TIDMMLIN

RNS Number : 6923M

Molins PLC

29 August 2013

29 August 2013 FOR IMMEDIATE RELEASE

Molins PLC

Half-year report for the six months ended 30 June 2013

Molins PLC, the international engineering and services company,

announces its results for the six months ended 30 June 2013.

Group Highlights

-- Order intake maintained at same levels as last year

-- Increase in Group sales of 20% to GBP47.8m (2012: GBP39.9m)

-- Increase in Group underlying profit before tax to GBP1.5m (2012: GBP0.8m)

-- Underlying earnings per share increased to 6.5p (2012: 3.6p)

-- Net funds of GBP5.6m

-- Interim dividend per share maintained at 2.5p (2012: 2.5p)

Dick Hunter, Chief Executive, commented:

"The Group has had a strong first half, with increases in both

sales and underlying profit. We have continued our investment

across the business, most notably in product development, as well

as through the expansion of our Packaging Machinery presence in

Asia.

The order book supports the Group's full year trading

performance being second half weighted as in previous years. The

Board's expectation of performance for the full year remains

unchanged."

Divisional Highlights

Scientific Services

-- Strong orders and sales growth at Cerulean, leading to improved trading performance

-- Order intake at Arista Laboratories lower than the prior

year, as the regulatory regime for the testing of tobacco products

in the USA has yet to be confirmed

-- Following investment in personnel, equipment and systems at

Arista in anticipation of increased demand, trading performance was

lower in the first half of the year

Packaging Machinery

-- Order intake maintained, with sales increase of 16% supported by strong opening order book

-- Trading performance at similar levels to previous year, reflecting slightly lower margins

-- Sales and service operations established in Asia

Tobacco Machinery

-- Sales growth of 22% reflecting strong opening order book for new machinery

-- Trading performance improved with increase in margins

For further information, please contact:

Molins PLC Tel: +44(0)1908

Dick Hunter, Chief Executive 246870

David Cowen, Group Finance Director

Canaccord Genuity Limited

Bruce Garrow Tel: +44(0)20 7523

8350

MHP Communications Tel: +44(0)20 3128

Andrew Jaques, Simon Hockridge, Naomi 8100

Lane

MOLINS is an international business providing high performance

machinery and instrumentation, as well as services and support for

the production, packaging and analysis of consumer products. The

Group serves its customers through its wide geographic spread of

sales, service and manufacturing locations. The Group is focused on

the organic development of its businesses, through targeted product

development, excellence in customer service and ongoing operational

efficiency improvements, supported by acquisitive growth where

appropriate.

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated)(4) (restated)(4)

Sales GBP47.8m GBP39.9m GBP93.0m

Underlying operating profit(1) GBP1.5m GBP0.8m GBP4.9m

Underlying profit before tax(2) GBP1.5m GBP0.8m GBP4.9m

Underlying earnings per share(3) 6.5p 3.6p 21.8p

Dividends per share 2.5p 2.5p 5.5p

Net funds GBP5.6m GBP5.7m GBP7.4m

Statutory profit before tax GBP0.7m GBP0.2m GBP4.5m

Statutory profit for the period GBP0.7m GBP0.2m GBP3.8m

Basic earnings per share 3.5p 1.0p 20.6p

(1) Before non-underlying net charge of GBP0.4m (30 June 2012:

GBP0.5m; 31 December 2012: GBP0.3m)

(2) Before non-underlying net charge of GBP0.8m (30 June 2012:

GBP0.6m; 31 December 2012: GBP0.4m), comprising net charges

included in operating profit of GBP0.4m (30 June 2012: GBP0.5m; 31

December 2012: GBP0.3m) and interest expense on pension scheme

balances of GBP0.4m (30 June 2012: GBP0.1m; 31 December 2012:

GBP0.1m)

(3) Before non-underlying net charge of GBP0.6m (30 June 2012:

GBP0.5m; 31 December 2012: GBP0.3m), comprising net charges

included in operating profit of GBP0.3m (30 June 2012: GBP0.4m; 31

December 2012: GBP0.2m) and interest expense on pension scheme

balances of GBP0.3m (30 June 2012: GBP0.1m; 31 December 2012:

GBP0.1m), all figures after tax

(4) Restated to reflect amendments to IAS 19 Employee benefits

and consequent changes to the Group's accounting policies

INTERIM MANAGEMENT REPORT

Operating results

Group sales in the six months to 30 June 2013 increased by 20%

to GBP47.8m (2012: GBP39.9m) and underlying operating profit

(before non-underlying net charges) increased to GBP1.5m (2012:

GBP0.8m). Additionally the Group incurred charges of GBP0.4m (2012:

GBP0.4m) in respect of administering the Group's defined benefit

pension schemes and GBP0.4m (2012: GBP0.1m) financing expense

arising as a result of the accounting for the Group's pension

schemes. Reported profit before tax was GBP0.7m (2012: GBP0.2m).

The net tax charge on underlying profit (before non-underlying net

charges) was GBP0.2m (2012: GBP0.1m), with a net tax credit of

GBP0.2m (2012: GBP0.1m) in respect of non-underlying net charges,

resulting in profit for the period of GBP0.7m (2012: GBP0.2m), of

which underlying profit was GBP1.3m (2012: GBP0.7m). Basic earnings

per share amounted to 3.5p (2012: 1.0p) and underlying earnings per

share (before non-underlying net charges) amounted to 6.5p (2012:

3.6p). The Group's net funds position at 30 June 2013 was GBP5.6m

(31 December 2012: GBP7.4m).

