TIDMCAM

RNS Number : 1597Q

Camellia PLC

28 August 2014

Camellia Plc

Half yearly report for period ended 30 June

2014

Highlights from the

results

Six months Six months

ended ended

30 June 30 June

2014 2013

GBP'000 GBP'000

Revenue 101,537 113,753

Trading (loss)/profit (6,400) 8,741

(Loss)/profit before

tax (6,893) 11,930

Headline (loss)/profit

before tax (3,398) 12,466

(Loss)/profit for

the period (6,010) 6,565

Earnings per share (214.8) p 156.9 p

Interim dividend 34 p 34 p

Chairman's statement

The headline loss before tax was GBP3,398,000 for the six months

to 30 June 2014 compared with a profit of GBP12,466,000 in the same

period last year. Headline profit or loss is a measure of

underlying performance which is not impacted by exceptional and

other items. After taking account of exceptional items the loss

before tax for the six month period to 30 June 2014 amounted to

GBP6,893,000 (2013: GBP11,930,000 profit).

The disappointing results are, as previously advised, primarily

due to adverse climatic conditions, continued difficulties in our

engineering division and higher costs at Duncan Lawrie Private

Bank.

The board has declared an interim dividend of 34p per ordinary

share payable on 3 October 2014 to shareholders registered on 5

September 2014.

Tea

India

There were periods of sustained drought during the first part of

the year. This resulted in a substantial crop loss, particularly in

Assam, and encouraged the proliferation of pests and disease which

further reduced the crop.

While tea prices in Assam have been stable those in the Dooars

have increased over the same period last year.

Bangladesh

As in India, Bangladesh suffered extensively from drought in

April and May which has reduced its production. Tea prices have

recovered from low points last year due to an increase in the rate

of import tax, but still remain significantly below those prices

achieved in the first part of 2013.

Africa

Production in both Kenya and Malawi has been good due to the

beneficial pattern of rainfall for a large part of the six month

period. Our operation in Kenya has, on occasion been selling its

tea at below cost of production. Although remaining volatile,

prices have shown an improving trend over the last few weeks, but

remain below the average price achieved during 2013.

Tea prices in Malawi are significantly below those achieved in

the same period last year.

As previously announced, a substantial loss has been incurred in

Africa from changes in the fair value of biological assets,

primarily as a result of an 8 per cent. revaluation of the Malawi

kwacha against the US dollar during the period to 30 June 2014.

Edible nuts

The macadamia nut production in Malawi is marginally ahead of

the same period last year, while the harvest in South Africa had

only just commenced within the period under review. Prices for

macadamia nuts are holding firm in the international markets.

A new colour sorter has been installed in our processing factory

in South Africa which should make a meaningful contribution to

increasing the throughput and reducing the cost of production.

The macadamia planted by Kakuzi in Kenya is showing encouraging

signs of development and a reasonable crop will probably be

harvested in 2016.

A large pistachio crop has set on our pistachio orchard in

California. The unknown factor is what proportion of that crop will

be 'blanks' and this will, of course, not be known until the

harvest in September.

Other horticulture

The avocado crop presently being harvested at Kakuzi in Kenya is

substantially ahead of the same period last year, as is the crop

packed from outgrowers. Sale prices in the market have been

affected by fruit arriving from other origins and are generally

expected to be lower than last year.

California experienced a major freeze in the early part of the

year and this affected both the quality and quantity of our citrus

production.

The soya crop in Brazil is approximately the same as the

previous year although selling prices are higher.

The grape harvest on our wine estate in South Africa increased

substantially over the previous year and some progress is being

made in increasing the number of higher value bottles of wine

sold.

Food storage and distribution

The substantial competition in the cold storage industry

continues and margins are constantly under pressure. The results

for the year to date are below those of the previous year but some

initiatives have been taken to develop the spread of work

undertaken by our operations.

The Netherlands have been moving slowly out of recession and

this, together with a favourable Yen exchange rate, has contributed

to improved results for our food distribution business.

Engineering

Our engineering division based in Scotland and centred on AJT

Engineering at Aberdeen has continued to perform well.

The operations at British Metal Treatments, GU Cutting and

Grinding and Loddon Engineering are showing improved results over

the previous year.

