Results of Placing and Open Offer

April 01 2010 - 2:00AM

UK Regulatory

TIDMHGT

RNS Number : 5808J

HG Capital Trust PLC

01 April 2010

THIS ANNOUNCEMENT IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE IN, OR INTO

THE UNITED STATES, CANADA, AUSTRALIA, JAPAN, NEW ZEALAND OR SOUTH AFRICA.

HgCapital Trust plc announces the results of the Firm Placing and Placing and

Open Offer of New Ordinary Shares (with Subscription Shares attached) and Bonus

Issue of Subscription Shares

London, 1 April 2010: Further to the announcement on 11 March 2010, HgCapital

Trust plc (the "Company") is pleased to announce that it has received

commitments for a total of GBP50 million through the Firm Placing and Placing

and Open Offer of New Ordinary Shares (with Subscription Shares attached) at 845

pence per New Ordinary Share.

The Open Offer closed for acceptances at 11:00 a.m. on 30 March 2010. The

Company received valid acceptances for a total of 1,026,317 New Ordinary Shares

(with Subscription Shares attached) from Qualifying Shareholders under the Open

Offer raising gross proceeds of approximately GBP8.7 million. This represents

approximately 58.2 per cent. of the Open Offer Shares. All valid applications

under the Open Offer (including applications for Excess Shares) will be

satisfied in full.

The remaining 736,755 Open Offer Shares (with Subscription Shares attached) have

been allocated to the Conditional Placees with whom they had been placed,

raising gross proceeds of approximately GBP6.2 million. A further 4,154,088 New

Ordinary Shares (with Subscription Shares attached) have been allocated to the

Firm Placees raising gross proceeds of approximately GBP35.1 million.

In aggregate, 6,220,783 Subscription Shares will be issued pursuant to the Firm

Placing, Placing and Open Offer and the Bonus Issue.

The Firm Placing, Placing and Open Offer and Bonus Issue are conditional, inter

alia, upon the approval of Shareholders at the General Meeting, to be held at

3:00 p.m. on 6 April 2010 and Admission occurring by no later than 8.00 a.m. on

7 April 2010 or such later time or date (not later than 30 April 2010) as the

parties to the Placing and Offer Agreement may agree.

Application has been made to the UKLA for the New Ordinary Shares and the

Subscription Shares to be admitted to the Official List and to the London Stock

Exchange for the New Ordinary Shares and the Subscription Shares to be admitted

to trading on the London Stock Exchange's main market for listed securities. It

is expected that Admission will become effective on 7 April 2010 and that

dealings in the New Ordinary Shares and the Subscription Shares will commence at

8.00 a.m. on 7 April 2010.

The New Ordinary Shares, when issued and fully paid, will be identical to and

rank pari passu with the Existing Ordinary Shares in all respects including

ranking for dividends. The Subscription Shares will be listed separately on the

Official List and admitted to trading separately on the London Stock Exchange.

The ISIN number and SEDOL code for the Ordinary Shares are GB0003921052 and

0392105 respectively.

The ISIN number and SEDOL code for the Subscription Shares are GB00B62CQW90 and

B62CQW9 respectively.

Roger Mountford, Chairman of HgCapital Trust, said: "We are very pleased to have

received such strong support for the fundraising which will result in a

significant widening of the Company's investor base. We welcome new investors

to the Company and thank existing Shareholders for their continued support. The

additional funds raised place the Company in an even stronger position to take

advantage of the investment opportunities that are emerging following the

recession and credit crunch. Within the last week the Company has announced its

investment in two acquisitions, JLA and StepStone Solutions."

Capitalised terms used in this announcement shall, unless the context otherwise

requires, bear the meanings given to them in the Prospectus dated 11 March 2010.

RBS Hoare Govett Limited, which is authorised and regulated by the Financial

Services Authority, is acting exclusively for the Company and no one else in

connection with the Offer and is not advising any person or treating any person

as its customer in relation to the Offer and will not be responsible to anyone

other than the Company for providing the protections afforded to clients of RBS

Hoare Govett or for providing advice in relation to the Offer or any matter

referred to herein.

For further details:

+----------------------+----------------------+----------------------+

| HgCapital Trust | Roger Mountford | +44 (0) 20 7089 7888 |

+----------------------+----------------------+----------------------+

| HgCapital | Ian Armitage | +44 (0)20 7089 7888 |

+----------------------+----------------------+----------------------+

| RBS Hoare Govett | Gary Gould | +44 (0) 20 7678 8000 |

| Limited | | |

+----------------------+----------------------+----------------------+

| | Stuart Klein | |

+----------------------+----------------------+----------------------+

| Maitland | Neil Bennett | +44 (0)20 7379 5151 |

+----------------------+----------------------+----------------------+

| | Rowan Brown | |

+----------------------+----------------------+----------------------+

About HgCapital Trust plc

HgCapital Trust plc is a listed investment trust which provides investors with

the opportunity to invest in all private equity deals managed by HgCapital,

alongside its institutional clients and through a publicly traded vehicle.

HgCapital is an experienced and well-resourced private equity firm with a strong

long-term track record managing more than GBP3 billion for some of the world's

leading institutional and private investors.