Scientific Services

Sales in the period increased by 23% to GBP11.4m (2012: GBP9.3m)

leading to an operating profit of GBP0.1m (2012: GBP0.1m loss). The

division, with its main facilities in the UK and USA, comprises

Arista Laboratories, an independent tobacco and smoke constituent

analytical laboratory, and Cerulean, which supplies process and

quality control instruments to the tobacco industry, as well as

other instruments and machinery to other industrial sectors. Order

intake at Cerulean was strong in most areas, with the key Chinese

market remaining buoyant and the order book being supported by a

large, one-off project for a customer in North Africa. Sales grew

in the period for both instruments and aftermarket products, which

represented one-third of revenues. The growth in revenues led to a

commensurate increase in profitability. The business continues to

develop its product range both in the tobacco sector and to address

other non-tobacco end markets.

Order intake at Arista Laboratories was lower than in the same

period last year. Although it was expected that regulatory

requirements for the testing and reporting of tobacco product

constituents in the USA would have been confirmed by the Food and

Drug Administration (FDA) in the first half of the year, the

regulatory framework was not forthcoming and the latest indication

from the FDA is that guidance will be published in December 2013.

This has meant that activity levels at Arista have been

considerably lower than the business is capable of delivering and

these relatively low levels are expected to continue during the

rest of the year. The business is fully operational from its new

laboratory facility in Richmond, Virginia where it services all the

tobacco industry's tobacco and smoke testing requirements, and from

where non-tobacco testing will be carried out as the business

extends its activities into other end markets.

Packaging Machinery

Sales in the period increased by 16% to GBP18.4m (2012:

GBP15.9m) and operating profit was GBP0.1m (2012: GBP0.1m, before

reorganisation costs). The division supplies engineering services

and capital equipment through ITCM, based in the UK, and Langen

Packaging Group, based in the Netherlands and Canada. In addition,

during the first part of this year, Langen has established sales

and service offices in Asia to support customers' growth plans in

that region. Order intake overall has remained at similar levels to

last year, with momentum in the European part of the division being

offset by weaker demand in North America. Good levels of order

prospects remain for the second half of the year across all

regions. The increase in sales in the first half was supported by a

strong opening order book, although margins were reduced as a

result of an increase in high-engineering content projects, with a

lower proportion of sales of standardised machines. Sales and

marketing costs have increased in the period in support of the

investment in infrastructure in Asia.

Tobacco Machinery

Sales in the period increased by 22% to GBP18.0m (2012:

GBP14.7m) and operating profit increased to GBP1.3m (2012:

GBP0.8m). The division designs, manufactures, markets and services

specialist machinery for the tobacco industry from its facilities

in the UK, USA, Brazil, Singapore and Czech Republic. Sales of new

and rebuild machines were supported by a strong opening order book

and also by the receipt of orders which required quick response

times, which the division was able to deliver, reflecting the

efficiency of its operations and the support it provides its

customer base. Although order intake overall was slightly weaker

than in the same period last year, current order prospects are

relatively strong. Activity levels in the period were good which,

together with the margins earned on increased sales, resulted in a

strong financial performance. The division continues its focus on

new product development and continuing improvements in service

performance.

Non-underlying items

Non-underlying items in the period comprise charges in respect

of the administration costs of the Group's defined benefit pension

schemes and financing expense on pension scheme balances, which are

detailed in the Pension schemes section below. Additionally, in the

six months to 30 June 2012 and twelve months to 31 December 2012,

charges in respect of reorganisations of GBP0.1m and GBP1.0m

respectively were incurred. Cash payments of GBP0.6m were made in

the period to 30 June 2013 in respect of reorganisations in earlier

periods.

Cash

Net funds at 30 June 2013 were GBP5.6m (30 June 2012: GBP5.7m;

31 December 2012: GBP7.4m). Net cash inflow from operating

activities in the first half of the year was GBP1.3m, which is net

of reorganisation costs paid of GBP0.6m, deficit recovery payments

to the UK defined benefit pension scheme of GBP0.6m and tax paid of

GBP0.7m. Net capital and product development cash outflow was

GBP2.5m. Ordinary dividends of GBP0.6m were paid in the period.

Pension schemes

The Group is responsible for defined benefit schemes in the UK

and the USA, in which there are no active members, which it

accounts for in accordance with IAS 19 Employee benefits. Changes

to IAS 19 have taken effect for 2013 reporting, with the prior year

comparative figures being restated. Financing income/expense is now

calculated by applying the discount rate used for valuing the

schemes' liabilities to the value of the net pension

asset/liability at the beginning of the year, rather than

calculating financing income by applying the expected return on

assets to the value of the schemes' assets at the beginning of the

year and financing expense by applying the discount rate to the

value of the schemes' liabilities at the beginning of the year. As

the discount rate is lower than the expected return on assets,

financing income/expense is lower than would have been reported

under IAS 19 before its requirements changed. Additionally for 2013

reporting, the expense of administering the pension schemes can no

longer be accounted for as a reduction in the expected return on

schemes' assets and is instead charged separately to operating

profit within the income statement.