Less satisfactory are the continuing losses at Abbey Metal where

the regaining of contracts lost subsequent to the fire is proving

more difficult than anticipated. In addition, there are supplier

programme delays at Abbey Metal's operation in Germany resulting in

the start-up costs having to be absorbed over a longer period.

AKD Engineering continues to suffer from the run-off costs

associated with a large contract which remains the subject of a

legal dispute.

Banking

In the first six months Duncan Lawrie Private Bank suffered from

one-off costs associated with specific regulatory compliance

matters and a change in the senior management in the company.

Lending also reduced due to a more competitive market, although

there are signs this business may gradually increase over the next

few months.

Prospects

In my chairman's statement which accompanied the 2013 report and

accounts I warned shareholders that the group's success was partly

dependent on benign climatic conditions. We experienced a number of

adverse climatic conditions in the first half of the year which

have affected our results. We are still in periods of major

harvesting and the impact of climatic conditions in the second half

of the year will, of course, have a significant part to play in our

results for that period. For these reasons, it remains difficult to

give any indication of the likely outcome for the full year but the

board nonetheless expects the second half to be more favourable

than the first.

M C Perkins

Chairman

28 August 2014

Camellia Plc 01622 746655

Malcolm Perkins, Chairman

Anil Mathur, Finance Director

Julia Morton, Company Secretary

Charles Stanley Securities 020 7149 6000

Russell Cook

Carl Holmes

Interim management report

The chairman's statement forms part of this report and includes

important events that have occurred during the six months ended 30

June 2014 and their impact on the financial statements set out

herein.

Principal risks and uncertainties

The directors' report in the statutory financial statements for

the year ended 31 December 2013 (the accounts are available on the

company's website: www.camellia.plc.uk) highlighted risks and

uncertainties that could have an impact on the group's businesses.

As these businesses are widely spread both in terms of activity and

location, it is unlikely that any one single factor could have a

material impact on the group's performance. These risks and

uncertainties continue to be relevant for the remainder of the

year. In addition, the chairman's statement included in this report

refers to certain specific risks and uncertainties that the group

is presently facing.

Statement of directors' responsibilities

The directors confirm that these condensed financial statements

have been prepared in accordance with IAS 34 'Interim Financial

Reporting' as adopted by the European Union, and that the interim

management report herein includes a fair review of the information

required by sections 4.2.7 and 4.2.8 of the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority.

The directors of Camellia Plc are listed in the Camellia Plc

statutory financial statements for the year ended 31 December 2013.

Mr C P T Vaughan-Johnson did not seek re-election at the annual

general meeting. There have been no other subsequent changes of

directors and a list of current directors is maintained on the

group's website at www.camellia.plc.uk.

By order of the board

M C Perkins

Chairman

28 August 2014

Consolidated income statement

for the six months ended 30 June 2014

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Notes GBP'000 GBP'000 GBP'000

Revenue 4 101,537 113,753 251,267

Cost of sales (81,389) (79,367) (162,665)

---------- ---------- -----------

Gross profit 20,148 34,386 88,602

Other operating income 1,076 1,134 2,129

Distribution costs (4,411) (4,980) (12,264)

Administrative expenses (23,213) (21,799) (47,284)

---------- ---------- -----------

Trading (loss)/profit 4 (6,400) 8,741 31,183

Share of associates' results 6 466 445 980

Profit on non-current assets 7 - - 542

Profit on disposal of available-for-sale investments 294 57 1,349

(Loss)/gain arising from changes in fair value of biological

assets:

---------- ---------- -----------

Gain/(loss) excluding Malawi Kwacha exceptional (loss)/gain 128 (23) 10,061

Malawi Kwacha (loss)/gain (3,548) - 11,032

---------- ---------- -----------

8 (3,420) (23) 21,093

---------- ---------- -----------

(Loss)/profit from operations (9,060) 9,220 55,147

Investment income 1,113 1,159 2,417

---------- ---------- -----------

Finance income 1,527 1,937 3,417

Finance costs (206) (424) (878)

Net exchange gain 102 608 1,031

Employee benefit expense (369) (570) (1,486)

