of net cash flow

to movement in net funds/(debt)

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

Increase/(decrease) in cash

in the period 1.1 (6.7) (0.7)

Cash (inflow)/outflow from

movement in liquid resources (2.5) - 4.6

Cash outflow from decrease in

debt and lease financing - 0.4 14.6

----- ----- -----

Change in net funds/(debt)

resulting from cash flows (1.4) (6.3) 18.5

Translation difference 0.1 (0.1) (0.3)

----- ----- -----

Movement in net funds/(debt)

in the period (1.3) (6.4) 18.2

Opening net funds/(debt) 10.9 (7.3) (7.3)

----- ----- -----

Closing net funds/(debt) 9.6 (13.7) 10.9

===== ===== =====

Reconciliation of movements

in shareholders funds

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

Profit/(loss) for the period 1.3 (15.3) (12.9)

Dividends (0.9) (2.3) (2.9)

----- ----- -----

Retained profit/(loss) for the period 0.4 (17.6) (15.8)

Property revaluation - - 1.4

Goodwill adjustment on sale of business - 1.9 1.9

Issue of ordinary share capital - 0.1 0.1

Redemption of ordinary share capital (0.3) - -

Other recognised gains and

losses for the period 1.2 (0.1) -

----- ----- -----

Net increase/(decrease) in

shareholders' funds 1.3 (15.7) (12.4)

Opening shareholders' funds 70.4 82.8 82.8

----- ----- -----

Closing shareholders' funds 71.7 67.1 70.4

===== ===== =====

Notes

1.Segmental analysis

Turnover

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

By activity

Continuing operations

Tobacco Machinery 35.8 52.2 100.2

Packaging Machinery 23.3 19.6 40.4

----- ----- -----

59.1 71.8 140.6

Discontinued operations - 29.6 29.6

----- ----- -----

59.1 101.4 170.2

Exceptional items - - -

----- ----- -----

59.1 101.4 170.2

===== ===== =====

1.Segmental analysis

Operating profit/(loss)

6 months to 6 months to 12 months to

30 June 30 June 31 Dec

1999 1998 1998

#m #m #m

By activity

Continuing operations

Tobacco Machinery 0.1 3.0 6.4

Packaging Machinery 1.8 1.4 2.1

----- ----- -----

1.9 4.4 8.5

Discontinued operations - 0.6 0.6

----- ----- -----

1.9 5.0 9.1

Exceptional items - (16.0) (16.0)

----- ----- -----

1.9 (11.0) (6.9)

===== ===== =====

2. At 30 June 1999, provisions for liabilities and charges include

#5.0m (December 1998: #8.9m, June 1998 #16.0m) in respect of

restructuring and rationalisation of the Tobacco Machinery division.

3. Post balance sheet event

On 26 August 1999 the Group entered into an agreement with its

former business, Langston, which was sold in 1998, to accept

early repayment, at a discount, of the subordinated loan note

which formed part of the proceeds of sale. At the same time a

number of other Langston related assets have been realised and

various obligations have been discharged. These transactions

have an overall cash benefit to the Group of some #4.0 million,

of which #2.5 million has already been received.

4. The results for the full year 1998 have been extracted from the

Group's full accounts for that year which included an

unqualified audit report and have been filed with the Registrar

of Companies.

5. The interim financial statements have been prepared on the

basis of the accounting policies set out in the Group's 1998

statutory accounts. In the half year results and the balance

sheet at 30 June 1999 FRS 12 and 14 have been adopted.

6. The financial information for the half year has not been

audited, although the auditors have carried out a review.

7. Earnings per ordinary share are based upon the profit after

taxation less the preference dividend and on a weighted average

of 35,571,549 shares in issue during the period (1998:35,571,021).

8. The preference dividend payable on 30 June 1999 amounted to

#27,000 (1998:#18,900).

9. The cost of the interim dividend of 2.5p per ordinary share

for the six months to 30 June 1999 will amount to #0.9m.

10. Year 2000

The Company has established a comprehensive Group-wide programme

to ensure that with reasonable certainty:

a) all products currently supplied by Group companies have been

tested and are year 2000 compliant when operated as designed

and specified;

b) all material management information systems are, or will be

in reasonable time, year 2000 compliant;

c) key suppliers have demonstrated their own commitment to

continuity of supply of goods and services and have given

reasonable assurances concerning compliance of products.

Progress in implementation is regularly reported to the Board,

and such progress is considered to be satisfactory.

However, given the unique nature and complexity of the problem

it is not possible for any organisation to be certain that there

will be no year 2000 disruption, even if its own systems are

compliant in all material respects.

A number of the Group's business systems have been upgraded

which, as well as dealing with year 2000 compliance, will also

have the benefit of increased functionality and efficiency.

Total expenditure in the six months ended 30 June 1999, relating

at least in part to year 2000 compliance, amounted to #1.1m

(full year 1998:#1.3m, first half year 1998:#0.7m) of which

#0.6m (full year 1998:#0.6m, first half year 1998:#0.3m)

represents capital expenditure.

11. The average US dollar exchange rate for the period to 30

June 1999 was US$1.61(1998:US$1.65) and the rate at 30 June 1999

was US$1.58 (1998:US$1.67). The rate at 31 December 1998 was

US$1.66.

END

IR KXFFBKKKFBKZ

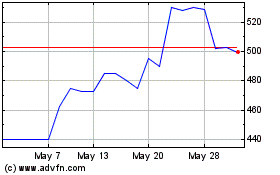

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024