The IAS 19 valuation of the UK scheme at 30 June 2013 shows a

surplus of GBP0.8m (GBP0.5m net of deferred tax), compared with a

deficit of GBP13.9m (GBP10.7m net of deferred tax) at the beginning

of the period. The value of the scheme's assets at 30 June 2013 was

GBP333.8m (31 December 2012: GBP322.5m), and the value of the

scheme's liabilities was GBP333.0m (31 December 2012: GBP336.4m).

The net valuation of the USA pension schemes at 30 June 2013, with

total assets of GBP15.2m, showed a deficit of GBP4.4m (GBP2.7m net

of deferred tax), compared with a deficit of GBP5.3m (GBP3.2m net

of deferred tax) at the beginning of the period. The aggregate

expense of administering the pension schemes was GBP0.4m (2012:

GBP0.4m). The net financing expense on pension scheme balances was

GBP0.4m (2012: GBP0.1m).

The UK scheme was subject to a formal actuarial valuation as at

30 June 2012. This valuation is close to completion and is expected

to show a deficit as at that date of approximately GBP53m. The

level of deficit funding required is expected to increase from

GBP1.2m per annum to GBP1.7m per annum (increasing by inflation)

from July 2013, which is expected to equate to a deficit recovery

period of 17 years.

Related party transactions

There has been no material change in the nature of related party

transactions from those described in note 29 of the 2012 Annual

Report and Accounts and these are also referred to in note 13 of

this Half-year report.

Risks

Molins is subject to a number of risks which could have a

serious impact on the performance of the business. The Board

regularly considers the principal risks that the Group faces and

how to mitigate their potential impact. The key risks to which the

business is exposed have not changed significantly over the past

six months and are not expected to do so over the remaining six

months of the financial year. Further information on the principal

risks and uncertainties faced by the Group is included on pages 13

and 14 of the Group's 2012 Annual Report and Accounts.

Cautionary statement

This Interim management report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other reason. The IMR contains certain forward-looking

statements. These statements are made by the directors in good

faith based on the information available to them up to the time of

their approval of this report and such information should be

treated with caution due to the inherent uncertainties, including

both economic and business risk factors, underlying any such

forward-looking information. This IMR has been prepared for the

Group as a whole and therefore emphasises those matters which are

significant to Molins PLC and its subsidiary undertakings when

viewed as a whole.

Dividend

The Board has declared an interim dividend of 2.5p per ordinary

share (2012: 2.5p), which will be paid on 10 October 2013 to

ordinary shareholders registered at the close of business on 20

September 2013. Dividends paid to shareholders in the six months to

30 June 2013 were 3.0p per ordinary share (2012: 2.75p).

Outlook

The order book supports the Group's full year trading

performance being second half weighted as in previous years. The

Board's expectation of performance for the full year remains

unchanged.

RESPONSIBILITY STATEMENT OF THE DIRECTORS IN RESPECT OF THE

HALF-YEAR REPORT

We confirm that to the best of our knowledge:

* the condensed set of financial statements has been

prepared in accordance with IAS 34 Interim financial

reporting as adopted by the EU; and

* the Interim management report includes a fair review

of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during

the first six months of the financial year and their impact

on the condensed set of financial statements; and a description

of the principal risks and uncertainties for the remaining

six months of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the

first six months of the current financial year and that

have materially affected the financial position or performance

of the Group during that period; and any changes in the

related party transactions described in the last annual

report that could do so.

By order of the Board

Dick Hunter

Chief Executive

David Cowen

Group Finance Director

29 August 2013

CONDENSED CONSOLIDATED INCOME STATEMENT

6 months to 30 June 6 months to 30 June 2012

2013 (restated)

----------------------------------------- -----------------------------------------

Non-underlying Non-underlying

(note 5) (note 5)

Underlying GBPm Total Underlying GBPm Total

Notes GBPm GBPm GBPm GBPm

Revenue 4 47.8 - 47.8 39.9 - 39.9

Cost of sales (35.2) - (35.2) (28.8) - (28.8)

------------ ---------------- --------- ------------ ---------------- ---------

Gross profit 12.6 - 12.6 11.1 - 11.1

Other operating

income - - - - - -

Distribution expenses (4.2) - (4.2) (4.0) - (4.0)

Administrative

expenses (6.4) (0.4) (6.8) (6.3) (0.5) (6.8)

Other operating

expenses (0.5) - (0.5) - - -

------------ ---------------- --------- ------------ ---------------- ---------

4,

Operating profit 7 1.5 (0.4) 1.1 0.8 (0.5) 0.3

Financial income 6 0.1 - 0.1 0.1 - 0.1

Financial expenses 6 (0.1) (0.4) (0.5) (0.1) (0.1) (0.2)

------------ ---------------- --------- ------------ ---------------- ---------

Net financing 4,

expense 6 - (0.4) (0.4) - (0.1) (0.1)