---------- ---------- -----------

Net finance income 9 1,054 1,551 2,084

---------- ---------- -----------

(Loss)/profit before tax (6,893) 11,930 59,648

-------------------------------------------------------------- ----- ---------- ---------- -----------

Comprising

* headline (loss)/profit before tax 5 (3,398) 12,466 38,150

* exceptional items, (loss)/gain arising from changes

in fair value of biological assets and other

financing gains and losses 5 (3,495) (536) 21,498

---------- ---------- -----------

(6,893) 11,930 59,648

-------------------------------------------------------------- ----- ---------- ---------- -----------

Taxation 10 883 (5,365) (22,105)

---------- ---------- -----------

(Loss)/profit for the period (6,010) 6,565 37,543

---------- ---------- -----------

(Loss)/profit attributable to:

Owners of the parent (5,934) 4,359 28,297

Non-controlling interests (76) 2,206 9,246

---------- ---------- -----------

(6,010) 6,565 37,543

---------- ---------- -----------

Earnings per share - basic and diluted 12 (214.8) p 156.9p 1,020.2p

Statement of comprehensive income

for the six months ended 30 June 2014

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

(Loss)/profit for the period (6,010) 6,565 37,543

---------- ---------- -----------

Other comprehensive (expense)/income:

Items that will not be reclassified subsequently to profit or loss:

Remeasurements of post employment benefit obligations (note 16) (3,460) 12,287 11,611

Deferred tax movement in relation to post employment benefit obligations - - 14

---------- ---------- -----------

(3,460) 12,287 11,625

---------- ---------- -----------

Items that may be reclassified subsequently to profit or loss:

Foreign exchange translation differences (3,782) 14,227 (23,888)

Available-for-sale investments:

Valuation (losses)/gains taken to equity (6) 2,277 3,367

Transferred to income statement on sale (4) (31) (873)

Tax relating to components of other comprehensive income - - (142)

---------- ---------- -----------

(3,792) 16,473 (21,536)

---------- ---------- -----------

Other comprehensive (expense)/income for the period, net of tax (7,252) 28,760 (9,911)

---------- ---------- -----------

Total comprehensive (expense)/income for the period (13,262) 35,325 27,632

---------- ---------- -----------

Total comprehensive (expense)/income attributable to:

Owners of the parent (12,718) 30,957 23,143

Non-controlling interests (544) 4,368 4,489

---------- ---------- -----------

(13,262) 35,325 27,632

---------- ---------- -----------

Consolidated balance sheet

at 30 June 2014

30 June 30 June 31 December

2014 2013 2013

Notes GBP'000 GBP'000 GBP'000

Non-current assets

Intangible assets 7,367 7,300 7,349

Property, plant and equipment 13 98,381 97,865 95,840

Biological assets 124,184 128,246 127,215

Prepaid operating leases 848 977 890

Investments in associates 7,339 7,448 7,343

Deferred tax assets 203 332 212

Financial assets 57,589 56,768 60,001

Other investments 8,780 8,700 8,745

Retirement benefit surplus 16 636 740 653

Trade and other receivables 6,623 17,303 4,113

-------- -------- -----------

Total non-current assets 311,950 325,679 312,361

-------- -------- -----------

Current assets

Inventories 36,427 40,471 38,820

Trade and other receivables 63,509 74,840 69,754

Other investments 1,749 1,004 1,000

Current income tax assets 2,969 1,452 433

Cash and cash equivalents 14 263,199 266,688 289,623

-------- -------- -----------

Total current assets 367,853 384,455 399,630

-------- -------- -----------

Current liabilities

Borrowings 15 (7,361) (11,740) (3,051)

Trade and other payables (244,905) (238,097) (265,117)

Current income tax liabilities (3,421) (8,248) (5,965)

Employee benefit obligations 16 (422) (1,187) (448)

Provisions (360) (458) (360)

-------- -------- -----------

Total current liabilities (256,469) (259,730) (274,941)

-------- -------- -----------

Net current assets 111,384 124,725 124,689

-------- -------- -----------

Total assets less current liabilities 423,334 450,404 437,050

-------- -------- -----------

Non-current liabilities

Borrowings 15 (53) (102) (78)

Trade and other payables (6,928) (9,787) (2,451)