The Trust has won the Investment Week Private Equity Investment Trust of the

Year every year since 2005.

IMPORTANT INFORMATION

This announcement is an advertisement and is not a prospectus and it does not

constitute an offer to sell or a solicitation of an offer to buy any securities

described herein in the United States or in any other jurisdiction, nor shall

it, by the fact of its distribution, form the basis if, or be relied upon, in

connection with any contract therefor. No offer, invitation or inducement to

acquire shares or other securities in the Company ("Shares") is being made by or

in connection with this announcement. The Offer described in this announcement

is being made solely by means of a prospectus published on 11 March 2010 in

connection therewith (the "Prospectus") and any decision to buy Shares in the

Company should be made solely on the basis of the information contained in the

Prospectus. The Prospectus supersedes all information provided before the date

of the Prospectus and any investment decision must be made only on the basis of

the information contained therein.

The information presented herein is not an offer for sale within the United

States of any equity shares or other securities of the Company. The Company has

not been and will not be registered under the US Investment Company Act of 1940,

as amended (the "Investment Company Act"). In addition, the Shares have not been

and will not be registered under the US Securities Act of 1933, as amended (the

"Securities Act") or any other applicable law of the United States.

Consequently, the Shares may not be offered or sold or otherwise transferred

within the United States, or to, or for the account or benefit of, US Persons,

except pursuant to an exemption from the registration requirements of the

Securities Act and under circumstances which will not require the Company to

register under the Investment Company Act. No public offering of the Shares is

being made in the United States. The Shares may only be resold or transferred in

accordance with the restrictions set forth in the Prospectus to be published in

connection with any proposed offering and related subscription documents. This

communication should not be distributed, forwarded, transferred, reproduced, or

otherwise transmitted, directly or indirectly, to any persons within the United

States or to any US Persons unless it is lawful to do so.

The promotion of the Company and the distribution of this document in the United

Kingdom is restricted by law. Accordingly, this communication is directed only

at (i) persons outside the United Kingdom to whom it is lawful to communicate

it, or (ii) persons having professional experience in matters relating to

investments who fall within the definition of "investment professionals" in

Article 19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (as amended), or (iii) high net worth companies,

unincorporated associations and partnerships and trustees of high value trusts

as described in Article 49(2) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended) and persons who receive this

communication who do not fall within (i), (ii) or (iii) above should not rely on

or act upon this communication.

Certain statements contained in this announcement may be forward-looking

statements. By their nature, forward-looking statements involve a number of

risks, uncertainties and assumptions that could cause actual results or events

to differ materially from those expressed or implied by the forward-looking

statements. These risks, uncertainties and assumptions could adversely affect

the outcome and financial effects of the plans and events described herein. The

Company undertakes no obligation to update its view of such risks and

uncertainties or to publicly announce the result of any revisions to the

forward-looking statements made herein, except where it would be required to do

so under applicable law. Such statements are based on current expectations and

are subject to a number of risks and uncertainties that could cause actual

results or events to differ materially from those expressed or implied by the

forward-looking statements.

No representation or warranty, express or implied, is made or given by or on

behalf of the Company or HgCapital or any of their respective affiliates or any

of such person's directors, officers or employees or any other person as to the

accuracy, completeness or fairness of the information or opinions contained in

this announcement and no responsibility or liability is accepted for any such

information or opinions.

This announcement does not constitute a recommendation concerning the Shares.

All investments risk the loss of capital and the value of shares may go down as

well as up. There is no guarantee or assurance that an investment in the Company

will achieve its investment objective. An investment in the Company is

speculative and should form only part of a complete investment program, and an

investor must be able to bear the loss of its entire investment. Shares may

involve a high degree of risk. Prospective investors are advised to seek expert

legal, financial, tax and other professional advice before making any investment

decision.

The release, publication or distribution of this announcement in certain

jurisdictions may be restricted by law and therefore persons in such

jurisdictions into which this announcement is released, published or distributed

should inform themselves about and observe such restrictions.

This announcement and the information contained herein is not for publication,

distribution or release in, or into, directly or indirectly, the United States,

Canada, Australia, Japan, New Zealand, South Africa or any other jurisdiction in

which such publication, distribution or release would be contrary to applicable

law or regulation, or to US persons. The information contained herein does not

constitute an offer of securities for sale including in the United States,

Australia, Canada, Japan, New Zealand, South Africa or any other jurisdiction in

which such offer would be contrary to applicable law or regulation, or to US

Persons.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROISDMFWFFSSESD

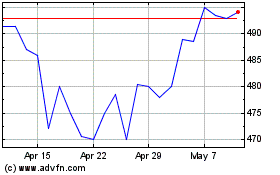

Hg Capital (LSE:HGT)

Historical Stock Chart

From Oct 2024 to Nov 2024

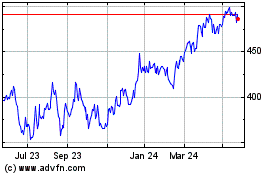

Hg Capital (LSE:HGT)

Historical Stock Chart

From Nov 2023 to Nov 2024