------------ ---------------- --------- ------------ ---------------- ---------

Profit before

tax 4 1.5 (0.8) 0.7 0.8 (0.6) 0.2

Taxation 8 (0.2) 0.2 - (0.1) 0.1 -

------------ ---------------- --------- ------------ ---------------- ---------

Profit for the

period 1.3 (0.6) 0.7 0.7 (0.5) 0.2

============ ================ ========= ============ ================ =========

Basic earnings

per ordinary share 9 3.5p 1.0p

Diluted earnings

per ordinary share 9 3.4p 0.9p

------------ ---------------- --------- ------------ ---------------- ---------

CONDENSED CONSOLIDATED INCOME STATEMENT

12 months to 31 December 2012

(restated)

-------------------------------------------

Non-underlying

(note 5)

Underlying GBPm Total

Notes GBPm GBPm

Revenue 4 93.0 - 93.0

Cost of sales (65.7) - (65.7)

------------- ----------------- ---------

Gross profit 27.3 - 27.3

Other operating income - 1.5 1.5

Distribution expenses (8.0) - (8.0)

Administrative expenses (13.7) (1.8) (15.5)

Other operating expenses (0.7) - (0.7)

------------- ----------------- ---------

4,

Operating profit 7 4.9 (0.3) 4.6

Financial income 6 0.2 - 0.2

Financial expenses 6 (0.2) (0.1) (0.3)

------------- ----------------- ---------

4,

Net financing expense 6 - (0.1) (0.1)

------------- ----------------- ---------

Profit before tax 4 4.9 (0.4) 4.5

Taxation 8 (0.8) 0.1 (0.7)

------------- ----------------- ---------

Profit for the period 4.1 (0.3) 3.8

============= ================= =========

Basic earnings per

ordinary share 9 20.6p

Diluted earnings

per 9 19.9p

ordinary share

------------- ----------------- ---------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated) (restated)

GBPm GBPm GBPm

Profit for the period 0.7 0.2 3.8

------------- ------------- -------------

Other comprehensive income/(expense)

Items that will not be reclassified

to profit or loss 15.9 (12.5) (17.6)

Actuarial gains/(losses)

(4.0) 3.3 4.4

Tax on items that will not be reclassified

to profit or loss

------------- ------------- -------------

11.9 (9.2) (13.2)

------------- ------------- -------------

Items that may be reclassified subsequently

to profit or loss

Currency translation movements arising 0.3 (0.7) (0.7)

on foreign currency net investments

(0.1) (0.2) 0.3

Effective portion of changes in fair

value of cash flow hedges

- (0.1) -

Net changes in fair value of cash flow

hedges transferred to profit or loss

------------- ------------- -------------

0.2 (1.0) (0.4)

------------- ------------- -------------

Other comprehensive income/(expense)

for the period 12.1 (10.2) (13.6)

------------- ------------- -------------

Total comprehensive income/(expense)

for the period 12.8 (10.0) (9.8)

============= ============= =============

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital

Share Share Translation redemption Hedging Retained Total

capital premium reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

6 months to 30 June

2013

Balance at 1 January

2013 5.0 26.0 3.5 3.9 0.2 (8.1) 30.5

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period

Other comprehensive - - - - - 0.7 0.7

income/(expense) for

the period - - 0.3 - (0.1) 11.9 12.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

income/(expense) for

the period - - 0.3 - (0.1) 12.6 12.8

---------- ---------- -------------- ------------ ---------- ----------- ---------

Dividends to shareholders - - - - - (0.6) (0.6)

Equity-settled share-based

transactions - - - - - 0.1 0.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total transactions

with owners, recorded

directly in equity - - - - - (0.5) (0.5)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 30 June

2013 5.0 26.0 3.8 3.9 0.1 4.0 42.8

========== ========== ============== ============ ========== =========== =========

6 months to 30 June

2012

Balance at 1 January

2012 5.0 26.0 4.2 3.9 (0.1) 2.0 41.0

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period,

as restated

Other comprehensive

income/(expense) for - - - - - 0.2 0.2

the period,

as restated - - (0.7) - (0.3) (9.2) (10.2)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

income/(expense) for

the period - - (0.7) - (0.3) (9.0) (10.0)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Dividends to shareholders - - - - - (0.5) (0.5)

Equity-settled share-based

transactions - - - - - 0.1 0.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total transactions

with owners, recorded

directly in equity - - - - - (0.4) (0.4)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 30 June

2012 5.0 26.0 3.5 3.9 (0.4) (7.4) 30.6

========== ========== ============== ============ ========== =========== =========

12 months to 31 December

2012

Balance at 1 January

2012 5.0 26.0 4.2 3.9 (0.1) 2.0 41.0

---------- ---------- -------------- ------------ ---------- ----------- ---------

Profit for the period,

as restated

Other comprehensive

income/(expense) for - - - - - 3.8 3.8

the period,

as restated - - (0.7) - 0.3 (13.2) (13.6)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total comprehensive

income/(expense) for

the period - - (0.7) - 0.3 (9.4) (9.8)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Dividends to shareholders - - - - - (1.0) (1.0)

Equity-settled share-based

transactions - - - - - 0.2 0.2

Tax on items recorded

directly in equity - - - - - 0.1 0.1

---------- ---------- -------------- ------------ ---------- ----------- ---------

Total transactions

with owners, recorded

directly in equity - - - - - (0.7) (0.7)

---------- ---------- -------------- ------------ ---------- ----------- ---------