Deferred tax liabilities (37,173) (36,923) (39,318)

Employee benefit obligations 16 (24,652) (19,626) (21,546)

Other non-current liabilities (104) (105) (103)

Provisions (225) (375) (300)

-------- -------- -----------

Total non-current liabilities (69,135) (66,918) (63,796)

-------- -------- -----------

Net assets 354,199 383,486 373,254

-------- -------- -----------

Equity

Called up share capital 17 282 283 283

Share premium 15,298 15,298 15,298

Reserves 301,232 325,823 316,885

-------- -------- -----------

Equity attributable to owners of the parent 316,812 341,404 332,466

Non-controlling interests 37,387 42,082 40,788

-------- -------- -----------

Total equity 354,199 383,486 373,254

-------- -------- -----------

Consolidated cash flow statement

for the six months ended 30 June 2014

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Notes GBP'000 GBP'000 GBP'000

Cash generated from operations

Cash flows from operating activities 18 (6,659) (171) 34,247

Interest paid (272) (423) (1,189)

Income taxes paid (6,257) (5,526) (12,653)

Interest received 1,655 1,814 3,393

Dividends received from associates 241 206 203

---------- ---------- -----------

Net cash flow from operating activities (11,292) (4,100) 24,001

Cash flows from investing activities

Purchase of intangible assets (232) (88) (399)

Purchase of property, plant and equipment (7,782) (7,618) (17,290)

Insurance proceeds for non-current assets - - 542

Proceeds from sale of non-current assets 109 352 577

Biological assets - new planting (2,879) (1,585) (4,817)

Part disposal of a subsidiary 141 49 76

Non-controlling interest subscription - - 21

Purchase of own shares (471) (925) (1,107)

Proceeds from sale of investments 4,028 5,272 9,583

Purchase of investments (3,178) (2,864) (14,032)

Income from investments 1,113 1,159 2,417

---------- ---------- -----------

Net cash flow from investing activities (9,151) (6,248) (24,429)

Cash flows from financing activities

Equity dividends paid - - (3,388)

Dividends paid to non-controlling interests (2,950) (2,017) (3,480)

New loans - 39 78

Loans repaid (103) (55) (56)

Finance lease payments (9) (27) (38)

---------- ---------- -----------

Net cash flow from financing activities (3,062) (2,060) (6,884)

---------- ---------- -----------

Net decrease in cash and cash equivalents (23,505) (12,408) (7,312)

Cash and cash equivalents at beginning of period 72,900 81,373 81,373

Exchange (losses)/gains on cash (782) 2,976 (1,161)

---------- ---------- -----------

Cash and cash equivalents at end of period 48,613 71,941 72,900

---------- ---------- -----------

For the purposes of the cash flow statement, cash and cash

equivalents are included net of overdrafts repayable on demand.

These overdrafts are excluded from the definition of cash and cash

equivalents disclosed on the balance sheet.

For the purposes of the cash flow statement cash and cash

equivalents comprise:

Cash and cash equivalents 263,199 266,688 289,623

Less banking operation funds (207,248) (183,087) (213,785)

Overdrafts repayable on demand (included in current liabilities - borrowings) (7,338) (11,660) (2,938)

-------- -------- --------

48,613 71,941 72,900

-------- -------- --------

Statement of changes in equity

for the six months ended 30 June 2014

Non-

Share Share Treasury Retained Other controlling Total

capital premium shares earnings reserves Total interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2013 284 15,298 (400) 288,362 10,266 313,810 39,691 353,501

Total

comprehensive

income/(expense)

for the period - - - 16,616 14,341 30,957 4,368 35,325

Dividends - - - (2,446) - (2,446) (2,017) (4,463)

Non-controlling

interest

subscription - - - 8 - 8 40 48

Purchase of own

shares (1) - - (925) 1 (925) - (925)

------- ------- -------- -------- -------- ------- ----------- -------

At 30 June 2013 283 15,298 (400) 301,615 24,608 341,404 42,082 383,486

------- ------- -------- -------- -------- ------- ----------- -------

At 1 January 2013 284 15,298 (400) 288,362 10,266 313,810 39,691 353,501

Total

comprehensive

income/(expense)

for the period - - - 39,805 (16,662) 23,143 4,489 27,632

Dividends - - - (3,388) - (3,388) (3,480) (6,868)