Balance at 31 December

2012 5.0 26.0 3.5 3.9 0.2 (8.1) 30.5

========== ========== ============== ============ ========== =========== =========

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 30 June 31 Dec

2013 2012 2012

Notes GBPm GBPm GBPm

Non-current assets

Intangible assets 14.9 14.6 14.5

Property, plant and equipment 11.8 10.7 11.7

Investment property 0.8 - -

Employee benefits 7 0.8 - -

Deferred tax assets 3.7 5.2 7.8

---------- ---------- ---------

32.0 30.5 34.0

---------- ---------- ---------

Current assets

Inventories 19.5 18.1 18.1

Trade and other receivables 21.6 19.0 21.5

Current tax assets 0.1 0.1 -

Cash and cash equivalents 14.0 12.2 13.3

---------- ---------- ---------

55.2 49.4 52.9

---------- ---------- ---------

Current liabilities

Trade and other payables (28.2) (24.8) (26.9)

Current tax liabilities (1.1) (0.8) (1.0)

Provisions (1.5) (1.3) (1.7)

---------- ---------- ---------

(30.8) (26.9) (29.6)

---------- ---------- ---------

Net current assets 24.4 22.5 23.3

---------- ---------- ---------

Total assets less current liabilities 56.4 53.0 57.3

---------- ---------- ---------

Non-current liabilities

Interest-bearing loans and borrowings (8.4) (6.5) (5.9)

Employee benefits 7 (4.4) (15.9) (19.2)

Deferred tax liabilities (0.8) - (1.7)

---------- ---------- ---------

(13.6) (22.4) (26.8)

---------- ---------- ---------

Net assets 4 42.8 30.6 30.5

========== ========== =========

Equity

Issued capital 5.0 5.0 5.0

Share premium 26.0 26.0 26.0

Reserves 7.8 7.0 7.6

Retained earnings 4.0 (7.4) (8.1)

---------- ---------- ---------

Total equity 42.8 30.6 30.5

========== ========== =========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated) (restated)

Notes GBPm GBPm GBPm

Operating activities Operating profit

Non-underlying items included in operating

profit

Amortisation Depreciation 1.1 0.3 4.6

Defined benefit scheme pension service 0.4 0.5 0.3

costs

Other non-cash items Defined benefit 0.7 0.6 1.4

scheme pension payments Working capital

movements: - increase in inventories

- decrease/(increase) in trade and

other receivables - increase in trade

and other payables - increase/(decrease)

in provisions

0.9 1.0 2.1

- 0.5 0.9

0.1 0.1 (0.3)

(0.6) (0.8) (1.6)

(1.2) (2.6) (2.6)

0.6 1.3 (0.7)

0.4 1.2 3.5

0.2 (0.1) 0.3

------------- ------------- -------------

Cash generated from operations before 2.6 2.0 7.9

reorganisation Reorganisation costs

paid 5 (0.6) (0.3) (0.5)

------------- ------------- -------------

Cash generated from operations Taxation 2.0 1.7 7.4

paid

(0.7) (0.4) (0.8)

------------- ------------- -------------

Net cash from operating activities 1.3 1.3 6.6

------------- ------------- -------------

Investing activities

Interest received 0.1 0.1 0.2

Proceeds from sale of property, plant 0.1 - 0.1

and equipment Acquisition of property,

plant and equipment Acquisition of

investment property Capitalised development

expenditure

(1.0) (1.5) (3.9)

(0.7) - -

(0.8) (0.4) (1.2)

------------- ------------- -------------

Net cash from investing activities (2.3) (1.8) (4.8)

------------- ------------- -------------

Financing activities Interest paid

Net increase against revolving facilities

Dividends paid

(0.1) (0.1) (0.2)

2.3 1.3 0.7

10 (0.6) (0.5) (1.0)

------------- ------------- -------------

Net cash from financing activities 1.6 0.7 (0.5)

------------- ------------- -------------

Net increase in cash and cash equivalents 0.6 0.2 1.3

Cash and cash equivalents at 1 January 11 13.3 12.3 12.3

Effect of exchange rate fluctuations 0.1 (0.3) (0.3)

on cash held

------------- ------------- -------------

Cash and cash equivalents at period

end 14.0 12.2 13.3

============= ============= =============

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

1. General information

The Half-year results for the current and comparative period are

unaudited but have been reviewed by the auditor, KPMG Audit Plc,

and its report is set out on page 18. The information for the year

ended 31 December 2012 does not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The Group's

statutory accounts have been reported on by the Group's auditor and

delivered to the Registrar of Companies.The report of the auditor

was (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying its report, and (iii) did not contain a

statement under section 498(2) or (3) of the Companies Act 2006.

The Group's statutory accounts for the year ended 31 December 2012

are available from the Company's registered office at Rockingham

Drive, Linford Wood East, Milton Keynes MK14 6LY or from the

Group's website at www.molins.com.

Having made due enquiries the directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. For this reason,

they continue to adopt the going concern basis in preparing the

condensed set of financial statements.

The condensed set of financial statements was approved by the

Board of directors on 29 August 2013.

2. Basis of preparation

(a) Statement of compliance

The condensed set of financial statements for the six months

ended 30 June 2013 has been prepared in accordance with IAS 34

Interim financial reporting as adopted by the EU and the Disclosure

and Transparency Rules of the UK's Financial Conduct Authority. It

does not include all of the information required for full annual

financial statements and should be read in conjunction with the

financial statements of the Group for the year ended 31 December

2012.