Non-controlling

interest

subscription - - - 8 - 8 88 96

Purchase of own

shares (1) - - (1,107) 1 (1,107) - (1,107)

------- ------- -------- -------- -------- ------- ----------- -------

At 31 December

2013 283 15,298 (400) 323,680 (6,395) 332,466 40,788 373,254

Total

comprehensive

(expense)/income

for the period - - - (9,394) (3,324) (12,718) (544) (13,262)

Dividends - - - (2,513) - (2,513) (2,950) (5,463)

Non-controlling

interest

subscription - - - 48 - 48 93 141

Purchase of own

shares (1) - - (471) 1 (471) - (471)

------- ------- -------- -------- -------- ------- ----------- -------

At 30 June 2014 282 15,298 (400) 311,350 (9,718) 316,812 37,387 354,199

------- ------- -------- -------- -------- ------- ----------- -------

Notes to the accounts

1 Basis of preparation

These financial statements are the interim condensed

consolidated financial statements of Camellia Plc, a company

registered in England, and its subsidiaries (the "group") for the

six month period ended 30 June 2014 (the "Interim Report"). They

should be read in conjunction with the Report and Accounts (the

"Annual Report") for the year ended 31 December 2013.

The financial information contained in this interim report has

not been audited and does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. A copy of the

statutory accounts for the year ended 31 December 2013 has been

delivered to the Registrar of Companies. The auditors' opinion on

these accounts was unqualified and does not contain an emphasis of

matter paragraph or a statement made under Section 498(2) and

Section 498(3) of the Companies Act 2006.

The interim condensed financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") including IAS 34 "Interim Financial Reporting". For these

purposes, IFRS comprise the Standards issued by the International

Accounting Standards Board ("IASB") and Interpretations issued by

the International Financial Reporting Interpretations Committee

("IFRIC") that have been adopted by the European Union.

The preparation of the condensed interim financial report

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amount of assets and liabilities, income and expense.

In preparing this condensed interim financial report, the

significant judgements made by management in applying the group's

accounting policies and the key sources of estimation uncertainty

were the same as those applied to the consolidated financial

statements for the year ended 31 December 2013 with the exception

of changes in estimates that are required in determining the

provision for income taxes.

Where necessary, the comparatives have been reclassified from

the previously reported interim results to take into account any

presentational changes made in the Annual Report.

These interim condensed financial statements were approved by

the board of directors on 28 August 2014. At the time of approving

these financial statements, the directors have a reasonable

expectation that the company and the group have adequate resources

to continue to operate for the foreseeable future. They therefore

continue to adopt the going concern basis of accounting in

preparing the financial statements.

2 Accounting policies

These interim condensed financial statements have been prepared

on the basis of accounting policies consistent with those applied

in the financial statements for the year ended 31 December 2013.

Amendments to IFRSs effective for the financial year ending 31

December 2014 are not expected to have a material impact on the

group.

3 Cyclical and seasonal factors

Due to climatic conditions the group's tea operations in India

and Bangladesh produce most of their crop during the second half of

the year. Tea production in Kenya remains at consistent levels

throughout the year but in Malawi the majority of tea is produced

in the first six months.

Soya and maize in Brazil and citrus in California are generally

harvested in the first half of the year. In California the

pistachio crop occurs in the second half of the year and has 'on'

and 'off' years. Avocados in Kenya are mostly harvested in the

second half of the year.

There are no other cyclical or seasonal factors which have a

material impact on the trading results.