(b) Judgements and estimates

The preparation of the condensed set of financial statements

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and reported

amounts of assets and liabilities, income and expense. Actual

results may differ from these estimates.

In preparing the condensed set of financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were of the same type as those that applied to the financial

statements for the year ended 31 December 2012.

3. Significant accounting policies

Except as described below, the accounting policies in these

interim financial statements are the same as those applied in the

Group's consolidated financial statements as at and for the year

ended 31 December 2012. The following changes in accounting

policies are also expected to be reflected in the Group's

consolidated financial statements as at and for the year ending 31

December 2013.

Changes in accounting policies

As required, the Group has adopted amendments to IAS 19 Employee

benefits, including consequential amendments to other standards,

with a date of initial application of 1 January 2013, and restated

the prior year's results accordingly. The Group has changed its

accounting policies with respect to the basis for accounting for

financing income/expense on the value of the defined benefit

pension schemes' assets/liabilities and with respect to the costs

of administering the defined benefit pension schemes.

The Group determines financing income/expense for the period by

applying the discount rate used for valuing the schemes'

liabilities to the value of the net pension asset/liability at the

beginning of the year. Previously, the Group calculated financing

income by applying the expected return on assets to the value of

the schemes' assets at the beginning of the year and financing

expense by applying the discount rate to the value of the schemes'

liabilities at the beginning of the year (taking into account any

changes during the period as a result of contributions and benefit

payments). Additionally, the expense of administering the pension

schemes is now charged separately to operating profit within the

income statement. Previously it was accounted for as a reduction in

the expected return on schemes' assets.

For the period to 30 June 2012, the restatement has reduced

profit for the period as previously reported by GBP1.8m and

increased other comprehensive income by GBP1.8m. For the year to 31

December 2012, the restatement has reduced profit for the period as

previously reported by GBP3.8m and increased other comprehensive

income by GBP3.8m.

4. Operating segments

The Group has three operating segments which are the Group's

three divisions. These divisions form the basis of the Group's

management and internal reporting structure. Further details in

respect of the Group structure and performance of the three

divisions are set out in the Interim management report.

Revenue Profit

6 months 6 months 12 months 6 months 6 months 12 months

to 30 June to 30 to 31 to 30 June to 30 June to 31 Dec

June Dec

2013 2012 2012 2013 2012 2012

(restated) (restated)

GBPm GBPm GBPm GBPm GBPm GBPm

Scientific

Services 11.4 9.3 23.1 0.1 (0.1) 1.2

Packaging

Machinery 18.4 15.9 38.8 0.1 0.1 1.5

Tobacco Machinery 18.0 14.7 31.1 1.3 0.8 2.2

------------ ---------- ----------- ---------------- ------------- -------------

47.8 39.9 93.0

============ ========== ===========

Underlying

operating

profit 1.5 0.8 4.9

Non-underlying items included in operating

profit (0.4) (0.5) (0.3)

---------------- ------------- -------------

Operating profit 1.1 0.3 4.6

Net financing

expense (0.4) (0.1) (0.1)

---------------- ------------- -------------

Profit before tax 0.7 0.2 4.5

================ ============= =============

Net financing expense includes dividends paid on preference

shares. The Company has in issue 900,000 6% fixed cumulative

preference shares. The preference dividend is payable on 30 June

and 31 December and amounted to GBP0.1m in the 12 months ended 31

December 2012.

30 June 30 June 31 Dec

2013 2012 2012

Segment assets GBPm GBPm GBPm

Scientific Services 12.9 12.5 13.6

Packaging Machinery 20.9 19.6 19.1

Tobacco Machinery 23.7 24.3 26.5

---------- ---------- ---------

Total segment assets 57.5 56.4 59.2

Total segment liabilities (27.4) (29.0) (29.9)

Segment net assets - continuing operations 30.1 27.4 29.3

Net liabilities - discontinued operations (0.2) (0.1) (0.1)

Unallocated net assets 12.9 3.3 1.3

---------- ---------- ---------

Total net assets 42.8 30.6 30.5

========== ========== =========

There have been no changes to the basis of segmentation or the

measurement basis for the segment profit or loss since 31 December

2012.

5. Non-underlying items

Charges classified as non-underlying items were incurred in

respect of the administration costs of the Group's defined benefit

pension schemes, which are paid for out of the assets of the

Group's pension schemes, and financing expense on pension scheme

balances, and which are detailed in note 7 below. Additionally, in

the 6 months to 30 June 2012 and 12 months to 31 December 2012,

charges in respect of reorganisations of GBP0.1m and GBP1.0m were

incurred. Cash payments of GBP0.6m were made in the period to 30

June 2013 in respect of reorganisations in earlier periods, of

which GBP0.2m was paid to the UK defined benefit pension

scheme.

6. Net financing expense

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated) (restated)

GBPm GBPm GBPm

Financial income

Amounts receivable on cash and cash

equivalents 0.1 0.1 0.2

---------- ---------- ----------

0.1 0.1 0.2

---------- ---------- ----------

Financial expenses

Defined benefit pension scheme finance (0.4) (0.1) (0.1)

expense

Amounts payable on bank loans and (0.1) (0.1) (0.1)

overdrafts

Preference dividends paid - - (0.1)

---------- ---------- ----------

(0.5) (0.2) (0.3)

---------- ---------- ----------

Net financing expense (0.4) (0.1) (0.1)

========== ========== ==========

7. Employee benefits

The Group accounts for pensions under IAS 19 Employee benefits.

A formal valuation of the UK defined benefit pension scheme is

being carried out as at 30 June 2012, and formal valuations of the

USA defined benefit schemes were carried out as at 1 January 2013,

and their assumptions, modified as appropriate, have been applied

in the condensed set of financial statements, updated to reflect

actual experience and conditions at 30 June 2013. Profit before tax

for the 6 months to 30 June 2013 includes charges in respect of IAS

19 pension schemes administration costs of GBP0.4m (6 months to 30

June 2012: GBP0.4m; 12 months to 31 December 2012: GBP0.8m) and

financing expense on pension scheme balances of GBP0.4m (6 months

to 30 June 2012: GBP0.1m; 12 months to 31 December 2012: GBP0.1m).

Also included within profit before tax in the 12 months to 31

December 2012 were credits totalling GBP1.5m in respect of actions

taken within the Group's pension scheme in the UK. Payments to the

Group's UK defined benefit scheme in the period included GBP0.6m in

respect of the agreed deficit recovery plan.

Employee benefits as shown in the condensed consolidated

statement of financial position were:

30 June 30 June 31 Dec

2013 2012 2012

GBPm GBPm GBPm

UK scheme

Fair value of assets 333.8 315.7 322.5

Present value of defined benefit obligations (333.0) (326.0) (336.4)

--------- --------- ---------

Defined benefit asset/(liability) 0.8 (10.3) (13.9)

========= ========= =========

USA schemes

Fair value of assets 15.2 15.0 14.7

Present value of defined benefit obligations (19.6) (20.6) (20.0)

--------- --------- ---------

Defined benefit liability (4.4) (5.6) (5.3)

========= ========= =========

8. Taxation

The Group tax charge for the 6 months to 30 June 2013 amounted

to GBPnil (6 months to 30 June 2012: GBPnil; 12 months to 31

December 2012: GBP0.7m) and is calculated as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated) (restated)

GBPm GBPm GBPm

Tax charge on underlying profit 0.2 0.1 0.8

Tax credit on non-underlying items (0.2) (0.1) (0.1)

---------- ---------- ----------

Taxation - - 0.7

========== ========== ==========

The Group's consolidated effective tax rate in respect of

underlying profit for the 6 months to 30 June 2013 is 11% (6 months

to 30 June 2012: 11%; 12 months to 31 December 2012: 16%).

The UK Finance Bill 2013, which contains legislation for some of

the proposals announced by the Chancellor in the 20 March 2013

Budget, was substantively enacted on 2 July 2013. The Bill

introduced a further reduction in the rate of UK corporation tax to

21% from 1 April 2014 and to 20% from 1 April 2015. Deferred tax

assets and liabilities are measured at tax rates that are enacted

or substantively enacted at the end of the reporting period and

therefore the reduction in the corporate tax rate from 23% to 20%

has not been taken into account in the calculation of the effective

tax rate applied in this condensed set of financial statements.

9. Earnings per share

Basic earnings per ordinary share is based upon the profit for

the period and on a weighted average of 19,326,857 shares in issue

during the period (6 months to 30 June 2012: 19,048,071; 12 months

to 31 December 2012: 19,067,302). The weighted average number of

shares excludes shares held by the employee trust in respect of the

Company's long-term incentive arrangements.

Diluted earnings per ordinary share is based upon the profit for

the period and on a diluted weighted average of 19,856,326 shares

in issue during the period (6 months to 30 June 2012: 19,687,662;

12 months to 31 December 2012: 19,795,541). The diluted weighted

average number of shares includes the diluting effect, if any, of

own shares held by the employee trust.

Underlying earnings per ordinary share and diluted underlying

earnings per ordinary share amounted to 6.5p for the 6 months to 30

June 2013 (6 months to 30 June 2012: 3.6p; 12 months to 31 December

2012: 21.8p) in respect of underlying earnings per share and 6.4p

(6 months to 30 June 2012: 3.5p; 12 months to 31 December 2012:

21.0p) in respect of diluted underlying earnings per ordinary

share. The calculations of underlying earnings per ordinary share

and diluted underlying earnings per ordinary share are based on

underlying profit for the 6 months to 30 June 2013 of GBP1.3m (6

months to 30 June 2012: GBP0.7m; 12 months to 31 December 2012:

GBP4.1m) which is calculated as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

(restated) (restated)

GBPm GBPm GBPm

Profit for the period 0.7 0.2 3.8

Financing expense on pension scheme balances 0.3 0.1 0.1

(net of tax)

Non-underlying items included in operating 0.3 0.4 0.2

profit (net of tax)

------------ ------------ ------------

Underlying profit for the period 1.3 0.7 4.1

============ ============ ============

10. Dividends

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

GBPm GBPm GBPm

Dividends to shareholders paid in the period

Final dividend for the year ended 31 December

2011

of 2.75p per share

Interim dividend for the year ended 31

December 2012 - 0.5 0.5

of 2.5p per share

Final dividend for the year ended 31 December - - 0.5

2012

of 3.0p per share 0.6 - -

----------- ----------- ----------

0.6 0.5 1.0

=========== =========== ==========

An interim dividend for the year ending 31 December 2013 of 2.5p

per ordinary share will be paid on 10 October 2013 to ordinary

shareholders registered at the close of business on 20 September

2013.