4 Segment reporting

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Trading Trading Trading

Revenue (loss)/profit Revenue profit/(loss) Revenue profit/(loss )

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Agriculture and horticulture 61,494 (1,327) 75,851 11,827 175,116 41,383

Engineering 17,900 (1,675) 14,568 (976) 29,587 (5,599)

Food storage and distribution 14,996 330 15,264 365 30,785 772

Banking and financial services 6,098 (960) 7,026 (24) 13,568 121

Other operations 1,049 (39) 1,044 32 2,211 179

------- ------------- ------- ------------- ------- ------------

101,537 (3,671) 113,753 11,224 251,267 36,856

------- ------- -------

Unallocated corporate expenses* (2,729) (2,483) (5,673)

------------- ------------- ------------

Trading (loss)/profit (6,400) 8,741 31,183

Share of associates' results 466 445 980

Profit on non-current assets - - 542

Profit on disposal of

available-for-sale investments 294 57 1,349

(Loss)/gain arising from changes in

fair value of biological assets (3,420) (23) 21,093

Investment income 1,113 1,159 2,417

Net finance income 1,054 1,551 2,084

------------- ------------- ------------

(Loss)/profit before tax (6,893) 11,930 59,648

Taxation 883 (5,365) (22,105)

------------- ------------- ------------

(Loss)/profit after tax (6,010) 6,565 37,543

------------- ------------- ------------

* Unallocated corporate expenses include group marketing

expenses of GBPnil (2013: half year GBP487,000 - year GBP881,000)

incurred on behalf of banking and financial services and

agriculture and horticulture segments.

5 Headline (loss)/profit

The group seeks to present an indication of the underlying

performance which is not impacted by exceptional items or items

considered non-operational in nature. This measure of (loss)/profit

is described as 'headline' and is used by management to measure and

monitor performance.

The following items have been excluded from the headline

measure:

- Exceptional items, including profit and losses from

disposal of non-current assets and available-for-sale

investments.

- Gains and losses arising from changes in fair value

of biological assets, which are a non-cash item, and

the directors believe should be excluded to give a

better understanding of the group's underlying performance.

- Financing income and expense relating to retirement

benefits.

Headline (loss)/profit before tax comprises:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Trading (loss)/profit (6,400) 8,741 31,183

Share of associates' results 466 445 980

Investment income 1,113 1,159 2,417

Net finance income 1,054 1,551 2,084

Exclude

* Employee benefit expense 369 570 1,486

------- ------- -------

Headline finance income 1,423 2,121 3,570

------- ------- -------

Headline (loss)/profit before tax (3,398) 12,466 38,150

------- ------- -------

Non-headline items in (loss)/ profit before tax

comprise:

Exceptional items

Profit on disposal of non-current assets - - 542

Profit on disposal of available-for-sale investments 294 57 1,349

------- ------- -------

294 57 1,891

(Loss)/gain arising from changes in fair value of

biological assets (3,420) (23) 21,093

Employee benefit expense (369) (570) (1,486)

------- ------- -------

Non-headline items in (loss)/profit before tax (3,495) (536) 21,498

------- ------- -------

6 Share of associates' results

The group's share of the results of associates is analysed

below:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Profit before tax 826 793 1,643

Taxation (360) (348) (663)

---------- ---------- -----------

Profit after tax 466 445 980

---------- ---------- -----------

7 Profit on non-current assets

In 2013 a profit of GBP542,000 (Six months to 30 June 2014:

GBPnil - to 30 June 2013: GBPnil) was realised following part

recovery of insurance claims received in relation to the property,

plant and equipment destroyed by the fire in 2011 at one of the tea

processing factories owned by Eastern Produce Malawi Limited.

8 (Loss)/gain arising from changes in fair

value of biological assets

During the period to 30 June 2014 the Malawian Kwacha

appreciated in value from 712.19 to the pound sterling at 1 January

2014 to 676.73 to the pound sterling at 30 June 2014. The

functional currency of our Malawian subsidiaries is the kwacha. Our

principal assets in Malawi are our agricultural assets. As they

generate revenues in currencies other than the kwacha their value

in hard currency has not risen in the period. Accordingly, the

revaluation of the agricultural assets in kwacha under IAS 41 at 30

June 2014 generated a loss of GBP3,548,000 (Six months to 30 June

2013: GBPnil) due to the currency revaluation which is included in

the overall loss arising from changes in fair value of biological

assets of GBP3,420,000 (Six months to 30 June 2013: GBP23,000)

charged to the income statement. This has been largely offset by a

foreign exchange translation gain credited to reserves.