11. Reconciliation of net cash flow to movement in net funds

6 months 6 months 12 months

to 30 June to 30 June to 31 Dec

2013 2012 2012

GBPm GBPm GBPm

Net increase in cash and cash equivalents 0.6 0.2 1.3

Cash outflow from movement in borrowings (2.3) (1.3) (0.7)

----------- ----------- ----------

Change in net funds resulting from cash

flows (1.7) (1.1) 0.6

Translation movements (0.1) (0.3) (0.3)

----------- ----------- ----------

Movement in net funds in the period (1.8) (1.4) 0.3

Opening net funds 7.4 7.1 7.1

----------- ----------- ----------

Closing net funds 5.6 5.7 7.4

=========== =========== ==========

Analysis of net funds

Cash and cash equivalents - current assets 14.0 12.2 13.3

Interest-bearing loans and borrowings -

non-current liabilities (8.4) (6.5) (5.9)

----------- ----------- ----------

Closing net funds 5.6 5.7 7.4

=========== =========== ==========

12. Financial risk management

The Group's financial risk management objectives and policies

are consistent with those disclosed in the financial statements for

the year ended 31 December 2012.

At 1 January 2013 and 30 June 2013 the Group held all financial

instruments at Level 2 (as defined in IFRS 7 Financial instruments:

disclosures) and there have been no transfers of assets or

liabilities between levels of the fair value hierarchy.

Categories of financial instruments

30 June 30 June 31 Dec

2013 2012 2012

GBPm GBPm GBPm

Financial assets

Derivative instruments in designated - 0.1 1.0

hedge accounting relationship

Loans and receivables (including cash 28.1 26.0 29.3

and cash equivalents)

------- ------- ------

28.1 26.1 30.3

======= ======= ======

Financial liabilities

Derivative instruments in designated 0.4 0.5 0.5

hedge accounting relationship

Amortised cost 36.2 30.8 32.3

------- ------- ------

36.6 31.3 32.8

======= ======= ======

Amortised cost comprises interest-bearing loans and borrowings

and trade and other payables, excluding foreign currency

derivatives.

The Group enters into forward foreign exchange contracts solely

for the purpose of minimising currency exposures on sale and

purchase transactions. The Group classified its forward foreign

exchange contracts used for hedging as cash flow hedges and states

them at fair value.

The fair value is the gain/loss on all open forward foreign

exchange contracts at the period end. These amounts are based on

the market values of equivalent instruments at the period end date

and all relate to those forward foreign exchange contracts that

have been designated as effective cash flow hedges under IAS 39

Financial instruments - recognition and measurement.

13. Related parties

The Group has related party relationships with its directors and

with the UK and USA pension schemes. There has been no material

change in the nature of the related party transactions described in

note 29 of the 2012 Annual Report and Accounts.

14. Half-year report

The Half-year report will be sent to all shareholders in

September 2013 and additional copies will be available from the

Company's registered office at Rockingham Drive, Linford Wood East,

Milton Keynes MK14 6LY or from the Group's website at

www.molins.com.

INDEPENDENT REVIEW REPORT TO MOLINS PLC

Introduction

We have been engaged by the Company to review the condensed set

of financial statements in the Half-year report for the six months

ended 30 June 2013 which comprises the condensed consolidated

income statement, condensed consolidated statement of comprehensive

income, condensed consolidated statement of changes in equity,

condensed consolidated statement of financial position, condensed

consolidated statement of cash flows and the related explanatory

notes. We have read the other information contained in the

Half-year report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

This report is made solely to the company in accordance with the

terms of our engagement to assist the company in meeting the

requirements of the Disclosure and Transparency Rules ("the DTR")

of the UK's Financial Conduct Authority ("the UK FCA"). Our review

has been undertaken so that we might state to the company those

matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not

accept or assume responsibility to anyone other than the company

for our review work, for this report, or for the conclusions we

have reached.

Directors' responsibilities

The Half-year report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the Half-year financial report in accordance with the DTR

of the UK FCA.

The annual financial statements of the Group are prepared in

accordance with IFRSs as adopted by the EU. The condensed set of

financial statements included in this Half-year financial report

has been prepared in accordance with IAS 34 Interim Financial

Reporting as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the Half-year report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK and Ireland) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the Half-year report for the six months ended 30 June 2013 is

not prepared, in all material respects, in accordance with IAS 34

as adopted by the EU and the DTR of the UK FCA.

Peter Selvey

for and on behalf of KPMG Audit Plc

Chartered Accountants

Altius House

One North Fourth Street

Milton Keynes

MK9 1NE

29 August 2013

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEDFWAFDSELA

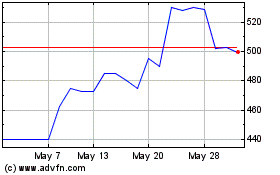

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024