In the year to 31 December 2013 the Malawian kwacha depreciated

in value from 544.05 to the pound sterling at 1 January 2013 to

712.19 to the pound sterling at 31 December 2013. Accordingly, the

revaluation of the agricultural assets in kwacha under IAS 41 at 31

December 2013 generated a credit of GBP18,631,000 including a gain

of GBP11,032,000 due to the currency devaluation which was included

in the overall gain of GBP21,093,000 credited to the income

statement. This was largely offset by a foreign exchange

translation loss charged to reserves.

9 Finance income and costs

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Interest payable on loans and bank overdrafts (205) (424) (874)

Interest payable on obligations under finance leases (1) - (4)

---------- ---------- -----------

Finance costs (206) (424) (878)

Finance income - interest income on short-term bank deposits 1,527 1,937 3,417

Net exchange gain on foreign currency balances 102 608 1,031

Employee benefit expense (369) (570) (1,486)

---------- ---------- -----------

Net finance income 1,054 1,551 2,084

---------- ---------- -----------

The above figures do not include any amounts relating to the

banking subsidiaries.

10 Taxation on profit on ordinary activities

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Current tax

Overseas corporation tax 1,205 7,005 13,941

Deferred tax

Origination and reversal of timing differences

Overseas deferred tax (2,088) (1,640) 8,164

---------- ---------- -----------

Tax on profit on ordinary activities (883) 5,365 22,105

---------- ---------- -----------

Tax on profit on ordinary activities for the six months to 30

June 2014 has been calculated on the basis of the estimated annual

effective rate for the year ending 31 December 2014.

11 Equity dividends

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Amounts recognised as distributions to equity holders in the period:

Final dividend for the year ended 31 December 2013 of

91.00p (2012: 88.00p) per share 2,513 2,446 2,446

---------- ----------

Interim dividend for the year ended 31 December 2013 of

34.00p per share 942

-----------

3,388

-----------

Dividends amounting to GBP57,000 (2013: six months GBP55,000 -

year GBP78,000) have not been included as group companies hold

62,500 issued shares in the company. These are classified as

treasury shares.

Proposed interim dividend for the year ended 31 December 2014 of

34.00p (2013: 34.00p) per share 939 942

------ ------

The proposed interim dividend was approved by the board of

directors on 28 August 2014 and has not been included as a

liability in these financial statements.

12 Earnings per share (EPS)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

Earnings EPS Earnings EPS Earnings EPS

GBP'000 Pence GBP'000 Pence GBP'000 Pence

Basic and diluted EPS

Attributable to ordinary shareholders (5,934) (214.8) 4,359 156.9 28,297 1,020.2

-------- ------ -------- ----- -------- -------

Basic and diluted earnings per share are calculated by dividing

the earnings attributable to ordinary shareholders by the weighted

average number of ordinary shares in issue of 2,762,531 (2013: six

months 2,778,775 - year 2,773,762), which excludes 62,500 (2013:

six months 62,500 - year 62,500) shares held by the group as

treasury shares.

13 Property, plant and equipment

During the six months ended 30 June 2014 the group acquired

assets with a cost of GBP7,782,000 (2013: six months GBP7,618,000 -

year GBP17,290,000). Assets with a carrying amount of GBP37,000

were disposed of during the six months ended 30 June 2014 (2013:

six months GBP212,000 - year GBP327,000).

14 Cash and cash equivalents

Included in cash and cash equivalents of GBP263,199,000 (2013:

six months GBP266,688,000 - year GBP289,623,000) are cash and

short-term funds, time deposits with banks and building societies

and certificates of deposit amounting to GBP207,248,000 (2013: six

months GBP183,087,000 - year GBP213,785,000), which are held by

banking subsidiaries and which are an integral part of the banking

operations of the group.

15 Borrowings

Borrowings (current and non-current) include loans and finance

leases of GBP76,000 (2013: six months GBP182,000 - year GBP191,000)

and bank overdrafts of GBP7,338,000 (2013: six months GBP11,660,000

- year GBP2,938,000). The following loans and finance leases were

repaid during the six months ended 30 June 2014:

GBP'000

Balance at 1 January 2014 191

Exchange differences (3)

Repayments

Loans (103)

Finance lease liabilities (9)

--------

Balance at 30 June 2014 76

--------

16 Retirement benefit schemes

The UK defined benefit pension scheme for the purpose of IAS 19

has been updated to 30 June 2014 from the valuation as at 31

December 2013 by the actuary and the movements have been reflected

in this interim statement. Overseas schemes have not been updated

from 31 December 2013 valuations as it is considered that there

have been no significant changes.

An actuarial loss of GBP3,460,000 was realised in the period, of

which a gain of GBP599,000 was realised in relation to the scheme

assets and a loss of GBP4,059,000 was realised in relation to

changes in the underlying actuarial assumptions. The assumed

discount rate has decreased to 4.25% (31 December 2013: 4.50%), the

assumed rate of inflation (CPI) has decreased to 2.35% (31 December

2013: 2.50%) and the assumed rate of increases for salaries to

2.35% (31 December 2013: 2.50%). There has been no change in the

mortality assumptions used.

17 Share Capital

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Authorised: 2,842,000 (2013: 30 June 2,842,000

* 31 December 2,842,000) ordinary shares of 10p each 284 284 284

------- ------- -----------

Allotted, called up and fully paid: ordinary shares of 10p each:

At 1 January - 2,829,700 (2013: 2,842,000) shares 283 284 284

Purchase of own shares - 5,200 (2013: 30 June 10,192

* 31 December 12,300) shares (1) (1) (1)

------- ------- -----------

At 30 June - 2,824,500 (2013: 30 June 2,831,808

* 31 December 2,829,700) shares 282 283 283

------- ------- -----------

Group companies hold 62,500 issued shares in the company. These

are classified as treasury shares.

On 6 June 2013 the directors were authorised to purchase up to a

maximum of 277,950 ordinary shares and during the period 5,200

shares were purchased. Upon cancellation of the shares purchased, a

capital redemption reserve is created representing the nominal

value of the shares cancelled.

18 Reconciliation of (loss)/profit from operations to cash

flow

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

(Loss)/profit from operations (9,060) 9,220 55,147

Share of associates' results (466) (445) (980)

Depreciation and amortisation 4,810 4,890 9,527

Impairment of non-current assets - - 22

Loss/(gain) arising from changes in fair value of biological assets 3,420 23 (21,093)

Profit on disposal of non-current assets (72) (141) (792)

Profit on disposal of investments (294) (57) (1,348)

Pensions and similar provisions less payments (599) (871) (392)

Biological assets capitalised cultivation costs (2,356) (4,378) (5,444)

Biological assets decreases due to harvesting 4,287 4,682 7,977

(Increase)/decrease in working capital (1,471) 502 (671)

Net increase in funds of banking subsidiaries (4,858) (13,596) (7,706)

---------- ---------- -----------

(6,659) (171) 34,247

---------- ---------- -----------

19 Reconciliation of net cash flow to movement in net cash

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2014 2013 2013

GBP'000 GBP'000 GBP'000

Decrease in cash and cash equivalents in the period (23,403) (12,408) (7,312)

Net cash outflow from decrease in debt 112 43 16

---------- ---------- -----------

Decrease in net cash resulting from cash flows (23,291) (12,365) (7,296)

Exchange rate movements (881) 2,958 (1,161)

---------- ---------- -----------

Decrease in net cash in the period (24,172) (9,407) (8,457)

Net cash at beginning of period 72,709 81,166 81,166

---------- ---------- -----------

Net cash at end of period 48,537 71,759 72,709

---------- ---------- -----------

20 Contingencies

During 2013, one of the group's trading subsidiaries made a

legal claim against one of its customers. The customer has

subsequently raised a counter claim. Neither the contingent asset

arising from the claim nor a provision for the counter claim have

been recognised.

21 Related party transactions

There have been no related party transactions that had a

material effect on the financial position or performance of the

group in the first six months of the financial year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PRMATMBBTBBI

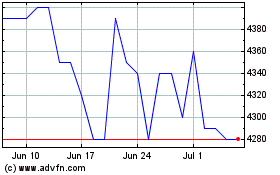

Camellia (LSE:CAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

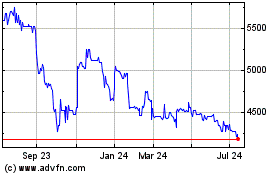

Camellia (LSE:CAM)

Historical Stock Chart

From Jul 2023 to Jul 2024